Beruflich Dokumente

Kultur Dokumente

2 4 Limitations Internal Controls

Hochgeladen von

reza4uOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2 4 Limitations Internal Controls

Hochgeladen von

reza4uCopyright:

Verfügbare Formate

Financial Accountability Handbook Financial Accountability Handbook

> > Vo l u m e 2 Governance

Information Sheet 2.4 Limitations of Internal Controls Introduction

An effective internal control system can only ever provide reasonable assurance that an agencys operating systems, financial controls, reporting and other agency processes are working effectively. No matter how well designed and operated, internal control systems cannot provide absolute assurance that agency objectives have been, and will continue to be, met. Designing and implementing effective systems of internal control requires management to clearly understand agency objectives and its operating environment. Management also needs to recognise the inherent limitations in the design and application of systems that may impact on the ultimate delivery of agency objectives and services. This Information Sheet is designed to highlight the inherent limitations in systems of internal controls and processes, and suggest actions to minimise potential internal control breakdowns.

Internal controls potential limitations

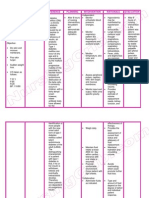

Effective internal control systems reduce the probability of errors or omissions in agency operations. However, there can be limitations in the effectiveness of internal controls. These limitations may result from system omissions, human factors, resource constraints or lack of system flexibility. For example, causes of breakdowns in internal control systems may include: a culture that does not reinforce the value of internal controls staff carelessness, poor judgement or lack of knowledge staff taking short-cuts instead of following procedures staff failing to recognise or act on unusual transactions internal control processes which do not reflect changed operating conditions, specific agency activities or potential new risks collusion by staff for personal gain or other motives controls fail to capture or flag unusual transactions, and controls and processes are viewed as a hindrance in the delivery of agency services so are overridden.

Actions to minimise internal control breakdowns might include: management displaying a culture of responsiveness to identified control weaknesses and encouraging reporting of internal control weaknesses training in internal control processes as part of staff induction, with regular follow up training easy access to user-friendly documented internal procedures having a financial management practice manual that reflects current practice of the agency regular review of potential risks that may significantly impact agency operations regular review and update of internal operational, financial and other processes

>> Volume 2

Governance

IS 2.4 Limitations of Internal Controls

Financial Manage internal audit and risk management functions ment Framework establishment of effective > Overview and implementation of an effective fraud, corruption and official misconduct mitigation > design Diagram

strategy.

Ju 2008 ne

assessment and adoption of audit recommendations, when appropriate, and

Smaller agencies and bodies

Smaller agencies and offices with few staff (for example, departmental regional offices) may have limited opportunities to apply internal control processes as rigorously as would be the case in larger offices (for example, less effective segregation of duties due to limited staff numbers). In these instances, it is suggested that agency management consider the adoption of innovative measures to assist in mitigating the impact of potential limitations in agency internal control systems. Examples of such measures may include: spot checks of various transactions regular reporting from agency management on specific operational matters and agreed key performance indicators, and for smaller statutory bodies, utilising independent board members to approve or review transactions.

Further information

If you have any questions concerning the Financial Accountability Handbook, please contact the relevant Business Branch of Treasury for your agency. Alternatively, email the Financial Management Helpdesk with details of your query and a response will be provided: Email: fmhelpdesk@treasury.qld.gov.au

Financial Accountability Handbook

Date Issued: November 2012

Page 2 of 2

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Vivekananda'S Conception of Normative Ethics and Resolution Ethical Problems in BusinessDokument8 SeitenVivekananda'S Conception of Normative Ethics and Resolution Ethical Problems in BusinessYajat BhargavNoch keine Bewertungen

- Clay & Shale Industries in OntarioDokument193 SeitenClay & Shale Industries in OntarioJohn JohnsonNoch keine Bewertungen

- List of Marketing Metrics and KpisDokument5 SeitenList of Marketing Metrics and KpisThe KPI Examples ReviewNoch keine Bewertungen

- Emergency Floatation Helicoptero PDFDokument14 SeitenEmergency Floatation Helicoptero PDFterrywhizardhotmail.com The Best Of The Best.Noch keine Bewertungen

