Beruflich Dokumente

Kultur Dokumente

1 - 2013 Futures Report: New York Tech Scene - Overview

Hochgeladen von

Anonymous Feglbx5Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

1 - 2013 Futures Report: New York Tech Scene - Overview

Hochgeladen von

Anonymous Feglbx5Copyright:

Verfügbare Formate

Q

1 - 2013 | Futures Report

Ashkn Zandieh | 212.400.6083 | azandieh@absre.com

New York Tech Scene | Overview

The New York tech scene flourished in 2012. Startups in the media, mobile, and fashion tech set record-breaking numbers in funding as well as real estate growth. Funding rounds across all levels were strong, leading to entrepreneurs working across multiple platforms to expand their business and real estate footprint. The dramatic increase in leasing activity from both startups and established tech companies made New York one of the strongest tech markets in the country. Midtown South, New Yorks tech epicenter, boasts the lowest office vacancy rate in the country. Direct average rental rates steadily rose by 17%, to an average of $55 per square foot, from Q1 2012 to Q4 2012. By comparison, during the same period, Midtown rents grew by 6.9% to $48 per square foot and Lower Manhattan rents incrementally grew by 1.9% to $35.50 per square foot. Since Google purchased 111 Eighth Avenue, a 2.9 million square-foot building in Chelsea, the tech and real estate landscape has dramatically changed. Googles natural ability to attract top-tier talent from around the world has helped the overall talent pool in New York, leading to an increase in engineers, designers, and startups alike migrating to New York. Moda Operandi and Fab, two of the more popular startups in New York, expanded their real estate footprint by moving south and taking space in Chelsea upon the announcement of their VC capital injection in 2012. Moda Operandi announced their move from 72 Madison to 315 Hudson Street, taking nearly 24,882 square feet, while the fast growing Fab nearly doubled their space when they took 23,500 square feet at 95 Morton Street. Multinational tech-based companies like tech giants eBay and Google both established themselves in New York by planting roots in Midtown South in 2012. eBay early in the year announced their move to 625 Avenue of the Americas.

Office Class A and B Vacant Available Average Office Rent Avg. Net Absorption Rate

LoMa Midtown South Midtown 0.00% 4.00% 8.00%

LoMa Midtown South Midtown $15.00 $35.00 $55.00

LoMa Midtown South Midtown 0.00% 0.20% 0.40%

Ashkn Zandieh | 212.400.6083 | azandieh@absre.com

Real Estate | Market Overview

Midtown South has been able to drive real estate leasing activity, by having its own organic identity. Midtown Souths natural ability to attract entrepreneurs and startups has helped shape not only real estate but also its identity. While Midtown has been able to attract larger tech firms with favorable leases in order to help create its own tech identity, Lower Manhattan (LoMa) is still finding its place. However, with low rental rates and a PR push from the Bloomberg Administration and the NYCEDC, some startups might find it beneficial to explore the option of growing in LoMa. North of Madison (NoMad) and Meatpacking are areas worth taking notice of in terms of tech activity. The cultural shift has generated activity in NoMad, where startups might find suitable space outside of Union Square/Flatiron. The recent sale of 2840 West 23rd Street in Meatpacking may provide relief for priced out tenants in Midtown Souths leasing market.

Q1 2013

Vacancy Rate Leasing Activity Avg. Asking Rental Avg. Time on Market

Midtown South

Midtown South: Real Estate Forecast

Tech will remain strong in Midtown South in 2013. While rental rates will continue to put pressure on startups that desire a Midtown South zip code, growing startups might remain reluctant to move outside of Midtown South due largely in part to sociological factors. Even though startups in growth mode are looking to expand their real estate footprint, some startups would rather reconfigure their current space than move, putting a halt on leasing activity in 2013. Chelsea, Union Square, and SoHo, submarkets of Midtown South, have spearheaded the way in terms of institutional real estate investments and leasing activity in 2012. Average rental rates have reached $50 to $70 per square foot for some tech-friendly buildings. As one of the tightest markets in the country, all three submarkets combined have seen a significant 11.5% decrease in vacancy, driven largely by Chelsea and Union Squares recent leasing activity. While techs real estate footprint continues to grow, so does the interest and appetite for investors. With the potential of tremendous economic gain from the tech and startup scene, leasing activity, as well as investing, will most likely increase in 2013.

