Beruflich Dokumente

Kultur Dokumente

Manila Standard Today - Business Daily Stocks Review (February 5, 2013)

Hochgeladen von

Manila Standard TodayCopyright

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Manila Standard Today - Business Daily Stocks Review (February 5, 2013)

Hochgeladen von

Manila Standard TodayCopyright:

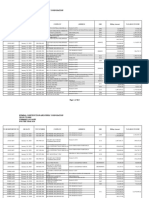

MST Business Daily Stocks Review

M

S

T

Tuesday, February 5, 2013

52 Weeks

High Low

STOCKS

Previous

Close

High

Low

FINANCIAL

83.20

81.25

83.05

105.00

103.00

104.80

1.06

0.94

0.94

56.60

56.10

56.60

2.00

2.00

2.00

18.98

18.50

18.80

31.40

30.90

31.25

13.00

10.98

13.00

0.85

0.85

0.85

2.92

2.92

2.92

24.75

24.60

24.75

107.40

105.40

106.10

1.99

1.96

1.99

99.00

97.70

99.00

111.00

103.00

109.00

460.00

456.80

460.00

67.90

66.00

66.00

176.00

172.00

174.40

1091.00

1090.00

1090.00

120.80

120.00

120.30

2.52

2.52

2.52

INDUSTRIAL

38.00

28.70

Aboitiz Power Corp.

38.15

38.20

38.00

38.10

13.58

6.22

Agrinurture Inc.

7.70

7.76

7.70

7.75

2.26

1.24

Alliance Tuna Intl Inc.

1.96

1.99

1.91

1.96

1.62

1.20

Alsons Cons.

1.31

1.31

1.30

1.31

61.00

17.10

Asiabest Group

18.70

18.78

18.32

18.74

4.99

2.12

Calapan Venture

4.37

4.10

4.10

4.10

3.12

2.41

Chemrez Technologies Inc.

2.97

2.95

2.90

2.95

27.75

7.60

Cirtek Holdings (Chips)

27.80

27.80

26.50

27.75

4.55

4.32

DNL Industries Inc.

6.35

6.480

6.22

6.43

7.16

4.83

Energy Devt. Corp. (EDC)

7.28

7.35

7.20

7.32

10.40

3.60

EEI

13.22

13.26

12.96

13.20

3.80

1.00

Euro-Med Lab.

1.82

1.82

1.81

1.82

24.00

12.80

First Gen Corp.

26.05

27.00

25.80

26.20

95.50

58.50

First Holdings A

104.20

108.00

104.40

106.10

24.60

16.50

Ginebra San Miguel Inc.

16.64

17.48

16.64

17.00

0.027

0.0110 Greenergy

0.0200

0.0200

0.0190

0.0200

14.00

10.00

Holcim Philippines Inc.

13.60

13.60

13.50

13.50

5.49

3.80

Integ. Micro-Electronics

4.05

4.20

3.98

4.20

2.35

0.61

Ionics Inc

0.660

0.750

0.650

0.710

120.00

89.00

Jollibee Foods Corp.

112.90

112.90

109.00

111.90

11.70

5.70

Lafarge Rep

11.52

11.46

11.24

11.42

8.40

1.44

LMG Chemicals

2.56

2.73

2.47

2.68

14.66

3.70

LT Group

14.06

14.10

13.88

13.96

22.50

1.39

Manchester Intl. A

13.90

14.80

13.60

14.14

23.00

1.50

Manchester Intl. B

14.04

14.04

13.62

14.00

33.50

20.55

Manila Water Co. Inc.

35.75

35.95

35.40

35.65

7.50

2.00

Mariwasa MFG. Inc.

5.60

6.00

5.67

5.80

18.80

8.76

Megawide

18.200

18.400

18.080

18.280

291.20

218.80 Mla. Elect. Co `A

299.80

299.80

294.80

299.60

6.75

3.20

Panasonic Mfg Phil. Corp.

4.50

5.00

4.50

5.00

12.20

7.50

Pancake House Inc.

7.50

8.45

8.45

8.45

6.82

2.09

Pepsi-Cola Products Phil.

6.29

6.47

6.29

6.44

13.60

9.70

Petron Corporation

12.30

12.72

12.02

12.52

13.70

10.20

Phinma Corporation

13.60

13.20

13.00

13.20

14.94

8.03

Phoenix Petroleum Phils.

