Beruflich Dokumente

Kultur Dokumente

IRS f13614nr

Hochgeladen von

Martin PetroskyCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IRS f13614nr

Hochgeladen von

Martin PetroskyCopyright:

Verfügbare Formate

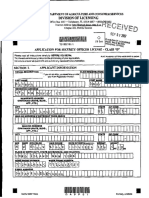

Form 13614NR (Rev.

9-2011)

Nonresident Alien Intake and Interview Sheet

First: Visa #: Passport #:

OMB# 1545-2075 Middle Initial:

Last or Family Name: ITIN or Social Security #: Date of Birth:

(mm/dd/yyyy)

Telephone #:

)

Yes No

e-mail Address: Were you ever a U.S. citizen? Yes No

Were you a U.S. citizen or resident alien the entire year? U.S. Local Street Address: City: Foreign Residence Address: Address Line 2: Foreign Country: Country of Citizenship: Are you married? Are you a: Yes No

State:

Zip Code:

Province/County: Country that issued Passport: If YES, is your spouse in the U.S.? Resident of Mexico No Yes No Yes No

Postal Code:

U.S. National Yes No

Resident of Canada Yes

Resident of South Korea Yes No

Resident of India Yes No

Dependent Information

U.S. citizen, U.S. resident alien, U.S. national, or a resident of Canada, Mexico, or South Korea Did the Did you Did child person provide provide have more than more than Gross 50% of 50% of Income their their own of $3,700 support? support? or more?

First Name

Last Name

Date of Birth (mm/dd/yyyy)

ITIN or SSN

Relationship to you (son, daughter, Months etc.) in U.S.

Did person file joint return?

What is the date you FIRST entered the United States? Entry Immigration Status - Check one: U.S. Immigrant/Permanent Resident H-1 Temporary Employee Other: (List) Current Immigration Status - Check one: U.S. Immigrant/Permanent Resident H-1 Temporary Employee Other: (List)

/

F-2 Spouse or child of Student J-2 Spouse or child of Exchange Visitor

F-1 Student *J-1 Exchange Visitor

F-1 Student *J-1 Exchange Visitor Yes No

F-2 Spouse or child of Student J-2 Spouse or child of Exchange Visitor

Have you ever changed your visa type or U.S. immigration status? If Yes, indicate the date and nature of the change. Enter the type of U.S. visa you held during these years: 2005 2006 2007 2008

/

2009 2010

*If Immigration status is J-1, what is the subtype? Check one: 01 Student 02 Short Term Scholar Form 13614NR (Rev. 9-2011) 05 Professor Other: (List) 12 Research Scholar Department of the Treasury Internal Revenue Service

Catalog Number 39748B

What is the actual primary activity of the visit? Check one: 04 Lecturing 01 Studying in a Degree Program 05 Observing 02 Studying in a Non-Degree Program 03 Teaching 06 Consulting 2005 2006 2007 2008

07 Conducting Research 08 Training 09 Demonstrating Special Skills

10 Clinical Activities 11 Temporary Employment 12 Here with Spouse

Were you present in the United States as a teacher, trainee or student for any part of 2 of the 6 prior calendar years? 2009 2010 Yes No Were you present in the U.S. as a teacher, trainee or student for any part of more than 5 calendar years? How many days (including vacations, nonworkdays and partial days) were you present in the U.S. during: 2009 2010 2011 List the dates you entered and left the United States during 2011:

Date entered United States mm/dd/yyyy Date departed United States mm/dd/yyyy Date entered United States mm/dd/yyyy Date departed United States mm/dd/yyyy

Did you file a U.S. income tax return for any year before 2011? If Yes, give latest year / / Form number filed

Yes

No Yes No No

(d) Amount of exempt income in current tax year

During 2011, did you apply to be a green card holder (lawful permanent resident) of the United States? Do you have an application pending to change your status to lawful permanent resident? 1. Are you claiming the benefits of a U.S. income tax treaty with a foreign country? If Yes, enter the appropriate information in the columns below:

(a) Country (b) Tax Treaty Article

No

Yes

Yes

(c) Number of months claimed in prior tax years

2. Were you subject to tax in a foreign country on any of the income shown in 1(d) above? Information about academic institution you attended in 2011 Name: Address: Name of the director of your academic or specialized program: Address: Telephone Number:

Yes

No

Telephone Number:

