Beruflich Dokumente

Kultur Dokumente

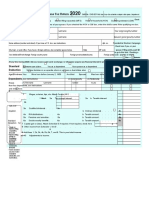

Individual Income Tax Return

Hochgeladen von

MNCOOhioCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Individual Income Tax Return

Hochgeladen von

MNCOOhioCopyright:

Verfügbare Formate

Auditor Kelly Carr

Marion City Income Tax Return - Individual 233 West Center Street Marion, Ohio 43302 740-387-6926

Part Year Resident Date Moved In _______/_______/________ Date Moved Out _______/________/________ FOR CALENDAR YEAR 2012 - Due on or before April 15th, 2013

If the address caption is not correct please make any necessary changes

The Income Tax Department hours: Monday to Thursday 8:00 a.m. to 5:00 p.m. Fridays 8:00 a.m. to 1:00 p.m. excluding Holidays

If you do not anticipate having taxable income next year indicate your reason on your return and we will close your account

TAX OFFICE USE ONLY

Name: C/O Address: City: Use your City Account Number

1. Wages (attach all applicable W-2's) 2. Unreimbursed Employee Business Expenses (attach Federal Form 2106- Statutory Employees attach copy of Federal Schedule C) 3. Taxable Wages (subtract Line 2 from Line 1) 4. Business and Rental Income 5. Total taxable Income (losses from Line 4 are not deductible from Line 3) 6. Total Tax (multiply line 5 by 1.75%) 7. Credits 7a. Tax withheld for Marion 7b. Marion Tax paid by partnerships on behalf of owner 7c. Tax paid to other cities (see income tax return instructions for the change) 7d. Total Credit (add 7a, 7b and 7c) 8. Tax less credits (subtract line 6 from line 7d) 9. Estimated tax paid and credit carryovers from prior tax years 10. Tax Due (subtract Line 9 from Line 8) 11. Distribution of overpayment: a. Apply credit to next year's estimated tax b. Refund $ $ $ $ $

$ $ $ $ $ $

$ $ $ $

12. Late Penalty $__________ plus Interest $____________ plus Tax Due $___________ = Tax Due

NOTE IF THE BALANCE DUE IS LESS THAN $1.00 NO PAYMENT IS DUE, IF THE OVERPAYMENT IS LESS THAN $1.00 NO REFUND WILL BE ISSUED.

DECLARATION OF ESTIMATED MARION, OHIO CITY INCOME TAX FOR 2013

Declaration required only if estimated tax due (line 15) is $200.00 or more estimated taxable income (Salaries, Wages, Commissions, etc., before payroll deductions) and/or (estimated net profits) 13. Total income subject to tax $________________ multiply by 2.0% (2013 tax rate) 14. Estimated credits (tax withheld, paid by partnerships, paid to other cities) 15. Net Tax Due (line 13 less Line 14) 16. First installment of declaration (not less than 1/4 of line 15) 17. Less overpayment from line 11A above: ($______________) = Balance due with return: $ $ $ $ $

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN, INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF MY KNOWLEDGE AND BELIEF, IT IS TRUE, CORRECT AND COMPLETE. DECLARATION OF PREPAPER (OTHER THAN TAXPAYER) IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

DATE:_________________________

Signature of Taxpayer/Agent

_______________________________________

________________________ Social Security Number or Federal ID Number ________________________ Social Security Number or Federal ID Number

Signature of Preparer Preparer ID No. ________________________

__________________________________

Signature of Taxpayer/Agent

_______________________________________

Schedule 1 - Business/Rental Income 1. Business Income (loss) from Sole Proprietorships (Attach federal Schedule C, C-EZ, or F) 2. Allocation % (if Resident Individual or if all of the business was conducted within Marion, enter 100%) (Schedule 2, Line 12) 3. Business Income (loss) Subject to City Tax 4. Rental Income - Attach Federal Schedule E (Resident Schedule include all rental income, non-residents include only rental income earned within Marion) 5. Business Income (loss) from partnerships (from Schedule 3) 6. Total Business/Rental Income (loss)-If positive, enter amount on line 6 here and on line 4 of your return. If negative, enter "loss" on line 4 of your return.

