Beruflich Dokumente

Kultur Dokumente

MCCM 3Q2012ReviewOutlook

Hochgeladen von

richardck61Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

MCCM 3Q2012ReviewOutlook

Hochgeladen von

richardck61Copyright:

Verfügbare Formate

Q3 2012 Market Review & Outlook

Morgan Creek Capital Management

MORGAN CREEK CAPITAL MANAGEMENT

Letter to Fellow Investors

Russian Roulette: Ginza Style

Having just spent three days in Tokyo, I came up with the theme for this quarters letter and also ran across some interesting investment ideas that I will weave into the Market Outlook section. I have been to Japan a number of times over the years and I have always been struck by a number of things: 1) how massive Tokyo is in terms of developed area (takes longer to get to Narita than to the Denver airport), 2) how amazingly clean the city is (almost Disneyland-esque with the freshly washed sidewalks and lack of graffiti), 3) how vibrant the city is in terms of commerce, retail and Source: Gloobbi.com restaurants (in contrast to my expectations of how depressed a city would be after a 23-year bear market) and 4) how formal the city remains in a world that has gone to casual everyday everywhere else (businessmen wear ties, taxi drivers wear hats, doormen wear white gloves and everyone still bows when you arrive and when you leave). However, the most amazing thing that strikes me every time I visit is the question of why so many people in Japan eat Fugu (blowfish) given that there is a nonzero chance that after you eat it (wait for it), you will die. It would be one thing to eat something that might cause some sort of unpleasant allergic reaction like hives but to actively decide to eat something that could end your life if it is not prepared with exact correctness, seems like a very bad risk/reward decision. It seems to me that given the huge variety of types of raw fish that one can eat while enjoying sushi and sashimi, one would simply omit the one raw fish that can cause the following symptoms; dizziness, exhaustion, headache, nausea, or difficulty breathing, the victim remains conscious but cannot speak or move, eventually breathing stops and asphyxiation follows, essentially putting you in a permanent state of zombie slumber. However, given the massive amount of Fugu that is consumed each year in Japan (10,000 tons) and the fact that every time I go to Japan one of my hosts insists that I go to their favorite restaurant that has the very best Fugu Chef (fully licensed, of course, although I cant help but wonder who does the tasting while these chefs are being trained and licensed), I would clearly be wrong in my assumption (since I dont partake, I always find a way to suggest a different style of restaurant). Why anyone would want to voluntarily ingest something that contains a neurotoxin that is 1,000 times as poisonous as potassium cyanide, I am still trying to figure out. Perhaps it is the purported tingling sensation in the lips and tongue that drives people to eat Fugu (I would assume it is the same as the feeling I have after a trip to the dentist for a filling and I have never had the desire to seek that feeling) or perhaps it is the thrill of taking the risk and trying to cheat death if the chef happens to nick the liver (where the most potent toxin resides) when he is fileting the blowfish into paper thin strips. I actually think it might simply be the very common human condition of confusing probabilities and possibilities. Given the relatively small number of deaths each year that result from eating improperly prepared Fugu, the average person might make the assumption that the probability of them actually consuming a piece of blowfish that will kill them is very small and therefore there is not much risk. Herein lies the flaw in the logic. If the outcome is death, any probability above zero (i.e. possibility) seems like too much risk to take given that there is no need to eat Fugu given all the other fish choices. I am sure there has been a great deal of study on why people eat blowfish and perhaps it is a cultural thing that is peculiar to Japan, I dont know, but in the end I am at a loss why people would play this Ginza-inspired version of Russian Roulette. Interestingly, this same question can be applied to the current investment landscape as it appears that many people are making similarly poor risk/reward decisions (albeit without truly lethal consequences in most cases) when deciding where to allocate capital today. We actually wrote in Buckle Up & Buckle Down about a similar type of risk/reward decision in wearing a seatbelt (another life/death decision) and said that the absence of a truly horrible outcome over a short period of time does not decrease the need for having low volatility strategies at the core of your portfolio (and clearly doesnt argue for reducing them at that time in favor of taking on more risk). The recent positive returns in the

Q 3 2 0 1 2 Market Review & Outlook

Third Quarter 2012

capital markets driven by the liquidity provided by the global Central Banks in response to the Financial Crisis has seemingly blinded investors to the actual level of risk in the equity markets and suspended the discernment between probabilities and possibilities. In fact, there has been a growing chorus of support for the idea that a diversified approach to investing (e.g., The Endowment Model) has become unnecessary and that concentrating your assets in equities (particularly U.S. equities) is a more attractive strategy, as the outsized returns that were produced over the past three years are, seemingly, proof of that strategys efficacy. There are considerable flaws with the logic of this conclusion: 1) positive outcomes do not imply positive decisions/processes, 2) three years is not a complete market cycle and ignores the impact of the negative fourth year that preceded the last three, 3) assuming that above average returns can persist in perpetuity defies the definition of average and 4) the conclusion does not account for the impact of the Central Bank stimulus on the recent outcome. In Fugu terms: 1) the fact that you ate blowfish and did not die does not mean it was a good decision to eat Fugu, 2) the fact that no one has died at this particular Fugu restaurant in the past three months does not negate the fact that two patrons died there the month before, 3) the fact that you did not ingest enough tetrodotoxin to kill you does not mean the next piece will not kill you and 4) the fact that your current Fugu chef prepared the Fugu appropriately (i.e. non-death inducing) does not imply that the next Fugu chef you encounter will be as skilled. Since the market peak in 2000, we have been living in a very unique investment environment where the Fugu analogy has become increasingly more important and instructive. When valuations reached the extreme levels that they did after the Tech Bubble, there was a very poor risk/reward to investing in equities (owning the wrong ones could kill your net worth, Cisco still down 83% since 2000) and the problem of probabilities and possibilities reared its ugly head. Was it possible that Cisco would be the first trillion-dollar company? Yes, but it was highly probable that paying $286 dollars for every dollar of Ciscos earnings was going to generate huge losses of wealth (the key to success in investing is to focus on probabilities and steering clear of betting on possibilities, i.e. gambling). Why did people continue to buy Cisco in 2000 at $100 a share (vs. $17 today)? Why do people eat blowfish? I can posit an answer to the first question and, as I indicated above, I am at a loss on the second question. People bought Cisco in April of 2000 because they couldnt stand watching their friends get rich any longer and they simply capitulated to the tech stock buying frenzy and completely disregarded any analysis of risk and reward, any evaluation of possibilities and probabilities (it was possible that the P/E ratio would go from 286 to 300, but it was probable that the P/E would go to 20). They were convinced by the recent performance that companies like Cisco could only go up in price and that the dinosaur value managers like Warren Buffet and Jeremy Grantham who kept sounding the alarm bells that valuations were stupid (from Berkshire Hathaways 2000 letter) had lost their edge and didnt get the new economy. We know how that story ended-NASDAQ fell 80% over the next three years, the S&P 500 fell nearly in half and 401(k)s became 201(k)s. Then the Fed pumped $1 trillion into the economy and triggered a stock market rally from 2003 to 2007 that drove the S&P 500 and DJIA back to their previous peak levels. This time it was the Financials turn in the spotlight as investors clamored to own all things related to the Housing Bubble and paying 4X book value for a stodgy old bank was all the rage. Despite the very unattractive risk/reward of buying equities at those valuations (even worse when adjusted for the massive leverage in the system at the time), diners ate more Fugu and ended up killing their net worth again when the markets collapsed in 2008 (I know of one investor who bought $1 million of financial stocks when the SEC banned short selling of financials in July 2008 and by February of 2009 those stocks were worth $100,000). This time, the Fed launched QE I and (with help from other global Central Banks) pumped $4 trillion into the financial system and shocked the patient back to life (the equivalent of an Epi-Pen to the heart) and produced a huge 80% rebound off the bottom in March of 2009. When the first dose of monetary stimulus ended, the equity markets resumed their downward spiral, falling (20%) in two short months in May/June 2010. That correction should have been a reminder to investors that the risk/reward of equities at those levels of valuation was unattractive and that a more diversified approach to building a portfolio was likely to be a more prudent course of action (like saying to your host, I think I will skip the Fugu and stick to fatty tuna

