Beruflich Dokumente

Kultur Dokumente

Tax treaty exemption request

Hochgeladen von

Joseph WelchOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tax treaty exemption request

Hochgeladen von

Joseph WelchCopyright:

Verfügbare Formate

DIRECO-GERAL

DOS

4

IMPOSTOS

1099 013 Lisboa

DGCI

P O RT U G A L

REPBLICA

PORTUGUESA

DSRI - Direco

Av.

a

de Servios das Relaes Internacionais

28

Eng.

Duarte

Pacheco,

MINISTRIO DAS FINANAS

Te l : 3 5 1 . 2 1 . 3 8 3 4 2 0 0 F a x : 3 5 1 . 2 1 . 3 8 3 4 4 1 4 E - m a i l : d s r i @ d g c i . m i n - f i n a n c a s . p t

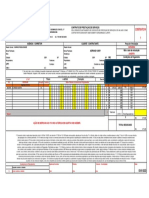

MOD. 21-RFI

PEDIDO DE DISPENSA TOTAL OU PARCIAL DE RETENO NA FONTE DO IMPOSTO PORTUGUS, EFECTUADO AO ABRIGO DA CONVENO PARA EVITAR A DUPLA TRIBUTAO ENTRE PORTUGAL E: CLAIM FOR TOTAL OR PARTIAL EXEMPTION FROM PORTUGUESE WITHHOLDING TAX, UNDER THE CONVENTION FOR THE AVOIDANCE OF DOUBLE TAXATION BETWEEN PORTUGAL AND:

IDENTIFICAO DO BENEFICIRIO EFECTIVO DOS RENDIMENTOS IDENTIFICATION OF THE BENEFICIAL OWNER OF THE INCOME

NOME / DENOMINAO SOCIAL NAME / BUSINESS NAME DOMICLIO FISCAL (Rua, nmero e andar) TAX RESIDENCE (Street, number and oor)

Nmero de Identicao Fiscal (NIF) no pas de residncia

Tax Identication Number (TIN) in the country of residence

CDIGO POSTAL POSTCODE CORREIO ELECTRNICO: E-MAIL:

LOCALIDADE CITY

PAS COUNTRY

NIF PORTUGUS (Ver instrues)

PORTUGUESE TIN (see instructions)

II

IDENTIFICAO DOS RENDIMENTOS DESCRIPTION OF THE INCOME

1 - DIVIDENDS 1.1 - FROM SHARES

1 - DIVIDENDOS 1.1 - DE ACES

QUANTIDADE NUMBER OF SHARES

ENTIDADE EMITENTE OU CDIGO ISIN ISSUER OR ISIN CODE

1.2 - RESTANTES DIVIDENDOS

1.2 - OTHER DIVIDENDS

VALOR DA PARTICIPAO SOCIAL VALUE OF THE PARTICIPATION

ENTIDADE PARTICIPADA PARTICIPATED ENTITY

2 - JUROS 2.1 - DE VALORES MOBILIRIOS REPRESENTATIVOS DA DVIDA

2 - INTEREST 2.1 - FROM DEBT SECURITIES

VALOR NOMINAL NOMINAL POSITION

DESIGNAO DO VALOR MOBILIRIO OU CDIGO ISIN DESCRIPTION OF SECURITIES OR ISIN CODE

DATA DE AQUISIO (aaaa/mm/dd) ACQUISITION DATE (yyyy/mm/dd)

_________/_______/______ _________/_______/______

ENTIDADE EMITENTE ISSUER

2.2 - RESTANTES JUROS

2.2 - OTHER INTEREST DATA DA CONSTITUIO (aaaa/mm/dd) STARTING DATE (yyyy/mm/dd)

_________/_______/______ _________/_______/______

NATUREZA DOS CRDITOS NATURE OF THE DEBT CLAIMS

VALOR DOS CRDITOS VALUE OF THE DEBT CLAIMS

3 - ROYALTIES

3 - ROYALTIES

NATUREZA DAS ROYALTIES NATURE OF THE ROYALTIES

DATA DA CELEBRAO DO CONTRATO (aaaa/mm/dd) DATE OF CONCLUSION OF THE CONTRACT (yyyy/mm/dd)

_________/_______/______ _________/_______/______

4 - TRABALHO INDEPENDENTE 6 - PENSES 6.1 - DE NATUREZA PRIVADA

4 - INDEPENDENT PERSONAL SERVICES 6. - PENSIONS 6.1 - OTHER THAN FROM GOVERNMENT SERVICE

5 - TRABALHO DEPENDENTE

5 - INCOME FROM EMPLOYMENT

6.2 - DE NATUREZA PBLICA

6.2 - FROM GOVERNMENT SERVICE

7 - REMUNERAES PBLICAS 7 - INCOME FROM GOVERNMENT SERVICE 8 - PRESTAES DE SERVIOS 8 - SERVICES RENDERED Comisses Comissions 9 - RESTANTES RENDIMENTOS Identique a natureza do rendimento Describe the nature of the income Outras Other 9 - OTHER INCOME Especique Specify

III

CERTIFICAO DAS AUTORIDADES FISCAIS COMPETENTES DO ESTADO DE RESIDNCIA DO BENEFICIRIO EFECTIVO CERTIFICATION BY THE COMPETENT TAX AUTHORITIES OF THE BENEFICIAL OWNER'S STATE OF RESIDENCE

CERTIFICA-SE QUE A ENTIDADE IDENTIFICADA NO QUADRO I /FOI RESIDENTE FISCAL, NOS TERMOS DO ART 4 DA CONVENO PARA EVITAR A DUPLA TRIBUTAO, EM , NO(S) ANO(S) ______ A ______ ESTANDO SUJEITA A IMPOSTO SOBRE O RENDIMENTO. WE CERTIFY THAT THE ENTITIY IDENTIFIED IN BOX I IS/WAS RESIDENT FOR TAX PURPOSES, UNDER ARTICLE 4 OF THE CONVENTION FOR THE AVOIDANCE OF DOUBLE TAXATION, IN , IN THE YEAR(S) ______ TO ______ AND IS /WAS SUBJECT TO INCOME TAX.