During 2011 did you receive:

Scholarships or Fellowship Grants Wages, Salaries or Tips Interest or Dividend Income Distributions from IRA, Pension or Annuity Business Income Unemployment Compensation Capital gains or losses Any Other Income

(gambling, lottery, prizes, awards, rents, royalties, etc.) Form 13614NR (Rev. 9-2011) Yes Yes Yes Yes Yes Yes Yes Yes No No No No No No No No

Did you have:

Casualty or Theft Losses Student Loan Interest State or Local Income Taxes Charitable Contributions Moving Expenses Business Expenses Child/Dependent Care Expenses IRA Contributions

Yes Yes Yes Yes Yes Yes Yes Yes No No No No No No No No

Catalog Number 39748B

Department of the Treasury Internal Revenue Service

Das könnte Ihnen auch gefallen

- IMM5540E (Must Filled)Dokument4 SeitenIMM5540E (Must Filled)arshiya_nawaz7802Noch keine Bewertungen

- Application Form: Newfoundland and Labrador Provincial Nominee Program International Entrepreneur CategoryDokument23 SeitenApplication Form: Newfoundland and Labrador Provincial Nominee Program International Entrepreneur CategoryJigar MokaniNoch keine Bewertungen

- CIT0002EDokument0 SeitenCIT0002EBujar NuhiuNoch keine Bewertungen

- Pre-Application Questionnaire For Immigration To Canada: Personal InformationDokument7 SeitenPre-Application Questionnaire For Immigration To Canada: Personal InformationRahul ChaudharyNoch keine Bewertungen

- Canada Visa FormDokument4 SeitenCanada Visa Formlemuel_queNoch keine Bewertungen

- W-7 FormDokument1 SeiteW-7 FormRaviLifewideNoch keine Bewertungen

- Rose Hudson Workbook Case StudyDokument6 SeitenRose Hudson Workbook Case StudyMary O'KeeffeNoch keine Bewertungen

- Ds160 GuideDokument6 SeitenDs160 GuideRajat PaniNoch keine Bewertungen

- CanadaDokument4 SeitenCanadaBryan MayoralgoNoch keine Bewertungen

- ApplicationSnapshot JAMAICAROYAL-1098202010234104Dokument8 SeitenApplicationSnapshot JAMAICAROYAL-1098202010234104Jamaica Royal100% (1)

- FW 7Dokument1 SeiteFW 7klumer_xNoch keine Bewertungen

- WWW - Irs.gov Pub Irs-PDF Fw7Dokument1 SeiteWWW - Irs.gov Pub Irs-PDF Fw7desikudi9000Noch keine Bewertungen

- NSNP 100 Application FormDokument7 SeitenNSNP 100 Application FormRonaldo HertezNoch keine Bewertungen

- 2012-2013 Texas Application For State Financial Aid (TASFA) : (For House Bill 1403/senate Bill 1528 Students Only)Dokument4 Seiten2012-2013 Texas Application For State Financial Aid (TASFA) : (For House Bill 1403/senate Bill 1528 Students Only)jposada09Noch keine Bewertungen

- NSNP 100 12may2015 EnglishDokument24 SeitenNSNP 100 12may2015 EnglishFarzadNoch keine Bewertungen

- ApplicationDokument5 SeitenApplicationwinston8459Noch keine Bewertungen

- Schedule 1 Background DeclarationDokument4 SeitenSchedule 1 Background DeclarationYlianna ZhukevychNoch keine Bewertungen

- Eof SupplementDokument4 SeitenEof Supplementsonukakandhe007Noch keine Bewertungen

- Imm0008e BUDokument0 SeitenImm0008e BUskyyeisthebestNoch keine Bewertungen

- IMM1344E To keep Scribd a valuable resource for everyone, we require that certain uploads meet a set of quality standards. Among other requirements, you should upload something that is not already on Scribd and that you have permission to use. The best way to make sure what you are uploading will meet our quality standards is to upload something you wrote yourself, which will always be accepted.Dokument7 SeitenIMM1344E To keep Scribd a valuable resource for everyone, we require that certain uploads meet a set of quality standards. Among other requirements, you should upload something that is not already on Scribd and that you have permission to use. The best way to make sure what you are uploading will meet our quality standards is to upload something you wrote yourself, which will always be accepted.Harry H Lee100% (1)