Q 3 2 0 1 2 Market Review & Outlook

Third Quarter 2012

and salmon thank you). Instead, the Fed came to the rescue again and launched QE II and the markets were off to the races again, this time rising nearly 40% (half as much as last time, but such is the pattern of effect of steroid usage) and investors decided that the outcome was more important than the process. Dont worry about valuations and the probabilities of meaningful losses, just focus on the Bernanke Put and the possibility of endless gains. Have another order of blowfish and if you are still breathing afterwards then it is all good. But all good things must come to an end (or so that was the case up until the invention of QEternity) and QE II ended and the markets responded to gravity and fell (20%) again from July to September 2011. Not to be deterred, the Fed responded with Operation Twist and the European Central Bank (ECB) got into the acronym game with LTRO and more liquidity meant more rally and markets surged again. Diversified portfolios, which had historically protected capital so well in the corrections, lagged materially during the liquidity induced melt-ups, and the derision reached a fever pitch by the end of Q1 this year. However, like clockwork, the stimulus programs came to an end and markets began their next correction, falling (10%) during April/May and things were actually looking downright ugly in July when markets were down another (5%) as rumors of declining earnings began to surface, but our friendly neighborhood Central Bankers, Ben and Mario teamed up in September to give us promises of unlimited bond purchases to keep the dinner party going. The only problem at this point in the story is that since the announcements of unlimited anti-neurotoxins for all (you can eat all the Fugu you want as there is a magic antidote available should your breathing stop) the stock markets have actually gone down, not up (like the Central Bank instruction manual says) and patrons are beginning to wheeze ever so slightly. The real question that investors should be asking themselves is not whether the markets are up off of the bottom (they clearly are, but they are also flat over five years and flat over twelve years, for good reasons), but rather how far down would they be if the Central Banks had not intervened? What is the probability that equities would be higher today than a year ago given that GDP growth is collapsing, the European Crisis is not solved, the Fiscal Cliff is not resolved, China is approaching hard-landing status, and corporate earnings were down in Q3 (and look to be down for the year in 2013)? What is the probability that eating fish laced with neurotoxins is a good idea? What is the possibility that U.S. stocks could trade to fair value (around 1,000 depending on who is doing the calculations)? Do you have time to make another fortune if the Central Banks have run out of bullets after a correction to fair value? What is the probability that a diversified portfolio strategy will produce better results in a challenging market environment? Should investors be more focused on return OF capital (like investors in Japan) rather than return ON capital (and stretching for yield by assuming greater levels of duration, credit and equity risk)? Does the fact that equity markets quickly bounced back from their losses in each of the past three years guarantee that they will quickly bounce back from the next loss? At the end of the day, the answers to these questions all relate to the construct that it is not the probability of whether there will be another correction that is critically important, but rather the potential magnitude of the damage to your net worth when the correction occurs. Similarly, if you eat some bad tuna, you get a stomachache. If you eat bad Fugu, you die. In investment parlance, that is what we call a permanent loss of capital. So why would an investor make the case for owning a more concentrated portfolio in todays environment rather than utilizing a more diversified portfolio approach? Have the three big risks that we discussed in European Vacathlon dissipated? (I actually think they may have gotten worse.) Has the expected return to U.S. equities risen back to normal levels where we should expect to earn a normal risk premium and achieve the long-term expected return of 7% real? (Jeremy Grantham predicts expected real returns in U.S. equities over the next seven years is likely to be close to zero, and we are reminded that his predictions have been accurate to the high 90% range over past couple of decades.) Given that the Beta to the equity market over the past three years has been more than double the long-term average, why would one assume that that trend was sustainable and that mean reversion was not likely to occur? Similarly, why would an investor not rebalance away from Beta (long only) today in favor of Alpha (long-short) today given that we have observed a very consistent three year cycle between Alpha and Beta in the equity markets (this cycle is particularly linked to the Central Bank stimulus activities, so one argument might be that if there is now permanent QE, then equity

Q 3 2 0 1 2 Market Review & Outlook

Third Quarter 2012

markets should permanently rally)? Another way to think about the choice between owning more stocks and owning an Endowment Model portfolio today might be to ask yourself whether you would risk losing 50% of your wealth to make a 6% return? At first glance this question might seem like a trick/trap question, but it is simply based on the probabilities and possibilities that exist in the marketplace at the current time. The consensus for EPS in the S&P 500 is around $100 and with a 15 P/E ratio, the target upside for the market is 1,500, or about a 6% increase from current levels. On the other side, we know from history that Recessions produce about a 45% drop in the market on average (the last two dropped around 50%) and there is a growing belief that there will be a U.S. Recession in early 2013 (some now say there could be a negative GDP print in Q4 due to Sandy). It is possible that the P/E could rise more than 15 or that EPS could surprise to the upside, but neither outcome is probable. It is possible that we avoid a Recession in the U.S. thanks to the Oil boom in North Dakota or the emerging Manufacturing Renaissance (a Japanese analyst I met told me that in his recent meeting with Honda management, they told him they were planning all incremental car production increases to be in the U.S. rather than China given lower energy costs and higher productivity), but it is not probable given the rapid slowdown in Europe and China and the impact of the Fiscal Cliff. These points keep leading me back to the same question, why would anyone eat Fugu? The original bad risk/reward game, Russian Roulette entailed putting a single bullet in a six shooter, spinning the chamber, pointing the gun at your temple, pulling trigger and hoping for the best. Again, not an activity with a lot of upside if you ask me (small adrenaline rush if you dont die or death, seems like a really bad trade), but enough people have been involved with the game to have it become part of history and popular culture. The Ginza version of the game involves eating raw fish that might be laced with a highly potent neurotoxin, seemingly another activity without a lot of upside (small tingling sensation in the mouth or death, again, a bad trade). Abandoning the diversified model of investing to buy more U.S. equities at valuations that appear to imply meaningful downside in an environment with 80% of the worlds economies in contraction and profits falling seems like just one more example of an activity without a lot of upside. Understandably, the downside to the last activity is not nearly as severe as the other two. That said, what impact would a loss of 50% of your investments have on your financial health if it were to happen for the third time in 13 years? The other critical point here is that the diversified investment model does have exposure to U.S. equities (and can have lots of exposure to U.S. equities like we did at UNC in 1999), but it appears to be more prudent today to wait until we have more clarity on the three big risks before we become less diversified. Roulette is generally a game you dont want to play. If you play in Las Vegas, you will lose money (of course a few people do get lucky and win, but the house odds are too high and the vast majority of players lose). If you play the Russian, or Ginza version, it appears safe to say that the bad outcomes outweigh the good outcomes. So, to quote the WOPR (the military supercomputer) from the classic 1983 movie War Games when trying to decide whether to play the game called Global Thermonuclear War, the only winning move is not to play.

