Beruflich Dokumente

Kultur Dokumente

The Mosiac of Stock Analysis Part 2: Basic Valuation

Hochgeladen von

djmphdOriginaltitel

Copyright

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

The Mosiac of Stock Analysis Part 2: Basic Valuation

Hochgeladen von

djmphdCopyright:

Overview

Vigilant management

Long term prospects

Stable and understandable

Undervalued

Summary

The Mosaic of Stock Analysis

Part 2: Basic valuation

Based on Warren Buffetts four rules

David J. Moore, Ph.D.

www.efcientminds.com

May 14, 2013

Overview

Vigilant management

Long term prospects

Stable and understandable

Undervalued

Summary

The four rules

The company under consideration must...

1 2 3 4

be managed by vigilant leaders, have long term prospects, be stable and understandable, and be currently undervalued.

Overview

Vigilant management

Long term prospects

Stable and understandable

Undervalued

Summary

Indicators of vigilant management

vigilant: keeping careful watch for possible danger or difculties Too much debt possible danger or difculty Debt < 0.5 Equity For every $1 of equity there is no more than $0.50 of debt. Unable to meet short term obligations possible danger or difculty Current assets current ratio = > 1.5 Current liability

Overview

Vigilant management

Long term prospects

Stable and understandable

Undervalued

Summary

Why hold for the long term?

Sustained earnings. Wouldnt you like to receive dividends year after year? Taxes. Take a look at tax rates vs. holding periods1 : Ordinary income rate ST gains LT gains 5yr gains 15% 15% 10% 8% 28% 28% 20% 18% 31% 31% 20% 18% 36% 36% 20% 18% 39.6% 39.6% 20% 18% Also note that selling every 5 years reduces the amount reinvested and therefore long-run returns.

1 Source:

www.buffettsbooks.com

Overview

Vigilant management

Long term prospects

Stable and understandable

Undervalued

Summary

How to assess long term prospects

Do you see the products being used 30 years from now?

iPhones 30 years from now? No. Some type of communication device, Yes. Apps 30 years from now? The app itself no. Programming skills, yes. Candy 30 years from now? Yes. Fans 30 years from now? Yes.

This is perhaps one of the most subjective of the rules. I have no metrics. Perhaps R&D as a percent of sales? What makes you believe this company is going to be around 30 years from now?

Overview

Vigilant management

Long term prospects

Stable and understandable

Undervalued

Summary

Indicators of stability

Equity: Steady or growing equity. BVPS Earnings: Steady or steadily growing EPS . Debt: Steady Debt-to-Equity ratio averaging 0.5 or less. The more volatility the more difcult it is to forecast and value.

Overview

Vigilant management

Long term prospects

Stable and understandable

Undervalued

Summary

Understandability

Not understandable to me

Facebook: falsied accounting statements, very likely that no one reading this has spent a dime there, not sure how they are going to make money. XM Radio: with MP3 players, iPods, Pandora, etc., who would pay for XM service?

Understandable to me

Chevron: people drive to work and buy gas. Kraft: people must eat. Cisco: this presentation once converted to ones and zeroes passes through Cisco equipment.

Overview

Vigilant management

Long term prospects

Stable and understandable

Undervalued

Summary

How to calculate intrinsic value

Determine growth and discount rates. More on this subject in the next slide.

Use LOGEST to compute BVPS growth rate g . Compare to IGR and SGR . Use the 10 year treasury rate for i .

Compute value of BVPS 10 years from now. BV10 = BV0 (1 + g )10 Compute present value of 10 years of dividends. DPStot = Compute intrinsic value IV = BV10 (1 + i )10 + DPStot DPS0 i 1 1 (1 + i )n

Overview

Vigilant management

Long term prospects

Stable and understandable

Undervalued

Summary

Growth and discount rates

The two most critical factors are also the most difcult to estimate: g and i . Your value add will be in the justication of g and i . Growth rate g

Will BVPS continue to grow at the same rate g over the next 10 years? If yes, why? If higher or lower, why?

Discount rate i

In the previous slide the 10 year treasury was used to establish a maximum price. At that price or above you are better off purchasing a 10 year treasury for the same return with no risk. The discount rate should be commensurate with the companies risk and your required return. Could just use 10% or an industry specic number from my research.

Overview

Vigilant management

Long term prospects

Stable and understandable

Undervalued

Summary

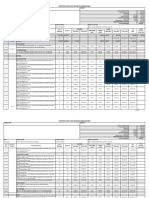

The whole presentation on one slide

Rule 1 2 3 4

Description Vigilant leadership Long term prospects Stable and understandable Undervalued

Metrics D /E < 0.5, CR > 1.5 ? BVPS , EPS , D /E MV < PV [BV10 ] + PV [Div]

The stock analyst adds value (pun intended) by determining long term growth prospects, growth rates g , and discount rates i . The intrinsic value model presumes book grate will grow at g over the next 10 years, dividends will remain constant, and P/B = 1 10 years from now.

