Beruflich Dokumente

Kultur Dokumente

Appendix A - Market Study

Hochgeladen von

Edmund PaulOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Appendix A - Market Study

Hochgeladen von

Edmund PaulCopyright:

Verfügbare Formate

East African Community (EAC)

Feasibility Study for a Natural Gas Pipeline from Dar es Salaam to Tanga (Tanzania) and Mombasa (Kenya)

Market Study

April 2011

Market study-Natural Gas Pipeline from Dar to Mombasa

Table of Contents

List of Abbreviations and Units 1 2 2.1 2.2 2.3 3 3.2 3.3 3.4 3.5 3.6 4 4.1 4.2 4.3 4.4 5 5.1 5.2 6 Background Scope of the project Involved parties Present infrastructure Extension of pipeline Dar es Salaam Market Dar es Salaam Projection Tanga market Other domestic markets Tanzania projection Rakgas gas demand forecast Tanzania Mombasa market Power sector gas demand Industrial gas demand Mombasa projections Rakgas gas demand forecast Mombasa Gas production and demand Gas production Gas demand References 2 4 5 5 6 6 8 10 11 11 11 12 14 14 16 17 18 19 19 19 22

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

List of Abbreviations and Units

Abbreviations AfDB CNG EWURA ENPV ERR FIRR FNPV LNG NBV Orca PAT Songas TANESCO TPDC African Development Bank Compressed Natural Gas Energy and Water Utilities Regulatory Authority, Tanzania Economic Net Present Value Economic Internal Rate of Return Financial Internal Rate of Return Financial Net Present Value Liquefied Natural Gas Netback Value Orca Exploration Group Inc. PanAfrican Energy Tanzania Songas Limited Tanzania Electric Supply Company Tanzania Petroleum Development Corporation

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

Volumes scf scfd Mscf MMscf Bcf Nm^3 1 scf 1 scf Standard Cubic Feet Standard Cubic Feet per day 10^3 Standard Cubic Feet 10^6 Standard Cubic Feet 10^9 Standard Cubic Feet Normal Cubic Metre 0.0268 Nm^3 0.028 Sm^3

Energy kW 1 kJ 1 MJ 1 kWh 1 scf 1 Nm^3 1 Sm^3 10^3 Watt 1.055 BTU = 10^3 Joule 10^6 Joule 3.6 MJ 1.025 BTU 39.9 MJ 36.35 MJ

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

Background

This report is part of the Phase 2 outputs from the Feasibility Study for a Natural Gas Pipeline from Dar es Salaam to Tanga and Mombasa. The report comprises the output from Activities 4 and 7. Gas demand The potential demand is separated in demand for Dar es Salaam, demand for Tanga, and demand for Mombasa. The Dar es Salaam market is not relevant as such for the feasibility study of the extension of the gas pipeline from Dar es Salaam to Mombasa. However, the market study is used to determine if the there will be sufficient supply of gas and capacity in existing (and decided) infrastructure, to cover the domestic demand in Tanzania and expected exports to Kenya. The market study for Dar es Salaam is mainly based on information from EAC1, TPDC2, TANESCO3, Songas and ORCA Exploration Group4, as well as information from Energy and Water Utilities Regulatory Authority (EWURA). So far there is only little information available about the potential demand in Tanga, and no information about the potential demand in Arusha and Moshi. The demand for Mombasa is mainly based on information from Ministry of Energy and the Kenya LNG Study5and the Least Cost Power Development Plan6. Gas supply The potential supply of gas from Songo Songo is based on information from the operator of the gas field at Songo Songo7. The Market Study was submitted to counterpart by end of October 2010 for commenting. The comments received have been incorporated in this version.

The East African Power Master Plan Study Pre-feasibility Study of Gas Pipeline Development, Rakgas Tanzania Limited, 25 November 2009 as well as power point presentation of potential gas demend in Tanzania 3 TANESCO website 4 Strategic Growth, Annual Report 2009, Orca Exploration Group Inc. 5 Kenya LNG Study Phase 1Final Report, Ministry of Energy, Republic of Kenya 2010 6 Least Cost Power Development Plan, Study Period 2010-2030, Ministry of Energy Kenya, 31 March 2010 7 See 4.

