Beruflich Dokumente

Kultur Dokumente

Martha Stewart & Insider Trading

Hochgeladen von

Kat McReynoldsCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Martha Stewart & Insider Trading

Hochgeladen von

Kat McReynoldsCopyright:

Verfügbare Formate

Kathleen McReynolds MBA 5050: Business Law

Martha Stewart Insider Trading

Martha Stewart Living Omnimedia Martha Stewart was once best known as a high-profile business womanmore specifically, as the founder and front-woman of Martha Stewart Living. She formed the corporation in 1997, combining several business ventures into one entity that would eventually manage an impressive portfolio: four core magazines, an Emmy award-winning television show, a weekly segment on CBS, dozens of books, a newspaper column, a radio program, and a popular merchandising website. On October 19, 1999, Stewart became a billionaire when the IPO of Martha Stewart Living Omnimedia (ticker MSO) more than doubled her net worth overnight. Because Marthas personality was virtually synonymous with her brand, the companys rise to power sent the domestic diva into the spotlight. On December 27, 2001, however, Martha received interesting information from her Merrill Lynch broker, Peter Bacanovic, regarding a company in which Martha held stock. Martha Stewart would soon give journalists much more to talk about than cinnamon scones and doilies

ImClones FDA Rejection ImClone Systems, Inc., a bio-pharmaceutical firm, was founded in 1984 by Sam Waksal whose vision was to develop breakthrough medicines in the field of oncology. ImClone had a particularly promising colon cancer drug Erbitux under review by the FDA in 2001, but in December of that year confidence in the new drug began to waver. On December 4th following a meeting with the FDA, an employee of ImClone composed an internal memo implying that Erbitux might not be approved after all. Sam Waksals brother (and co-founder of ImClone) sold $50M in shares just two days later. On Christmas Day in 2001, Waksals brother learned that Erbituxs chances of FDA approval had dropped to about 1%. He quickly shared this news with Sam, who flew home to divest in the company. Sam informed several family members of the news and they scrambled to sell $15M in shares collectively. Waksal knew that ImClone planned to publicly announce the FDA rejection after trading ended on the following daya blackout day on which insiders could not trade. Desperate, he eventually had to forge a signature of the ImClone General Council to complete the transaction.

Marthas Tip That same day, Martha received her fateful phone call from Bacanovics assistant. The Merrill Lynch broker left a message with Martha explaining that the CEO of ImClone and his family (also clients of Bacanovics) had just sold all of their shares in the company. Martha returned the call as soon as her flight landed and spoke

Kathleen McReynolds MBA 5050: Business Law

Martha Stewart Insider Trading

to Douglas Faneuil from 1:30pm until 1:41 pm. Just two minutes after the phone call ended, Faneuil executed the transaction, selling Marthas 3,928 ImClone shares at $58 per share. On December 28th, the FDA publicly reported that it had rejected ImClones drug Erbitux. The next trading day saw ImClone stock value drop about 16%. Bacanovics tip had saved her $45,673.

The SEC Gets Involved Compliance officers at Merrill Lynch noticed the suspiciously well-timed sales and questioned Bacanovic on the matter, but his weak defense prompted them to report the incident to the SEC. In early 2002, the SEC began investigating the ImClone trades. Waksal was arrested and charged for insider trading in June, at which time Marthas investigation finally became more prominent. Although Stewart maintained her innocence throughout the investigation, she and her associates sold $79 million worth of MSO stock just before news of the investigation went public (some of her shareholders even sued her for doing this!). By late June 2002, MSO stock had fallen to a low of $13.60 per share, and by August it had fallen under $9 per share. During the investigations, Bacanovic and Stewart insisted that they had agreed upon a stop-loss order at $60 on December 20th regarding Stewarts ImClone shares. Martha claimed that she had no recollection of Bacanovics tip nor did she know that he was the broker for Waksal. On June 4, 2003, a federal grand jury indicted Stewart and Bacanovic. Stewart was accused of securities fraud, obstruction of justice, conspiracy, and making false statements. Bacanovic was charged with obstruction of justice, conspiracy, making false statements and perjury.

Conviction and Sentencing On March 5, 2004, Martha Stewart was found guilty on all counts and sentenced to five months in prison and five months of home confinement and was fined $30,000. Bacanovic was convicted of all counts except falsifying documents. He was sentenced to five months in prison, five months of home detention, two years of probation, and was fined $4,000. In a separate earlier trial (October 2002), Faneuil pled guilty to accepting a payoff to hush Marthas trade. He was fined $4,000 but served no jail time. Waksal also pled guilty to tipping off his family and selling his own stock illegally. He was sentenced to seven years in prison, the harshest penalty in the case.