- Description: Tags: GprototypeDokument4 SeitenDescription: Tags: Gprototypeanon-129489Noch keine Bewertungen

- Immigration Flowchart Roadmap To Green CardDokument1 SeiteImmigration Flowchart Roadmap To Green CardAmit Patel100% (1)

- Supporting Information: Results, Please Check The Box in The Pending' Column. PendingDokument6 SeitenSupporting Information: Results, Please Check The Box in The Pending' Column. PendingsuazulianprincessNoch keine Bewertungen

- Application For Naturalization: Part 1. Your Name (The Person Applying For Naturalization)Dokument10 SeitenApplication For Naturalization: Part 1. Your Name (The Person Applying For Naturalization)HKF1971Noch keine Bewertungen

- Student Application 2008Dokument15 SeitenStudent Application 2008mariavrfNoch keine Bewertungen

- Bog FW Form English AccessibleDokument4 SeitenBog FW Form English AccessiblecarlosNoch keine Bewertungen

- Application For Student Finance: This Form Is Also Available FromDokument34 SeitenApplication For Student Finance: This Form Is Also Available FromsgtparishNoch keine Bewertungen

- 1 2014 Application FormDokument2 Seiten1 2014 Application FormDayna BrownNoch keine Bewertungen

- STUDENT FINANCE Applcation FormDokument32 SeitenSTUDENT FINANCE Applcation FormsachinieNoch keine Bewertungen

- Application For Visitor Visa (Temporary Resident Visa) : Validate Clear FormDokument4 SeitenApplication For Visitor Visa (Temporary Resident Visa) : Validate Clear FormJorge Andres AvendañoNoch keine Bewertungen

- Imm 008Dokument26 SeitenImm 008Rizwan HameedNoch keine Bewertungen

- The Internship ApplicationDokument12 SeitenThe Internship ApplicationMuhammad JawadNoch keine Bewertungen

- Uniform Income & Expense Statement: Contact InformationDokument4 SeitenUniform Income & Expense Statement: Contact InformationMaria ENoch keine Bewertungen

- Usa Customer Form Fill UpDokument2 SeitenUsa Customer Form Fill Uptanjina.mahbubNoch keine Bewertungen

- Ds 174 Application FormDokument7 SeitenDs 174 Application FormKhawaja HarisNoch keine Bewertungen

- 2010-11 Application LIU OT ProgramDokument2 Seiten2010-11 Application LIU OT ProgramMeital NaftaliNoch keine Bewertungen

- Work & Travel USA: Application Winter 2012 / 2013Dokument5 SeitenWork & Travel USA: Application Winter 2012 / 2013Miguel AngelNoch keine Bewertungen

- Uk Employment Visa Forms (Vaf2)Dokument21 SeitenUk Employment Visa Forms (Vaf2)MANOJ V RNoch keine Bewertungen

- BOGFWApp 0809Dokument2 SeitenBOGFWApp 0809DVCfinaidNoch keine Bewertungen

- US Internal Revenue Service: f13614Dokument2 SeitenUS Internal Revenue Service: f13614IRSNoch keine Bewertungen

- Pre-Interview QuestionnaireDokument5 SeitenPre-Interview Questionnairebishirmuhammadyuda2140Noch keine Bewertungen

- CIT0001EDokument6 SeitenCIT0001EdphomsNoch keine Bewertungen

- Application Form: Advanced Learning LoanDokument12 SeitenApplication Form: Advanced Learning Loanklumer_xNoch keine Bewertungen

- International Undergraduate Application: Apply - Wcu.eduDokument6 SeitenInternational Undergraduate Application: Apply - Wcu.eduHasen BebbaNoch keine Bewertungen

- Il444 2378BDokument14 SeitenIl444 2378BKevin MccullumNoch keine Bewertungen

- Final 11-14-12cws Jubilee ApplicationDokument5 SeitenFinal 11-14-12cws Jubilee ApplicationAnastasiafynnNoch keine Bewertungen

- Employment Application: Yrs. MoDokument5 SeitenEmployment Application: Yrs. Mospakdaman1Noch keine Bewertungen

- US Immigration Exam Study Guide in English and SpanishVon EverandUS Immigration Exam Study Guide in English and SpanishBewertung: 1 von 5 Sternen1/5 (3)

