Beruflich Dokumente

Kultur Dokumente

Understanding FDI in Retail

Hochgeladen von

Khalid IbrahimCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Understanding FDI in Retail

Hochgeladen von

Khalid IbrahimCopyright:

Verfügbare Formate

COMMENTARY

Understanding FDI in Retail

What Can Economic Principles Teach Us?

Abhirup Sarkar

The recent debate on the acceptability of foreign direct investment in the retail sector in India has been mostly political. It is necessary to look into the pros and cons of FDI in retail from a purely economic point of view. This article identies the safeguards that should be undertaken before allowing giant multinationals to function in the country.

Abhirup Sarkar (abhirup@isical.ac.in) is with the Indian Statistical Institute Calcutta, Kolkata.

he recent policy of allowing 51% foreign direct investment (FDI) in multi-brand retail has generated political feuds rather than proper economic debates. Politicians seldom speak with ifs and buts; their arguments are rarely burdened with caveats, warnings and qualications. They take onedimensional positions and avoid complicated reasoning with a view to be specic and not confuse their audience. It is not at all surprising, therefore, that the political parties which are advocating FDI in retail refuse to accept that there is any dark side to it while those who are opposing the policy see none of its positive aspects. But the proposed policy is primarily an economic one and like many such policies it is likely to affect different groups of people differently. It is, therefore, both necessary and desirable to understand the possible effects of the policy on the overall economy and on the groups and fragments of people lying within it. In short, the economic truth, lying somewhere in between the two extreme positions politicians have taken, needs to be carefully located. Before we get into such an endeavour, the salient features of the proposed FDI policy in multi-brand retail may be recollected. The policy, which was cleared by the union cabinet on 24 November 2011, allows up to 51% foreign equity in a retail company, provided the total investment by foreigners in the company is at least $100 million. Of this foreign investment, one-half is to be invested in back-end infrastructure including cold chains, refrigeration, transportation, packing, sorting and processing. These investments will be allowed only in cities with a population of more than one million. According to the 2011 Census, there are 53 such cities out of a total of 7,935 cities and towns in the country. Finally, the retail company receiving the FDI is required to source at least 30% of

january 5, 2013

its ware from Indian micro and small enterprises which have capital investment of not more than $1 million. Big capital in retail is not new to the country. It has been a while since big domestic capital has entered the retail sector in India. One might have thought that the entry of foreign capital would pose uncomfortable competition for the domestic capitalists who have invested in the retail sector. But this is not actually so. The announced policy has allowed the foreign investor to hold only 51% of the total shares leaving the remaining 49% for its domestic counterpart. Joint ventures are, therefore, built into the corporate structure which the new policy would entail. This has made the domestic capitalists happy. They expect to gain access to state of the art storage technologies and international markets through collaborations with giant international retailers and thereby increase their own prots. The domestic big retailers are, therefore, welcoming 51% FDI in multibrand retail with open arms. It is a few others who are apprehensive. Identifying the Changes But before we can draw up the full menu of gainers and losers from the new policy, it is necessary to understand the changes that are likely to be brought about through the introduction of giant multinationals into the Indian retail market. In particular, we must understand and identify the major changes which the multinationals are expected to bring about and which could not be brought about by domestic big retailers. After identifying the changes, we shall separately talk about the effects of these changes on different groups of the population. As far as we can see, there are three such big changes. The rst important change that the multinational retailers are likely to introduce is state of the art storage technology that the multinational retailers possess and which is not known to big domestic retailers. This technology is expected to improve the supply chain and prevent wastage in a big way. Estimates of wastage of foodgrains, fruits and vegetables in the country vary between 20% and 40% of the total produce. It is argued that a signicant

