Beruflich Dokumente

Kultur Dokumente

Business Law Full Notes B.com Part 26

Hochgeladen von

Abhimanyu SinghOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Business Law Full Notes B.com Part 26

Hochgeladen von

Abhimanyu SinghCopyright:

Verfügbare Formate

DEPARTMENT OF COMMERCE BACHELOR OF COMMERCE (B.COM.

)

Three-Year Full Time Programme Ordinances 1. The Bachelor degree in Commerce of Mahatma Gandhi Kashi Vidyapith shall be conferred on 10+2 students who have completed prescribed course of study for not less than three years spread over three academic years and have passed the examination as prescribed under the relevant ordinances. 2. The method of teaching adopted shall be combination of lectures and seminars by the faculty and guest speakers, case discussions, students presentation, use of audio-visual devices, computers etc. The minimum qualification for admission shall be a 10+2 from any School/College in India or abroad recognized or equivalent thereto. For admission in B.Com three year course the candidate must have any of the following subject at +2 level. Commerce or Economics or Mathematics. However the candidate having Biology subject at +2 level is not eligible for admission in B.Com. course. 3. (a) Under this programme there are 125(One hundred Twenty Five) seats out of which seats are reserved as follows: SC candidates ST candidates OBC candidates 21% 2% 27%

(b) 25% of available seats shall be reserved for girl students on vertical reservation basis. Necessary reservation will be given to the wards of employees and teachers of the university as per university rules. 1

(c) Colleges under the Jurisdiction of the university are permitted to admit students on the basis of sanctioned strength of the college from time to time. 4. The admission shall be made through written test or on Merit basis as decided by the University/College from time to time. 5. The schedule of fee to be paid in each year by the students shall be as per University Rules formulated from time to time. In addition to the above, annual examinations fee will be payable separately as per university rules. 6. No student will be permitted to pursue any other course of study or take up an employment during the tenure of this programme. 7. No candidates shall be allowed to appear in the annual examination unless he/she has attended at least 75% of the lectures in each paper . 8. The evaluation of the students shall be done on the basis of the written annual examination having 100 marks in each paper. A. Duration of annual written examination carrying 100 marks in each paper shall be of three hours. B. A candidate will be declared to have passed the annual examination if she/he secures passing marks as prescribed by the university. C. The final result of the candidates shall be declared on the basis of combined results of all the annual examination of B.Com. I, B.Com. II and B.Com. III. A candidate securing 60% or more marks or above will be awarded first division and candidates securing 45% or more but less than 60% marks in the aggregate will be placed in II division and candidate securing 33% or more but less than 45% marks in the aggregate will be placed in IIIrd division. 2

9. Students shall be eligible for the facility of improvement/ back paper in two papers in each year as per university rules. 10. A candidate who fails in an annual examination or fails to clear back paper, shall be permitted to appear in the annual examination as a casual student only on the completion of his prescribed course of study. Such students shall be treated as paripassue with regular students of the concerned year. 11. The Bachelors Degree of Commerce shall consist of the course structure and detailed syllabus prescribed in the Annexure 1.

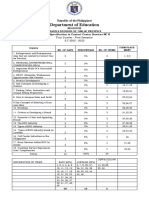

Annexture-1 SYLLABUS BACHELOR OF COMMERCE (THREE YEARS FULL TIME PROGRAMME) B.Com. Part 1 Paper Code BC 101 Paper Name External (Yearly Examination) 100 100 100 100 100 80 OR 100 Practical Total

BC 102 BC 103

BC 104 BC 105 BC106 (A) OR BC106 (B)

Business Organisation and Management Financial Accounting Business Regulatory Framework Business Economics Business Statistics Introduction to Computer Applications OR Business Mathematics / Office Management Grand Total