- US Immigration Exam Study Guide in English and Spanish: Study Guides for the US Immigration Test, #12Von EverandUS Immigration Exam Study Guide in English and Spanish: Study Guides for the US Immigration Test, #12Noch keine Bewertungen

- US Immigration Exam Study Guide in English and Albanian: Study Guides for the US Immigration TestVon EverandUS Immigration Exam Study Guide in English and Albanian: Study Guides for the US Immigration TestNoch keine Bewertungen

- IRAs, 401(k)s & Other Retirement Plans: Strategies for Taking Your Money OutVon EverandIRAs, 401(k)s & Other Retirement Plans: Strategies for Taking Your Money OutBewertung: 4 von 5 Sternen4/5 (18)

- Immigration and Family Law: An Attorney's Toolbox of Best PracticesVon EverandImmigration and Family Law: An Attorney's Toolbox of Best PracticesNoch keine Bewertungen

- US Immigration Exam Study Guide in English and ChineseVon EverandUS Immigration Exam Study Guide in English and ChineseNoch keine Bewertungen

- Grant County v. Vogt (Wisconsin Supreme Court, 7182014) Wi-DriveawayDokument43 SeitenGrant County v. Vogt (Wisconsin Supreme Court, 7182014) Wi-DriveawayMartin PetroskyNoch keine Bewertungen

- Santiago v. E.W. Bliss Co., 2012 IL 111792 111792Dokument23 SeitenSantiago v. E.W. Bliss Co., 2012 IL 111792 111792Martin PetroskyNoch keine Bewertungen

- John Bad Elk v. U.S 177 U.S 529Dokument6 SeitenJohn Bad Elk v. U.S 177 U.S 529Martin PetroskyNoch keine Bewertungen

- Grant County v. Vogt (Wisconsin Supreme Court, 7182014) Wi-DriveawayDokument43 SeitenGrant County v. Vogt (Wisconsin Supreme Court, 7182014) Wi-DriveawayMartin PetroskyNoch keine Bewertungen

- Anti Federalist Papers, The Special EditionDokument334 SeitenAnti Federalist Papers, The Special EditionMartin PetroskyNoch keine Bewertungen

- Town of Castle Rock Colorado v. Gonzales (2004) - US Supreme Court Case That States That Law Enforcement Does NOT Owe A Duty To Protect People From HarmDokument82 SeitenTown of Castle Rock Colorado v. Gonzales (2004) - US Supreme Court Case That States That Law Enforcement Does NOT Owe A Duty To Protect People From HarmMartin PetroskyNoch keine Bewertungen

- Schware v. Board of Bar Examiners 353 US 232 (1957)Dokument15 SeitenSchware v. Board of Bar Examiners 353 US 232 (1957)Martin PetroskyNoch keine Bewertungen

- TRINSEY V PAGLIARO Statements of Counsel Insufficient 1964Dokument2 SeitenTRINSEY V PAGLIARO Statements of Counsel Insufficient 1964Martin Petrosky100% (5)

- John Bad Elk v. U.S 177 U.S 529Dokument6 SeitenJohn Bad Elk v. U.S 177 U.S 529Martin PetroskyNoch keine Bewertungen

- Hurtado v. People of State of California, 110 U.S. 516 (1884)Dokument17 SeitenHurtado v. People of State of California, 110 U.S. 516 (1884)Martin PetroskyNoch keine Bewertungen

- Sims v. AhrensDokument45 SeitenSims v. AhrensMartin PetroskyNoch keine Bewertungen

- Soowal v. Marden 452 - So. - 2d - 625, - 1984 - Fla. - App. - LEXIS - 13935Dokument3 SeitenSoowal v. Marden 452 - So. - 2d - 625, - 1984 - Fla. - App. - LEXIS - 13935Martin Petrosky100% (1)

- McVeigh v. State 205 - Ga. - 326, - 53 - S.E.2d - 462, - 1949 - Ga. - LEXIDokument10 SeitenMcVeigh v. State 205 - Ga. - 326, - 53 - S.E.2d - 462, - 1949 - Ga. - LEXIMartin PetroskyNoch keine Bewertungen

- Union Jack Newspaper - October 2012Dokument16 SeitenUnion Jack Newspaper - October 2012Publisher UJNoch keine Bewertungen

- CERT. OF CANDIDACY - ForDokument13 SeitenCERT. OF CANDIDACY - Forwwe_jhoNoch keine Bewertungen

