Beruflich Dokumente

Kultur Dokumente

Internship Report

Hochgeladen von

Rani BakhtawerOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Internship Report

Hochgeladen von

Rani BakhtawerCopyright:

Verfügbare Formate

Acknowledgement

I am very thankful to Almighty Allah the most beneficent, the most mercy full who has given the strength to complete this task. I am also thankful to branch manager and operational manager respectively of the bank of Punjab 7, Egerton road. Without whose guidance and support it would not have been possible for me to accomplish this assignment.

Furthermore, I am indebted to the GC University team & staff of the bank of punjab.7, Egerton road Lahore. From whom i have gained much experience regarding operational work of bank is concerned. The last but not the last I convey my credit and thankfulness to the GC universities. Without whose well in time support and guidance it would be much difficult for me to achieve this task successfully.

Executive Summary The bank of Punjab(BOP) established in 1989 and got the status of scheduled bank in 1994. The bank of punjab offer the number of products in their customer. There are

INTERNSHIP REPORT

284 branches of BOP in the whole country. Functionally the bank of punjab is divided in the division and the each division is headed by the general managers. The government of the punjab holds the majority of the shares in BOP. It is doing business in commercial banking and the retail banking and the retail banking. Corporate banking treasury and investment and trade finance. The shares of BOP are traded in all three exchanges of the Pakistan. My internship program period is 4th of July to 14th of August 2012. During internship, I worked in accounts opening department. Clearing department, remittance department, fixed deposit and receipt and cash vault. As for as the different ratios of the Bank Of Punjab, they all give the healthy sign regarding financial position of the bank as well as the operation results of the different financial years. All ratios are fully in accordance with the banking industrys standard and norm which is a yard stick to measure the performance of any bank. These ratios depict and indicate that the financial strength of the on a higher side and further prospect of the bank is brighter. At the end the conclusion is the part of the report. Bibliography is the part, which contain all the references I, obtained data to prepare this report.

History of Banking in Pakistan: Pakistan came into being on 14th August, 1947; sufficient banking services were available in the areas forming Pakistan. Out of the total branches of the nearly 3,500 in

2

INTERNSHIP REPORT

the undivided India, as many as about 1,500 branches were existing in these areas. It was agreed between the two countries that reserve bank of India shall continue to function in the Pakistan territory until 30th September 1948 and that Indian notes would continue to be legal tender at Pakistan until 30th September 1948. Unfortunately, relationship between the two countries became most strained immediately after independence; banking was mostly in the lands of Hindus who immediately started transferring their offices and assets into India. As a result most of the banks in Pakistan were closed down and even those which were open were not doing any effective business. The number of banking office in Pakistan came down to about 200 on 30th June 1948. Branches of some European banks were also functioning in a limited manner, financing in export of crops, and their number was limited to about 20. It was only the Habib bank, which transferred its office from Bombay to Karachi Austral Asia bank was another bank, which was in existence in the Pakistan territory at the time of independence. Despite of best efforts on the part of government of Pakistan, no heady way could be made on this behalf and reserve bank of India was in no mood to help the new country. Imperial bank of India, agent of the reserve bank of India also started closing down its branches in Pakistan. Reserve bank also refused to advance money to Pakistan to make essential payments such as salaries etc, also Pakistans share of Rs.75 billion in cash balance was with held by bank, causing hardships to the newly born state. In view of these hopeless state affairs it was agreed between the two countries that reserve bank would serve as monetary authority in Pakistan only up to 30th June 1948.

Nationalization of Banks The principle of nationalization of banks is to stream line the operation of commercial banks in such a way that it may be conductive to the development activities in process in

3

INTERNSHIP REPORT

the country. Since the commercial banks were owned controlled by big business groups of the country it was feared that these banks would not maintain uniformity in their operational and would be instrumental to inflationary pressure. However, the considerations behind nationalization are To form uniformity in the policy of the commercial banks so they may serve the best national interest. To make the operation of commercial banks highly sensitive and responsive to the policy of the government relation to financial matters. To make the credit policy of the commercial banks more purpose full and effective especially in the development of economic sectors of the country. It acts as an agent of the State Bank of Pakistan To make the best use of the funds available at the disposal of these banks for the economic development of the country. To eliminate unhealthy and uneconomic competition among commercial banks.

To development strong money banks market in the country so that the value of currency may be maintained at stable level both in national facilities to exporter and agriculturists which have not been satisfactory in the past few years.

History of Bank of Punjab: The bank was established in 1989, pursuant to The Bank of Punjab Act 1989, and was given the status of a retail bank in 1994. The Bank of Punjab is working as a scheduled commercial bank with its network of 272 branches at all major business centre in the country. The Bank provides all types of banking services such as Deposit in Local Currency, Client Deposit in Foreign Currency, Remittances, and Advances to Business, Trade, Industry and Agriculture. The Bank of Punjab has indeed entered a new era of science to the nation under experience and professional hands of its management. The Bank of Punjab plays a vital role in the national economy through mobilization of hitherto untapped local resources, promoting savings and providing funds for investments. Attractive rates of profit on all types of

4

INTERNSHIP REPORT

deposits, opening of Foreign Currency Accounts and handling of Foreign Exchange business such as Imports, Exports and Remittances, Financing, Trade and Industry for working capital requirements and money market operations are some facilities being provided by the Bank. The lending policy of Bank is not only cautious and constructive but also based on principles of prudent lending with maximum emphasis on security. Overview: The Bank of Punjab functions as a scheduled commercial bank, with a network of 272 branches in major business centers throughout the country. It provides a wide range of banking services, including deposit in local currency; client deposit in foreign currency; remittances; and advances to business, trade, industry and agriculture. First Punjab Modaraba (FPM), a wholly owned subsidiary of the bank, was established in 1992 and is being managed by Punjab Modaraba Services (Pvt) Ltd. Vision, Mission and values Statement: Vision, mission and values are key milestones for any organization. Overall Vision: The board of directors has approved the following vision, mission and values of the bank: To be a customer focused bank with service excellence. Mission statement: To exceed the expectations of our stakeholders by leveraging our relationship with the Government of Punjab and delivering a complete range of professional solutions with a focus on programmed driven products & services in the Agriculture and Middle Tier Markets through a motivated team. Slogan:Progress and Prosperity

Core Values: Our Customer: As our first priority.

