Beruflich Dokumente

Kultur Dokumente

Icmap Taxation Paper 2012

Hochgeladen von

Rahib KhanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Icmap Taxation Paper 2012

Hochgeladen von

Rahib KhanCopyright:

Verfügbare Formate

INSTITUTE OF COST AND MANAGEMENT ACCOUNTANTS OF PAKISTAN New Fall (E) 2011, April 2012 Examinations

Thursday, the 19th April 2012

BUSINESS TAXATION (S-302) STAGE 3 Time Allowed : 02 Hours 45 Minutes (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) Maximum Marks: 80 Roll No.:

Attempt ALL questions. Answers must be neat, relevant and brief. In marking the question paper, the examiners take into account clarity of exposition, logic of arguments, effective presentation, language and use of clear diagram/ chart, where appropriate. Read the instructions printed inside the top cover of answer script CAREFULLY before attempting the paper. Use of non-programmable scientific calculators of any model is allowed. DO NOT write your Name, Reg. No. or Roll No. anywhere inside the answer script. Question No.1 Multiple Choice Question printed separately, is an integral part of this question paper. Question Paper must be returned to invigilator before leaving the examination hall.

Marks Q.2 (a) In the light of the Section 6 of the Income Tax Ordinance, 2001 relating to Pakistansource royalty and fee for technical services received by a non-resident person, answer the following: (i) At which rate shall the tax be imposed? 01 01 03

(ii) On which amount shall the tax be imposed? (iii) On which types of royalty / fee for technical services this section shall not apply? (b) Section 13 of the Income Tax Ordinance, 2001 deals with the valuation of perquisites provided by an employer for the purposes of computing the income of an employee for a tax year chargeable to tax under the head salary. How the following perquisites shall be treated? (i) Services of a housekeeper, driver, gardener, or other domestic assistant.

02 02 02 02

(ii) Utilities provided by the employer. (iii) Obligation of an employee to repay an amount owing by the employee to another person is paid by the employer. (iv) Loan made to the employee by the employer with no profit payable or the profit payable is less than benchmark rate. (c) Answer the following as per Section 16 of the Income Tax Ordinance, 2001: (i) Mr. Abubakar rented out his flat to Mr. Munnaf. At the time of rent agreement Mr. Abubakar received an amount from the tenant, which is not adjustable against monthly rent. How this amount shall be treated?

02

(ii) If on termination of the tenancy, the above mentioned amount is refunded to the tenant before expiry of ten years and the house is not let out to any other person, how this situation shall be treated? (iii) Where the circumstances as mentioned in (ii) above occur and the property is let out to another person (succeeding tenant) and from the succeeding tenant an amount is received which is not adjustable against rent, how the refund of the deposit of old tenant and the receipt of the new deposit shall be treated?

02

03

PTO

1 of 3

BT-Apr.2012

Q.3 (a) As per Section 29 of the Income Tax Ordinance, 2001 relating to Bad Debts reply the following: (i) Under what conditions a person shall be allowed deduction for bad debts in a tax year?

Marks

04 01 04

(ii) What will be the maximum amount of deduction? (iii) Where a person was allowed a deduction in a tax year for bad debt and in a subsequent tax year the person receives in cash or kind any amount in respect of that debt, how this amount shall be treated? (b) (i) In the light of Rule 87 of the Income Tax Rules, 2002 describe the procedure for the registration of income tax practitioners.

05 02

(ii) What is the duration of the registration of a person as an Income Tax Practitioner under Rule 88 of the Income Tax Rules, 2002?

Q.4 (a) Define the following terms as given in the Sales Tax Act, 1990: (i) Firm 01 01 05

(ii) Open market price (b) (i) Under Section 23 of the Sales Tax Act, 1990, a registered person making a taxable supply is required to issue a serially numbered tax invoice at the time of supply of goods containing certain particulars. What are these particulars?

(ii) Can the above mentioned invoice at (b) (i) be issued by an unregistered person? (c) What are the penalties in respect of the following offences under Section 33 of the Sales Tax Act, 1990? (i) A person who fails to maintain records required under Section 22 and 24 of this Act or the rules made thereunder.

01

02 02

(ii) Any person who obstructs an authorized officer in the performance of his official duty in general or in respect of Section 31 of the Act.

