Beruflich Dokumente

Kultur Dokumente

Economics............ Cost Analysis

Hochgeladen von

Ganesh ReddyOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Economics............ Cost Analysis

Hochgeladen von

Ganesh ReddyCopyright:

Verfügbare Formate

In an earlier article we focused on the Big 4 IT companies (TCS, Infosys, Wipro and HCL), identified the four revenue

drivers, and found out which of those were sector versus company specific. Now, this article focuses on the cost structure of these companies with particular reference to employee costs. We examine 1QFY13 QoQ costs to determine whether the core operating cost components are controllable by the company, or are they uniform across the IT sector? Operating Costs and its core components: For the IT services sector, the primary operating cost drivers are: 1. Cost of revenue (CoR): This includes employee related costs, fees to external consultants/subcontracting costs, travel costs, facility expenses and depreciation, etc. 2. Selling, General and Administrative expenses (SG&A): These primarily comprise of employee costs (non-billable/project related employees), fees to consultants, allocation of depreciation costs, travel, marketing, etc. Basically, these are indirect costs, which are incurred over and above the CoR. IT companies are primarily export driven. So, a large portion of their revenues are generated in USD and other foreign currencies. However, most of the operating costs are incurred in Indian rupees. With the rupee depreciation, cost increases as a percentage of revenue could well mask the real situation. Hence, we also focus on the absolute cost increases during the quarter. The table below shows 1QFY13 numbers related to the above two core operating cost components, with particular reference to cost of employees. We also looked at 4QFY12 numbers for which relevant results were similar. So, for simplicity we focused our analysis and discussion on 1QFY13 knowing that our conclusions were validated by 4QFY12 numbers.

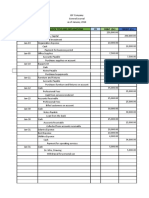

Table 1: 1QFY13 Big 4 Operating Cost Related Parameters

Key Operating Costs Parameters CoR as a % of revenue CoR increase CoR increase in employee costs S,G &A as a % of revenue S,G&A increase S,G&A increase in employee costs TCS Infosys Wipro 53.8% 13.2% 15.2% 18.7% 10.5% 10.4% 11.8% 8.3% HCL 9.1% NA NA 6.1% NA NA 60.4% 66.3% 64.8% 49.0% 43.0% 10.7% 11.0% 10.6% 14.0% 5.7% 3.2% NA NA

CoR Employee cost in as a % of revenue 38.3%

11.6% 12.7% 15.8%

S,G&A Employee cost as a % of revenue 12.5%

Note: Click here for quarterly results of the IT sector

Cost of Revenue (CoR): As the table above shows, for 1QFY13 TCS showed a QoQ CoR increase of 13.2% against a USD constant currency revenue (CCR) growth of 4%, and a 15% rupee revenue growth. CoR made up 53.8%

