Beruflich Dokumente

Kultur Dokumente

Japanese GDP - Q42008 - Feb 2009

Hochgeladen von

International Business TimesOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Japanese GDP - Q42008 - Feb 2009

Hochgeladen von

International Business TimesCopyright:

Verfügbare Formate

Jay H.

Bryson, Global Economist

jay.bryson@wachovia.com ● 1-704-383-3518

February 17, 2009

Japanese GDP Plunged in Fourth Quarter

A collapse in exports has contributed to the worst Japanese recession since the end of the Second World War. With

few policy tools at the government’s disposal, Japanese economic prospects will depend crucially on growth in the

rest of the world.

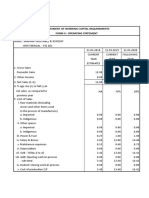

Japan in Worst Slump Since the End of the Second World War Japanese Real GDP

Recently released data show that Japanese GDP plunged at an annualized 10.0%

Bars = Compound Annual Rate Line = Yr/Yr % Change

10.0%

rate of 12.7 percent in the fourth quarter relative to the previous quarter 7.5% 7.5%

(see top chart). The methodology to calculate Japanese GDP changed in 5.0% 5.0%

1994, but it appears that the plunge in the fourth quarter was the sharpest 2.5% 2.5%

rate of contraction since the first quarter of 1974. Relative to the fourth 0.0% 0.0%

quarter of 2007 real GDP fell 4.6 percent, making the current slump the -2.5% -2.5%

worst downturn since at least 1955 (probably since the end of the Second

-5.0% -5.0%

World War).

-7.5% -7.5%

There were no bright spots in the GDP data. The single biggest contributor -10.0% -10.0%

to the sharp drop in overall GDP was the 45 percent annualized plunge in Compound Annual Growth: Q4 @ -12.7%

-12.5% -12.5%

exports that is consistent with the nosedive in industrial production in the Year-over-Year Percent Change: Q4 @ -4.6%

-15.0% -15.0%

fourth quarter (see middle chart). Japan is an important supplier of capital 2000 2001 2002 2003 2004 2005 2006 2007 2008

goods to other Asian countries, and the collapse in global trade in the wake

of the credit crunch has hit the Japanese economy especially hard. Non- Japanese Industrial Production Index

Year-over-Year Percent Change

residential investment spending in Japan also fell sharply in the fourth 10.0% 10.0%

quarter, contracting at an annualized rate of 20 percent. Consumer

5.0% 5.0%

spending fell 1.6 percent.

The good news is that the Japanese economy will probably not continue to 0.0% 0.0%

shrink at the same rate that it did in the fourth quarter. For starters, it is -5.0% -5.0%

unlikely that exports will continue to nosedive at the same rate in the

quarters ahead. In addition, imports rose 12 percent in the fourth quarter, -10.0% -10.0%

which probably helps to explain the rise in inventories. Imports will -15.0% -15.0%

probably decline significantly in the quarters ahead as businesses attempt

to pare back unwanted stocks. -20.0%

IPI: Dec @ -21.7%

-20.0%

3-Month Moving Average: Dec @ -13.9%

The bad news is that Japanese policymakers have few tools at their -25.0% -25.0%

disposable to stimulate the economy. Late last year the Bank of Japan (BoJ) 1997 1999 2001 2003 2005 2007 2009

cut its policy rate from 0.50 percent to 0.10 percent. Even if the BoJ goes all

Japanese Exchange Rate

the way to zero, only 50 bps of monetary easing will do little to bring about JPY per USD

150 150

a self-sustaining recovery. Two decades of worth of sluggish growth and

fiscal stimulus has caused the government debt-to-GDP ratio to rise to 140 140

more than 170 percent, constraining the ability of the government to prime

130 130

the pump via even more fiscal spending. The fate of the Japanese economy

over the next year or two will depend largely on economic growth in the 120 120

rest of the world, which isn’t looking too good at present.

110 110

In that regard, the strength of the yen versus most currencies does not help

Japanese exports (see bottom chart). Although we look for the yen to give 100 100

up some of its gains over the next few quarters, Japanese export growth

90 90

will probably be very sluggish for the next few quarters. Therefore, the

JPY per USD: Feb @ 91.9

Japanese economy likely will remain mired in deep recession for the 80 80

1995 1997 1999 2001 2003 2005 2007 2009

foreseeable future.

