Beruflich Dokumente

Kultur Dokumente

Aifs

Hochgeladen von

Tanmay MehtaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Aifs

Hochgeladen von

Tanmay MehtaCopyright:

Verfügbare Formate

Prof.

Lin Guo FIN 417

HBS Case: Hedging Currency Risks at AIFS

Due date: April 12, 2012

Instructions: This case should be done individually. You should prepare a written analysis, and hand in two copies of your analysis on April 12 in class. Only hard copies of the case analysis are accepted. I will submit one of the copies to the Deans office for assessment purpose. Each student should also bring his/her own copy of the write-up to class, as well as the case itself, so that we can refer to the specifics in our discussion. The text analysis of your case should be about 3-5 pages (double-spaced). You should download the excel spreadsheet for the case at the Blackboard, complete the quantitative analysis using the spreadsheet, and attach the spreadsheet to your case write-up to support your arguments.

Your write-up should begin with an opening paragraph that defines the main problem in the case and your recommended solution. The remainder of your paper should support your conclusion and recommendations. This support should be based on your definition of the problem and inferences that you draw from the facts of the case. Structure is important for your argument to be lucid and transparent.

The grading will be based on the quality of your analysis and writing. Points will be deducted for grammar mistakes and typos.

Your case should address the following questions:

1. What gives rise to the currency exposure at AIFS?

2. What would happen if Archer-Lock and Tabaczynski did not hedge at all?

3. What would happen with a 100% hedge with forwards? A 100% hedge with options? Use the forecast final sales volume of 25,000 and analyze the possible outcomes relative to the "zero impact" scenario described in the case.

4. What happens if sales volumes are lower or higher than expected as outlined at the end of the case?

5. What hedging decision would you advocate?

Key Problem

The American Institute for Foreign Studies (AIFS) organizes study abroad programs and cultural exchanges for American students. The firm's revenues are mainly in U.S. dollars, but most of its costs are in euros. AIFS sets guaranteed prices for its exchanges and tours a year in advance, before its final sales figures are known. If the dollar depreciates against the Euro during this period, AIFSs cost would be higher when measuring in dollars, and negatively impact the firms profit. In order to hedge its foreign exchange exposure, AIFS can use an appropriate balance between forward contracts and currency options to achieve the goal.

The Case with No Hedging If the exchange rate remains constant at $1.22/euros then AIFS will not incur a foreign exchange loss or a gain. It would cost $1220 per participant at this exchange rate. If the dollar depreciates against euro, the actual dollar costs would be above $1220, and then there would be a negative impact. If actual dollar costs were lower than expected, the impact would be positive. Thus, with a sales volume of 25,000 participants and the exchange rate rises to $1.48/euros then AIFS will be subject to a loss of $4,391,892. If the exchange rate drops to $1.01/euros then AIFS will save $5,198,020.

The Case with Forward Hedging 100%

The Case with Option Hedging 100%

Sales Volume Variation

Recommendation Hedging Currency Risks at AIFS

1. The final sales volume and the final dollar exchange rate gives rise to the currency exposure risk. Prices are set 1 year ahead of time so any fluctuation in the exchange rate will potentially cause a loss or savings to AIFS when the currency is exchanged.

2. If the exchange rate remains constant at $1.22/euros then AIFS will not incur a loss or a gain. It would cost $1220 per participant at this exchange rate. If actual dollar costs were above this level, then there would be a negative impact. If actual dollar costs were lower than expected, the impact would be positive. Thus, with a sales volume of 25,000 participants and the exchange rate rises to $1.48/euros then AIFS will be subject to a loss of $4,391,892. If the exchange rate drops to $1.01/euros then AIFS will save $5,198,020.

3. With a 100% forward hedge under a final sales volume of 25,000 participants, AIFS is facing a dollar inflow of $25,000,000. Under this assumption, the optimal amount of expenses would be 1000 Euros per student. Risk arises when currency rates between the Euro and the dollar fluctuate. From the European perspective, there is 25 million Euros in underlying exposure. If 25 million Euros were bought forward at the 1.22 $/euro rate, then 30.5 million dollars will be sold. If the contract was signed in June 2004, then 1 year 30.5 million dollars can be spent for 25 million Euros, leaving a net position of 0 Euros and 30.5 million dollars (100% forward hedge). With this forward hedge, AIFS is completely mitigating the exchange rate risk between the dollar and the Euro, and are thus protected from losing money if the exchange rate approaches 1.48$/Euro. With a 100% option hedge,

4. The higher or lower sales volume would exaggerate whatever gains or losses AIFS will realize. We are able to utilize the AIFS shifting box to determine what the reactions to differing sales volume versus the exchange rate. If the volume is low and the exchange rate is out of the money, the loss will be lower than if the volume was the same as projected.

