Beruflich Dokumente

Kultur Dokumente

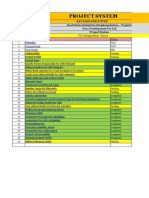

Costing Notebook

Hochgeladen von

remarkuOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Costing Notebook

Hochgeladen von

remarkuCopyright:

Verfügbare Formate

Controlling Notes General tasks of Management Accounting Accounting Architecture SAP FSCM Cash Management , Treasury Management , Loans

s , Market Risk Management FI- GL, AP, AR, Asset Accounting IM- Planning, Investment and finance processes for capital Investment MA(CO)- prepare operating data for business analysis and management decision making Management Accounting Internal Reporting purpose Financial Accounting- External Reporting purpose

Overhead Cost controlling(CO-OM) and Product Cost Controlling (CO-PC) flow into Profitability Analysis (CO-PA) together with revenue data used to

Calculate operating results OVERHEAD COST CONTROLLING It takes costs that cannot be assigned directly to goods and services of a company and allocate them according to their cause. Account assignment objects for such objects are cost centers and internal orders PRODUCT COST CONTROLLING Takes the costs for producing goods and services PROFITABILITY AND SALES ACCOUNTING Its main focus is the determination of the actual business profit and loss

Integration Within Management Accounting and with Other SAP Applications

Logistics 1. Goods Issued cogs a/c dr to inventory a/c Creates a cost posting in Management Accounting 2. Delivery of finished goods from production Management accounting can cause a posting to inventory

3. Product costs estimates created in mangement accounting Updates price fields in Material master record 4. Creation of purchase orders Generates commitment postings within mangement accounting Manufacturing area of logistics Bill of material and routings Product cost controlling Production orders are cost objects used to track and control production costs Sales order managemnt is primary source for revenue billing postings Make to order scenario COMPONENTS OF MANAGEMENT ACCOUNTING Components and value flows in management accounting 1. Cost center accounting It is ideal means for monitoring overhead costs 2. Product Cost Controlling Calculates the costs incurred when a service is provided or product is manufactured. Used to calculate minimum product price 3. Profitability Analysis Analyzes the profit or loss according to individual market segments 1. Overhead Costs Indirect costs 2. Cost centers

Area at which costs are incurred. CC can be created based on activities provided, functional considerations, physical location, allocation criteria or Management area. 3. Activity Type Type of activity that can be provided by a cost center 4. Business processes Combine activity flows within a organisation across individual cost centers 5. Internal orders Used to analyse , plan and collect the costs arising from internal activities CONTROLLING AREA A controlloing area may contain more than one company code and these company codes can include more than one currency. But the company codes assigned to a controlling area must all use same chart of accounts. The control indicator can be used to activate or deactivate certain controlling components and functions for a fiscal Year. ASSIGNMENT OF ORGANISATION UNITS You can assign more than one controlling area to a given operating concern. Changes to assignments are not a problem provided you have not created Any master data or transaction data. Assignment

When controlling area same as the company code (1:1) Controlling area currency Controlling area currency must be same as the company code currency Object Currency Different currency can be defined to account asssignment object ( cost center etc) otherthan controlling currency. Transaction Currency Currency in which Document is posted to management accounting is the transaction currency. Fiscal year variants of company code and controlling area can contain different numbers of special periods , they must have same number of posting periods 2. Multiple company codes to controlling area. (1:n) Cross company code Controlling area currency Controlling area currency may be different from the company code currency. Object Currency Different currency can be defined to account asssignment object ( cost center etc) otherthan controlling currency only if all assigned company codes have Same currency identical to controlling area currency. Other wise account assignment object will automatically be the company code currency. Transaction Currency Currency in which Document is posted to management accounting is the transaction currency.

Fiscal year variants of company code and controlling area can contain different numbers of special periods , they must have same number of posting periods

COST CENTERS Master data contains information that remains the same over a long period of time. Transaction data is short-lived and is assigned to master data. Cost elements describe the origin of costs. Cost elements are of two types primary and secondary. Primary cost elements are elements used in production that are procured from outside the company. Secondary Cost elements are elements used in production that are produced within the company. Cost centers define the areas of responsibility that incur and influence costs. Activity types are production activities and services provided to organisation by a cost center. They are used for allocating costs.