Overview

Vigilant management

Long term prospects

Stable and understandable

Undervalued

Summary

Future enhancements

Incorporate risk .

The resulting E [R ] must have risk associated with it. The model is highly sensitive to g . Perhaps use LOGEST to produce g as well.

Include P/B multipliers

The model currently presumes stock will/could be sold in 10 years at the then-current book value, i.e., P/B = 1. However, some stocks trade at P/B multiples way over 1. Could combine E [P/B ] and [P/B ] to arrive at E [R ] and [R ].

Incorporate VAR-type analysis

What is the 5% worst case P/B over the past 10 years? What is the 5% worst case g over the past 10 years?

Das könnte Ihnen auch gefallen

- Applying Historical Context To Home Value EstimatesDokument38 SeitenApplying Historical Context To Home Value EstimatesdjmphdNoch keine Bewertungen

- 2015 FAME VII Conference NotesDokument28 Seiten2015 FAME VII Conference NotesdjmphdNoch keine Bewertungen

- Fall 2014 Fund Introduction PresentationDokument24 SeitenFall 2014 Fund Introduction PresentationdjmphdNoch keine Bewertungen

- Distressed Property Valuation and Optimization of Loan Restructure TermsDokument15 SeitenDistressed Property Valuation and Optimization of Loan Restructure TermsdjmphdNoch keine Bewertungen

- Establishing A Market For Securitized LDC Debt: Feasibility and ViabilityDokument26 SeitenEstablishing A Market For Securitized LDC Debt: Feasibility and ViabilitydjmphdNoch keine Bewertungen

- 2014 FAME VI Conference NotesDokument39 Seiten2014 FAME VI Conference NotesdjmphdNoch keine Bewertungen

- Value at RiskDokument2 SeitenValue at RiskdjmphdNoch keine Bewertungen

- A Framework For Restructuring Debt in Developing Countries Through The Creation of Special Sovereign Borrowing EntitiesDokument34 SeitenA Framework For Restructuring Debt in Developing Countries Through The Creation of Special Sovereign Borrowing EntitiesdjmphdNoch keine Bewertungen

- 2014 G.A.M.E. IV Conference NotesDokument43 Seiten2014 G.A.M.E. IV Conference NotesdjmphdNoch keine Bewertungen

- FAME V Conference NotesDokument14 SeitenFAME V Conference NotesdjmphdNoch keine Bewertungen

- Conditional Estimation of Linear Asset Pricing Models Using Alternative Marginal Utility Growth InstrumentsDokument3 SeitenConditional Estimation of Linear Asset Pricing Models Using Alternative Marginal Utility Growth InstrumentsdjmphdNoch keine Bewertungen

- An Alternative Marginal Utility Growth Proxy For Use in Asset Pricing ModelsDokument12 SeitenAn Alternative Marginal Utility Growth Proxy For Use in Asset Pricing ModelsdjmphdNoch keine Bewertungen

- Finance Toolbox Rev1Dokument2 SeitenFinance Toolbox Rev1djmphdNoch keine Bewertungen

- My Take On The 2008 Financial CrisisDokument17 SeitenMy Take On The 2008 Financial CrisisdjmphdNoch keine Bewertungen

- My Ph.D. DissertationDokument158 SeitenMy Ph.D. DissertationdjmphdNoch keine Bewertungen

- Mba Case 2 - Value Based ManagementDokument13 SeitenMba Case 2 - Value Based Managementdjmphd100% (1)

- 2011 Debt Ceiling CrisisDokument6 Seiten2011 Debt Ceiling CrisisdjmphdNoch keine Bewertungen

- AIG Bailout PictureDokument1 SeiteAIG Bailout PicturedjmphdNoch keine Bewertungen

- The Cadence of FinanceDokument29 SeitenThe Cadence of FinancedjmphdNoch keine Bewertungen

- Internal and Sustainable Growth RatesDokument4 SeitenInternal and Sustainable Growth RatesdjmphdNoch keine Bewertungen

- Proof of PVAn Formula SimplificationDokument1 SeiteProof of PVAn Formula SimplificationdjmphdNoch keine Bewertungen

- RSM CsDokument1 SeiteRSM CsdjmphdNoch keine Bewertungen

- Portfolio Risk Two WaysDokument1 SeitePortfolio Risk Two WaysdjmphdNoch keine Bewertungen

- The Mosaic of Stock Analysis Part 3: Ratio AnalysisDokument8 SeitenThe Mosaic of Stock Analysis Part 3: Ratio AnalysisdjmphdNoch keine Bewertungen

- HP CEO Pay 1999 To 2012Dokument1 SeiteHP CEO Pay 1999 To 2012djmphdNoch keine Bewertungen