of revenue. For Infosys, the QoQ CoR growth was 11.8% against a CCR decline of 0.4%, and a 9% rupee revenue growth. CoR made up 60.4% of revenue. For Wipro's IT services segment, the QoQ CoR growth was 8.3%, versus a CCR growth of 0.4% and a rupee revenue growth of 9.6%. CoR made up 66% of revenue. For HCL, we compared 4QFY12 (HCL follows a June year end) with 3QFY12. HCL saw a 9% CoR growth against a CCR growth of 4.6% and a rupee revenue growth of 13.5%. All these show that CoR as a percentage of revenue and its increase does vary by company. CoR Employee Costs: In 1QFY13,TCS CoR employee costs represented 38.3% and it increased by 15.2% QoQ. For Infosys CoR employee costs represented 49% and it increased by 15.2% QoQ. For Wipro's IT services segment, the corresponding breakup for CoR and SG&A was not available in their annual reports. But for Wipro Ltd. as a whole, employee expenses in 1QFY13 were 43% and it grew 11% QoQ . HCL too did not report any breakup for CoR and SG&A (HCL follows a June year end). Further, while TCS announced pay hikes during the quarter, Infosys neither implemented nor did it make any future commitment with respect to pay hikes. For Wipro and HCL, the full effect of pay hikes will be more visible in the coming quarters. Another interesting point to note over here is that although the increase in employee costs over the quarter was the highest for TCS, employee costs as a percentage of revenues was in the late 30's for TCS, compared to the late 40's for Infosys, and early 40's for Wipro. These variations by company lead us to infer that CoR employee cost management for project related employees is more of a company specific issue. And even with disproportionate billable employee costs, the companies were basically able to consistently maintain the employee cost structures with respect to their revenues. Selling, General and Administrative Expenses (SG&A): In the case of TCS, SG&A comprised of approximately 19% of revenues in 1QFY13. SG&A related employee expenses made up 12.5% of revenues and grew by 10.4% QoQ. For Infosys, SG&A represented 11.6% of revenues in 1QFY13. SG&A related employee expenses were 5.7% of revenues in 1QFY13 and it grew by 3.2% QoQ. For Wipro's IT Services segment, SG&A was 12.7% of revenues in 1QFY13 and it grew by 14% QoQ. Finally, HCL's SG&A made up 15.8% of revenues and grew at 6.1% QoQ. Overall, TCS seems to present an atypical picture as SG&A ate up nearly 19% of revenues, whereas for Infosys, Wipro and HCL this ratio was in the 12%-16% range. We note that while HCL was smart enough to restrict the SG&A growth to 6% in 1QFY13, the figure was comparatively larger for Wipro at 14%; Infosys and TCS saw a similar growth of approximately 11%. SG&A Employee Costs:

A further drill down (within the limits of data availability) reveals that SG&A employee costs were 12.5% and 5.7% of TCS's and Infosys's respective revenues in 1QFY13. Again, the figures compel us to note that overall SG&A and SG&A employee costs are essentially company and not sector specific drivers. Effect on operating profit: Our objective was to examine the two operating cost components - CoR, SG&A and with a particular focus on employee costs to know whether any uniformity with respect to those exists across the Big4. Having done so, to provide a complete picture, the table below shows the impact on the growth of the respective operating profits (revenues less operating costs) of the Big 4.

Table 2: 1QFY13 QoQ Key Operating profit parameters for the Big 4 IT companies

Sequential increase (in Rs) Revenue Cost of Revenue S,G&A Employee costs within cost of revenue Operating profit TCS Infosys Wipro 12.1% 13.2% 10.5% 15.2% 11.3% 8.6% 11.8% 8.3% HCL 9.1% 6.1% NA 9.5% 13.5%

10.6% 14.0% 10.7% 11.0%

1.7% 10.9% 40.4%

The above table clearly shows that different sequential increases with respect to revenue, CoR and S,G&A across the Big4 had different impacts on the respective operating profits: Less than proportionate increases with respect to CoR and S,G&A compared to revenue in case of HCL magnified its operating profit growth by 40%, whereas for Infosys the result was opposite. Conclusion: Our detailed analysis of operating cost structures leads us to conclude that although the Big4 Indian IT companies offer similar services and operate in same geographies, each of them has control over and manages their operating costs differently. And this naturally has varying effects on their operating profits. We further conclude that the timeless essence of studying each company closely holds true even when companies are in the same sector.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Soal Asis Ak2 Pertemuan 1Dokument2 SeitenSoal Asis Ak2 Pertemuan 1Aisya Fadhilla ShamaraNoch keine Bewertungen

- Customers - The Focus of Service ManagementDokument31 SeitenCustomers - The Focus of Service ManagementMuthusamy SenthilkumaarNoch keine Bewertungen

- A Comparative Study of Performance of Local Banks in Sultanate of OmanDokument10 SeitenA Comparative Study of Performance of Local Banks in Sultanate of OmanResearch StudiesNoch keine Bewertungen