LOCAL CITY DATA (AAAA/MM/DD DATE (YYYY/MM/DD) ASSINATURA E SELO OFICIAL SIGNATURE AND OFFICIAL STAMP

_____________/________/________

ENTIDADE ENTITY

EXEMPLAR DESTINADO ENTIDADE OBRIGADA A EFECTUAR A RETENO NA FONTE COPY FOR THE ENTITY OBLIGED TO WITHHOLD TAX

DIRECO-GERAL

DOS

4

IMPOSTOS

1099 013 Lisboa

DGCI

P O RT U G A L

REPBLICA

PORTUGUESA

DSRI - Direco

Av.

a

de Servios das Relaes Internacionais

28

Eng.

Duarte

Pacheco,

MINISTRIO DAS FINANAS

Te l : 3 5 1 . 2 1 . 3 8 3 4 2 0 0 F a x : 3 5 1 . 2 1 . 3 8 3 4 4 1 4 E - m a i l : d s r i @ d g c i . m i n - f i n a n c a s . p t

MOD. 21-RFI

PEDIDO DE DISPENSA TOTAL OU PARCIAL DE RETENO NA FONTE DO IMPOSTO PORTUGUS, EFECTUADO AO ABRIGO DA CONVENO PARA EVITAR A DUPLA TRIBUTAO ENTRE PORTUGAL E: CLAIM FOR TOTAL OR PARTIAL EXEMPTION FROM PORTUGUESE WITHHOLDING TAX, UNDER THE CONVENTION FOR THE AVOIDANCE OF DOUBLE TAXATION BETWEEN PORTUGAL AND:

IDENTIFICAO DO BENEFICIRIO EFECTIVO DOS RENDIMENTOS IDENTIFICATION OF THE BENEFICIAL OWNER OF THE INCOME

NOME / DENOMINAO SOCIAL NAME / BUSINESS NAME DOMICLIO FISCAL (Rua, nmero e andar) TAX RESIDENCE (Street, number and oor)

Nmero de Identicao Fiscal (NIF) no pas de residncia

Tax Identication Number (TIN) in the country of residence

CDIGO POSTAL POSTCODE CORREIO ELECTRNICO: E-MAIL:

LOCALIDADE CITY

PAS COUNTRY

NIF PORTUGUS (Ver instrues)

PORTUGUESE TIN (see instructions)

II

IDENTIFICAO DOS RENDIMENTOS DESCRIPTION OF THE INCOME

1 - DIVIDENDS 1.1 - FROM SHARES

1 - DIVIDENDOS 1.1 - DE ACES

QUANTIDADE NUMBER OF SHARES

ENTIDADE EMITENTE OU CDIGO ISIN ISSUER OR ISIN CODE

1.2 - RESTANTES DIVIDENDOS

1.2 - OTHER DIVIDENDS

VALOR DA PARTICIPAO SOCIAL VALUE OF THE PARTICIPATION

ENTIDADE PARTICIPADA PARTICIPATED ENTITY

2 - JUROS 2.1 - DE VALORES MOBILIRIOS REPRESENTATIVOS DA DVIDA

2 - INTEREST 2.1 - FROM DEBT SECURITIES

VALOR NOMINAL NOMINAL POSITION

DESIGNAO DO VALOR MOBILIRIO OU CDIGO ISIN DESCRIPTION OF SECURITIES OR ISIN CODE

DATA DE AQUISIO (aaaa/mm/dd) ACQUISITION DATE (yyyy/mm/dd)

_________/_______/______ _________/_______/______

ENTIDADE EMITENTE ISSUER

2.2 - RESTANTES JUROS

2.2 - OTHER INTEREST DATA DA CONSTITUIO (aaaa/mm/dd) STARTING DATE (yyyy/mm/dd)

_________/_______/______ _________/_______/______

NATUREZA DOS CRDITOS NATURE OF THE DEBT CLAIMS

VALOR DOS CRDITOS VALUE OF THE DEBT CLAIMS

3 - ROYALTIES

3 - ROYALTIES

NATUREZA DAS ROYALTIES NATURE OF THE ROYALTIES

DATA DA CELEBRAO DO CONTRATO (aaaa/mm/dd) DATE OF CONCLUSION OF THE CONTRACT (yyyy/mm/dd)

_________/_______/______ _________/_______/______

4 - TRABALHO INDEPENDENTE 6 - PENSES 6.1 - DE NATUREZA PRIVADA

4 - INDEPENDENT PERSONAL SERVICES 6. - PENSIONS 6.1 - OTHER THAN FROM GOVERNMENT SERVICE

5 - TRABALHO DEPENDENTE

5 - INCOME FROM EMPLOYMENT

6.2 - DE NATUREZA PBLICA

6.2 - FROM GOVERNMENT SERVICE

7 - REMUNERAES PBLICAS 7 - INCOME FROM GOVERNMENT SERVICE 8 - PRESTAES DE SERVIOS 8 - SERVICES RENDERED Comisses Comissions 9 - RESTANTES RENDIMENTOS Identique a natureza do rendimento Describe the nature of the income Outras Other 9 - OTHER INCOME Especique Specify

III

CERTIFICAO DAS AUTORIDADES FISCAIS COMPETENTES DO ESTADO DE RESIDNCIA DO BENEFICIRIO EFECTIVO CERTIFICATION BY THE COMPETENT TAX AUTHORITIES OF THE BENEFICIAL OWNER'S STATE OF RESIDENCE

CERTIFICA-SE QUE A ENTIDADE IDENTIFICADA NO QUADRO I /FOI RESIDENTE FISCAL, NOS TERMOS DO ART 4 DA CONVENO PARA EVITAR A DUPLA TRIBUTAO, EM , NO(S) ANO(S) ______ A ______ ESTANDO SUJEITA A IMPOSTO SOBRE O RENDIMENTO. WE CERTIFY THAT THE ENTITIY IDENTIFIED IN BOX I IS/WAS RESIDENT FOR TAX PURPOSES, UNDER ARTICLE 4 OF THE CONVENTION FOR THE AVOIDANCE OF DOUBLE TAXATION, IN , IN THE YEAR(S) ______ TO ______ AND IS /WAS SUBJECT TO INCOME TAX.