2 1

Comments from counterparts

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

2

2.1

Scope of the project

Involved parties

Tanzania Petroleum Development Corporation (TPDC), which is a state owned company, owns the reserves in Songo Songo jointly with PanAfrican Energy Tanzania (PAT). There is a Production Sharing Agreement (PSA) between TPDC and PAT. A proportion of the Songo Songo gas, called Protected Gas, is sold to Songas Limited (Songas) under a 20 year gas agreement. Songas Limited (Songas) is the owner of the wells, the gas processing plant and the pipeline from Songo Songo to Ubungo. Songas is the operator of the high pressure pipeline system and the Ubungo power plant. Shareholders of Songas are Globeleq, TPDC, TANESCO, Tanzania Development Finance Company Limited (TDFL) and FMO from the Netherlands. ORCA Exploration (Orca) operates in Tanzania through its wholly owned subsidiary PanAfrican Energy Tanzania (PAT). Orca/PAT and TPDC have an exclusive right to produce and market Additional Gas (see section 3.1.2), which is all gas reserves from Songo Songo in excess of Protected Gas (see section 3.1.1). Orca/PAT has been contracted by Songas to operate the wells and the gas processing plant and Orca/PAT owns and operates the gas distribution system in Dar es Salaam (Ringmain). Tanzania Electric Supply Company Limited (TANESCO) is a state owned power production, transmission and distribution company. TANESCO is shareholder of Songas and buys electricity from the Songas owned Ubungo Power Plant according to a Power Purchase Agreement. TANESCO also buys Additional Gas from Orca/PAT for operation of the TANESCO owned power plants at Ubungo and Tagete. Globeleq is the principal shareholder of Songas, through the financing subsidiary Globeleq East Africa Capital Limited.

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

2.2

2.2.1

Present infrastructure

Initial project

Reserves

The gas is produced from the Songo Songo main field with an estimated reserve GIIP of 1345 Bcf by the end of 2009. The infrastructure that processes and transports the gas from the Songo Songo field to Ubungo near Dar es Salaam was commissioned in July 20048. The infrastructure comprises a gas processing facility on Songo Songo with two gas processing trains; a 25 kilometres 12" offshore pipeline from the field to the Somanga Funga Landfall; a 207 kilometres 16" onshore pipeline to the Ubungo power plant; a 16 kilometres 8" lateral pipeline to the Wazo Hill cement plant.

Infrastructure

The gas processing facility on Songo Songo has a capacity of 2* 35 MMscfd. The original specifications of the pipeline from Songo Songo Island to Ubungo would allow a capacity of approximately 65 MMscfd. During the development Government of Tanzania decided to increase the dimension to allow for a capacity of 105 MMscfd. GOT borrowed USD 4.386 million from IDA to finance the increase in pipeline capacity from Songo Songo to Ubungo (Over-sizing). Distribution The low pressure distribution system comprises 50 kilometres of low pressure pipeline in Dar es Salaam, four pressure reduction stations and two separate connections to the 16" high pressure pipeline.

2.2.2 Expansion project During 2009 Songas has proposed a new long term infrastructure expansion project comprising two new gas processing trains and pipeline compression to increase the throughput capacity to 144 MMscfd9.

2.3

Extension of pipeline

The scope of this study is the extension of the pipeline from Ubungo to Mombasa.

8 9

Strategic Growth, Annual Report 2009, Orca Exploration Group Inc. Ibid p. 19

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

The problem about sufficient transport capacity from Songo Songo to Ubungo will not be addressed in this feasibility study. In the report on "Methodology for Financial and Economic Analysis" it is assumed that the gas transported to Mombasa is charged a transport tariff for transport from Songo Songo to Ubungo similar to the processing and transport tariff charged to Additional Gas.

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

Dar es Salaam Market

The market in Dar es Salaam consists of power plants and industrial consumers. In the following the demand in Dar is assessed with the purpose to identify assumptions for the Mombasa market to be assessed in section 5. The Dar es Salaam market is separated in Protected Gas and Additional Gas.

