Beruflich Dokumente

Kultur Dokumente

Deposit Account Rates + Fees Tiaa

Hochgeladen von

shoppingonlyCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Deposit Account Rates + Fees Tiaa

Hochgeladen von

shoppingonlyCopyright:

Verfügbare Formate

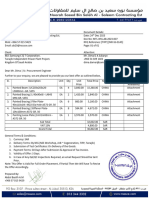

1lAACRLl 1Ru31 C0MPAN, l3B

bPU5l1 AGRMN1

DWK05100 (Eff 02/12)

TABLE OF CONTENTS

Page

TERMS AND CONDITIONS

Agreement.........................................................................................................1

Deposits ............................................................................................................2

Withdrawals.......................................................................................................4

Overdrafts .........................................................................................................4

Payment Order of tems....................................................................................5

Transfer Limitations...........................................................................................6

Early Withdrawal Penalties ...............................................................................6

Stop Payments..................................................................................................7

Ownership Types ..............................................................................................9

Backup Withholding and TN Certification.........................................................9

Arbitration........................................................................................................13

ELECTRONIC FUND TRANSFERS...................................................................13

FUNDS AVAILABILITY DISCLOSURE..............................................................18

SUBSTITUTE CHECKS......................................................................................19

TRUTH-IN-SAVINGS DISCLOSURE..................................................................21

nterest Checking............................................................................................21

High Yield Savings..........................................................................................21

Money Market Account ...................................................................................22

REMOTE DEPOSIT SERVICE............................................................................22

INTEREST RATE - See separate encIosed sheet.

FEES - See separate encIosed sheet.

TERMS AND CONDITIONS OF YOUR ACCOUNT

AGREEMENT - This document, along with any other documents we give you

pertaining to your account(s), is a contract that establishes rules which control

your account(s) with us. Please read this carefully. f you sign the signature card

or open or continue to use the account, you agree to these rules. Separate

schedules of rates, qualifying balances, and fees are included with this

document. f you have any questions, please call us.

This agreement is subject to applicable federal laws and the laws of the state of

Missouri (except to the extent that this agreement can and does vary such rules

or laws). The body of state and federal law that governs our relationship with you,

however, is too large and complex to be reproduced here. The purpose of this

document is to:

(1) summarize some laws that apply to common transactions;

(2) establish rules to cover transactions or events which the law does not regulate;

(3) establish rules for certain transactions or events which the law regulates but

permits variation by agreement; and

(4) give you disclosures of some of our policies to which you may be entitled or

in which you may be interested.

f any provision of this document is found to be unenforceable according to its

terms, all remaining provisions will continue in full force and effect. We may

permit some variations from our standard agreement, but we must agree to any

variation in writing for your account or in some other document.

1

DWK05100 (Eff 02/12)

As used in this document the words "we, "our, and "us mean TAA-CREF Trust

Company, FSB and the words "you and "your mean the account holder(s) and

anyone else with the authority to deposit, withdraw, or exercise control over the

funds in the account. The headings in this document are for convenience or

reference only and will not govern the interpretation of the provisions. Unless it

would be inconsistent to do so, words and phrases used in this document should

be construed so the singular includes the plural and the plural includes the singular.

CONSUMER REPORTS/INFORMATION REPORTING - You agree that in

connection with your application for Deposit Accounts, we are permitted to obtain

information about you from one or more consumer reporting agencies. You

further agree that we are permitted to obtain additional consumer reports from

time to time in connection with maintaining, reviewing, or collecting on your

Deposit Accounts. We may report your performance under this Agreement to

consumer reporting agencies and others, to the fullest extent permitted by law.

ACCOUNT ELIGIBILITY - Our accounts are available to U.S. citizens and

permanent residents of the 50 United States and the District of Columbia who are

at least eighteen (18) years old and have a valid tax identification number. We

reserve the right to limit the number of accounts that you may establish with us.

LIABILITY - You agree, for yourself (and the person or entity you represent if you

sign as a representative of another) to the terms of this account and the

accompanying schedule of charges. You authorize us to deduct these charges

directly from the account balance as accrued. You will pay any additional

reasonable charges for services you request which are not covered by this

agreement.

Each of you also agrees to be jointly and severally (individually) liable for any

account shortage resulting from charges or overdrafts, whether caused by you or

another with access to this account. This liability is due immediately, and can be

deducted directly from the account balance whenever sufficient funds are

available. You have no right to defer payment of this liability, and you are liable

regardless of whether you signed the item or benefited from the charge or

overdraft. You will also be liable for our costs to collect the deficit as well as for our

reasonable attorneys' fees, to the extent permitted by law, whether incurred as a

result of collection or in any other dispute involving your account including, but not

limited to, disputes between you and another joint owner; you and an authorized

signer or similar party; or a third party claiming an interest in your account.

DEPOSITS - We will give only provisional credit until collection is final for any

items, other than cash, we accept for deposit (including items drawn "on us).

Before settlement of any item becomes final, we act only as your agent,

regardless of the form of indorsement or lack of indorsement on the item and

even though we provide you provisional credit for the item. We may reverse any

provisional credit for items that are lost, stolen, or returned. We are not

responsible for transactions by mail or outside depository until we actually record

them. We will treat and record all transactions received after our "daily cutoff

time on a business day we are open, or received on a day we are not open for

business, as if initiated on the next business day that we are open. At our option,

we may take an item for collection rather than for deposit. We do not accept

deposits in foreign currency.

2

DWK05100 (Eff 02/12)

INDORSEMENTS - We may accept for deposit any item payable to you or your

order, even if they are not indorsed by you. We may give cash back to any one of

you. We may supply any missing indorsement(s) for any item we accept for

deposit or collection, and you warrant that all indorsements are genuine.

DEPOSIT DELIVERY AND PREPARATION

You may deliver deposits through various methods. The method and time of

delivery determines when you receive credit for the deposit. f we credit your

account for the amount shown on the deposit slip, the credit is subject to our

subsequent verification, and our determination of the amount of your deposit is

final and binding.

You agree to prepare your deposit in accordance with our instructions which may

include the use of an approved deposit envelope and deposit ticket, if required.

We may charge a fee for deposits made without a deposit slip or which do not

use your deposit slip. You authorize us to open the deposit envelope in your

absence and credit the contents to your account. We may treat the contents of

the deposit envelope as not accepted for deposit until we have verified the

contents. f your deposit includes items that we do not accept for deposit, we may

hold those items until you claim them.

DIRECT DEPOSITS - f, in connection with a direct deposit plan, we deposit any

amount in an account which should have been returned to the Federal

Government for any reason, you authorize us to deduct the amount of our liability

to the Federal Government from the account or from any other account you have

with us, without prior notice and at any time, except as prohibited by law. We

may also use any other legal remedy to recover the amount of our liability.

TRANSACTIONS BY MAIL - You may deposit checks by mail. You should

indorse the check being sent through the mail with the words "For Deposit Only

and should include your correct account number underneath to ensure the check

is credited to the correct account. You should use the pre-encoded deposit slips

found behind your checks in your checkbook if you have one. f you do not use

your deposit slip or otherwise provide us with instructions indicating how or

where the check should be credited, we may apply it to any account or any loan

balance you have with us or we may return the check to you. We will not provide

receipts for deposits that are mailed to us. We may charge you an account

research fee for deposits made without a properly completed deposit slip.