LOCAL CITY DATA (AAAA/MM/DD DATE (YYYY/MM/DD) ASSINATURA E SELO OFICIAL SIGNATURE AND OFFICIAL STAMP

_____________/________/________

ENTIDADE ENTITY

EXEMPLAR DESTINADO ADMINISTRAO FISCAL DO ESTADO DE RESIDNCIA DO BENEFICIRIO DO RENDIMENTO COPY FOR THE TAX AUTHORITIES OF THE BENEFICIARY'S COUNTRY OF RESIDENCE

DIRECO-GERAL

DOS

4

IMPOSTOS

1099 013 Lisboa

DGCI

P O RT U G A L

REPBLICA

PORTUGUESA

DSRI - Direco

Av.

a

de Servios das Relaes Internacionais

28

Eng.

Duarte

Pacheco,

MINISTRIO DAS FINANAS

Te l : 3 5 1 . 2 1 . 3 8 3 4 2 0 0 F a x : 3 5 1 . 2 1 . 3 8 3 4 4 1 4 E - m a i l : d s r i @ d g c i . m i n - f i n a n c a s . p t

MOD. 21-RFI

PEDIDO DE DISPENSA TOTAL OU PARCIAL DE RETENO NA FONTE DO IMPOSTO PORTUGUS, EFECTUADO AO ABRIGO DA CONVENO PARA EVITAR A DUPLA TRIBUTAO ENTRE PORTUGAL E: CLAIM FOR TOTAL OR PARTIAL EXEMPTION FROM PORTUGUESE WITHHOLDING TAX, UNDER THE CONVENTION FOR THE AVOIDANCE OF DOUBLE TAXATION BETWEEN PORTUGAL AND:

IDENTIFICAO DO BENEFICIRIO EFECTIVO DOS RENDIMENTOS IDENTIFICATION OF THE BENEFICIAL OWNER OF THE INCOME

NOME / DENOMINAO SOCIAL NAME / BUSINESS NAME DOMICLIO FISCAL (Rua, nmero e andar) TAX RESIDENCE (Street, number and oor)

Nmero de Identicao Fiscal (NIF) no pas de residncia

Tax Identication Number (TIN) in the country of residence

CDIGO POSTAL POSTCODE CORREIO ELECTRNICO: E-MAIL:

LOCALIDADE CITY

PAS COUNTRY

NIF PORTUGUS (Ver instrues)

PORTUGUESE TIN (see instructions)

II

IDENTIFICAO DOS RENDIMENTOS DESCRIPTION OF THE INCOME

1 - DIVIDENDS 1.1 - FROM SHARES

1 - DIVIDENDOS 1.1 - DE ACES

QUANTIDADE NUMBER OF SHARES

ENTIDADE EMITENTE OU CDIGO ISIN ISSUER OR ISIN CODE

1.2 - RESTANTES DIVIDENDOS

1.2 - OTHER DIVIDENDS

VALOR DA PARTICIPAO SOCIAL VALUE OF THE PARTICIPATION

ENTIDADE PARTICIPADA PARTICIPATED ENTITY

2 - JUROS 2.1 - DE VALORES MOBILIRIOS REPRESENTATIVOS DA DVIDA

2 - INTEREST 2.1 - FROM DEBT SECURITIES

VALOR NOMINAL NOMINAL POSITION

DESIGNAO DO VALOR MOBILIRIO OU CDIGO ISIN DESCRIPTION OF SECURITIES OR ISIN CODE

DATA DE AQUISIO (aaaa/mm/dd) ACQUISITION DATE (yyyy/mm/dd)

_________/_______/______ _________/_______/______

ENTIDADE EMITENTE ISSUER

2.2 - RESTANTES JUROS

2.2 - OTHER INTEREST DATA DA CONSTITUIO (aaaa/mm/dd) STARTING DATE (yyyy/mm/dd)

_________/_______/______ _________/_______/______

NATUREZA DOS CRDITOS NATURE OF THE DEBT CLAIMS

VALOR DOS CRDITOS VALUE OF THE DEBT CLAIMS

3 - ROYALTIES

3 - ROYALTIES

NATUREZA DAS ROYALTIES NATURE OF THE ROYALTIES

DATA DA CELEBRAO DO CONTRATO (aaaa/mm/dd) DATE OF CONCLUSION OF THE CONTRACT (yyyy/mm/dd)

_________/_______/______ _________/_______/______

4 - TRABALHO INDEPENDENTE 6 - PENSES 6.1 - DE NATUREZA PRIVADA

4 - INDEPENDENT PERSONAL SERVICES 6. - PENSIONS 6.1 - OTHER THAN FROM GOVERNMENT SERVICE

5 - TRABALHO DEPENDENTE

5 - INCOME FROM EMPLOYMENT

6.2 - DE NATUREZA PBLICA

6.2 - FROM GOVERNMENT SERVICE

7 - REMUNERAES PBLICAS 7 - INCOME FROM GOVERNMENT SERVICE 8 - PRESTAES DE SERVIOS 8 - SERVICES RENDERED Comisses Comissions 9 - RESTANTES RENDIMENTOS Identique a natureza do rendimento Describe the nature of the income Outras Other 9 - OTHER INCOME Especique Specify