3.1.1 Protected gas Under the Gas Processing and Transportation Agreement signed in 2001, the Protected Gas from Songo Songo is sold under a 20 year gas agreement to Songas for: Operation of turbines at the Ubungo power plant (182MW); Onward sale to the Tanzania Portland Cement Company (TPCC) for the operation of kilns 2 and 3 at the Wazo Hill cement plant; Electrification of villages along the pipeline.

The gas agreement is running from July 31, 2004 until July 31, 2024. The consumption of Protected Gas is 80.5% of total gas consumption at the Ubungo complex.

3.1.2 Additional gas Additional gas is sold by Orca/PAT to: Operation of turbines at the Ubungo power plant (42 MW); Onward sale to TANESCO Ubungo power plant (102 MW) in operation August 2008; Onward sale to TANESCO Tegeta power plant (45 MW) commissioned in November 2009; Onward sale to TPCC for operation of kiln 4 at the Wazo Hill cement plant in operation March 2009;

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

Onward sale to 32 industries and 1 hotel by the end of 2009. About 10 potential industrial customers are waiting for connection10.

The consumption of Additional Gas is 19.5% of total gas consumption at the Ubungo complex. By the end of 2009 there was 189 MW of installed gas fired generation in Tanzania that is being powered by Additional Gas.

Table 1 Assumptions for power sector gas demand in Dar es Salaam

Installed capacity MW Ubungo (Protected Gas) TANESCO Ubungo TANESCO Tegeta

Source: TANESCO and TPDC

Load factor % 185 102 45 77 70 80

Efficiency

Commission year

% 40 40 Jan 2009 40 Oct 2009

3.1.3 Projections for the power sector The power plant IPTL and Dowans are not converted to gas because of a dispute11. We assume that IPTL will be connected in 2012 and Dowans two years later in 2014. A new power plant Kinyerezi could be connected in 2017.

Table 2 Assumptions about power plants to be connected

Installed capacity

Load factor

Efficiency

Assumed connection year

MW IPTL Dowans Kinyerezi

Source: TANESCO and TPDC

% 100 112 240 70 70 70

% 40 40 34 2012 2014 2017

10 11

Information from TPDC Strategic Growth, Annual Report 2009, Orca Exploration Group Inc.

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

10

The connection years are based on the assumption that there will be financial as well as labour force limitations to undertake several large infrastructure projects at the same time.

3.1.4 Projections for industrial sector TPDC has informed that about 10 potential industrial consumers are waiting for connection12 Orca/PAT do not expect major increase in the number of industrial customers but an increase in the demand from already connected customers. Based on the application from Songas for an adjustment of the gas processing and transportation tariff, EWURA13 made a forecast for industrial consumption from 2010 to 2014.

3.2

Dar es Salaam Projection

We operate with 3 scenarios for Dar es Salaam. Dar Low: Power sector demand for gas until 2017 as described in section 3.1.3 and then constant, i.e. further increases in electricity demand will be based on hydro power and other fuels. Industrial sector demand for gas until 2014 as described in section 3.1.4 and then constant.

Dar Medium: Power sector demand for gas until 2017 as described in section 3.1.3 (same as for Dar Low) and then the demand will increase with an assumed growth of 1% per year until 2035. Industrial sector demand for gas until 2014 as described in section 3.1.4 (same as Dar Low) and then the demand will increase with an assumed growth of 1% per year until 2035.

Dar High: Power sector demand for gas until 2017 as described in section 3.1.3 (same as for Dar Low) and then the demand will increase with an assumed growth of 2% per year until 2035.

Information from TPDC Memorandum on Songas Processing and Transportation Tariff Adjustment, EWURA, order No. 09-004.

13

12

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

11

Industrial sector demand for gas until 2014 as described in section 3.1.4 (same as Dar Low) and then the demand will increase with an assumed growth of 2% per year until 2035.

The assumed growth rates are based on growth in the demand of gas of 1% (medium) and 2% (high) per year. This does not mean that the growth in the economy in general or in that region is limited to a growth of 1 or 2 %. An economic growth in a region of 5-10% does not necessarily increase the gas demand with 5-10%.