5

INTERNSHIP REPORT

Profitability:

For the prosperity of our stake holders that allows us to constantly invest, improve and succeed.

Corporate Social Responsibility: Recognition & Reward: Excellence: Integrity: Respect: Organizational Structure: Bank of Punjab is mainly divided into two main heads, Divisions and Departments. Under the head of division department several further departments are working. These include administration, operation, business development and others etc. Similarly, department head is further categorized into several sub departments, each of it working and handling entire system at its own end. These includes Organization and Model serving its institute by providing best rules and regulations that suits banking sector, information and technology deals with updating software, developing new software, deals with online transfer and also it handles security and protective measures. Similarly, department of shares deals with share price, number of shares and its allocation etc. To enrich lives of community where we operate. For talented & high performing employees. In everything we do. In all our dealings. For our customers & each other.

INTERNSHIP REPORT

Main Offices: Head Office of Bank of Punjab is at Gulberg III Lahore whereas, established at Ejerton road, Lahore. main branch is

The Bank has been divided into seven different regions which are as follows: Lahore Region Faisalabad Region Gujranwala Region Rawalpindi Region Karachi/Quetta Region Multan Region Peshawar Region

These regions further consist of several numbers of branches working under them. LAHORE REGION: In Lahore region The Bank of Punjab have 65 branches out of which 11 branches are dealing in foreign exchange. In Lahore region regional office is at 7 Ejerton roads Lahore.

7

INTERNSHIP REPORT

FAISALABAD REGION: In Faisalabad region The Bank of Punjab have 38 branches, out of which 4 branches are dealing in foreign exchange. GUJRANWALA REGION: In Gujranwala Region, there are 45 branches. In this region 5 branches are providing foreign exchange banking facility. RAWALPINDI REGION: In Rawalpindi region BOP have 41 branches with 4 branches dealing in foreign exchange. MULTAN REGION: In Multan region Bop have 60 branches, out of which 7 branches are providing the foreign exchange services facility. KARACHI REGION: There are only four branches in this region. All these branches are dealing in foreign exchange branches. Annexure of Organizational structure is attached at the end of report. Branch Structure: Bank of Punjab (7, Ejerton road, Lahore) is a main branch. It is headed by Chief Manager. All the operations are carefully looked after by Chief Operation Manager of the branch .Rest of the officers i.e. Operation Supportive and Cash Officers, credit officers are governed by Chief operation manager of branch. Branch offers loans, remittance, online facility, clearing, account opening facility to customers. It is a main branch so it has some features not common as all branches which are as follows: Cash vault is only in main branch which is responsible to send cash to local branches of the bank.

8

INTERNSHIP REPORT

Only this branch can transfer funds to out stations This branch is responsible for clearing distribution. Cheques after the NIFT procedure firstly present in main branch and this branch distribute them among different branches.

Working and allocations of officers to different departments are depicted by branch structure annexure, provided at the end of report. NATURE of ORGANIZATION and KINDS of BUSUNESS ACTIVITIES The Bank of Punjab functions as a scheduled commercial bank, with a network of 284 branches in major business centers throughout the country. It provides a wide range of banking services, including deposit in local currency; client deposit in foreign currency; remittances; and advances to business, trade, industry and agriculture. First Punjab Modaraba (FPM), a wholly owned subsidiary of the bank, was established in 1992 and is being managed by Punjab Modaraba Services (Pvt) Ltd.

PRODUCT LINES: Deposit Product(s): Current Account: The Accounts shall be opened upon submission of duly filled-in Banks prescribed Account Opening Form properly introduced in the manner provided and on submitting all such documents as may be revised by the Bank. The Bank reserves the right to demand such relevant documents even after opening of account as deemed necessary. The Bank has the right to refuse to open an Account without assigning any reason.

9

INTERNSHIP REPORT

The Accounts shall be opened with an initial/minimum deposit as stipulated by the Bank from time to time unless specifically exempted. A distinctive number shall be allotted to every account and this number should be quoted in all correspondence relating to the account and at the time of making a deposit or withdrawal. The Bank reserves the right to change the Account Number or any part of it in order to meet its book keeping/administration requirement. However, intimation of change in the account number shall be sent to the account holder.

The Accounts may be opened singly in one name or jointly in two or more names. Deposit may be accepted from minors provided the account is opened and operated through a guardian. The Account thus opened will continue to be operated upon by the guardian even if the minor attains the age of majority.

All monies/instruments to be deposited in an account should be accompanied by a pay-in-slip showing the title and number of the account. Withdrawals will not be allowed against post dated (payable on any future date) and stale (06 months after issuance date) Cheques and against un-cleared funds.

Basic Banking Account: The minimum initial deposit will be Rs.1000. No profit will be Payable. No fee (service charges) for maintaining such accounts will be charged. There will be no limit for maintain minimum balance. In the cases, there balance in BBAs remaining "NIL" for a continuous 6 month period, such accounts will be closed. Account holder will be allowed a maximum of 2 deposit transactions and 2 checking withdrawals, free of charge either through cash/through clearing per month otherwise service charges of a regular banking account shall be applicable for that month as per Bank's Schedule of Charges. PLS Account: The Accounts shall be opened upon submission of duly filled-in Banks prescribed Account Opening Form properly introduced in the manner provided and on submitting all such documents as may be revised by the Bank. The Bank reserves the right to demand such relevant documents even after opening of account as deemed

10

INTERNSHIP REPORT

necessary The Bank has the right to refuse to open an Account without assigning any reason. The Accounts shall be opened with an initial/minimum deposit as stipulated by the Bank from time to time unless specifically exempted. A distinctive number shall be allotted to every account and this number should be quoted in all correspondence relating to the account and at the time of making a deposit or withdrawal. The Bank reserves the right to change the Account Number or any part of it in order to meet its book keeping/administration requirement. However, intimation of change in the account number shall be sent to the account holder. The Accounts may be opened singly in one name or jointly in two or more names. PLS-Saving Profit plus Account: Individuals, corporations, organizations and various provincial / federal government departments can open accounts under the scheme. This is an operating/cheque account. The accounts can be opened in individual or joint names. The deduction of Zakat and Withholding tax will be applicable as per law of the land. Profit payable on half yearly basis.