- Mba Case 1 WaccDokument7 SeitenMba Case 1 WaccdjmphdNoch keine Bewertungen

- Corporate Finance FlexText™ 3eDokument364 SeitenCorporate Finance FlexText™ 3edjmphd100% (3)

- Payout PolicyDokument6 SeitenPayout PolicydjmphdNoch keine Bewertungen

- The Mosaic of Stock Analysis Part 1: Stock ScreeningDokument31 SeitenThe Mosaic of Stock Analysis Part 1: Stock Screeningdjmphd100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Receipts Awaiting Remittance ReportDokument6 SeitenReceipts Awaiting Remittance ReportShakhir MohunNoch keine Bewertungen

- RPG Capability List 2022 Rev.58Dokument71 SeitenRPG Capability List 2022 Rev.58ErwinNoch keine Bewertungen

- Bhavesh NotpedDokument9 SeitenBhavesh Notpedpunavatbhavesh123Noch keine Bewertungen

- Cases On MarketingDokument28 SeitenCases On MarketingDevadutt M.SNoch keine Bewertungen

- 25.10 Trades in ServicesDokument40 Seiten25.10 Trades in ServicesVũ Thảo NhiNoch keine Bewertungen

- Chapter 12 Capital BudgetingDokument34 SeitenChapter 12 Capital BudgetingHalim NordinNoch keine Bewertungen

- Swiss FleetDokument1 SeiteSwiss FleetYannik ChiesiNoch keine Bewertungen

- OD327589244046057100Dokument5 SeitenOD327589244046057100shaileshyadac98Noch keine Bewertungen

- Week 5 Quiz - EssayDokument3 SeitenWeek 5 Quiz - EssayJohn Edwinson JaraNoch keine Bewertungen

- Spikes Boom and Crash MentorshipDokument48 SeitenSpikes Boom and Crash MentorshipKANTCHAKOU Nestor100% (1)

- MRF Tyres Brand Expansion StrategyDokument87 SeitenMRF Tyres Brand Expansion StrategyMohit BansalNoch keine Bewertungen

- AFG Country MetaData en EXCELDokument282 SeitenAFG Country MetaData en EXCELHammna AshrafNoch keine Bewertungen

- Strategic Management Report On Wal-MartDokument16 SeitenStrategic Management Report On Wal-MartSukanta100% (10)

- Contractors Registration ApplicationDokument10 SeitenContractors Registration ApplicationDilip Jinna0% (1)

- Chapter 4: The Theory of Individual Behavior Answers To Questions and ProblemsDokument11 SeitenChapter 4: The Theory of Individual Behavior Answers To Questions and ProblemsAmal IriansahNoch keine Bewertungen

- PRO-RATION Individual Vs IndividualDokument16 SeitenPRO-RATION Individual Vs IndividualLicardo, Marc PauloNoch keine Bewertungen

- Questions AMADokument4 SeitenQuestions AMAEnat EndawokeNoch keine Bewertungen

- Flipkart Invoice FormatDokument1 SeiteFlipkart Invoice FormatSAHIL RANANoch keine Bewertungen

- Hilton 11e Chap001Dokument29 SeitenHilton 11e Chap001Hoàng Lan Anh NguyễnNoch keine Bewertungen

- Revision For Business GrammarDokument8 SeitenRevision For Business GrammarMai Thúy VyNoch keine Bewertungen

- CIR vs. First E Bank Tower Condo Corp RulingDokument2 SeitenCIR vs. First E Bank Tower Condo Corp RulingJULIAN NOEL VELASCO0% (1)

- Construction Cost Estimate BreakdownDokument5 SeitenConstruction Cost Estimate BreakdownSignificant AntNoch keine Bewertungen

- Financial Table Analysis of ZaraDokument9 SeitenFinancial Table Analysis of ZaraCeren75% (4)

- Emails HRDokument44 SeitenEmails HRRishu SrivastavaNoch keine Bewertungen

- Marriott's Project Chariot Offers Shareholders ValueDokument7 SeitenMarriott's Project Chariot Offers Shareholders Valuesurya rajanNoch keine Bewertungen

- July BillDokument2 SeitenJuly BillKarthik BhatNoch keine Bewertungen

- Cost Management For Product Life CycleDokument15 SeitenCost Management For Product Life CycleHannah Jane Arevalo LafuenteNoch keine Bewertungen

- Reaction Paper (Chapter 13)Dokument5 SeitenReaction Paper (Chapter 13)Arsenio RojoNoch keine Bewertungen

- Manage inventory effectively with ABC analysisDokument12 SeitenManage inventory effectively with ABC analysisTrường MinhNoch keine Bewertungen

- Expert Compensation Guide 2023Dokument19 SeitenExpert Compensation Guide 2023ΧΡΗΣΤΟΣ ΜΠΑΡΤΖΟΣNoch keine Bewertungen