III

CERTIFICAO DAS AUTORIDADES FISCAIS COMPETENTES DO ESTADO DE RESIDNCIA DO BENEFICIRIO EFECTIVO CERTIFICATION BY THE COMPETENT TAX AUTHORITIES OF THE BENEFICIAL OWNER'S STATE OF RESIDENCE

CERTIFICA-SE QUE A ENTIDADE IDENTIFICADA NO QUADRO I /FOI RESIDENTE FISCAL, NOS TERMOS DO ART 4 DA CONVENO PARA EVITAR A DUPLA TRIBUTAO, EM , NO(S) ANO(S) ______ A ______ ESTANDO SUJEITA A IMPOSTO SOBRE O RENDIMENTO. WE CERTIFY THAT THE ENTITIY IDENTIFIED IN BOX I IS/WAS RESIDENT FOR TAX PURPOSES, UNDER ARTICLE 4 OF THE CONVENTION FOR THE AVOIDANCE OF DOUBLE TAXATION, IN , IN THE YEAR(S) ______ TO ______ AND IS /WAS SUBJECT TO INCOME TAX.

LOCAL CITY DATA (AAAA/MM/DD DATE (YYYY/MM/DD) ASSINATURA E SELO OFICIAL SIGNATURE AND OFFICIAL STAMP

_____________/________/________

ENTIDADE ENTITY

EXEMPLAR DESTINADO AO BENEFICIRIO DO RENDIMENTO COPY FOR THE BENEFICIARY OF THE INCOME

IV

QUESTIONRIO (A RESPONDER PELO BENEFICIRIO DO RENDIMENTO) QUESTIONS (TO BE ANSWERED BY THE BENEFICIAL OWNER)

A - A PREENCHER POR PESSOAS SINGULARES E POR PESSOAS COLECTIVAS A - TO BE FILLED IN BY INDIVIDUALS, COMPANIES AND ANY OTHER BODY OF PERSONS 1 - Dispe de estabelecimento estvel ou instalao xa em Portugal ? 1 - Do you have a permanent establishment or a xed base in Portugal? Sim Yes No No No No

2 - Participa no capital social da(s) entidade(s) devedora(s) dos rendimentos em percentagem igual ou superior a 10% ? Sim Yes 2 - Do you participate in the share capital of the debtor(s) of income in a percentage of 10% or more? Em caso armativo, indique a(s) entidade(s) e a(s) percentagem(ns) correspondente(s) If yes, please indicate the debtor(s) and the corresponding percentage(s)

________________________________________________________________________________________________________________________________ ________________________________________________________________________________________________________________________________ 3 - Pertence aos rgos sociais da(s) entidade(s) devedora(s) dos rendimentos ? 3 - Do you belong to the board of directors or to the supervisory board of the debtor(s) of the income? Em caso armativo especique If yes, please specify Sim Yes No No

B - A PREENCHER SOMENTE POR PESSOAS SINGULARES B - TO BE FILLED IN ONLY BY INDIVIDUALS 1 - No(s) ano(s) civil(is) em que os rendimentos vo ser pagos ou colocados sua disposio, vai residir em Portugal ? 1 - Will you stay in Portugal during the calendar year(s) in which the income will be paid or put at your disposal? Sim Yes Em caso armativo, indique a estimativa do nmero de dias de permanncia If yes, please indicate the estimated number of days of your stay 2 - Dispe de habitao permanente em Portugal ? 2 - Do you have a permanent home in Portugal? Em caso armativo, indique o endereo If yes, please indicate the address 3 - Indique a sua data de nascimento (AAAA/MM/DD) e a nacionalidade 3 - Please indicate your date of birth (YYYY/MM/DD) __________/________/________ and your nationality IDENTIFICAO DO INTERMEDIRIO FINANCEIRO NO RESIDENTE EM PORTUGAL IDENTIFICATION OF THE FINANCIAL INTERMEDIARY NON RESIDENT IN PORTUGAL NOME/DENOMINAO SOCIAL NAME/BUSINESS NAME Sim Yes No No No No

DOMICLIO FISCAL TAX RESIDENCE

NIF no pas de residncia TIN in the country of residence

CDIGO POSTAL POSTCODE

LOCALIDADE CITY

PAS COUNTRY

VI

IDENTIFICAO DA ENTIDADE RESIDENTE EM PORTUGAL QUE SE ENCONTRA OBRIGADA A EFECTUAR A RETENO NA FONTE IDENTIFICATION OF THE ENTITY RESIDENT IN PORTUGAL OBLIGED TO WITHHOLD TAX NOME/DENOMINAO SOCIAL NAME/BUSINESS NAME Nmero de Identicao Fiscal (NIF) Tax Identication Number (TIN)

VII

IDENTIFICAO DO REPRESENTANTE LEGAL DO BENEFICIRIO EFECTIVO DOS RENDIMENTOS IDENTIFICATION OF THE BENEFICIAL OWNERS LEGAL REPRESENTATIVE NOME/DENOMINAO SOCIAL NAME/BUSINESS NAME Nmero de Identicao Fiscal (NIF) Tax Identication Number (TIN)

VIII

DECLARAO DO BENEFICIRIO EFECTIVO DOS RENDIMENTOS OU DO SEU REPRESENTANTE LEGAL STATEMENT BY THE BENEFICIAL OWNER OR BY THE LEGAL REPRESENTATIVE