$ $ $ $ $ $

Schedule 2 - Business Allocation Formula In determining the portion of net profits of a business earned within the city, the taxpayer shall use an allocation formula based on property, sales and payroll. The taxpayer may use an actual accounting of net profits earned. Property Located in Marion Property Located Everywhere Average Value of Property Beginning of Year End of Year Beginning of Year End of Year 1. Real Property at Original Cost 2. Tangible Personal Property at Original Cost 3. Total Real and Tangible Property add Line 1 & 2 4. Total of Beginning and End of Year Totals 5. Average Value of owned property (line 4 divided by 2) 6. Rented property (Value at 8 x Annual Rental) 7. Average Value - Add Lines 5 & 6 Calculation of Taxable Portion 8. Property Factor (line7) 9. Sales Factor 10. Payroll Factor 11. Add the percentages from Lines 8,9 & 10 12. Allocation % (divide line 11 by the number of factors used - a factor with a zero in the "everywhere" column is not used) Schedule 3 - Business/Rental Income Pass Through Entities DO NOT INCLUDE INCOME FROM S CORPORATIONS Owners may use this form to calculate their taxable income from a pass-through entity. If you own more than one pass-through, please make copies of this schedule and complete a separate schedule for each pass-through. Residents should include all income from pass-through entities regardless of where the income is earned. Non-Resident should only include income earned within the city. The pass-through entity should provide you the information on how much of your income was earned within the city. Pass-Through Entity Name: _____________________________________ Pass-Through Entity EIN: _____________________ 1. Ordinary Income 2. Income (loss) from Rental Real Estate 3. Income (loss) from other Rentals 4. Guaranteed Payments to Partners 5. Other Income 6. Subtotal - Add lines 1 through 5 7. Charitable Contributions 8. Section 179 Deduction 9. Deductions related to portfolio income 10. Other Deductions if Deductible by a C Corporation 11. Total Deductions - Add lines 7 through 10 12. Subtotal - Subtract Line 11 from Line 6 13. Add 5% of intangible income not related to disposition of capital assets 13a. Interest 13b. Dividends 13c. Gross Royalties 13d. Other Portfolio Income 13e. Add lines 13a, 13b, 13c, & 13d 13f. Multiply line 13e by 5% 14. Add taxes based on income deducted on Schedule K-1 in determining ordinary or rental income 15. If included as a deduction on any previous line, add back amounts deducted for retirement plans, health insurance and/or life insurance for an owner-employee 16. Total Additions - add lines 13f, 14 and 15 17. Adjusted Federal Taxable Income - Add lines 12 and 16 Attach a copy of your Federal Schedule K-1 Within Marion Everywhere Percentage

$ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

Das könnte Ihnen auch gefallen

- GSA Process Overview 4-24-2018Dokument12 SeitenGSA Process Overview 4-24-2018Tynesha95% (44)

- NewsCorp Employee DiscountsDokument27 SeitenNewsCorp Employee DiscountsMyifone SpaceyNoch keine Bewertungen

- 2015 Tax Return Documents (US Auto Motors LLC) Revised PDFDokument20 Seiten2015 Tax Return Documents (US Auto Motors LLC) Revised PDFzlNoch keine Bewertungen

- UntitledDokument10 SeitenUntitledJosh SofferNoch keine Bewertungen

- File by Mail Instructions For Your Federal Amended Tax ReturnDokument14 SeitenFile by Mail Instructions For Your Federal Amended Tax ReturnRyan MayleNoch keine Bewertungen

- Will Frost 2013 Tax Return - T13 - For - RecordsDokument146 SeitenWill Frost 2013 Tax Return - T13 - For - RecordsjessicaNoch keine Bewertungen

- Business Income Tax ReturnDokument2 SeitenBusiness Income Tax ReturnMNCOOhioNoch keine Bewertungen

- Rs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Dokument17 SeitenRs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Moysés Isper NetoNoch keine Bewertungen

- U.S. Individual Income Tax Return: See Separate InstructionsDokument4 SeitenU.S. Individual Income Tax Return: See Separate InstructionsNewsTeam20100% (1)

- 2007 Federal ReturnDokument2 Seiten2007 Federal ReturnbradybunnellNoch keine Bewertungen

- Electronic Filing Instructions For Your 2008 Federal Tax ReturnDokument14 SeitenElectronic Filing Instructions For Your 2008 Federal Tax ReturnjakeNoch keine Bewertungen

- Preview Copy Do Not File: Profit or Loss From BusinessDokument1 SeitePreview Copy Do Not File: Profit or Loss From BusinessRon KnightNoch keine Bewertungen

- Claimant/Job Seeker: Jimmy Burt Claimant ID Number: 0001729376 245 Brown RD Lake Charles, LA 70611-5312Dokument1 SeiteClaimant/Job Seeker: Jimmy Burt Claimant ID Number: 0001729376 245 Brown RD Lake Charles, LA 70611-5312Jimmy BurtNoch keine Bewertungen

