Beruflich Dokumente

Kultur Dokumente

Rating of Different Banks

Hochgeladen von

Niraj VishwakarmaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Rating of Different Banks

Hochgeladen von

Niraj VishwakarmaCopyright:

Verfügbare Formate

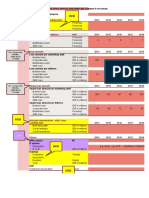

Fund Name HDFC Arbitrage Direct HDFC Arbitrage Retail HDFC Balanced HDFC Balanced Direct HDFC Capital

Builder HDFC Capital Builder Direct HDFC Cash Mgmt Call HDFC Cash Mgmt Call Direct HDFC Cash Mgmt Savings HDFC Cash Mgmt Savings Direct HDFC Cash Mgmt Treasury Adv Ret HDFC Cash Mgmt Treasury Adv Ret Direct HDFC Childrens Gift-Inv

Launch Date Jan-2013 Oct-2007 Aug-2000 Jan-2013 Jan-1994 Jan-2013 Feb-2002 Jan-2013 Nov-1999 Jan-2013 Nov-1999 Jan-2013 Feb-2001

Category Hybrid: Arbitrage Hybrid: Arbitrage Hybrid: Equity-oriented Hybrid: Equity-oriented Equity: Large & Mid Cap Equity: Large & Mid Cap Debt: Liquid Debt: Liquid Debt: Liquid Debt: Liquid Debt: Ultra Short Term Debt: Ultra Short Term Hybrid: Equity-oriented Hybrid: Equity-oriented Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Equity: Multi Cap Equity: Multi Cap Debt: Others Equity: Large & Mid Cap Equity: Large & Mid Cap Debt: Ultra Short Term Debt: Ultra Short Term Debt: Ultra Short Term Debt: Ultra Short Term Debt: Gilt Medium & Long Term

Rating Unrated --

Risk Grade -Below Avg. Below Avg.

Return Grade Below Avg. High -Above Avg. -Low -Avg. -Below Avg. -High -High -Avg. --High -High -Avg. -Avg. -Avg. ----Above Avg. -Avg. -Avg. -Avg. -Below Avg.

1 Year Return -8.94 5.10 -9.77 -8.08 -9.52 -8.67 -8.44 -7.42 -0.49 -9.40 6.50 -10.65 -9.58 -11.43 -8.92 -7.60 -6.72 5.21 -9.52 -10.44 -10.01 -6.40

Expense Ratio -0.90 1.91 -2.27 -0.20 -0.12 -0.78 -2.08 -2.25 -2.33 -0.01 1.78 -0.52 -0.63 -0.52 -0.50 -0.50 -1.00 2.00 -1.00 -1.50 -1.50 -1.00

Unrated

-Avg.

Unrated

-Above Avg.

Unrated

-Avg.

Unrated

-Avg.

Unrated

-Low

HDFC Childrens Gift-Inv Direct Jan-2013 HDFC Childrens Gift-Sav Feb-2001

Unrated

-Below Avg.

HDFC Childrens Gift-Sav Direct Jan-2013 HDFC Core & Satellite HDFC Core & Satellite Direct HDFC Debt Fund for Cancer Cure HDFC Equity HDFC Equity Direct Dec-1994 Jan-2013 Sep-2004 Jan-2013 Mar-2011

Unrated

-Above Avg.

Unrated Unrated

--Above Avg.

Unrated

-Above Avg.

HDFC Floating Rate Income LT Jan-2003 HDFC Floating Rate Income LT Jan-2013 Direct HDFC Floating Rate Income ST Oct-2007 Wholesale HDFC Floating Rate Income ST Jan-2013 Wholesale Direct HDFC Gilt Long-term HDFC Gilt Long-term Direct HDFC Gilt Short-term HDFC Gilt Short-term Direct HDFC Gold HDFC Gold Direct HDFC Gold ETF HDFC Growth HDFC Growth Direct HDFC HI Short-term HDFC HI Short-term Direct HDFC High Interest HDFC High Interest Direct HDFC Income HDFC Income Direct HDFC Index Nifty Jul-2001 Jan-2013 Jul-2001 Jan-2013 Oct-2011 Jan-2013 Jul-2010 Aug-2000 Jan-2013 Feb-2002 Jan-2013 Apr-1997 Jan-2013 Aug-2000 Jan-2013 Jul-2002

Unrated

-Low

Unrated

-Avg. -Above Avg.

Debt: Gilt Medium & Long Unrated Term Debt: Gilt Short Term Debt: Gilt Short Term Gold: Funds Gold: Funds Gold: Funds Equity: Large & Mid Cap Equity: Large & Mid Cap Debt: Short Term Debt: Short Term Debt: Income Debt: Income Debt: Income Debt: Income Equity: Large Cap Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated

----Avg. -Above Avg. -High -High -Above Avg.

Fund Name HDFC Index Nifty Direct HDFC Index Sensex HDFC Index Sensex Direct HDFC Index Sensex Plus

Launch Date Jan-2013 Jul-2002 Jan-2013 Jul-2002

Category Equity: Large Cap Equity: Large Cap Equity: Large Cap Equity: Large Cap Equity: Large Cap Equity: Infrastructure Equity: Infrastructure Equity: Tax Planning Equity: Tax Planning Debt: Liquid Debt: Liquid Equity: Large & Mid Cap Equity: Large & Mid Cap Hybrid: Debt-oriented Aggressive Hybrid: Debt-oriented Aggressive Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Debt: Income Debt: Income Equity: Mid & Small Cap Equity: Mid & Small Cap Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Equity: Multi Cap Equity: Multi Cap Hybrid: Equity-oriented Hybrid: Equity-oriented Debt: Ultra Short Term Debt: Ultra Short Term Debt: Short Term Debt: Short Term Equity: Tax Planning Equity: Tax Planning Equity: Large & Mid Cap Equity: Large & Mid Cap

Rating Unrated --

Risk Grade -Above Avg.

Return Grade Below Avg. -High -Above Avg. -Above Avg. -Avg. -Avg. -Above Avg. -Avg. -Avg. -Above Avg. -Above Avg. -Above Avg. -Avg. -High -Above Avg. -Below Avg. -Above Avg. -High --

1 Year Return -7.48 -8.93 --5.88 -7.52 -9.35 -3.35 -8.97 -7.79 -10.35 -8.67 -6.24 -7.47 --0.82 -6.18 -9.84 -9.37 -4.42 -6.53 --

Expense Ratio -1.00 -1.00 -2.18 -2.11 -0.12 -2.24 -1.55 -2.11 -0.25 -1.89 -1.75 -1.75 -2.32 -1.80 -0.30 -1.15 -1.84 -1.78 --

Unrated

-Below Avg.

HDFC Index Sensex Plus Direct Jan-2013 HDFC Infrastructure HDFC Infrastructure Direct HDFC LT Advantage HDFC LT Advantage Direct HDFC Liquid HDFC Liquid Direct HDFC Long-term Equity Feb-2008 Jan-2013 Dec-2000 Jan-2013 Oct-2000 Jan-2013 Jan-2006

Unrated

-Above Avg.

Unrated

-Avg.

Unrated

-Avg.

Unrated

-Avg.

HDFC Long-term Equity Direct Jan-2013 HDFC MIP Long-term HDFC MIP Long-term Direct HDFC MIP Short-term HDFC MIP Short-term Direct HDFC Medium Term Opportunities HDFC Medium Term Opportunities Direct HDFC Mid-Cap Opportunities HDFC Mid-Cap Opportunities Direct HDFC Multiple Yield HDFC Multiple Yield Direct Dec-2003 Jan-2013 Dec-2003 Jan-2013 Jun-2010 Jan-2013 Jun-2007 Jan-2013 Sep-2004 Jan-2013

Unrated

-Below Avg.

Unrated

-Avg.

Unrated

-Avg.

Unrated

-Below Avg.

Unrated

-Below Avg.

Unrated

-Low

HDFC Multiple Yield Plan 2005 Aug-2005 HDFC Multiple Yield Plan 2005 Jan-2013 Direct HDFC Premier Multi-Cap Mar-2005 HDFC Premier Multi-Cap Direct Jan-2013 HDFC Prudence HDFC Prudence Direct HDFC Short Term Opportunities HDFC Short Term Opportunities Direct HDFC Short-term HDFC Short-term Direct HDFC Taxsaver HDFC Taxsaver Direct HDFC Top 200 HDFC Top 200 Direct Jan-1994 Jan-2013 Jun-2010 Jan-2013 Feb-2002 Jan-2013 Mar-1996 Jan-2013 Sep-1996 Jan-2013

Unrated

-Avg.

Unrated

-Avg.

Unrated

-Above Avg.

Unrated

-Above Avg.

Unrated

-Below Avg.

Unrated

-Avg.