Declaro que sou (a entidade identicada no Quadro I ) o benecirio efectivo dos rendimentos mencionados no presente formulrio e que esto correctos todos os elementos nele indicados. Mais declaro que estes rendimentos no esto efectivamente conexos com qualquer estabelecimento estvel ou instalao xa localizados em Portugal. I state that I am (the entity identified in Box I is) the beneficial owner of the income mentioned in this form and that the information included herein is accurate. I further declare that this income is not effectively connected with any permanent establishment or fixed base situated in Portugal. Local City Assinatura: Signature: Data (AAAA/MM/DD) Date (YYYY/MM/DD)

_____________/________/________

Signatrio Autorizado: Nome Authorized signatory: Name

Funo: Title/Position:

Form. mod. 21 - RFI (Pedido de dispensa total ou parcial de reteno na fonte do imposto portugus)

INSTRUES DE PREENCHIMENTO

OBSERVAES PRVIAS O presente formulrio destina-se a solicitar a dispensa total ou parcial de reteno na fonte do imposto portugus, quando o benecirio do rendimento seja residente em pas com o qual Portugal tenha celebrado Conveno para Evitar a Dupla Tributao. Deve ser preenchido, em triplicado, pelo benecirio efectivo dos rendimentos obtidos em territrio portugus (ou pelo seu representante legal em Portugal) destinando-se cada um dos exemplares, depois de certicados pela autoridade scal competente do Estado da residncia do benecirio efectivo dos rendimentos, entidade indicada na parte inferior direita das pginas que o compem. O formulrio vlido pelo prazo mximo de um ano. O benecirio dos rendimentos dever informar imediatamente a entidade devedora ou pagadora caso se veriquem alteraes nos pressupostos de que depende a dispensa total ou parcial de reteno na fonte. No caso de dividendos de aces e juros de valores mobilirios representativos de dvida, o formulrio dever ser entregue ao intermedirio nanceiro junto do qual o benecirio efectivo tem a conta de valores mobilirios que, por sua vez, o reencaminhar para a entidade residente em Portugal obrigada a efectuar a reteno na fonte. Qualquer que seja a natureza dos rendimentos indicados no quadro II a entrega do formulrio junto da entidade portuguesa obrigada a efectuar a reteno na fonte dever vericar-se at ao termo do prazo estabelecido para a entrega do respectivo imposto. Essa entidade conservar o exemplar que lhe foi remetido, devendo apresent-lo apenas quando solicitado e no prazo que for xado. O pedido de dispensa de reteno na fonte s se considera entregue quando o formulrio estiver integral e correctamente preenchido. Este formulrio pode ser obtido junto das autoridades scais competentes dos Estados com os quais Portugal celebrou Conveno para Evitar Dupla Tributao, e ainda via Internet, na pgina www.dgci.min-nancas.pt, devendo, neste ltimo caso, a quarta pgina ser impressa em triplicado no verso das trs primeiras.

QUADRO I Destina-se identicao do benecirio efectivo dos rendimentos. O nome/denominao social, bem como a morada, devem estar completos e, quando preenchidos manualmente, devem ser inscritos com letra maiscula. O primeiro Nmero de Identicao Fiscal (NIF) a inscrever corresponde ao do pas de residncia do benecirio dos rendimentos. Dever ainda ser preenchido o NIF portugus que, caso no exista, ser obrigatoriamente requerido pela entidade obrigada a efectuar a reteno na fonte de imposto. A indicao do endereo de correio electrnico (e-mail) facultativa. QUADRO II Neste quadro, destinado identicao dos rendimentos, deve assinalar-se a natureza dos rendimentos que vo ser obtidos em Portugal de acordo com as denies e/ou mbito de aplicao dos artigos da Conveno Para Evitar a Dupla Tributao aplicvel. Em particular, o campo 8 (prestaes de servios) deve ser assinalado relativamente aos casos que caiam no mbito do art 7 da Conveno, isto , quando se trate de rendimentos de prestaes de servios a incluir no lucro das empresas. No campo 1.1, o cdigo ISIN de preenchimento obrigatrio, quando exista, dispensando a indicao da entidade emitente. Dever ser entregue um nico formulrio a cada entidade residente em Portugal obrigada a efectuar a reteno na fonte de imposto sobre rendimentos obtidos em territrio portugus. No caso de as linhas serem insucientes, devero ser utilizados os formulrios que forem necessrios.

QUADRO III Este quadro reservado certicao pelas autoridades scais competentes do Estado da residncia do benecirio dos rendimentos. QUADRO IV Responder SIM ou NO s questes colocadas, especicando quando aplicvel. QUADRO V Este quadro s deve ser preenchido nos casos em que o benecirio detm aces ou valores mobilirios representativos de dvida em conta aberta junto de um intermedirio nanceiro no residente em Portugal. Como se referiu em observaes prvias, ser esta entidade que reencaminhar o formulrio, depois de devidamente preenchido e certicado, para a entidade residente em Portugal obrigada a efectuar a reteno na fonte.

QUADRO VI Quadro destinado identicao da entidade residente em Portugal que se encontra obrigada a efectuar a reteno na fonte do imposto. QUADRO VII Destina-se identicao do representante legal do benecirio dos rendimentos, a identicar obrigatoriamente apenas nos casos em que este pretenda que seja o seu representante legal a solicitar a dispensa total ou parcial da reteno na fonte do imposto devido em Portugal. QUADRO VIII A declarao constante deste quadro deve ser assinada pelo benecirio efectivo, ou pelo seu representante legal em Portugal.