Corporate Premier Account: This account has been introduced for corporate clients. This is an operating/cheque account Profit on the account will be calculated on daily product basis by determining the slab on the basis of average balance maintained in the account. The deduction of Zakat and Withholding tax will be applicable as per law of the land. Consumer Financing Schemes: Existing schemes: BOP House Loan Scheme. BOP Car Loan Scheme. BOP Quick cash scheme. BOP Smart Cash Personal Loan.

11

INTERNSHIP REPORT

BOP Aasaish Loan Scheme. BOP Motorcycle Leasing Scheme.

1.1 BOP House Loan Scheme: Preamble: The government of Pakistan has desired that bank should launch housing schemes for all segments of society particularly low& middle classes. State bank of Pakistan has also amended its policy on housing finance to facilitate banks in developing and marketing their housing finance products. Therefore, in line with the government policy, we are launching housing finance scheme titled BOP house loan. This will enhance the image of our bank as a provider of new products. Purpose: BOP house loan term finance facility for purchase of house/ flat or construction of house on self owned plot or for renovation/ home improvement.

Target Market: Salaried Individuals (SI) Self Employed Professionals (SEP) Self Employed Businessmen (SEB

Eligibility Criteria:

12

INTERNSHIP REPORT

Eligibility Criteria for Salaried Individuals: Age between 25 and 60 Years or retirement date; whichever is earlier. Minimum Take Home Salary is Rs. 10,000/Permanent. Employee with Minimum 03 Years of continuous job Experience including 01 year with current employer. (02 Year for BOP Employees including probationary period). Maintaining Salary Account in any bank. Have valid CNIC. Residing or working in launching cities.

Eligibility Criteria for SEP\ SEB: Age between 25 and 60 Years or retirement date; whichever is earlier (60 Years at maturity of facility) Minimum 03 Years in current business. Minimum Monthly Net Income is Rs. 20,000/- (Established through Tax Return or Income Estimation Report of outsourced agencies or Bank Statement). Have valid CNIC Residing or working in launching cities. Tax Payer.

BOP Car Loan Scheme: Preamble: In order to equip our field force with new products of financing for credit expansion and in line with the policy of state bank of Pakistan for consumer financing, our bank is launching car loan scheme. This scheme will also overcome the competition of other bank and will also meet the growing demand of our customers/ general public.

Purpose:

13

INTERNSHIP REPORT

BOP car loan is a lease facility for purchasing brand new locality manufactured/ assembled car for personal use & light commercial vehicles. The light commercial vehicles are available only for corporate customers. Target market: Salaried Individuals (SI) Self Employed Professionals (SEP) Self Employed Businessmen (SEB)

Eligibility Criteria: Eligibility Criteria for Govt. Employees & BOP Employees: Age between 25 and 59 Years or retirement date; whichever is earlier (59 Years at maturity of facility). Minimum Take Home Salary is Rs. 10,000/Permanent Govt. Employee with Minimum 03 Years of job Experience. (01 Year for BOP Employees). Maintaining Salary Account in any bank. Have valid Driving License & CNIC. Residing or working in launching cities.

Eligibility Criteria for Private Employees: Age between 25 and 59 Years or retirement date; whichever is earlier (59 Years at maturity of facility) Minimum Take Home Salary is Rs. 15,000/Permanent Pvt. Employee with Minimum 03 Years of job Experience including 01 year with current employer. Maintaining Salary Account with any bank. Have valid Driving License & CNIC Residing or working in launching cities.

14

INTERNSHIP REPORT

Eligibility Criteria for SEB\ SEP: Age between 25 and 57 Years or retirement date; whichever is earlier (57 Years at maturity of facility) Minimum 03 Years in current business. Minimum Monthly Net Income is Rs. 20,000/- (Established through Tax Return or Income Estimation Report of outsourced agencies or Bank Statement). Have valid Driving License & CNIC.

Documents Required:

For Salaried Person: Copy of valid CNIC Latest Salary Slip / Employer Certificate on organizations letter head (as per BOP specimen). Two Recent Photographs. Bank Statement for last 6 months. Latest Copy of utility bills (Electricity & phone). Income Tax Return/Wealth Statement OR Non-Tax Payees Form, if applicant is a nontax payer.

For Self Employed Professional /Businessmen: Copy of CNIC. Two Recent Photographs. Bank Statement for last 01 Year of Business Accounts. Latest Copy of utility bills (Electricity & phone) of Residence. Income Tax Return/Wealth Statement OR Non-Tax Payees Form, if applicant is a nontax payer.

15

INTERNSHIP REPORT

Business Related Documents: Latest copy of utility bills (Electricity & phone) of current business address. Documentary evidence in business or in the profession for the last 2 years. Proprietorship Certificate/Partnership deed. Copy of Professional Degree (For Professionals).

Security: Car will be registered in the name of Bank as per lease agreement. Comprehensive Insurance Policy (Insurance Certificate/policy will be sent directly to the branch by the Insurance Company). Post Dated Cheques as per the repayment schedule. Three (03) undated cheques of marked up amount (Principal + Mark-up) Any additional guarantee, if required as per the contents of the approval letter.