3.3

Tanga market

So far there is not much information about the potential market in Tanga. According to the Minutes of Meeting from the Inception meeting September 2010, TPDC has informed that the industrial market in Tanga is around 8-10 MMscfd of which the cement plant will be the main consumer. EAC has in March 2011 informed about considerations of a new power plant of 100 MW in Tanga. Due to the timing of this information the 100 MW are not included in the calculations.

3.4

Other domestic markets

Gas supply to the markets in Arusha and Moshi will depend on the feasibility of the main pipeline from Dar es Salaam. The demands from the potential markets in Arusha and Moshi are estimated to be small and will not as such influence the decision about implementing the main pipeline. The market in Bagamoyo may be supplied depending on the routing of the main pipeline.

3.5

Tanzania projection

The total domestic demand for gas comprising Dar es Salaam and Tanga is presented below (excluding the plans on a new 100 MW power plant in Tanga).

Table 3 Potential gas demand in Dar es Salaam

2009

2035 Low

2035 High MMscfd 212 16 228

MMscf MMscfd MMscf Power sector Industry Total 19,725 3,296 23,021 54 9 63 46,227 4,974 51,201

MMscfd MMscf 127 14 140 77,357 5,749 83,106

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

12

The daily demand is calculated as annual demand divided by 365. Songas is currently processing and transporting up to 70 MMscfd of natural gas to markets in Dar es Salaam14. With a market in Tanga of approximately 10 MMscfd15 the total 2035 domestic demand would be approximately 3,650 MMscfd (Low) and 6,108 MMscfd (High).

3.6

Rakgas gas demand forecast Tanzania

In November 2009, Rakgas Tanzania Limited presented a pre-feasibility study16 comprising a projection of the gas market in Tanzania and Kenya.

Table 4

Rakgas/PDC gas demand forecast Tanzania

MMscfd 1 Songo Songo customers 2 Additional 300 MW near Dar 3 300 MW in Tanga 4 Additional industrial Total 160 60 60 15 295

Comments: Re. 1: It is not possible to identify the power plants included as Songo Songo customers. An increase in gas consumption from 60 MMscfd to 160 MMscfd should correspond to an increase of around 500 MW new power generation capacity. IPTL and Dowans are around 210 MW together, which leaves almost 300 MW undocumented. Re. 2: We believe that the additional 300 MW near Dar is the 250 MW in Kinyerezi. Re. 3: The expected 300 MW thermal capacity in Tanga is not included in neither TANESCO planning nor EAC planning.

Application to EWURA for approval of a revised gas processing and transportation tariff, October 23, 2008. 15 Information from TPDC 16 Pre-feasibility Study of Gas Pipeline Development, Processing, Transportation and Distribution: Tanzania. PDC - Rakgas Tanzania Limited, 25 November 2009.

14

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

13

Re. 4: We find this a high estimate if it refers to additional industry but realistic if it is total industry. Reducing the Rakgas/PDC with 2*300 MW power generation capacity corresponding to around 120 MMscfd results in a total demand of 175 MMscfd from 2017. We have not made an appraisal of the Rakgas study but used it to double check available information.

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

14

Mombasa market

The basic source for information about the potential market in Mombasa is the LNG study17 and the Least Cost Power Development Plan (LCPDP)18.

4.1

Power sector gas demand

4.1.1 Present potential gas demand According to the LCPDP there are four existing power plants in the Mombasa area that could be converted to gas. In addition one plant - Kipevu III - is expected to be commenced in 2011. The following general assumptions are made about the power plants:

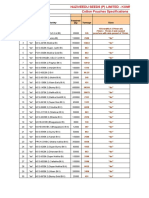

Table 5 Assumptions for power sector gas demand in Mombasa

Installed capacity MW Kipevu I Kipevu II Tsavo Kipevu GT Rabai

Fuel type

Load factor %

Efficiency

Retirement year

% 80 80 40 40 2024 2019

75 Diesel 74 Diesel

60 Kerosene 90 Diesel

80 90

40 40

2014

Source: Least Cost Power Development Plan, Ministry of Energy March 2010.