Q 3 2 0 1 2 Market Review & Outlook

Third Quarter 2012

Third Quarter Review

Since the Financial Crisis in 2008 there has been a trend toward increasing Central Bank activity in the capital markets that has reduced the duration of normal cycles in the economy and investment markets. Before this onslaught of the acronyms-- QE, LTRO, ESM, OMT, etc. -- the markets had a certain rhythm that followed the natural business cycle of expansion, maturation, recession and recovery and the time horizons for investors was measured in years (for some long-term focused investors like the Endowments, even decades) rather than quarters, months and days. Writing a quarterly review was fairly straightforward as these trends spanned several periods and in any one quarter there was a central theme that drove investment results. In the New Abnormal environment (with government intervention rampant and nothing normal at all about the cycles) it has become much more challenging to analyze and evaluate the results during a quarter, as there are now significant shifts intra-quarter that require analysis and commentary in order to understand the outcomes within the period. The third quarter of 2012, in fact, was three very different periods and the investment environment changed radically over the course of the 92 days. The strategies needed to be successful within the markets over the quarter were meaningfully different during the first three weeks of July, the period from late July to midSeptember and the last two weeks of the quarter. So, the Central Bankers took a line from Mr. Shakespeare and we had an Alls Well That Ends Well in Q3 and while the overall outcome was rather pleasant for most investors over the entire period (most markets were positive), the journey was fraught with peril and tumult which chased increasing numbers of investors to the sidelines (cash and bonds) so they did not participate in the upside that resulted from the Midsummer Nights Dream-y gifts from Mario and Ben. The third quarter began in a rather Tempest-like state as the fears that had triggered the April/May corrections (Europe, Fiscal Cliff and China) were back at the forefront of investors minds and equity markets were in free fall, long Treasuries and Bunds were surging as safe havens and the prospect of no additional stimulus before the U.S. election had put markets squarely in Risk-Off

mode. There were legitimate reasons for investors to be afraid. Measure for Measure, global economic growth was looking rather scary as Europes recession worsened, Japan slipped back toward contraction, the U.S. economic data continued to slide and Chinas growth rate tumbled as the current leadership refrained from responding to the incessant calls for more PBOC stimulus (perhaps it was sandbagging to help the new leadership beat expectations or perhaps there is so much internal conflict within the Party that there is gridlock). Corporate profits around the world were in decline as margins began to roll over in reflection of the slower growth. But, most worrisome, was the escalation of borrowing costs for Italy and Spain as the European Debt Crisis was beginning to spiral out of control as the true costs of a Spanish Bank bailout became apparent to the Troika. Talk of a Spexit (Spanish exit from the Euro) replaced the conversations about a Grexit (the Greek version) as Spain is a real country and while few in the Eurozone would miss Greece if it left (other than Germany who needs the country all-in to keep up their Mercantilist domination plan; like the Chinese they exploit a hugely undervalued currency to feed their industrial production machine and extract wealth from the Periphery, a sinister, but genius plan) the specter of Spain leaving was a serious problem and the market tenor reflected that fear. Enter stage right, The Merchant of Venice, Sir Mario. On July 26, Mr. Draghi gave his now famous Beleeeeeve me, it will be beeeeeeg enough speech and the second act of Q3 went from tragedy to comedy as the promise of the ECB to buy them all (Spanish and Italian bonds, please ignore the loss of sovereignty requirement in order to get the money or the fact that no bonds were actually bought, but whos counting, this is just a confidence game) put a floor under the capital markets and Risk-On was back with a vengeance. Investors who were clamoring for the safety of Treasuries and Bonds (Swiss bonds actually went to negative interest rates) only days before, suddenly couldnt get enough of the peripheral junk bonds and equities. We talked about the risks of a melt-up in the worst European equity markets in European Vacathlon and post the Draghi speech, boy did we get a melt-up. Over the next six weeks, Spanish markets surged 28%, Italy jumped 20%,

Q 3 2 0 1 2 Market Review & Outlook

Third Quarter 2012

France rallied 9%, just to name a few, but those moves all paled in comparison to the dead cat bounce we saw in Greece which screamed up 53%, primarily due to the law of small numbers (percentage increase looks bigger on smaller base since the market was down 90% from peak). One thing to keep in mind about the move in Greek stocks is the old joke about what is the difference between being down 90% and down 95%?, you have lost half your money. While the Athens exchange has indeed nearly doubled in recent months, we can recall a similar situation in a large company in the U.S. that had a monster rally off a similar 90% decline only to end up down 99% when it became apparent that the business model was not fixed and the prospects for the future were not very bright. (Have conditions in Greece improved or are the future prospects much different than Eastman Kodak? Maybe, but scenes from the public worker riots and the threat of expulsion from the Euro might indicate otherwise.) It wasnt just Europe that promised more punch in the punch bowl. Not to be outdone by the ECB, the Fed kept the promise train rolling and Ben the Bard said As You Like It during his August speech in Jackson Hole and hinted at Endless Summer bond purchases in the future (since dubbed QEternity); and that was enough for all equity markets to get in on the party and there was a global melt-up in equity markets through Labor Day. Even without the Peoples Bank of China (PBOC) taking the plunge into the liquidity pool, emerging markets came along for the ride as investors bought everything for fear of missing another QE induced equity rally. Despite the fact that most of the Central Bank liquidity simply resides on bank balance sheets (lending has not recovered and monetary velocity has collapsed) and has not gotten into the broader economy, liquidity is flowing to capital markets during these expansion phases. Why not borrow at next to nothing and buy stocks with higher yields (hence the relentless bid for the mega-caps and multi-nationals) if there is no risk because the Central Banks have your back? Right up through the actual announcement of QE III on September 13, that question seemed rhetorical at best and downright silly at worst. However, in a very interesting buy the rumor, sell the news moment something very strange occurred over the last two weeks of the quarter.