With a lower sales volume but in the money interest rate the gain would be realized, however again it would be smaller than the gain with the expected 25,000 participant value. For a higher sales volume and out of the money exchange rate the loss would be the highest possible, which can be hedged by using an option. If the sales volume is high and the rate is in the money, this would be the highest possible gain, however it would also require AIFS to buy more currency. This is both good and bad news, because the exchange rate could be out of the money by the time AIFS is able to buy more currency. However if the exchange rate was in the money this option would be the best possible situation, creating the highest revenues of all possibilities.

5. The option hedge strategy would be the policy we would advocate because AIFS purchases foreign currency based on the projected sales volumes. The option strategy provides the best protection from the fluctuation in both exchange rates and sales volumes. We believe that due to the industry in which AIFS operates, the company is more likely to experience higher fluctuations in sales volumes than in the exchange rates. The option strategy provides a more versatile option to hedge against this potential risk because AIFS will not be locked into a specific rate, as is the case with forward hedges.

Das könnte Ihnen auch gefallen

- ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term InvestingVon EverandETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term InvestingBewertung: 2 von 5 Sternen2/5 (1)

- Case AIFSDokument11 SeitenCase AIFSSara Ceniceros100% (1)

- DAAS2 DocxdgsdgsdDokument4 SeitenDAAS2 DocxdgsdgsdemrangiftNoch keine Bewertungen

- Hedging currency risks at AIFSDokument5 SeitenHedging currency risks at AIFSmandeep_hs7698100% (1)

- Aifs Case - Fin 411Dokument2 SeitenAifs Case - Fin 411Tanmay MehtaNoch keine Bewertungen

- AIFSDokument1 SeiteAIFSTanmay MehtaNoch keine Bewertungen

- AIFS Case Study SolutionsDokument4 SeitenAIFS Case Study SolutionsOmarChehimi83% (6)

- Aifs/ Finance Case StudyDokument5 SeitenAifs/ Finance Case StudyMohit Kumar GuptaNoch keine Bewertungen

- Hedging at AIFS-1Dokument4 SeitenHedging at AIFS-1Mayank NayakNoch keine Bewertungen

- Hedging Currency Risk at AIFSDokument6 SeitenHedging Currency Risk at AIFSbssilver123_5267248494% (18)

- Hedging Currency Risks at AIFSDokument4 SeitenHedging Currency Risks at AIFSMaría de Lourdes Santos QuinteroNoch keine Bewertungen

- AISFDokument2 SeitenAISFamitaquariusNoch keine Bewertungen

- EADS FX Hedging Strategies ComparisonDokument8 SeitenEADS FX Hedging Strategies ComparisonSarvagya JhaNoch keine Bewertungen

- Aifs Assignment IfmDokument5 SeitenAifs Assignment Ifmsumbul imran100% (1)

- Hedging Currency Risk at AifsDokument1 SeiteHedging Currency Risk at Aifstime passNoch keine Bewertungen

- Aifs ExcelDokument3 SeitenAifs Excelu0909098Noch keine Bewertungen

- Aifs ExcelDokument1 SeiteAifs ExcelKumarVelivelaNoch keine Bewertungen

- MDP Case-TemplateDokument2 SeitenMDP Case-Templatekarol lnNoch keine Bewertungen

- GM Foreign Exchange HedgeDokument4 SeitenGM Foreign Exchange HedgeRima Chakravarty Sonde100% (1)

- Aifs ExcelDokument2 SeitenAifs ExcelDinesh Kumar0% (2)

- Foreign Exchange Hedging Strategies at General MotorsDokument8 SeitenForeign Exchange Hedging Strategies at General MotorsMoh. Farid Adi PamujiNoch keine Bewertungen

- FX Risk Hedging at EADS: Group 1-Prachi Gupta Pranav Gupta Sarvagya Jha Harshvardhan Singh Puneet GargDokument9 SeitenFX Risk Hedging at EADS: Group 1-Prachi Gupta Pranav Gupta Sarvagya Jha Harshvardhan Singh Puneet GargSarvagya JhaNoch keine Bewertungen