Kenya LNG Study Phase 1Final Report, Ministry of Energy, Republic of Kenya 2010 Least Cost Power Development Plan, Study Period 2010-2030, Ministry of Energy Kenya, 31 March 2010

18

17

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

15

4.1.2 Future potential gas demand In addition to the commencement of Kipevu III in 2011, we assume that a new capacity of 300 MW is installed in 2014 and further 300 MW in 2017. A new 400 kV electricity transmission line is being constructed from Mombasa to Nairobi. The line shall transfer electricity from thermal power plants in coastal area to Nairobi. The power plants include the Kipevu III 120 MW as well as a proposed 300 MW coal fired plant expected to be commenced in 2014. The transmission line is being financed by Government of Kenya, African Development Bank, European Investment Bank and the French Development Agency19. The LCPDP have no details about the amount of conventional thermal power plant to be built in the period 2010-2030. In section 5.5.4 it is mentioned that gas turbines are modelled at an estimated cost of 833 USD/kW which is a competitive unit cost compared to other thermal solutions. The LCPDP concludes that "Though these plants have low initial capital outlay, they have high operational costs subject to fluctuations in international crude prices"20 It is assumed that the future value of CO2 emission will make electricity produced on natural gas competitive with electricity produced on coal and the 600 MW expected for Nairobi is included in the projection.

Table 6 Assumptions for new power plants in Mombasa area

Installed capacity MW Kipevu III New 1 New 2

Fuel type

Load factor %

Efficiency

Commencing year

% 90 90 90 50 50 50 2011 2014 2017

120 Diesel 300 Coal 300 Coal

www.powergenworldwide.com August 2010 Least Cost Power Development Plan, Study Period 2010-2030, Ministry of Energy Kenya, 31 March 2010, page 66.

20

19

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

16

4.2

Industrial gas demand

4.2.1 Present potential gas demand According to the LNG study21 a number of large industries are identified as potential gas customers. We assume that these industries can convert to gas rather fast so they will be ready to connect when the gas is available in Mombasa.

Table 7 Fuel consumption in existing industries

Fuel type Athi River Cement Mabati Rolling Mills Mabati Rolling Mills - heating Bamburi cement plant Milly Glass Works Milly Glass Works Coal

Unit Metric tons

Unit per year 2009 125,000

LPG

Cubic metres

3,927

Electricity

GWh

131

Coal

Metric tons

100,740

Diesel

litres

5,666,667

LPG

Cubic metres

2,655

Source: Kenya LNG study, 2010

4.2.2 Future potential gas demand There have been significant variations in GDP in constant prices in Kenya during the last 10 years. According to IMF the GDP growth in 2007 was 7.1% while the growth in 2009 was 2.5%. The real growth of GDP for 2010 is expected by IMF to be around 4%. The LNG study assumes that industrial consumption will increase with 5% per year. The LNG study operates with a low and a high case for industrial demand projection. The low case includes conversion of diesel and electricity consumers mentioned industries. The high case includes conversion as in the low case supplemented by the coal consumers. The LNG study assumes that the industrial growth in the region will continue to grow at approximately 5% per year

21

Kenya LNG Study Phase 1Final Report, Ministry of Energy, Republic of Kenya 2010

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

17

which will be directly reflected in the consumption of end-users22. We find this growth rate high as an average for the next 20 years and have reduced the rate to 2% per year in our forecast. We assume that all potential consumers mentioned in section 4.2.1 (also coal fired) are converting to natural gas when available. After conversion we operate with three scenarios as described in section 4.3. It is further assumed that potential industrial customers will be offered a discount in tariff to compensate for conversion costs and provide an incentive (see the report Methodology for Financial and Economic Analysis section 4.3).

4.3

Mombasa projections

We operate with 3 scenarios: Mombasa Low: Power sector demand for gas until 2017 will increase as described in section 5.1.2 (which includes the 600MW expected to be transported to Nairobi) and then constant until 2035, i.e. the further increase in electricity demand will be covered by other sources than gas. Industrial sector demand for gas comprises a conversion of the potential demand described in 4.2.2 and then constant.