Form mod. 21 RFI (Claim for total or partial exemption from Portuguese withholding tax)

INSTRUCTIONS FOR COMPLETION

PRELIMINARY OBSERVATIONS: The purpose of this form is to claim total or partial exemption from Portuguese withholding tax, in cases where the benecial owner is resident in a country with which Portugal has concluded a Convention for the Avoidance of Double Taxation. It has to be completed in triplicate by the benecial owner of the income derived in Portuguese territory (or by the legal representative in Portugal). After each copy is duly certied by the competent tax authority of the benecial owners State of residence, it must be sent to the entity indicated at the right bottom. This form shall be valid for a maximum period of one year. The benecial owner of the income must immediately inform the payer if any of the conditions to benet from partial or total relief from withholding tax ceases to be met. As to dividends from shares and interest from debt securities, the form must be sent to the nancial intermediary that holds the securities in an account on behalf of benecial owner. Afterwards the nancial intermediary will forward the form to the entity resident in Portugal obliged to withhold tax. Whatever the nature of the income in box II, the form must be submitted to the Portuguese resident entity obliged to withhold tax, not later than the tax due date. This entity will keep the copy and will present it only when required within the established deadline. The claim for total or partial exemption from Portuguese withholding tax is deemed to be submitted only when the form is entirely and correctly lled in. This form is available at the competent tax authorities of the States with which Portugal has concluded a Convention for the Avoidance of Double Taxation and also on the Internet at www.dgci.min-nancas.pt. In case it is downloaded from this webpage, the fourth page has to be printed out in triplicate on the reverse side of the three rst pages.

BOX I This box is intended to identify the benecial owner of the income. The name /business name, as well as the address, must be complete and in capital letters when handwritten. The rst Tax Identication Number (TIN) to enter is the one from the benecial owners country of residence. The Portuguese TIN must also be entered. In case it does not exist, it must be required by the entity obliged to withhold tax. The indication of the e-mail address is optional.

BOX II This box is intended to identify the income. The nature of the income that will be derived in Portugal, accordingly to the denitions and/or application scope of the articles of the applicable Convention for the Avoidance of Double Taxation, must be marked. In particular, box 8 (services rendered) must be marked in cases provided for under Article 7 of the Convention i.e. if the income derived as a consideration for services rendered is included in the business prots. In box 1.1 it is mandatory to complete the ISIN code, whenever there is one, being not necessary to indicate the issuer. Each entity resident in Portugal obliged to withhold tax from income derived in Portuguese territory must receive a single form. If there are not enough lines, please use the number of forms necessary. BOX III This box is restricted to the certication by the competent tax authorities of the benecial owners State of residence.

BOX IV Answer Yes or No to the questions and specify whenever applicable.

BOX V This box must only be completed in cases where the shares or the debt securities are held in an account by a nancial intermediary non resident in Portugal on behalf of the benecial owner. As above referred in the preliminary observations, this entity will forward the form, after duly lled in and certied, to the entity resident in Portugal obliged to withhold tax.

BOX VI This box is intended to identify the entity resident in Portugal which is obliged to withhold tax.

BOX VII This box is intended to identify the benecial owners legal representative, this completion is only mandatory in cases, where the benecial owner wants the legal representative to claim the total or partial exemption from withholding tax due in Portugal.

BOX VIII The statement in this box must be signed by the benecial owner of the income or by the legal representative in Portugal.

Das könnte Ihnen auch gefallen

- Declaração anual de IRT Modelo 2 AngolaDokument1 SeiteDeclaração anual de IRT Modelo 2 AngolaGraciana Garcia100% (1)

- Limpeza Coca-Cola NampulaDokument9 SeitenLimpeza Coca-Cola Nampulaarlindo machavaNoch keine Bewertungen

- CONTROLE DE FREQUÊNCIA: REGISTROS E IRREGULARIDADESDokument4 SeitenCONTROLE DE FREQUÊNCIA: REGISTROS E IRREGULARIDADESTúlio Magnus De Mello LeonardoNoch keine Bewertungen

- Sla & SLMDokument5 SeitenSla & SLMThiago Fernandes LemosNoch keine Bewertungen

- Termo de Ciência - Uso de CelularDokument1 SeiteTermo de Ciência - Uso de CelularJessica MarquesNoch keine Bewertungen

- Contrato serviços telecomunicações condomínioDokument9 SeitenContrato serviços telecomunicações condomínioLivia Araujo100% (2)

- Anexo FDokument1 SeiteAnexo FHumberto Ben JoshuaNoch keine Bewertungen

- Modelo de Contrato de Fornecimento de Material ElétricoDokument4 SeitenModelo de Contrato de Fornecimento de Material ElétricoGercéu Ricarte SilvaNoch keine Bewertungen

- Adriano Kamy PDFDokument1 SeiteAdriano Kamy PDFAna Paula FermoNoch keine Bewertungen

- Contrato Empreitada Vista Dos Jatobás Jctec (4231)Dokument12 SeitenContrato Empreitada Vista Dos Jatobás Jctec (4231)Leonardo LiraNoch keine Bewertungen

- Mapa de Mais-Valias e Menos-ValiasDokument4 SeitenMapa de Mais-Valias e Menos-ValiasmotoriderNoch keine Bewertungen

- Recebimento de bens na Divisão de PatrimônioDokument1 SeiteRecebimento de bens na Divisão de PatrimôniorafispereiraNoch keine Bewertungen

- Relatório CAPES-Cuba sobre missões de estudo e trabalhoDokument3 SeitenRelatório CAPES-Cuba sobre missões de estudo e trabalhokducosteira1981Noch keine Bewertungen

- Apresentação Indelec Cliente FinalDokument51 SeitenApresentação Indelec Cliente FinalCaroline Rodrigues100% (1)

- Carta Chamada VistoDokument2 SeitenCarta Chamada VistoIsaac FranciscoNoch keine Bewertungen

- Termo de entrega e aceite definitivo de obraDokument2 SeitenTermo de entrega e aceite definitivo de obraanna ketllen soaresNoch keine Bewertungen

- PropWebSiteClienteDokument7 SeitenPropWebSiteClienteAnderson Araujo Siqueira100% (1)

- Solicitação Autorização SubcontrataçãoDokument3 SeitenSolicitação Autorização SubcontrataçãoFernando De AndradeNoch keine Bewertungen