vol xlviIi no 1

EPW Economic & Political Weekly

12

COMMENTARY

part of this wastage would be avoided if foreign investors bring in state of the art technology. The second big change that the multinational retailers are likely to bring about is more international trade. A little reection will convince the reader that the magnitude of international trade depends on the extent to which arbitrage possibilities across countries can be made use of. Making use of arbitrage possibilities, one can buy a commodity in a country where it is cheaper and sell it in another country where it is dear. A traders job is to identify the international arbitrage possibilities and trade accordingly to make prots. It stands to reason that a giant multinational trader, with its more elaborate procurement and distribution networks, will do the job more efciently and extensively than a relatively small domestic retailer. But if that is so, entry of multinational retailers into the Indian market is likely to increase the volume of Indian international trade. This is likely to happen for any given level of restrictions on international trade. The third change refers to the scale of operation of big retail in India. The giant multinationals along with the domestic retailers with whom they are going to form joint ventures are going to have much greater nancial power than the domestic big retailers alone. Therefore, in the new set-up, big organised retail is likely to cover a much larger portion of the market than before. Advanced Storage Technology The primary effect of advanced storage technology is gain in efciency. Agricultural products which were being wasted so far would be available for consumption, once the state of the art technology is introduced. This is pretty obvious. Much less obvious and of paramount importance is the answer to the question: who are winning and who are losing on account of this efciency gain? Indeed, introduction of better technology can lead to losses for some groups of people and gains from some others as the following example from history would illustrate. Let us go back to the days of the industrial revolution in England. The industrial revolution started with mechanisation

Economic & Political Weekly EPW

of the production process. Mechanisation replaced labour by capital. The immediate effect of this was a fall in the demand for labour in the economy. It is no accident, therefore, that the condition of the labouring class remained abysmal till the middle of the 1840s. This was true not only of England but also of continental Europe. Details of this predicament are found in the historical accounts of Hobsbawm (1962), in theoretical discourses of Hicks (1969) and in the literary narratives of Dickens and others. It also formed the empirical basis of the writings of Karl Marx and Friedrich Engels. Slowly, however, the condition of the working class started improving. The new mechanised processes, though employing less labour, yielded more prots. These prots were reinvested and over time there was a signicant expansion of economic activity in the European cities. This, in turn, increased the demand for labour and consequently the real wage. From Hobsbawm (1975) we learn that by the third quarter of the 19th century, there was a visible improvement in the condition of the working class all over Europe and a general faith in liberal capitalism was established in the west. This historical episode teaches us two important lessons. First, there was a trade-off bet ween the short and the long run as far as technical progress during the industrial revolution was concerned. In the short run it brought misery for the labouring class, but in the long run it certainly improved their living standards. Second, this tradeoff is intergenerational and fell entirely on the working class. We shall argue that the new storage technology, which the retail multinationals are likely to bring in, is likely to have an effect similar to that of mechanisation during the industrial revolution. Under the assumption that the buyers side of the market would become more competitive with the entry of multinational retailers, an improvement in storage technology would increase the demand for agricultural goods in village markets. Moreover, products that went rotten and wasted before would now be available for sale to the urban markets which would imply a fall in selling costs to urban markets and a further rise in

vol xlviIi no 1

the demand for the product in the rural market. The rise in demand would increase the price of the agricultural commodities in question. The important question is: who will benet and who will lose from all this? A rise in the prices of agricultural goods in rural markets is likely to benet farmers who sell parts of their products in the market. These are essentially large- and medium-sized farmers. A price rise would certainly benet these farmers. The higher price would also induce these farmers to invest more in agriculture, thereby raising production and productivity. There is a ip side though. The average landholding in rural India is not very large. According to estimates given by the National Sample Survey report Seasonal Variations in the Operational Land Holding in India, 2002-02 the average operational holding in rural India is only 1.1 hectares. In addition, in some Indian states like West Bengal, Bihar, Orissa, Assam, Kerala, Tamil Nadu, Himachal Pradesh and Uttar Pradesh the average landholding is below one hectare. These are mere average gures. There is a lot of inequality in landholdings which these averages do not reect. According to the Agricultural Census of India 2000-01, 63% of the landholdings comprise holdings by marginal farmers (with less than one hectare of land). But taken together, the marginal farmers account for only 19% of the total area operated. To this, one must add the large number of landless peasants in the agricultural sector. According to the National Sample Survey report mentioned above, more than 40% of rural households do not have any land. These gures, in turn, indicate that a large number of rural households do not produce enough to sell to the market and a signicant proportion of them actually buy from the rural market to sustain themselves and their families. A rise in agricultural prices, especially the prices of foodgrains, would certainly hurt these poor people, at least in the short run. Some of these poor bought the cheap rotten food available in the village market at throwaway prices. Their survival will become difcult and poverty is likely to increase.