- Captura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Dokument4 SeitenCaptura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Adriana AnsurezNoch keine Bewertungen

- U.S. Individual Income Tax Return: Filing StatusDokument2 SeitenU.S. Individual Income Tax Return: Filing StatusSammi Bowe100% (1)

- 2009 Income Tax ReturnDokument5 Seiten2009 Income Tax Returngrantj820Noch keine Bewertungen

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDokument72 SeitenInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001Noch keine Bewertungen

- 2021 - TaxReturn 2pagessignedDokument3 Seiten2021 - TaxReturn 2pagessignedDedrick RiversNoch keine Bewertungen

- U.S. Individual Income Tax Return 1040A: Filing StatusDokument3 SeitenU.S. Individual Income Tax Return 1040A: Filing StatusYosbanyNoch keine Bewertungen

- U.S. Return of Partnership Income: Employer Identification NoDokument16 SeitenU.S. Return of Partnership Income: Employer Identification Nosherr jones100% (1)

- Please Review The Updated Information Below.: For Begins After This CoversheetDokument3 SeitenPlease Review The Updated Information Below.: For Begins After This CoversheetDavid FreiheitNoch keine Bewertungen

- Individual Tax ReturnDokument6 SeitenIndividual Tax Returnaklank_218105Noch keine Bewertungen

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- Captura de Pantalla T 2023-05-28 A La(s) 22.18.24Dokument69 SeitenCaptura de Pantalla T 2023-05-28 A La(s) 22.18.24rozaj519Noch keine Bewertungen

- 2021-2022 Tax ReturnDokument3 Seiten2021-2022 Tax ReturnMmmmmmmNoch keine Bewertungen

- File by Mail Instructions For Your 2009 Federal Tax ReturnDokument11 SeitenFile by Mail Instructions For Your 2009 Federal Tax ReturnjakeNoch keine Bewertungen

- 1Dokument1 Seite1hansNoch keine Bewertungen

- MLFA Form 990 - 2016Dokument25 SeitenMLFA Form 990 - 2016MLFANoch keine Bewertungen

- Zambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Dokument15 SeitenZambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Yaidhyt PradoNoch keine Bewertungen

- U.S. Individual Income Tax Return: Filing StatusDokument3 SeitenU.S. Individual Income Tax Return: Filing StatuspyatetskyNoch keine Bewertungen

- Mart1552 21i FCDokument23 SeitenMart1552 21i FCOlga M.Noch keine Bewertungen

- Brooklyn Museum 2019 IRS Form 990Dokument64 SeitenBrooklyn Museum 2019 IRS Form 990Lee Rosenbaum, CultureGrrlNoch keine Bewertungen

- 2020FTFCS 2022-02-26 1645943726435Dokument5 Seiten2020FTFCS 2022-02-26 1645943726435Mark Bagliani100% (1)

- Rhonda TX RTNDokument18 SeitenRhonda TX RTNobriens05Noch keine Bewertungen

- Baher Isack Adem 2022 Tax ReturnDokument20 SeitenBaher Isack Adem 2022 Tax Returnadammura043100% (1)

- Cars1dav 21i CCDokument25 SeitenCars1dav 21i CCDavid CarsonNoch keine Bewertungen

- Form W-4 (2018) : Specific InstructionsDokument4 SeitenForm W-4 (2018) : Specific InstructionsRony MartinezNoch keine Bewertungen

- 2013 Tax Return (Shep-Ty DBA Embrace)Dokument24 Seiten2013 Tax Return (Shep-Ty DBA Embrace)Game ChangerNoch keine Bewertungen

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Dokument2 Seiten1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNoch keine Bewertungen

- 2014 Alabama Possible 990Dokument39 Seiten2014 Alabama Possible 990Alabama PossibleNoch keine Bewertungen

- Young Acc 137 Kongai, Tsate 1040Dokument26 SeitenYoung Acc 137 Kongai, Tsate 1040Kathy YoungNoch keine Bewertungen

- 2016 1040 Individual Tax Return Engagement LetterDokument11 Seiten2016 1040 Individual Tax Return Engagement LettersarahvillalonNoch keine Bewertungen

- 2016 California Resident Income Tax Return Form 540 2ezDokument4 Seiten2016 California Resident Income Tax Return Form 540 2ezapi-351598796Noch keine Bewertungen

- Profit or Loss From Business: Linda Gercken 156-56-8670Dokument2 SeitenProfit or Loss From Business: Linda Gercken 156-56-8670ROB100% (1)