Act III of Q3 was quite different than Act II and there was much drama (that continued into the first part of Q4, but more on that in the next letter) as market observers and pundits could not understand why equities were falling again despite the open-ended promise of the Central Banks to buy government (and Agency) bonds. Perhaps someone surmised that if there was a need for unlimited QE that the underlying problems in the global Comedy of Errors we are living in today were really big. Perhaps someone figured out that the Feds continual purchase of mortgages was a necessity to get the damaged collateral off of bank balance sheets so they could buy more Treasuries for two reasons. One, because Japan and China werent buying as many as before and the U.S. had to issue lots more because the debt was spiraling out of control with $1 trillion plus deficits. And two, that the global financial system (particularly in Europe) was dangerously light on quality collateral to keep the over-leveraged system from collapsing on itself and the Fed had to clear the decks at the banks to allow them to buy more Treasuries so they could loan them to the European banks so they could rehypothecate (lend them again and again) them over and over to shore up their hopelessly damaged balance sheets that are chock full of sovereign debt (formerly known as AAA) that is worth materially less than par. Perhaps it was the 7.4% GDP print in China that seems highly inflated when compared to electricity usage figures that indicate more like 2% to 3% growth. Perhaps it was the fact that 80% of global economies had PMIs in the contraction zone (below 50) and the recessions were getting worse, not better, in many places. Perhaps it was simply a little bit of collateral damage as the electioneering of oil prices (and hence gasoline prices) down in advance of the U.S. election (Presidents dont get reelected with high gas prices) dragged equities down with them as the correlation of stocks to oil prices has risen dramatically since the Financial Crisis. Whatever the cause, the quarter ended much like it began, antithetically to the middle as prices of equities faded and prices of safe haven bonds surged. Over the course of the entire quarter Risk-On trumped Risk-Off and the best strategy was to buy the dip in July and head to the beach for the summer like the Merry Wives of Windsor and ignore the market noise, feeling

Q 3 2 0 1 2 Market Review & Outlook

Third Quarter 2012

secure that Two Gentlemen of Verona, Ben and Mario, had the situation well in hand. That strategy would have paid handsomely as equity markets delivered returns that nearly matched their average annual return in the three months. U.S. markets were strong with the S&P 500 rising 6.4% (interestingly large caps dominated small caps returning 7% vs. 5.3%), which brought CYTD returns to a surprisingly strong 16.4% (perhaps even more amazing is the TTM number at 30.2% vs. the 19262011 average twelve month return of 9.8%). With the dollar under pressure, international equities got a lift from the currency and finished better than the U.S. markets with EAFE rising 6.9% and EM jumping 7.7%. Europe was the star performer surging 8.7% and Japan lagged (again) down (0.8%). The quarterly numbers actually mask the strength of equity markets during the mid-quarter rally as many markets jumped more than 15% over a few weeks and some of the highest Beta markets soared as much as 25%+. Whether it was short covering (there were more attempts at Taming of the Shrew(s) by implementing short selling bans across Europe) or leveraged speculators borrowing cheaply and carry-trading the higher yielding markets was less material to the story than it was an everyone in the pool kind of summer right up till the official end of summer on Labor Day. On the other side of the capital markets, bond returns were relatively muted as volatility in interest rates and the stampede out of safe haven assets in August led to the Barclays Aggregate Index managing only a 1.6% return. Long Treasuries had a wild quarter, surging 5% in the first weeks of July, falling 11% during the Draghi Days of August and jumping 6% in the last two weeks post QE III to finish flat at 0.2%. There were some bright spots in the credit markets as high yield bonds continued to surge, up 4.5% and emerging market bonds jumped 6.7%. For the CYTD, these two strategies have produced very equity-like returns, rising 12.1% and 14.2%, respectively. The other asset class that has been acting much like bonds in past quarters, as the yield grab went hyperbolic, has been REITs. However, in Q3, REITs took a little a little vacation time and were basically flat, although they are up a very robust 16.6% for the year.

Q3 was a story of Loves Labours Lost for hedge fund managers and was not a great time to be in any kind of hedged strategy, as the dramatic volatility chewed up the CTAs and Macro guys, the Euro melt-up caught the long/short guys with their shorts up and the continued ZIRP made it tough on the arbitrage and market neutral strategies. For the period, the HFN Equity Long/Short Index rose a scant 2.9%, CTAs managed only 1.1%, the HFRI Macro Index was 1.8% and the HFRI Absolute Return Index was actually down fractionally, (-0.1%). There has been an interesting cyclicality to the relative performance of the hedged strategies over the past four years. During the corrections of Q1 2009, Q2 2010, Q3 2011 and Q2 2012, the need for hedging has been acute and the performance of the non-traditional strategies has been very accretive to a diversified portfolio as the protection of capital has been very strong. The challenge has been that the following quarters have produced very difficult relative returns for hedged strategies as the interventions of the Central Bankers have driven markets back into a Risk-On posture after each successive correction. Q3 was another example where the Alpha earned in Q2 was erased over the course of only a few weeks. As we discussed above the shortening of the investment cycles has become a meaningful challenge for fundamentally-oriented managers. While there was a small cohort of long/short equity managers that have been able to morph their strategies to participate in the new environment, closer inspection reveals that perhaps it was simply that they held large positions in Apple. Q3 began, and ended, looking more tragic than comedic and there was some real drama in the middle portion as the competing forces of a global economic slowdown and global Central Bank largesse produced a fairly benign investment environment. In fact, the bulls might say that the bears are making Much Ado About Nothing in their concerns about European Sovereign debt risks, Fiscal Cliffs and Chinese hard landings. The bears might counter that the Kondratieff Winters Tale is far from over and the worst is actually yet to come as the Boomers continue to age and reduce consumption causing stress in the global economy. As we near the end of the Twelfth Night of the new Millennium and hope that we make it past the Mayan Calendar end date of December

Q 3 2 0 1 2 Market Review & Outlook

Third Quarter 2012

22, it appears to us that the past few months may be a preview of what is in store for investors in the New Year.

Market Outlook

Given the Risk-On, Risk-Off nature of the markets over the past few years, we wrote in each of the last two letters of the risks of the diversified portfolio approach, or Endowment Model, not delivering strong relative returns in the Risk-On phases. We wrote in Buckle Up & Buckle Down that we fully anticipate that Ben and Mario are likely to jump on their steamrollers and try to smooth out the bumps sometime in the summer and then we followed that up in European Vacathlon with a diversified Endowment Model strategy will, from time to time, lead the indices during tough times like the second quarter, but may lag the indices during ebullient times that could emerge if Ben and Mario find the keys to the steamrollers. The Central Bank boys took extended vacations this summer and waited till after Labor Day to fire up the heavy machinery but they had spent the summer customizing the engines and just the anticipation of unlimited QE was enough to trigger precisely the type of index lagging quarter that we had anticipated. We talked about remaining focused on risk reduction, diversification and discipline and we were early again (often a euphemism for wrong, but pretty sure early just means early this time), but the three big risks are far from solved; in fact, arguments can be made that they have yet to be addressed in any meaningful way. Europe has made no actual loans to shore up the Spanish and Italian financial systems. The U.S. Congress has not even met yet to begin talking about how to develop a plan to address the Fiscal Cliff. China has deferred any stimulus activity to avoid a hard landing until the new government comes into power in 2013. We argued that in times like this the focus needs to be on special niches and special people, putting capital in the hands of the most talented and experienced managers and striving for consistency of returns rather than being subjected to volatility of returns. We used the analogy of the marathon last quarter to talk about the periodicity problem and the expectation that investors have today that a strategy needs to win every period (that used to be measured years, but now quarters and even months)