BOP Quick Cash Scheme:

Description: The state bank of Pakistan has been emphasizing to promote consumer financing in Pakistan. This has importance as it is strongly linked with the growth of industrial and trading activities in the country. SBP has followed bank to provide financing facilities to general public for purchase of locally manufactured customer durable. In order to meet the other objectives the bank has decided to launch a new scheme under the name and style of BOP quick cash. Purpose: BOP Quick Cash is personal running finance facility for Salaried Class for meeting their day to day personal needs

16

INTERNSHIP REPORT

BOP Smart Cash Personal Loan Scheme: Purpose: BOP Smart Cash Personal Loan Scheme is personal DF facility for meeting personal needs & repayable through monthly installments. Target Market: Salaried Individuals (SI) Self Employed Professionals (SEP)

Eligibility:Eligibility Criteria for Govt. /Armed Forces/BOP Employees: Age between 25 and 59 Years or retirement date; whichever is earlier (59 Years at maturity of facility). Minimum Take Home Salary is Rs. 10,000/Contractual Employees are also eligible but loan should be adjusted before 06months of the expiry of contract. Moreover, departmental undertaking / one Personal Guarantee of senior grade but not less than grade 16 officer, shall be obtained for contractual employees (Financial commitment of Guarantor should be established through E-CIB report & Salary Slip/Employer Certificate/Bank Statement of salary account showing monthly credits of salary amount) Maintaining Salary Account with any bank. Have valid CNIC. Age between 25 and 59 Years or retirement date; whichever is earlier (59 Years at maturity of facility). Minimum Take Home Salary is Rs. 15,000/Permanent Pvt. Employee with Minimum 05 Years of job Experience including 01 year with current employer. Maintaining Salary Account with any bank. Have valid CNIC.

Eligibility Criteria for Private Employees:

17

INTERNSHIP REPORT

Eligibility Criteria for SEP: Age between 25 and 57 Years (57 Years at maturity of facility). Minimum 03 Years in current profession. Minimum Monthly Net Income is Rs.20,000/- (Established through Tax Return or Income Estimation Report of outsourced agencies or Bank Statement). Have valid CNIC. Documents Required: For Govt. /Armed Forces/BOP Employees: Copy of valid CNIC. Latest Salary Slip (Employer Certificate, if salary slip is not provided by employer). Employer Certificate on organizations letter head (as per BOP specimen) exempt for BOP employees. Copy of Contract Letter (for contractual employees). Bank Statement for last 06 months (where salary is being transferred). (exempt for BOP employees). Latest Copy of utility bills (Electricity & phone) (of present living address) (exempt for BOP employees). For Private Employees: Copy of valid CNIC. Two Recent Photographs. Latest Salary Slip (Employer Certificate, if salary slip is not provided by employer). Employer Certificate on organizations letter head (as per BOP specimen). Bank Statement for last 06 months (where salary is being transferred). Latest Copy of utility bills (Electricity & phone of present living address). Income Tax Returns of last two years.

For Self Employed Professionals: CNIC. Two Recent Photographs. Bank Statement for last 01 Year of Business Account. Latest Copy of utility bills (Electricity & phone) of Residence. Income Tax Returns of last two years.

18

INTERNSHIP REPORT

Business Related Documents: Latest copy of utility bills (Electricity & phone) of current business address. Documentary evidence in business or in the profession for the last 03 years. Copy of Professional Degree.

Security: Departmental Undertaking (waived for Govt. Officers of grade 17 & above and executives of corporate clients) Two Personal Guarantees of employees of equivalent/senior grades to the client or where no equivalent/senior grade officer is available then Personal Guarantee of two officers of grade 17 or above shall be obtained. (Financial commitment of Guarantor should be established through E-CIB report & Salary Slip/Employer Certificate/Bank Statement).

BOP Aasaish Loan Scheme: Preamble: Further to our four new computers finance scheme launched recently, we are pleased to announce for another new scheme titled BOP Aasaish loan to meet the demand of general public. Purpose: BOP Aasaish Loan is personal loan facility for banks target market for the purchase of Consumer durable goods for their personal use, repayable on easy installments". Target Market: Salaried Individuals (SI) Self Employed Professionals (SEP)

19

INTERNSHIP REPORT

Self Employed Businessmen (SEB)

Eligibility Criteria: 1.1.1.1 Eligibility Criteria for Govt. /Armed Forces/BOP Employees: Age between 21 and 59 Years or retirement date; whichever is earlier (59 Years at maturity of facility). Minimum Take Home Salary is Rs.7,000/Permanent Employee with Minimum 01 Year of job Experience. Contractual Employees are also eligible but loan should be adjusted before 03months of the expiry of contract. Moreover, departmental undertaking / one Personal Guarantee of equivalent or senior grade shall be obtained for contractual employees (Financial commitment of Guarantor should be established through E-CIB report & Salary Slip or Employer Certificate or Bank Statement of salary account showing monthly credits of salary amount). Maintaining Salary Account in any bank. Have valid CNIC. 1.1.1.2 Eligibility Criteria for Private Employees: Age between 24 and 59 Years or retirement date; whichever is earlier (59 Years at maturity of facility). Minimum Take Home Salary is Rs. 10,000/Permanent Pvt. Employee with Minimum 02 Years of job Experience including 01 year with current employer. Maintaining Salary Account with any bank. Have valid CNIC.

Eligibility Criteria for SEP/SEB: Age between 25 and 57 Years or retirement date; whichever is earlier (57 Years at maturity of facility). Minimum 02 Years in current business. Minimum Monthly Net Income is Rs.15,000/- (Established through Tax Return or Financial Statements or Bank Statement).

20

INTERNSHIP REPORT

Have valid CNIC. Residing or working in launching cities.

Documents Required:

1.1.1.3 For Govt. /Armed Forces/BOP Employees: Copy of valid CNIC Latest Salary Slip (Employer Certificate, if salary slip is not provided by employer) Employer Certificate on organizations letter head (as per BOP specimen) . Bank Statement for last 06 months (where salary is being transferred). Latest Copy of utility bills (Electricity & phone) (of present living address). 1.1.1.4 For Private Employees: Copy of valid CNIC. Two Recent Photographs. Latest Salary Slip (Employer Certificate, if salary slip is not provided by employer). Employer Certificate on organizations letter head (as per BOP specimen). Bank Statement for last 06 months (where salary is being transferred). Latest Copy of utility bills (Electricity & phone) (of present living address). 1.1.1.5 For self employed business professional: Copy of valid CNIC. Two Recent Photographs. Bank Statement for last 06 months of Business Accounts. Latest Copy of utility bills (Electricity & phone) of Residence. Income Tax Return/Wealth Statement OR Non-Tax Payees Form, if applicant is a nontax payer. In case of non-tax payer, one personal guarantee is required. 1.1.1.6 Business related documents: Latest copy of utility bills (Electricity & phone) of current business address. Documentary evidence in business or in the profession for the last 2 years. Proprietorship Certificate/Partnership deed.