Office Class B Vacant Available

Chelsea Flatiron/Union Sq SoHo

Average Office Rent

Chelsea Flatiron/Union Sq SoHo

Avg. Net Absorption Rate

Chelsea Flatiron/Union Sq SoHo

0.00%

2.00%

4.00%

$20.00

$40.00

$60.00

0.00% 0.20% 0.40% 0.60%

Ashkn Zandieh | 212.400.6083 | azandieh@absre.com

Co-working | The Future of New Yorks Start-Up Scene

Coworking is more than working in an open space, it is more about who you work with and the synergy that allows you to create innovation. Coworking is the future of working, says Jason Saltzman, founder of The Alley, adding that companies like Zappos proved it with a fun, flowy and collaborative work environment that lead to better products getting built. The concept of coworking has even attracted the attention of well established business like NBC and American Express. According to Saltzman, big businesses are looking at coworking and adopting the startup methodology to help open the channels of communication. Ultimately this will help seasoned companies to adapt to change more quickly. Overall, the ability to approach business-related problems from multiple angles through open communication and cross-collaboration is the undercurrent running through co-workspaces. Real Estate and Coworking: Midtown South, Silicon Alley, has seen the most notable amount of co-workspaces. On average, there are roughly 40 to 50 co-workspaces and thousands of startups within them in New York. Upon graduating, many of these startups are reluctant to move outside of Midtown South based on the connection, networking, and sociological impact of the area. This has also had a profound effect on Midtown South real estate. The supply constraint has pushed asking prices upward of $60 per square foot for office space in Class B buildings, leading to many startups to either co-locate or postpone their real estate growth.

Coworking / Incubator Spaces LoMa NorthBrooklyn Midtown MidtownSouth

The popularity and high demand for co-workspaces has also had a similar effect on real estate. Companies like TechSpace, Grind, and WeWork have been expanding throughout New York City, further expanding techs footprint. Co-workspaces have offered many early-stage startups the ability to enter the high barrier of entry in the New York market. This has increased the popularity and growth of many co-workspace operators. Most recently, San Francisco-based company 500 Startups, decided to enter the New York coworking market. The popular incubator and seed fund should leave an impact on the scene, especially when considering previously established co-workspaces. According to 500 Startups, half of the 5,000 square foot space at 28th Street and Park Avenue will be dedicated to its own portfolio companies, while accommodating other fledgling startups. Ultimately, the future of New Yorks tech scene is directly tied into the fabric of New Yorks coworking scene.

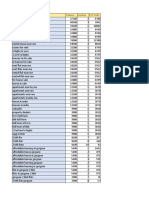

Future Report 2013 | Funding

The wealth of angel and VC investments in New York startups has suggested that the tech scene will continue to grow despite a Series A crunch. New York-based startups that have a monetization strategy might not feel the pinch felt in other parts of the country. Unlike the Silicon Valley model, which traditionally has focused on users, New York business-to-business startups focus their efforts on revenue, not investment. In addition, some startups might not need funding or additional funding beyond the seed or Series A stage. While the number of startups is growing, the number of VC funds is shrinking. According to the National Venture Capital Association (NVCA), US-based VC firms raised $20.6 billion disbursed from 182 funds in 2012, representing a 9.7% increase in capital but a 2.6% decrease in number of funds since 2011. New York (Metro) VC firms

Ashkn Zandieh | 212.400.6083 | azandieh@absre.com

Future Report 2013 | Funding (contd)

invested $2.3 billion in 397 deals in 2012, an 18% decrease in dollars and a 4.3% decrease in deals in 2011, according to the MoneyTree Report by PricewaterhouseCoopers LLP and the NVCA, based on data from Thomson Reuters. According to Mark Heesen, president of NVCA, the venture capital fundraising environment has settled into a new normal, which is characterized by a barbell structure of larger funds which are stage and industry agnostic on one end, and smaller, early-stage, industry- or region-specific funds on the other.