10.82

10.86

10.80

10.86

5.09

1.33

RFM Corporation

4.95

4.98

4.88

4.92

2.49

1.10

Roxas and Co.

2.25

2.26

2.26

2.26

3.90

2.30

Roxas Holdings

3.00

3.00

2.85

3.00

7.60

3.00

Salcon Power Corp.

4.60

4.75

4.60

4.60

122.50

100.00 San Miguel Corp `A

117.70

117.50

115.80

117.00

3000.00

240.00 San MiguelPure Foods `B

246.40

290.00

246.80

281.00

2.44

1.70

Splash Corporation

1.76

1.79

1.75

1.77

0.220

0.121

Swift Foods, Inc.

0.147

0.148

0.148

0.148

2.77

1.66

TKC Steel Corp.

1.70

1.72

1.72

1.72

1.41

1.08

Trans-Asia Oil

1.88

1.92

1.77

1.77

88.00

50.00

Universal Robina

89.70

90.20

88.00

89.70

5.50

1.05

Victorias Milling

1.55

1.57

1.53

1.53

2.08

0.450

Vitarich Corp.

0.97

1.03

0.96

1.01

18.00

2.65

Vivant Corp.

9.00

9.15

9.00

9.15

2.20

0.90

Vulcan Indl.

1.59

1.59

1.56

1.58

HOLDING FIRMS

1.03

0.65

Abacus Cons. `A

0.68

0.68

0.67

0.68

59.90

40.50

Aboitiz Equity

57.00

57.50

56.00

57.50

0.169

0.014

Alcorn Gold Res.

0.1610

0.1610

0.1550

0.1570

17.50

10.24

Alliance Global Inc.

19.80

20.65

19.68

20.50

2.70

1.88

Anglo Holdings A

2.36

2.36

2.30

2.33

5.95

3.30

Anscor `A

5.70

5.75

5.73

5.73

6.98

3.700

Asia Amalgamated A

5.00

5.18

5.01

5.10

2.98

0.90

ATN Holdings A

0.98

0.96

0.95

0.96

3.52

0.90

ATN Holdings B

1.03

1.04

0.93

1.02

552.50

332.00 Ayala Corp `A

574.00

581.50

568.00

576.00

64.80

42.80

DMCI Holdings

55.00

55.00

53.90

54.00

5.20

3.36

Filinvest Dev. Corp.

5.40

5.58

5.40

5.48

0.98

0.10

Forum Pacific

0.229

0.232

0.220

0.230

693.00

455.40 GT Capital

725.00

729.50

715.00

725.00

6.80

3.07

House of Inv.

7.70

8.00

7.51

7.80

40.70

24.50

JG Summit Holdings

40.00

40.30

39.50

40.00

8.20

2.08

Jolliville Holdings

7.00

5.71

5.71

5.71

5.60

3.30

Keppel Holdings `A

4.70

5.10

5.02

5.10

6.78

4.90

Lopez Holdings Corp.

7.22

7.40

7.17

7.35

1.54

0.81

Lodestar Invt. Holdg.Corp.

0.97

1.02

0.98

1.00

0.85

0.320

Mabuhay Holdings `A

0.580

0.670

0.590

0.630

3.82

1.710

Marcventures Hldgs., Inc.

2.00

2.01

1.94

1.97

5.03

3.48

Metro Pacific Inv. Corp.

5.36

5.30

5.21

5.27

6.63

4.38

Minerales Industrias Corp.

7.25

7.65

7.25

7.50

9.66

1.33

MJCI Investments Inc.

6.22

6.50

6.20

6.50

0.0680

0.044

Pacifica `A

0.0500

0.0500

0.0500

0.0500

0.66

0.42

Prime Orion

0.690

0.690

0.670

0.670

3.40

1.56

Republic Glass A

2.51

2.60

2.60

2.60

2.40

1.17

Seafront `A

2.26

2.30

2.20

2.20

0.420

0.300

Sinophil Corp.

0.340

0.345

0.335

0.335

923.00

557.00 SM Investments Inc.

980.00

1010.00

970.00

995.00

2.71

1.13

Solid Group Inc.

2.34

2.34

2.28

2.31

1.57

1.04

South China Res. Inc.