-----20

100 100 100 100 100 100 OR 100 600

Code: BC 101 BUSINESS ORGANISATION AND MANAGEMENT Objective: This course familiarizes the students with the basics and principles of management . Unit-1 Introduction: Concept, Nature, Process and Significance of Management; Managerial roles (Mintzberg); An overview of functional areas of Management; Development of management thought; Classical and Neo-classical System; Contingency approach. Planning: Concept, Process and types; Decision-Making: Concept and Process: Management by Objectives, Unit-II Organising: Concept, Nature, Process and Significance: Authority and Responsibility relationships: Centralisation and Decentralization; Departmentation; Organisational StructureForms and Contingency factors. Corporate Planning; Environment Analysis and Diagnosis; Strategy Formulation. Unit-III Direction: Concept and Techniques, Managerial Control- Concept and Process, Effective Control System. Techniques of Control; Motivation and Leading people at work: Motivation-Concept, Theories-Maslow, Herzberg, McGregor and Quchi, Financial and Non Financial Incentives, Leadership- Concept and Leadership styles, Likerts Four system of Leadership Unit-IV Coordination as an essence of Management, Communication- Natutre, Process, Networks and Barriers. Effective Communication. Management of change: Concept, Nature and Process of Planned Change, Resistance to change, Emerging Horizons of Management in a changing environment. REFERENCES: 1. Aswathappa & Yadumurth 2. Arunachalam, P. 3. Agrawal,R.C. 4. Gupta, N.S. 5. Jha, Bishwambhar 6. Jolshi, G.L. 7. Prasad, Jagdish 8. Shukla, Sudhir 9. Shukla, Sudhir :Business Organisation and Management :Business Organisation and Management :Prabandha ke Siddhant :Organisation Theory and Behaviour :Fundamentals of Industrial Organisation and Management :Vyavasayik Sanghathan Avam Prabandha :Vyavasayik Sanghathan Avam Prabandha : Vyavasayik Sanghathan Avam Prabandha : Management Concept & Principles

Code:BC-102 FINANCIAL ACCOUNTING Objective-: This course exposes the students to the basic concepts of accounting knowledge to develop financial accounting as applicable to various business institutions. Unit-I Nature and scope of Accounting : Accounting concepts and conventions, Indian and International Accounting standards. Accounting Mechanics: Double Entry System, Preparation of Journal Ledger and Trial Balance, Concept of Income and its Measurement. Preparation of Final Statement. Unit-II Royalty Accounts, Hire Purchase and Instalment Payment System, Insolvency Accounts Unit-III Departmental Accounts, Branch Accounts, Double Account System. Unit-IV Accounts of Insurance Companies, Computation of Fire Insurance claims Accounts of Banking companies Voyage accounts, Empties Accounts REFERENCES: 1. Jaisawal, K.S. :Financial Accounting (Both in Hindi & English Version) (Vaibhav laxmi Prakashan). 2010, Varanasi

Code : BC 103 BUSINESS REGULATORY FRAMEWORK Objective: The objective of this course is to provide a brief idea about the framework of Indian business laws. Unit-I Law of Contract (1872); Nature of Contract, Classifications of contract, Offer and Acceptance, Capacity of parties to Contract, Fee Consent: Consideration, Legality of object, Agreement declared Void Performance of Contract, Discharge of Contract, Remedies for Breach of Contract, Discharge of Contract. Unit-II Special Contracts, Indemnity, Guarantee, Bailment and Pledge Sale of Goods Act 1930: Formation of contract of sale, Goods and their classifications, Price; Conditions and Warranties; Transfer of Property in goods; Performance of the Contract of Sales; Unpaid Seller and his rights. Unit-III Definition of Negotiable Instructions; Features; Promissory Notes; Bill of Exchange and Cheque Holder in due course. Crossing of a cheque and Negotiable Instrument Act, 1881 its types, Negotiation and Assignment. Dishonor and Discharge of Negotiable Instrument. Unit-IV The Consumer Protection Act, 1986: Salient features, Definition of Consumer, Grievance redressal machinery, Foreign Exchanger Management Act, 2000. REFERENCES: 1. Basu, D.D. 2 Chawla & Garg 3. Chakraborty, A.H. 4. Chandha, P.R. 5. Kapoor, N.D. 6. Krishnamurthy, S. 7. Kuchhal, M.C. 8. Singh, Avtar 9. Singh, Avtar 10. Taxman 11. Shama R.C.&Vishnoi R.K.