Mombasa Medium: Power sector demand for gas until 2017 will increase as described in section 4.1.2 (same as Mombasa Low) and then increase will an assumed annual growth of 1% until 2035. Industrial sector demand will be built up as described in section 4.2.2 (same as Mombasa Low) and then increase with an assumed annual growth of 1% until 2035.

Mombasa High: Power sector demand for gas until 2017 will increase as described in section 4.1.2 (same as Mombasa Low) and then increase will an assumed annual growth of 2% until 2035. Industrial sector demand will be built up as described in section 4.2.2 (same as Mombasa Low) and then increase with an assumed annual growth of 2% until 2035.

Kenya LNG Study Phase 1Final Report, Ministry of Energy, Republic of Kenya 2010, page 54

22

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

18

The 600 MW to be installed in the Mombasa area with export to Nairobi will have an expected consumption of 33,000 MMscf or 90 MMscfd which is more than half of the Mombasa low scenario power sector demand from 2017. The 2009 figures in table 8 is what the demand would be if potential consumers could connect to a gas pipeline.

Table 8 Potential gas demand in Mombasa

2009

2035 Low MMscfd 153.9 16.9

2035 High MMscf 94,027 10,321 MMscfd 257.6 28.3 285.9

MMscf MMscfd MMscf Power sector Industry Total 19,008 6,167 25,176 52.1 16.9 69.0 56,188 6,167 62,355

170.8 104,347

The daily demand is calculated as annual demand divided by 365. Without the 600 MW power plant the low scenario demand would be reduced to approximately 29,271 MMscf or 80.2 MMscfd in 2035.

4.4

Rakgas gas demand forecast Mombasa

In November 2009, Rakgas Tanzania Limited presented a pre-feasibility study23 comprising a projection of the gas market in Tanzania and Kenya.

Table 9 Rakgas/PDC gas demand forecast Kenya

MMscfd Power sector Industry Total 60 40 100

Rakgas/PDC assumes that the planned 300 MW coal fired capacity will be replaced by natural gas. The industrial demand is expected to be mainly from the cement factory.

Pre-feasibility Study of Gas Pipeline Development, Processing, Transportation and Distribution: Tanzania. PDC - Rakgas Tanzania Limited, 25 November 2009.

23

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

19

5

5.1

Gas production and demand

Gas production

The operator Orca24 has informed that by 31December 2009 there was a production capacity of 217 MMscfd of which a required peak supply of approximately 45 MMscfd of Protected Gas. Management's Best Case assessment of Gas Initially in Place is 1,571 Bcf for the Songo Songo Field and Songo Songo North, with additional 727 Bcf in Songo Songo West. In total approximately 2,300 Bcf25.

5.2

Gas demand

The total projected demand from Dar es Salaam and Mombasa for the period 2012 to 2035 is presented below.

Table 10 Total gas demand 2012-2035

Low Bcf Dar and Tanga Mombasa Total 1,209 1,215 2,424

Medium Bcf 1,382 1,435 2,817

High Bcf 1,597 1,699 3,295

Even with the low scenarios there will be a critical balance between potential gas supply and potential demand. The low scenario will be reduced by approximately 662 Bcf if the 600 MW power capacity expected in Mombasa for electricity supply to Nairobi is not connected to gas. In that case there would be sufficient gas supply from Songo Songo. But with the information of the vast

24 25

Strategic Growth, 2009 Annual Report, Orca Exploration Group Inc. Ibid

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

20

gas reserves in Mnazi Bay there should be sufficient of gas to supply the demand in all scenarios. The demand in Dar es Salaam and Mombasa will at the project start be at the same amount around 25,000 MMscf in each city, but the market in Mombasa has a higher share of potential industrial consumers. In general industrial consumers have a higher willingness to pay compared to the power sector, but among the industries in Mombasa are industries that today use coal as fuel. In the low scenario the demand from the power sector in Mombasa increases more than the power sector in Dar es Salaam which is caused be an assumed connection of additional 720 MW. However, this increase is mainly caused by the 600 MW (33,000 MMscf) that is expected to supply Nairobi through the new transmission line and these power plants are - so far - assumed by Government of Kenya to be coal fired with a corresponding lower willingness to pay depending on the future price on carbon credits.