1.19

1.24

1.19

1.19

0.620

0.255

Wellex Industries

0.3000

0.3000

0.2950

0.3000

0.850

0.330

Zeus Holdings

0.560

0.570

0.540

0.540

PROPERTY

48.00

15.00

Anchor Land Holdings Inc.

17.10

17.10

17.10

17.10

3.89

2.37

A. Brown Co., Inc.

2.94

2.99

2.91

2.91

0.87

0.43

Araneta Prop `A

1.110

1.160

1.100

1.160

0.195

0.162

Arthaland Corp.

0.205

0.208

0.208

0.208

27.35

15.82

Ayala Land `B

30.40

30.45

30.05

30.30

5.62

4.00

Belle Corp. `A

5.20

5.23

5.16

5.19

9.00

2.51

Cebu Holdings

4.45

5.20

4.40

4.85

2.47

1.35

Century Property

2.10

2.09

2.06

2.06

3.00

1.50

City & Land Dev.

2.35

2.40

2.30

2.30

1.50

1.05

Cityland Dev. `A

1.15

1.15

1.15

1.15

0.092

0.060

Crown Equities Inc.

0.067

0.065

0.065

0.065

1.11

0.76

Cyber Bay Corp.

0.82

0.82

0.81

0.81

1.13

0.60

Empire East Land

1.050

1.050

1.020

1.050

0.435

0.152

Ever Gotesco

0.375

0.385

0.375

0.375

2.48

1.63

Global-Estate

2.17

2.18

2.15

2.18

1.66

1.06

Filinvest Land,Inc.

1.78

1.85

1.76

1.81

2.14

0.72

Interport `A

1.20

1.25

1.15

1.22

4.50

1.60

Keppel Properties

2.85

2.85

2.85

2.85

3.33

1.58

Megaworld Corp.

3.50

3.51

3.37

3.37

0.31

0.145

MRC Allied Ind.

0.1090

0.1110

0.1080

0.1080

0.990

0.240

Phil. Estates Corp.

0.6400

0.6400

0.6200

0.6200

0.67

0.41

Phil. Realty `A

0.510

0.520

0.500

0.520

22.30

11.86

Robinsons Land `B

22.70

22.70

22.00

22.70

7.71

2.35

Rockwell

3.05

3.06

3.03

3.05

3.15

1.98

Shang Properties Inc.

3.10

3.17

3.07

3.17

7.57

5.72

SM Development `A

6.36

6.60

6.28

6.55

18.20

12.10

SM Prime Holdings

18.30

18.50

18.16

18.16

0.84

0.65

Sta. Lucia Land Inc.

0.75

0.78

0.72

0.75

4.55

2.31

Starmalls

3.77

3.74

3.74

3.74

0.64

0.49

Suntrust Home Dev. Inc.

0.580

0.580

0.570

0.580

5.20

2.85

Vista Land & Lifescapes

5.280

5.340

5.270

5.330

SERVICES

42.00

24.10

ABS-CBN

40.70

40.70

39.70

39.90

18.98

1.05

Acesite Hotel

1.37

1.42

1.37

1.37

0.88

0.60

APC Group, Inc.

0.880

0.900

0.870

0.870

10.92

7.60

Asian Terminals Inc.

12.60

12.62

12.50

12.60

28.00

17.50

Berjaya Phils. Inc.

31.00

28.10

28.10

28.10

63.90

8.13

Bloomberry

14.22

14.16

14.00

14.10

0.2420

0.1010 Boulevard Holdings

0.1310

0.1380

0.1300

0.1350

24.00

3.65

Calata Corp.

3.84

3.90

3.75

3.79

77.00

52.40

Cebu Air Inc. (5J)

63.90

67.50

63.60

67.00

12.50

9.70

Centro Esc. Univ.

11.50

11.94

11.50

11.94

9.70

4.00

DFNN Inc.

4.60

4.60

4.50

4.60

5.47

1.80

Easy Call Common

2.75

2.90

2.75

2.90

1750.00

800.00 FEUI

1060.00

1060.00

1052.00

1052.00

1270.00

990.00 Globe Telecom

1187.00

1196.00

1185.00

1190.00

11.00

6.63

GMA Network Inc.

9.64

9.80

9.65

9.80

77.00

54.00

I.C.T.S.I.

77.10

80.00

77.10

78.90

0.98

0.36

Information Capital Tech.