Q.5 Mr. Abdul Rehman is Chief Accountant in a multinational company. He is assumed to have received the following perks during the tax year 2012: Income from Salary: Basic salary House rent allowance Utilities Employers contribution to recognized provident fund Medical allowance Leave encashment T.A / D.A for official duty Bonus During the year, tax has been deducted on salary at Rs.26,500. Further he has paid Zakat at Rs.35,000 under the Zakat and Ushar Ordinance and Rs.56,000 as donation to an approved institution. Mr. Abdul Rehman has been provided with a 1300cc car which cost Rs.1,250,000 to the company. The car is used for both personal and official purposes.

2 of 3

BT-Apr.2012

Rs. 412,500 182,800 40,600 31,950 37,300 50,600 33,300 82,500

Marks Capital Gain: Rs. Capital gain on buying and selling of shares of an unlisted company (shares were held for eight months). Income from Property: Four years ago he rented out his house for a monthly rent of Rs.24,000. At that time he also received Rs.120,000 from the tenant as deposit which is not adjustable against monthly rent. During the current tax year he received Rs.288,000 as rent. Required: Compute taxable income and tax liability of Mr. Abdul Rehman for the tax year 2012. 20 52,000

Q.6 (a) Section 3(1) of the Federal Excise Act, 2005 enumerates the types of goods and services on which duties of excise specified in the First Schedule are levied. What are those goods and services? (b) (i) As per Section 93 of the Customs Act, 1969 under which conditions the owner of the goods lodged in a warehouse shall be allowed access to the goods?

05

02 02

(ii) Who shall pay the expense incurred in providing access of the owner to the warehoused goods? Also mention the receiver of such amount and the time of payment. (c) In the light of the Federal Excise Act, 2005, define the following terms: (i) Establishment

01 01 01 THE END

(ii) Conveyance (iii) Import and export

TAX RATES FOR SALARIED TAXPAYERS FOR TAX YEAR 2012(EXTRACT) Sr.# 1. 2. 3. 4. 5. 6. Where the taxable income exceeds Where the taxable income exceeds Where the taxable income exceeds Where the taxable income exceeds Where the taxable income exceeds Where the taxable income exceeds Taxable Income Rs.550,000 Rs.650,000 Rs.750,000 Rs.900,000 Rs.1,050,000 Rs.1,200,000 but does not exceed but does not exceed but does not exceed but does not exceed but does not exceed but does not exceed Rs.650,000 Rs.750,000 Rs.900,000 Rs.1,050,000 Rs.1,200,000 Rs.1,450,000 Tax Rate 4.50% 6.00% 7.50% 9.00% 10.00% 11.00%

TAX RATES FOR INCOME FROM PROPERTY FOR TAX YEAR 2012 Sr. # (1) (2) (3) (4) Gross amount of rent Where the gross amount of rent does not exceed Rs.150,000. Where the gross amount of rent exceeds Rs.150,000 but does not exceed Rs.400,000. Where the gross amount of rent exceeds Rs.400,000 but does not exceed Rs.1,000,000. Where the gross amount of rent exceeds Rs.1,000,000. Nil 5% of the Rs.150,000. gross amount exceeding Rate of tax

Rs.12,500 plus 7.5% of the gross amount exceeding Rs.400,000. Rs.57,500 plus 10% of the gross amount exceeding Rs.1,000,000.

3 of 3

BT-Apr.2012

Das könnte Ihnen auch gefallen

- E UE Supplier Whtax 10-08-15 To 16-08-15Dokument3 SeitenE UE Supplier Whtax 10-08-15 To 16-08-15Rahib KhanNoch keine Bewertungen

- E UE Supplier Whtax 01-06-15 To 07-06-15Dokument3 SeitenE UE Supplier Whtax 01-06-15 To 07-06-15Rahib KhanNoch keine Bewertungen

- E UE Supplier Whtax 03-08-15 To 09-08-15Dokument3 SeitenE UE Supplier Whtax 03-08-15 To 09-08-15Rahib KhanNoch keine Bewertungen

- E UE Supplier Whtax 04-05-15 To 10-05-15Dokument3 SeitenE UE Supplier Whtax 04-05-15 To 10-05-15Rahib KhanNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Presley - Complaint Statement of Facts 0Dokument8 SeitenPresley - Complaint Statement of Facts 0Anonymous GF8PPILW5Noch keine Bewertungen

- Why Is Tax Important For The Company of A Country?: T + S + M I + X + GDokument2 SeitenWhy Is Tax Important For The Company of A Country?: T + S + M I + X + GAnonymous rcCVWoM8bNoch keine Bewertungen

- Pale Privileged CommunicationDokument9 SeitenPale Privileged CommunicationDiane UyNoch keine Bewertungen