- Practice Pointers With The Affidavit of Support in Immigration CourtDokument3 SeitenPractice Pointers With The Affidavit of Support in Immigration CourtUmesh HeendeniyaNoch keine Bewertungen

- Advanced Education-Standard Internal FormsDokument646 SeitenAdvanced Education-Standard Internal FormsUnited Conservative Party CaucusNoch keine Bewertungen

- Election Laws Cases (Part 1)Dokument467 SeitenElection Laws Cases (Part 1)heyhottieNoch keine Bewertungen

- Adult ListDokument3 SeitenAdult ListhutuguoNoch keine Bewertungen

- USA Visitor Visa Sponsor DocumentsDokument4 SeitenUSA Visitor Visa Sponsor Documentschdut0172100% (1)

- Publication 54 - IRSDokument44 SeitenPublication 54 - IRSabraham.caaNoch keine Bewertungen

- Macalintal V Comelec - Puno DissentDokument65 SeitenMacalintal V Comelec - Puno DissentCocoy LicarosNoch keine Bewertungen

- V-A-C-, AXXX XXX 523 (BIA Nov. 15, 2017)Dokument17 SeitenV-A-C-, AXXX XXX 523 (BIA Nov. 15, 2017)Immigrant & Refugee Appellate Center, LLCNoch keine Bewertungen

- Application For Permanent Identity Card HKSARDokument2 SeitenApplication For Permanent Identity Card HKSAR李卓倫Noch keine Bewertungen

- SAT ACT: Take ControlDokument4 SeitenSAT ACT: Take ControlgsinghindNoch keine Bewertungen

- UrsuleDokument2 SeitenUrsuleErine Njantang100% (1)

- generateRepPrintout Do PDFDokument1 SeitegenerateRepPrintout Do PDFmarcusolivusNoch keine Bewertungen

- Application Kit: Manitoba Provincial Nominee Program For BusinessDokument51 SeitenApplication Kit: Manitoba Provincial Nominee Program For BusinessMichael JohnsNoch keine Bewertungen

- Living in SeoulDokument248 SeitenLiving in SeoulaphroditeuraniaNoch keine Bewertungen

- Article IVDokument10 SeitenArticle IVPaul Reymon Torregosa MacanipNoch keine Bewertungen

- UnpublishedDokument19 SeitenUnpublishedScribd Government DocsNoch keine Bewertungen

- Verknüpfung Mit Resident PDFDokument2 SeitenVerknüpfung Mit Resident PDFasdNoch keine Bewertungen

- Appt Letter - Checklist For Interview-VisaDokument1 SeiteAppt Letter - Checklist For Interview-VisaMelanie Mijares EliasNoch keine Bewertungen

- Simple Citizenship InterviewDokument2 SeitenSimple Citizenship Interviewapi-250118528Noch keine Bewertungen

- Canada Job ImmegrationDokument4 SeitenCanada Job Immegrationpradipta1984Noch keine Bewertungen

- CARECEN Annual Report 2010Dokument20 SeitenCARECEN Annual Report 2010CARECENNoch keine Bewertungen

- N 400Dokument21 SeitenN 400Paul DalenNoch keine Bewertungen

- Alabama STAR ID BrochureDokument2 SeitenAlabama STAR ID BrochureBen CulpepperNoch keine Bewertungen

- Complaint For Declaratory and Injunctive ReliefDokument71 SeitenComplaint For Declaratory and Injunctive ReliefspiveynolaNoch keine Bewertungen

- Nasir Ali Khan, A059 549 769 (BIA April 26, 2017)Dokument15 SeitenNasir Ali Khan, A059 549 769 (BIA April 26, 2017)Immigrant & Refugee Appellate Center, LLCNoch keine Bewertungen

- Omar Mateen Florida Security Guard RecordsDokument63 SeitenOmar Mateen Florida Security Guard RecordsJason Sickles, Yahoo NewsNoch keine Bewertungen

- Returning Resident Status ApplicationDokument0 SeitenReturning Resident Status ApplicationArmend KasaNoch keine Bewertungen

- Document Checklist: Permanent Residence - Provincial Nominee Program and Quebec Skilled WorkersDokument5 SeitenDocument Checklist: Permanent Residence - Provincial Nominee Program and Quebec Skilled Workersahmadmasood786Noch keine Bewertungen