- Tiffany and CoDokument2 SeitenTiffany and Comitesh_ojha0% (2)

- Case StudyDokument4 SeitenCase StudylifeisyoungNoch keine Bewertungen

- Jet fuel price trends 1990-2011Dokument123 SeitenJet fuel price trends 1990-2011jk kumar100% (1)

- Module 4 Mini-Case SubmittedDokument4 SeitenModule 4 Mini-Case SubmittedRAD0% (1)

- General Motors Transactional Translational ExposuresDokument5 SeitenGeneral Motors Transactional Translational ExposuresRaghavendra Somasundaram100% (3)

- FX Risk Hedging at EADSDokument14 SeitenFX Risk Hedging at EADSAlexandra Ermakova100% (1)

- GM HedgingDokument27 SeitenGM HedgingYun Clare YangNoch keine Bewertungen

- Foreign Exchange Hedging Strategies at General MotorsDokument10 SeitenForeign Exchange Hedging Strategies at General MotorsHaninditaGuritnaNoch keine Bewertungen

- Should Porsche Hedge Its Foreign Exchange Risk1Dokument1 SeiteShould Porsche Hedge Its Foreign Exchange Risk1niaz Ali KhanNoch keine Bewertungen

- Presentation V2Dokument20 SeitenPresentation V2tintin50100% (1)

- Foreign Exchange Hedging Strategies at GDokument11 SeitenForeign Exchange Hedging Strategies at GGautam BindlishNoch keine Bewertungen

- Case 1 AIFS - SpreadsheetDokument19 SeitenCase 1 AIFS - SpreadsheetTomato1314Noch keine Bewertungen

- Foreign Exchange Hedging Strategies at General Motors: Case Study SolutionDokument27 SeitenForeign Exchange Hedging Strategies at General Motors: Case Study SolutionKrishna Kumar67% (3)

- Surrogate AdvertisingDokument11 SeitenSurrogate AdvertisingPrajwal MurthyNoch keine Bewertungen

- Foreign Exchange Hedging Strategies at General MotorsDokument7 SeitenForeign Exchange Hedging Strategies at General MotorsShashi Suman67% (3)

- CARREFOUR S.A. Case SolutionDokument3 SeitenCARREFOUR S.A. Case SolutionShubham PalNoch keine Bewertungen

- Porsche's FX Hedging and VW Acquisition StrategyDokument2 SeitenPorsche's FX Hedging and VW Acquisition StrategyRavi Patel100% (1)

- FNCE 6018 Group Project: Hedging at PorscheDokument2 SeitenFNCE 6018 Group Project: Hedging at PorschejorealNoch keine Bewertungen

- Carrefour SA International Business Finance 13013Dokument14 SeitenCarrefour SA International Business Finance 13013nadiafloreaNoch keine Bewertungen

- Foreign Exchange Hedging Strategies at General MotorsDokument7 SeitenForeign Exchange Hedging Strategies at General MotorsYun Clare Yang0% (1)

- Foreign Exchange Hedging Strategies at General MotorsDokument6 SeitenForeign Exchange Hedging Strategies at General MotorsNyamandasimunyolaNoch keine Bewertungen

- Foreign Exchange Hedging Strategies at General MotorsDokument6 SeitenForeign Exchange Hedging Strategies at General MotorsLarry Holmes100% (5)

- Foreign Exchange Hedging Strategies at General Motors CompetitiveDokument11 SeitenForeign Exchange Hedging Strategies at General Motors CompetitiveJayesh Bhandarkar25% (4)

- Chapter 12 SolutionsDokument11 SeitenChapter 12 SolutionsEdmond ZNoch keine Bewertungen

- Derivatives Future & OptionsDokument6 SeitenDerivatives Future & OptionsNiraj Kumar SahNoch keine Bewertungen

- FINA3020 Assignment3Dokument5 SeitenFINA3020 Assignment3younes.louafiiizNoch keine Bewertungen

- Purchasing Power Parity PPP Purchasing PowerDokument5 SeitenPurchasing Power Parity PPP Purchasing PowerInnocent MollaNoch keine Bewertungen

- Ch10 HW SolutionsDokument43 SeitenCh10 HW Solutionsgilli1trNoch keine Bewertungen

