Beruflich Dokumente

Kultur Dokumente

Sažetak-Poslovni Engleski 1 (1.kolokvij)

Hochgeladen von

Marina_Emilie24Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sažetak-Poslovni Engleski 1 (1.kolokvij)

Hochgeladen von

Marina_Emilie24Copyright:

Verfügbare Formate

TELEPHONING-zvanje,nazvati Answering the phone- Good morning/afternoon XYZ Ltd. How can I help you?

Introducing yourself- Hello, my name is Brown. Im calling from Graham & Sons. Asking for clarification- Could you repeat that please?What did you say your name was?How do you spell your name?Sorry, I didnt catch that.Im afraid its a bad line. Could you speak up, please?What exactly do you mean by.? Get who you want- Could I speak to Mr. Haggerty? Connecting a caller- One moment please. Explain reasons for calling- Im ringing to enquire about ..I need some more information aboutWe are interested in ..ing Explain theres a problem- I'm sorry, but the line's engaged at the moment.I'm sorry. There's no reply.Im afraid theres no reply.I'm sorry, but he/she's out of the office at the moment.I'm afraid he/she's on the other line at the moment. Leaving or taking messages/Offering to take a message- Could I leave a message?Could you give him/her a message?Would you like to leave a message?Can I take a message for him/her? Offering to help- Can I help you?Would you like to hold?Is there anyone else who could help you?Can anyone else help you?Can I take a message?Shall I ask him to call you back? Maybe I can help you?Perhaps he/she can call you back?Could he/she call you back? Could I have your name and number, please?Could you give me your name and number, please? Making arrangements- Can we set up a meeting?How about (on Monday, at 2 p,)? Promising action- Ill call you on ..Ill give her/him you message.I can check that for you. Sorry, I dont have that information now, but Ill get back to you as soon as I find out. Thank the other person-Thank you very much for your help.Thank you for calling.I look forward to your call.Good-bye and thanks. Arranging meetings-dogovoreni sastanci Ask for a meeting-Im not sure that is possible. I think we should have a meeting about this. Suggest a day-Are you free a Thursday? Suggest a time-How about 9 clock? Say that a day or time is not possible: Sorry,Im bussy on Thursday. Suggest another day or time-Its Friday,OK. How about Sunday? Say that a day or time is possible-Yes,9 clock is fine. Arrange the place-Your office or mine. Confirm the arrangement-Yes,thats fine Wendsday at eleven.

What the customer says to explain why hes calling:Hes calling for some information about loans. How the customer service advisor asks what information the customer needs:What would you like to know? Two phrases the customer uses to ask for information?But could you tell me about secured loans?Id like to know. What the customer service advisor asks to get more precise information:What type of security do you have in mind? How the customer service advisor asks for the customer name: Could you give me your name again? THE ORGANIZATION OF THE FINANCIAL INDUSTRY-organizacija financijske industrije Bonds-obveznice,potvrde o dugovanju-certificate of debt (usually interestbearing or discounted) that is issued by a government or corporation in order to raise money; the issuer is required to pay a fixed sum annually until maturity and then a fixed sum to repay the principal Capital-kapital Deposit-depozit- money deposited in a bank or some similar institution; Merger-pripajanje drutava- The phrase mergers and acquisitions (abbreviated M&A) refers to the aspect of corporate strategy, corporate finance and management dealing with the buying, selling and combining of different companies that can aid, finance, or help a growing company in a given industry grow rapidly without having to create another business entity. Mortgage-hipotekarni kredit- Mortgage is the transfer of an interest in property (or the equivalent in law - a charge) to a lender as a security for a debt usually a loan of money. While a mortgage in itself is not a debt, it is the lender's security for a debt. Shares and stocks-dionice Takeover-preuzimanje Current-account-tekui kredit To charge an interest rate-zaraunati kamatnu stopu Borrow-posuditi Lend-banka Secured loans-dobroosigurani kredit Security-instrument osiguranja-- Something deposited or given as assurance of the fulfilment of an obligation; a pledge.- A document indicating ownership or creditorship; a stock certificate or bond. Pay back/repay-otplatiti Branch-grana,podruje,poslovnica banke Asset-posjed,imovina Retail banks-maloprodajne banke Building societies-stambene tedionice