rather than having the expectation that the position at the finish line is more important than the position each mile along the course. The race is long from over and the challenges of the finishing stretch are mounting. 2012 is limping toward the finish line in the postelection, pre-Fiscal Cliff frenzy. The equity markets have sold off (4%) in the few days since the election and there is growing concern about the ability of Congress to get a deal done in order to avoid the negative impact of a significant cut in fiscal spending on GDP growth and corporate profits (and, ultimately, stock prices). As we said at the end of European Vacathlon, 2013 looms like Heartbreak Hill on the horizon and the proverbial can may have been kicked as far as it can go. In an environment of heightened volatility and uncertainty we have continued to promote staying true to the discipline of a diversified portfolio approach and rebalancing from strategies that have outperformed their long-term average to those strategies that have underperformed their long-term average. One particularly important area of opportunity is in the hedge fund space as the calls in the marketplace for reducing exposure to long/short strategies and adding more Beta to portfolios had reached a crescendo at the end of Q3. Interestingly, the results of the last two quarters put together give a slight edge to the long/short guys, but the trailing year was not even close as long equities had surged as much as 30% and investors were beginning to have trouble resisting the urge to chase the rally. In hindsight, we should have been more tactical to take advantage of the upward move, but we dont want to compound the error by jumping in after the fact and getting whipsawed. We believe that adding true long/short exposure (preferably Jones Model funds where gross exposure is around 200% and net exposure is around 50%) to portfolios is likely to produce solid returns (both absolute and relative) over the next few years as the three year equity market cycle moves back in favor of long/short for the 2012 to 2014 period (after lagging from 2009 to 2011). We see significant opportunities in the U.S. in healthcare and technology (most winners and losers), Europe (lots of cheap assets, some for good reasons, some for bad reasons) and even Japan (the BOJ is leaning toward reflation which could provide some Yen relief and boost earnings in some sectors and the dinosaur companies

Q 3 2 0 1 2 Market Review & Outlook

Third Quarter 2012

have become terminal shorts). Perhaps the most intriguing thing I learned on my recent trip to Tokyo was that Honda has decided that all incremental car assembly activities will be located in the U.S. plants and not in China. They have determined that the low cost of energy (thanks to the shale gas boom) and the rising costs of labor in China make it a better risk/reward to assemble vehicles in Ohio. This decision has important implications for a lot of investment ideas. It validates the energy thematic investments we have made in the U.S. around unconventional drilling and energy services. These strategies should produce strong returns for many years as energy demand continues to grow. There are dramatic implications for global franchise businesses that may follow Hondas lead and bring jobs and capital back to the U.S. that will impact GDP growth, worker incomes and, ultimately, consumption. Conversely, there will be lower growth in Chinese exports and while it may only be a marginal impact to overall growth given that other areas is still very strong, there will be knock-on effects to watch for if the trend moves beyond the large multi-nationals. Taken together, there could be an interesting reverseMercantilism as the U.S. builds products to sell to the wealthier emerging markets (this will play well for our Growth of the Asian consumer theme) and those capital flows will impact currency and credit markets in ways that were unimaginable only a few years ago. Add the impact of innovation through venture capital and you have an elixir for creating some significant domestic wealth creation opportunities, if you spend the time to find the second and third derivative investments ideas. The impact of QEternity is that the Fed will be buying mortgages from the banks for as far as the eye can see (which has reduced the attractiveness of some mortgage securities that we had liked) and will be making room for those same banks to buys lots of Treasuries (since it appears that few overseas investors want them any more). If the banks can make 2.5% risk-free, they are less likely to make other types of risky loans, so the opportunities in direct lending to corporations to real estate developers (and everything in between) have become increasingly attractive. Someone needs to step in and make these loans to keep the wheels of commerce

in motion and that creates significant opportunity. Many opportunities are somewhat illiquid, but they have high levels of security and the strong double-digit cash flow allows investors to have meaningful liquidity from the yield on the investments. For those investors who want truly liquid exposure to these types of loans, there are some listed securities that provide similar strategies, albeit with a slightly reduced return profile due to the cost of providing infrastructure to generate liquidity. We have done a great deal of work on these securities as a means to add value to our enhanced fixed income portfolios. Taking a variant perception on the emerging markets for a moment and making the case that the hype around the recent slowdown in China may be, perhaps, overdone (and the decimation in the A-Shares market has been even more overdone) could lead investors to begin to build positions in the emerging markets again. We think there will be some great long-biased opportunities in the years ahead and the only hesitation we have from going all-in is the risk of the uncertainty around the Fiscal Cliff and the potential for a real correction in the U.S. that would likely spill over into Emerging Markets, providing a better entry point in 2013. On the other hand, if the Fiscal Cliff deal happens next week, it will be off to the races in stocks, so it probably makes sense to begin nibbling here and maybe even use some LongTerm Equity Appreciation (LEAPs) strategies to get a little extra exposure in the near term (with a known downside loss, the price of the option) in case we see a melt-up. With P/E ratios in the single digits, GDP growth still robust, fantastic demographics and an underinvested global investor population, the long-term prospects for these markets are strong indeed. Beyond the BRICs, the frontier markets continue to look compelling (in fact, I am headed back to South Africa for more diligence in December) and there are countless ways to deploy capital into places like Africa that we believe will generate very strong returns in the next decade. Everything from infrastructure, to real estate, to consumer goods, to private growth capital, to agriculture, to mining; the list is very long. There will continue to be a very significant private to public arbitrage in these markets, but the opportunities in the public markets are getting more robust as the economies develop.

Q 3 2 0 1 2 Market Review & Outlook

Third Quarter 2012

We talked about the challenges to the energy and commodity markets during our first quarter call and discussed how the Risk-Off move that began in March was driving the dollar higher (safe haven status), which, in turn, was driving the commodity markets toward a roll over. The pain was swift as oil and gas prices fell precipitously, industrial metals prices collapsed and even the precious metals fell (which was the opposite of previous moves where gold was also seen as a safe haven). We have a theory on this that the Chinese government was pegging the Renminbi again (similar to what they did in 2008) to try and stem the export of inflation from the U.S. and Europe that was resulting from the excessive QE/LTRO liquidity that was leaking into speculative, leveraged, commodity trades. With high inflation, it was impossible for the PBOC to ease their own monetary policy and increase their money supply to stimulate their economy, so they had to fight back. The strategy worked quite well as inflation has plunged in China, from a high of 7.5% a year ago to 1.9% today. Not to be outmaneuvered, BenMario hit the speech trail and jawboned up their plans for Supereasing and, as we wrote in European Vacathlon, there was a high likelihood of a bounce in commodities in anticipation of the next round of QE/LTRO. Remember, that there is a plan behind all this money printing. The submerging markets need to deleverage and there are only four ways to do that; 1) pay back the debt (cant do that since revenues dont meet spending), 2) default on the debt (cant do that as those in power who default suddenly find themselves out of power, e.g. Argentina), 3) restructure the debt and extend the duration of the liabilities (this is possible at some point) and 4) inflate the debt away through devaluation of currency through money printing (actively engaged in this one). The dirty little secrets of the last option are that the poor in the devaluing countries get completely, how can I say this politely, messed up and the devaluing countries can export inflation to countries that have a currency pegged to their currency (think China and Hong Kong for the U.S. and the Periphery for Germany). Exporting inflation has a huge benefit that it neutralizes other competitive advantages, like lower labor costs, and makes it possible to bring back some economic activity (read jobs) to the home country. If we can get jobs back in the U.S. then the economy can grow a little faster and