Following your deposit, examine your statement carefully or call us to ensure that

we received the item. Do not send cash through the mail for deposit.

RETURNED ITEMS - f an item that is credited to your account is returned to us

at any time for any reason by the bank on which it is drawn or by any collecting

bank, you agree that we may accept that return and charge the item against your

account without regard to whether the other bank had paid or returned the item in

accordance with any applicable deadline or rule. You agree that we may debit

your account for any interest that may have been calculated or paid on the item

and that we may charge you a fee for the returned item in accordance with the

account fee schedule. We may debit the returned item on the earlier of the

business day it is returned to us or the business day that we receive notice that

the item is being returned to us. n some cases the bank on which a returned

item is drawn may send us either an electronic notice of return, an indemnified

3

DWK05100 (Eff 02/12)

copy of the original, or an image replacement document, rather than the original

item. You agree that we may act on, and that you are bound by, these just as if

the original item had been returned. You agree that we are not obligated to take

any action or inaction to recover payment for an item that is returned to us. f

there are not sufficient funds in your account to cover a returned item, we may

overdraw your account and charge you a fee. We will not be liable if debiting a

returned item to your account results in insufficient funds to cover any other items

that may be presented for payment. You agree to immediately repay any

overdraft caused by a returned item.

WITHDRAWALS - Unless clearly indicated otherwise on the account records,

any of you, acting alone, who signs to open the account or has authority to make

withdrawals may withdraw or transfer all or any part of the account balance at

any time. Each of you (until we receive written notice to the contrary) authorizes

each other person who signs or has authority to make withdrawals to indorse any

item payable to you or your order for deposit to this account or any other

transaction with us. We may refuse any withdrawal or transfer request which you

attempt on forms not approved by us, by any method we do not specifically

permit, which is greater in number than the frequency permitted, or which is for

an amount greater or less than any withdrawal limitations. Even if we honor a

nonconforming request, we may treat continued abuse of the stated limitations (if

any) as your act of closing the account. We will use the date the transaction is

completed by us (as opposed to the date you initiate it) to apply the frequency

limitations. f we are presented with an item drawn against your account that

would be a "substitute check, as defined by law, but for an error or defect in the

item introduced in the Substitute Check Creation Process, you agree that we

may pay such item.

We may require not less than seven (7) days' notice in writing before each

withdrawal from an interest-bearing account other than a certificate of deposit, or

from any other savings account as defined by Regulation D. Withdrawals from a

certificate of deposit prior to maturity or prior to any notice period may be

restricted and may be subject to penalty.

See the section below for information about when

you can withdraw funds you deposit.

OVERDRAFTS - The fact that we may honor withdrawal requests that overdraw

the available account balance does not obligate us to do so later. You agree that

we may charge fees for overdrafts and use subsequent deposits, including direct

deposits of social security or other government benefits, to cover such overdrafts

and overdraft fees. You agree that if we honor a withdrawal request that creates a

negative balance in your account, you will immediately repay the negative amount.

PROTECTING YOUR ACCOUNT FROM OVERDRAFTS - You can elect to

protect your checking account from overdrafts by telling us to advance funds

from a different deposit account that you have with us when a withdrawal

transaction would otherwise be declined or create a negative balance in excess

of ten dollars ($10.00) in your checking account if honored by us. f you choose

this option, you authorize us to withdraw funds in increments of one hundred

dollars ($100.00) from the account that you designate for this purpose and

deposit those funds into your checking account. For example, if you need us to

move $135 from the account that you have designated for overdraft protection

into your checking account in order to avoid an overdraft, we will withdraw $200

4

DWK05100 (Eff 02/12)

from that account and deposit it into your checking account. You agree that if

there is less than one hundred dollars ($100) or less than the necessary

increment of one-hundred dollars in the account that you use for overdraft

protection, we will not withdraw any amount and deposit it into your checking

account for this purpose. For example, if you need us to move $135 from the

account that you have designated for overdraft protection into your checking

account in order to avoid an overdraft, and there is only $165 dollars available in

the account you have designated for this purpose, we will not withdraw any

amount from that account even if there is sufficient funds available to cover the

overdraft.

PAYMENT ORDER OF ITEMS - The order in which items are paid is important if

there is not enough money in your account to pay all of the items that are

presented. The payment order can affect the number of items overdrawn or

returned unpaid and the amount of the fees you may have to pay. To assist you

in managing your account, we are providing you with the following information

regarding how we process those items.

Our policy is to process electronic transactions, checks and similar items in the

order in which they are received for the day on which they are processed.

f a check, item or transaction (other than an ATM or everyday debit card

transaction) is presented without sufficient funds in your account to pay it, we

may, at our discretion, pay the item (creating an overdraft) or return the item for

insufficient funds (NSF). The amounts of the overdraft and NSF fees are

disclosed in your fee schedule.

TELEPHONE TRANSFERS - A telephone transfer of funds from this account to

another account with us, if otherwise arranged for or permitted, may be made by

the same persons and under the same conditions generally applicable to

withdrawals made in writing. Unless a different limitation is disclosed in writing,

we restrict the number of transfers from a savings account to another account or

to third parties, to a maximum of six (6) per month (less the number of

"preauthorized transfers during the month). Other account transfer restrictions

may be described elsewhere.

ACH AND WIRE TRANSFERS - This agreement is subject to Article 4A of the

Uniform Commercial Code - Fund Transfers as adopted in the state in which you

have your account with us. f you originate a fund transfer for which Fedwire is

used, and you identify by name and number a beneficiary financial institution, an

intermediary financial institution or a beneficiary, we and every receiving or

beneficiary financial institution may rely on the identifying number to make

payment. We may rely on the number even if it identifies a financial institution,

person or account other than the one named. You agree to be bound by

automated clearing house association rules. These rules provide, among other

things, that payments made to you, or originated by you, are provisional until final

settlement is made through a Federal Reserve Bank or payment is otherwise

made as provided in Article 4A-403(a) of the Uniform Commercial Code. f we do

not receive such payment, we are entitled to a refund from you in the amount

credited to your account and the party originating such payment will not be

considered to have paid the amount so credited. f we receive a payment order to

credit an account you have with us by wire or ACH, we are not required to give

you any notice of the payment order or credit.

5

DWK05100 (Eff 02/12)

CURRENCY CONVERSIONS AND CROSS-BORDER TRANSACTIONS - f you

make a transaction using your Debit Card or ATM card in a currency other than

U.S. Dollars, MasterCard will convert the charge into a U.S. Dollar amount. The

MasterCard currency conversion procedure uses either a government-mandated

exchange rate, or a wholesale exchange rate selected by MasterCard. The

exchange rate MasterCard uses will be a rate in effect on the day the transaction

is processed and may differ from the rate in effect on the date of purchase or the

date the transaction was posted to your account.

MasterCard charges us a fee (called a currency conversion assessment) for

performing a currency conversion. n addition, MasterCard charges us a fee

(called an issuer cross-border assessment) on all cross-border transactions

regardless of whether there is a currency conversion. A cross-border transaction

is a transaction processed through the Global Clearing Management System or

the MasterCard Debit Switch in which the country of the merchant is different

than the country of the cardholder.