Wachovia Corporation Economics Group publications are distributed by Wachovia Corporation directly and through subsidiaries including, but

not limited to, Wachovia Capital Markets, LLC, Wachovia Securities, LLC and Wachovia Securities International Limited.

The information and opinions herein are for general information use only. Wachovia does not guarantee their accuracy or completeness, nor

does Wachovia assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Such

information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation

with respect to the purchase or sales of any security or as personalized investment advice. © 2009Wachovia Corp.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Whitney Houston Coroner ReportDokument42 SeitenWhitney Houston Coroner ReportSharonWaxman100% (4)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Order to Cash Life Cycle ExplainedDokument34 SeitenOrder to Cash Life Cycle ExplainedGaurav SrivastavaNoch keine Bewertungen

- Deped Coa2011 Observation RecommendationDokument81 SeitenDeped Coa2011 Observation RecommendationAnthony Sutton100% (7)

- Routing Mapping Payments As Transactions v3Dokument235 SeitenRouting Mapping Payments As Transactions v3Jj018320Noch keine Bewertungen

- Sample of New Format of Audit Report IN BANKDokument17 SeitenSample of New Format of Audit Report IN BANKAmit Malshe0% (1)

- Janalakshmi Financial Services PVT LTD Coca ReportDokument72 SeitenJanalakshmi Financial Services PVT LTD Coca ReportSelvaKumarMbaNoch keine Bewertungen

- NISM V A Sample 500 QuestionsDokument36 SeitenNISM V A Sample 500 Questionsbenzene4a182% (34)

- SWOT of BFSIDokument3 SeitenSWOT of BFSIsumit athwani100% (1)

- Audit Program Liabilities Against AssetsDokument11 SeitenAudit Program Liabilities Against AssetsRoemi Rivera Robedizo100% (3)

- IRS TeaPartyLetterDokument7 SeitenIRS TeaPartyLetterInternational Business TimesNoch keine Bewertungen

- Immigration Standards 3 0Dokument1 SeiteImmigration Standards 3 0International Business TimesNoch keine Bewertungen

- Gang of Eight Immigration ProposalDokument844 SeitenGang of Eight Immigration ProposalThe Washington PostNoch keine Bewertungen

- Immigration Standards 3 0Dokument1 SeiteImmigration Standards 3 0International Business TimesNoch keine Bewertungen

- DOT Letter-February Sequester HearingDokument2 SeitenDOT Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- Interior Letter-February Sequester HearingDokument4 SeitenInterior Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- Labor Letter-February Sequester HearingDokument4 SeitenLabor Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- State Letter-February Sequester HearingDokument5 SeitenState Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- Interior Letter-February Sequester HearingDokument4 SeitenInterior Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- HHS Letter-February Sequester HearingDokument3 SeitenHHS Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- Interior Letter-February Sequester HearingDokument4 SeitenInterior Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- Interior Letter-February Sequester HearingDokument4 SeitenInterior Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- Homeland Letter-February Sequester HearingDokument3 SeitenHomeland Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- Department of Commerce Sequestration Letter To CongressDokument4 SeitenDepartment of Commerce Sequestration Letter To CongressFedScoopNoch keine Bewertungen

- Education Letter-February Sequester HearingDokument3 SeitenEducation Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- Defense Letter-February Sequester HearingDokument3 SeitenDefense Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- Bills 112hr SC AP Fy13 DefenseDokument154 SeitenBills 112hr SC AP Fy13 DefenseInternational Business TimesNoch keine Bewertungen

- Energy Letter-February Sequester HearingDokument4 SeitenEnergy Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- A Bipartisan Path Toward Securing Americas Future FinalDokument4 SeitenA Bipartisan Path Toward Securing Americas Future FinalInternational Business TimesNoch keine Bewertungen

- CPAC ScheduleDokument18 SeitenCPAC ScheduleFoxNewsInsiderNoch keine Bewertungen

- Agriculture Letter-February Sequester HearingDokument7 SeitenAgriculture Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- Adam II 2011 Annual RPT Web Version CorrectedDokument177 SeitenAdam II 2011 Annual RPT Web Version CorrectedInternational Business Times100% (1)

- Omb Sequestration ReportDokument394 SeitenOmb Sequestration ReportJake GrovumNoch keine Bewertungen

- FedBillDokument5 SeitenFedBillInternational Business TimesNoch keine Bewertungen

- Έρευνα Αμερικανών ακαδημαϊκών για καταδίκες αθώων στις ΗΠΑ (1989-2012)Dokument108 SeitenΈρευνα Αμερικανών ακαδημαϊκών για καταδίκες αθώων στις ΗΠΑ (1989-2012)LawNetNoch keine Bewertungen