300 225 150 75 0

TTL# of Funds # of Follow-on Funds

# of New Funds Venture Capital$

$25,000 $20,000 $15,000 $10,000

2008

2009

2010

2011

2012

Industry to Watch: Real Estate Tech

In 2012, technology moved to one of the largest industries in the world, real estate. Since the launch of Zillow, Truilia, and the mobile/web marketplace several years ago, there has been very little change in the real estate tech scene. While, residential real estate firms like Corcoran and Douglas Elliman have been able to leverage social media and mobile platforms to reach a broader customer base, commercial real estate has been somewhat reluctant to change to the social forces around them. Disruptive and innovation are two words that arent synonymous with real estate. However, since the launch of 42 Floors and Compstak, commercial real estate is functioning for a new generation of commercial real estate professional and tenants. According to Danny Shachar, Director of Marketing at Compstak, technology is looking for new opportunities, and when sexier parts of the market have been saturated with the likes of consumeroriented products...investors and entrepreneurs are turning to the B2B markets. Ultimately, commercial real estate is one of the last few areas to be transformed and enhanced by technology. 42Floors:

42Floors is a commercial real estate and office space marketplace similar to a multiple-listing-service. The company was founded in November 2011. 42Floors makes office space rentals and commercial real estate listings easier to search by indexing business places for rent, coworking spaces, office sublets, and executive suites.

TechStarter Research Marketing & Real Estate Consulting TechStarter is the creative division of ABS Partners, one of the largest owners of office space/real estate in New York. It is the research marketing, leasing, and management team that handles all start-up requirements. TechStarter places importance on the micro and macro segments of the start-up/ tech scene, focusing on sustainability, growth, and synergy. Simply put, TechStater helps start-ups better understand real estate and their real estate footprint. The TechStarter Report is produced quarterly by: Ashkn Zandieh | Associate Director ABS Partners Real Estate, LLC We build partnerships that last

CompStak:

CompStak uses a crowd-sourced model to gather real estate information that is hard to come by, difficult to compile, or otherwise unavailable. CompStaks wedge into the market is a platform for the exchange of commercial lease comps. Brokers, landlords, appraisers and researchers use their site, and submit comps on completed commercial lease transactions.

200 Park Avenue South, New York, NY 10003 T 212.400.6060 F 212.400.9520 absre.com

2012. All rights reserved. No part of this publication may be reproduced by any means. The information contained in this document has been compiled from sources believed to be reliable. Tech Starter or any of their affiliates accept no liability or responsibility for the accuracy or completeness of the information contained herein and no reliance should be placed on the information contain in this document. Sources: TechStarter, ABS Partners Real Estate, LLC, CompStak, CoStar, NYCEDC, Made in NY, National Venture Capital Association, PricewaterhouseCoopers LLP, and Thomson Reuters Special Thanks to: 42 Floors, Compstak, The Alley, Gring, SpaceSplitter, TechSpace and Gust

Millions

$30,000

Das könnte Ihnen auch gefallen

- Laurence John Sortigosa: For: Accion ReinvidicatoriaDokument5 SeitenLaurence John Sortigosa: For: Accion ReinvidicatoriaRenzo Beaver Baco BalberonaNoch keine Bewertungen

- Money of The FutureDokument321 SeitenMoney of The FutureWeb Financial Group100% (1)

- The Best Research Reports On Disruption and Innovation Startups & Disruption - CBS INSIGHTS 2015Dokument57 SeitenThe Best Research Reports On Disruption and Innovation Startups & Disruption - CBS INSIGHTS 2015Arthur CahuantziNoch keine Bewertungen

- Progress Ventures Newsletter 3Q2018Dokument18 SeitenProgress Ventures Newsletter 3Q2018Anonymous Feglbx5Noch keine Bewertungen

- Chapter 13 LeaseDokument4 SeitenChapter 13 Leasemaria isabella100% (2)

- Florida Residential Lease AgreementDokument8 SeitenFlorida Residential Lease AgreementgraveborneNoch keine Bewertungen

- Property Law NotesDokument52 SeitenProperty Law NotesShantanu Tikadar67% (3)

- Fintech Trends & Disruption in Financial Services CB InsightDokument29 SeitenFintech Trends & Disruption in Financial Services CB InsightOxford Biochronometrics100% (1)