As a result, when you use your debit card or ATM card for a cross border

transaction, whether or not it is necessary for MasterCard to make a currency

conversion, we will charge you a fee. Please see the attached Fee Schedule for

the amount of this fee.

TRANSFER LIMITATIONS - For savings and money market accounts you may

make up to six (6) transfers or withdrawals by means of a preauthorized,

automatic, or telephonic transfer to another account of yours or to a third party or

by check, debit card, or similar order to a third party during any calendar month

(or statement cycle of at least four weeks). A preauthorized transfer includes any

arrangement with us to pay a third party from your account at (i) a predetermined

time; (ii) on a fixed schedule or (iii) upon oral or written orders including orders

received through the automated clearing house (ACH). f the transfer or

withdrawal is initiated in person, by mail, or at an ATM then there is no limit on

the number of payments that may be made directly to you, directly to us for

amounts you owe us, or transfers to other accounts you have with us.

Withdrawals by phone are also unlimited if you are requesting that a check be

mailed to you. f you exceed these limits, we may close your account or convert it

to a checking account.

EARLY WITHDRAWAL PENALTIES (and invoIuntary withdrawaIs) - We may

impose early withdrawal penalties on a withdrawal from a certificate of deposit

even if you don't initiate the withdrawal. For instance, the early withdrawal

penalty may be imposed if the withdrawal is caused by our setoff against funds

in the account or as a result of an attachment or other legal process. We may

close your account and impose the early withdrawal penalty on the entire

account balance in the event of a partial early withdrawal. See your Truth in

Savings Act Disclosure, which will be sent to you after you make a deposit into

your new certificate of deposit, for additional information about early withdrawal

penalties.

POSTDATED, INCOMPLETE, OR CONDITIONAL CHECKS - You agree not to

issue or present for deposit any postdated, incomplete, or restricted (for example

a check with "not valid for more than $500 written on it) checks. You agree that

we are not liable for paying, refusing to pay, accepting for deposit, or rejecting

and returning any check that is postdated, incomplete, or otherwise restricted.

6

DWK05100 (Eff 02/12)

CHECK PROCESSING - We may process items mechanically by relying on the

information encoded along the bottom of the items. This means that we may not

individually examine all of your items to determine if the item is properly

completed, signed and indorsed. You agree that we have not failed to exercise

ordinary care solely because we use an automated system to process items and

do not inspect all items processed in such a manner. We reserve the right not to

inspect each item because using an automated process helps us keep costs

down for you and all account holders. We may determine the amount of available

funds in your account for the purpose of deciding whether to return an item for

insufficient funds at any time between the time we receive the item and when we

return the item or send a notice in lieu of return. We need only make one

determination, but if we choose to make a subsequent determination, the

account balance at the subsequent time will determine whether there are

insufficient available funds.

FACSIMILE SIGNATURE - f you create a draft against your account using a

check writing service, a facsimile signature or any other method that does not

result in your personal signature on the draft, you agree that you will maintain the

security of any computer or other device by which a signature is affixed and that

you are solely responsible for the risk of using any such service or device even if

you are not negligent with regard to its use. You also agree that we may treat any

draft that is presented for payment that includes a facsimile signature, even if it

differs from any draft or signature that has been presented previously, as if it

includes your personal signature. You agree to indemnify us for all claims and

losses, including attorney's fees, that the bank may incur as a result of any

misuse of such service or device by any person.

TRUNCATION, SUBSTITUTE CHECKS, AND OTHER CHECK IMAGES - You

agree that if we receive an indemnified copy of your original check, a substitute

check, or an image of one of your checks rather than the original item, we may

pay the item as if the original had been presented to us. f you truncate an

original check and create a substitute check, or other paper or electronic image

of the original check, you warrant that no one will be asked to make payment on

the original check, a substitute check or any other electronic or paper image, if

the payment obligation relating to the original check has already been paid. You

also warrant that any substitute check you create conforms to the legal

requirements and generally accepted specifications for substitute checks. You

agree to indemnify us for any loss we may incur as a result of any truncated

check transaction you initiate. We can refuse to accept substitute checks that

have not previously been warranted by a bank or other financial institution in

conformance with the Check 21 Act. Unless specifically stated in a separate

agreement between you and us, we do not have to accept any other electronic or

paper image of an original check.

STOP PAYMENTS - Unless otherwise provided, the rules in this section cover

stopping payment of items such as checks and drafts. Rules for stopping

payment of other types of transfers of funds, such as consumer electronic fund

transfers, may be established by law or our policy. f we have not disclosed these

rules to you elsewhere, you may ask us about those rules.

We may accept an order to stop payment on any item from any one of you. You

must make any stop-payment order in the manner required by law and we must

7

DWK05100 (Eff 02/12)

receive it in time to give us a reasonable opportunity to act on it before our stop-

payment cutoff time. Requests submitted after 8:00 p.m. ET any business day

will become effective the next business day. Because stop-payment orders are

handled by computers, to be effective, your stop-payment order must precisely

identify the number, date, and amount of the item, and the payee. Failure to

provide the correct information may result in the item being paid. We are not

responsible for items being paid because of incorrect information. You agree to

reimburse us for all expenses and loss resulting from refusing payment pursuant

to this order, or if by reason of such stop payments other checks are returned

unpaid because of insufficient funds.

You may stop payment on any item drawn on your account whether you sign the

item or not, if you have an equal or greater right to withdraw from this account

than the person who signed the item. Generally, if your stop-payment order is

given to us in writing it is effective for twelve (12) months. Your order will lapse

after that time if you do not renew the order in writing before the end of the twelve

(12)-month period. f the original stop-payment order was verbal (including those

made through the Telephone Banking System) your stop-payment order must be

confirmed in writing in order to ensure that it remains in effect for twelve (12)

months. We are not obligated to notify you when a stop-payment order expires. A

release of the stop-payment request may be made only by the person who

initiated the stop-payment order. Additional limitations on our obligation to stop

payment are provided by law (e.g., we paid the item in cash or we certified the

item).

f you stop payment on an item and we incur any damages or expenses because of

the stop payment, you agree to indemnify us for those damages or expenses,

including attorneys' fees. You assign to us all rights against the payee or any other

holder of the item. You agree to cooperate with us in any legal actions that we may

take against such persons. You should be aware that anyone holding the item may

be entitled to enforce payment against you despite the stop-payment order.

LOST, DESTROYED, OR STOLEN OFFICIAL BANK CHECKS - Under some

circumstances you may be able to assert a claim for the amount of a lost,

destroyed, or stolen official bank check. To assert the claim: (a) you must be the

remitter (or drawer) of an official bank check or payee of the check, (b) we must

receive notice from you describing the check with reasonable certainty and

asking for payment of the amount of the check, (c) we must receive the notice in

time for us to have a reasonable opportunity to act on it, and (d) you must give us

a declaration (in a form we require) of your loss with respect to the check. You

can ask us for a declaration form. Even if all of these conditions are met, your

claim may not be immediately enforceable. We may pay the check until the

ninetieth day after the date of the check (or date of acceptance of an official bank

check). Therefore, your claim is not enforceable until the ninetieth day after the

date of the check or date of acceptance, and the conditions listed above have

been met. f we have not already paid the check, on the day your claim is

enforceable we become obligated to pay you the amount of the check. We will

pay you in cash or issue another official bank check.