21

INTERNSHIP REPORT

Copy of Professional Degree (For Professionals).

Security: Post Dated Cheques. Life Insurance of Borrower. Three (03) undated cheques of marked up amount (Principal + Mark-up). Any additional guarantee, if required as per the contents of the approval letter.

BOP Motorcycle Leasing Scheme:

Purpose: A lease facility to Salaried Individuals for the purchase of locally manufactured / assembled / imported motorcycles for their personal use.

Target Market: Employees of Govt. departments including semi-Govt, autonomous bodies, allied corporations, Private Employees, Personnel of Armed Forces, employees of corporate clients etc. Eligibility Criteria 1.1.1.7 Eligibility Criteria for Govt. Employees : Age between 25 and 58 Years or retirement date; whichever is earlier (58 Years at maturity of facility). Minimum Take Home Salary is Rs. 10,000/Permanent Govt. Employee with Minimum 03 Years of job Experience. Contractual Employees are also eligible but loan should be adjusted before 06-months of the expiry of contract. Moreover, departmental undertaking / one Personal Guarantee of grade 17 & above shall be obtained for contractual employees.

22

INTERNSHIP REPORT

Maintaining Salary Account with BOP. Have valid Driving License. Residing or working in launching cities. 1.1.1.8 Eligibility Criteria for Private Employees:

Age between 25 and 58 Years or retirement date; whichever is earlier (58 Years at maturity of facility). Minimum Take Home Salary is Rs. 15,000/Permanent Pvt. Employee with Minimum 03 Years of job Experience. Maintaining Salary Account with BOP. Have valid Driving License.

Documents Required: 1.1.1.9 Govt. Employees Maintaining Salary Account With BOP: Application Form CNIC copy Latest Salary Slip Employer Certificate 1.1.1.10 Private Employees Maintaining Salary Account With BOP: Application Form. CNIC copy. Latest Salary Slip / Employer Certificate. Bank Statement for last 03 months. Latest Copy of utility bills (Electricity & phone) Income Tax Return OR Non-Tax Payees Form, if applicant is a non-tax payer (as per specimen provided) - but One Personal Guarantee required for Non-Tax Payer (one Personal Guarantee of senior grade but not less than grade -16 shall be obtained). Security: Motorcycle shall be registered in the name of BOP. Comprehensive Insurance Plan including Motorcycle insurance & Life Insurance of borrower.

23

INTERNSHIP REPORT

Agriculture scheme:

Kisan Dost Aabiari Scheme. Islah-E-Arazi Scheme.

Farm Transport Scheme Mechanization Support Scheme Kisan Dost Tractor Finance Scheme Agri Mall Finance Scheme Commercial Agro Services Finance Scheme Lease Finance Facility for Purchase of Tractor under Green Tractor Scheme. Scheme for Controlled Sheds Auto Lease Financing Scheme

BOP ATM / Debit Card:

BOP Apna Cash Card is an ATM plus Debit Card: 1. The front of the card will have the following matter on it: Card Holders Name International Bin Number (6 Digits - XXXXXX) Card Number (YYYYYYYYYY) (total IMD+CARD num has to be = 16

2. The back of the card will have: Magnetic Strip Signature Panel Conditions of Usage M-Net and M-Net logo

24

INTERNSHIP REPORT

Service(s): The BOP Debit Card holders will be able to transact at any of the 1000 + Merchants across the country. The following services can be utilized at the Point of Sale (POS) terminals:

Purchasing: Your BOP Debit Card can be used in place of cash at all outlets where the M-Net logo is displayed. This is a service which lets you pay directly from your account without using cash. When a payment is made through the debit card, your account is directly debited.

Balance Enquiry: The Point of Sale (POS) terminal also lets you view your balance of all the linked accounts to your card.

Sites: BOP Debit Card Holders can transact at any of M Net merchant locations country wide. These POS terminals are available at Shopping Malls to Petrol Stations. The list of country-wide merchants is attached as Annexure I. All merchants who display the M-Net logo will accept the BOP Debit Card.

Plastic with M-Net logo: All new plastic that will be ordered from now on will bear the M-Net logo. The existing plastic will be used for customers who want the debit card facility, as the cost of the wastage of scrapping our existing stock is too high. Merchants will have to be informed to accept all BOP plastic, irrespective of M-Net logo. New order of plastic will bear M-Net logo.

25

INTERNSHIP REPORT

Customer Eligibility: The ATM Card will be issued to Savings and Current Account holders who maintain their accounts with the bank and in terms of the account opening documentation are authorized to operate the account singly or jointly. For Joint Accounts, which are operated on the signature of any one of the account holders, ATM / Debit card can be issued. The joint accountholders will be jointly & severally liable for any transactions processed by the use of the cards and the terms and conditions as laid down shall be jointly & severally binding on all account holders. Cards will not be issued on the following accounts: Any non-personal account i.e. Companies, Organizations, Trust Account, Government account and Collection account etc. Dormant, inoperative, blocked or restricted accounts. Accounts with NIL balance. Term Deposit Accounts. NIDF Accounts. (Non Interest Demand Finance Accounts) Accounts requiring thumb / photo for operation (illiterate accounts). ATM/Debit cards can only be issued on LCY. Use of electronic media in decision making Electronic data gives exact values and figures which top level management required. Because of electronic data they came across to know those minute things which impacts a lot on final place. Through this they can measure exact profit and loss accounts, assets and liabilities up to a branch level from where they can decide which should be kept and which should not. Through this top level management is able to decide which product should be taken into course for further level or which should stop. Electronic data make management able to take decision at any point of time. Following software are used in The Bank Of Punjab BOP 2001 is used for transactions Symantic antivirus