- Income Tax Return 2019Dokument6 SeitenIncome Tax Return 2019Cindy WheelerNoch keine Bewertungen

- Ezra Daniels TaxDokument11 SeitenEzra Daniels TaxJulio Romero100% (1)

- Ahtasham Ahmed Case - CompressedDokument19 SeitenAhtasham Ahmed Case - CompressedarsssyNoch keine Bewertungen

- Bar and Restaurant Assistance FundDokument126 SeitenBar and Restaurant Assistance FundMNCOOhio100% (1)

- Client Copy Return 2020 For AT PRODUCTS & SERVICES LLCDokument18 SeitenClient Copy Return 2020 For AT PRODUCTS & SERVICES LLCEdwin Altamiranda100% (2)

- U.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010Dokument6 SeitenU.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010victor liuNoch keine Bewertungen

- FD 941 Apr-Jun 2017 PDFDokument3 SeitenFD 941 Apr-Jun 2017 PDFScott WinklerNoch keine Bewertungen

- Ferrer vs. Herbert BautistaDokument1 SeiteFerrer vs. Herbert BautistaHal Jordan100% (2)

- Chapter 5 - Employee Benefits Part 1Dokument7 SeitenChapter 5 - Employee Benefits Part 1XienaNoch keine Bewertungen

- Sample Affidavit of Loss - BIR CORDokument9 SeitenSample Affidavit of Loss - BIR CORMelissaNoch keine Bewertungen

- Sales Warranty CasesDokument44 SeitenSales Warranty CasesKim Roque-AquinoNoch keine Bewertungen

- Eric Lesser & Alison Silber - 2013 Joint Tax ReturnDokument2 SeitenEric Lesser & Alison Silber - 2013 Joint Tax ReturnSteeleMassLiveNoch keine Bewertungen

- Think Computer Foundation 2009 Tax ReturnDokument10 SeitenThink Computer Foundation 2009 Tax ReturnTaxManNoch keine Bewertungen

- Please To Do Not Use The Back ButtonDokument2 SeitenPlease To Do Not Use The Back ButtonDavid MillerNoch keine Bewertungen

- Return of Organization Exempt From Income Tax: WWW - Irs.gov/form990 For Instructions and The Latest InformationDokument50 SeitenReturn of Organization Exempt From Income Tax: WWW - Irs.gov/form990 For Instructions and The Latest InformationNBC MontanaNoch keine Bewertungen

- 2011 Income Tax ReturnDokument4 Seiten2011 Income Tax Returnsalazar17Noch keine Bewertungen

- Certain Government Payments: Copy B For RecipientDokument2 SeitenCertain Government Payments: Copy B For RecipientDylan Bizier-Conley100% (1)

- Make Necessary Changes in Only Orange Colored Fields.: Proceed To Calculation Will Be Initially "No"Dokument36 SeitenMake Necessary Changes in Only Orange Colored Fields.: Proceed To Calculation Will Be Initially "No"xakilNoch keine Bewertungen

- Important Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Dokument1 SeiteImportant Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Victor ErazoNoch keine Bewertungen

- 2010 Income Tax ReturnDokument2 Seiten2010 Income Tax ReturnCkey ArNoch keine Bewertungen

- Please Print or Type All AnswersDokument2 SeitenPlease Print or Type All AnswerselktonclerkNoch keine Bewertungen

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDokument2 SeitenInterest Charge On DISC-Related Deferred Tax Liability: Sign HereInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Noch keine Bewertungen

- Section24-Prior Year Salary OverpaymentsDokument8 SeitenSection24-Prior Year Salary OverpaymentsP45 TesterNoch keine Bewertungen

- Main Street Improvement PlanDokument27 SeitenMain Street Improvement PlanMNCOOhioNoch keine Bewertungen

- Bar and Restaurant Assistance FundDokument286 SeitenBar and Restaurant Assistance FundMNCOOhioNoch keine Bewertungen

- The West End Neighborhood PlanDokument25 SeitenThe West End Neighborhood PlanMNCOOhioNoch keine Bewertungen

- Hospital Regions and ZonesDokument4 SeitenHospital Regions and ZonesMNCOOhioNoch keine Bewertungen

- Covid-19 Reopening GuidanceDokument8 SeitenCovid-19 Reopening GuidanceMNCOOhioNoch keine Bewertungen

- Park System Master PlanDokument57 SeitenPark System Master PlanMNCOOhio100% (1)

- Westgate Shopping CenterDokument2 SeitenWestgate Shopping CenterMNCOOhioNoch keine Bewertungen