Statistical key figures , which are values that describe the cost center , are used as a basis for allocations (distribution and assessments) and for Performing key figure analysis. The standard hierarchy is a structure to which all cost centers within the Controlling area must be assigned. Cost center It the location where cost is incurred. For the purpose of overhead controlling , cost centers are grouped together in Decision , control and responsibility. To map this struture you create cost center standard hierarchy. Each level or node of the hierarchy is known as cost center group. Cost centers that are created or changed from within the standard hierarchy have the status Inactive. You can change the assignments of the organisational units during the course of fiscal year only if . 1. the currency of new company code is same as the currency of old company code. 2. only posted planning data. 3. The cost center is not assigned to a fixed asset , work center or HR master Record. Cost center category

It is indicator in cost center master data which specifies the category of the Cost center. Cost center categories enable you to assign the same characteristics to similar cost centers. Can also be used for cost calculations, wher it controls what percentage of the overheads apply to that cost center category. OKEON, KS01- Cost center creation, KE51- Profit center creation Before profit center is created setting has to be made in Contollin area *

COST ELEMENT

Primary costs and revenues flow from FI to Management Accounting. Secondary cost elements can be created only in Management Accounting. Exam of PCE material costs and salary costs SCE re used to identify internal costs flow ex. Assessments and settlements.

ACTIVITY TYPE The activity type classifies the activities that are to be performed within a company by one or several cost centers. Activity types serves as tracing factors for cost allocation. In Internal activity allocation , the quantity of the activity eg no of consulting hours are entered manually or automatically. The system calculates the cost based on activity price and generates Debit to receiver Credit to sender Internal activity allocation is carried out using secondary cost allocation. Restriction of use of activity type can be made by entering cost center category in activity type master data. Activity type category is used to determine whether and how an activity is allocated eg: directly, indirectly or not allocated. Create activity type KL01

STATISTICAL KEY FIGURE STKF are used for tracing factors for repostings and allocations. SKfs are figures relating to cost centers, profit centers and overhead cost orders. Eg: number of employees, the length of long distance calls. It may be value representing the services provided by one particular cost center. Eg, no of employees in transportationcost center who provide repair services. You can post both planned and actual statistical key figures It can be used for distribution and assessment and for key figure analysis. SKFs are either fixed values or a totals value Fixed value is carried over from the period in which it is entered to other fiscal years. Only when there is any change in value a new posting has to be

Done. The fiscal year total is average of periods total. Totals value is posted in the period in which it is entered. Long-distance Calls. The fiscal year total is the sum of all period values.

Das könnte Ihnen auch gefallen

- Concepts, Tools, and Frameworks For Practitioners: David Dranove AND Sonia MarcianoDokument27 SeitenConcepts, Tools, and Frameworks For Practitioners: David Dranove AND Sonia MarcianosaatwickNoch keine Bewertungen

- Trade Your Way To Financial Freedom PDFDokument23 SeitenTrade Your Way To Financial Freedom PDFPolinNoch keine Bewertungen

- Controlling TheoryDokument19 SeitenControlling TheorysrinivasNoch keine Bewertungen

- Actual Values Flowing To CODokument3 SeitenActual Values Flowing To COSUDIPTADATTARAYNoch keine Bewertungen

- S4 HANA Vs ECC - COPADokument8 SeitenS4 HANA Vs ECC - COPAumang patodiaNoch keine Bewertungen

- Controlling: Cost AccountingDokument144 SeitenControlling: Cost AccountingBharat WealthNoch keine Bewertungen

- Unit 6: Asset AccountingDokument22 SeitenUnit 6: Asset AccountingJose Rengifo LeonettNoch keine Bewertungen

- Business ManagementDokument36 SeitenBusiness ManagementGerehNoch keine Bewertungen

- Co Glossary (New)Dokument127 SeitenCo Glossary (New)chapx032Noch keine Bewertungen