26

INTERNSHIP REPORT

SWIFT software is used for foreign remittances VERISYSES is used for the recognition of the person from NADRA NAB Office of foreign asset control list(OFAC) Kyc for risk evaluation

FINANCIAL ANALYSIS BALANCE SHEET of LATEST FIVE YEARS (000) 2011 Cash and balances with treasury banks Balances with other banks Lending to financial institutions Investment Advances Operating fixed assets Deferred tax assets Other assets Total assets Bills payable Borrowings Deposits and other accounts Subordinated loans Liabilities against assets Deferred tax liabilities Other liabilities Total liabilities Share Capital Reserves Unappropriated profit 7,831 6,506,275 270,224,941 5,287,974 1,914,956 13,887 5,223,045 225,521,803 5,287,974 2,012,492 4,700,166 210,493,920 5,287,974 573,779 4,564,257 182,165,995 5,287,974 7,427,232 19,907 30,632 40,321 2,205,530 2,983,977 215,978,767 4,230,379 7,427,232 3,468,956

27

2010 14,069,601 3,276,234 7,309,587 56,402,954 120,818,021 3,534,660 14,063,694 9,715,522 229,190,273 581,100 11,526,783 208,176,988

2009 13,043,705 2,185,782 1,053,550 57,960,105 121,315,799 3,427,267 11,921,146 5,762,509 216,669,863 875,618 1,404,014 190,858,215

2008 10,685,057 2,178,455 633,333 22,711,980 131,731,158 3,471,838 8,388,162 6,109,137 185,909,120 1,219,801 12,278,773 164,072,532

2007 14,210,302 1,927,662 2,450,000 73,461,693 133,899,143 3,252,759 5,789,116 234,990,675 93,7647 17,842,915 191,968,377

16,698,333 3,607,107 7,447,375 92,581,306 127,129,501 3,597,483 13,886,769 16,049,657 280,997,531 850,569 24,963,566 237,896,700

INTERNSHIP REPORT

Accumulated loss Share deposit money Surplus/(Deficit) on revaluation of assets Total owners equity

(14,067,841) (14,352,989) (10,330,839) (7,658,686) 17,000,000 637,501 10,772,590 10,000,000 2,947,477 3,668,470 10,000,000 645,029 6,175,943 (1,313,395) 3,743,125

3,885,341 19,011,908

Figure 1- Balance sheet of latest 5 years

Income Statement of The Latest Five Years (000) 2011 Mark-up/return/interest earned Mark-up/return/interest expensed Net mark-up/ interest income Provision against nonperforming loans and advances Provision for diminution in the value of investments Bad debts written off directly Net mark-up/ interest income after provisions NON MARKUP/INTEREST INCOME Fee, commission and 724,499 561,688 657,114 577,630 659,488

28

2010 18,220,175

2009

2008

2007 17,539,538

20,685,011 21,073,271 (388,260) (3,164,234)

15,641,832 18,801,642 19,022,494 (581,467) (3,380,662) 559,604

17,752,969 13,939,377 16,614,000 3,600,161 1,138,969 1,616,421

9,241,653 531,654 2,760,724

18,863,580 24,479

941,183 2,244,320 (3,901,795) (13,563,498)

366,387 246,869 1,712,392 (18,090,998)

INTERNSHIP REPORT

brokerage income Dividend income Income from dealing in foreign currencies Gain on sale and redemption of securities Unrealized gain / (Loss) on revaluation of investments classified as held for trading Other income Total nonmarkup/interest income NON MARKUP/INTEREST EXP. Administrative expenses Provision against lending to financial institutions Provision against off balance sheet items Other charges Total nonmarkup/interest expenses Extra ordinary/unusual items PROFIT /(loss)BEFORE TAXATION Taxation current Prior years Deferred PROFIT/ (loss) AFTER 174,774 347,973 (2,157,119) (4,029,277) 78,491 (4,383,406) (10,069,005) 522,747 (6,186,396) (14,373,920) (16,832,906) 207,600 1,052,000 (8,033,001) (10,059,505) (6,186,396) 4,855,569 170,700 (19,921) 250,772 4,454,018

29

286,375 160,089 330,025 (5,383)

402,779 134,488

920,943 247,570

2,020,896 324,328

1,812,870 377,233 2,039,535

293,303 (124,238) 18,020 733,787

(1,193) 494,103 1,989,708 473,055 1,883,333 2,218,749 518,553

526,185 4,182,826 547,635 5,436,761

3,954,066 1,121

3,426,329

3,028,377 -

2,799,933 10,101

2,255,342 -

(244,111) 205 3,711,281

740,000 1,605 4,167,934 794 114,700

292 37,950 2,293,584

3,029,171

2,924,734 -

INTERNSHIP REPORT

TAXATION Accumulated loss/ unappropriated profit Brought Forward Transfer to statuary reserve Transfer from surplus on revaluation of fixed assets - net of tax Accumulated loss carried forward Profit available for appropriation Basic Earnings/ (loss) per share Rupees Figure 2-income statement of last five year Learning in Departments ACCOUNT OPENING DEPARTMENT Bank and customer relation ship starts with the opening of account so it is very sensitive department. I start my internship with account opening department and spend ten days under the supervision of the account opening officer. Here I learnt lot of things which are as follow How to fill the account opening form of the individual/joint account or a company Documents which are necessary for the different customers to open an account like for individual CNIC card is enough for sole proprietor NTN number or introduction of any BOP staff person which ever is available is compulsory. In case of private companies resolution copy. Company letter head, Form 29 SECP registered office certificate, certificate of incorporation is required. In case of public limited companies only one extra document is required then the private limited companies that is certificate of incorporation. Different types of stamps for different forms like signature verified stamp, signature admitted stamp, original CNIC seen stamp in case of the account of

30

(14,352,989)

(10,330,839)

(7,658,686)

3,452,842

3,226,961

(69,595) 6,770 7,127

2,894,000 7,502

(1,057,595) 5,572 5,866

(14,067,814) 0.66

(14,352,989) (7.62)

(261,834) (19.04)

2,400,819 (19.02)

7,686,845 10.53

INTERNSHIP REPORT

illiterate person Mark of identification stamp, signature affix in my presence and verified stamp. Verisysis from NADRA to cobfirm the person identity NAB and office of foreign asset control list(OFAC) Signature specimen card(SS card) How to close the account. Check filling Deposit slip filling

REMITTENCE DEPARTMENT

After the account opening department next department was the remittance department. I spend a week in the remittance department. Remittance department transfer the funds from one bank to another bank of from one place to another place. Bank of Punjab transfers the money through Demand Draft. Pay order. the Bank of Punjab provides the following facilities in the remittance department Demand draft Pay order Online banking With the modernization in bank TT and MT are closed now .people prefers the Online Facility and if online facility is improved DD and Pay orders will also me rare.