13

january 5, 2013

COMMENTARY

If farmers with positive marketable surplus start getting better prices for their produce and if due to the increased price incentive there is an expansion of agricultural output, one can argue that eventually there would be an increase in the demand for agricultural labour and a consequent increase in agricultural wage. In other words, higher farm prices induced by better storage technology is likely to have gradual trickle-down effects and in the long run it is not unlikely that everybody in the rural sector will benefit from improved storage. So we find a clear analogy between the European experience during the industrial revolution and what might happen in the Indian rural sector after giant multinationals start acquiring foodgrains from Indian village markets. For the rural poor it would be misery in the short run and a possible improvement in the long run. The problem is that no one knows how long the long run is going to be. If misery continues for too long, the policy itself would become politically unsustainable, especially in view of the fact that, however faulty, India has a

democracy which was absent in England during the industrial revolution and is missing in some contemporary nations like China which have brought in FDI into their retail sectors. Some critiques of FDI in retail have, however, raised doubts as to whether farm prices are going to go up at all after giant multinationals start procuring from village markets. Their argument is that once the multinationals are into the market, the local supply chains will be destroyed and the big retailers will emerge as monopoly procurers. Once they establish themselves as monopoly procurers, they can dictate their price and it goes without saying that their dictated price will not be favourable to the farmers. Can this actually happen? Apparently, there are a number of factors which might prevent this from happening. First, there could be competition between multinationals over procuring farm products which will keep prices from falling too low. Second, even if multinationals enter into tacit collusions of not entering into one anothers procurement territory and each one emerges as a local monopoly as

far as procurements is concerned, there is always the possibility and incentive of domestic traders re-entering the market as buyers if multinationals are offering very low prices. This will prevent the multinationals from actually reducing their buying price below a certain level. Third, the minimum support price offered by the government will act as another barrier to price reduction. If multinationals offer very low prices, the farmers will have an incentive of selling to the government which, in turn, will prevent multinationals from offering very low prices. Pushing Local Traders Out Unfortunately, these factors may not necessarily stop the multinational from pushing a significant portion of the local traders out of the market. The multinational may do so by entering into exclusive interlinked contracts with the farmers. It is well known that rural markets in India witness a lot of interlinked contracts. A common interlinkage is bet ween the product market and the credit market. The local moneylender, who also happens

EW

Decentralisation and Local Governments

Edited by

T R Raghunandan

The idea of devolving power to local governments was part of the larger political debate during the Indian national movement. With strong advocates for it, like Gandhi, it resulted in constitutional changes and policy decisions in the decades following Independence, to make governance more accountable to and accessible for the common man. The introduction discusses the milestones in the evolution of local governments post-Independence, while providing an overview of the panchayat system, its evolution and its powers under the British, and the stand of various leaders of the Indian national movement on decentralisation. This volume discusses the constitutional amendments that gave autonomy to institutions of local governance, both rural and urban, along with the various facets of establishing and strengthening these local self-governments.

Authors:

V M Sirsikar Nirmal Mukarji C H Hanumantha Rao B K Chandrashekar Norma Alvares Poornima Vyasulu, Vinod Vyasulu Niraja Gopal Jayal Mani Shankar Aiyar Benjamin Powis Amitabh Behar, Yamini Aiyar Pranab Bardhan, Dilip Mookherjee Amitabh Behar Ahalya S Bhat, Suman Kolhar, Aarathi Chellappa, H Anand Raghabendra Chattopadhyay, Esther Duflo Nirmala Buch Ramesh Ramanathan M A Oommen Indira Rajaraman, Darshy Sinha Stphanie Tawa Lama-Rewal M Govinda Rao, U A Vasanth Rao Mary E John Pratap Ranjan Jena, Manish Gupta Pranab Bardhan, Sandip Mitra, Dilip Mookherjee, Abhirup Sarkar M A Oommen J Devika, Binitha V Thampi

Pp xii + 432

ISBN 978-81-250-4883-1

2012

Rs 695

www.orientblackswan.com Mumbai Chennai NewDelhi Kolkata Bangalore Bhubaneshwar Ernakulam Guwahati Jaipur Lucknow Patna Chandigarh Hyderabad Contact: info@orientblackswan.com