- Aral Pan 7 Sinaunang Kabihasnan Sa Asya (Pagsasanay Sa Mag-Aaral)Dokument7 SeitenAral Pan 7 Sinaunang Kabihasnan Sa Asya (Pagsasanay Sa Mag-Aaral)Ailea Jeanne Gonzales Castellano100% (1)

- Philippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws JurisprudenceDokument15 SeitenPhilippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws Jurisprudencerunish venganzaNoch keine Bewertungen

- 9 Go V Colegio de San Juan de LetranDokument9 Seiten9 Go V Colegio de San Juan de LetranDebbie YrreverreNoch keine Bewertungen

- ACCA Booking Form 15.4Dokument2 SeitenACCA Booking Form 15.4sivasivasapNoch keine Bewertungen

- Scribd Loan AgreementDokument2 SeitenScribd Loan AgreementBng Gsn100% (1)

- PERSONDokument3 SeitenPERSONapi-19731109100% (2)

- Case-Digest-MMDA-vs-Concerned-Residents PDFDokument2 SeitenCase-Digest-MMDA-vs-Concerned-Residents PDFsayyedNoch keine Bewertungen

- Sarcos V CastilloDokument6 SeitenSarcos V CastilloTey TorrenteNoch keine Bewertungen

- Far Eastern University Institute of Law: Subject Offerings and ScheduleDokument4 SeitenFar Eastern University Institute of Law: Subject Offerings and ScheduleJames Patrick NarcissoNoch keine Bewertungen

- Robes-Francisco v. CFIDokument15 SeitenRobes-Francisco v. CFIsigfridmonteNoch keine Bewertungen

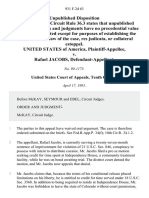

- United States v. Rafael Jacobs, 931 F.2d 63, 10th Cir. (1991)Dokument3 SeitenUnited States v. Rafael Jacobs, 931 F.2d 63, 10th Cir. (1991)Scribd Government DocsNoch keine Bewertungen

- People Vs ParulanDokument6 SeitenPeople Vs ParulanChristian Ian LimNoch keine Bewertungen

- Confidentiality Undertaking: To Be Notarized On Non-Judicial Stamp Paper)Dokument4 SeitenConfidentiality Undertaking: To Be Notarized On Non-Judicial Stamp Paper)ARPIT MAHESHWARINoch keine Bewertungen

- Sarmiento v. Zaratan, G.R. No. 167471 (2007)Dokument3 SeitenSarmiento v. Zaratan, G.R. No. 167471 (2007)Keyan MotolNoch keine Bewertungen

- Affidavit-Inconsistency in Names Sammy NgigiDokument2 SeitenAffidavit-Inconsistency in Names Sammy NgigiWinnieNoch keine Bewertungen

- CIR V Petron CorpDokument15 SeitenCIR V Petron CorpChristiane Marie BajadaNoch keine Bewertungen

- Information For Qualified TheftDokument2 SeitenInformation For Qualified TheftMarvin H. Taleon II100% (7)

- Berrien County, Michigan August 2, 2022 - UNOFFICIAL Candidate ListDokument6 SeitenBerrien County, Michigan August 2, 2022 - UNOFFICIAL Candidate ListWXMINoch keine Bewertungen

- Chapter 07Dokument27 SeitenChapter 07Rollon NinaNoch keine Bewertungen

- BOC Personnel Orders Transferring 228 PersonnelDokument5 SeitenBOC Personnel Orders Transferring 228 PersonnelPortCallsNoch keine Bewertungen

- How To Write A Good Position Paper For MUNDokument7 SeitenHow To Write A Good Position Paper For MUNAhmet Yildirim100% (2)

- Opposition Motio To Dismiss Complaint Cuyos SuanDokument5 SeitenOpposition Motio To Dismiss Complaint Cuyos SuanFrancis DinopolNoch keine Bewertungen

- Perfecto Pallada v. People of The PhilippinesDokument2 SeitenPerfecto Pallada v. People of The PhilippinesDaniela Sandra AgootNoch keine Bewertungen

- Ra 7691Dokument23 SeitenRa 7691Elenita OrdaNoch keine Bewertungen

- Uniform Civil CodeDokument27 SeitenUniform Civil CodeREKHA SINGH100% (2)

- Criminal Justice SystemDokument58 SeitenCriminal Justice SystemnietsrikNoch keine Bewertungen

- Stopping Illegal Flyposting: EnforcementDokument8 SeitenStopping Illegal Flyposting: EnforcementRussell SharlandNoch keine Bewertungen