Unrated

--

Fund Name IDBI Dynamic Bond

Launch Date Feb-2012

Category Debt: Income Debt: Income Debt: Gilt Medium & Long Term Debt: Gilt Medium & Long Term Gold: Funds Gold: Funds Gold: Funds Equity: Large Cap Equity: Large Cap Debt: Liquid Debt: Liquid Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Equity: Large Cap Equity: Large Cap Equity: Multi Cap Equity: Multi Cap Equity: Large & Mid Cap Equity: Large & Mid Cap Debt: Ultra Short Term Debt: Ultra Short Term Debt: Ultra Short Term Debt: Ultra Short Term

Rating Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated ----------

Risk Grade ----------

Return Grade

1 Year Return

Expense Ratio -1.99 --------1.70 -1.00 2.05 -0.15 -2.23 -1.50 -1.50 ---1.40 -0.49 --

IDBI Dynamic Bond Direct Jan-2013 IDBI Gilt IDBI Gilt Direct IDBI Gold IDBI Gold Direct IDBI Gold ETF Dec-2012 Jan-2013 Aug-2012 Jan-2013 Nov-2011

6.67 --9.50 -9.09 -6.52 -10.81 ---9.63 -9.45 --

IDBI India Top 100 Equity May-2012 IDBI India Top 100 Equity Jan-2013 Direct IDBI Liquid IDBI Liquid Direct IDBI MIP IDBI MIP Direct IDBI Nifty Index IDBI Nifty Index Direct IDBI Nifty Junior Index IDBI Nifty Junior Index Direct IDBI RGESS Series 1 Plan A Direct IDBI RGESS Series 1 Plan A Reg IDBI Short Term Bond IDBI Short Term Bond Direct IDBI Ultra Short Term IDBI Ultra Short Term Direct Jul-2010 Jan-2013 Feb-2011 Jan-2013 May-2010 Jan-2013 Sep-2010 Jan-2013 Mar-2013 Mar-2013 Mar-2011 Jan-2013 Sep-2010 Jan-2013

Avg. Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated ---------High Unrated -Below Avg. Unrated --

Above Avg. ---------Above Avg. -Avg. --

Fund Name ICICI Prudential Advisor-Aggressive Direct

Launch Date Jan-2013

Category

Rating

Hybrid: Debt-oriented Unrated Aggressive

Risk Grade --

Return Grade --

1 Year Return --

Expense Ratio --

ICICI Prudential Advisor-Aggressive Reg

Nov-2003

Hybrid: Debt-oriented Aggressive

High

Above Avg.

7.02

0.74

ICICI Prudential Advisor-Cautious Reg Nov-2003

Hybrid: Debt-oriented Unrated Conservative

--

--

7.82

0.75

ICICI Prudential Advisor-Cautious Reg Jan-2013 Direct

Hybrid: Debt-oriented Unrated Conservative

--

--

--

--

ICICI Prudential Advisor-Moderate Direct

Jan-2013

Hybrid: Debt-oriented Unrated Aggressive

--

--

--

--

ICICI Prudential Advisor-Moderate Reg

Nov-2003

Hybrid: Debt-oriented Aggressive

Above Avg. Avg.

8.63

0.74

ICICI Prudential Advisor-Very Aggressive Reg

Nov-2003

Equity: Large & Mid Cap

Low

Avg.

5.48

0.75

ICICI Prudential Advisor-Very Aggressive Reg Direct

Jan-2013

Equity: Large & Mid Cap

Unrated

--

--

--

--

ICICI Prudential Advisor-Very Cautious Direct

Jan-2013

Debt: Income

Unrated

--

--

--

--

ICICI Prudential Advisor-Very Cautious Reg

Nov-2003

Debt: Income

Unrated

--

--

8.37

0.75

ICICI Prudential Balanced Direct

Jan-2013

Hybrid: Equityoriented

Unrated

--

--

--

--

ICICI Prudential Balanced Reg

Oct-1999

Hybrid: Equityoriented

Below Avg.

Avg.

13.01

2.27

Reg

ICICI Prudential Banking & PSU Debt Aug-2010

Debt: Income

Low

Below Avg.

9.18

0.90

ICICI Prudential Banking & PSU Debt Jan-2013 Reg Direct

Debt: Income

Unrated

--

--

--

--

Fund Name

Launch Date

Category

Rating

Risk Grade

Return Grade

1 Year Return

Expense Ratio

ICICI Prudential Banking and Financial Services Direct

Jan-2013

Equity: Banking

Unrated

--

--

--

--

ICICI Prudential Banking and Financial Services Reg

Aug-2008

Equity: Banking

Low

Above Avg.

24.50

2.42

ICICI Prudential Blended Plan A Direct

Jan-2013

Hybrid: Arbitrage

Unrated

--

--

--

--

ICICI Prudential Blended Plan A Reg

May-2005

Hybrid: Arbitrage

Above Avg. Above Avg.

10.98

0.90

ICICI Prudential Blended Plan B Option I Direct

Jan-2013

Hybrid: Debt-oriented Unrated Conservative

--

--

--

--

ICICI Prudential Blended Plan B Option I Reg

May-2005

Hybrid: Debt-oriented Conservative

Above Avg. Below Avg.

9.89

0.90

ICICI Prudential Capital Protection Oriented Series I

Jun-2011

Hybrid: Debt-oriented Unrated Conservative

--

--

8.42

2.16

ICICI Prudential Capital Protection Oriented Series II

Jul-2011

Hybrid: Debt-oriented Unrated Conservative

--

--

9.20

2.15

ICICI Prudential Capital Protection Oriented Series III

Jul-2011

Hybrid: Debt-oriented Unrated Conservative

--

--

9.83

2.18

ICICI Prudential Capital Protection Oriented Series III Plan A

Dec-2012

Hybrid: Debt-oriented Unrated Conservative

--

--

--

--

ICICI Prudential Capital Protection Oriented Series III Plan B

Dec-2012

Hybrid: Debt-oriented Unrated Conservative

--

--

--

--

ICICI Prudential Capital Protection Oriented Series III Plan C

Dec-2012

Hybrid: Debt-oriented Unrated Conservative

--

--

--

--

ICICI Prudential Capital Protection Oriented Series III Plan D

Jan-2013

Hybrid: Debt-oriented Unrated Conservative

--

--

--

--

Fund Name

Launch Date

Category

Rating

Risk Grade

Return Grade

1 Year Return

Expense Ratio

ICICI Prudential Capital Protection Oriented Series III Plan D Direct

Jan-2013

Hybrid: Debt-oriented Unrated Conservative

--

--

--

--

ICICI Prudential Capital Protection Oriented Series III Plan E

Jan-2013

Hybrid: Debt-oriented Unrated Conservative

--

--

--

--

ICICI Prudential Capital Protection Oriented Series III Plan E Direct

Jan-2013

Hybrid: Debt-oriented Unrated Conservative

--

--

--

--

ICICI Prudential Capital Protection Oriented Series III Plan F

Feb-2013

Hybrid: Debt-oriented Unrated Conservative

--

--

--

--

ICICI Prudential Capital Protection Oriented Series III Plan F Direct

Feb-2013

Hybrid: Debt-oriented Unrated Conservative

--

--

--

--

ICICI Prudential Capital Protection Oriented Series IV

Oct-2011

Hybrid: Debt-oriented Unrated Conservative

--

--

10.93

1.85

ICICI Prudential Capital Protection Oriented Series IX

May-2012

Hybrid: Debt-oriented Unrated Conservative

--

--

--

2.00

ICICI Prudential Capital Protection Oriented Series V

Sep-2011

Hybrid: Debt-oriented Unrated Conservative

--

--

12.80

1.99

ICICI Prudential Capital Protection Oriented Series VI

Jan-2012

Hybrid: Debt-oriented Unrated Conservative

--

--

9.29

1.99

ICICI Prudential Capital Protection Oriented Series VII

Feb-2012

Hybrid: Debt-oriented Unrated Conservative

--

--

--

2.13

ICICI Prudential Capital Protection Oriented Series VIII

Mar-2012

Hybrid: Debt-oriented Unrated Conservative

--

--

--

2.20

ICICI Prudential Capital Protection Oriented Series X

Jun-2012

Hybrid: Debt-oriented Unrated Conservative

--

--

--

2.00

ICICI Prudential Capital Protection Oriented Series XI

Apr-2012

Hybrid: Debt-oriented Unrated Conservative

--

--

--

2.09

Fund Name

Launch Date

Category

Rating

Risk Grade

Return Grade

1 Year Return

Expense Ratio

ICICI Prudential Capital Protection Oriented Series XII

Jun-2012

Hybrid: Debt-oriented Unrated Conservative

--

--

--

0.74

ICICI Prudential ChildCare Direct-Gift Jan-2013

Hybrid: Equityoriented

Unrated

--

--

--

--

ICICI Prudential ChildCare-Gift Reg

Aug-2001

Hybrid: Equityoriented

High

Avg.