:Introduction to the Constitution of India :Marchantile Law :Industrial Licensing & Industries :Business Law :Business Law :Economic Legislation :Business Law :Mercantile Law :Company Law :Mercantile Law :Business Regnlatory Framework (Hindi&English) Version

Code: BC 104 BUSINESS ECONOMICS

Objective: This Course is meant to acquaint the students with the principles of Business Economics as are applicable in business. Units-I Introduction: Nature and scope of Business Economics, Utility; Meaning, Kinds, & Measurement of utility, Law of Demand, Law of marginal diminishing utility, Elasticity of Demand; Concept and measurement of elasticity of demand, Price, Income and Cross Elasticity, Determinants of Elasticity of Demand, Importance of elasticity of demand. Units-II Theory of Cost: Short run & Long run Cost Curve-Traditional and Modern approaches. Production function: Law of Variable proportion; Isoquants; Economic Regions and Optimum factor Combination; Expansion Path; Ridge lines, Returns to scale; Internal and external economics and diseconomies. Units-III Price-Output decisions under different market conditions - Perfect and Imperfect Competition, Monopoly, Monopolistic competition, Oligopoly, Duopoly, Non-price competition, Price discrimination and produce differentiation. Units-IV Theory of Distribution: Marginal Productivity Theory and Modern Theory, Wage-Meaning, Determination of wage Rate under perfect competition and Monopoly, Rent concept : Recardian and Modern Theories of Rent; Quasi-rent. Interests - Concept and Theories of Interest, Profit Concept and Theories of profit . REFERENCES: 1. Ahuja, M.L. 2. Bansal, S.N. 3. John, P., Gould jr.&Edward p. Lajear 4. Jhingan, M.L. 5. Jhingan,M.L. 6. Jdain, K.P. 7. Kkoutsoyuianni, A. 8. Mishra, J.P. 9. Kanaodia, Suresh.K., Shukla, Sudhir. K. And Singh, R.K. 10. Singh. H. K. 11.Vishnoi R. K. :Business Economics :Uccha Aaarthik Siddhant :Micro-Economic Theory :Samashti Arthashastra :Vyashsti arthashastra :Principles of Economics :Modern Micro Economics : Vyashti Arthashastra : Vyavsayik Arthashastra (Vaibhav Laxmi Prakashn) 2010,Varanasi : Managerial Economic :Business Economics

Code: BC 105 Business Statistics Objective: It enables the students to gain undergoing of Statistical techniques as are applicable to business. Unit-I Introduction to Statistics: Meaning, Scope, Importance and Limitation, Managerial Application, Statistical Investigation- Planning and organization, Statistical units, Methods of Investigation, Census and Sampling. Collection of Data- Primary and Secondary Data, Editing of DataClassification of data, Frequency Distribution and Statistical Series, Tabulation of DataDiagrammatical and Graphical Presentation of Data. Analysis of Data, Interpretation of Data. Unit-II Measures of Central Tendency Mean, Median, Mode, Geometric and Harmonic Mean; Dispersion Range, Quartile, Percentile, Quartile Deviation, Mean Deviation, Standard Deviation and its Co- efficient, Co-efficient of Variation and Variance, Test of Skewness and Dispersion, Its Importance, Co-efficient of Skewness Unit III Correlation- Meaning, application, types and degree of correlation, Methods- Scatter Diagram, Karl Pearsons Coefficient of Correlation, Spearmans Rank Coefficient of Correlation. Regression Analysis Meaning, Importance, Simple Regression Equation. Standard error of estimates. Index Number: - Meaning, Types and Uses, Methods of constructing Price Index Number, Fixed Base Method, Chain-Base Method, Base conversion, Base shifting deflating and splicing. Consumer Price Index Number, Fishers Ideal Index Number, Reversibility TestTime and Factor. Unit IV Interpolation and Extrapolation: Meaning, Importance Methods- Binomial, Newtons Lagranges Analysis of Time Series:-Meaning, Importance and Components of a Time Series. Decomposition of Time Series:- Moving Average Method and Method of Least square. Business Forecasting. References: 1. Chikodi & Satya Prasad 2. Gupta & Gupta 3. Gupta, B.N. 4. Hooda, R.P. 5. Lal, Muking 6. Paul, Joseph & Raphael 7. Puri, V.K. 8. Rastogi, K.K. 9. Sinha, B.C. 10. Jaisawal K.S.