31

INTERNSHIP REPORT

DEMAND DRAFT An order to pay the money to the payee who is residing out side the city, Demand draft can be for a customer who may or may not have the account in the bank but the other persons account must be maintained with the bank for which the payer demanded the demand draft If the Demand draft request is against the Cash the Bank of Punjab charge its fees. There are no fees of demand draft for the person who is the account holder of the Bank branch. PAY ORDER Pay order is the order money but this payment is to be maid within the city. In other worts it can be said that the payee and the payer should be in one city. In pay order payment can be made in cash. Clearing and transfer.

CLEARING DEPARTMENT I worked in clearing department for one week. I learnt there about different kinds of clearing. I was told there the main objective of the clearing. i was told in this department about the different types of clearing in which THE bank of Punjab deals and about there stamping. The bank of Punjab Deals in the following types of clearing: Normal/ Local clearing Same day Clearing Intercity clearing Outward bill of collection(OBC)

The Bank Of Punjab charge fee against the Same day clearing and against the cheques which are dishonored. During the work in clearing department I also learn the different types of stamps for clearing Stamps for Normal Clearing Crossing stamp at the face of cheque.

32

INTERNSHIP REPORT

Clearing stamp of the next working day at the face of the cheque. Discharge stamp at the back of the cheque with officer signature.

Stamps For Same Day Clearing Crossing stamp at the face of cheque. Clearing stamp of the next working day at the face of the cheque. Discharge stamp at the back of the cheque with officer signature Same Day Clearing Stamp at the face of the cheque.

Stamps for Intercity Clearing Crossing stamp at the face of cheque. Clearing stamp of the next working day at the face of the cheque. Discharge stamp at the back of the cheque with officer signature Intercity Clearing Stamp at the face of the cheque.

Stamps for outward bills of collection Crossing stamp at the face of cheque. Clearing stamp of the next working day at the face of the cheque. Discharge stamp at the back of the cheque with officer signature

If the cheque In favor of the BANK OF PUNJAB branch outside the Lahore city then this cheque will not sent in intercity clearing. This cheque will directly cash. Stamping for this is as same as for others. In the clearing department I also observe the different types of crossing. i.e. Simple crossing

In simple crossing these two lines are drawn on the Left top corner of the cheque. It means amount can be transferred in any persons account. Payees account only crossing Payees account only

In this type of crossing two parallel line are drawn on the left top corner of the cheque and payees account only is written between these lines. these types of cheques can only

33

INTERNSHIP REPORT

transferred into mentioned persons account only. These cheques can be transferred into any other A/c only when the issuer cancelled the stamp Simple crossing and co & co.

Two parallel lines are drawn on the left top corner of the cheque with the addition of the word & co. Theses types of cheques can be transfer into any person account after endorsement. The person who endorses the cheque will sign on the back of cheque. The person whose name the cheque is endorsed will write on the back of cheque and will verify the signatures. Some times not negotiable is written on some cheques it means amount can transfer only into the mentioned persons account. These cheques are not transferable in other persons account. TERM DEPOSIT AND RECEIPT During my internship I also avail the chance to study the different term deposit schemes of the bank of Punjab main branch Lahore. I spend three days hare and learn the procedure of fixing the money. Customer can fix the money either in cheque of cash form A form is filled and signed by the customer along with SS card. A certificate is given to the customer normally Pay order against the cheque or cash which ever is presented for fixing the money. If the customer want to withdraw the money before the time period specified he has to fill the form and sign it After completing the formality amount is credited in the customer account along with the profit. Detail of different schemes of THE Banked Punjab TERM SCHEME Duration 1 month 3 month Profit Rate 7 8.75

34

INTERNSHIP REPORT

6 month 1 year 2 years

9.25 10.50 10.60

Customer can only eligible to gain the profit if its amount remain within the custody of bank for minimum 7 days. Otherwise no profit. ADVANCE PROFIT SCHEME Minimum Rs. 100,000/- investment is required for this scheme. Duration 3 months 6 months 12 months 15 months 18 months Amount of profit Rs 2220/Rs.4600/Rs.9900/ Rs.11875/Rs.13650/-

In the third scheme 11 profit is offered on fixing the money for one year. 11.15% profit is offered on fixing the money for Two years. SWOT Analysis SWOT stands for strength , weakness ,opportunity ,Threats. Strength and weakness is internal and opportunity and threats are external. So we can say SWOT analysis is the internal as well as the external analysis of the organization. SWOT analysis of the BOP is given as follow: STRENGTH BOPs branches are scattered all over the country to provide services to their customers. Unlike the many other bank BOP deals with every customer. Either a salaried person or High profile customer. BOP provides cheque book and ATM within A week which is very efficient as compare to other banks.