- Accounts Payable Accounting Overview and Invoice Processing: SAP End-User TrainingDokument104 SeitenAccounts Payable Accounting Overview and Invoice Processing: SAP End-User TrainingMuthu RamanNoch keine Bewertungen

- Revenue Recognition Cookbook 2021-04Dokument140 SeitenRevenue Recognition Cookbook 2021-04Ashok BezawadaNoch keine Bewertungen

- GL Comparioson With ECC and S4 HANADokument20 SeitenGL Comparioson With ECC and S4 HANADipomoySahaNoch keine Bewertungen

- Assembly To Order Process - SAP BlogsDokument2 SeitenAssembly To Order Process - SAP BlogsDipak BanerjeeNoch keine Bewertungen

- Sap Controlling: Functionality and ImplementationDokument26 SeitenSap Controlling: Functionality and ImplementationRajenderNoch keine Bewertungen

- OpenSAP s4h27 Week 1 All SlidesDokument86 SeitenOpenSAP s4h27 Week 1 All SlidesFabio FialhoNoch keine Bewertungen

- Sap Simple Finance TutorialDokument16 SeitenSap Simple Finance TutorialAnusha ReddyNoch keine Bewertungen

- Info Memo Telkom Fy2008Dokument18 SeitenInfo Memo Telkom Fy2008prakososantosoNoch keine Bewertungen

- Controlling 2Dokument4 SeitenControlling 2yewalesudarshanNoch keine Bewertungen

- The Reward and Remuneration Series Handbook PDFDokument320 SeitenThe Reward and Remuneration Series Handbook PDFOdhis KanayoNoch keine Bewertungen

- Talent Acquisition and RetentionDokument15 SeitenTalent Acquisition and RetentionSwati BagariaNoch keine Bewertungen

- Accounting and Financial Close (J58)Dokument14 SeitenAccounting and Financial Close (J58)Ahmed Al-SherbinyNoch keine Bewertungen

- Configuration of Leased Asset AccountingDokument2 SeitenConfiguration of Leased Asset AccountingPavan UlkNoch keine Bewertungen

- Fi-Co SAP Systems Application and Products in Data ProcessingDokument295 SeitenFi-Co SAP Systems Application and Products in Data ProcessingPrabhakarNoch keine Bewertungen

- Activity Based Costing PDF Product Cost Planning Calculated Abc Sap PDFDokument15 SeitenActivity Based Costing PDF Product Cost Planning Calculated Abc Sap PDFValdivia MagalyNoch keine Bewertungen

- SAP BPC Activity Flow - An Overview!: Corporate Performance IntelligenceDokument2 SeitenSAP BPC Activity Flow - An Overview!: Corporate Performance Intelligenceshah04174Noch keine Bewertungen

- Chap 019Dokument45 SeitenChap 019ducacapupuNoch keine Bewertungen

- Make-to-Stock (MTS) Production With Batch Management, WM & HUMDokument2 SeitenMake-to-Stock (MTS) Production With Batch Management, WM & HUMcreater127abNoch keine Bewertungen

- Real EstateDokument481 SeitenReal EstatePedroNoch keine Bewertungen

- Part - 2 Product Costing - Activity Rate Calculation: Cost Center in A PlantDokument3 SeitenPart - 2 Product Costing - Activity Rate Calculation: Cost Center in A PlantAvengers endgameNoch keine Bewertungen

- SAP Functional Area DerivingDokument1 SeiteSAP Functional Area DerivingKIKNoch keine Bewertungen

- SAP BPC On HANA Knowledgebase: Implementation GuideDokument100 SeitenSAP BPC On HANA Knowledgebase: Implementation Guideanbuka7Noch keine Bewertungen

- Product CostingDokument40 SeitenProduct CostingMohan RajNoch keine Bewertungen

- SAP Controlling and COST Center Accounting (CO-CCA)Dokument17 SeitenSAP Controlling and COST Center Accounting (CO-CCA)Ancuţa CatrinoiuNoch keine Bewertungen

- S4HANA Cloud For FinanceDokument2 SeitenS4HANA Cloud For FinancemonaNoch keine Bewertungen

- Contract Allocation - Stand Alone Selling PriceDokument19 SeitenContract Allocation - Stand Alone Selling PricenagalakshmiNoch keine Bewertungen