- Universal FM CaseDokument6 SeitenUniversal FM Casekiller drama100% (1)

- Carrefour Case Study 36847Dokument5 SeitenCarrefour Case Study 36847nadiaflorea0% (1)

- FIN437 Answers To The Recommended Questions Portfolio ManagementDokument6 SeitenFIN437 Answers To The Recommended Questions Portfolio ManagementSenalNaldoNoch keine Bewertungen

- New Microsoft Word DocumentDokument6 SeitenNew Microsoft Word DocumentCharmi SatraNoch keine Bewertungen

- Chapter 8Dokument20 SeitenChapter 8Ersin AnatacaNoch keine Bewertungen

- Hedging Currency Risks (Dynamic Hedging Strategies Based On O&A Trading ModelsDokument12 SeitenHedging Currency Risks (Dynamic Hedging Strategies Based On O&A Trading ModelsevergreennarenNoch keine Bewertungen

- Investment Strategy For The Long TermDokument4 SeitenInvestment Strategy For The Long Termthomakis68Noch keine Bewertungen

- 8 Basic Forex Market ConceptsDokument5 Seiten8 Basic Forex Market ConceptsSachinNoch keine Bewertungen

- Economic ExposureDokument7 SeitenEconomic ExposureChi NguyenNoch keine Bewertungen

- S and PDokument12 SeitenS and PTanmay MehtaNoch keine Bewertungen

- BPM AssignmentDokument31 SeitenBPM AssignmentTanmay Mehta0% (1)

- Business Communication Iii: Tanmay Mehta 527Dokument6 SeitenBusiness Communication Iii: Tanmay Mehta 527Tanmay MehtaNoch keine Bewertungen

- 22 Bond ValuationDokument26 Seiten22 Bond ValuationTanmay MehtaNoch keine Bewertungen

- GD TypesDokument2 SeitenGD TypesTanmay MehtaNoch keine Bewertungen

- Bond valuation and yield analysisDokument35 SeitenBond valuation and yield analysisTanmay MehtaNoch keine Bewertungen

- Advanced ExcelDokument4 SeitenAdvanced ExcelTanmay MehtaNoch keine Bewertungen

- Book Building Process: Get QuoteDokument9 SeitenBook Building Process: Get QuoteTanmay MehtaNoch keine Bewertungen

- Kishore BiyaniDokument5 SeitenKishore BiyaniTanmay MehtaNoch keine Bewertungen

- FX Hedging Techniques for Managing Currency RiskDokument7 SeitenFX Hedging Techniques for Managing Currency RiskTanmay Mehta0% (2)

- Valuation of Fixed Income SecuritiesDokument29 SeitenValuation of Fixed Income SecuritiesTanmay MehtaNoch keine Bewertungen

- Cfa1 Secret Sauce DemoDokument9 SeitenCfa1 Secret Sauce DemoTanmay MehtaNoch keine Bewertungen

- 22 Bond ValuationDokument26 Seiten22 Bond ValuationTanmay MehtaNoch keine Bewertungen

- 22 Bond ValuationDokument26 Seiten22 Bond ValuationTanmay MehtaNoch keine Bewertungen

- Hedging at AIFS-1Dokument4 SeitenHedging at AIFS-1Mayank NayakNoch keine Bewertungen

- Americanhomeproductscorporation Copy 120509004239 Phpapp02Dokument6 SeitenAmericanhomeproductscorporation Copy 120509004239 Phpapp02Tanmay Mehta100% (1)

- Hedging at AIFS-1Dokument4 SeitenHedging at AIFS-1Mayank NayakNoch keine Bewertungen

- Itc - Mpeg Case StudyDokument12 SeitenItc - Mpeg Case StudyTanmay MehtaNoch keine Bewertungen

- Lease Vs Hire FM FinalDokument60 SeitenLease Vs Hire FM FinalTanmay MehtaNoch keine Bewertungen

- Energy ManagementDokument10 SeitenEnergy ManagementTanmay MehtaNoch keine Bewertungen

- Itc - Mpeg Case StudyDokument29 SeitenItc - Mpeg Case StudyTanmay MehtaNoch keine Bewertungen

- Ctpat Prog Benefits GuideDokument4 SeitenCtpat Prog Benefits Guidenilantha_bNoch keine Bewertungen