Insurance companies-osiguravajua drutva Investment banks-investicijske banke- A financial institution that deals primarily with raising capital, corporate mergers and acquisitions, and securities trades. Conglomerates-skupina firmi-groups of companies that have joined together Deregulated-liberalizacija,pravila o poslovanju,poputa se-abolished ir ended rules and restrictions Fines-novane kazne-sums of money paid as penalties for breaking the law Prohibited-zabrane-made it illegal to do something Regulation-pravila, propisi,regulirati-contro of something by rules or laws Repealed-ukinuti -cancelled or ended Underwriting-jamiti,garantirati-guaranteeing to buy a companys newly issued stocks if no one else does Issue shares-izdati,izdavati- to issue = bring out, publish, come out, go on sale Obey-potivati,pridravati se. part-ownership-dio,vlasnitvo- shared ownership of business or property outlays-izdaci-amounts of money spent for particular purposes to fall, fell, fallen-pada- to drop or come down freely under the influence of gravity. commercial bank-komercijalna banka- a bank primarily engaged in making short-term loans from funds deposited in current accounts to acquire-neto srei- to gain possession of: acquire 100 shares of stock. TEKST!! REGULATION AND DEREGULATION-uredba i deregulacija In the late 1920s, several American commercial banks that were underwritng security issues for companies weren't able to sell the stocks to the public, because there wasnt't enough demand. So they used money belonging to their depositors to buy these securities. If the stock price later fell, their customers lost a lot of money. This led the government to ste pup the regulation of banks, to protect depositors funds, and to maintain investitors confidence in the banking system.In 1993 the Glass-Steagall Act was passed,which prohibiled America commercial banks from underwriting securities. Only investment banks could issue stocks for corporations. In Britain too, retail or commercial banks remained separate from investment or merchant banks. A similar law was passed in Japan after World War 2. Half a century later, in the 1980s and 90s,many banks were looking for new markets and higher profit sin a period of increasing globalization. So most industrialized countries deregulated their financial systems. The GlassSteagall Act was repealed. A lot of commercial banks merged with or ayquired investment banks and insurance companies, which created large financial

conglomerates. The larger American and British banks now offer customers a complete range of financial services, as the universal banks in Germany and Switzerland have done for a long time. The law forbidding US commercial banks from operating in more than one state was also abolished. In Britain, many building societies, which specialized in mortgages, started to offer the same services as commercial banks. Yet in all countries, financial institions are still quite strictly controlled, either by the central bank or another financial authority. In 2002, ten of Wall Street's biggest banks paid fines of 1,4 bilion for having advised investors, int he 1990s, to buy stocks in companies that they knew had financial difficulties. They had done this in order to get investment banking business from these companies-exactly the kind of practice that led the US government to separate commercian and investment banking in the 1930s. RETAIL BANKING-maloprodaja,poslovanje za graanstvo Strip out-razdvojiti-1. (Engineering / Mechanical Engineering) (tr) to remove the working parts of (a machine)2. (Chemistry) to remove (a chemical or component) from a mixture3. separate Exaggeration-pretjerivati-. To represent as greater than is actually the case; overstate: exaggerate the size of the enemy force; exaggerated his own role in the episode. Asset-imovina-2. A valuable item that is owned. Income-dohodak- The amount of money or its equivalent received during a period of time in exchange for labour or services, from the sale of goods or property, or as profit from financial investments. Currency-valuta- Money in any form when in actual use as a medium of exchange, especially circulating paper money. Liabilities-obveze- liabilities The financial obligations entered in the balance sheet of a business enterprise. National income-nacionalni dohodak- The total net value of all goods and services produced within a nation over a specified period of time, representing the sum of wages, profits, rents, interest, and pension payments to residents of the nation. Rise-poveati se-. To increase in size, volume, or level: The river rises every spring. Big-scale /Large-scale-irokih razmjera- Large in scope or extent. Lucrative-profitabilan,unosan- producing a profit; profitable; remunerative Decline-smanjenje,pad- To deteriorate gradually; fail. Balance-stanje rauna- The difference between such totals, either on the credit or the debit side. Cheque-ek- A written order to a bank to pay the amount specified from funds on deposit; a draft. Queue-red- A line of waiting people or vehicles.