14

january 5, 2013 vol xlviIi no 1

EPW Economic & Political Weekly

Orient Blackswan Pvt Ltd

COMMENTARY

to be a trader, typically enters into an interlinked contract with a farmer by giving him a production loan with the stipulation that the farmer has to sell his output exclusively to the trader-cumlender. The contract species the rate of interest on the loan and the price at which the commodity is to be sold. In such contracts, the trader-cum-lender would give a loan at a lower interest (compared to the interest at which the farmer can raise a loan by himself) to ensure production efciency and at the same time buy the product at a price which is much lower than the market price. Now, the multinational, to ensure production efciency and guarantee uninterrupted supply, can indeed enter into an interlinked contract with the farmer through contract farming arrangements. Since the multinational is likely to have access to a cheaper source of funds, it can drive out the local trader by offering a lower rate of interest to the farmer. But this does not improve the condition of the farmer, who will have to receive a lower price as well. His fate will simply shift from the grip of the local moneylender to that of the multinational, and the latter would squeeze as much prot out of the farmer as possible just like the local moneylender. However, as the multinational has a better storage facility, it is likely to lift more output from the farmers through interlinked contract farming than the output that was being lifted by local traders (who are now driven out of the market) through interlinked contracts. Therefore, the net output lifted from the market through interlinked contracts is likely to increase after the entry of the multinationals. This would imply a rise in the open market price. As already discussed, the rise in price would be benecial to net sellers in the open market and harmful for net buyers. For those under interlinked contracts, the economic condition would hardly change. To recapitulate, multinationals can procure from the rural market in two different ways. They can either buy directly from the rural market or they can procure by entering into interlinked contracts. We have argued that both would lead to an increase in farm prices in the rural

Economic & Political Weekly EPW

markets beneting net sellers and hurting net buyers. Viewed differently, the price rise is likely to benet the relatively afuent and hurt the relatively poor in the rural sector, at least in the short run. The next obvious question is: how would the entry of giant multinational retailers affect the urban market and the urban consumers? To answer this we have to look into the second aspect of FDI in retail, namely, more free international trade. Facilitating International Trade We have already argued that multinational retailers can facilitate international trade, that is, they can make unhindered ow of commodities across countries possible, more efciently than domestic big retailers. This is simply because of the multinationals size and reach. For a country like India what would it imply? Given that multinational retailers sell mostly consumers goods, it is reasonable to assume that the giant retailers will be importing manufactures from abroad, especially from China and other south-east Asian countries, and exporting agricultural goods to other countries through their overseas stores. This would be in conformity with the comparative advantage India has at present as far as consumer goods are concerned. Of course, there is a requirement that the retailers would have to source 30% of their domestic sales from the domestic market. This would imply that they would have to market some Indian manufactures also, but the bulk of their sales should consist of foreign manufactures and Indian agricultural goods. Urban consumers would certainly benet from a wider variety of manufactured consumer goods from abroad. They would also enjoy the ambience provided by the giant retail stores. But what about the producers? What about employment? One has to concede that the Indian manufacturing sector is not yet mature enough to face Chinese competition. Indeed very few countries in the world are able to ght back the Chinese onslaught in this respect. It is more than likely, therefore, that the giant retailers will ood the Indian market with low-priced Chinese trinkets

vol xlviIi no 1

and as a result Indian medium and small manufacturing units will suffer. Loss of employment is quite on the cards. It is not at all clear as to what extent it is necessary at this point in time to indulge in such unequal competition. Export of agricultural goods has other kinds of problems. First, exports would tend to increase domestic prices. If foodgrains are exported and their prices go up, that would have an adverse effect on the poor. We have already indicated the possibility of price increase in the rural market and its effect on the rural poor. An increase in the price of foodgrains in the urban market, due to export of foodgrains, would affect the urban poor as well. Second, opening up to trade is likely to increase uncertainty of the farmers. There is a well-known literature following Newbery and Stiglitz (1984) which points to the possibility that in an uncertain environment with no formal insurance market, international trade in agricultural goods may hurt the trading countries. We simply repeat here the basic line of reasoning and argue that it applies in the present context as well. The essential idea runs as follows: agricultural output in a less developed country like India is heavily dependent upon the weather and hence is terribly uncertain. In a closed economy the market itself provides insurance. If output is low, the market price is high, and hence the product of price and quantity, which is the farmers gross income, is more or less stable. Similarly, if output is high, price is low and once more the product of price and quantity remains stable. But once the economy opens up to trade, this inverse relationship between price and quantity is lost. Most countries are unable to affect the international price. Therefore, when domestic output is low due to a bad rainfall, there is no guarantee that there will be a corresponding compensatory increase in the price. As a result the income of the farmer is prone to risk and uctuation. Coming back to the present, we wish to point out that when a giant multinational retailer procures foodgrains, fruits or vegetables from a rural market in India, there is no guarantee that those products would be sold within India.