- Modelo de ConviteDokument36 SeitenModelo de ConviteRaydemNoch keine Bewertungen

- Check List de Conferencia de Documentos de EmpreiteirosDokument1 SeiteCheck List de Conferencia de Documentos de EmpreiteirosTiago RoseanneNoch keine Bewertungen

- Atestado capacidade técnica empresa construçãoDokument1 SeiteAtestado capacidade técnica empresa construçãoRian Lima VidalNoch keine Bewertungen

- Recibo Pedreiro Pintor Mão de ObraDokument1 SeiteRecibo Pedreiro Pintor Mão de ObraJhon LenoNoch keine Bewertungen

- Termo Notebooks SuprisulDokument5 SeitenTermo Notebooks SuprisulEdson Nascimento100% (1)

- Impermeabilização condomínio Golden StyleDokument14 SeitenImpermeabilização condomínio Golden StyleJakeline FelixNoch keine Bewertungen

- Relatorio Contas Sonangol 2016 PTDokument54 SeitenRelatorio Contas Sonangol 2016 PTPedro Gelson100% (1)

- Devolução de Aparelho Telefônico - Termo de DevoluçãoDokument1 SeiteDevolução de Aparelho Telefônico - Termo de DevoluçãoAlessandro FloresNoch keine Bewertungen

- Análise e acompanhamento de obras de unidades isoladasDokument25 SeitenAnálise e acompanhamento de obras de unidades isoladasJeferson CarvalhoNoch keine Bewertungen

- Parecer Tecnico LicitacaoDokument2 SeitenParecer Tecnico LicitacaoFabinho Juntá Ká Afer TuxáNoch keine Bewertungen

- Compilação TécnicaDokument35 SeitenCompilação TécnicaPedro Sousa100% (1)

- Financiamento Hotel BDMG até R$10,5MDokument5 SeitenFinanciamento Hotel BDMG até R$10,5MAnjos NunesNoch keine Bewertungen

- Protecção Dados LeiDokument57 SeitenProtecção Dados Leijols76Noch keine Bewertungen

- Modelo de Distrato de Serviços ContábeisDokument4 SeitenModelo de Distrato de Serviços ContábeisDe MarcoNoch keine Bewertungen

- Comunicação interna e externa em obrasDokument8 SeitenComunicação interna e externa em obrasRicardo Tambellini VeigaNoch keine Bewertungen

- 2.check List - Mob e Alt. Contratos SubcontratadaDokument7 Seiten2.check List - Mob e Alt. Contratos SubcontratadaFabricio JuniorNoch keine Bewertungen

- Rescisão de contratos: cartas de rescisãoDokument8 SeitenRescisão de contratos: cartas de rescisãoArmando Alves dos Santos100% (1)

- Termo de Confidencialidade FuncionariosDokument4 SeitenTermo de Confidencialidade FuncionariosLeonardo RamiresNoch keine Bewertungen

- Termo de AceiteDokument1 SeiteTermo de AceiteReinan TK ReisNoch keine Bewertungen

- Guia técnico para projetos e obrasDokument24 SeitenGuia técnico para projetos e obrasviniciusNoch keine Bewertungen

- Contrato de prestação de serviços para elaboração de projeto hospitalarDokument92 SeitenContrato de prestação de serviços para elaboração de projeto hospitalarWilson JustinoNoch keine Bewertungen

- Constru ComprasDokument12 SeitenConstru ComprasEduardo StarostaNoch keine Bewertungen

- Manual de Procedimentos CCP PDFDokument84 SeitenManual de Procedimentos CCP PDFSandra ViriatoNoch keine Bewertungen

- Termo de acordo de pagamentoDokument1 SeiteTermo de acordo de pagamentoSERVICE COLETA LTDA MENoch keine Bewertungen

- Auditoria de certificação ISO e IATF da Automotiv do Brasil em dezembroDokument2 SeitenAuditoria de certificação ISO e IATF da Automotiv do Brasil em dezembroAutomotiv do Brasil100% (1)

- Manutenção de computadoresDokument1 SeiteManutenção de computadoresGeremias Soares da CruzNoch keine Bewertungen

- T-Cross - MY 2021 - 21A.5B1.TCR.66Dokument287 SeitenT-Cross - MY 2021 - 21A.5B1.TCR.66Orlando NettoNoch keine Bewertungen

- Contrato de assistência técnicaDokument2 SeitenContrato de assistência técnicaHudsonNoch keine Bewertungen

- COT Construcao PF v25Dokument23 SeitenCOT Construcao PF v25Atila RNoch keine Bewertungen

- Registro de saídas de materiais do almoxarifadoDokument3 SeitenRegistro de saídas de materiais do almoxarifadojose ricardo candidoNoch keine Bewertungen

- Checklist Do Síndico EleitoDokument1 SeiteChecklist Do Síndico EleitoRoberto CostardNoch keine Bewertungen

- Manual de garantias construtivasDokument95 SeitenManual de garantias construtivasParanoá EngenhariaNoch keine Bewertungen

- Termo de Compromisso de EstágioDokument4 SeitenTermo de Compromisso de EstágioAmina lorenaNoch keine Bewertungen

- Modelo de recibo de entrega e devolução da CTPSDokument1 SeiteModelo de recibo de entrega e devolução da CTPSPeyton SoyerNoch keine Bewertungen

- Termo de Confidencialidade Que Entre SiDokument5 SeitenTermo de Confidencialidade Que Entre Sifafefi123Noch keine Bewertungen

- DISTRATO DE ARRENDAMENTO COMERCIALDokument2 SeitenDISTRATO DE ARRENDAMENTO COMERCIALLuciana Santos da SilvaNoch keine Bewertungen