- Digital Media and Internet Sector Update - Spring 2012 FinalDokument52 SeitenDigital Media and Internet Sector Update - Spring 2012 Finalstupac7864Noch keine Bewertungen

- Dotcom Bubble - Urvashi AryaDokument3 SeitenDotcom Bubble - Urvashi AryaUrvashiNoch keine Bewertungen

- Consolidated Final ListDokument21 SeitenConsolidated Final ListVidhu Vasav0% (1)

- Agrarian Relations and Friar LandsDokument13 SeitenAgrarian Relations and Friar LandsJessica PenaflorNoch keine Bewertungen

- Sample Rental Agreement in BangaloreDokument2 SeitenSample Rental Agreement in Bangaloreaditya_potturi66% (29)

- Winning in Growth Cities 2012Dokument54 SeitenWinning in Growth Cities 2012Gen ShibayamaNoch keine Bewertungen

- Samson VS Court of Appeals, Santos & Sons IncDokument3 SeitenSamson VS Court of Appeals, Santos & Sons IncFebe Anne AglangaoNoch keine Bewertungen

- The Power of Entrepreneur Networks: How New York City Became The Role Model For Other Urban Tech HubsDokument32 SeitenThe Power of Entrepreneur Networks: How New York City Became The Role Model For Other Urban Tech HubscrainsnewyorkNoch keine Bewertungen

- Endeavor Insiaght Partnership For NYC Tech EntrepreneursDokument32 SeitenEndeavor Insiaght Partnership For NYC Tech EntrepreneurscrainsnewyorkNoch keine Bewertungen

- Up, Up and Away: RTR Financial Services Supports Lutheran HealthcareDokument12 SeitenUp, Up and Away: RTR Financial Services Supports Lutheran HealthcareelauwitNoch keine Bewertungen

- TechViewPoint April2015 PDFDokument9 SeitenTechViewPoint April2015 PDFAnonymous Feglbx5Noch keine Bewertungen

- Analyzing The Attributes in Customer Purchase Decision of Apartments Towards Technicraft DevelopersDokument73 SeitenAnalyzing The Attributes in Customer Purchase Decision of Apartments Towards Technicraft DevelopersNischith GowdaNoch keine Bewertungen

- Building A Digital CityDokument28 SeitenBuilding A Digital CityChasity WrightNoch keine Bewertungen

- HBR DocumentDokument14 SeitenHBR Documentsandipan majiNoch keine Bewertungen

- As Tech Hub, City Is 2nd To Silicon: ValleyDokument1 SeiteAs Tech Hub, City Is 2nd To Silicon: ValleyBrittany Christine ToscanoNoch keine Bewertungen

- Industry AnalysisDokument10 SeitenIndustry Analysisapi-497949503Noch keine Bewertungen

- Retail: ResearchDokument4 SeitenRetail: ResearchAnonymous Feglbx5Noch keine Bewertungen

- Construction and The Internet - New Wiring - The EconomistDokument2 SeitenConstruction and The Internet - New Wiring - The EconomistYaín GodoyNoch keine Bewertungen

- Sample Real Estate Research PaperDokument6 SeitenSample Real Estate Research Paperfemeowplg100% (1)

- Industry 4.0: Volume Lii July 2020Dokument8 SeitenIndustry 4.0: Volume Lii July 2020Andy HuffNoch keine Bewertungen

- Social Media LeadsDokument2 SeitenSocial Media LeadssaaigeeNoch keine Bewertungen

- OEWD Dashboard - Feb 2013Dokument6 SeitenOEWD Dashboard - Feb 2013Jack GallagherNoch keine Bewertungen

- LA Tech Venture Capital AlmanacDokument102 SeitenLA Tech Venture Capital AlmanacAGjjjjkjjNoch keine Bewertungen

- Zillow Short ThesisDokument5 SeitenZillow Short ThesisWriteMyCollegePaperForMeJackson100% (2)

- Hbs - Tech ClusterDokument25 SeitenHbs - Tech ClusterMayra EliceguiNoch keine Bewertungen