Current account-tekui raun-an account at a bank or building society against which cheques may be drawn at any time US name checking account Savings account-tedni raun- a bank account that accumulates interest Statement izvadak sa rauna- an account containing a summary of bills or invoices and displaying the total amount due Standing order-trajni nalog- Also called banker's order an instruction to a bank by a depositor to pay a stated sum at regular intervals Direct debit-izravno ili direktno tereenje rauna- an order given to a bank or building society by a holder of an account, instructing it to pay to a specified person or organization any sum demanded by that person or organization Apply for-zahtjev,zatraiti- To make a formal, usually written, request for something Loan-zajam- A sum of money lent at interest. Overdraft-dozvoljeni minus,prekoraenje rauna-- The amount overdrawn. Foreign currency-strana valuta,deviza- A currency not belonging to your own country Travellers cheque-putniki ekovi- A cheque for a fixed amount that can be bought from a bank and cashed for local currency in another country TEKST!! BANKS TO RELY ON BRANCHES TO DRIVE GROWTH-Banke se trebaju pouzdati u svoje poslovnice za budui rast Banks will rely on branches to drive future growth rather than the internet, according to new research.A study of 2,709 customers by Deloitte and Touche, the professional services firm, showed that the bank branch in the preferred channel for 52 per cent of customers interviewed. Only 16 per cent preferred to bank using the telephone and 8 per cent used the internet. The study also showed that the bank brench is preferred by 45 per cent of customers in the affluent AB social group- contradicting the notion that sophisticated customers avoid branches. Nick Sandall, retail financial services partner at Deloitte and Touche, said he believed that the main banks in the UK were planning to reverse a decade of under-investment in branches by putting the network at the heart of their strategy. Although some banks, such as Abbey Nationas, are ahead of the game in their efforts to revolutionise the way in which they use branches to reach the consumer, we expect all banks to invest substantially in reshaping their branch networks and the activities within, he said. Deloitte and Touche believed that the successful retail bank of the future needed to give careful consideration to areas such as branch design, staffing and location.Abey National, which has introduced Costa coffee shops into some of its branches, reports that banking product sales have increased in these locations. EMAIL ETIQUETTE-email etiketa

-Clearly summarize the contens of your message in the subject line, e.g. write May 23 Project Management Team Meeting Agenda rather than just Meeting.. -Dont use the Cc-carbon copy function to copy your message to everyone unless you really need to. -Usse Bcblind c.c. when sending a message to a large group of people who dont know each other. -If you normally address a person as Ms,Mrs,Mr,then thats what you do in a first email;if you normally call them by their first name,then you do that. -Replay to a message, dont start a new email. Keep th thread by leaving he orginal messages attached. -If you need someone to give you information or do something for you,be very specific. -Smileys are used in personal emails and are not appropriate fo9r business. -Use the spel check and re-read you message one last time before yoo send it. TEST!!! Prijevod Obveznice - bonds hipotekarni kredit - mortgage unosan - lucrative Financiranje - finance Vlastiti - own Definicije Assets anything of value owned by a business;for a bank,the loans it has made Lucrative profitable ( describes an activity that makes a profit ) policy -

Povezivanje Maturity date Trodable instruments Assets recart Inplement polices Pitanja What services would you expect a ratail or commercial bank to offer? What are the two main ways in which large companies and corporations raise capital? Why do large companies general prefer not to borrow from banks? What from of income do bank get from large companies?

Pismeni ispit struktura pitanja Gap-fill exercise umetanje rijei koje nedostaju (u poznatom tekstu) Prevoenje specifinih izraza s engleskog na hrvatski i s hrvatskog na engleski Spajanje rijei i njihovih definicija Spajanje rijei kolokacije Kratki odgovori na pitanja iz obraenog gradiva

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Robber Bridegroom Script 1 PDFDokument110 SeitenRobber Bridegroom Script 1 PDFRicardo GarciaNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- English File: Grammar, Vocabulary, and PronunciationDokument4 SeitenEnglish File: Grammar, Vocabulary, and PronunciationFirstName100% (2)

- ICFR Presentation - Ernst and YoungDokument40 SeitenICFR Presentation - Ernst and YoungUTIE ELISA RAMADHANI67% (3)