- Gender Inequality and Its Impact On Mental HealthDokument20 SeitenGender Inequality and Its Impact On Mental Healthbanipreet kaurNoch keine Bewertungen

- Solution Manual For Understanding Business 12th Edition William Nickels James Mchugh Susan MchughDokument36 SeitenSolution Manual For Understanding Business 12th Edition William Nickels James Mchugh Susan Mchughquoterfurnace.1ots6r100% (51)

- Transfer CaseDokument46 SeitenTransfer Casebantuan.dtNoch keine Bewertungen

- Power - of - Suffering 2Dokument21 SeitenPower - of - Suffering 2jojiNoch keine Bewertungen

- The Internet of ThingsDokument33 SeitenThe Internet of ThingsKaedara KazuhaNoch keine Bewertungen

- Certification Programs: Service As An ExpertiseDokument5 SeitenCertification Programs: Service As An ExpertiseMaria RobNoch keine Bewertungen

- April FoolDokument179 SeitenApril FoolrogeraccuraNoch keine Bewertungen

- Modern Steel ConstructionDokument70 SeitenModern Steel ConstructionohundperNoch keine Bewertungen

- Syllabus (2020) : NTA UGC-NET Computer Science and ApplicationsDokument24 SeitenSyllabus (2020) : NTA UGC-NET Computer Science and ApplicationsDiksha NagpalNoch keine Bewertungen

- Note 15-Feb-2023Dokument4 SeitenNote 15-Feb-2023Oliver ScissorsNoch keine Bewertungen

- Worship Aid - May Crowning 2020Dokument5 SeitenWorship Aid - May Crowning 2020Kevin RyanNoch keine Bewertungen

- Minuto hd8761Dokument64 SeitenMinuto hd8761Eugen Vicentiu StricatuNoch keine Bewertungen

- Sensory Play Activities Kids Will LoveDokument5 SeitenSensory Play Activities Kids Will LoveGoh KokMingNoch keine Bewertungen

- Introduction To Hydraulic System in The Construction Machinery - Copy ALIDokument2 SeitenIntroduction To Hydraulic System in The Construction Machinery - Copy ALImahadNoch keine Bewertungen

- Support of Roof and Side in Belowground Coal MinesDokument5 SeitenSupport of Roof and Side in Belowground Coal MinesNavdeep MandalNoch keine Bewertungen

- Btech Me 5 Sem Heat and Mass Transfer Eme504 2020Dokument2 SeitenBtech Me 5 Sem Heat and Mass Transfer Eme504 2020SuryaNoch keine Bewertungen

- Warranties Liabilities Patents Bids and InsuranceDokument39 SeitenWarranties Liabilities Patents Bids and InsuranceIVAN JOHN BITONNoch keine Bewertungen

- HRIRDokument23 SeitenHRIRPhuong HoNoch keine Bewertungen

- MODULE-6 Human Person As Embodied SpiritDokument18 SeitenMODULE-6 Human Person As Embodied SpiritRoyceNoch keine Bewertungen

- Nursing Care Plan Diabetes Mellitus Type 1Dokument2 SeitenNursing Care Plan Diabetes Mellitus Type 1deric85% (46)

- Test Bank For Macroeconomics 8th Canadian Edition Andrew AbelDokument16 SeitenTest Bank For Macroeconomics 8th Canadian Edition Andrew AbelstebinrothNoch keine Bewertungen

- National Article Writing Competition 2020: Centre For Competition and Investment Laws and PolicyDokument8 SeitenNational Article Writing Competition 2020: Centre For Competition and Investment Laws and PolicyNisha PasariNoch keine Bewertungen

- Internet in My LifeDokument4 SeitenInternet in My LifeАндріана ПрусNoch keine Bewertungen

- 1) About The Pandemic COVID-19Dokument2 Seiten1) About The Pandemic COVID-19محسين اشيكNoch keine Bewertungen

- CE - 441 - Environmental Engineering II Lecture # 11 11-Nov-106, IEER, UET LahoreDokument8 SeitenCE - 441 - Environmental Engineering II Lecture # 11 11-Nov-106, IEER, UET LahoreWasif RiazNoch keine Bewertungen

- Industrial Marketing Module 2Dokument32 SeitenIndustrial Marketing Module 2Raj Prixit RathoreNoch keine Bewertungen