- Universal AllocationDokument18 SeitenUniversal Allocationcv babu100% (1)

- SAP Hierarchy OverviewDokument38 SeitenSAP Hierarchy OverviewsowjanyaNoch keine Bewertungen

- SAP FICO Financial AccountingDokument4 SeitenSAP FICO Financial AccountingNeelesh KumarNoch keine Bewertungen

- ASAP RoadmapDokument34 SeitenASAP RoadmapAnkur NautiyalNoch keine Bewertungen

- SAP S/4HANA Embedded Analytics: Experiences in the FieldVon EverandSAP S/4HANA Embedded Analytics: Experiences in the FieldNoch keine Bewertungen

- Chambal Fertilizer PO. PDFDokument2 SeitenChambal Fertilizer PO. PDFRizvan QureshiNoch keine Bewertungen

- SAP CO PPT'sDokument5 SeitenSAP CO PPT'sTapas BhattacharyaNoch keine Bewertungen

- Parameters of The S&OP Supply Planning OperatorDokument23 SeitenParameters of The S&OP Supply Planning OperatorLevent OturakNoch keine Bewertungen

- FBL1N Report PDFDokument5 SeitenFBL1N Report PDFAdaikalam Alexander Rayappa0% (1)

- ABAP To Hana3 - OkDokument36 SeitenABAP To Hana3 - OkDaniel PorciunculaNoch keine Bewertungen

- Finacle 10 CommandDokument36 SeitenFinacle 10 CommandPANKAJ MAHESHWARI100% (3)

- Assessment To COBIT 4.1 Maturity ModelDokument5 SeitenAssessment To COBIT 4.1 Maturity ModelReda El HaraouiNoch keine Bewertungen

- Process CostingDokument13 SeitenProcess CostingPrateekNoch keine Bewertungen

- SAP Cloud ALM Functional OverviewDokument40 SeitenSAP Cloud ALM Functional Overviewdgsdgs7Noch keine Bewertungen

- Design Document Co Profitabilty Analysis Author/ApproverDokument19 SeitenDesign Document Co Profitabilty Analysis Author/ApproverAncuţa CatrinoiuNoch keine Bewertungen

- Material Ledger Setting in SAP S4 HanaDokument5 SeitenMaterial Ledger Setting in SAP S4 HanaRahul pawadeNoch keine Bewertungen

- Bpi S4hana Fi MM ConfigDokument110 SeitenBpi S4hana Fi MM Configrohit randiveNoch keine Bewertungen

- Speed Up Your Profitability Analysis Performance With SAP HANA's CO-PA AcceleratorDokument8 SeitenSpeed Up Your Profitability Analysis Performance With SAP HANA's CO-PA Acceleratorpasssion69Noch keine Bewertungen

- Solution PrestSAPCollectManDokument89 SeitenSolution PrestSAPCollectManAnit GautamNoch keine Bewertungen

- SAP Certified Application Associate - Financial Accounting With SAP ERP 6.0 EHP5Dokument3 SeitenSAP Certified Application Associate - Financial Accounting With SAP ERP 6.0 EHP5Jay BandaNoch keine Bewertungen

- SAP - Online Transaction Processing (OLTP)Dokument17 SeitenSAP - Online Transaction Processing (OLTP)subbu sapNoch keine Bewertungen

- Easy Cost Planning in PSDokument6 SeitenEasy Cost Planning in PSabhi12345634Noch keine Bewertungen

- Cost Component StructureDokument7 SeitenCost Component StructurePRATAP SAPMMNoch keine Bewertungen

- Bộ Câu Hỏi Ts410Dokument22 SeitenBộ Câu Hỏi Ts410Việt Nguyễn QuốcNoch keine Bewertungen

- New Asset AccountingDokument19 SeitenNew Asset AccountingShruti ChapraNoch keine Bewertungen

- S4F23Dokument229 SeitenS4F23Aurora Da CunhaNoch keine Bewertungen

- SAP BI70 MaterialDokument197 SeitenSAP BI70 MaterialChaituNoch keine Bewertungen