:Business Statistics :Business Statistics :Sankhyiki :Statistics for Business Economics :Sankhyki Ke Prarambhik Siddhant :Business Statistics :Elements of Business Statistics :Sankyiki :Sankhyiki Ke Tattva : Business Statistics (Both in Hindi & English) (Vaibhav Laxmi Prakashn) 2010,Varanasi

Code: BC 106-A

INTRODUCTION TO COMPUTER APPLICATIONS Objective: To develop in students an appreciation of detailed working of computers, different software and Hardware systems available in the industry and its ability to the business. Units-I Computer: An Introduction- Computer in Business, Elements of Computer System Set-up ; Indian computing Environment, components of a computer system, Generations of computer and computer languages; Software PC- Software packages-An introduction, Disk Operating system and windows: Number systems and codes. Computer Arithmatics. Units-II Introduction to a Spreadsheet software, Creation of spreadsheet Applications; Range, Formulas, Function, Data Base Functions in spreadsheet: Graphics on spreadsheet. Presentation GraphicsCreating as presentation on a PC . . Units-III Relevance of Data Base Management Systems and Interpretations of Applications; DBMS system Network, Hierarchical and relational database, application of DBMS systems. Data Base Language, Dbase package, Basics of data processing; Data Hierarchy and Data file structure, Data files organizations; Master and Transaction file. Programme development cycle. Units-IV Word processing : Meaning and role of word processing in creating of document, Editing, formatting and printing document using tools such as spelling checks, Thousers etc. in Word processors, (MS word) Data Communication Networking-LAN& WANS. Management of data, processing systems in Business organizations. REFERENCES: 1. David, Van over 2. Laudon & Laudon 3. Mansfield, Ron 4. Taxali 5 Singh.A.K. : Foundations of Business Systems : Management Information System : Working in Microsoft Office : PC Software made easy : Introduction to Computer Applications

10

Code : BC 106-B BUSINESS MATHEMATICS Objective: The objective of this course is enable the student to have the required knowledge of Mathematics as is applicable to business and economic situations. Unit-I Materials and Determinants: Definition of matrix; Types of materials, Algebra of materials; Properties of Determinants; Calculation of values of Determinants upto third order; Adjoint of materials, Elementary row or column operations; Finding inverse of a matrix through adjoint and elementary row or column operation; Solution of system of linear equations having unique solution and involving not more than three variables. Unit-II Compound Interest and Annuities; Different types of intrest rates; Concept of Present Value and amount of a sum; Types of Annuities, Present value and amount of an annuity including the case of continuous Compounding; Valuation of simple loans and debentures; problems relating to sinking funds. Unit-III Calculus (Problems and Theorems Involving trignometrical ratios are not to be done). Differentiation: Partial derivatives upto second order; Homogeneity of Functions and Eulers theorem; Total differentials; Differentiation of implicit function with the help of total differentials. Maximum and Minimum: Cases of one variable involving second or higher order derivatives; Cases of two variables involving not more than one constraint. Integration: Integration as anti-derivative process; Standard form; Methods of Integration; Finding areas of Simple cases; consumers and Proceducers surplus; Nature; Commodities Learning Curve; Leontiff Input-output Model. Unit-IV Linear Programming: Formulation of L.P.P.: Graphical method of solution; Problems relating to two variables including the case of mixed constraints; Cases having no solution, multiple solutions; Unbounded solution and redundant constraints. Simplex Method: Solution of Problems upto three variables, including cases of mixed constraints; Duality; Transportation Problem. REFERENCES: 1.Agarwal, G.K. :Vyavasayik Garit 2. Agrawal, R.S. :Mathematics 3.Gupts, B.N. :Vyavasayik Garit 4.Kapoor, V.K. :Business Mathematics 5.Ranganath, Sampanji, R. & Rajaram :A Text Book of Business Mathematics 6.Soni, R.S. :Business Mathematics 7.Vohra, N.D. :Quantitative Techniques in Management 8.Zameeruddin, Khanka & Bhambri :Business Mathematics 9. Wahi, G.P. and Sukla, Sudhir .K. :Business Mathematics

11

Code: BC 106(B) OFFICE MANAGEMENT Unit-1 Modern Office: Concept, Characteristics of Modern office, Importance, Functions, Central Office; Office organization:- Meaning, Process principles, Departmentalization of Office, Communication, Correspondence and system:- Meaning, importance of Mail, Meaning and importance of mail system. Unit-II Typing:- Meaning, Centralization and decentralization of Typing services, Duplicating:Meaning, Process, Stationary; Office Filing system. Office Forms Unit III Office system and Procedure and Flow of work, Office report Indexing, Office Machine and Furniture, work Simplification office Manuals. Unit IV Office Reports, Personnel Management, Reception, Correspondence, Computer.