At our option, we may pay you the amount of the check before your claim

becomes enforceable. However, we will require you to agree to indemnify us for

any losses we might suffer. This means that if the check is presented after we

pay your claim, and we pay the check, you are responsible to cover our losses.

We may require you to provide a surety bond to assure that you can pay us if we

suffer a loss.

8

DWK05100 (Eff 02/12)

OWNERSHIP OF ACCOUNT AND BENEFICIARY DESIGNATION - These rules

apply to this account depending on the form of ownership and beneficiary

designation, if any, specified on the account records. We make no representations

as to the appropriateness or effect of the ownership and beneficiary designations,

except as they determine to whom we pay the account funds.

IndividuaI Account - is an account in the name of one person.

Joint Account - With Survivorship (And Not As A Tenancy By The Entirety

Or As Tenants In Common) - is an account in the name of two or more

persons. Each of you intend that when you die the balance in the account

(subject to any previous pledge to which we have agreed) will belong to the

survivor(s). f two or more of you survive, you will own the balance in the account

as joint tenants with survivorship and not as tenants in common.

Husband And Wife As A Tenancy By The Entirety - is an account in the name

of two persons who are husband and wife as tenants by the entirety.

Pay-On-Death Account (not subject to the Nonprobate Transfers Law of

Missouri) - f two or more of you create such an account, you own the account

jointly with survivorship. Beneficiaries cannot withdraw unless: (1) all persons

creating the account die, and (2) the beneficiary is then living. f two or more

beneficiaries are named and survive the death of all persons creating the

account, such beneficiaries will own this account in equal shares, without right of

survivorship. The person(s) creating either of these account types reserves the

right to: (1) change beneficiaries, (2) change account types, and (3) withdraw all

or part of the account funds at any time.

UTMA Accounts - Under the Uniform Transfers to Minors Act, the funds in the

account are owned by the child who has unconditional use of the account when

he or she reaches the age of majority. Before that time, the account may be

accessed only by the custodian (or successor custodian), and the funds must be

used for the benefit of the child. We, however, have no duty or agreement

whatsoever to monitor or insure that the acts of the custodian (or successor

custodian) are for the child's benefit. For this type of account, the child's SSN/TN

is used for the Backup Withholding Certification.

Fiduciary Accounts - Accounts may be opened by a person acting in a fiduciary

capacity. This account may be opened and maintained by a person or persons

named as a trustee under a written trust agreement, or as executors,

administrators, or conservators under court orders. You understand that by

merely opening such an account, we are not acting in the capacity of a trustee in

connection with the trust nor do we undertake any obligation to monitor or

enforce the terms of the trust or letters.

BACKUP WITHHOLDING/TIN CERTIFICATION - Federal tax law requires us to

report interest payments we make to you of ten dollars ($10) or more in a year, and

to include your taxpayer identification number (TN) on the report (the taxpayer

identification number is your social security number if you are an individual).

nterest includes dividends, interest and bonus payments for purposes of this rule.

9

DWK05100 (Eff 02/12)

Therefore, we require you to provide us with your TN and to certify that it is correct.

n some circumstances, federal law requires us to withhold and pay to the RS a

percentage of the interest that is earned on funds in your accounts. This is known

as backup withholding. We will not have to withhold interest payments when you

open your account if you certify your TN and certify that you are not subject to

backup withholding due to underreporting of interest. We may subsequently be

required to begin backup withholding if the RS informs us that you supplied an

incorrect TN or that you underreported your interest income.

DORMANT ACCOUNTS - For any account other than a certificate of deposit, if

there is no activity for twelve (12) months other than the crediting of interest, you

agree that the bank may charge you a monthly dormant account fee as described

in the Fee Schedule. You further agree that if we choose to delay when we start

charging you this fee, we do not waive our right to begin charging it at a later

date. You agree that we may, at our discretion, choose to close any account that

you maintain with us that we have determined to be dormant.

STATEMENTS - Your duty to report unauthorized signatures, aIterations

and forgeries - You must examine your statement of account with "reasonable

promptness. f you discover (or reasonably should have discovered) any

unauthorized signatures or alterations, you must promptly notify us of the

relevant facts. As between you and us, if you fail to do either of these duties, you

will have to either share the loss with us, or bear the loss entirely yourself

(depending on whether we used ordinary care and, if not, whether we

substantially contributed to the loss). The loss could be not only with respect to

items on the statement but also to other items with unauthorized signatures or

alterations by the same wrongdoer.

You agree that the time you have to examine your statement and report to us will

depend on the circumstances, but will not, in any circumstance, exceed a total of

thirty (30) days from when the statement is first sent or made available to you.

You further agree that if you fail to report any unauthorized signatures, alterations

or forgeries in your account within sixty (60) days of when we first send or make

the statement available, you cannot assert a claim against us on any items in that

statement, and as between you and us the loss will be entirely yours. This sixty

(60)-day limitation is without regard to whether we used ordinary care. The

limitation in this paragraph is in addition to that contained in the first paragraph of

this section.

Your duty to report other errors - n addition to your duty to review your

statements for unauthorized signatures, alterations and forgeries, you agree to

examine your statement with reasonable promptness for any other error - such

as an encoding error. You agree that the time you have to examine your

statement and report to us will depend on the circumstances. However, such

time period shall not exceed sixty (60) days. Failure to examine your statement

and report any such errors to us within sixty (60) days of when we first send or

make the statement available precludes you from asserting a claim against us for

any such errors on items identified in that statement and as between you and us

the loss will be entirely yours.

Errors reIating to eIectronic fund transfers or substitute checks - For

information on errors relating to electronic fund transfers (e.g., computer, debit

card or ATM transactions) refer to your disclosure and

10

DWK05100 (Eff 02/12)

the sections on consumer liability and error resolution below. For information on

errors relating to a substitute check you received, refer to your disclosure entitled

Substitute Checks and Your Rights.

MASTERCARD ZERO LIABILITY PROTECTION - When your MasterCard debit

card is used for point-of-sale transactions that do not require a personal

identification number (PN), you may not be responsible for unauthorized

purchases provided that your account is in good standing, you have exercised

reasonable care in safeguarding your card (for example registering certain cards)

from any unauthorized use, and you have not reported two (2) or more

unauthorized events in the past twelve (12) months. Unauthorized use means

that you did not provide, directly, by implication or otherwise, the right to use your

card and you received no benefit from the "unauthorized purchase. f any of the

conditions set forth above are not met, you may be liable for the transaction to

the extent set forth in the disclosure included below.

RESOLVING ACCOUNT DISPUTES - We may place an administrative hold on

the funds in your account (refuse payment or withdrawal of the funds) if it

becomes subject to a claim adverse to (1) your own interest; (2) others claiming

an interest as survivors or beneficiaries of your account; or (3) a claim arising by

operation of law. The hold may be placed for such period of time as we believe

reasonably necessary to allow a legal proceeding to determine the merits of the

claim or until we receive evidence satisfactory to us that the dispute has been

resolved. We will not be liable for any items that are dishonored as a

consequence of placing a hold on funds in your account for these reasons.