8.88

2.40

ICICI Prudential ChildCare-Study Direct

Jan-2013

Hybrid: Debt-oriented Unrated Conservative

--

--

--

--

ICICI Prudential ChildCare-Study Reg Aug-2001

Hybrid: Debt-oriented Conservative

Above Avg. High

11.95

1.50

ICICI Prudential Corporate Bond Direct

Jan-2013

Debt: Short Term

Unrated

--

--

--

--

ICICI Prudential Corporate Bond Reg Sep-2004

Debt: Short Term

Avg.

Below Avg.

9.99

1.53

ICICI Prudential Discovery Direct

Jan-2013

Equity: Mid & Small Cap

Unrated

--

--

--

--

ICICI Prudential Discovery Inst I

Mar-2006

Equity: Mid & Small Cap

Below Avg.

High

14.26

1.00

ICICI Prudential Discovery Reg

Jul-2004

Equity: Mid & Small Cap

Below Avg.

High

12.98

1.92

ICICI Prudential Dynamic Bond Direct Jan-2013

Debt: Income

Unrated

--

--

--

--

ICICI Prudential Dynamic Bond Prem Jun-2009 Plus

Debt: Income

Below Avg.

Above Avg.

10.87

0.32

ICICI Prudential Dynamic Bond Reg

Jun-2009

Debt: Income

Below Avg.

Avg.

10.63

0.32

ICICI Prudential Dynamic Direct

Jan-2013

Equity: Large & Mid Cap

Unrated

--

--

--

--

ICICI Prudential Dynamic Inst

May-2011

Equity: Large & Mid Cap

Unrated

--

--

7.47

1.20

Fund Name

Launch Date

Category

Rating

Risk Grade

Return Grade

1 Year Return

Expense Ratio

ICICI Prudential Dynamic Inst I

Mar-2006

Equity: Large & Mid Cap

Low

High

7.68

1.00

ICICI Prudential Dynamic Reg

Oct-2002

Equity: Large & Mid Cap

Below Avg.

Above Avg.

6.63

1.82

ICICI Prudential Eq Volatility Advantage Direct

Jan-2013

Hybrid: Equityoriented

Unrated

--

--

--

--

ICICI Prudential Eq Volatility Advantage Reg

Dec-2006

Hybrid: Equityoriented

Low

Above Avg.

16.23

2.41

ICICI Prudential Equity Arbitrage Direct

Jan-2013

Hybrid: Arbitrage

Unrated

--

--

--

--

ICICI Prudential Equity Arbitrage Inst Dec-2006

Hybrid: Arbitrage

Above Avg. High

11.20

1.50

ICICI Prudential Equity Arbitrage Reg Dec-2006

Hybrid: Arbitrage

High

Avg.

10.85

1.50

ICICI Prudential FMCG Direct

Jan-2013

Equity: FMCG

Unrated

--

--

--

--

ICICI Prudential FMCG Reg

Mar-1999

Equity: FMCG

Unrated

--

--

31.79

2.44

ICICI Prudential Flexible Income Direct

Jan-2013

Debt: Ultra Short Term

Unrated

--

--

--

--

ICICI Prudential Flexible Income Reg Sep-2002

Debt: Ultra Short Term

Below Avg.

Avg.

9.49

0.90

ICICI Prudential Floating Rate Direct

Jan-2013

Debt: Ultra Short Term

Unrated

--

--

--

--

ICICI Prudential Floating Rate Reg

Nov-2005

Debt: Ultra Short Term

Below Avg.

Avg.

9.46

1.10

ICICI Prudential Focused Bluechip Equity Direct

Jan-2013

Equity: Large Cap

Unrated

--

--

--

--

Fund Name ICICI Prudential Focused Bluechip Equity Inst I

Launch Date May-2008

Category Equity: Large Cap

Rating

Risk Grade Low

Return Grade Above Avg.

1 Year Expense Return Ratio 10.07 1.20

ICICI Prudential Focused Bluechip Equity Reg

May-2008

Equity: Large Cap

Below Avg.

Above Avg.

9.21

1.82

ICICI Prudential Gilt Investment Direct

Jan-2013

Debt: Gilt Medium & Long Term

Unrated

--

--

--

--

ICICI Prudential Gilt Investment PF Direct

Jan-2013

Debt: Gilt Medium & Long Term

Unrated

--

--

--

--

ICICI Prudential Gilt Investment PF Reg

Nov-2003

Debt: Gilt Medium & Long Term

Above Avg. Below Avg.

9.42

1.75

ICICI Prudential Gilt Investment Reg

Aug-1999

Debt: Gilt Medium & Long Term

Avg.

Avg.

10.56

1.50

ICICI Prudential Gilt Treasury Direct

Jan-2013

Debt: Gilt Short Term Unrated

--

--

--

--

ICICI Prudential Gilt Treasury PF Reg Jan-2004

Debt: Gilt Short Term

Above Avg. Below Avg.

7.27

1.25

ICICI Prudential Gilt Treasury PF Reg Jan-2013 Direct

Debt: Gilt Short Term Unrated

--

--

--

--

ICICI Prudential Gilt Treasury Reg

Aug-1999

Debt: Gilt Short Term

Avg.

Avg.

8.60

1.25

ICICI Prudential Gold ETF

Jul-2010

Gold: Funds

Unrated

--

--

6.62

1.00

ICICI Prudential Income Direct

Jan-2013

Debt: Income

Unrated

--

--

--

--

ICICI Prudential Income Opportunities Direct

Jan-2013

Debt: Income

Unrated

--

--

--

--

ICICI Prudential Income Opportunities Inst

Aug-2008

Debt: Income

Above Avg. Above Avg.

10.96

1.50

ICICI Prudential Income Reg

Jun-1998

Debt: Income

Above Avg. Below Avg.

10.07

1.75

Fund Name

Launch Date

Category

Rating

Risk Grade

Return Grade

1 Year Return

Expense Ratio

ICICI Prudential Index Direct

Jan-2013

Equity: Large Cap

Unrated

--

--

--

--

ICICI Prudential Index Reg

Feb-2002

Equity: Large Cap

Avg.

Above Avg.

6.09

1.50

ICICI Prudential Indo Asia Equity Direct

Jan-2013

Equity: Large Cap

Unrated

--

--

--

--

ICICI Prudential Indo Asia Equity Inst Sep-2007

Equity: Large Cap

Low

Above Avg.

11.59

2.38

ICICI Prudential Indo Asia Equity Reg Sep-2007

Equity: Large Cap

Low

Above Avg.

11.59

2.38

ICICI Prudential Infrastructure Direct Jan-2013

Equity: Infrastructure Unrated

--

--

--

--

ICICI Prudential Infrastructure Inst I

Mar-2006

Equity: Infrastructure

Avg.

Above Avg.

-1.95

1.00

ICICI Prudential Infrastructure Reg

Aug-2005

Equity: Infrastructure

Avg.

Avg.

-2.94

1.89

ICICI Prudential Liquid Plan Direct

Jan-2013

Debt: Liquid

Unrated

--

--

--

--

ICICI Prudential Liquid Plan Reg

Nov-2005

Debt: Liquid

Below Avg.

Above Avg.

9.51

1.00

ICICI Prudential Long-term Direct

Jan-2013

Debt: Income

Unrated

--

--

--

--

ICICI Prudential Long-term Reg

May-2009

Debt: Income

Below Avg.

Avg.

9.48

1.25

ICICI Prudential MIP 25 Direct

Jan-2013

Hybrid: Debt-oriented Unrated Conservative

--

--

--

--

ICICI Prudential MIP 25 Reg

Mar-2004

Hybrid: Debt-oriented Conservative

High

Above Avg.