0.425

0.435

0.425

0.425

18.40

5.00

Imperial Res. `A

5.65

5.25

5.25

5.25

10.00

4.65

IPeople Inc. `A

9.50

9.50

8.82

9.10

4.70

1.75

IP Converge

4.10

4.10

4.01

4.02

22.00

0.019

IP E-Game Ventures Inc.

0.023

0.024

0.023

0.023

1.65

0.54

IPVG Corp.

0.66

0.68

0.66

0.66

0.0850

0.040

Island Info

0.0510

0.0530

0.0510

0.0530

3.4400

2.170

ISM Communications

2.1700

2.3800

2.2600

2.3800

9.90

6.28

Leisure & Resorts

9.31

9.25

9.18

9.20

3.46

2.28

Liberty Telecom

2.40

2.40

2.40

2.40

2.65

1.05

Lorenzo Shipping

1.30

1.55

1.55

1.55

3.96

2.70

Macroasia Corp.

2.65

2.70

2.50

2.70

0.84

0.60

Manila Bulletin

0.80

0.80

0.74

0.80

4.08

1.34

Manila Jockey

2.77

2.78

2.71

2.75

22.95

13.78

Pacific Online Sys. Corp.

14.00

13.98

13.98

13.98

3.47

1.49

Paxys Inc.

2.87

2.88

2.83

2.86

12.00

7.15

Phil. Racing Club

10.54

10.70

10.42

10.70

98.00

21.00

Phil. Seven Corp.

103.90

103.90

103.00

103.00

17.88

12.10

Philweb.Com Inc.

14.26

14.24

14.16

14.22

2886.00

2096.00 PLDT Common

2880.00

2918.00

2880.00

2912.00

0.39

0.27

PremiereHorizon

0.330

0.330

0.330

0.330

34.45

17.90

Puregold

36.20

36.50

35.75

36.00

STI Holdings

1.03

1.03

1.01

1.02

14.18

3.30

Touch Solutions

8.99

13.38

9.02

13.36

0.72

0.35

Waterfront Phils.

0.420

0.425

0.415

0.425

4.50

1.14

Yehey

1.410

1.420

1.380

1.380

MINING & OIL

0.0070

0.0039 Abra Mining

0.0055

0.0055

0.0053

0.0054

6.20

4.01

Apex `A

4.57

4.58

4.55

4.58

6.22

3.00

Apex `B

4.95

4.60

4.60

4.60

19.82

16.80

Atlas Cons. `A

22.25

22.30

21.95

22.05

48.00

10.00

Atok-Big Wedge `A

23.45

23.00

22.10

23.00

0.345

0.210

Basic Energy Corp.

0.285

0.290

0.280

0.285

29.00

18.60

Benguet Corp `A

18.80

18.74

18.74

18.74

2.12

0.82

Century Peak Metals Hldgs

0.99

0.99

0.99

0.99

1.68

1.02

Coal Asia

0.92

0.93

0.91

0.92

61.80

12.10

Dizon

15.00

15.40

14.72

15.10

1.21

0.48

Geograce Res. Phil. Inc.

0.52

0.53

0.51

0.52

1.79

0.8600 Lepanto `A

1.170

1.160

1.140

1.160

2.070

0.9200 Lepanto `B

1.270

1.270

1.250

1.270

0.085

0.047

Manila Mining `A

0.0650

0.0650

0.0640

0.0650

0.087

0.047

Manila Mining `B

0.0710

0.0720

0.0700

0.0700

36.50

15.78

Nickelasia

21.50

21.70

20.75

21.00

12.84

4.70

Nihao Mineral Resources

3.90

0.49

3.85

3.96

1.100

0.008

Omico

0.6400

0.5800

0.5600

0.5800

8.40

3.07

Oriental Peninsula Res.

3.350

3.410

3.350

3.360

0.032

0.016

Oriental Pet. `A

0.0230

0.0240

0.0220

0.0230

0.033

0.017

Oriental Pet. `B

0.0240

0.0250

0.0240

0.0250

7.05

5.62

Petroenergy Res. Corp.

6.61

7.24

6.77

6.83

27.85

12.52

Philex `A

18.10

18.360

17.880

18.34

48.00

8.50

PhilexPetroleum

33.00

33.70

33.00

33.50

0.062

0.024

Philodrill Corp. `A

0.044

0.046

0.044

0.045

257.80

200.00 Semirara Corp.

250.00

250.00

247.00

250.00

0.028

0.014

United Paragon

0.0180

0.0180

0.0180

0.0180

PREFERRED

50.00

22.65

ABS-CBN Holdings Corp.