- Building A Tax Calculation ApplicationDokument11 SeitenBuilding A Tax Calculation ApplicationMartin De LeoNoch keine Bewertungen

- Define Cost Component Structure: The Following Applies To Product CostingDokument9 SeitenDefine Cost Component Structure: The Following Applies To Product CostingDundi AkulaNoch keine Bewertungen

- Gera KDSDokument65 SeitenGera KDSrakeshsingh9811Noch keine Bewertungen

- MySAP OverviewDokument64 SeitenMySAP Overviewsudhanshugarg75% (4)

- Implementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesVon EverandImplementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesNoch keine Bewertungen

- Integrated Business Planning A Complete Guide - 2020 EditionVon EverandIntegrated Business Planning A Complete Guide - 2020 EditionNoch keine Bewertungen

- The Marketing Challenge of Low Resource CustomersDokument7 SeitenThe Marketing Challenge of Low Resource Customersvivek mithraNoch keine Bewertungen

- GL3 e Chap 03Dokument33 SeitenGL3 e Chap 03chinki chatoriNoch keine Bewertungen

- Resource Based View in Strategic Management of Public Organizations A Review of The LiteratureDokument12 SeitenResource Based View in Strategic Management of Public Organizations A Review of The LiteraturemahedNoch keine Bewertungen

- Annual Report Ace Hardware Indonesia 2018 PDFDokument160 SeitenAnnual Report Ace Hardware Indonesia 2018 PDFBang BegsNoch keine Bewertungen

- VSM Ladrillera LatesaDokument2 SeitenVSM Ladrillera LatesaMeylin CaballeroNoch keine Bewertungen

- Sample Accountant CV - Great Sample ResumeDokument4 SeitenSample Accountant CV - Great Sample ResumedrustagiNoch keine Bewertungen

- This Study Resource Was: (Question)Dokument3 SeitenThis Study Resource Was: (Question)Mir Salman AjabNoch keine Bewertungen

- Figure 6-2: Refer To Figure 6-2. The Price CeilingDokument5 SeitenFigure 6-2: Refer To Figure 6-2. The Price Ceiling刘佳煊Noch keine Bewertungen

- Sustainable Supply Chain Quality Management - A Systematic Review PDFDokument19 SeitenSustainable Supply Chain Quality Management - A Systematic Review PDFFery PermadiNoch keine Bewertungen

- Operational RiskDokument7 SeitenOperational RiskBOBBY212Noch keine Bewertungen

- Chief Engineering - Job DescDokument3 SeitenChief Engineering - Job DescKartiman KtmNoch keine Bewertungen

- Cooperation Agreement - Novi Klijent - Croatia BranchDokument5 SeitenCooperation Agreement - Novi Klijent - Croatia Branchodvjetnik.muminagicNoch keine Bewertungen

- (MIDTERM) AAP - Module 5 PSA-315-320-330-450Dokument6 Seiten(MIDTERM) AAP - Module 5 PSA-315-320-330-45025 CUNTAPAY, FRENCHIE VENICE B.Noch keine Bewertungen

- MTH302 FormulasDokument3 SeitenMTH302 FormulasmankhokharNoch keine Bewertungen

- Account Statement For Account:0820001500005003: Branch DetailsDokument28 SeitenAccount Statement For Account:0820001500005003: Branch DetailsAnmol DeepNoch keine Bewertungen

- Summer Training SwapnilDokument94 SeitenSummer Training SwapnilSwapnil Kumar SinghNoch keine Bewertungen

- A Study On Risk Management Tools and Techniques in Life Insurance Industry in IndiaDokument30 SeitenA Study On Risk Management Tools and Techniques in Life Insurance Industry in IndiadevilNoch keine Bewertungen

- Kristi Noem 4th Quarter ReportDokument211 SeitenKristi Noem 4th Quarter ReportPat PowersNoch keine Bewertungen

- Lecture 5Dokument28 SeitenLecture 5Dalia SamirNoch keine Bewertungen

- Solution Manual For Advanced Accounting 7th by JeterDokument36 SeitenSolution Manual For Advanced Accounting 7th by Jeterbraidscanty8unib100% (43)