- Petition For Bail Nonbailable LampaDokument3 SeitenPetition For Bail Nonbailable LampaNikki MendozaNoch keine Bewertungen

- Bank ATM Use CasesDokument12 SeitenBank ATM Use Casessbr11Noch keine Bewertungen

- M. J. T. Lewis - Surveying Instruments of Greece and Rome (2001)Dokument410 SeitenM. J. T. Lewis - Surveying Instruments of Greece and Rome (2001)Jefferson EscobidoNoch keine Bewertungen

- Fundamentals of Group DynamicsDokument12 SeitenFundamentals of Group DynamicsLimbasam PapaNoch keine Bewertungen

- The Rime of The Ancient Mariner (Text of 1834) by - Poetry FoundationDokument19 SeitenThe Rime of The Ancient Mariner (Text of 1834) by - Poetry FoundationNeil RudraNoch keine Bewertungen

- Presentation Airbnb ProfileDokument14 SeitenPresentation Airbnb ProfileGuillermo VillacrésNoch keine Bewertungen

- 2 - (Accounting For Foreign Currency Transaction)Dokument25 Seiten2 - (Accounting For Foreign Currency Transaction)Stephiel SumpNoch keine Bewertungen

- Four Year Plan DzenitaDokument4 SeitenFour Year Plan Dzenitaapi-299201014Noch keine Bewertungen

- Thd04e 1Dokument2 SeitenThd04e 1Thao100% (1)

- Family Decision MakingDokument23 SeitenFamily Decision MakingNishant AnandNoch keine Bewertungen

- Spoken Word (Forever Song)Dokument2 SeitenSpoken Word (Forever Song)regNoch keine Bewertungen

- UBFHA V S BF HomesDokument11 SeitenUBFHA V S BF HomesMonique LhuillierNoch keine Bewertungen

- Injection Pump Test SpecificationsDokument3 SeitenInjection Pump Test Specificationsadmin tigasaudaraNoch keine Bewertungen

- MSDS Blattanex GelDokument5 SeitenMSDS Blattanex GelSadhana SentosaNoch keine Bewertungen

- An/Trc - 170 TrainingDokument264 SeitenAn/Trc - 170 Trainingkapenrem2003Noch keine Bewertungen

- Decemeber 2020 Examinations: Suggested Answers ToDokument41 SeitenDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNoch keine Bewertungen

- Millwright Local Union 2158 PAC - 8048 - VSRDokument10 SeitenMillwright Local Union 2158 PAC - 8048 - VSRZach EdwardsNoch keine Bewertungen

- CBLM FBS NC-II (Develop and Update Food and Beverage Service)Dokument24 SeitenCBLM FBS NC-II (Develop and Update Food and Beverage Service)Angel PanganibanNoch keine Bewertungen

- Plessy V Ferguson DBQDokument4 SeitenPlessy V Ferguson DBQapi-300429241Noch keine Bewertungen

- Dental CeramicsDokument6 SeitenDental CeramicsDeema FlembanNoch keine Bewertungen

- Peace Corps Samoa Medical Assistant Office of The Public Service of SamoaDokument10 SeitenPeace Corps Samoa Medical Assistant Office of The Public Service of SamoaAccessible Journal Media: Peace Corps DocumentsNoch keine Bewertungen

- Bartolome vs. MarananDokument6 SeitenBartolome vs. MarananStef OcsalevNoch keine Bewertungen

- Verb TensesDokument3 SeitenVerb TensesVeronicaGelfgren92% (12)

- Administrative Clerk Resume TemplateDokument2 SeitenAdministrative Clerk Resume TemplateManuelNoch keine Bewertungen

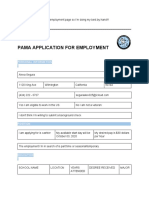

- Pam ApplicationDokument3 SeitenPam Applicationapi-534834656Noch keine Bewertungen

- SCI1001 Lab 7 MarksheetDokument2 SeitenSCI1001 Lab 7 Marksheetnataliegregg223Noch keine Bewertungen

- Fini Cat K-Max 45-90 enDokument16 SeitenFini Cat K-Max 45-90 enbujin.gym.essenNoch keine Bewertungen