CLAIM OF LOSS - f you claim a credit or refund because of a forgery, alteration,

or any other unauthorized withdrawal, you agree to cooperate with us in the

investigation of the loss, including giving us an affidavit containing whatever

reasonable information we require concerning your account, the transaction, and

the circumstances surrounding the loss. You will notify law enforcement

authorities of any criminal act related to the claim of lost, missing, or stolen

checks or unauthorized withdrawals. We will have a reasonable period of time to

investigate the facts and circumstances surrounding any claim of loss. Unless we

have acted in bad faith, we will not be liable for special or consequential

damages, including loss of profits or opportunity, or for attorneys' fees incurred

by you. You agree that you will not waive any rights you have to recover your

loss against anyone who is obligated to repay, insure, or otherwise reimburse

you for your loss. You will pursue your rights or, at our option, assign them to us

so that we may pursue them. Our liability will be reduced by the amount you

recover or are entitled to recover from these other sources.

ACCOUNT HOLDS - f we have reason to suspect that your account has been or

is being used for any irregular or illegal activities, we may place a hold on the

balance in the account and on the balances in any additional accounts you have

with us without any liability to you while we investigate. f we place a hold on your

account(s), we will notify you as required by law.

LEGAL ACTIONS AFFECTING YOUR ACCOUNT - f we are served with a

subpoena, restraining order, writ of attachment or execution, levy, garnishment,

search warrant, or similar order relating to your account (termed "legal action in

11

DWK05100 (Eff 02/12)

this section), we will comply with that legal action. Or, in our discretion, we may

freeze the assets in the account and not allow any payments out of the account

until a final court determination regarding the legal action. We may do these

things even if the legal action involves less than all of you. n these cases, we will

not have any liability to you if there are insufficient funds to pay your items

because we have withdrawn funds from your account or in any way restricted

access to your funds in accordance with the legal action. Any fees or expenses

we incur in responding to any legal action (including, without limitation, attorneys'

fees and our internal expenses) may be charged against your account. The list of

fees applicable to your account(s) provided elsewhere may specify additional

fees that we may charge for certain legal actions.

SETOFF - We may (without prior notice and when permitted by law) set off the

funds in this account against any due and payable debt you owe us now or in the

future, by any of you having the right of withdrawal, to the extent of such persons'

or legal entity's right to withdraw. f the debt arises from a note, "any due and

payable debt includes the total amount of which we are entitled to demand

payment under the terms of the note at the time we set off, including any balance

the due date for which we properly accelerate under the note.

This right of setoff does not apply to this account if prohibited by law. For

example, the right of setoff does not apply to this account if: (a) it is an ndividual

Retirement Account or similar tax-deferred account, or (b) the debt is created by

a consumer credit transaction under a credit card plan (but this does not affect

our rights under any consensual security interest), or (c) the debtor's right of

withdrawal only arises in a representative capacity. We will not be liable for the

dishonor of any check when the dishonor occurs because we set off a debt

against this account. You agree to hold us harmless from any claim arising as a

result of our exercise of our right of setoff.

AMENDMENTS AND TERMINATION - We may change any term of this

agreement. Rules governing changes in interest rates are provided separately.

For other changes, we will give you reasonable notice in writing or by any other

method permitted by law. We may also close this account at any time upon

reasonable notice to you and tender of the account balance personally or by

mail. Notice from us to any one of you is notice to all of you.

CHANGING ACCOUNT PRODUCTS - We may change your account to another

product offered by us at any time by giving you notice that your account will be

changed to another product on a specified date. f your account is a certificate of

deposit, the change will not occur before the next maturity date of your certificate

of deposit. f you do not close your account before the date specified in the

notice, we may change your account to that other product on the date specified

in the notice.

ACCOUNT TRANSFER - This account may not be transferred or assigned

without our prior written consent.

ADVISORY AGAINST ILLEGAL USE - You agree not to use your card(s) for

illegal gambling or other illegal purpose. Display of a payment card logo by, for

example, an on-line merchant does not necessarily mean that transactions are

lawful in all jurisdictions in which the cardholder may be located.

12

DWK05100 (Eff 02/12)

MONITORING AND RECORDING TELEPHONE CALLS - We may monitor or

record phone calls for security reasons and to ensure that you receive courteous

and efficient service. You consent in advance to any such recording. We need

not remind you of our recording before each phone conversation.

ARBITRATION - This Agreement contains a pre-dispute arbitration clause, which

will survive the termination of this Agreement and the Account. By signing an

arbitration agreement, you and TAA-CREF Trust Company, FSB agree as

follows:

All parties to this Agreement are giving up the right to sue each other in

court, including the right to a trial by jury, except as provided by the rules of

the arbitration forum in which a claim is filed.

Arbitration awards are generally final and binding; a party's ability to have a

court reverse or modify an arbitration award is very limited.

The ability of the parties to obtain documents, witness statements and other

discovery is generally more limited in arbitration than in court proceedings.

The arbitrators do not have to explain the reason(s) for their awards.

The rules of some arbitration forums may impose time limits for bringing a

claim in arbitration. n some cases, a claim that is ineligible for arbitration

may be brought in court.

The rules of the arbitration forum in which the claim is filed, and any

amendments thereto, will be incorporated into this Agreement.

The arbitrator shall have no authority to award punitive damages or any other

kind of damages not measured by the prevailing party's actual damages.

T S AGREED THAT ANY CONTROVERSY OR CLAM ARSNG OUT OF OR

RELATNG TO THS AGREEMENT, OR THE BREACH THEREOF, OR THE

ACCOUNT WLL BE SETTLED BY ARBTRATON ADMNSTERED BY THE

AMERCAN ARBTRATON ASSOCATON ("AAA). THE RULES OF THE

ARBTRATON WLL BE THOSE N GENERAL USE BY THE AAA, EXCEPT AS

MODFED BY THS SECTON OR OTHERWSE AGREED TO BY THE

PARTES. JUDGMENT UPON THE AWARD RENDERED BY THE

ARBTRATOR MAY BE ENTERED N ANY COURT HAVNG JURSDCTON

THEREOF. THE ARBTRATON WLL BE BEFORE A SNGLE ARBTRATOR

AND WLL BE HELD N THE CTY OF ST. LOUS, MSSOUR. THE

PREVALNG PARTY WLL BE ENTTLED TO RECOVER TS REASONABLE

ATTORNEYS' FEES AND EXPENSES OF LTGATON, NCLUDNG EXPERT

COSTS, N ANY SUCH ARBTRATON.

-------------

ELECTRONIC FUND TRANSFERS -

YOUR RIGHTS AND RESPONSIBILITIES

Please read this disclosure carefully because it tells you your rights and

obligations under the Electronic Fund Transfers Act for the transactions listed.

You should keep this notice for future reference.

ELECTRONIC FUND TRANSFER SERVICES - The following electronic fund

transfer services are available to you when you open a deposit account with

TAA-CREF Trust Company, FSB.

Direct deposits of payments from the Federal Government such as social

security, veteran's benefits, or other such payments that you receive.

13

DWK05100 (Eff 02/12)

Direct deposits of payroll to your account if your employer offers and you sign up

for this service.