there may be a way to get some additional tax revenues to pay back some of the debt (it sounds good; probably wont work very well, but it will work a little). The other benefit is that the ability to export stuff to those countries helps neutralize some of the destruction of the home market currency and there is a slim chance that the process buys enough time that the deleveraging and restructuring actually is achieved. This plan sounds very elegant, but the problem of plans conceived in moderation (in a nice quiet conference room full of Ivy League educated academics) is that they must fail when circumstances are set in extremes (the rock em, sock em real world; thank you, Prince Metternich). In the end, the Golden Rule still applies and he who has the gold, makes the rules and China has more gold (money, resources, people) today, so while they have not been fighting back much during their government handover, we expect less Rope-a-Dope and more Float like a butterfly, sting like a bee in the New Year. The last paragraph provides some context for why we remain bullish on energy and natural resources and do not think we have seen the end of the commodity super cycle. There was an interesting (although completely logical) sell off in commodities (particularly oil) in the weeks leading up to the election. Rumors of a release from the Strategic Petroleum Reserve and abnormally high (some might say aberrant) storage numbers helped push oil prices down (15%) plus and gasoline prices fell precipitously (which was important as there is an inverse relationship between Presidential popularity and gasoline prices). With no signs of inflation anywhere in the developed world (in fact we still fear deflation more than inflation) and receding inflation in the developing world, rapidly declining global GDP growth and escalating risks of further slowdowns due to the Fiscal Cliff in the U.S. and the collateral damage inflicted by Austerity in the E.U., there have been growing sentiment that commodities were done and that real assets were not going to deliver the returns that many had expected. We will take the over. With the election over and QEternity firmly in place, we see continued escalation of debt in the developed world that will lead to further weakness in currencies and long-term appreciation of hard assets. Yes, there is continued short-term risk to real assets if we

Q 3 2 0 1 2 Market Review & Outlook

10

Third Quarter 2012

have a meaningful correction in stocks due to falling EPS triggered by a U.S. Recession. In that scenario, money would flow to Treasuries causing increased demand for dollars and a subsequent decline in commodity prices, but we see that eventuality as a fantastic buying opportunity and we will be ready to back up the truck and buy commodity linked equities when that occurs, most likely, sometime in the first quarter of next year. In the meantime, we will continue to deploy capital into the private energy markets in the Morgan Creek Partners series (MCP) where we can buy real assets in the ground at below market prices, hedge some of the commodity price risk by selling production forward in the futures markets and even getting a modest amount of leverage to generate mid-teens net returns. The best (defined as optimal risk/reward ratio) investment opportunities we see on a daily basis continue to be found in the private capital markets, from mezzanine lending, to growth capital, to leveraged buyouts of small/ mid-sized businesses, to real estate development, to distressed debt acquisition, to venture capital, to energy and mining & materials. The relative lack of capital in these markets due to the abandonment of these strategies by the banks and investors who are overly focused on liquidity (even when they dont need the money) has created a generational opportunity to deploy capital into strong cash-flowing businesses and investments at prices we have not seen for decades. Granted, there is a cost in terms of illiquidity for some number of years but the rewards for that risk are outsized and the probability of making superior returns is very high. In fact, a very famous hedge fund manager who has retired to manage his own capital laid out an outstanding analysis of the opportunity set in the markets that I have completely co-opted (borrowing someones idea is creative intelligence). He said if you construct a 2 by 2 McKinsey Matrix of Public/Private Investments and Low/High Risk, you get four quadrants of very unequal opportunity. He noted that the Low Risk Public investments were the most expensive he had ever seen since everyone was so afraid and were all hiding in the defensive, dividend paying stocks (given he wasnt alive in the Nifty Fifty period he was excused for not knowing that those names were just a tad more expensive than today) so he was avoiding these at all costs (good plan as

they have fallen the hardest lately, i.e. Apple). Next were the High Risk Public investments that were incredibly cheap as no one wants to own anything even remotely cyclical for fear of rapidly falling economic growth and profits. While logical, there is a price that makes every risk worth taking (except eating Fugu) and it is time to begin nibbling on the cheapest value-oriented stocks to create a core, long-term, portfolio. Next were the High Risk Private assets and he mentioned that those were also as expensive as he had ever seen since most of the money that actually will take some illiquidity (mostly large pensions and SWFs) has gone to a small number of the Big Uglies and they are all beating each others brains in to pay too much for large businesses that they can lever up (banks will lend to companies that dont need the money that actually shed jobs and not to small businesses that actually create jobs, go figure) to levels that are nearly equivalent to the 2007 bubble and we know how this movie ends - badly. The concentration of money going to big buyouts creates huge swaths of opportunity in other buyout and growth capital strategies. The good news is those are the opportunities we allocate to in the MCP, MCP Asia and MCP Co-Investment funds. Finally, there were the Low Risk Private assets that are tremendously undervalued, as there is no capital available for these types of transactions since the banks have had to reign in their lending activities while they repair their broken balance sheets (as discussed above). These opportunities include direct loans to all kinds of activities including, but not limited to, real estate development, equipment financing, trade financing and myriad other opportunities where the demise of the shadow banking system has left a hole in the lending system. These types of transactions have very high coupons (often reaching double digits) and have outstanding security (asset based lending), have low duration (under four years on average with some strategies measured in months) and you can get an equity kicker (warrants) on many of the loans as the supply/ demand is so favorable to the lenders. Making mid-teens returns on well-secured loans is a fantastic way to compound wealth in a period of Financial Repression and we are so enamored of these strategies that we are exploring the creation of a new Strategic Income Fund to pursue these opportunities. Please let us know if you would like to learn more about this