43.00

43.00

41.30

43.00

580.00

505.00 Ayala Corp. Pref `A

520.00

522.00

522.00

522.00

105.50

100.00 First Gen G

105.00

104.90

104.90

104.90

108.00

101.00 First Phil. Hldgs.-Pref.

101.40

101.50

101.30

101.50

11.02

6.52

GMA Holdings Inc.

10.12

10.18

10.06

10.18

116.70

104.10 PCOR-Preferred

107.60

107.60

107.60

107.60

SMC Preferred A

75.00

75.00

74.95

75.00

79.50

73.00

SMC Preferred B

75.25

75.25

75.15

75.15

SMC Preferred C

76.45

76.30

76.30

76.30

1050.00

1000.00 SMPFC Preferred

1040.00

1035.00

1020.00

1028.00

1.92

0.96

Swift Pref

1.47

1.30

1.30

1.30

WARRANTS & BONDS

2.28

0.68

Megaworld Corp. Warrants

2.41

2.49

2.35

2.35

SME

11.88

4.21

Ripple E-Business Intl

7.65

9.10

7.80

7.80

77.10

100.00

1.82

595.00

2.20

23.90

32.95

22.00

0.95

3.25

39.20

104.90

3.06

96.20

109.00

500.00

60.00

169.10

1100.00

140.00

2.70

57.30

56.60

0.68

48.00

1.60

17.90

18.50

7.95

0.62

2.00

3.00

71.75

1.69

59.00

71.80

239.00

29.75

100.00

879.00

69.00

1.71

Banco de Oro Unibank Inc.

Bank of PI

Bankard, Inc.

China Bank

BDO Leasing & Fin. Inc.

COL Financial

Eastwest Bank

Filipino Fund Inc.

First Abacus

I-Remit Inc.

Maybank ATR KE

Metrobank

Natl Reinsurance Corp.

Phil. National Bank

Phil. Savings Bank

PSE Inc.

RCBC `A

Security Bank

Sun Life Financial

Union Bank

Vantage Equities

81.80

102.80

0.96

56.60

2.00

18.98

31.40

11.50

0.82

2.90

24.65

107.50

1.98

99.00

107.00

460.00

67.90

176.00

1090.00

121.00

2.53

Close Change Volume

Net Foreign

Trade/Buying

1.53

1.95

(2.08)

0.00

0.00

(0.95)

(0.48)

13.04

3.66

0.69

0.41

(1.30)

0.51

0.00

1.87

0.00

(2.80)

(0.91)

0.00

(0.58)

(0.40)

13,071,190

1,184,760

2,548,000

292,810

201,000

624,100

1,181,800

5,400

20,000

13,000

19,400

2,812,300

265,000

623,470

5,120

13,500

446,940.00

501,830

115

230,590

126,000

141,779,431.00

(1,649,535.00)

(0.13)

0.65

0.00

0.00

0.21

(6.18)

(0.67)

(0.18)

1.26

0.55

(0.15)

0.00

0.58

1.82

2.16

0.00

(0.74)

3.70

7.58

(0.89)

(0.87)

4.69

(0.71)

1.73

(0.28)

(0.28)

3.57

0.44

(0.07)

11.11

12.67

2.38

1.79

(2.94)

0.37

(0.61)

0.44

0.00

0.00

(0.59)

14.04

0.57

0.68

1.18

(5.85)

0.00

(1.29)

4.12

1.67

(0.63)

2,357,900

47,900

357,000

1,485,000

27,900

1,000

42,000

29,700

21,741,500

28,618,400

2,891,100

28,000

3,803,600

1,392,540

50,900

82,100,000

73,600

79,000

1,141,000

851,380

1,266,400

1,647,000

1,290,900

97,500

16,700

1,634,200

147,500

1,232,100

296,760

4,000

100

8,964,800

21,331,000

14,900

428,300

4,926,000

7,000

236,000

41,000

590,140

440,800

322,000

230,000

18,000

86,357,000

1,781,680

4,244,000

1,922,000

12,700

527,000

34,528,690.00

(77,220.00)

3,860.00

0.00

0.88

(2.48)