9.43

1.97

ICICI Prudential MIP 5

Apr-2011

Hybrid: Debt-oriented Unrated Conservative

--

--

7.64

2.24

Fund Name ICICI Prudential MIP 5 Direct ICICI Prudential MIP Direct ICICI Prudential MIP Reg ICICI Prudential Midcap Direct ICICI Prudential Midcap Inst I ICICI Prudential Midcap Reg

Launch Date Jan-2013 Jan-2013 Oct-2000 Jan-2013 Mar-2006 Oct-2004

Category

Rating

Hybrid: Debt-oriented Unrated Conservative Hybrid: Debt-oriented Unrated Conservative Hybrid: Debt-oriented Conservative Equity: Mid & Small Cap Equity: Mid & Small Cap Equity: Mid & Small Cap Debt: Liquid Debt: Liquid Hybrid: Debt-oriented Unrated Conservative Hybrid: Debt-oriented Unrated Conservative Hybrid: Debt-oriented Unrated Conservative Hybrid: Debt-oriented Unrated Conservative Hybrid: Debt-oriented Unrated Conservative Hybrid: Debt-oriented Unrated Conservative Hybrid: Debt-oriented Unrated Conservative Hybrid: Debt-oriented Unrated Conservative Hybrid: Debt-oriented Unrated Conservative Hybrid: Debt-oriented Unrated Conservative Equity: Multi Cap Equity: Multi Cap Unrated Unrated Unrated Unrated

Risk Grade --Avg. --

Return Grade --Avg. --

1 Year Return --8.63 -5.37 3.81 -9.52 12.34 11.86 9.51 12.13 12.50 12.12

Expense Ratio --2.03 -1.00 2.34 -1.00 2.20 2.19 2.24 2.07 1.99 1.99

Above Avg. Below Avg. Above Avg. Low -Below Avg. -------Above Avg. -------

ICICI Prudential Money Market Direct Jan-2013 ICICI Prudential Money Market Reg Mar-2006

ICICI Prudential Multiple Yield Plan A May-2011 ICICI Prudential Multiple Yield Plan B Jun-2011 ICICI Prudential Multiple Yield Plan C Aug-2011 ICICI Prudential Multiple Yield Plan D Sep-2011 ICICI Prudential Multiple Yield Plan E ICICI Prudential Multiple Yield Series 2A ICICI Prudential Multiple Yield Series 2C ICICI Prudential Multiple Yield Series 2D ICICI Prudential Multiple Yield Series 2E ICICI Prudential Multiple Yield Series Apr-2012 Apr-2012 Jan-2012 Dec-2011 Nov-2011 Dec-2011

--

--

11.67

2.20

--

--

11.31

2.20

--

--

--

2.22

--

--

--

1.99

2F

ICICI Prudential Nifty Junior Index ICICI Prudential Nifty Junior Index Direct ICICI Prudential R.I.G.H.T. ICICI Prudential Regular Gold Savings ICICI Prudential Regular Gold Savings Direct

Jun-2010 Jan-2013

---

---

10.17 --

1.50 --

Sep-2009 Oct-2011

Equity: Tax Planning Gold: Funds

Unrated Unrated

---

---

17.78 5.79

2.49 0.50

Jan-2013

Gold: Funds

Unrated

--

--

--

--

Fund Name

Launch Date Nov-2010 Jan-2013

Category

Rating

Risk Grade Low

Return Grade Below Avg. --

1 Year Return 9.25 --

Expense Ratio 1.54 --

ICICI Prudential Regular Savings ICICI Prudential Regular Savings Direct ICICI Prudential SPIcE ICICI Prudential Services Industries Direct ICICI Prudential Services Industries Reg ICICI Prudential Short-term Direct ICICI Prudential Short-term Inst ICICI Prudential Short-term Reg

Debt: Income Debt: Income Unrated

--

Jan-2003 Jan-2013

Equity: Large Cap Equity: Others

Unrated Unrated

---

---

9.85 --

0.80 --

Nov-2005

Equity: Others

Unrated

--

--

9.44

2.39

Jan-2013 Feb-2003 Oct-2001

Debt: Short Term Debt: Short Term Debt: Short Term Equity: Large Cap Equity: Large Cap Equity: Tax Planning Equity: Tax Planning Equity: Technology Equity: Technology Equity: Large Cap Equity: Large Cap Equity: Large Cap Equity: Large Cap Equity: Large Cap Equity: Large Cap Equity: International Equity: International

Unrated

-Avg.

-High

-10.08 9.51 -5.87 -10.98 -13.73 -10.33 8.74 -8.94 7.40 ---

-0.80 1.30 -2.42 -1.98 -2.49 -1.00 2.33 -1.00 2.26 2.50 --

Above Avg. Avg. Unrated ---

ICICI Prudential Target Returns Direct Jan-2013 ICICI Prudential Target Returns Reg ICICI Prudential Tax Direct ICICI Prudential Tax Plan Reg ICICI Prudential Technology Direct ICICI Prudential Technology Reg ICICI Prudential Top 100 Direct ICICI Prudential Top 100 Inst I ICICI Prudential Top 100 Reg ICICI Prudential Top 200 Direct ICICI Prudential Top 200 Inst I ICICI Prudential Top 200 Reg ICICI Prudential US Bluechip Equity ICICI Prudential US Bluechip Equity Direct ICICI Prudential Ultra Short Term Direct May-2009 Jan-2013 Aug-1999 Jan-2013 Jan-2000 Jan-2013 Mar-2006 Jun-1998 Jan-2013 Mar-2005 Sep-1994 Jul-2012 Jan-2013

Above Avg. Above Avg. Unrated -Avg. Unrated Unrated Unrated ---Below Avg. Below Avg. Unrated -Avg. Avg. Unrated Unrated ---High ---High High -Above Avg. Above Avg. ---

Jan-2013

Debt: Ultra Short Term

Unrated

--

--

--

--

Launch Date ICICI Prudential Ultra Short Term Reg Jun-2009 Fund Name

Category Debt: Ultra Short Term

Rating Unrated

Risk Grade --

Return Grade --

1 Year Expense Return Ratio 8.91 0.95

Fund Name Axis Banking Debt Axis Banking Debt Direct Axis Capital Protection Oriented Series 1 Axis Capital Protection Oriented Series 2 Axis Capital Protection Oriented Series 3 Axis Capital Protection Oriented Series 4 Axis Capital Protection Oriented Series 5 Axis Constant Maturity 10 Year Axis Constant Maturity 10 Year Direct Axis Dynamic Bond Axis Dynamic Bond Direct Axis Equity Axis Equity Direct Axis Focused 25 Axis Focused 25 Direct Axis Gold Axis Gold Direct Axis Gold ETF Axis Hybrid Series 1 Axis Hybrid Series 2 Axis Hybrid Series 3 Axis Income Axis Income Direct Axis Income Saver Axis Income Saver Direct Axis Liquid Direct Axis Liquid Inst Axis Long Term Equity

Launch Date Jun-2012 Jan-2013 Nov-2011 Dec-2011 Dec-2011 Feb-2012 Oct-2012 Jan-2012 Jan-2013 Apr-2011 Jan-2013 Dec-2009 Jan-2013 Jun-2012 Jan-2013 Oct-2011 Jan-2013 Nov-2010 Aug-2011 Aug-2011 Sep-2011 Mar-2012 Jan-2013 Jun-2010 Jan-2013 Jan-2013 Mar-2010 Dec-2009

Category Debt: Ultra Short Term Debt: Ultra Short Term Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Debt: Gilt Medium & Long Term Debt: Gilt Medium & Long Term Debt: Income Debt: Income Equity: Large & Mid Cap Equity: Large & Mid Cap Equity: Large Cap Equity: Large Cap Gold: Funds Gold: Funds Gold: Funds Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Debt: Income Debt: Income Hybrid: Debt-oriented Aggressive Hybrid: Debt-oriented Aggressive Debt: Liquid Debt: Liquid Equity: Tax Planning Equity: Tax Planning Equity: Mid & Small Cap Equity: Mid & Small Cap Debt: Short Term Debt: Short Term

Rating Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated ----------

Risk Grade ----------

Return Grade

1 Year Return

Expense Ratio -0.20 --2.12 2.16 2.10 2.16 -1.50 -2.11 -2.21 -2.36 -0.50 -1.00 2.17 2.10 2.25 1.50 -2.16 --0.23 2.35 -2.48 --0.98

1.26 1.04 1.48 0.13 -8.19 -9.54 -14.71 ---3.78 -6.47 0.53 0.68 1.24 --8.20 --9.49 12.39 -24.19 --9.81

High Unrated -Avg. Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated --------------Avg. Low Unrated Unrated Unrated Unrated ----Above Avg.

Avg. -Avg. --------------Above Avg. Above Avg. ----Avg.