Q 3 2 0 1 2 Market Review & Outlook

11

Third Quarter 2012

opportunity. Another low risk strategy that has become increasingly attractive in the past few quarters is Absolute Return. The demographic wave of aging Baby Boomers is creating huge demand for income and yield (hence the dramatic volume of money shifting from stocks to bonds). However, in a world of Financial Repression the yields available on bonds have collapsed (even for risky strategies like high yield where the yield is no longer high) and the risks of capital loss have become increasingly acute if interest rates were to rise (you lose more when rates rise from a low base rate). Investors have seen many instances of meaningful losses in their bond portfolios in the past year when rates have spiked and the rising volatility has triggered a search for other forms of consistent returns. Enter the Absolute Return strategies. While Absolute Return got a black eye during the financial crisis, managers that survived the downturn have retooled their strategies (less leverage, more risk controls and no illiquidity) and have quietly generated high single digit returns over the past four years with very low volatility. That which does not kill (you) makes (you) stronger clearly applies in this space and the survivors are poised to capture significant new assets and continue to grow and develop their teams and strategies. We have seen solid returns in MCAR over this same period and can see a clear path to generating returns that consistently beat fixed income and, importantly, provide protection against losses from rising rates (if and when they occur) thanks to a positive correlation to interest rates. To sum things up, the outlook as we head toward 2013 is challenging, at best, and downright scary, at worst. There are many big issues that need to be addressed in the developed world and a great deal of restructuring and deleveraging that has to be completed in order to get back to a more normal market environment. Because of those challenges, the near term is likely to continue to be very volatile and filled with uncertainty punctuated by unexpected events that challenge conventional thinking on allocating and deploying investment capital. This is truly a time for Alternative Thinking About Investments, and time to focus on the Risk/Reward ratio in every asset, or strategy, that an investor contemplates adding

to their portfolio. There are tremendous opportunities available to investors who take this alternative path and there are likely to be great disappointments for those who stay on the more conventional path. Diversification, discipline and creativity will be prized in the years ahead as we manage through the intersection of the greatest demographic transition in history and the greatest monetary experiment in history. It is time to focus on probabilities and possibilities and, most importantly, it is time to stay away from the Fugu. Morgan Creeks 8 Annual Market Outlook Investment Forum will be held December 4-5, 2012 in New York City. For more details on this event and other recent news at Morgan Creek, please visit our Investor Education tab on www.morgancreekcap.com or contact Andrea Szigethy at aszigethy@morgancreekcap.com. During this event we will share our Market Outlook for the New Year and have an incredibly strong line-up of external speakers to pose challenging questions, provide provocative content and stimulate engaging conversations as we all prepare for the challenges that 2013 may bring. Current speakers include: Israel Englander, Founder Millennium Management; Dr. Amlan Roy, Managing Director & Head, Global Demographics and Pension Research, Credit Suisse; Howard H. Newman, President and CEO, Pine Brook; and, J. Kevin Kenny, CIO of the Emerging Sovereign Group. To reserve your seat at this event please register at:

th

http://morgancreekcap.com/registration/Winter/ WinterRegistrations2012.aspx. We look forward to seeing many of you in New York and encourage you to attend. We are extremely mindful of the trauma many of you are experiencing from the destruction wrought by Hurricane Sandy, and share our hopes for your safety and wellbeing as you navigate this difficult period. For those of you affected, Morgan Creek is ready to help you in any way that we can. As we wrote to our fellow colleagues and friends recently, if you need access to your investment information or if we can offer support or assistance in any way, please contact a member of the

Q 3 2 0 1 2 Market Review & Outlook

12

Third Quarter 2012

Client Service Team. The New York office was not damaged in the storm, we have power and systems access, and our local professionals there are safe and continue to monitor the markets and work on behalf of our clients. Morgan Creek made a donation to the Food Bank of New York City to support ongoing relief efforts for the victims of Hurricane Sandy. Our prayers and hopes for a steady recovery go out to all of you and your communities. We are very excited about the opportunities we see in the New Year and expect to have a lively and fruitful discussion on the best ways to protect capital and capture Alpha in these challenging times. We are grateful for your support and partnership.

Regards,

Mark W. Yusko Chief Executive Officer & Chief Investment Officer

This document is for informational purposes only. This is neither an offer to sell nor a solicitation of an offer to buy interests in any security. Neither the Securities and Exchange Commission nor any State securities administrator has passed on or endorsed the merits of any such offerings, nor is it intended that they will. Morgan Creek Capital Management, LLC does not warrant the accuracy, adequacy, completeness, timeliness or availability of any information provided by non-Morgan Creek sources.

Q 3 2 0 1 2 Market Review & Outlook

13

Das könnte Ihnen auch gefallen

- GM Insights - Asymmetry - 9-20Dokument16 SeitenGM Insights - Asymmetry - 9-20richardck61Noch keine Bewertungen

- Mauldin October 29Dokument18 SeitenMauldin October 29richardck61Noch keine Bewertungen

- Mauldin October 12Dokument5 SeitenMauldin October 12richardck61Noch keine Bewertungen

- Mauldin October 26Dokument8 SeitenMauldin October 26richardck61Noch keine Bewertungen

- 50 Slides For The Gold Bulls Incrementum Chartbook.01Dokument50 Seiten50 Slides For The Gold Bulls Incrementum Chartbook.01Zerohedge100% (1)

- Friedberg 3Q ReportDokument16 SeitenFriedberg 3Q Reportrichardck61Noch keine Bewertungen

- Mauldin July 13Dokument10 SeitenMauldin July 13richardck61Noch keine Bewertungen

- Mauldin August 24Dokument8 SeitenMauldin August 24richardck61Noch keine Bewertungen

- Six Ways NIRP Is Economically NegativeDokument14 SeitenSix Ways NIRP Is Economically Negativerichardck61Noch keine Bewertungen

- Keynote SacksDokument7 SeitenKeynote Sacksrichardck61Noch keine Bewertungen

- Degussa Marktreport Engl 22-07-2016Dokument11 SeitenDegussa Marktreport Engl 22-07-2016richardck61Noch keine Bewertungen

- Gold Vs Gold MinersDokument8 SeitenGold Vs Gold Minersrichardck61Noch keine Bewertungen

- Econsymposium Goodfriend PaperDokument38 SeitenEconsymposium Goodfriend Paperrichardck61Noch keine Bewertungen

- Second Quarter 2016 - Quarterly ReportDokument20 SeitenSecond Quarter 2016 - Quarterly Reportrichardck61Noch keine Bewertungen

- Report From Abu Dhabi ... and DallasDokument13 SeitenReport From Abu Dhabi ... and Dallasrichardck61Noch keine Bewertungen

- Mauldin June 25Dokument20 SeitenMauldin June 25richardck61Noch keine Bewertungen

- Mauldin July 3Dokument16 SeitenMauldin July 3richardck61Noch keine Bewertungen

- Mauldin June 4Dokument15 SeitenMauldin June 4richardck61Noch keine Bewertungen

- ODT Note 1 Unloved TreasuriesDokument2 SeitenODT Note 1 Unloved Treasuriesrichardck61Noch keine Bewertungen

- Mauldin May 9Dokument18 SeitenMauldin May 9richardck61Noch keine Bewertungen

- Global Macro Commentary May 3 - Diagnoses MatterDokument2 SeitenGlobal Macro Commentary May 3 - Diagnoses MatterdpbasicNoch keine Bewertungen

- Global Macro Commentary April 28 - Debt DebtDokument3 SeitenGlobal Macro Commentary April 28 - Debt Debtrichardck61Noch keine Bewertungen