REFERENCES: 1. Mishra.Ashok .K. : karyalya Prabandh (Vaibhav Laxmi Prakashn) 2010,Varanasi

12

SYLLABUS BACHELOR OF COMMERCE (THREE YEARS FULL TIME PROGRAMME) B.Com. Part II Paper Code BC 201 BC 202 BC 203 BC 204 BC 205 BC206 (A) OR BC206 (B) Paper Name External (Yearly Examination) 100 100 100 100 100 100 OR 80 20 Practical Total

Corporate Accounting Marketing Cost Accounting Business Finance Auditing Business Communication OR Business Graphics & Multimedia Management Grand Total

------

100 100 100 100 100 100 OR 100 600

13

Code: BC 201 CORPORATE ACCOUNTING Objective: This course enables the students to develop awareness about corporate accounting in conformity with the provisions of Companies Act. Unit-1 Issue, Forfeiture and Re-issue of Shares: Redemption of Preference Shares; Issue and Redemption of Debentures, Underwriting of Shares and Debentures. Unit-II Profits prior to Incorporation, Final Accounts , Valuation of Goodwill and Shares. Unit-III Accounting for Amalgamation of Companies as per Indian Accounting Standard 14; Accounting for Internal Reconstruction, Liquidation of Companies. Unit-IV Consolidated Balance Sheet of Holding Companies with one subsidiary only. Analysis of Financial Statement-Various Techniques Statement of changes in Financial Position on working Capital basis, Familiarity with Indian Accounting Standard-3. REFERENCES: 1. Chaturvedi, C.L. 2. Gupta, R.L. 3. Gupta, R.L. 4. Maheshwari, S.N. 5. Monga, J.R. & Ahuja 6. Moore, C.L. & Jaodi cke, R.K. 7. Shukla, Meharchand 8. Shukla, S.M. 9.Shukla, M.C, Grewal, T.S. & Gupta,S.C. 10.Jaiswal K.S. : Advance Accountancy : Company Accounts : Advanced Accountancy : Corporate Accounting : Financial Accounting : Managerial Accounting : Advance Accounting : Advance Accountancy :Advance Accounts :Corporate Accounting (Both English&Hindi)

14

Code: BC-202 MARKETING Objective-: The objective of this course is to help students to understand the concept of marketing and its applications. Unit-I Introduction: Nature and Scope of marketing; importance of marketing as a business function, and in the economy; Marketing concepts- traditional and modern; selling Vs. Marketing; marketing mix; marketing environment. Consumer behavior and market segmentation: Nature, scope and significance of consumer behaviour; Market segmentation- concept and importance; Bases for market segmentation. Unit-II Product: Concept of product, Consumer and industrial goods; Product planning and development; Packaging role and functions; Brand name and Trade Mark; After Sales Services; Product Life cycle concept. Price: Importance of price in the marketing mix Factors, affecting price of a product/Service; Discount and rebates. Unit-III Distribution Channels and Physical Distribution; Distribution Channels- Concept and Role; Types of distribution channels; Factors affecting choice of a distribution channel; Retailer and whole seller; physical distribution of goods; Transportation; warehousing; Inventory control; Order Processing. Unit-IV Promotion: Methods of promotion; Optimum promotion mix; Advertising media: their relative merits and limitations, Characteristics of an effective advertisement; Personal Selling; Selling as a career; Classification of a successful sales person; Functions of Salesman. REFERENCES: 1. Cundiff, Edward, W. & Still, R.R. 2. Kotler, Phillip 3. Kotler, Phillip & Armstrong, Gray 4. Mamoria, C.B,Mamoria Satish & Suri, R.K. 5. Ramaswami & Namakumari 6. Sontakki,C.M. 7. Sherlekar, S.A. 8. Stanton, W.J., Etzel Michael, J. & Walker Bruce, J. 9. Srivastava, Prem Kumar 10.William, M. Pride & Ferrel, O.C. 11. Shukla,Ajit 12.Shukla Ajit : Basic Marketing- Concepts, Decisions and Strategies : Marketing Management : Principles of Marketing : Marketing Management : Marketing Management : Marketing Management : Marketing Management : Fundamentals of Marketing : Vipanan Prabandha : Marketing : Marketing Management (Hindi) : Viparan