Other deposits to your account that are handled electronically such as an

automated clearing house transaction that we receive from a third party or that

we initiate on your behalf or a check image that we allow you to present to us

using our remote deposit service if we make that service available to you.

Withdrawals from your account that you authorize a third party to undertake on

your behalf when we receive a properly completed request from the third party to

transfer funds to them.

Transfers of funds from an account you have with us to a different deposit

account or to a loan account that you have with us that you request either by

telephone, our on-line banking service, our automated telephone banking

service, an automated teller machine, or our mobile banking service if it is made

available to you. You will be required to verify your identity to use any of these

electronic fund transfer services.

Transfers of funds from an account you have with us to an account you have with

a different bank either by telephone or our on-line banking service. You will be

required to verify your identity to use any of these electronic fund transfer

services.

Transfers of funds from an account you have with us to third parties using our bill

pay service either by telephone, our on-line banking service, our automated

telephone banking service, or our mobile banking service if it is made available to

you. You will be required to verify your identity to use any of these electronic fund

transfer services.

Transfers or withdrawals of funds as instructed by your use of a debit or ATM

card if one is provided to you.

FEES - There is no fee for most of the electronic fund transfer services that we

make available to you. However, there are fees for the services described below.

f you use our bill pay service to request an expedited payment to a third party,

there is a fee for that service. The current fee for an expedited payment is five

dollars ($5.00) if the expedited payment can be completed electronically or

twenty-five dollars ($25.00) if the expedited payment must be made by check.

You will be told what the fee is at the time you request this service.

f you use an ATM card or debit card to withdraw cash in a foreign currency, we

will charge you two dollars ($2.00) plus two-percent (2%) of the amount you

withdraw once it is converted to U.S. Dollars.

f you use a debit card to make a purchase in a foreign currency or for any

transaction that MasterCard classifies as a cross-border transaction (see the

above for more details about these

transactions), we will charge you a fee equal to two-percent (2%) of the

transaction amount whether or not it is necessary to convert it into U.S. dollars. f

the transaction requires a currency conversion, the fee will be based on the

amount after it is converted to U.S. Dollars.

LIMITATIONS ON ELECTRONIC FUND TRANSFERS - The following limitations

apply to electronic fund transfers.

You may not make cash withdrawals from an ATM totaling more than $1,000.00

per day using an ATM or debit card.

14

DWK05100 (Eff 02/12)

You may not use your debit card to make transactions totaling more than $7,500

in any one day. No more than $2,500 of those transactions may be PN (non-

signature) based transactions.

You may not use our bill pay service to arrange for a single electronic fund

transfer in excess of $10,000 or for total electronic fund transfers in any one day

in excess of $10,000. You may not use the expedited payment feature of our bill

pay service, if it is made available to you, to arrange for a single electronic fund

transfer in excess of $2,500 or for total electronic fund transfers in any one day in

excess of $5,000. Depending on your account status, we may allow you to

arrange for transactions that exceed these limits, but doing so once does not

obligate us to allow future transactions that exceed these limits.

For Savings and Money Market Accounts you may make up to six transfers or

withdrawals by means of a preauthorized, automatic, or telephonic transfer to

another account of yours or to a third party or by check, debit card, or similar

order to a third party during any calendar month (or statement cycle of at least

four weeks). A preauthorized transfer includes any arrangement with us to pay a

third party from your account at (i) a predetermined time; (ii) on a fixed schedule

or (iii) upon oral or written orders including orders received through the

automated clearing house (ACH). f the transfer or withdrawal is initiated in

person, by mail, or at an ATM then there is no limit on the number of payments

that may be made directly to you, directly to us for amounts you owe us, or

transfers to other accounts you have with us. Withdrawals by phone are also

unlimited if you are requesting that a check be mailed to you. f you exceed these

limits, we may close your account or convert it to a checking account.

ATM OPERATOR AND NETWORK FEES - When you use an ATM, you may be

charged a fee by the ATM operator or by any network used. You may be charged

a fee for a balance inquiry even if you do not complete a fund transfer.

DOCUMENTATION

TerminaI transfers - You can get a receipt at the time you make a transfer from

your account using an ATM or a point-of-sale terminal. However, you may not get

a receipt if the amount of the transfer is fifteen dollars ($15) or less.

Preauthorized credits - f you have arranged to have direct deposits made to

your account at least once every sixty (60) days from the same person or

company, you can call us at 1-855-TAA-FSB (842-2372) or use our on-line

banking service www.banking.tiaa-cref.org to find out whether or not the deposit

has been made.

Periodic statements - We will make a periodic statement for your checking,

savings, money market, and certificate of deposit accounts available to you at

least four times a year. Electronic fund transfers will be listed on your statement.

BUSINESS DAYS - Our business days are Monday through Friday Excluding

Federal Holidays

STOPPING PREAUTHORIZED PAYMENTS - f you have told us in advance to

make regular payments out of your account, you can stop any of these payments

by calling us at 1-855-TAA-FSB (1-855-842-2372), by writing to us at TAA-CREF

15

DWK05100 (Eff 02/12)

Trust Company, FSB, P.O. Box, 2140, Cranberry Township, PA 16066 or by using

our on-line banking service to instruct us to stop the payment. We must receive

your request at least three (3) business days before the payment is scheduled to

be made. f you call or use our on-line banking service, we may also require you to

put your request in writing and get it to us within fourteen (14) days.

Please refer to the attached Fee Schedule for the amount we will charge you for

each stop-payment order you give.

f you tell us to stop one of these payments at least three (3) business days

before the transfer is scheduled, and we do not do so, we will be liable for your

losses or damages unless we required and did not receive written confirmation of

a stop payment request that you made by telephone by using our on-line banking

service with the fourteen (14) days, and the transfer takes place after the

fourteen (14) day period. We will not be responsible for failing to act on your stop

payment instructions if you do not give us precise and correct information about

the payment that is to be stopped.

NOTICE OF VARYING AMOUNTS - f you have arranged for regularly

scheduled transactions that a third party will initiate for you and the amounts of

those transactions may vary, the third party will tell you, ten (10) days before

each transaction, the date and amount of the transaction.

FINANCIAL INSTITUTION'S LIABILITY - f we do not complete a transfer to or

from your account on time or in the correct amount according to our agreement

with you, we will be liable for your losses or damages unless:

(1) through no fault of ours, you do not have enough money in your account to

make the transfer;

(2) the funds in your account are not yet available for withdrawal, or are

otherwise appropriately held from withdrawal;

(3) you have an overdraft line of credit and the transfer would exceed the credit

limit;

(4) the automated teller machine where you are making the transfer does not

have enough cash;

(5) the terminal or system was not working properly and you knew about the

breakdown when you started the transfer;

(6) circumstances beyond our control (such as fire or flood) prevent the

transfer, despite reasonable precautions that we have taken; or

(7) an exception otherwise stated in our agreement with you would apply.

CONFIDENTIALITY - We will disclose information to third parties about your

account or the transfers you make:

(1) where it is necessary for completing transfers;

(2) in order to verify the existence and condition of your account for a third

party, such as a credit bureau or merchant;

(3) in order to comply with government agency or court orders; or

(4) as explained in the separate Privacy Disclosure.