Axis Long Term Equity Direct Jan-2013 Axis Midcap Axis Midcap Direct Axis Short Term Direct Axis Short Term Inst Feb-2011 Jan-2013 Jan-2013 Mar-2010

Fund Name Axis Treasury Advantage Direct

Launch Date Jan-2013

Category Debt: Ultra Short Term Debt: Ultra Short Term Hybrid: Others Hybrid: Others

Rating Unrated --

Risk Grade --

Return Grade

1 Year Return -9.52 10.38 --

Expense Ratio -0.77 2.26 -

Axis Treasury Advantage Inst Mar-2010 Axis Triple Advantage Jul-2010 Axis Triple Advantage Direct Jan-2013

Below Avg. Unrated Unrated ---

Avg. ---

Fund Name Kotak 50 Kotak 50 Direct Kotak Balance Kotak Balance Direct Kotak Bond Plan A Kotak Bond Plan A Direct Kotak Bond Short-term

Launch Date Dec-1998 Jan-2013 Nov-1999 Jan-2013 Nov-1999 Jan-2013 Apr-2002

Category Equity: Large Cap Equity: Large Cap Hybrid: Equity-oriented Hybrid: Equity-oriented Debt: Income Debt: Income Debt: Short Term Debt: Short Term Equity: Large & Mid Cap Equity: Large & Mid Cap Equity: Mid & Small Cap Equity: Mid & Small Cap Hybrid: Arbitrage Hybrid: Arbitrage Equity: Large & Mid Cap Equity: Large & Mid Cap Debt: Ultra Short Term Debt: Ultra Short Term Debt: Ultra Short Term Debt: Ultra Short Term Debt: Liquid Debt: Liquid Debt: Gilt Medium & Long Term Debt: Gilt Medium & Long Term Debt: Gilt Medium & Long Term Debt: Gilt Medium & Long Term Debt: Gilt Short Term Debt: Gilt Short Term Equity: International Equity: International Gold: Funds Gold: Funds Gold: Funds

Rating

Risk Grade Below Avg. -Avg.

Return Grade Avg. -Avg. -Above Avg. -Below Avg. -Avg. -Below Avg. -Avg. -Avg. -Avg. -Avg. -High -High -Above Avg. -Avg. -------

1 Year Expense Return Ratio 9.87 2.13 -10.76 -11.67 -9.47 -11.52 -14.89 -9.68 -8.34 -9.38 -9.37 -9.60 -13.03 -12.99 -7.50 -19.75 -5.93 -6.73 -2.50 -1.79 -1.50 -2.50 -2.50 -1.08 -0.75 -0.74 -0.41 -0.27 -1.85 -1.85 -1.50 -1.48 -0.50 -1.00

Unrated

Unrated

-Above Avg.

Unrated

-Above Avg.

Kotak Bond Short-term Direct Jan-2013 Kotak Classic Equity Kotak Classic Equity Direct Kotak Emerging Equity Jul-2005 Jan-2013 Mar-2007

Unrated

-Avg.

Unrated

-Avg.

Kotak Emerging Equity Direct Jan-2013 Kotak Equity Arbitrage Sep-2005 Kotak Equity Arbitrage Direct Jan-2013 Kotak Equity FoF Kotak Equity FoF Direct Kotak Flexi Debt Plan A Kotak Flexi Debt Plan A Direct Kotak Floater LT Kotak Floater LT Direct Kotak Floater ST Kotak Floater ST Direct Kotak Gilt Investment PF & Trust Kotak Gilt Investment PF & Trust Direct Kotak Gilt Investment Regular Kotak Gilt Investment Regular Direct Kotak Gilt Saving Kotak Gilt Saving Direct Kotak Global Emerging Market Kotak Global Emerging Market Direct Kotak Gold Kotak Gold Direct Kotak Gold ETF Jan-2013 Dec-1998 Jan-2013 Dec-1998 Jan-2013 Aug-2007 Jan-2013 Mar-2011 Jan-2013 Jul-2007 Jul-2004 Jan-2013 May-2008 Jan-2013 Aug-2004 Jan-2013 Jul-2003 Jan-2013 Nov-2003

Unrated

-Below Avg.

Unrated

-Avg.

Unrated

-Avg.

Unrated

-Above Avg.

Unrated

-Above Avg.

Unrated

-Avg.

Unrated

-Avg.

Unrated

-Avg.

Unrated Unrated Unrated Unrated Unrated Unrated

-------

Fund Name Kotak Hybrid FTP Series I Kotak Income Opportunities Kotak Income Opportunities Direct Kotak Liquid Plan A Kotak Liquid Plan A Direct Kotak MIP Kotak MIP Direct Kotak Mid-Cap Kotak Mid-Cap Direct Kotak Multi Asset Allocation Kotak Multi Asset Allocation Direct Kotak Nifty ETF Kotak Opportunities Kotak Opportunities Direct Kotak PSU Bank ETF Kotak Select Focus Kotak Select Focus Direct Kotak Sensex ETF Kotak Tax Saver Kotak Tax Saver Direct

Launch Date Jan-2012 Apr-2010 Jan-2013 Nov-2003 Jan-2013 Nov-2003 Jan-2013 Jan-2005 Jan-2013 Jan-2011 Jan-2013 Jan-2010 Aug-2004 Jan-2013 Nov-2007 Aug-2009 Jan-2013 May-2008 Oct-2005 Jan-2013

Category Hybrid: Debt-oriented Conservative Debt: Short Term Debt: Short Term Debt: Liquid Debt: Liquid Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Equity: Mid & Small Cap Equity: Mid & Small Cap Hybrid: Others Hybrid: Others Equity: Large Cap Equity: Multi Cap Equity: Multi Cap Equity: Banking Equity: Large & Mid Cap Equity: Large & Mid Cap Equity: Large Cap Equity: Tax Planning Equity: Tax Planning

Rating Unrated --

Risk Grade --

Return Grade

1 Year Expense Return Ratio 8.20 2.00 9.32 -9.50 -10.97 -14.06 -10.75 -7.53 8.65 --7.07 13.04 -8.10 10.48 -2.09 -0.21 -2.25 -2.34 -2.11 -0.50 2.14 -0.65 2.32 -0.50 2.30 --

High Unrated -Above Avg. Unrated -Avg. Unrated -Avg. Unrated Unrated Unrated Unrated ----Avg. Unrated -High Avg. Unrated -Avg. Above Avg. Unrated --

Avg. -Above Avg. -Below Avg. -Avg. ----Below Avg. -Below Avg. Avg. -Avg. Avg. --

Fund Name SBI Arbitrage Opportunities SBI Arbitrage Opportunities Direct SBI Bluechip SBI Bluechip Direct

Launch Date Oct-2006 Jan-2013 Jan-2006 Jan-2013

Category Hybrid: Arbitrage Hybrid: Arbitrage Equity: Large & Mid Cap

Rating

Risk Grade Avg. -Avg. ---Above Avg. -Avg.

Return Grade Below Avg. -Avg. ---Avg. -High ---High -----

1 Year Expense Return Ratio 9.33 2.08 -18.73 -8.09 7.37 12.82 -11.77 -5.18 -29.76 -42.82 -6.04 -2.35 -1.98 2.21 2.06 -1.73 -2.00 -2.21 -2.60 -0.55

Unrated

Equity: Large & Mid Cap Unrated Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Equity: Large & Mid Cap Equity: Large & Mid Cap Unrated Debt: Income Debt: Income Hybrid: Others Hybrid: Others Equity: Mid & Small Cap Equity: Mid & Small Cap Equity: FMCG Equity: FMCG Gold: Funds Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated

SBI Capital Protection Oriented Mar-2011 Fund Series II SBI Capital Protection Oriented Sep-2011 Fund Series III SBI Contra SBI Contra Direct SBI Dynamic Bond SBI Dynamic Bond Direct SBI Edge SBI Edge Direct SBI Emerging Businesses Jul-1999 Jan-2013 Jan-2004 Jan-2013 Oct-2003 Jan-2013 Sep-2004

---Avg. -----

SBI Emerging Businesses Direct Jan-2013 SBI FMCG SBI FMCG Direct SBI Gold Jul-1999 Jan-2013 Sep-2011

Fund Name SBI Gold Direct SBI Gold ETS SBI IT SBI IT Direct SBI Infrastructure SBI Infrastructure Direct SBI Magnum Balanced SBI Magnum Balanced Direct SBI Magnum COMMA SBI Magnum COMMA Direct Plan

Launch Date Jan-2013 Apr-2009 Jul-1999 Jan-2013 Jun-2007 Jan-2013 Oct-1995 Jan-2013 Jul-2005 Jan-2013

Category Gold: Funds Gold: Funds Equity: Technology Equity: Technology Equity: Infrastructure Equity: Infrastructure Hybrid: Equity-oriented Hybrid: Equity-oriented Equity: Others Equity: Others Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Equity: Large Cap Equity: Large Cap Debt: Ultra Short Term Debt: Ultra Short Term Debt: Gilt Medium & Long Term Debt: Gilt Medium & Long Term Debt: Gilt Short Term Debt: Gilt Short Term Equity: Mid & Small Cap Equity: Mid & Small Cap Debt: Income Debt: Income Debt: Ultra Short Term Debt: Ultra Short Term Equity: Large Cap Equity: Large Cap Debt: Liquid Debt: Liquid Debt: Liquid Debt: Liquid Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Equity: Mid & Small Cap Equity: Mid & Small Cap Equity: Large & Mid Cap

Rating Unrated Unrated Unrated Unrated -----

Risk Grade -----

Return Grade

1 Year Return -6.84 8.65 --6.56 -18.22 --11.76 -10.20 -11.53 -9.73 -11.22 -9.21 -15.24 -12.84 -9.56 -6.75 -9.16 -9.12 -12.88 -9.67 -16.69 -13.33

Expense Ratio -0.94 2.70 -2.38 -2.52 -2.52 -1.56 -2.23 -0.28 -1.29 -0.92 -2.26 -1.62 -1.00 -1.50 -0.34 -0.37 -2.18 -1.67 -2.56 -2.50

Above Avg. Unrated -Avg. Unrated Unrated Unrated ---Above Avg. Unrated -Avg. Unrated -Below Avg. Unrated -Avg. Unrated -Avg. Unrated -Below Avg. Unrated -Above Avg. Unrated -Above Avg. Unrated -Above Avg. Unrated -Avg. Unrated -Below Avg. Unrated -Avg. Unrated -Low Unrated -High Unrated -Above Avg.