35

INTERNSHIP REPORT

In the BOP account is opened within the day while some banks take a week for the process. The branchs employees are very polite and deal the customers as thy are their own people. Bop is the punjab government bank so it enjoys some political benefits as well. In the syndicated loan to agriculture Bop share is most of all the other banks. The branch staff is very talented and hardworking

WEAKNESSES Formalities in the branch are very high. For example to open a account customer has to sign at least 15-20 times on a form which irritates them. The online system of the branch is poor. Some time customer has to wait 2-3 hours to avail the services. Charges in the branch are very high. For example like the other banks BOP does not provide free clearing service, free cheque book And etc The IT facilities in the branch are very poor. Systems are out of age which delays the process. In the branch employees are overburdened. A single person is performing 3-4 duties at a time OPPORTUNITIES BOP can extend its customer base by increasing the no. of branches in other cities. Product Development: Introduction of new products and service in other segments and markets (mobile banking, credit cards) International Market: BOP can venture into the international market and extend its network Aggressive Strategy: BOP can use aggressive marketing techniques to increase its market share THREATS The competitive environment of the bank is very hostile and aggressive

36

INTERNSHIP REPORT

Government being the major stock holder of the bank can release itsshare to some other party and stop supporting the bank The economic condition of the country are not stable political instability is also very dangerous for the bank as it is semi government organization. BOP is losing its market share to the completion due to t r a d i t i o n banking practice

Conclusion The Bank has recovered much faster after a major shock, now it is traveling on t h e road of success with a steady pace. It is contributing a lot t o w a r d s t h e i n d u s t r i a l development and mid tier segment of the P a k i s t a n s e c o n o m y . A s i d e f r o m t h e g e n e r a l banking, the development of the agriculture sector of Pakistan is a phenomenal object ive which no other financial institution has yet achieved with such success. The Bank of Punjab has always strived to remain in the line of leading banks and has consistently shows steady growth in every aspect of its solutions. The vision and mission of t he Bank of Punjab are true image of its existence Recommendations BOP top management should have to revise the formalities in order to facilitate the customers. The charge on different services should be revised to compete the market. The IT facilities should be improved. The ATM machine has to be replaced as early as possible In the branch staff workshops should be organised for technical knowledge. The management has to take serious steps to recover the loans. The pressure of work and shortage of time creates negative effects; BPOs management should provide adequate facilities and allocate sufficient staff according to the requirements of each branch. Bop should launch bank cheque books to attract the customers.

37

INTERNSHIP REPORT

38

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Timeliness of Filing BP 22 CasesDokument2 SeitenTimeliness of Filing BP 22 CasesConcepcion CejanoNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Banking and Insurance (Bbh461) - 1515423225879Dokument8 SeitenBanking and Insurance (Bbh461) - 1515423225879SamarthGoelNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Central Bank statement for Madhabi BhattacharyaDokument3 SeitenCentral Bank statement for Madhabi BhattacharyaAvignan BhattacharyaNoch keine Bewertungen

- MCQs On The Negotiable Instruments Act, 1881 Part 1Dokument11 SeitenMCQs On The Negotiable Instruments Act, 1881 Part 1Piyush KandoiNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Mercantile Law 2016 Bar Examinations No AnswersDokument4 SeitenMercantile Law 2016 Bar Examinations No AnswersDiane Dee YaneeNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- New Scheme - May 2022 Ca Inter - Group 1 Paper 2-Syllabus 100A Question PaperDokument14 SeitenNew Scheme - May 2022 Ca Inter - Group 1 Paper 2-Syllabus 100A Question PaperPunith KumarNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- PNB Savings Account FeaturesDokument28 SeitenPNB Savings Account Featuresgauravdhawan1991Noch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Financial Accounting Test1Dokument5 SeitenFinancial Accounting Test1musa mosesNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

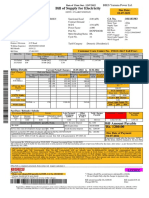

- Bill of Supply For Electricity: Due Date: 02-07-2022Dokument2 SeitenBill of Supply For Electricity: Due Date: 02-07-2022QSEKCERT FSSAINoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- San Mateo Vs PP DigestDokument3 SeitenSan Mateo Vs PP DigestJohn Leo SolinapNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Economic and Political Weekly Vol. 47, No. 18, MAY 5, 2012Dokument84 SeitenEconomic and Political Weekly Vol. 47, No. 18, MAY 5, 2012RegNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Distributor Empanelment Form: Name As Mentioned On ARN Card / CertificateDokument3 SeitenDistributor Empanelment Form: Name As Mentioned On ARN Card / CertificateHimanshu TiwariNoch keine Bewertungen

- Sanction Letter Capital FloatDokument2 SeitenSanction Letter Capital FloatVinod GhadgeNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Disbursement Voucher FormDokument9 SeitenDisbursement Voucher FormMarife Monterola TanNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Report of BCBLDokument52 SeitenReport of BCBLTakia FerdousNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Order 37, CPC, Summary Suits PDFDokument11 SeitenOrder 37, CPC, Summary Suits PDFharsh vardhan50% (2)

- Nego Cases DigestedDokument82 SeitenNego Cases DigestedMark AnthonyNoch keine Bewertungen

- Edgar A. TagoonDokument20 SeitenEdgar A. TagoonEdgarNoch keine Bewertungen

- You're Enrolled in Auto Pay:: Shop AccessoriesDokument4 SeitenYou're Enrolled in Auto Pay:: Shop AccessoriesRaez RodilladoNoch keine Bewertungen

- Commercial Preweek Notes by Zarah CastroDokument34 SeitenCommercial Preweek Notes by Zarah CastroChrislyned Garces-Tan100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Bcin Exams PDFDokument12 SeitenBcin Exams PDFG.A29% (7)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Net BankingDokument15 SeitenNet BankingKiranmySeven KiranmySevenNoch keine Bewertungen

- Audit-II-Chapter 6Dokument11 SeitenAudit-II-Chapter 6mulunehNoch keine Bewertungen

- Audit of Taj HotelDokument34 SeitenAudit of Taj HotelAkashTokeNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Mirae Asset Emerging Bluechip Fund Application FormDokument4 SeitenMirae Asset Emerging Bluechip Fund Application Formrkdgr87880Noch keine Bewertungen

- Activity 4Dokument1 SeiteActivity 4Coleen Joy Sebastian PagalingNoch keine Bewertungen

- Canara Robeco Large Cap Plus Fund FormDokument8 SeitenCanara Robeco Large Cap Plus Fund Formrkdgr87880Noch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Nibl InformationsDokument50 SeitenNibl InformationsPraveen MandalNoch keine Bewertungen

- AIS RomneyDokument9 SeitenAIS RomneyHiromi Ann ZoletaNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)