15

Code: BC 203 COST ACCOUNTING Objective: This course exposes the students to the basic concepts and the tools used in cost accounting. Unit-I Nature and Scope of Cost Accounting, Cost Vs. Management Accounting. Elements of Cost and their Classification,. Installation of Costing System. Accounting for Material: Pricing of Material issues, Material Control, Techniques, , Treatment of material losses. Unit-II Accounting for Labour: Labour Cost Control, Procedure, Labour turnover, Idle time and overtime. Methods of Wage Payment- Time and Piece Rates, Incentive Schemes. Accounting for overheads: Classification and Departmentalization, Methods of Absorption of Overheads, Under and Over Absorption of Overheads Unit-III Cost Ascertainment: Unit Costing, Job Costing, Batch Costing, Contract Costing. Unit-IV Operating Costing. Process Costing, Reconciliation of Cost and Financial Accounts. Cost Records: Integral and Non-integral system; REFERENCES: 1. Arora, M.N. 2. Bansal, M.R. & Saxena, V.M. 3. Gupta, R.K. 4. Gupta, L.B. 5. Jain, S.P. & Narang, K.L. 6. Khan, M.Y. & Jain, P.K. 7. Maheshwari, S.N. 8. Prakash, Jagdish 9. Shukla, S.M. 10.Tulasian, P.C. 11.Shukla, Sudhir : Cost Accounting- principles and Practice : Lagat Lekhankan : Lagat Lekhankan : Lagat Lekha : Cost Accounting : Management Accounting : Advanced Problems and Solutions in Cost Accounting : Lagat Lekhankan : Lagat Lekha : Practical Costing : Cost Accounting

16

Code: BC 204 BUSINESS FINANCE

Objective: The objective of this course is to help students understand the conceptual framework of business finance. Units-I Business Finance- Nature and Scope, Financial Management Objective Profit Vs. Wealth Maximization Decision areas: Investment, Financial and Dividend Decisions, Capital Budgeting:Nature, Importance and its major evaluation criteria. Units-II Cost of Capital- Meaning importance, Calculation of Cost of Debt, Preference capital, Equity capital and Retained Earnings, Combined (weighted) Cost of Capital. Capitalization- Meaning, Over and under Capitalization, Theory of Capitalization. Capital Structure- Meaning determinants . Units-III Dividend Policies: Issues in Dividend policies; Dividend models.Determinents of dividend policy Sources of Funds: Long term Funds, Short- term funds. Nature, significance and determinants of Working Capital requirement Units-IV Capital Market- (a) New Issue Market (b) Secondary market- Functions and role of Stock Exchange (BSE, NSE), Important Provisions of SEBI (Listing procedure and legal requirements),pricing and marketing of Public Issue). Money Market: Indian money marketsComposition and Structure, Acceptance and Discount houses and Call money market. REFERENCES: 1. Avadhani, V.A. 2. Bhalla, V.K. 3. Brigham, E.F.Gapenski, L.C. & Ehrhardt, M.C. 4. Chandra, Prasanna 5. Khan, M.Y. & Jain, P. K. 6. Mclaney, E.J. 7. Pandey, I.M. 8. Van Horne, J.C. : Finacial System : Modern Working Capital Management : Financial Management- Theory and Practice : Financial Management Theory and Practice : Financial Management Text and Problems : Financial Services. Business Finance Theory and Practice : Financial Management : Financial Management and Policy