- 1Dokument10 Seiten1himanshu guptaNoch keine Bewertungen

- Acca FeeDokument2 SeitenAcca FeeKamlendran BaradidathanNoch keine Bewertungen

- Authors LibraryDokument1.128 SeitenAuthors Libraryauthoritybonus75% (12)

- Det Syll Divisional Accountant Item No 19Dokument2 SeitenDet Syll Divisional Accountant Item No 19tinaantonyNoch keine Bewertungen

- LGEIL competitive advantagesDokument3 SeitenLGEIL competitive advantagesYash RoxsNoch keine Bewertungen

- Appointment and Authority of AgentsDokument18 SeitenAppointment and Authority of AgentsRaghav Randar0% (1)

- The Builder's Project Manager - Eli Jairus Madrid PDFDokument20 SeitenThe Builder's Project Manager - Eli Jairus Madrid PDFJairus MadridNoch keine Bewertungen

- GAO Report On Political To Career ConversionsDokument55 SeitenGAO Report On Political To Career ConversionsJohn GrennanNoch keine Bewertungen

- Swift MessageDokument29 SeitenSwift MessageAbinath Stuart0% (1)

- Surbhi Lohia - Vikash Kandoi - : Page - 1Dokument23 SeitenSurbhi Lohia - Vikash Kandoi - : Page - 1Neetesh DohareNoch keine Bewertungen

- Managing Human Resources at NWPGCLDokument2 SeitenManaging Human Resources at NWPGCLMahadi HasanNoch keine Bewertungen

- SMDDokument2 SeitenSMDKhalil Ur RehmanNoch keine Bewertungen

- MphasisDokument2 SeitenMphasisMohamed IbrahimNoch keine Bewertungen

- Get Surrounded With Bright Minds: Entourage © 2011Dokument40 SeitenGet Surrounded With Bright Minds: Entourage © 2011Samantha HettiarachchiNoch keine Bewertungen

- Manage Greenbelt Condo UnitDokument2 SeitenManage Greenbelt Condo UnitHarlyne CasimiroNoch keine Bewertungen

- Βιογραφικά ΟμιλητώνDokument33 SeitenΒιογραφικά ΟμιλητώνANDREASNoch keine Bewertungen

- AdvancingDokument114 SeitenAdvancingnde90Noch keine Bewertungen

- APSS1B17 - Contemporary Chinese Society and Popcult - L2 (Week 3)Dokument28 SeitenAPSS1B17 - Contemporary Chinese Society and Popcult - L2 (Week 3)Arvic LauNoch keine Bewertungen

- Corporate BrochureDokument23 SeitenCorporate BrochureChiculita AndreiNoch keine Bewertungen

- Injection Molding Part CostingDokument4 SeitenInjection Molding Part CostingfantinnoNoch keine Bewertungen

- Shubham MoreDokument60 SeitenShubham MoreNagesh MoreNoch keine Bewertungen

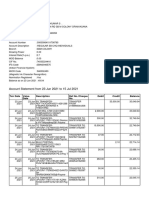

- Account Statement From 23 Jun 2021 To 15 Jul 2021Dokument8 SeitenAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterpriseNoch keine Bewertungen

- SC upholds conviction for forgery under NILDokument3 SeitenSC upholds conviction for forgery under NILKobe Lawrence VeneracionNoch keine Bewertungen

- NSU FALL 2012 FIN254.9 Term Paper On Aramit LimitedDokument24 SeitenNSU FALL 2012 FIN254.9 Term Paper On Aramit LimitedSamaan RishadNoch keine Bewertungen

- Nike's Winning Ways-Hill and Jones 8e Case StudyDokument16 SeitenNike's Winning Ways-Hill and Jones 8e Case Studyraihans_dhk3378100% (2)

- ERP Selection Keller Manufacturing 850992 - EmeraldDokument10 SeitenERP Selection Keller Manufacturing 850992 - EmeraldNiraj KumarNoch keine Bewertungen

- Group 2Dokument54 SeitenGroup 2Vikas Sharma100% (2)

- Project Management Assignment 2Dokument11 SeitenProject Management Assignment 2Melissa Paul75% (8)

- IBM Brand Equity Restoration and Advertising EvolutionDokument17 SeitenIBM Brand Equity Restoration and Advertising EvolutionJuandtaNoch keine Bewertungen