Below Avg. -Avg. ---Above Avg. -Above Avg. -Avg. -Avg. -High -Avg. -High -Above Avg. -Avg. -Avg. -Avg. -Avg. -Avg. -Below Avg. -Low

SBI Magnum Children's Benefit Jan-2002 SBI Magnum Children's Benefit Jan-2013 Plan Direct SBI Magnum Equity SBI Magnum Equity Direct SBI Magnum Floating Rate Savings Plus Bond SBI Magnum Floating Rate Savings Plus Bond Direct SBI Magnum Gilt Long-term SBI Magnum Gilt Long-term Direct SBI Magnum Gilt Short-term SBI Magnum Gilt Short-term Direct SBI Magnum Global SBI Magnum Global Direct SBI Magnum Income SBI Magnum Income Direct SBI Magnum Income Floating Rate LTP SBI Magnum Income Floating Rate LTP Direct SBI Magnum Index SBI Magnum Index Direct SBI Magnum InstaCash SBI Magnum InstaCash Direct SBI Magnum InstaCash Liquid Floater SBI Magnum InstaCash Liquid Floater Direct SBI Magnum MIP SBI Magnum MIP Direct SBI Magnum MIP Floater Nov-1990 Jan-2013 Jul-2004 Jan-2013 Dec-2000 Jan-2013 Dec-2000 Jan-2013 Sep-1994 Jan-2013 Nov-1998 Jan-2013 Jul-2004 Jan-2013 Jan-2002 Jan-2013 May-1999 Jan-2013 Aug-2005 Jan-2013 Mar-2001 Jan-2013 Nov-2005

SBI Magnum MIP Floater Direct Jan-2013 SBI Magnum Midcap SBI Magnum Midcap Direct SBI Magnum MultiCap Mar-2005 Jan-2013 Sep-2005

Fund Name SBI Magnum MultiCap Direct SBI Magnum Multiplier Plus SBI Magnum Multiplier Plus Direct SBI Magnum Taxgain SBI Magnum Taxgain Direct SBI PSU SBI PSU Direct SBI Pharma SBI Pharma Direct SBI Premier Liquid SBI Premier Liquid Direct SBI Regular Savings SBI Regular Savings Direct SBI Sensex ETF SBI Short Term Debt SBI Short Term Debt Direct SBI Tax Advantage Series I SBI Tax Advantage Series II SBI Ultra Short Term Debt SBI Ultra Short Term Debt Direct

Launch Date Jan-2013 Feb-1993 Jan-2013 Mar-1993 Jan-2013 Jun-2010 Jan-2013 Jul-1999 Jan-2013 Mar-2007 Jan-2013 Oct-2003 Jan-2013 Mar-2013 Jul-2007 Jan-2013 Mar-2008 Mar-2012 Jul-2007 Jan-2013

Category

Rating --

Risk Grade -Avg.

Return Grade Below Avg. -Avg. -----Avg. -Avg. --Above Avg. ---Avg. --

1 Year Return -9.58 -10.09 --6.39 -26.96 -9.46 -9.32 --10.22 -10.31 -9.27 --

Expense Ratio -2.21 -2.01 -2.52 -2.70 -0.15 -2.08 --0.63 -2.30 0.50 0.25 --

Equity: Large & Mid Cap Unrated Equity: Multi Cap Equity: Multi Cap Equity: Tax Planning Equity: Tax Planning Unrated Unrated

-Avg. -----Below Avg.

Equity: Large & Mid Cap Unrated Equity: Large & Mid Cap Unrated Equity: Pharma Equity: Pharma Debt: Liquid Debt: Liquid Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Equity: Large Cap Debt: Short Term Debt: Short Term Equity: Tax Planning Equity: Tax Planning Debt: Ultra Short Term Debt: Ultra Short Term Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated

-Above Avg. --Above Avg. ---Low --

Fund Name ING Balanced ING Balanced Direct ING Core Equity ING Core Equity Direct ING Dividend Yield ING Dividend Yield Direct ING Gilt PF Dynamic

Launch Date Apr-2000 Jan-2013 May-1999 Jan-2013 Oct-2005 Jan-2013 Mar-2004

Category Hybrid: Equity-oriented

Rating

Risk Grade Avg. -Avg.

Return Grade Below Avg. -Avg. -High -------Below Avg. -Above Avg. --

1 Year Expense Return Ratio 5.75 2.76 -8.24 -9.19 -11.22 ---24.07 -9.71 -6.83 -2.76 2.64 2.64 2.63 2.63 1.57 1.50 -1.57 1.52 1.52 1.89 1.89 2.63 2.63

Hybrid: Equity-oriented Unrated Equity: Large & Mid Cap Equity: Large & Mid Cap Equity: Multi Cap Equity: Multi Cap Debt: Gilt Medium & Long Term Debt: Gilt Medium & Long Term Debt: Gilt Medium & Long Term Debt: Gilt Medium & Long Term Equity: International Equity: International Debt: Income Debt: Income Equity: Large Cap Equity: Large Cap Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated

-Below Avg. -------High -Avg. --

ING Gilt PF Dynamic Cyclical 2012 Mar-2012 ING Gilt PF Dynamic Cyclical 2012 Jan-2013 Direct ING Gilt PF Dynamic Direct ING Global Real Estate Retail ING Global Real Estate Retail Direct ING Income ING Income Direct ING Large Cap Equity ING Large Cap Equity Direct Jan-2013 Dec-2007 Jan-2013 May-1999 Jan-2013 Feb-2004 Jan-2013

Fund Name ING Latin America Equity ING Latin America Equity Direct ING Liquid Super Inst ING Liquid Super Inst Direct ING MIP ING MIP Direct ING Midcap ING Midcap Direct FoF

Launch Date Jul-2008 Jan-2013 Aug-2005 Jan-2013 Feb-2004 Jan-2013 May-2005 Jan-2013

Category Equity: International Equity: International Debt: Liquid Debt: Liquid Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Equity: Mid & Small Cap

Rating Unrated Unrated

Risk Grade --Avg.

Return Grade --Avg. ---Below Avg. ---Avg. ---------Low ----------Avg. --

1 Year Expense Return Ratio 0.45 1.94 -9.26 -5.08 -5.04 -7.17 -11.02 -0.72 --4.92 -10.81 -9.03 -0.39 -3.68 7.90 -10.16 -7.84 -8.43 -9.65 -1.94 0.31 0.88 1.99 1.99 2.64 2.64 0.57 0.57 1.03 1.03 1.33 1.33 0.77 0.77 0.87 0.87 0.85 0.85 2.60 2.60 2.45 1.13 -0.90 -1.17 -1.25 -1.29 1.29

Unrated Unrated Unrated

---Above Avg. ---Avg.

Equity: Mid & Small Cap Unrated Equity: Large & Mid Cap Equity: Large & Mid Cap Debt: Income Debt: Income Unrated Unrated Unrated

ING OptiMix 5 Star Multi Manager Dec-2006

ING OptiMix 5 Star Multi Manager Jan-2013 FoF Direct ING OptiMix Active Debt Multi Manager FoF ING OptiMix Active Debt Multi Manager FoF Direct ING OptiMix Asset Allocator MMFoF ING OptiMix Asset Allocator MMFoF Direct ING OptiMix Global Commodities ING OptiMix Global Commodities Direct ING OptiMix Income Growth MMFoF 15% Equity Option A ING OptiMix Income Growth MMFoF 15% Equity Option A Direct ING OptiMix Income Growth MMFoF 30% Equity Option A ING OptiMix Income Growth MMFoF 30% Equity Option A Direct Dec-2006 Jan-2013 Jul-2006 Jan-2013 Aug-2008 Jan-2013 Apr-2006 Jan-2013 Apr-2006 Jan-2013

---------Above Avg.