- St. Peter's Reopening PlanDokument9 SeitenSt. Peter's Reopening PlanMNCOOhioNoch keine Bewertungen

- Summary Alert IndicatorsDokument3 SeitenSummary Alert IndicatorsMNCOOhioNoch keine Bewertungen

- IAFF Local 266Dokument2 SeitenIAFF Local 266MNCOOhioNoch keine Bewertungen

- GENERAL Election Candidate/Issues ListDokument33 SeitenGENERAL Election Candidate/Issues ListMNCOOhio100% (1)

- South Main ST MailingDokument6 SeitenSouth Main ST MailingMNCOOhioNoch keine Bewertungen

- Resume SureshDokument2 SeitenResume SureshSiva BandiNoch keine Bewertungen

- VAT Pre-TestDokument6 SeitenVAT Pre-TestGorden Kafare BinoNoch keine Bewertungen

- Tax Up34t5024Dokument1 SeiteTax Up34t5024Mohd AhtishamNoch keine Bewertungen

- Premier Steel Re-Rolling Mills (PVT) LTD: Shabnin Rahman Shorna Lecturer Department of Management North South UniversityDokument22 SeitenPremier Steel Re-Rolling Mills (PVT) LTD: Shabnin Rahman Shorna Lecturer Department of Management North South UniversityDipu VaiNoch keine Bewertungen

- Chapter 3Dokument16 SeitenChapter 3Zhang XuantaoNoch keine Bewertungen

- Chapter 3Dokument12 SeitenChapter 3Briggs Navarro BaguioNoch keine Bewertungen

- MBA - Financial Management Final ExamDokument13 SeitenMBA - Financial Management Final ExamJessica BoehmNoch keine Bewertungen

- Management AnalysisDokument23 SeitenManagement AnalysisMiracle Vertera100% (1)

- Tax Avoidance and Firm ValueDokument18 SeitenTax Avoidance and Firm Valuenovie endi nugrohoNoch keine Bewertungen

- Indicative Taxnet Profile: Personal InformationDokument4 SeitenIndicative Taxnet Profile: Personal InformationAbdul WadoodNoch keine Bewertungen

- Reference: Answers)Dokument11 SeitenReference: Answers)Jaivardhan KanoriaNoch keine Bewertungen

- GST On Reverse ChargeDokument5 SeitenGST On Reverse ChargeHEERA BABU MERTIANoch keine Bewertungen

- HB 12-1105 Concerning Wind Energy Property RightsDokument3 SeitenHB 12-1105 Concerning Wind Energy Property RightsSenator Mike JohnstonNoch keine Bewertungen

- Standard Means Test FormDokument2 SeitenStandard Means Test FormNicole HernandezNoch keine Bewertungen

- Rebecca RossiDokument1 SeiteRebecca RossiDelageNoch keine Bewertungen

- Arpita Webinar ReportDokument18 SeitenArpita Webinar ReportArpita R NagpureNoch keine Bewertungen

- Income Tax Parent Disable Form EFMB1CS - ES2120220303110030WMUDokument5 SeitenIncome Tax Parent Disable Form EFMB1CS - ES2120220303110030WMUDaniel SohNoch keine Bewertungen

- Train Law RecommendationDokument10 SeitenTrain Law RecommendationMaria Angelica PanongNoch keine Bewertungen

- Eros 1Dokument7 SeitenEros 1pakistanNoch keine Bewertungen

- Business Case Summaries - PFC2020-0963Dokument51 SeitenBusiness Case Summaries - PFC2020-0963Darren KrauseNoch keine Bewertungen

- Lakh Datta Flour MillsDokument14 SeitenLakh Datta Flour MillsjimmuNoch keine Bewertungen

- Summer Internship Project Akanksha GuptaDokument17 SeitenSummer Internship Project Akanksha GuptaSahil KhannaNoch keine Bewertungen

- 9708 s02 Er 1+2+3+4Dokument14 Seiten9708 s02 Er 1+2+3+4Hana DanNoch keine Bewertungen

- LO: 1, Bloom: AP, Difficulty: Simple, Time: 5-7, AACSB: Analytic, AICPA BB: Critical Thinking, AICPA FC: Reporting, AICPA PC: Problem SolvingDokument2 SeitenLO: 1, Bloom: AP, Difficulty: Simple, Time: 5-7, AACSB: Analytic, AICPA BB: Critical Thinking, AICPA FC: Reporting, AICPA PC: Problem Solving7seas498 7seas498Noch keine Bewertungen