Beruflich Dokumente

Kultur Dokumente

Advanced Conversation - Mid-Term Presentation Money Laundering

Hochgeladen von

Lauremi Lisbeth Perez ColladoOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Advanced Conversation - Mid-Term Presentation Money Laundering

Hochgeladen von

Lauremi Lisbeth Perez ColladoCopyright:

Verfügbare Formate

The goal of a large number of criminal acts is to generate a profit for the individual or group that carries out

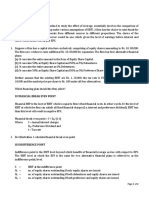

the act. Money laundering is the processing of these criminal proceeds to disguise their illegal origin. This process is of critical importance, as it enables the criminal to enjoy these profits without jeopardizing their source. The most common types of criminals who need to launder money are drug traffickers, embezzlers, corrupt politicians and public officials, mobsters, terrorists and con artists. How much money is laundered per year? Money laundering is an illegal activity which occurs outside of the normal range of economic and financial statistics. The United Nations Office on Drugs and Crime (UNODC) conducted a study to determine the magnitudes of illicit funds generated by drug trafficking and organized crimes and to investigate to what extent these funds are laundered. The report estimates that in 2009, criminal proceeds amounted to 3.6% of global GDP, with 2.7% (or USD 1.6 trillion) being laundered. How is money laundered? The basic money laundering process has three steps: 1. Placement - At this stage, the launderer inserts the dirty money into a legitimate financial institution. This is often in the form of cash bank deposits. This is the riskiest stage of the laundering process because large amounts of cash are pretty conspicuous, and banks are required to report high-value transactions. 2. Layering - Layering involves sending the money through various financial transactions to change its form and make it difficult to follow. Layering may consist of several bank-to-bank transfers, wire transfers between different accounts in different names in different countries, making deposits and withdrawals to continually vary the amount of money in the accounts, changing the money's currency, and purchasing high-value items (boats, houses, cars, diamonds) to change the form of the money. This is the most complex step in any laundering scheme, and it's all about making the original dirty money as hard to trace as possible. 3. Integration - At the integration stage, the money re-enters the mainstream economy in legitimatelooking form -- it appears to come from a legal transaction. At this point, the criminal can use the

money without getting caught. It's very difficult to catch a launderer during the integration stage if there is no documentation during the previous stages.

There are lots of money-laundering techniques that authorities know about and probably countless others that have yet to be uncovered. Here are some of the more popular ones: Structuring deposits Also known as smurfing, this method entails breaking up large amounts of money into smaller, less-suspicious amounts. In the United States, this smaller amount has to be below $10,000. The money is then deposited into one or more bank accounts either by multiple people (smurfs) or by a single person over an extended period of time. Overseas banks Money launderers often send money through various "offshore accounts" in countries that have bank secrecy laws. A complex scheme can involve hundreds of bank transfers to and from offshore banks. According to the International Monetary Fund, "major offshore centers" include the Bahamas, Bahrain, the Cayman Islands, Hong Kong, Antilles, Panama and Singapore. Shell companies These are fake companies that exist for no other reason than to launder money. They take in dirty money as "payment" for supposed goods or services but actually provide no goods or services; they simply create the appearance of legitimate transactions through fake invoices and balance sheets. The injection of laundered money into any economy transforms them into a productive source of working capital, but this is bad, because it corrupts banks, government officials, it contaminated legal sectors of the economy, pushes out legitimate and foreign capital, deflates and un-stabilizes the control of money and enhances a cross-the-border capital movement, which increases the volatility of the exchange rate.