Hybrid: Asset Allocation Unrated Hybrid: Asset Allocation Unrated Equity: International Equity: International Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Conservative Hybrid: Debt-oriented Aggressive Hybrid: Debt-oriented Aggressive Equity: Large & Mid Cap Equity: Large & Mid Cap Equity: Tax Planning Hybrid: Others Hybrid: Others Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated Unrated

ING OptiMix Multi Manager Equity Apr-2007 Option A ING OptiMix Multi Manager Equity Jan-2013 Option A Direct ING OptiMix RetireInvest Series I ING Optimix Financial Planning Aggressive ING Optimix Financial Planning Aggressive Direct ING Optimix Financial Planning Cautious ING Optimix Financial Planning Cautious Direct ING Optimix Financial Planning Conservative ING Optimix Financial Planning Conservative Direct ING Optimix Financial Planning Prudent ING Optimix Financial Planning Prudent Direct ING Short Term Income ING Short Term Income Direct Mar-2007 May-2011 Jan-2013 May-2011 Jan-2013 May-2011 Jan-2013 May-2011 Jan-2013 Aug-2002 Jan-2013

----------Avg.

Debt: Ultra Short Term Unrated Debt: Ultra Short Term Unrated Hybrid: Others Hybrid: Others Hybrid: Others Hybrid: Others Debt: Short Term Debt: Short Term Unrated Unrated Unrated Unrated Unrated

--

Fund Name ING Tax Savings ING Tax Savings Direct ING Tax Savings Direct ING Treasury Advantage Inst ING Treasury Advantage Inst Direct

Launch Date Mar-2004 Jan-2013 Jan-2013 Mar-2007 Jan-2013

Category Equity: Tax Planning Equity: Tax Planning Equity: Tax Planning Debt: Ultra Short Term

Rating

Risk Grade Avg. --Below Avg. --

Return Grade Avg. --Above Avg. --

1 Year Expense Return Ratio 5.02 2.62 --8.88 -2.62 2.62 0.52 0.61

Unrated Unrated

Debt: Ultra Short Term Unrated

Debt: Ultra Short Term

BSL Floating Rate LT -G

Returns and Risk Aggregates Rating & Risk Fund Rating Fund Risk Grade Fund Return Grade Modern Portfolio Stat R-Squared Below Average Alpha Above Average Beta Volatility Measures 0.02 Mean 2.72 Standard Deviation 0.03 Sharpe Ratio

9.44 0.20 14.00

Das könnte Ihnen auch gefallen

- May 2011 Risk Grade Return Grade: Equity: Large CapDokument5 SeitenMay 2011 Risk Grade Return Grade: Equity: Large Capmoiz_tigerNoch keine Bewertungen

- HDFCDokument3 SeitenHDFCraheja_ashishNoch keine Bewertungen

- Fund Manager RRSF Equity:-Omprakash KuckianDokument16 SeitenFund Manager RRSF Equity:-Omprakash KuckianJoe BenzNoch keine Bewertungen

- Corporate Presentation - RetailDokument15 SeitenCorporate Presentation - RetailamitozNoch keine Bewertungen

- Institutional Characteristics Financing StructureDokument7 SeitenInstitutional Characteristics Financing StructurenancyagarwalNoch keine Bewertungen

- ValueResearchFundcard IDFCGSFInvestmentRegular 2013apr14Dokument6 SeitenValueResearchFundcard IDFCGSFInvestmentRegular 2013apr14gauravpandey1Noch keine Bewertungen

- PMS Pitch - String of Pearls PDFDokument40 SeitenPMS Pitch - String of Pearls PDFSatish Kumar SubudhiNoch keine Bewertungen

- India: Financial Services: Still Amid Choppy Waters Stocks Not Yet Ready For UpturnDokument25 SeitenIndia: Financial Services: Still Amid Choppy Waters Stocks Not Yet Ready For UpturnPranjayNoch keine Bewertungen

- Summer Internship Project ReportDokument29 SeitenSummer Internship Project ReportPallavi sharmaNoch keine Bewertungen

- ValueResearchFundcard HDFCEquity 2012sep21Dokument6 SeitenValueResearchFundcard HDFCEquity 2012sep21Gaurav KhullarNoch keine Bewertungen

- Indiabulls Gilt FundDokument4 SeitenIndiabulls Gilt FundYogi173Noch keine Bewertungen

- Jade Group: Company ProfileDokument18 SeitenJade Group: Company Profilesajd1Noch keine Bewertungen

- Investment ManagementDokument24 SeitenInvestment ManagementPratik PrakashNoch keine Bewertungen

- Comparative Analysis of HDFC Mutual Fund Schemes With Its CompetitorsDokument20 SeitenComparative Analysis of HDFC Mutual Fund Schemes With Its Competitorsvis8474Noch keine Bewertungen

- Live SchemesDokument20 SeitenLive SchemesHalai NileshNoch keine Bewertungen

- Personal Finance NotesDokument17 SeitenPersonal Finance NotesOggy SharmaNoch keine Bewertungen

- Type The Document TitleDokument60 SeitenType The Document TitledevrajkinjalNoch keine Bewertungen

- S&P 2018 10 24Dokument7 SeitenS&P 2018 10 24florent.montaubinNoch keine Bewertungen

- Financial Planning: S.B. Mainak Faculty Member National Insurance AcademyDokument55 SeitenFinancial Planning: S.B. Mainak Faculty Member National Insurance AcademyRajesh YadavNoch keine Bewertungen

- HDFC BANK (Housing Development Finance Corporation Limited)Dokument17 SeitenHDFC BANK (Housing Development Finance Corporation Limited)Academic BunnyNoch keine Bewertungen

- Fundcard DWSCashOpportunitiesRegDokument4 SeitenFundcard DWSCashOpportunitiesRegYogi173Noch keine Bewertungen

- Investment Returns Iii: Loose Ends: No Garnishing Allowed in Investment AnalysisDokument16 SeitenInvestment Returns Iii: Loose Ends: No Garnishing Allowed in Investment AnalysisAnshik BansalNoch keine Bewertungen

- Credit Rating MatrixDokument12 SeitenCredit Rating MatrixNaman SharmaNoch keine Bewertungen

- Types of Protection Plan: Retirement PlansDokument2 SeitenTypes of Protection Plan: Retirement PlansclementdsilvaNoch keine Bewertungen

- Reliance Money LTD: Presentation of Industrial Internship Project On Derivatives & Portfolio Management ServicesDokument40 SeitenReliance Money LTD: Presentation of Industrial Internship Project On Derivatives & Portfolio Management ServicesdashrathkabraNoch keine Bewertungen

- Valuation of GoodwillDokument27 SeitenValuation of Goodwillgaurivishwakarma215Noch keine Bewertungen

- Financial Ratio AnalysisDokument8 SeitenFinancial Ratio AnalysisrapsisonNoch keine Bewertungen

- Investment FundamentalsDokument16 SeitenInvestment FundamentalsJay-Jay N. ImperialNoch keine Bewertungen

- HDFC SlicDokument83 SeitenHDFC Slicsidd4893Noch keine Bewertungen

- Assignment of Personal Financial Planning MGT-636 Submitted To:-Bavdeep Singh Submitted By:-Ramandeep Kaur RQ3707B43 7450070076Dokument10 SeitenAssignment of Personal Financial Planning MGT-636 Submitted To:-Bavdeep Singh Submitted By:-Ramandeep Kaur RQ3707B43 7450070076Ramandeep GhangasNoch keine Bewertungen

- Personal Financial PlanningDokument25 SeitenPersonal Financial Planninghari gallaNoch keine Bewertungen

- Credit Operations: Div. Corporate, Middle, SME, Buss LinkageDokument2 SeitenCredit Operations: Div. Corporate, Middle, SME, Buss LinkagePutuMahayanaNoch keine Bewertungen

- Jeff Gundlach Fixed Income PlaybookDokument83 SeitenJeff Gundlach Fixed Income PlaybookValueWalk100% (1)

- FS Analysis Ratio AnalysisDokument88 SeitenFS Analysis Ratio AnalysisJane AtendidoNoch keine Bewertungen

- Mutual Fund RankDokument2 SeitenMutual Fund Rankdeep0523Noch keine Bewertungen

- Adr GDR Idr 2003Dokument25 SeitenAdr GDR Idr 2003Sumit AroraNoch keine Bewertungen

- Personal Investment Capsule 1newDokument22 SeitenPersonal Investment Capsule 1newgary_sawNoch keine Bewertungen

- NJ India PVTDokument4 SeitenNJ India PVTDivyesh GandhiNoch keine Bewertungen

- FMI MF Bond FundsDokument13 SeitenFMI MF Bond FundsChirag BadayaNoch keine Bewertungen

- DiptanshuDokument50 SeitenDiptanshukratika maheshwariNoch keine Bewertungen

- Equity OutlookDokument1 SeiteEquity OutlooksieausNoch keine Bewertungen

- Corporate Presentation Globe Capital Market LimitedDokument20 SeitenCorporate Presentation Globe Capital Market LimitedAmeet ChandanNoch keine Bewertungen

