Beruflich Dokumente

Kultur Dokumente

Accounting Principles

Hochgeladen von

aumit0099Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting Principles

Hochgeladen von

aumit0099Copyright:

Verfügbare Formate

OXFORD CAMBRIDGE AND RSA EXAMINATIONS Advanced Subsidiary GCE

ACCOUNTING

Unit F011: Accounting Principles Specimen Mark Scheme The maximum mark for this paper is 80.

F011MS

This document consists of 7 printed pages and 1 blank page.

SP (SLM) T12103 OCR 2007 [QAN 500/2302/0] OCR is an exempt Charity

[Turn Over

2 INSTRUCTIONS TO EXAMINERS Own Figure Rule (of) Where of is indicated, a figure which is incorrect solely because of an error in an earlier part of the question may be awarded the appropriate marks as if it were correct. Quality of Written Communication The rubric states: *In these two questions/sub-questions, you will be assessed on the quality of your written communication. In one of these questions, the focus will be on your ability to present numerical information legibly and in an appropriate accounting format. In the other, you will be assessed on the legibility and style of writing, the clarity and coherence of your arguments and the accuracy of your spelling, punctuation and grammar. 4% of the paper marks are available for rewarding Quality of Written Communication, as follows: Levels of Response for Numerical Questions Level 2 Mark 2 Description Almost all account headings, terms and balances are included appropriately and in line with accounting conventions. Figures are legible with effective use made of columns and sub-totals. Accounts are ruled off as appropriate. Some account headings, terms and balances are included though not always adhering to accounting conventions. Most figures are legible. Some appropriate use is made of columns and sub-totals. Some accounts are ruled off as appropriate. Responses which fail to achieve the standard required for Level 1.

1 0

Levels of Response for Narrative Questions Level Mark Description Ideas, some complex, are expressed clearly and quite fluently, using an appropriate style of writing. Arguments made are generally relevant and are constructed in a logical and coherent manner. There are few errors of spelling, punctuation and grammar, and those that are made are not intrusive and do not obscure meaning. Relatively straightforward or simple ideas are expressed in a generally appropriate style of writing which sometimes lacks clarity or fluency. Arguments have some limited coherence and structure, occasionally showing relevance to the main focus of the question. There are errors of spelling, punctuation and grammar which are noticeable and sometimes intrusive but do not totally obscure meaning. Responses which fail to achieve the standard required for Level 1.

3 Questio n Number 1* Max Mark

Answer

Scarlett Trading and Profit and Loss Account for the year ended 31 December 2006 Sales Sales returns Opening stock Purchases Drawings Purchase returns Closing stock Cost of sales Gross Profit Discounts received Commission received Discounts allowed Carriage outwards Motor expenses Salaries (31,500 + 600) General expenses (28,350 - 450 - 3,000) Insurance Loan interest (2,750 + 250) Bad debts Provision for doubtful debts Depreciation premises Depreciation motor vehicles Depreciation office equipment Net Profit 900 1,500 10,000 32,100 24,900 7,000 3,000 150 50 2,100 10,500 2,800 [1] [1] [1] [2] [3] [1] [2] [1] [2] [1] [1] [2] 95,000 89,750 20,500 173,000 193,500 6,000 4,000 183,500 16,500 [1] 167,000 181,000 1,000 2,750 184,750 [1] [2] [1] [1] [1] [1] 356,000 8,000 348,000 [1]

4 Questio n Number 1* contd Max Mark

Answer

Balance Sheet as at 31 December 2006

Fixed Assets Premises Motor vehicles Office equipment 92,400 31,500 16,200 140,100 Current Assets Stock Debtors (15,000 300) General expenses prepaid Commission receivable owing Bank Current Liabilities Creditors Loan interest accrued Salaries accrued 10% Loan Working capital Long Term Liabilities 10% Loan Financed by: Capital Net Profit Drawings (7,000 + 6,000) 60,000 89,750 149,750 13,000 136,750 [2] [1] [1of] 15,000 136,750 [1] 13,300 250 600 15,000 [1] [1] [1] [1] 29,150 11,650 151,750 16,500 14,700 450 250 8,900 40,800 [1] [2] [1] [1] [1] [2][1of]

NB Up to an additional two marks can be awarded for the candidates quality of written communication (numerical responses) Total Marks [46]