3.54

(1.27)

0.53

2.00

(2.04)

(0.97)

0.35

(1.82)

1.48

0.44

0.00

1.30

0.00

(18.43)

8.51

1.80

3.09

8.62

(1.50)

(1.68)

3.45

4.50

0.00

(2.90)

3.59

(2.65)

(1.47)

1.53

(1.28)

0.00

0.00

(3.57)

536,000

1,210,480

504,140,000

16,667,400

425,000

360,800

95,500

129,000

354,000

477,940

2,618,430

2,417,100

210,000

112,850

1,577,900

1,921,700

500

25,000

4,878,200

4,212,000

7,992,000

1,392,000

35,360,900

1,840,300

9,700

1,850,000

1,877,000

5,000

124,000

110,000

870,390

1,292,000

47,000

140,000

6,771,000

68,000.00

25,600,583.50

(320,000.00)

168,838,658.00

0.00

(1.02)

4.50

1.46

(0.33)

(0.19)

8.99

(1.90)

(2.13)

0.00

(2.99)

(1.22)

0.00

0.00

0.46

1.69

1.67

0.00

(3.71)

(0.92)

(3.13)

1.96

0.00

0.00

2.26

2.99

(0.77)

0.00

(0.80)

0.00

0.95

500

555,000

5,383,000

10,000

8,268,400

4,042,600

5,698,000

5,771,000

91,000

5,000

3,000,000

464,000

13,790,000

1,120,000

13,600,000

47,745,000

1,804,000

5,000

101,903,000

3,880,000

3,643,000

900,000

3,846,500

308,000

728,000

11,079,700

10,237,300

3,734,000

2,000

439,000

10,737,300

(1.97)

0.00

(1.14)

0.00

(9.35)

(0.84)

3.05

(1.30)

4.85

3.83

0.00

5.45

(0.75)

0.25

1.66

2.33

0.00

(7.08)

(4.21)

(1.95)

0.00

0.00

3.92

9.68

(1.18)

0.00

19.23

1.89

0.00

(0.72)

(0.14)

(0.35)

1.52

(0.87)

(0.28)

1.11

0.00

(0.55)

(0.97)

48.61

1.19

(2.13)

103,900

379,000

9,665,000

52,200

300

9,924,300

183,570,000

1,141,000

1,699,100

3,000

91,000

9,000

590

122,570

629,300

2,069,020

50,000

500

60,400

136,000

75,600,000

417,000

460,000

168,000

2,503,500

2,000

6,000

3,000

64,000

411,000

6,200

310,000

142,500

10,520

4,386,400

110,670

83,000

5,110,200

7,895,000

4,933,400

370,000

79,000

(1.82)

380,000,000

0.22

91,000

(7.07)

10,000

(0.90)

1,075,800

(1.92)

9,200

0.00

3,660,000

(0.32)

500

0.00

225,000

0.00

5,154,000

0.67

145,600

0.00

4,640,000

(0.85)

10,801,000

0.00

11,111,000

0.00

220,790,000

(1.41)

138,110,000

(2.33)

3,211,800

1.54

5,637,000

(9.38)

269,000

0.30

1,263,000

0.00

889,200,000

4.17

44,100,000

3.33

927,500

1.33

4,928,100

1.52

399,500

2.27

691,500,000

0.00

304,150

0.00

117,300,000

#VALUE!

0.00

257,800

0.38

200

(0.10)

650

0.10

410

0.59

740,300

0.00

360

0.00

545,180

(0.13)

13,470

(0.20)

2,000

(1.15)

5,000

(11.56) 2,000

(2.49)

23,000

1.96

8,000

(8,297,819.50)

2,790,000.00

(2,678,350.00)

(98,230,621.00)

6,839,917.00

(31,820.00)

(7,865,474.50)

14,534,468.00

4,456,962.00

(122,050.00)

(23,703,431.00)

95,562,657.00

16,070,208.00

15,389,340.00

18,900,406.00

(500,850.00)

733,702.00

696,880.00

5,400.00

(22,304.00)

7,000.00

(2,872,360.00)

20,699,386.00

18,239,624.00

845.00

2,453,712.00

(3,841,428.00)

2,012,520.00

12,279,750.00

19,368,507.00

548,690.00

29,600.00

12,420,900.00

100,230,984.50

(2,597,450.00)