- Automation Alley Technolgy Industry ReportDokument13 SeitenAutomation Alley Technolgy Industry ReportpkampeNoch keine Bewertungen

- Are You Enjoying Globalization Yet? The Surprising Implications For BusinessDokument11 SeitenAre You Enjoying Globalization Yet? The Surprising Implications For Businessgal3688Noch keine Bewertungen

- Mayor Bloomberg Announces Request For Proposals For New or Expanded Engineering and Applied Sciences Campus in New York CityDokument5 SeitenMayor Bloomberg Announces Request For Proposals For New or Expanded Engineering and Applied Sciences Campus in New York CityofficeofsstraussNoch keine Bewertungen

- Urban Tech AnalysisDokument1 SeiteUrban Tech AnalysisAnonymous Feglbx5Noch keine Bewertungen

- Real Estate Media White Paper 2016Dokument4 SeitenReal Estate Media White Paper 2016Akila Devdayan WeerasingheNoch keine Bewertungen

- Official Top 10 Tech Cities RankingsDokument4 SeitenOfficial Top 10 Tech Cities RankingsAnonymous Feglbx5Noch keine Bewertungen

- Opening Statement 12 16 09Dokument8 SeitenOpening Statement 12 16 09NYC Council Tech in Govn't CommitteeNoch keine Bewertungen

- ENR04232012 500 Section Final1782916695Dokument71 SeitenENR04232012 500 Section Final1782916695Mohammad OmairNoch keine Bewertungen

- New York Silicon Alley Weekly Newsletter 10-February-2012Dokument7 SeitenNew York Silicon Alley Weekly Newsletter 10-February-2012muhammadaliehsanNoch keine Bewertungen

- 07 14 09 NYC JMC UpdateDokument9 Seiten07 14 09 NYC JMC Updateapi-27426110Noch keine Bewertungen

- A Little Guide To Equity CrowdfundingDokument10 SeitenA Little Guide To Equity CrowdfundingAgroEmpresario ExportadorNoch keine Bewertungen

- 09 10 07 NYC JMC UpdateDokument10 Seiten09 10 07 NYC JMC Updateapi-27426110Noch keine Bewertungen

- 2016 June Global Perspectives 08-18-2016Dokument8 Seiten2016 June Global Perspectives 08-18-2016National Association of REALTORS®Noch keine Bewertungen

- Today Tech Job MarketDokument2 SeitenToday Tech Job MarketI Gede Agastya Darma LaksanaNoch keine Bewertungen

- Next Big ThingDokument7 SeitenNext Big ThingtonerangerNoch keine Bewertungen

- Whats Hot in Commercial Real Estate in 2013Dokument37 SeitenWhats Hot in Commercial Real Estate in 2013Cassidy TurleyNoch keine Bewertungen

- Offices 2020 Hong Kong Report - EngDokument20 SeitenOffices 2020 Hong Kong Report - EngEugene WongNoch keine Bewertungen

- The Future of WorkplaceDokument8 SeitenThe Future of WorkplaceJazreel HardinNoch keine Bewertungen

- Real Estate Marketing' (NCR) : Amity School of Business Internship Report ONDokument41 SeitenReal Estate Marketing' (NCR) : Amity School of Business Internship Report ONVidushi Gautam100% (1)

- CrowdfundingDokument7 SeitenCrowdfundingaishariaz342Noch keine Bewertungen

- Openland (Formerly Statecraft) - YC Interview AnswersDokument7 SeitenOpenland (Formerly Statecraft) - YC Interview AnswersDevansh SharmaNoch keine Bewertungen

- GY300 Topic 4 Week 5Dokument7 SeitenGY300 Topic 4 Week 5Shaista FarooqNoch keine Bewertungen

- CDFwhitepaperyingwenDokument19 SeitenCDFwhitepaperyingwenFinal ShineNoch keine Bewertungen

- Quadrangle: Core BusinessDokument14 SeitenQuadrangle: Core BusinessK Rachit PatelNoch keine Bewertungen

- Nab Assignment 1Dokument2 SeitenNab Assignment 1Nabeel HussainNoch keine Bewertungen