5 Question Number 2(a) Bal b/d 255,000 255,000 Provision for depreciation Machinery Disposal Bal c/d [1] 66,000 48,500 114,500 (16,500 + 3,000 = 19,500) Disposal of Machinery Machinery 90,000 [1] Depn Machinery Bank Profit & Loss [1] 90,000 Office Equipment Bal b/d Bank 110,000 36,000 146,000 [1] [1] 146,000 [3] Provision for depreciation Office Equipment 50,800 50,800 (11,000 + 1,800 = 12,800) 2(b)* Straight line is easy to calculate and therefore less chance of any error. It provides an equal amount of depreciation each year to be charged to the profit and loss account. It is useful for assets that reduce in value evenly throughout their life. An appropriate method for Office Equipment. Straight line may not be appropriate for Machinery as it does not lose value evenly throughout its life. Reducing balance may be a more appropriate method for Machinery, as it should be used for assets that have a heavier fall in value in the earlier years and less in later years, low repairs and maintenance in the early years which will increase in later years. 2 x 3 marks 1 for point plus up to 2 for development NB Up to an additional two marks can be awarded for the candidates quality of written communication (narrative responses) [8] [1] [1] Bal b/d Profit and Loss 38,000 12,800 50,800 [4] [1] [1] Bal c/d 146,000 [1] 66,000 16,000 8,000 90,000 [5] [1] [1] [1] [1] Bal b/d Profit and Loss 95,000 19,500 114,500 [5] [1] [2](1of) [1] Max Mark 90,000 165,000 255,000 [3] [1] [1]

Answer Machinery Disposal Bal c/d

6 Question Number 2(c) Max Mark

Answer

Depreciation does not provide funds for replacement of an asset, there is no movement of cash. It is a book-keeping entry, debit profit and loss, credit provision for depreciation. Depreciation is an application of the accruals concept, it is matched with the benefit a fixed asset provides over a period. It spreads the cost over the useful life of the asset. 2 x 3 marks 1 for point plus up to 2 for development Total Marks Paper Total [6] [34] [80]

7 Assessment Objectives Grid (includes QWC) Question 1* 2(a) 2(b)* 2(c) Totals * Includes QWC AO1 18 6 0 0 24 AO2 28 6 2 0 36 AO3 10 8 6 6 20 Total 46 20 8 6 80

8 [BLANK PAGE]

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Secimen: Advanced Gce AccountingDokument8 SeitenSecimen: Advanced Gce Accountingaumit0099Noch keine Bewertungen

- Accounting ApplicationsDokument8 SeitenAccounting Applicationsaumit0099Noch keine Bewertungen

- Articles - Harvard Business Review - Mckinsey Awards For Best HBR ArticlesDokument7 SeitenArticles - Harvard Business Review - Mckinsey Awards For Best HBR ArticlesSandeepSingh67% (3)

- Accounting PrinciplesDokument12 SeitenAccounting Principlesaumit0099Noch keine Bewertungen

- Accounting PrinciplesDokument8 SeitenAccounting Principlesaumit0099Noch keine Bewertungen

- C - M GC: Ase Study C OmputersDokument3 SeitenC - M GC: Ase Study C Omputersaumit0099Noch keine Bewertungen

- Erratum Notice: Igcse Economics Syllabus 0455 O Level Economics Syllabus 2281 4. Curriculum ContentDokument1 SeiteErratum Notice: Igcse Economics Syllabus 0455 O Level Economics Syllabus 2281 4. Curriculum Contentaumit0099Noch keine Bewertungen

- Cadbury ReoprtDokument4 SeitenCadbury Reoprtaumit0099Noch keine Bewertungen

- Cadbury ReoprtDokument4 SeitenCadbury Reoprtaumit0099Noch keine Bewertungen

- International MarketingDokument15 SeitenInternational Marketingaumit0099Noch keine Bewertungen

- Case StudyDokument3 SeitenCase Studyaumit0099Noch keine Bewertungen

- GamepayDokument1 SeiteGamepayaumit0099Noch keine Bewertungen

- Case StudyDokument3 SeitenCase Studyaumit0099Noch keine Bewertungen

- GamepayDokument1 SeiteGamepayaumit0099Noch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- BOQ 412692eDokument126 SeitenBOQ 412692erohitNoch keine Bewertungen