Kathleen McReynolds MBA 5050: Business Law

Martha Stewart Insider Trading

Aftermath The MSO stock declined steadily throughout the investigations and trial. It was once worth more than $2 billion, and crumbled to about one-fourth of that after trial. Interestingly, the price jumped up 37% in July 2004 when Martha received a relatively light sentence (she could have been in prison for 20 years). Perhaps the worst punishment for Martha was the demolition of her formerly pristine image. She stepped down from the Board of Directors and was never able to fully recover to her position of wealth and business success. She became the object of ridicule in popular media and stepped down from many of her previous ventures. The company even took her face off of the Martha Stewart Living magazine temporarily. Although she has overcome much and regained a place in the business world, she may never be able to achieve her former levels of success. As of February 7, 2012, the MSO stock closed at $4.77 per share with a market capitalization of about $264 million, merely a shadow of what the company used to be.

Insider Trading at a Glance The SEC defines illegal insider trading as buying or selling a security, in breach of a fiduciary duty or other relationship of trust and confidence, while in possession of material, nonpublic information about the security. Insider trading violations may also include tipping such information

Kathleen McReynolds MBA 5050: Business Law

Martha Stewart Insider Trading SOURCES CONSULTED

"Bacanovic's Life Ruined, His Lawyer Says at Sentencing." USATODAY.com. 16 July 2004. Web. 07 Feb. 2012. <http://www.usatoday.com/money/media/2004-07-16-bacanovic-sentencing_x.htm>. "Complaint: Martha Stewart and Peter Bacanovic." U.S. Securities and Exchange Commission (Home Page). Web. 07 Feb. 2012. <http://www.sec.gov/litigation/complaints/comp18169.htm>.

Farrell, Greg. "Martha Stewart Convicted of Four Felonies." USATODAY.com. 05 Mar. 2004. Web. 07 Feb. 2012. <http://www.usatoday.com/money/media/2004-03-05-stewart_x.htm>.

"Insider Trading." U.S. Securities and Exchange Commission (Home Page). Web. 07 Feb. 2012. <http://www.sec.gov/answers/insider.htm>. "MSO: Summary for Martha Stewart Living Omnimedia- Yahoo! Finance." Yahoo! Finance. Web. 07 Feb. 2012. <http://finance.yahoo.com/q?s=MSO>. "Seattle Times Newspaper." Community.seattletimes.nwsource.com. Web. 07 Feb. 2012. <http://community.seattletimes.nwsource.com/archive/?date=20040305>. "SEC Charges Martha Stewart, Broker Peter Bacanovic with Illegal Insider Trading." U.S. Securities and Exchange Commission (Home Page). Web. 07 Feb. 2012. <http://www.sec.gov/news/press/2003-69.htm>. ORourke, J. "Martha Stewart Living Omnimedia Inc.: The Fall of an American Icon." Public Relations Review 30.4 (2004): 447-57. Print.

Das könnte Ihnen auch gefallen

- Fishmas Events CalendarDokument1 SeiteFishmas Events CalendarKat McReynoldsNoch keine Bewertungen

- Golf Tournament Poster For Grandfather Home For ChildrenDokument1 SeiteGolf Tournament Poster For Grandfather Home For ChildrenKat McReynoldsNoch keine Bewertungen

- JEXTRA Business Case StudyDokument5 SeitenJEXTRA Business Case StudyKat McReynoldsNoch keine Bewertungen

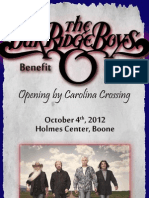

- Oak Ridge Boys Benefit Concert BrochureDokument1 SeiteOak Ridge Boys Benefit Concert BrochureKat McReynoldsNoch keine Bewertungen

- Oak Ridge Boys Benefit Concert FlyerDokument1 SeiteOak Ridge Boys Benefit Concert FlyerKat McReynoldsNoch keine Bewertungen

- The Digital Music Supply Chain - How Streaming Is Catalyzing A TransformationDokument24 SeitenThe Digital Music Supply Chain - How Streaming Is Catalyzing A TransformationKat McReynolds100% (9)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Astm C845 PDFDokument3 SeitenAstm C845 PDFJohn Richard NelsonNoch keine Bewertungen

- SelList R206072020Dokument71 SeitenSelList R206072020akshay aragadeNoch keine Bewertungen

- Khagendra Guragain (Garima Bank)Dokument55 SeitenKhagendra Guragain (Garima Bank)Indramaya RayaNoch keine Bewertungen

- Barangay Tax Code Sample PDFDokument14 SeitenBarangay Tax Code Sample PDFSusan Carbajal100% (2)