Figure 1

100,000 80,000 60,000 40,000 20,000 -

Gas market in Dar

Dar Market, MMscf

Dar, Low growth (constant from 2017)

Dar, 2% growth

Dar, 1% growth

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

21

Figure 2

140,000 120,000 100,000 80,000 60,000 40,000 20,000 -

Gas market in Mombasa

Mombasa Market, MMscf

Mombasa, 2% growth

Mombasa, 1% growth

Mombasa, low growth

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

22

References

East African Community: East African Power Master Plan East African Community Secretariat, Report of the 17th Meeting of the Energy Committee, Arusha, June 2010. East African Petroleum Conference 2007: Songo Songo and Mnazi Bay Gas Projects: Contribution to Economic Development, Eng. Joyce Kisamo, TPDC, March 2007. Kenya: Kenya LNG Study, Phase 1 Final Report, Ministry of Energy, Republic of Kenya, 2010. Kenya Vision 2030, Sector Plan for Energy 2008-2012, Government of the Republic of Kenya, 2008. Least Cost Power Development Plan, Study Period 2010-2030, Ministry of Energy, Republic of Kenya, 2010. Power Situation in Kenya, Hindpal S. Jabbal, Energy Regulatory Commission, August 2009. Tanzania: Application to EWURA for approval of a revised gas processing and transportation tariff, 23 October 2008. Memorandum on Songas Processing and Transportation Tariff Adjustment, EWURA order No. 09-004.27 February 2009. Pre-feasibility Study of Gas Pipeline Development, Rakgas Tanzania Limited, 25 November 2009

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Market study-Natural Gas Pipeline from Dar to Mombasa

23

Strategic Growth, Annual Report 2009, Orca Exploration Group Inc. TANESCO website Tanzania Gas Development and Utilization, Eng. Joyce Kisamo, Tanzania Petroleum Development Corporation, 2009. Tanzania Petroleum Development Corporation. The Export of Gas and Electricity from Tanzania to Kenya, Pre-Feasibility Study, February 1992. TPDC power point presentations.

http://projects.cowiportal.com/ps/A005705/Documents/3 Project documents/4_Report/Phase3/P-073620-033.docx

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- ToR For Capacity Building Consultants Jul2014Dokument2 SeitenToR For Capacity Building Consultants Jul2014Edmund PaulNoch keine Bewertungen

- Terms of Reference - Kap Eu Vac TanzaniaDokument9 SeitenTerms of Reference - Kap Eu Vac TanzaniaEdmund PaulNoch keine Bewertungen

- Unit 10Dokument22 SeitenUnit 10Edmund PaulNoch keine Bewertungen

- Clement Asuliwonno 2011Dokument90 SeitenClement Asuliwonno 2011Edmund PaulNoch keine Bewertungen

- Agricultural Marketing and Supply Chain Management in TanzaniaDokument72 SeitenAgricultural Marketing and Supply Chain Management in TanzaniaEdmund PaulNoch keine Bewertungen

- Prospects For Jatropha Biofuels in Developing Countries: An Analysis For Tanzania With Strategic Niche ManagementDokument22 SeitenProspects For Jatropha Biofuels in Developing Countries: An Analysis For Tanzania With Strategic Niche ManagementEdmund PaulNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Case 3 GROUP-6Dokument3 SeitenCase 3 GROUP-6Inieco RacheleNoch keine Bewertungen

- 1 3 Quest-Answer 2014Dokument8 Seiten1 3 Quest-Answer 2014api-246595728Noch keine Bewertungen

- Garden Club of Virginia RestorationsDokument1 SeiteGarden Club of Virginia RestorationsGarden Club of VirginiaNoch keine Bewertungen

- Venue:: Alberta Electrical System Alberta Electrical System OperatorDokument48 SeitenVenue:: Alberta Electrical System Alberta Electrical System OperatorOmar fethiNoch keine Bewertungen

- Coerver Sample Session Age 10 Age 12Dokument5 SeitenCoerver Sample Session Age 10 Age 12Moreno LuponiNoch keine Bewertungen