- Partnership CasesDokument104 SeitenPartnership CasesLUNANoch keine Bewertungen

- November 15Dokument16 SeitenNovember 15MLastTryNoch keine Bewertungen

- Pay Commission ReportDokument762 SeitenPay Commission ReportddetvmNoch keine Bewertungen

- Shashank Kantheti Hyd 12 13Dokument5 SeitenShashank Kantheti Hyd 12 13kshashankNoch keine Bewertungen

- Congratulations On The Bonus Accrued!: Gajbhiye AmitkumarDokument2 SeitenCongratulations On The Bonus Accrued!: Gajbhiye Amitkumaramit gajbhiyeNoch keine Bewertungen

- Provident Apllication FormDokument2 SeitenProvident Apllication FormIan Khay Castro50% (2)

- Customer Satisfaction of Sunlife Insurance Company Ltd.Dokument43 SeitenCustomer Satisfaction of Sunlife Insurance Company Ltd.SharifMahmudNoch keine Bewertungen

- High Speed RailDokument24 SeitenHigh Speed RailmattNoch keine Bewertungen

- Ei 0501Dokument4 SeitenEi 0501Trina DominguezNoch keine Bewertungen

- NB Corp Purchased A 100 000 Face Value Bond of Myers CorpDokument1 SeiteNB Corp Purchased A 100 000 Face Value Bond of Myers CorpHassan JanNoch keine Bewertungen

- Sources of Public Revenue and Classification of TaxesDokument3 SeitenSources of Public Revenue and Classification of TaxesSiddhuNoch keine Bewertungen

- Acccob1 Partnership Operations Additional ExercisesDokument2 SeitenAcccob1 Partnership Operations Additional ExercisesJazehl Joy ValdezNoch keine Bewertungen

- Banks: Its Role in The Financial Life of A NationDokument13 SeitenBanks: Its Role in The Financial Life of A NationEhsan Karim100% (1)

- ch14 TestDokument43 Seitench14 TestDaniel HunksNoch keine Bewertungen

- Macro1 PDFDokument23 SeitenMacro1 PDFPMNoch keine Bewertungen

- Accounting Journal (Shiela) Output 1Dokument5 SeitenAccounting Journal (Shiela) Output 1TJ JT100% (1)

- CMO Integrated Marketing SVP in Los Angeles CA Resume Lynn FergusonDokument1 SeiteCMO Integrated Marketing SVP in Los Angeles CA Resume Lynn FergusonLynnFerguson2100% (1)

- CIMA Process Costing Sum and AnswersDokument4 SeitenCIMA Process Costing Sum and AnswersLasantha PradeepNoch keine Bewertungen

- AICPA Newly Released MCQsDokument54 SeitenAICPA Newly Released MCQsDaljeet SinghNoch keine Bewertungen

- Conceptual FrameworkDokument12 SeitenConceptual FrameworkShiela PanglimaNoch keine Bewertungen

- Petitioner vs. vs. Respondent: Second DivisionDokument13 SeitenPetitioner vs. vs. Respondent: Second DivisionRNJNoch keine Bewertungen

- Post Office Recurring Deposit (Amendment) Rules. 1999.Dokument12 SeitenPost Office Recurring Deposit (Amendment) Rules. 1999.Latest Laws TeamNoch keine Bewertungen

- Basic Concept of EconomicsDokument19 SeitenBasic Concept of EconomicsmitalptNoch keine Bewertungen

- Tax Administration: BTX 2 Zahor, TalibDokument74 SeitenTax Administration: BTX 2 Zahor, TalibdeogratiasNoch keine Bewertungen

- Exam1 Practice Exam SolutionsDokument37 SeitenExam1 Practice Exam SolutionsSheehan T Khan100% (3)

- SecA - Group 14 - ClearEyesCataractsClinicDokument7 SeitenSecA - Group 14 - ClearEyesCataractsClinicSumit100% (2)

- Chapter 15 ExrecisesDokument7 SeitenChapter 15 ExrecisesZain MajaliNoch keine Bewertungen