- Section F-Group 10 (Real Estate)Dokument21 SeitenSection F-Group 10 (Real Estate)Meghwant ThakurNoch keine Bewertungen

- For Immediate Release PR-387-11 October 31, 2011Dokument5 SeitenFor Immediate Release PR-387-11 October 31, 2011officeofsstraussNoch keine Bewertungen

- 2012 JulyDokument8 Seiten2012 Julyjen8948Noch keine Bewertungen

- For Immediate Release (4 Pages) Contact: Monday July 8, 2013 James Delmonte (212) 729-6973 EmailDokument4 SeitenFor Immediate Release (4 Pages) Contact: Monday July 8, 2013 James Delmonte (212) 729-6973 EmailAnonymous Feglbx5Noch keine Bewertungen

- April 2012Dokument3 SeitenApril 2012Anonymous Feglbx5Noch keine Bewertungen

- SparkLabs Global Technology and Internet Market Bi-Monthly Review 0920 2015Dokument10 SeitenSparkLabs Global Technology and Internet Market Bi-Monthly Review 0920 2015SparkLabs Global VenturesNoch keine Bewertungen

- 6 19 13 Allen TestimonyDokument2 Seiten6 19 13 Allen TestimonyRizwan HashimNoch keine Bewertungen

- JLL SlidedeckDokument16 SeitenJLL SlidedeckAjay RamakrishnanNoch keine Bewertungen

- Innovation PDFDokument35 SeitenInnovation PDFAnonymous Feglbx5Noch keine Bewertungen

- Houston's Office Market Is Finally On The MendDokument9 SeitenHouston's Office Market Is Finally On The MendAnonymous Feglbx5Noch keine Bewertungen

- CIO Bulletin - DiliVer LLC (Final)Dokument2 SeitenCIO Bulletin - DiliVer LLC (Final)Anonymous Feglbx5Noch keine Bewertungen

- ValeportDokument3 SeitenValeportAnonymous Feglbx5Noch keine Bewertungen

- The Woodlands Office Submarket SnapshotDokument4 SeitenThe Woodlands Office Submarket SnapshotAnonymous Feglbx5Noch keine Bewertungen

- 4Q18 Washington, D.C. Local Apartment ReportDokument4 Seiten4Q18 Washington, D.C. Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDokument6 SeitenHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5Noch keine Bewertungen

- 4Q18 Houston Local Apartment ReportDokument4 Seiten4Q18 Houston Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDokument9 SeitenMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5Noch keine Bewertungen

- THRealEstate THINK-US Multifamily ResearchDokument10 SeitenTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5Noch keine Bewertungen

- 4Q18 North Carolina Local Apartment ReportDokument8 Seiten4Q18 North Carolina Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- 4Q18 Philadelphia Local Apartment ReportDokument4 Seiten4Q18 Philadelphia Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- 4Q18 South Florida Local Apartment ReportDokument8 Seiten4Q18 South Florida Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- 4Q18 Atlanta Local Apartment ReportDokument4 Seiten4Q18 Atlanta Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- 4Q18 New York City Local Apartment ReportDokument8 Seiten4Q18 New York City Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- Asl Marine Holdings LTDDokument28 SeitenAsl Marine Holdings LTDAnonymous Feglbx5Noch keine Bewertungen

- 4Q18 Boston Local Apartment ReportDokument4 Seiten4Q18 Boston Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- 3Q18 Philadelphia Office MarketDokument7 Seiten3Q18 Philadelphia Office MarketAnonymous Feglbx5Noch keine Bewertungen

- 4Q18 Dallas Fort Worth Local Apartment ReportDokument4 Seiten4Q18 Dallas Fort Worth Local Apartment ReportAnonymous Feglbx5Noch keine Bewertungen

- Fredericksburg Americas Alliance MarketBeat Industrial Q32018Dokument1 SeiteFredericksburg Americas Alliance MarketBeat Industrial Q32018Anonymous Feglbx5Noch keine Bewertungen

- 2018 U.S. Retail Holiday Trends Guide - Final PDFDokument9 Seiten2018 U.S. Retail Holiday Trends Guide - Final PDFAnonymous Feglbx5Noch keine Bewertungen