- HUAWEI P8 Lite - Software Upgrade GuidelineDokument8 SeitenHUAWEI P8 Lite - Software Upgrade GuidelineSedin HasanbasicNoch keine Bewertungen

- BUS 301 - Hospitality Industry Vietnam - Nguyễn Thị Thanh Thuý - 1632300205Dokument55 SeitenBUS 301 - Hospitality Industry Vietnam - Nguyễn Thị Thanh Thuý - 1632300205Nguyễn Thị Thanh ThúyNoch keine Bewertungen

- 755th RSBDokument32 Seiten755th RSBNancy CunninghamNoch keine Bewertungen

- Narrative of John 4:7-30 (MSG) : "Would You Give Me A Drink of Water?"Dokument1 SeiteNarrative of John 4:7-30 (MSG) : "Would You Give Me A Drink of Water?"AdrianNoch keine Bewertungen

- STS INVENTOR - Assignment 3. If I Were An Inventor For StsDokument2 SeitenSTS INVENTOR - Assignment 3. If I Were An Inventor For StsAsuna Yuuki100% (3)

- Peptic UlcerDokument48 SeitenPeptic Ulcerscribd225Noch keine Bewertungen

- Jesus Hold My Hand EbDokument2 SeitenJesus Hold My Hand EbGregg100% (3)

- Cotton Pouches SpecificationsDokument2 SeitenCotton Pouches SpecificationspunnareddytNoch keine Bewertungen

- Cui Et Al. 2017Dokument10 SeitenCui Et Al. 2017Manaswini VadlamaniNoch keine Bewertungen

- SOLO FrameworkDokument12 SeitenSOLO FrameworkMaureen Leafeiiel Salahid100% (2)

- A Brief History of LinuxDokument4 SeitenA Brief History of LinuxAhmedNoch keine Bewertungen

- AX Series Advanced Traffic Manager: Installation Guide For The AX 1030 / AX 3030Dokument18 SeitenAX Series Advanced Traffic Manager: Installation Guide For The AX 1030 / AX 3030stephen virmwareNoch keine Bewertungen

- EMP Step 2 6 Week CalendarDokument3 SeitenEMP Step 2 6 Week CalendarN VNoch keine Bewertungen

- Research On Goat Nutrition and Management in Mediterranean Middle East and Adjacent Arab Countries IDokument20 SeitenResearch On Goat Nutrition and Management in Mediterranean Middle East and Adjacent Arab Countries IDebraj DattaNoch keine Bewertungen

- CA39BDokument2 SeitenCA39BWaheed Uddin Mohammed100% (2)

- Harper 2001Dokument6 SeitenHarper 2001Elena GologanNoch keine Bewertungen

- SPE-199498-MS Reuse of Produced Water in The Oil and Gas IndustryDokument10 SeitenSPE-199498-MS Reuse of Produced Water in The Oil and Gas Industry叶芊Noch keine Bewertungen

- Effect of Innovative Leadership On Teacher's Job Satisfaction Mediated of A Supportive EnvironmentDokument10 SeitenEffect of Innovative Leadership On Teacher's Job Satisfaction Mediated of A Supportive EnvironmentAPJAET JournalNoch keine Bewertungen

- PH Water On Stability PesticidesDokument6 SeitenPH Water On Stability PesticidesMontoya AlidNoch keine Bewertungen

- Haryana at A Glance: Geographical AreaDokument1 SeiteHaryana at A Glance: Geographical AreasonuNoch keine Bewertungen

- Part A Questions and AnswersDokument10 SeitenPart A Questions and Answerssriparans356Noch keine Bewertungen

- DODGER: Book Club GuideDokument2 SeitenDODGER: Book Club GuideEpicReadsNoch keine Bewertungen

- Latvian Adjectives+Dokument6 SeitenLatvian Adjectives+sherin PeckalNoch keine Bewertungen

- Internship Report On A Study of The Masterbranding of Dove: Urmee Rahman SilveeDokument45 SeitenInternship Report On A Study of The Masterbranding of Dove: Urmee Rahman SilveeVIRAL DOSHINoch keine Bewertungen

- Harlem Renaissance LiteratureDokument2 SeitenHarlem Renaissance LiteratureSylvia Danis100% (1)