- 2016 06 13 Montreal LDBDokument11 Seiten2016 06 13 Montreal LDBrichardck61Noch keine Bewertungen

- The Bail in or How You Could Lose Your Money in The Bank 2016.05.30Dokument3 SeitenThe Bail in or How You Could Lose Your Money in The Bank 2016.05.30richardck61Noch keine Bewertungen

- Mauldin April 13Dokument11 SeitenMauldin April 13richardck61Noch keine Bewertungen

- First Quarter 2016 - Quarterly ReportDokument16 SeitenFirst Quarter 2016 - Quarterly Reportrichardck61Noch keine Bewertungen

- An Open Letter To The Next President: Newport Beach, New York, and An SIC Conference UpdateDokument16 SeitenAn Open Letter To The Next President: Newport Beach, New York, and An SIC Conference Updaterichardck61Noch keine Bewertungen

- Global Macro Commentary Januray 4 - The Bond AwakensDokument3 SeitenGlobal Macro Commentary Januray 4 - The Bond AwakensdpbasicNoch keine Bewertungen

- Aloveaffairindiaandgold 20160323Dokument4 SeitenAloveaffairindiaandgold 20160323richardck61Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- CH 2 How LAN and WAN Communications WorkDokument60 SeitenCH 2 How LAN and WAN Communications WorkBeans GaldsNoch keine Bewertungen

- Application Problems 1 Through 3Dokument5 SeitenApplication Problems 1 Through 3api-4072164490% (1)

- WS-250 4BB 60 Cells 40mm DatasheetDokument2 SeitenWS-250 4BB 60 Cells 40mm DatasheetTejash NaikNoch keine Bewertungen

- 14 DETEMINANTS & MATRICES PART 3 of 6 PDFDokument10 Seiten14 DETEMINANTS & MATRICES PART 3 of 6 PDFsabhari_ramNoch keine Bewertungen

- Personal Information: Witec Smaranda 11, A3 Bis, Blvd. Chisinau, Bucharest, Romania 0040722597553Dokument6 SeitenPersonal Information: Witec Smaranda 11, A3 Bis, Blvd. Chisinau, Bucharest, Romania 0040722597553MirelaRoșcaNoch keine Bewertungen

- Induction-Llgd 2022Dokument11 SeitenInduction-Llgd 2022Phạm Trúc QuỳnhNoch keine Bewertungen

- General Mathematics 2nd Quarter ExamDokument3 SeitenGeneral Mathematics 2nd Quarter ExamDeped TambayanNoch keine Bewertungen

- Basic Details: Government Eprocurement SystemDokument4 SeitenBasic Details: Government Eprocurement SystemNhai VijayawadaNoch keine Bewertungen

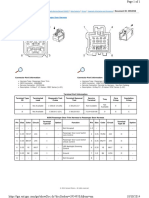

- HP ELITEBOOK 8740W Inventec Armani 6050A2266501Dokument61 SeitenHP ELITEBOOK 8740W Inventec Armani 6050A2266501Gerardo Mediabilla0% (2)

- Pa 28 151 161 - mmv1995 PDFDokument585 SeitenPa 28 151 161 - mmv1995 PDFJonatan JonatanBernalNoch keine Bewertungen

- X606 PDFDokument1 SeiteX606 PDFDany OrioliNoch keine Bewertungen

- Orthopanton Villa System MedicalDokument61 SeitenOrthopanton Villa System MedicalOscarOcañaHernándezNoch keine Bewertungen

- Adding Print PDF To Custom ModuleDokument3 SeitenAdding Print PDF To Custom ModuleNguyễn Vương AnhNoch keine Bewertungen

- South West Mining LTD - Combined CFO & HWA - VerDokument8 SeitenSouth West Mining LTD - Combined CFO & HWA - Verapi-3809359Noch keine Bewertungen

- Sample Pilots ChecklistDokument2 SeitenSample Pilots ChecklistKin kei MannNoch keine Bewertungen

- Vacuum Dehydrator & Oil Purification System: A Filter Focus Technical Publication D1-14Dokument1 SeiteVacuum Dehydrator & Oil Purification System: A Filter Focus Technical Publication D1-14Drew LeibbrandtNoch keine Bewertungen

- 04.CNOOC Engages With Canadian Stakeholders PDFDokument14 Seiten04.CNOOC Engages With Canadian Stakeholders PDFAdilNoch keine Bewertungen

- User Custom PP Install74Dokument2 SeitenUser Custom PP Install74Zixi FongNoch keine Bewertungen

- Evaluating The Policy Outcomes For Urban Resiliency in Informal Settlements Since Independence in Dhaka, Bangladesh: A ReviewDokument14 SeitenEvaluating The Policy Outcomes For Urban Resiliency in Informal Settlements Since Independence in Dhaka, Bangladesh: A ReviewJaber AbdullahNoch keine Bewertungen

- DMP 2021 TPJ SRDokument275 SeitenDMP 2021 TPJ SRishu sNoch keine Bewertungen

- Tankguard AR: Technical Data SheetDokument5 SeitenTankguard AR: Technical Data SheetAzar SKNoch keine Bewertungen

- Tourism: The Business of Hospitality and TravelDokument33 SeitenTourism: The Business of Hospitality and TravelNajla Nabila AurelliaNoch keine Bewertungen

- A-Panel Dual Polarization Half-Power Beam Width Adjust. Electr. DowntiltDokument2 SeitenA-Panel Dual Polarization Half-Power Beam Width Adjust. Electr. DowntiltUzair AkbarNoch keine Bewertungen

- UK LL M Thesis - Builders' Liability in UK Law Under TortDokument16 SeitenUK LL M Thesis - Builders' Liability in UK Law Under TortRajan UppiliNoch keine Bewertungen

- Alfa Laval Plate Heat Exchangers: A Product Catalogue For Comfort Heating and CoolingDokument8 SeitenAlfa Laval Plate Heat Exchangers: A Product Catalogue For Comfort Heating and CoolingvictoryanezNoch keine Bewertungen

- Finman General Assurance Corporation Vs - The Honorable Court of AppealsDokument2 SeitenFinman General Assurance Corporation Vs - The Honorable Court of AppealsNorie De los ReyesNoch keine Bewertungen

- Charts & Publications: Recommended Retail Prices (UK RRP)Dokument3 SeitenCharts & Publications: Recommended Retail Prices (UK RRP)KishanKashyapNoch keine Bewertungen

- Cost Volume Profit AnalysisDokument7 SeitenCost Volume Profit AnalysisMatinChris KisomboNoch keine Bewertungen

- University of Nottingham Department of Architecture and Built EnvironmentDokument43 SeitenUniversity of Nottingham Department of Architecture and Built EnvironmentDaniahNoch keine Bewertungen

- Guide To Networking Essentials Fifth Edition: Making Networks WorkDokument33 SeitenGuide To Networking Essentials Fifth Edition: Making Networks WorkKhamis SeifNoch keine Bewertungen