15

january 5, 2013

COMMENTARY

Indeed, they could be sold in any part of the world at the international price. This increases the risk of a low income shock. In other words, farmers who are likely to get a better price on an average when multinationals procure from Indian rural markets will also be subjected to greater risk. Yet another problem of opening up to trade is with respect to the balance of payments. While the inow of foreign capital in the retail sector is likely to improve our balance of payments situation, as investment opportunities get saturated, this improvement in the capital account is likely to phase out with the passage of time. The current account, on the other hand, may worsen over time, with cheap manufactured imports exceeding uncertain agricultural exports. Therefore, a balance of payment crisis cannot be ruled out with the value of the rupee falling and the cost of oil imports increasing. If that happens, that is if the price of oil increases because of a balance of payment crisis, the poor will once more suffer. Scale Effects of Organised Retail Finally, we come to the much-debated issue as to whether and to what extent entry of foreign capital in organised retail would lead to the closing down of traditional and unorganised trade. It will not be far-fetched to assume that the giant multinationals would enter the Indian retail market at a scale which the domestic organised retailers can hardly match. This would be possible not only because of their superior storage technology, but also due to their immense nancial strength and experience. The mammoth presence of these retailers, in turn, can hurt the traditional traders in two different, but not mutually exclusive, ways. First, as the multinational retailers start procuring from the village markets, there will be less left for the indigenous traders to trade with. This will obviously reduce the volume of the latters activities. In this context one can think of two existing supply chains. There is one that is routed through oligopolistic big traders controlling the village markets. We may call this the main supply chain. In addition, there is a small

16

supply chain where the farmer or the small trader buying from the farmer sells directly to urban markets. Though the multinationals can do sufcient damage to the big-trader managed supply chains, the small supply chains, being run on a very low prot basis, may still survive. It is not unusual to nd these small sellers selling to urban consumers in western cities where big retailers control a signicant portion of the market. Second, the indigenous traders will face direct competition from the giant retailers in the urban consumer markets. Some argue that since FDI in retail is allowed only in big cities with large consumer markets, the effect of competition from giant retailers on indigenous traders will be negligible. On reection, however, it does not appear to be so. If we assume that the total urban demand for consumer goods at any point in time does not change with the entry of the multinational, then any gain in sales by the giant retailer must denote a corresponding fall in sales by the indigenous traders. The situation could be somewhat different if the entrant multinational could create additional demand for its commodities without affecting the indigenous segment. The possibility cannot be ruled out, but the extent to which it can happen remains doubtful. It is likely that the multinational retailers will differentiate their goods in terms of quality selling more standardised and quality controlled products. And these goods would bear the implicit or even explicit certicates of reliability. This would fragment the market, pushing upscale customers to the multinationals and the relatively less afuent to the traditional traders. In the process, because of the quality assurance, the multinational stores will create some additional demand. But it is inevitable that more afuent customers, who had been buying from small shops in the absence of better alternatives, will move to the giant stores, thereby eroding the customer base of the traditional shops. Concluding Remarks What can we conclude from all these arguments? Since we have tried to present the arguments both for and against FDI

january 5, 2013

in retail, our stand may seem confusing. Therefore, it is necessary to be specic about the conclusions and policy suggestions we wish to make. We are not suggesting by any means that FDI should be prevented from entering the retail sector. One must understand that one would be going against progress if one fails to take advantage of the capital and the advanced technology FDI in retail can offer. The new policy, however, will involve huge losses of jobs and livelihood among traditional traders. At the same time, new jobs would be created in the giant stores and their newly built supply chains. In the short run, the net outcome on aggregate employment is still likely to be negative, at best ambiguous. But in the longer run, as prots are reinvested and organised retail keeps on expanding, and as newer avenues open up for the underprivileged, the policy would pay off. This had happened during the industrial revolution. This has happened more recently when computers came into our lives in a big way. It would not have been prudent, for example, if we had shunned computers because they would destroy jobs for the numerous typists who used to crowd the city streets with their archaic typewriters and have virtually disappeared with the advent of the new technology. But this long-run view should not make us think for a moment that the short run can be ignored. We must realise that like in the past, the technological and organisational changes that the giant multinationals are likely to bring about entails short-run sacrices. Unfortunately, like always, the brunt of these sacrices will be borne by the less afuent. Therefore, the government should take enough protective measures to guard the interests of these helpless people. This is required not only on moral grounds but also for the sake of making the policy politically feasible. What kind of protective measures can the government take? First, the public distribution system should have enough inltration and bite in the rural areas to protect the rural poor from a possible rise in the prices of grains and vegetables. Second, the government should reconsider