- Wilmington Office MarketDokument5 SeitenWilmington Office MarketWilliam HarrisNoch keine Bewertungen

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDokument7 SeitenUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5Noch keine Bewertungen

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDokument1 SeiteRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5Noch keine Bewertungen

- Hampton Roads Americas Alliance MarketBeat Office Q32018Dokument2 SeitenHampton Roads Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5Noch keine Bewertungen

- Fredericksburg Americas Alliance MarketBeat Retail Q32018Dokument1 SeiteFredericksburg Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5Noch keine Bewertungen

- Fredericksburg Americas Alliance MarketBeat Office Q32018Dokument1 SeiteFredericksburg Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5Noch keine Bewertungen

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDokument1 SeiteRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5Noch keine Bewertungen

- Roanoke Americas Alliance MarketBeat Retail Q32018 FINALDokument1 SeiteRoanoke Americas Alliance MarketBeat Retail Q32018 FINALAnonymous Feglbx5Noch keine Bewertungen

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Dokument2 SeitenHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5Noch keine Bewertungen

- Contract of Lease 11.10.20 (Clean Copy)Dokument7 SeitenContract of Lease 11.10.20 (Clean Copy)Tanya IbanezNoch keine Bewertungen

- Orca RealtyDokument24 SeitenOrca RealtyPawel PawelNoch keine Bewertungen

- Contract of LeaseDokument3 SeitenContract of LeaseJudeRamosNoch keine Bewertungen

- 2020 BValuation ReportDokument440 Seiten2020 BValuation Reportraj28_999Noch keine Bewertungen

- Broll - Company Profile PDFDokument16 SeitenBroll - Company Profile PDFRama KarunagaranNoch keine Bewertungen

- Sagrada Orden Case - TortsDokument2 SeitenSagrada Orden Case - TortsQuennie DisturaNoch keine Bewertungen

- Now This Lease Witnessth As FollowsDokument1 SeiteNow This Lease Witnessth As Followsk.g.thri moorthyNoch keine Bewertungen

- ZOSIMA Vs SalimbagatDokument4 SeitenZOSIMA Vs SalimbagatSheila ManitoNoch keine Bewertungen

- Contract of Lease ApartmentDokument5 SeitenContract of Lease ApartmentEmilio SorianoNoch keine Bewertungen

- Michigan Rental Application FormDokument2 SeitenMichigan Rental Application FormvadarsuperstarNoch keine Bewertungen

- Rent ReceiptDokument1 SeiteRent ReceiptHarish LakhaniNoch keine Bewertungen

- Zoning For Housing in LowellDokument39 SeitenZoning For Housing in LowellJared AlvesNoch keine Bewertungen

- 4296346Dokument5 Seiten4296346mohitgaba19Noch keine Bewertungen

- Force Majeure and Its Impact On Real Estate Leases PDFDokument9 SeitenForce Majeure and Its Impact On Real Estate Leases PDFBharat BhushanNoch keine Bewertungen

- Related Real Estate LAWS.11.17.12Dokument66 SeitenRelated Real Estate LAWS.11.17.12rochelNoch keine Bewertungen

- Food BazaarDokument1 SeiteFood BazaarAlvin WongNoch keine Bewertungen

- Declaratory Relief - Pdic V Ca Et AlDokument1 SeiteDeclaratory Relief - Pdic V Ca Et AlChrizller Meg SalamatNoch keine Bewertungen

- The Tamil Nadu Cultivating Tenants Procection Act, 1955Dokument21 SeitenThe Tamil Nadu Cultivating Tenants Procection Act, 1955Ashraf AliNoch keine Bewertungen

- Morgan Marie Leasing Company Signs An Agreement On January 1Dokument1 SeiteMorgan Marie Leasing Company Signs An Agreement On January 1M Bilal SaleemNoch keine Bewertungen

- Activity #1Dokument5 SeitenActivity #1Lyka Nicole DoradoNoch keine Bewertungen

- 90 Day Eviction NoticeDokument2 Seiten90 Day Eviction Noticej3r1c0d5Noch keine Bewertungen

- REIZ Covid PowerPointDokument9 SeitenREIZ Covid PowerPointROMEO BONDENoch keine Bewertungen