CONSUMER LIABILITY FOR UNAUTHORIZED TRANSFERS - Tell us AT

ONCE if you believe that an unauthorized electronic fund transfer has occurred or

if you believe that one may occur because access to your account (for example

your debit or ATM card or your personal identification information) may no longer

16

DWK05100 (Eff 02/12)

be secure and may be used without your permission. Telephoning is the best way

of keeping your possible losses down. f you do not tell us about an unauthorized

fund transfer or fail to tell us that access to your account may no longer be secure,

you could lose all the money in your account (plus your maximum overdraft line of

credit). f you do notify us, your liability will be limited as follows.

f you tell us within two (2) business days after you learn that access to your

account may no longer be secure, you can lose no more than fifty ($50) for

unauthorized transfers out of your account. f you do NOT tell us within two (2)

business days after you learn that access to your account may no longer be

secure, and we can prove we could have stopped someone from accessing your

account without your permission if you had told us, you could lose as much as

$500.

f your statement shows transfers that you did not make, tell us at once. f you do

not tell us within sixty (60) days after the statement was mailed to you, you may

not get back any money you lost after the sixty (60) days if we can prove that we

could have stopped someone from taking the money if you had told us in time. f

a good reason (such as a long trip or a hospital stay) kept you from telling us, we

may extend this time period.

RESOLVING ERRORS OR QUESTIONS ABOUT YOUR TRANSFERS - Call or

write us at the telephone number or address listed below or through our on-line

banking service as soon as you can if you think your statement or receipt is

wrong or if you need more information about a transfer listed on a statement or

receipt. We must hear from you no later than sixty (60) days after we made the

FRST statement on which the problem or error appeared available to you.

Provide us with the following information:

(1) your name and account number (if any);

(2) a description of the error or the transfer you are unsure about, and explain

as clearly as you can why you believe it is an error or why you need more

information;

(3) the dollar amount of the suspected error.

f you tell us about an error by telephone or by using our on-line banking service,

we may require that you send us your complaint or question in writing within ten

(10) business days.

We will determine whether an error occurred within ten (10) business days

(twenty (20) business days if the transfer involved a new account) after we hear

from you and will correct any error promptly. f we need more time, however, we

may take up to forty-five (45) days (ninety (90) days if the transfer involved a new

account, a point-of-sale transaction, or a foreign-initiated transfer) to investigate

your complaint or question. f we decide to do this, we will credit your account

within ten (10) business days (twenty (20) business days if the transfer involved a

new account) for the amount you think is in error, so that you will have the use of

the money during the time it takes us to complete our investigation. f we ask you

to put your complaint or question in writing and we do not receive it within ten

(10) business days, we may not credit your account. Your account is considered

a new account for the first thirty (30) days after the first deposit is made, unless

each of you already has an established account with us before this account is

opened.

We will tell you the results within three (3) business days after completing our

investigation. f we decide that there was no error, we will send you a written

explanation. f we credit your account while we investigate and later conclude

17

DWK05100 (Eff 02/12)

that no error occurred we will debit your account for the amount that was

credited.

You may ask for copies of the documents that we used in our investigation.

CONTACT US - Here is how to contact us with a question about an electronic

fund transfer, to report an error with an electronic fund transfer, to tell us about

an unauthorized transfer, or to tell us that access to your account may no longer

be secure.

Write us at:

TAA-CREF Trust Company, FSB

Customer Service

P.O. Box 2134

Cranberry Township, PA 16066

Or Telephone us at:

1-855-TAA-FSB (842-2372)

Or use our on-line banking service at:

www.banking.tiaa-cref.org

-------------

YOUR ABILITY TO WITHDRAW FUNDS

This policy statement applies to all deposit accounts.

Our policy is to make funds from your check deposits available to you on the

second business day after the day we receive your deposit, with the first $200

available on the first business day after the day of your deposit. Funds from

electronic deposits initiated by the payer (for example direct deposits of payroll or

other payments like government benefits) will be available on the day we credit

the deposit to your account. Funds from electronic funds transfers or automated

clearing house transactions that we initiate on your behalf will be available on the

business day following the day we credit the deposit to your account. Cash, wire

transfers, and some specified check deposits will also be available before the

second business day, as detailed below. Once the funds are available, you can

withdraw them in cash and we will use the funds to pay checks that you have

written.

Please remember that even after we have made funds available to you, and you

have withdrawn the funds, you are still responsible for checks you deposit that

are returned to us unpaid and for any other problems involving your deposit.

For determining the availability of your deposits, every day is a business day,

except Saturdays, Sundays, and federal holidays. f you make a deposit before

5:00 P.M. ET on a business day that we are open, we will consider that day to be

the day of your deposit. However, if you make a deposit after 5:00 P.M. ET or on

a day we are not open, we will consider that the deposit was made on the next

business day we are open.

Same-Day AvaiIabiIity

Funds from electronic direct deposits to your account will be available on the day

we receive the deposit.

18

DWK05100 (Eff 02/12)

Next-Day AvaiIabiIity

Funds from the following deposits are available on the first business day after the

day of your deposit:

U.S. Treasury checks that are payable to you.

Wire transfers.

Checks drawn on TAA-CREF Trust Company, FSB.

Other Check Deposits Subject to Second-Day AvaiIabiIity

The first $200 from a deposit of other checks will be available on the first

business day after the day of your deposit. The remaining funds will be available

on the second business day after the day of your deposit. For example, if you

deposit a check of $700 on a Monday, $200 of the deposit is available on

Tuesday. The remaining $500 is available on Wednesday.

f we cash a check for you that is drawn on another bank, we may withhold the

availability of a corresponding amount of funds that are already in your account.

Those funds will be available at the time funds from the check we cashed would

have been available if you had deposited it.

f we accept for deposit a check that is drawn on another bank, we may make

funds from the deposit available for withdrawal immediately but delay your

availability to withdraw a corresponding amount of funds that you have on

deposit in another account with us. The funds in the other account would then not

be available for withdrawal until the time periods that are described elsewhere in

this disclosure for the type of check that you deposited.

LONGER DELAYS MAY APPLY

Funds you deposit by check may be delayed for a longer period under the

following circumstances:

We believe a check you deposit will not be paid.

You deposit checks totaling more than $5,000 on any one day.

You redeposit a check that has been returned unpaid.

You have overdrawn your account repeatedly in the last six months.

There is an emergency, such as failure of computer or communications

equipment.

We will notify you if we delay your ability to withdraw funds for any of these

reasons, and we will tell you when the funds will be available. They will

generally be available no later than the seventh business day after the day of

your deposit.

-------------

SUBSTITUTE CHECKS AND YOUR RIGHTS

As our customer we think it's important for you to know about substitute

checks. The following Substitute Check Disclosure provides information about

substitute checks and your rights.

What is a substitute check?

To make check processing faster, federal law permits banks to replace

original checks with "substitute checks. These checks are similar in size to

original checks with a slightly reduced image of the front and back of the

original check. The front of a substitute check states: "This is a legal copy of

19

DWK05100 (Eff 02/12)

your check. You can use it the same way you would use the original check.

You may use a substitute check as proof of payment just like the original

check.

Some or all of the checks that you receive back from us may be substitute

checks. This notice describes rights you have when you receive substitute

checks from us. The rights in this notice do not apply to original checks or to

electronic debits to your account. However, you have rights under other law

with respect to those transactions.