51,000.00

11,460.00

(1,020.00)

86,527,850.00

(64,092,563.00)

3,326,330.00

38,885,195.00

(5,327,045.00)

13,382,170.00

63,000.00

(79,541,648.00)

28,540.00

507,215,770.00

(9,280.00)

201,600.00

(515,420.00)

333,440.00

(66,688,660.00)

4,364,738.00

3,208,500.00

82,400.00

(5,750.00)

1,068,280.00

9,151,510.00

10,939,950.00

(47,008,470.00)

87,200.00

62,000.00

4,277,480.00

10,483,227.00

35,316,564.00

(2,352,810.00)

29,581,809.00

30,360.00

(17,800.00)

133,036.00

(16,149,254.00)

42,100.00

37,800.00

37,181,499.00

(4,500.00)

(1,652,685.00)

1,677,560.00

21,350.00

(3,800.00)

(724,500.00)

33,000.00

55,486.00

221,720.00

(27,014.00)

(14,308,358.00)

56,304,550.00

50,439,760.00

(25,500.00)

4,499,224.00

54,000.00

(187,470.00)

9,200.00

30,000.00

104,000.00

412,560.00

(2,768,505.00)

977,860.00

4,795,428.00

2,311,145.00

(126,000.00)

(3,087,794.00)

657,685.00

(30,450.00)

3,981,944.00

Das könnte Ihnen auch gefallen

- Logo QuizDokument16 SeitenLogo Quiz다네Noch keine Bewertungen

- Call CenterDokument7 SeitenCall CenterJadeAsurtoNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (March 21, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (March 21, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (October 1, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (October 1, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - August 24, 2012 IssueDokument1 SeiteManila Standard Today - August 24, 2012 IssueManila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (March 19, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (March 19, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (November 27, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (November 27, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (April 18, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (April 18, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 27, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 27, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (May 21, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (May 21, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (May 25, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (May 25, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (July 26, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (July 26, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 4, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 4, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (October 22, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (October 22, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 26, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 26, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (October 16, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (October 16, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (May 29, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (May 29, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (January 30, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (January 30, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (July 31, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (July 31, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (February 11, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (February 11, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (April 12, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (April 12, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (May 04, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (May 04, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (May 30, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (May 30, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (February 7, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (February 7, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stock Review (September 27, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stock Review (September 27, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (November 21, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (November 21, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (May 16, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (May 16, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 12, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 12, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (June 15, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (June 15, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (January 23, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (January 23, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (November 19, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (November 19, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (January 11, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (January 11, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (June 22, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (June 22, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (February 22, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (February 22, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (June 8, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (June 8, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (March 14, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (March 14, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (January 16, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (January 16, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (October 29, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (October 29, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 14, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 14, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (November 20, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (November 20, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (April 24, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (April 24, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (April 25, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (April 25, 2012)Manila Standard TodayNoch keine Bewertungen

- Stocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Dokument3 SeitenStocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Marcus AmabaNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (April 10, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (April 10, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 6, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 6, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (March 23, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (March 23, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stock Review (September 26, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stock Review (September 26, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stock Review (September 28, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stock Review (September 28, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (February 6, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (February 6, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 28, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 28, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (May 31, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (May 31, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (April 13, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (April 13, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (March 21, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (March 21, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (April 19, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (April 19, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (May 11, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (May 11, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (April 19, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (April 19, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (April 11, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (April 11, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (April 27, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (April 27, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (March 27, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (March 27, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 19, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 19, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (September 18, 2012)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (September 18, 2012)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 23, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 23, 2014)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (June 8, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (June 5, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (June 9, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (June 9, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (June 3, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 15, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 7, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (June 2, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (February 5, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (February 5, 2014)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (June 4, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 29, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 29, 2015)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Dokument1 SeiteManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 26, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 20, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 22, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 7, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Dokument1 SeiteManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 25, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 15, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 18, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 7, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 11, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stock Review (May 08, 2015)Dokument1 SeiteManila Standard Today - Business Daily Stock Review (May 08, 2015)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (July 3, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (July 3, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 12, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 12, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 13, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 7, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 5, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 6, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNoch keine Bewertungen

- Idea1 MDC Conzace BOTO 2023 AllocationDokument20 SeitenIdea1 MDC Conzace BOTO 2023 Allocationbadeth.bandejasNoch keine Bewertungen