17

Code: BC 205 AUDITING Objective: This course aims at imparting knowledge about the principles and methods of auditing and their applications. Unit-I Introduction: Meaning, Objectives and Importance of Auditing, Types of Audit. Limitation of Auditing. Audit Procedure: Audit programme, Audit Note Book, Audit Working Papers, Audit Files, Audit Evidence, Consideration for commencing an Audit, Routine checking and Test checking. Unit-II Internal Control: Meaning, Objectives and Auditors duties, Internal Check System: Meaning, Objectives advantages and disadvantages, Auditors Duties. Internal Check as regards cash receipts, Cash Payments, Wages, Sales and Purchases. Vouching: Meaning, Objectives, Importance. Vouching of Cash Transactions and Trading Transactions. Verification of Assets and Liabilities: Meaning, Objectives and Verification of various Assets and Liabillities. Unit III Audit of a Limited Companies: Appointment, Qualifications, Rights and Powers, Duties and Liabilities of a Company Auditor. Audit Report- Meaning and Importance, Clean and Qualified Audit Report, Audit Certificate, Audit of Divisible profits and Dividends. Unit IV Special Audit of Banking Companies and Insurance Companies. Special points in the Audit of Educational Institutions, Clubs and Hospitals, Nature and significance of Cost Audit; Tax Audit and Management Audit. References: 1. Attowood, Frank A. & Stein, Neil D. 2. Choudhari, Roy A.B. 3. Chatlia, S.V. 4. Dinkar, Pagare 5. Gupta, Kamal 6. Gupta & Bhatnagar 7. Kumar, Raj & Kanodia, Suresh 8. Moutz, R.K. 9. Pratt, Michael,J 10. Sharma, T.R. 11. Sharma, T.R. 12. Tandon, B.N. 13.Woolf, Emile

: Depauls Auditing : Modern Internal Auditing : Spicer and Peglers Practical Auditing : Principles and Practices of Auditing : Contemporary Auditing : Ankekshan : Ankekshan : Fundamentals of Auditing :Auditing principles and practice : Auditing principles and practice : Ankekshan : Principles of Auditing : Auditing Today

18

Code: BC 206-A BUSINESS COMMUNICATION Objective: The objective of this course is to develop effective business communication skills among the students. Unit-I Introducing Business Communication: Basic forms of Communicating ,Communication Models and processes; Principles of Effective Communication; Theories of Communication; Audience Analysis. Self Development and Communication: Development of Positive Personal Attitude; SWOT Analysis; Whole Communication. Unit-II Corporate Communication, Formal and Informal Communication, Networks; Grapevine; Barriers in Communication; Improving Communication. Practices in Business Communication: Group discussion; Mock interviews; Seminars; Effective Listening Exercises; Individual and Group Presentations and Report Writing. Unit-III Writing skills: planning business messages; Rewriting and editing, The first draft, Reconstructing the final draft; Business letters and memo formats; Appearance request letters, Good news and Bad news letter; Persuasive letters; Sales letters; Collection letters; Office Memorandum. Report writing: Introduction to a Proposal, Short report and Formal report, Report Preparation. Oral Presentation: Principles of Oral Presentations, Factors affecting Presentation, Sales Presentation, Training, Presentation, Conducting Surveys, Speeches to Motivate Effective Presentation Skills. Unit-IV Non-verbal aspects of Communication: Body language. Kinesics, Proxemics, Para language, Effective listening, Factors affecting Listening Exercises; Oral, Written and Video Sessions; Interviewing skills: Appearing in Interviews, Conducting Interviews, Writing Resume and Letter of Application. Modern forms of communicating: Fax, E-mail, Video Conferencing etc. International Communication: Cultural Sensitiveness and Cultural Context, Writing and presenting in international situations, Inter-cultural factors in Interactions. REFERENCES: 1. Arora, V.N. & Chandra, Lakshmi 2. Boyee & Shill 3. Kaul 4. Kaul 5. Murphy & Peek 6. Paul, Rajelra & Korlahali, J.S. 7. Ronald, Dule & Fielder, John S. 8. Sharma, R. C. & Krishna Mohan 9.Srivastva. Anjani

: Improve your writing : Business Communications Today : Business Communications : Effective Business Communications : Effective Business Communications : Essentials of Business Communication : Principles of Business Communication : Business Correspondence and Report Writing : Business Communication.