Money laundering is a crucial step in the success of drug trafficking and terrorist activities, not to mention white collar crime, and there are countless organizations trying to get a handle on the problem. In the United States, the Department of Justice, the State Department, the Federal Bureau of Investigation, theInternal Revenue Service and the Drug Enforcement Agency all have

divisions investigating money laundering and the underlying financial structures that make it work. The international community is fighting money laundering through various means, including the Financial Action Task Force on Money Laundering (FATF), which as of 2005 has 33 member states and organizations. The United Nations, the World Bank and the International Monetary Fund also have anti-money-laundering divisions.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Sample Financial Reports For Livelihood AssociationDokument7 SeitenSample Financial Reports For Livelihood AssociationOslec AtenallNoch keine Bewertungen

- EDDokument90 SeitenEDNitin Bhardwaj100% (1)

- Ernst & Young Islamic Funds & Investments Report 2011Dokument50 SeitenErnst & Young Islamic Funds & Investments Report 2011The_Banker100% (1)

- 10 - Gallardo vs. MoralesDokument6 Seiten10 - Gallardo vs. MoralesjieNoch keine Bewertungen

- Accounting HandbookDokument42 SeitenAccounting Handbookinfoyazid5Noch keine Bewertungen

- Money LaunderingDokument24 SeitenMoney Launderingateen rizalmanNoch keine Bewertungen

- Bond Basics: Yield, Price and Other Confusion - InvestopediaDokument7 SeitenBond Basics: Yield, Price and Other Confusion - InvestopediaLouis ForestNoch keine Bewertungen

- Technical Analysis in Forex TradingDokument7 SeitenTechnical Analysis in Forex TradingIFCMarketsNoch keine Bewertungen

- Chapter 11 - Part 1 - Accounting FranchisesDokument13 SeitenChapter 11 - Part 1 - Accounting FranchisesJane Dizon100% (1)

- Pioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesDokument4 SeitenPioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesPrajwal PaiNoch keine Bewertungen

- I2BE-Morning Evening PDFDokument10 SeitenI2BE-Morning Evening PDFusama sajawalNoch keine Bewertungen

- Malaysian Airline System Berhad Annual Report 04/05 (10601-W)Dokument87 SeitenMalaysian Airline System Berhad Annual Report 04/05 (10601-W)Nur AfiqahNoch keine Bewertungen

- Islamic Banking Situational Mcqs PDFDokument24 SeitenIslamic Banking Situational Mcqs PDFNajeeb Magsi100% (1)

- Capital Structure Policy I Ebit-Eps Analysis: Page 1 of 2Dokument2 SeitenCapital Structure Policy I Ebit-Eps Analysis: Page 1 of 2Danzo ShahNoch keine Bewertungen

- PBCom V CA, G.R. No. 118552, February 5, 1996Dokument6 SeitenPBCom V CA, G.R. No. 118552, February 5, 1996ademarNoch keine Bewertungen

- Cfas Millan 2020 Answer KeyDokument193 SeitenCfas Millan 2020 Answer KeyPEBIDA, DAVERLY N.Noch keine Bewertungen

- SEC 204 Status ReportDokument17 SeitenSEC 204 Status Reportthe kingfishNoch keine Bewertungen

- LJK UkkDokument55 SeitenLJK UkkSaepul RohmanNoch keine Bewertungen

- SP PaperDokument11 SeitenSP Paper9137373282abcdNoch keine Bewertungen

- Final Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Dokument7 SeitenFinal Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesNoch keine Bewertungen

- Arvog Finance Corporate Presentation 2022Dokument9 SeitenArvog Finance Corporate Presentation 2022Dinesh KandpalNoch keine Bewertungen

- Axis Smallcap FundDokument1 SeiteAxis Smallcap FundManoj JainNoch keine Bewertungen

- SA13 Consulting Services WednesdayDokument31 SeitenSA13 Consulting Services WednesdayAhmed AlyaniNoch keine Bewertungen

- Cost of Capital ChapterDokument25 SeitenCost of Capital ChapterHossain Belal100% (1)

- Laabh BookletDokument33 SeitenLaabh BookletSri RamNoch keine Bewertungen

- Cover LetterDokument2 SeitenCover LetterBilal AslamNoch keine Bewertungen

- Notes On MicrofinanceDokument8 SeitenNotes On MicrofinanceMapuia Lal Pachuau100% (2)

- Us Engineering Construction Ma Due DiligenceDokument52 SeitenUs Engineering Construction Ma Due DiligenceOsman Murat TütüncüNoch keine Bewertungen

- 3.2 Mathematics of RetailingDokument10 Seiten3.2 Mathematics of RetailingharizNoch keine Bewertungen

- Financial DerivativesDokument31 SeitenFinancial DerivativesSyed Roshan JavedNoch keine Bewertungen