vol xlviIi no 1

EPW Economic & Political Weekly

COMMENTARY

the gamut of tariffs and quantitative restrictions to counterbalance the effects of more easy international trade through multinational retailers. Third, the government should make an effort to compensate for the loss of jobs and livelihood, at least partially. The retail stores may be required to ll up a certain

proportion of their labour requirement from displaced small traders. Also for the purpose of making these small traders employable in the new set up, appropriate training programmes may be set-up by the government. The multinationals may be taxed, if required, to nance these programmes.

References

Hicks, John (1969): A Theory of Economic History (Oxford: Clarendon Press). Hobsbawm, Eric (1962): The Age of Revolution: Europe 1789-1848 (New York: Mentor Books). (1975): The Age of Capital, 1848-1875 (New York: Mentor Books). Newbery, John and Joseph Stiglitz (1984): Pareto Inferior Trade, Review of Economic Studies, Volume 51, No 1, pp 1-12.

Economic & Political Weekly

EPW

january 5, 2013

vol xlviIi no 1

17

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Form four geography questions and answersDokument57 SeitenForm four geography questions and answersMAslah Kader Boon0% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Community Garden Job DescriptionsDokument4 SeitenCommunity Garden Job DescriptionsToni AbleNoch keine Bewertungen

- Plumeria CareDokument1 SeitePlumeria CaretehbujaNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Solar Air Conditioning SystemsDokument150 SeitenSolar Air Conditioning SystemsAli AbdoNoch keine Bewertungen

- 3 Plant Layout & MHDokument79 Seiten3 Plant Layout & MHAmith Aaron100% (2)

- Public Private PartnershipDokument34 SeitenPublic Private PartnershipRamindra SuwalNoch keine Bewertungen

- Nestle business model analysisDokument14 SeitenNestle business model analysisSiddharth Sourav PadheeNoch keine Bewertungen

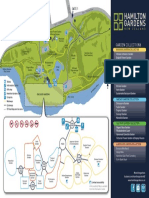

- Hamilton Gardens Map Download June2019Dokument1 SeiteHamilton Gardens Map Download June2019Sun WeaNoch keine Bewertungen

- Group3 MC2 SectionCDokument8 SeitenGroup3 MC2 SectionCKhalid IbrahimNoch keine Bewertungen

- Guidelines Resume VerificationDokument4 SeitenGuidelines Resume VerificationKhalid IbrahimNoch keine Bewertungen

- Careers - Case Study RadhaDokument2 SeitenCareers - Case Study RadhaAbhinavHarshalNoch keine Bewertungen

- Energy considerations: II 1 2 1 2 t 1 TI I 1 2 ω − ω = +Dokument5 SeitenEnergy considerations: II 1 2 1 2 t 1 TI I 1 2 ω − ω = +Sunny VermaNoch keine Bewertungen

- SteeringGeometry PDFDokument5 SeitenSteeringGeometry PDFKhalid IbrahimNoch keine Bewertungen

- MI 565 Tutorial 1Dokument1 SeiteMI 565 Tutorial 1Khalid IbrahimNoch keine Bewertungen

- G 149 S 83 Eligibility CertDokument1 SeiteG 149 S 83 Eligibility CertKhalid IbrahimNoch keine Bewertungen

- Placement Policy For StudentsDokument6 SeitenPlacement Policy For StudentsKhalid IbrahimNoch keine Bewertungen

- Bat Sample QuestionsfgdfgDokument36 SeitenBat Sample Questionsfgdfglefter_ioanNoch keine Bewertungen

- Invalid HTTP Request HeaderDokument8 SeitenInvalid HTTP Request HeaderKhalid IbrahimNoch keine Bewertungen