- Philippine Stock Market Buy Below Price ReportDokument4 SeitenPhilippine Stock Market Buy Below Price ReportAngelo LunaNoch keine Bewertungen

- Latest SC Cases ObliDokument5 SeitenLatest SC Cases ObliMaan LucsNoch keine Bewertungen

- South Luzon RegcrisDokument117 SeitenSouth Luzon RegcrisBalay GutierrezNoch keine Bewertungen

- AirPassCarAnnual2022 As of Feb 2023Dokument34 SeitenAirPassCarAnnual2022 As of Feb 2023Diyo NagamoraNoch keine Bewertungen

- Cem Registry October 31 2023Dokument42 SeitenCem Registry October 31 2023dexterbautistadecember161985Noch keine Bewertungen

- PLDT Area CodesDokument53 SeitenPLDT Area Codesjosh0% (1)

- Cheque Request SummaryDokument6 SeitenCheque Request SummaryPaul LeeNoch keine Bewertungen

- Pal Domestic Flight Schedules - May 2013Dokument6 SeitenPal Domestic Flight Schedules - May 2013Rolando DaclanNoch keine Bewertungen

- Philippine Airlines and PAL Express Flight ScheduleDokument2 SeitenPhilippine Airlines and PAL Express Flight ScheduleJohn Paul M. MoradoNoch keine Bewertungen

- Index of Advertisers UpdatedDokument8 SeitenIndex of Advertisers UpdatedjamNoch keine Bewertungen

- The Philippine Stock Exchange, Inc. Daily Quotation Report: December 27, 2021Dokument11 SeitenThe Philippine Stock Exchange, Inc. Daily Quotation Report: December 27, 2021craftersxNoch keine Bewertungen

- Fault zone service records reportDokument65 SeitenFault zone service records reportRey ValenzuelaNoch keine Bewertungen

- PESONet ParticipantsDokument2 SeitenPESONet ParticipantsKylene Maranan VillamarNoch keine Bewertungen

- List of Banks (Private Domestic)Dokument4 SeitenList of Banks (Private Domestic)Judil BanastaoNoch keine Bewertungen

- PPC List (Names)Dokument8 SeitenPPC List (Names)gcardinoza5150Noch keine Bewertungen

- STOCKS Listed CompaniesDokument6 SeitenSTOCKS Listed CompaniesgheecelmarkNoch keine Bewertungen

- Civil Aviation Authority of The Philippines Aerodrome Development & Management ServiceDokument32 SeitenCivil Aviation Authority of The Philippines Aerodrome Development & Management ServiceJelly Rose GonzalesNoch keine Bewertungen

- 2 Alorica Shuttle Service March 29-April 4 AM SHIFTDokument2 Seiten2 Alorica Shuttle Service March 29-April 4 AM SHIFTRafael John Guiraldo OaniNoch keine Bewertungen

- MD NAME ListDokument27 SeitenMD NAME ListNovelyn DalumpinesNoch keine Bewertungen

- Negotiable Instruments Case DigestDokument3 SeitenNegotiable Instruments Case DigestJr MateoNoch keine Bewertungen

- ClientsDokument2 SeitenClientsRicardo Delacruz100% (1)

- PSBank Home Loan - List Accredited DevelopersDokument2 SeitenPSBank Home Loan - List Accredited DevelopersAlora Uy Guerrero0% (1)

- Metrobank Holiday Full ScheduleDokument15 SeitenMetrobank Holiday Full ScheduleTheSummitExpressNoch keine Bewertungen

- Dev Phil 1Dokument102 SeitenDev Phil 1EyegateNoch keine Bewertungen

- Sources of Obligation (Art 1157 - 1162)Dokument9 SeitenSources of Obligation (Art 1157 - 1162)Mariz EreseNoch keine Bewertungen

- Kempal Construction and Supply Corporation 200-105-729-0000 Summary of Sales For The Year 2020Dokument162 SeitenKempal Construction and Supply Corporation 200-105-729-0000 Summary of Sales For The Year 2020Pajarillo Kathy AnnNoch keine Bewertungen

- Date Mm/dd/yyyy Name of Customer Bank Check # AmountDokument2 SeitenDate Mm/dd/yyyy Name of Customer Bank Check # AmountDerick DalisayNoch keine Bewertungen