- Controles internos pagamentosDokument31 SeitenControles internos pagamentosAran Nallis0% (1)

- Contrato de consultoria técnicaDokument4 SeitenContrato de consultoria técnicaPaul Syoung AnNoch keine Bewertungen

- Contrato serviços técnicos engenhariaDokument4 SeitenContrato serviços técnicos engenhariaMarceloNoch keine Bewertungen

- Contrato de fornecimento de laranjasDokument5 SeitenContrato de fornecimento de laranjasStefanie FreireNoch keine Bewertungen

- Portuguese tax residency certificate requestDokument2 SeitenPortuguese tax residency certificate requestvitor ferreiraNoch keine Bewertungen

- RFI - 21 - Uk (1) (13072)Dokument8 SeitenRFI - 21 - Uk (1) (13072)Maria Goreti GomesNoch keine Bewertungen

- CAP 16 Opoes 2022 Com Respostas Do ProblemasDokument31 SeitenCAP 16 Opoes 2022 Com Respostas Do ProblemasJulliana PiresNoch keine Bewertungen

- Módulo de Impressão de Declarações Assinadas MIDASDokument3 SeitenMódulo de Impressão de Declarações Assinadas MIDASEuler PanseriNoch keine Bewertungen

- História do INPSDokument1 SeiteHistória do INPSJoaquim Barbosa AguardemNoch keine Bewertungen

- Contrato de ColaboraçãoDokument11 SeitenContrato de Colaboraçãowutang86Noch keine Bewertungen

- Aula 00 - Legislação AduaneiraDokument72 SeitenAula 00 - Legislação AduaneiraEduardo FukushimaNoch keine Bewertungen

- Apostila de Matemática Financeira - Série de PagamentosDokument3 SeitenApostila de Matemática Financeira - Série de PagamentosNatália DaniloNoch keine Bewertungen

- RelatoriooutDokument7 SeitenRelatoriooutapi-255287425Noch keine Bewertungen

- Pagamento de parcela de consórcioDokument1 SeitePagamento de parcela de consórcioEduardoNoch keine Bewertungen

- Teoria Positiva da Contabilidade: revisão dos fundamentos após 10 anosDokument2 SeitenTeoria Positiva da Contabilidade: revisão dos fundamentos após 10 anosOdival Martins PereiraNoch keine Bewertungen

- Rico11Dokument11 SeitenRico11Fernando MedeirosNoch keine Bewertungen

- Modelos de carta de cobrançaDokument7 SeitenModelos de carta de cobrançaDanilo MilhomemNoch keine Bewertungen

- A Nova Contabilidade Pública e suas principais mudançasDokument93 SeitenA Nova Contabilidade Pública e suas principais mudançasUorisson100% (2)

- Perspectivas 2010 - A Política Monetária em 2010Dokument2 SeitenPerspectivas 2010 - A Política Monetária em 2010vmjuniorNoch keine Bewertungen

- Modelo Inicial FGTSDokument9 SeitenModelo Inicial FGTSurssulasantosNoch keine Bewertungen

- Dicas Exercícios Liquidez e EndividamentoDokument6 SeitenDicas Exercícios Liquidez e EndividamentoCarlos PedroNoch keine Bewertungen

- Receitas e Despesas - Perdas e GanhosDokument15 SeitenReceitas e Despesas - Perdas e GanhosEdmundo Valter TeixeiraNoch keine Bewertungen

- Estudo de Caso 2-1 Eurodisney PDFDokument11 SeitenEstudo de Caso 2-1 Eurodisney PDFFernanda FerreiraNoch keine Bewertungen

- Gitman 12e 525314 IM ch12 1Dokument38 SeitenGitman 12e 525314 IM ch12 1MjcNoch keine Bewertungen

- M7 Material Revisão - GabaritoDokument25 SeitenM7 Material Revisão - GabaritoTais SoaresNoch keine Bewertungen

- AULA 1 - SamuelBarbi - NovoMarcoDokument83 SeitenAULA 1 - SamuelBarbi - NovoMarcoSILVIANoch keine Bewertungen

- Política de crédito e cobrança de empresa de alumíniosDokument15 SeitenPolítica de crédito e cobrança de empresa de alumíniosNorthon MottaNoch keine Bewertungen

- Inovações em Lojas - Nestlé Até Você A BordoDokument2 SeitenInovações em Lojas - Nestlé Até Você A BordoGsmd Gouvêa De SouzaNoch keine Bewertungen

- Rafael Toro Livro 2 CeaDokument161 SeitenRafael Toro Livro 2 CeaFlaviana GuaitaNoch keine Bewertungen

- Gás Natural para Condomínio ComercialDokument2 SeitenGás Natural para Condomínio ComercialRafael LuzNoch keine Bewertungen

- Mercados financeiros e crescimento econômicoDokument29 SeitenMercados financeiros e crescimento econômicoAmanda PassosNoch keine Bewertungen

- Atividade Formativa Contratos e Responsabilidade CivilDokument3 SeitenAtividade Formativa Contratos e Responsabilidade CivilMichelle VieiraNoch keine Bewertungen

- Um Balanço Dos Nossos Fundos Recomendados em 2020 - Spiti11012021Dokument28 SeitenUm Balanço Dos Nossos Fundos Recomendados em 2020 - Spiti11012021Roney Andrade PortoNoch keine Bewertungen

- ItausaDokument21 SeitenItausaandre.torresNoch keine Bewertungen

- Crédito emergencial para MEI e MPEDokument17 SeitenCrédito emergencial para MEI e MPEPaulo Ferreira Lima LimaNoch keine Bewertungen

- Aula 03 - Apresentação Das Demonstrações Financeiras (IAS 1)Dokument11 SeitenAula 03 - Apresentação Das Demonstrações Financeiras (IAS 1)Refúgio AyniNoch keine Bewertungen