What are my rights regarding substitute checks?

n certain cases, federal law provides a special procedure that allows you to

request a refund for losses you suffer if a substitute check is posted to your

account (for example, if you think that we withdrew the wrong amount from

your account or that we withdrew money from your account more than once

for the same check). The losses you may attempt to recover under this

procedure may include the amount that was withdrawn from your account and

fees that were charged as a result of the withdrawal (for example, bounced

check fees).

The amount of your refund under this procedure is limited to the amount of

your loss or the amount of the substitute check, whichever is less. You also

are entitled to interest on the amount of your refund if your account is an

interest-bearing account. f your loss exceeds the amount of the substitute

check, you may be able to recover additional amounts under other law.

f you use this procedure, you may receive up to $2,500 of your refund (plus

interest if your account earns interest) within ten (10) business days after we

received your claim and the remainder of your refund (plus interest if your

account earns interest) not later than forty-five (45) calendar days after we

received your claim. We may reverse the refund (including any interest on the

refund) if we later are able to demonstrate that the substitute check was

correctly posted to your account.

Substitute Checks, Indemnified Copies, Images, and Image RepIacement

Copies

n some cases, we may receive an indemnified copy of your original check, a

substitute check, or an image of your check, instead of the original item. We

may act upon presentment of an indemnified copy, substitute check, or image

of your check and pay these items against your account, just as if the original

item had been presented.

How do I make a cIaim for a refund?

f you believe that you have suffered a loss relating to a substitute check that you

received and that was posted to your account, please contact us at:

1-855-TAA-FSB (1-855-842-2372). You must contact us within forty (40)

calendar days of the date that we mailed (or otherwise delivered by a means to

which you agreed) the substitute check in question or the account statement

showing that the substitute check was posted to your account, whichever is later.

We will extend this time period if you were not able to make a timely claim

because of extraordinary circumstances.

20

DWK05100 (Eff 02/12)

Your claim must include -

A description of why you have suffered a loss (for example, you think the

amount withdrawn was incorrect);

An estimate of the amount of your loss;

An explanation of why the substitute check you received is insufficient to

confirm that you suffered a loss; and

A copy of the substitute check or the following information to help us

identify the substitute check: the check number, the amount of the check,

the date of the check, and the name of the person to whom you wrote the

check.

-------------

TRUTH-IN-SAVINGS DISCLOSURE

INTEREST CHECKING ACCOUNT

Rate Information - See the attached Disclosure of Current Rates.

Frequency of Rate Changes - We may change the interest rate on your account

at any time.

Determination of Rate - At our discretion, we may change the interest rate on

your account.

Compounding and Crediting Frequency - nterest will be compounded every

day. nterest will be credited to your account every month.

Effect of CIosing an Account - f you close your account before interest is

credited, you will not receive the accrued interest.

Minimum BaIance to Open the Account - You must deposit $25.00 to open

this account.

DaiIy BaIance Computation Method - We use the daily balance method to

calculate the interest on your account. This method applies a daily periodic rate

to the principal in the account each day.

AccruaI of Interest on Noncash Deposits - nterest begins to accrue no later

than on the business day following the day we credit the deposit to your account.

Fees - See the attached Fee Schedule.

HIGH YIELD SAVINGS ACCOUNT

Rate Information - See the attached Disclosure of Current Rates.

Frequency of Rate Changes - We may change the interest rate on your account

at any time.

Determination of Rate - At our discretion, we may change the interest rate on

your account.

21

DWK05100 (Eff 02/12)

Compounding and Crediting Frequency - nterest will be compounded every

day. nterest will be credited to your account every month.

Effect of CIosing an Account - f you close your account before interest is

credited, you will not receive the accrued interest.

Minimum BaIance to Open the Account - You must deposit $25.00 to open

this account.

DaiIy BaIance Computation Method - We use the daily balance method to

calculate the interest on your account. This method applies a daily periodic rate

to the principal in the account each day.

AccruaI of Interest on Noncash Deposits - nterest begins to accrue no later

than on the business day following the day we credit the deposit to your account.

Fees - See the attached Fee Schedule.

Transaction Limitations - Transfers from a High Yield Savings account to

another account or to third parties by preauthorized, automatic, telephone, or

computer transfer or similar order are limited to six per statement cycle. No

transfers by check, draft or debit card are permitted.

MONEY MARKET ACCOUNT (MMDA)

Rate Information - See the attached Disclosure of Current Rates.

Frequency of Rate Changes - We may change the interest rate on your account

at any time.

Determination of Rate - At our discretion, we may change the interest rate on

your account.

Compounding and Crediting Frequency - nterest will be compounded every

day. nterest will be credited to your account every month.

Effect of CIosing an Account - f you close your account before interest is

credited, you will not receive the accrued interest.

Minimum BaIance to Open the Account - You must deposit $25.00 to open

this account.

DaiIy BaIance Computation Method - We use the daily balance method to

calculate the interest on your account. This method applies a daily periodic rate

to the principal in the account each day.

AccruaI of Interest on Noncash Deposits - nterest begins to accrue no later

than on the business day following the day we credit the deposit to your account.

Fees - See the attached Fee Schedule.

Transaction Limitations - Transfers from a Money Market account to another

account or to third parties by preauthorized, automatic, telephone, or computer

transfer or by check, draft, debit card, or similar order are limited to six per

statement cycle.

The foIIowing terms and conditions onIy appIy to you if you enroII in and

use our Remote Deposit Service.

REMOTE DEPOSIT SERVICE TERMS AND CONDITIONS

The Remote Deposit Service ("Remote Deposit) is provided to you by TAA-

CREF Trust Company, FSB ("Bank, "we, "us, "our). When used in this

agreement, "you and "your mean any person who enrolls in or is otherwise

authorized to use Remote Deposit. By enrolling in and continuing to use

Remote Deposit, you agree to be bound by the terms contained in this

agreement; you should print and retain it for future reference. The terms of

22

DWK05100 (Eff 02/12)

this agreement are in addition to any account agreements, disclosures and

other documents in effect from time to time governing your account.

GeneraI

Remote Deposit, if made available to you, allows you to electronically present

images of certain types of checks along with additional deposit related

information to us, or to a processor we select, for deposit into an account that

you maintain with the Bank. These images are created and transmitted by

using our website or a different website that we direct you to and a personal

computer and scanner, or by using a mobile cellular device that has the

appropriate software downloaded onto it.

Using Remote Deposit

You may cancel your enrollment in and use of Remote Deposit at any time.

You agree that we may change requirements for use of, suspend, or

discontinue Remote Deposit or your use of Remote Deposit at any time

without prior notice to you.

n order to use Remote Deposit, you will need to maintain certain hardware

and software. You agree to obtain and maintain necessary hardware and

software at your expense. We are not responsible for third party software you

may need for Remote Deposit. f required, software is to be obtained and/or

accepted by you and is subject to the agreement you make with the provider

of that software; we are not party to that agreement.

Remote Deposit is provided for your convenience and does not constitute the

official record of your account(s). You understand and agree that information

transmitted to and from you when you use Remote Deposit may not be

encrypted and may include personal or confidential information about you and