- FDI in Indian Retail Sector Analysis of Competition in Agri-Food SectorDokument57 SeitenFDI in Indian Retail Sector Analysis of Competition in Agri-Food SectorTimur RastomanoffNoch keine Bewertungen

- FAQs For Students For The Year 2012-13Dokument4 SeitenFAQs For Students For The Year 2012-13thanikavelNoch keine Bewertungen

- Best Practice Guidelines For Water Conservation in Buildings Shopping CentresDokument73 SeitenBest Practice Guidelines For Water Conservation in Buildings Shopping CentresKhalid IbrahimNoch keine Bewertungen

- Backyard Cattle Fattening PDFDokument5 SeitenBackyard Cattle Fattening PDFPassmore DubeNoch keine Bewertungen

- Best Practices EXPODokument6 SeitenBest Practices EXPOMarco GiallonardiNoch keine Bewertungen

- The Nutrient Cycle: How Essential Elements Fuel LifeDokument5 SeitenThe Nutrient Cycle: How Essential Elements Fuel LifeBenson MwathiNoch keine Bewertungen

- How Neolithic Farming Sowed Seeds of Modern InequalityDokument5 SeitenHow Neolithic Farming Sowed Seeds of Modern Inequalitygaellecintre100% (1)

- History and Development of Biological Control NotesDokument6 SeitenHistory and Development of Biological Control NotesDefrian MeltaNoch keine Bewertungen

- Integrated Pest Management Lab TechniquesDokument5 SeitenIntegrated Pest Management Lab TechniquesTrisha MalaluanNoch keine Bewertungen

- Advantages of Green BiotechnologyDokument9 SeitenAdvantages of Green BiotechnologyDanica JuanNoch keine Bewertungen

- General Biology 1 Final Exam Annotated BibliographyDokument2 SeitenGeneral Biology 1 Final Exam Annotated BibliographyElizabeth VillarealNoch keine Bewertungen

- Direct Seeding and TransplantingDokument3 SeitenDirect Seeding and TransplantingDycereel DyrenNoch keine Bewertungen

- FAO Forage Profile - ZimbabweDokument18 SeitenFAO Forage Profile - ZimbabweAlbyziaNoch keine Bewertungen

- Goose Production in Indonesia and Asia: Tri YuwantaDokument11 SeitenGoose Production in Indonesia and Asia: Tri Yuwantadiagnoz7auto7carsvanNoch keine Bewertungen

- 1.13 Diseases and Their ControlDokument24 Seiten1.13 Diseases and Their ControlAntonio Di MarzioNoch keine Bewertungen

- Roundup Powermax: Bag LabelDokument28 SeitenRoundup Powermax: Bag LabelMinenhle ChristianNoch keine Bewertungen

- HR and PYDokument95 SeitenHR and PYAditya100% (1)

- Sustainability 15 02109 v2Dokument21 SeitenSustainability 15 02109 v2Daira RodriguezNoch keine Bewertungen

- 2021 RegulationsDokument29 Seiten2021 RegulationsVinodh EwardsNoch keine Bewertungen

- Drone For Precision Agriculture Using IoTDokument5 SeitenDrone For Precision Agriculture Using IoTRudresh RakeshNoch keine Bewertungen

- Chapter - V Problems of UrbanizationDokument19 SeitenChapter - V Problems of UrbanizationAishwarya JoyNoch keine Bewertungen

- China's Water-Saving Irrigation Management System: Policy, Implementation, and ChallengeDokument17 SeitenChina's Water-Saving Irrigation Management System: Policy, Implementation, and ChallengeNguyen Van KienNoch keine Bewertungen

- Omar M Moma Thesis Outline 2Dokument20 SeitenOmar M Moma Thesis Outline 2Nor-Ton NB BatingkayNoch keine Bewertungen

- IED CH 6Dokument26 SeitenIED CH 6T “Tushar rajoria” RNoch keine Bewertungen

- 12 Concepts Organic Animal HusbandryDokument3 Seiten12 Concepts Organic Animal HusbandryMae Tabamo100% (1)

- Walk-In Interview: No. Position GradeDokument5 SeitenWalk-In Interview: No. Position GradeNur Sakinah IdrisNoch keine Bewertungen

- 2012 Field Trial Report Template V2latest - PPT (Autosaved)Dokument127 Seiten2012 Field Trial Report Template V2latest - PPT (Autosaved)Mark Jed0% (1)