- SOURAV'S SIP ON SBI MUTUAL FUND (Introduction)Dokument106 SeitenSOURAV'S SIP ON SBI MUTUAL FUND (Introduction)sourabha86100% (1)

- Group 1 - CQ-CL-03 Final Group Presentation.Dokument43 SeitenGroup 1 - CQ-CL-03 Final Group Presentation.Dilru RasanjalikaNoch keine Bewertungen

- Types of Mutual Fund Schemes Offered by Baroda Pioneer Mutual FundDokument15 SeitenTypes of Mutual Fund Schemes Offered by Baroda Pioneer Mutual FundNeha KumariNoch keine Bewertungen

- Terminologies 1. Credit Creation-: How Banks Actually Work?Dokument4 SeitenTerminologies 1. Credit Creation-: How Banks Actually Work?Poorvi VermaNoch keine Bewertungen

- Portfolio ManagementDokument9 SeitenPortfolio ManagementvenkatpogaruNoch keine Bewertungen

- Combined Equity KIM June 21 2014 01Dokument66 SeitenCombined Equity KIM June 21 2014 01ginga716Noch keine Bewertungen

- HDFC Final Report PDFDokument59 SeitenHDFC Final Report PDFsheenampasrichaNoch keine Bewertungen

- Why You Should Have Multiallocation FundsDokument5 SeitenWhy You Should Have Multiallocation FundsRanjan SharmaNoch keine Bewertungen

- BDC II Newsletter December 2015: Month BDC Fund II Hfri Ehi S&P 500 TR Dow JonesDokument8 SeitenBDC II Newsletter December 2015: Month BDC Fund II Hfri Ehi S&P 500 TR Dow JoneshowellstechNoch keine Bewertungen

- Risk Profile Analysis PDFDokument2 SeitenRisk Profile Analysis PDFRico Goya ValdezNoch keine Bewertungen

- Nonprofit Financial Ratios WorksheetDokument5 SeitenNonprofit Financial Ratios WorksheetAldo FjeldstadNoch keine Bewertungen

- Financial Risk ManagementDokument7 SeitenFinancial Risk ManagementdewpraNoch keine Bewertungen

- Part 2 Cash Flow Analysis - v1Dokument8 SeitenPart 2 Cash Flow Analysis - v1Johnny TsimNoch keine Bewertungen

- On Debt MarketsDokument73 SeitenOn Debt MarketsrashmiNoch keine Bewertungen

- A Fighting Chance: The High School Finance Education Everyone DeservesVon EverandA Fighting Chance: The High School Finance Education Everyone DeservesNoch keine Bewertungen

- Dr. AmbedkarDokument6 SeitenDr. AmbedkarNiraj VishwakarmaNoch keine Bewertungen

- Apollo PVTDokument1 SeiteApollo PVTNiraj VishwakarmaNoch keine Bewertungen

- Finance BookletDokument13 SeitenFinance BookletNiraj VishwakarmaNoch keine Bewertungen

- Constitution of IndiaDokument7 SeitenConstitution of IndiaNiraj VishwakarmaNoch keine Bewertungen

- Career With UsDokument2 SeitenCareer With UsNiraj VishwakarmaNoch keine Bewertungen

- Apollo PVTDokument1 SeiteApollo PVTNiraj VishwakarmaNoch keine Bewertungen

- 45654897Dokument1 Seite45654897saravanavelu39Noch keine Bewertungen

- Balance Sheet and Ratio Analysis of ItcDokument3 SeitenBalance Sheet and Ratio Analysis of ItcNiraj VishwakarmaNoch keine Bewertungen

- InflationDokument6 SeitenInflationNiraj VishwakarmaNoch keine Bewertungen

- InflationDokument6 SeitenInflationNiraj VishwakarmaNoch keine Bewertungen

- Indians Now Our Top MigrantsDokument31 SeitenIndians Now Our Top MigrantsNiraj VishwakarmaNoch keine Bewertungen

- Venture Capital in India - SEBI ReportDokument52 SeitenVenture Capital in India - SEBI Reportjaknap1802Noch keine Bewertungen

- A Primer For Investment Trustees: Jeffery V. Bailey, CFA Jesse L. Phillips, CFA Thomas M. Richards, CFADokument120 SeitenA Primer For Investment Trustees: Jeffery V. Bailey, CFA Jesse L. Phillips, CFA Thomas M. Richards, CFANiraj VishwakarmaNoch keine Bewertungen

- 06 FMA119 ASlides 34Dokument28 Seiten06 FMA119 ASlides 34Sean LcfNoch keine Bewertungen

- SebiDokument7 SeitenSebiAbhijeit BhosaleNoch keine Bewertungen

- Udin 2017Dokument37 SeitenUdin 2017msa_imegNoch keine Bewertungen

- Valuation of Open Item in Foreign CurrencyDokument12 SeitenValuation of Open Item in Foreign CurrencyVivek KumarNoch keine Bewertungen

- Performanta FinanciaraDokument9 SeitenPerformanta Financiarad0% (1)

- Hybrid Financing: Preferred Stock, Warrants, and ConvertiblesDokument4 SeitenHybrid Financing: Preferred Stock, Warrants, and ConvertiblesGungGek - ismNoch keine Bewertungen

- BFDokument11 SeitenBFTaher JamilNoch keine Bewertungen

- How To Manage Regulatory RiskDokument3 SeitenHow To Manage Regulatory Riskk3wlm3Noch keine Bewertungen

- Derivative'sDokument19 SeitenDerivative'svahid100% (2)

- Full Dissertation - Emerson Galina - Final After Defense - March 12th - 2019 PDFDokument108 SeitenFull Dissertation - Emerson Galina - Final After Defense - March 12th - 2019 PDFMarioNoch keine Bewertungen

- Us6421653 Ref 4Dokument63 SeitenUs6421653 Ref 4Gek CagatanNoch keine Bewertungen

- PK Tax News Jun 2008Dokument2 SeitenPK Tax News Jun 2008PKTaxServicesNoch keine Bewertungen

- Holt Cfroi ModelDokument8 SeitenHolt Cfroi ModelJosephNoch keine Bewertungen

- Question Bank IFDokument17 SeitenQuestion Bank IF919Pranav ShedgeNoch keine Bewertungen

- Doubtful Receivables & Bad DebtDokument4 SeitenDoubtful Receivables & Bad DebtsrinivasNoch keine Bewertungen

- Credit InstrumentsDokument67 SeitenCredit InstrumentsAnne Gatchalian100% (2)

- Asset Liability Management Canara BankDokument102 SeitenAsset Liability Management Canara BankAkash Jadhav0% (1)

- DELLFY10 Q2 Earnings PresentationDokument23 SeitenDELLFY10 Q2 Earnings PresentationwagnebNoch keine Bewertungen

- Constituents of The Financial System DD Intro NewDokument17 SeitenConstituents of The Financial System DD Intro NewAnonymous bf1cFDuepPNoch keine Bewertungen

- The Monster Guide To Candlestick PatternsDokument37 SeitenThe Monster Guide To Candlestick Patternsbrindha100% (6)

- International Financial Management/Fbe 436: Course SyllabusDokument15 SeitenInternational Financial Management/Fbe 436: Course SyllabusRuchit GandhiNoch keine Bewertungen

- Fin2700 Money, Banking and Financial Market Course Outline ABACDokument6 SeitenFin2700 Money, Banking and Financial Market Course Outline ABACPete JoempraditwongNoch keine Bewertungen

- Corporate ResturctureDokument26 SeitenCorporate ResturcturehetugotuNoch keine Bewertungen

- SampleDokument42 SeitenSampleArti GroverNoch keine Bewertungen

- 315 Strategy For Swing TradingDokument5 Seiten315 Strategy For Swing Tradingmr_ajeetsingh50% (2)

- Chapter 3Dokument22 SeitenChapter 3Feriel El IlmiNoch keine Bewertungen

- The Philippine Financial MarketDokument14 SeitenThe Philippine Financial MarketKylie Tarnate50% (2)

- Singapore Stock Exchange HardDokument24 SeitenSingapore Stock Exchange Harddesaichit_cdNoch keine Bewertungen

- 205 Fin MCQ 1Dokument30 Seiten205 Fin MCQ 1Azhar AliNoch keine Bewertungen

- International Financial Management Abridged 10 Edition: by Jeff MaduraDokument21 SeitenInternational Financial Management Abridged 10 Edition: by Jeff MaduraZohaib MaqboolNoch keine Bewertungen

- 361 Chapter 9 MC SolutionsDokument24 Seiten361 Chapter 9 MC SolutionsLouie De La TorreNoch keine Bewertungen

- M14 Krugman 46657 09 IE C14 FDokument50 SeitenM14 Krugman 46657 09 IE C14 FlucipigNoch keine Bewertungen