- FA Class SlidesDokument172 SeitenFA Class Slidesjohn100% (1)

- Case On Bond EvaluationDokument12 SeitenCase On Bond EvaluationZubairia Khan86% (14)

- Financial LiteracyDokument7 SeitenFinancial LiteracyRochelle Ann Galvez Gabaldon100% (1)

- GR+XII +Chapter++Test +National+IncomeDokument7 SeitenGR+XII +Chapter++Test +National+IncomeAkshatNoch keine Bewertungen

- BPI v. Sarabia Manor1111Dokument3 SeitenBPI v. Sarabia Manor1111Nadine Reyna CantosNoch keine Bewertungen

- Interest Rate Risk Management PDFDokument2 SeitenInterest Rate Risk Management PDFHARSHALRAVALNoch keine Bewertungen

- Interest Rate Swap DiagramDokument1 SeiteInterest Rate Swap DiagramTheGreatDealerNoch keine Bewertungen

- Trefi PresentationDokument16 SeitenTrefi PresentationLuis Miguel Garrido MarroquinNoch keine Bewertungen

- Inside The House of MoneyDokument3 SeitenInside The House of Moneyvlx82Noch keine Bewertungen

- Local Media1577402990991204520Dokument3 SeitenLocal Media1577402990991204520KsUnlockerNoch keine Bewertungen

- Cost of Captial MCQDokument5 SeitenCost of Captial MCQAbhishek Sinha50% (4)

- FAFDokument8 SeitenFAFShaminiNoch keine Bewertungen

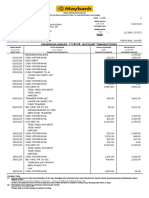

- Monthly Statement: This Month's SummaryDokument4 SeitenMonthly Statement: This Month's SummaryRavi WaghmareNoch keine Bewertungen

- Mod 2 Income Management-3Dokument13 SeitenMod 2 Income Management-3Shruti b ahujaNoch keine Bewertungen

- John Maynard Keynes The General Theory of Employment Interest and Money A Critique by Brett DiDonatoDokument23 SeitenJohn Maynard Keynes The General Theory of Employment Interest and Money A Critique by Brett DiDonatosoyouthinkyoucaninvest100% (1)

- 15 International FinanceDokument16 Seiten15 International FinanceRishabh SehrawatNoch keine Bewertungen

- Pledging of ReceivablesDokument2 SeitenPledging of ReceivablesPrince Alexis GarciaNoch keine Bewertungen

- Comparison Report On HIL, Everest and Visaka IndustriesDokument4 SeitenComparison Report On HIL, Everest and Visaka IndustriesHItesh priyhianiNoch keine Bewertungen

- Reo Rit - Fringe Benefits TaxDokument6 SeitenReo Rit - Fringe Benefits TaxJohn MaynardNoch keine Bewertungen

- Chap 18 Capital Budgeting ExercisesDokument48 SeitenChap 18 Capital Budgeting ExercisesVanessa Khodr50% (4)

- FASW - Consolidated FS - 31 Dec 2021 (Audited)Dokument70 SeitenFASW - Consolidated FS - 31 Dec 2021 (Audited)anon_344878694Noch keine Bewertungen

- Do Soaring Price and Mounting Demand in Indian Gold Market Speak of A Paradox?Dokument20 SeitenDo Soaring Price and Mounting Demand in Indian Gold Market Speak of A Paradox?Suhaas SharmaNoch keine Bewertungen

- ICBC Presentation 09Dokument24 SeitenICBC Presentation 09AhmadNoch keine Bewertungen

- Example of Muet WritingDokument6 SeitenExample of Muet WritingZulhelmie ZakiNoch keine Bewertungen

- Laporan Cash Flow ANTAM KomengDokument2 SeitenLaporan Cash Flow ANTAM KomengNiky SuryadiNoch keine Bewertungen

- Pupun01206130000493015 2023Dokument2 SeitenPupun01206130000493015 2023abhishekkumarasr847687Noch keine Bewertungen

- Online StatementDokument3 SeitenOnline StatementLong LeeNoch keine Bewertungen

- BBBY VlmaDokument5 SeitenBBBY VlmaDaniel MedeirosNoch keine Bewertungen

- 112380-237973 20190331 PDFDokument5 Seiten112380-237973 20190331 PDFKutty KausyNoch keine Bewertungen