- GA Assignment (Anushka Khare-320409)Dokument13 SeitenGA Assignment (Anushka Khare-320409)anushkaNoch keine Bewertungen

- ME 569 Stress and Strain RelationshipsDokument52 SeitenME 569 Stress and Strain RelationshipsعلىالمهندسNoch keine Bewertungen

- Ralph M. Lepiscopo v. George E. Sullivan, Warden, 943 F.2d 57, 10th Cir. (1991)Dokument2 SeitenRalph M. Lepiscopo v. George E. Sullivan, Warden, 943 F.2d 57, 10th Cir. (1991)Scribd Government DocsNoch keine Bewertungen

- Poe's "The Cask of AmontilladoDokument5 SeitenPoe's "The Cask of AmontilladoSherrie Lyn100% (1)

- ME 1102 Electric Circuits: Analysis of Resistive CircuitsDokument12 SeitenME 1102 Electric Circuits: Analysis of Resistive CircuitsTalha KhanzadaNoch keine Bewertungen

- Tenancy Request FormDokument2 SeitenTenancy Request Formofficebackup allmailNoch keine Bewertungen

- NaOH MSDSDokument4 SeitenNaOH MSDSTeguh PambudiNoch keine Bewertungen

- American Government and Politics Today The Essentials 17th Edition Bardes Test BankDokument25 SeitenAmerican Government and Politics Today The Essentials 17th Edition Bardes Test BankHeatherBrownjawf100% (55)

- Test PDFDokument9 SeitenTest PDFJessica TurnerNoch keine Bewertungen

- People of The Philippines Vs FloraDokument10 SeitenPeople of The Philippines Vs FloraPaul BarazonNoch keine Bewertungen

- 1 Bac Reading U2 - Society PDFDokument2 Seiten1 Bac Reading U2 - Society PDFEnglish With Simo75% (4)

- Jinnah's 14 Points & The Nehru ReportDokument3 SeitenJinnah's 14 Points & The Nehru Reporthely shahNoch keine Bewertungen

- Test Drive AgreementDokument5 SeitenTest Drive AgreementRedcorp_MarketingNoch keine Bewertungen

- ORDINANCE 2011-732: Code Providing For AnDokument89 SeitenORDINANCE 2011-732: Code Providing For AnThe Florida Times-UnionNoch keine Bewertungen

- Disclosure To Promote The Right To Information: IS 5290 (1993) : Specification For Landing Valves (CED 22: Fire Fighting)Dokument20 SeitenDisclosure To Promote The Right To Information: IS 5290 (1993) : Specification For Landing Valves (CED 22: Fire Fighting)Tanmoy Dutta100% (1)

- G.R. No. 173227Dokument6 SeitenG.R. No. 173227Maria Lourdes Nacorda GelicameNoch keine Bewertungen

- NOUN VERB ADJECTIVE ADVERB PREPOSITION CONJUNCTION 2000KATADokument30 SeitenNOUN VERB ADJECTIVE ADVERB PREPOSITION CONJUNCTION 2000KATAazadkumarreddy100% (1)

- Thailand 6N7D Phuket - Krabi 2 Adults Dec 23Dokument4 SeitenThailand 6N7D Phuket - Krabi 2 Adults Dec 23DenishaNoch keine Bewertungen

- Islamic Finance and The Digital Revolution: Vita ArumsariDokument9 SeitenIslamic Finance and The Digital Revolution: Vita Arumsaridido edoNoch keine Bewertungen

- 03082019051404nvxsmwloqt7g0ud4bh Estatement 072019 2407Dokument12 Seiten03082019051404nvxsmwloqt7g0ud4bh Estatement 072019 2407Manoj EmmidesettyNoch keine Bewertungen

- SB 912 064ulDokument2 SeitenSB 912 064ulRafael PeresNoch keine Bewertungen

- News You Can Use: 5-Star Resort 5-Star ResortDokument56 SeitenNews You Can Use: 5-Star Resort 5-Star ResortCoolerAds100% (5)

- Cocomangas Hotel Beach Resort V ViscaDokument7 SeitenCocomangas Hotel Beach Resort V Viscahehe kurimaoNoch keine Bewertungen

- SPPTChap 006Dokument16 SeitenSPPTChap 006iqraNoch keine Bewertungen

- Instant Download Smith and Robersons Business Law 15th Edition Mann Solutions Manual PDF Full ChapterDokument32 SeitenInstant Download Smith and Robersons Business Law 15th Edition Mann Solutions Manual PDF Full Chapterrappelpotherueo100% (7)

- CH 12 - PA 2Dokument2 SeitenCH 12 - PA 2lisahuang2032Noch keine Bewertungen