- University of Notre Dame v. HHS Et AlDokument57 SeitenUniversity of Notre Dame v. HHS Et AlDoug MataconisNoch keine Bewertungen

- Greater Mekong Species Report Web Ready Version Nov 14 2011-1-1Dokument24 SeitenGreater Mekong Species Report Web Ready Version Nov 14 2011-1-1International Business TimesNoch keine Bewertungen

- EtfilesDokument33 SeitenEtfilesInternational Business TimesNoch keine Bewertungen

- EtfilesDokument33 SeitenEtfilesInternational Business TimesNoch keine Bewertungen

- Mafaza RulesDokument12 SeitenMafaza RulesdaniaeldamNoch keine Bewertungen

- BrochureDokument591 SeitenBrochureRajkumarNoch keine Bewertungen

- The Books OF AccountingDokument37 SeitenThe Books OF AccountingediwowNoch keine Bewertungen

- CASE: Financial Services in IndiaDokument8 SeitenCASE: Financial Services in IndiaANCHAL SINGHNoch keine Bewertungen

- RBI Functions List: Traditional, Developmental, SupervisoryDokument25 SeitenRBI Functions List: Traditional, Developmental, Supervisorygeethark12100% (1)

- Internship Report On Credit Management of MTBLDokument61 SeitenInternship Report On Credit Management of MTBLtanvir100% (1)

- Funding Grid ToolDokument3 SeitenFunding Grid ToolSamuel Kagoru GichuruNoch keine Bewertungen

- St. Matthew Academy of Cavite: Answer: Denomination Number of Bills Peso AmountDokument11 SeitenSt. Matthew Academy of Cavite: Answer: Denomination Number of Bills Peso AmountJfSernioNoch keine Bewertungen

- The Classified Balance SheetDokument17 SeitenThe Classified Balance SheetNeha NaliniNoch keine Bewertungen

- Assessment of Working Capital Requirements Form Ii: Operating StatementDokument12 SeitenAssessment of Working Capital Requirements Form Ii: Operating StatementMD.SAFIKUL MONDALNoch keine Bewertungen

- APAS Openday Email FlyerDokument6 SeitenAPAS Openday Email FlyerJason MorrisNoch keine Bewertungen

- 1 Cash and Cash EquivalentsDokument3 Seiten1 Cash and Cash EquivalentsJohn Aries Reyes100% (1)

- Eviews Analysis : Determinant of Bank Profitability and It S Implication On Stock Return (Empirical Study at Banking in Indonesia Stock Exchange 2010-2014 Period) Luqman Hakim and ShafentiDokument20 SeitenEviews Analysis : Determinant of Bank Profitability and It S Implication On Stock Return (Empirical Study at Banking in Indonesia Stock Exchange 2010-2014 Period) Luqman Hakim and ShafentiGSA publishNoch keine Bewertungen

- Accounting for Time Value of MoneyDokument4 SeitenAccounting for Time Value of MoneyJessie John Credo Jr.Noch keine Bewertungen

- Conclusion and RecommendationsDokument3 SeitenConclusion and Recommendationsstore_2043370333% (3)

- UTI - Systematic Investment Plan (SIP) New Editable Application FormDokument4 SeitenUTI - Systematic Investment Plan (SIP) New Editable Application FormAnilmohan SreedharanNoch keine Bewertungen

- Pay Your Condo Fees Online or at the OfficeDokument1 SeitePay Your Condo Fees Online or at the OfficeKobe Lawrence VeneracionNoch keine Bewertungen

- Loan Details for Consumer Durable Purchase from KHOSLA ELECTRONICSDokument2 SeitenLoan Details for Consumer Durable Purchase from KHOSLA ELECTRONICSbuddhindraNoch keine Bewertungen

- Gruh Finance-MBA-Project Report Prince DudhatraDokument51 SeitenGruh Finance-MBA-Project Report Prince DudhatrapRiNcE DuDhAtRaNoch keine Bewertungen

- Curriculum Vitae 2 WebDokument2 SeitenCurriculum Vitae 2 WebedwardmkweleleNoch keine Bewertungen

- @enmagazine 2021 08 07 IFR AsiaDokument52 Seiten@enmagazine 2021 08 07 IFR AsiaWaising PwunNoch keine Bewertungen

- Lges Job Request FormDokument3 SeitenLges Job Request Formabubakarwahabi30Noch keine Bewertungen