19

Code: BC 206-B

BUSINESS GRAPHICS & MULTIMEDIA MANAGEMENT

Objective: The objective of this course is to develop creativity & enhance Practical ability in the student as well as learn the anatomy of a Computer System. Unit-I Computer System Components: Motherboard, Processor, Memory (RAM, ROM) Power supply, CD/DVD Drives, Video card, Monitors, Sound card, Speakers, Ports USB, Multiprogramming, Multitasking, On line processing.

Unit-II Introduction of Multimedia, Components of Multimedia, Multimedia Project development, Hardwares & Softwares for multimedia Presentation, Applications of Multimedia(Business, Homes Education & Training) Unit-III Microsoft Windows, features, Advantages, Controling & Managing Windows (Control Panel) MS PowerPoint, Templets, The different Views of Slides (Normal, Outline, slide, slide sorter, slide show) Setting up presentation with Auto Content Wizard. Unit-IV Computer Graphics, various types of Graphics program, Application of Graphics, Computer Aided Design, Computer Aided Manufacturing. Introduction to DTP packages, (PageMaker, Coral Draw, and Photoshop) REFERENCES: 1. Multimedia Making it work : Voughan, Tay. : Singh, A.K.

2. Computer Graphics & Multimedia Management

20

Das könnte Ihnen auch gefallen

- A Practical Approach to the Study of Indian Capital MarketsVon EverandA Practical Approach to the Study of Indian Capital MarketsNoch keine Bewertungen

- Financial Accounting (1st Year)Dokument18 SeitenFinancial Accounting (1st Year)RohitNoch keine Bewertungen

- Business Studies Notes PDFDokument85 SeitenBusiness Studies Notes PDFJáçøb Ñímø100% (1)

- Business Law Notes B.com Part 2 Punjab UniversityDokument80 SeitenBusiness Law Notes B.com Part 2 Punjab Universitysyeda tanuba50% (2)

- As-1 and As-2 Summary NotesDokument7 SeitenAs-1 and As-2 Summary NotesChandreshNoch keine Bewertungen

- Book of Business LawDokument114 SeitenBook of Business LawShahriar AlamNoch keine Bewertungen

- GST Notes For Vi SemesterDokument55 SeitenGST Notes For Vi SemesterNagashree RANoch keine Bewertungen

- Final Accounts of CompaniesDokument32 SeitenFinal Accounts of CompaniesbE SpAciAlNoch keine Bewertungen

- Company Secretary Exam PaperDokument4 SeitenCompany Secretary Exam Paperkalpesh veerNoch keine Bewertungen

- Questions On Value PF SupplyDokument4 SeitenQuestions On Value PF SupplyMadhuram SharmaNoch keine Bewertungen

- Commerce I.com Part 1 (Chapter 4)Dokument5 SeitenCommerce I.com Part 1 (Chapter 4)citystandard collegeNoch keine Bewertungen

- 2020 12-07-03938038 0 0000 AppelleeSecretaryOfStateKatieH PDFDokument44 Seiten2020 12-07-03938038 0 0000 AppelleeSecretaryOfStateKatieH PDFpaul weichNoch keine Bewertungen

- Business Law NotesDokument27 SeitenBusiness Law NotesTabish AhmedNoch keine Bewertungen

- Chapter 5 Corporations NoteDokument5 SeitenChapter 5 Corporations NoteLihui ChenNoch keine Bewertungen

- Business Associations 1 Class NotesDokument30 SeitenBusiness Associations 1 Class NotessakatuyaNoch keine Bewertungen

- Business LawDokument56 SeitenBusiness LawDiana Soni100% (1)

- Business Plan Template EcomDokument27 SeitenBusiness Plan Template EcomReflections DaysNoch keine Bewertungen

- Ooin@A/Sparchansraj: S.P.A.R.CDokument155 SeitenOoin@A/Sparchansraj: S.P.A.R.CadsaNoch keine Bewertungen

- Fema ActDokument34 SeitenFema ActKARISHMAATNoch keine Bewertungen

- AS - 12 - Accounting For Government GrantsDokument17 SeitenAS - 12 - Accounting For Government GrantsSankerps PsNoch keine Bewertungen

- NMIMS Semester 1 Assignment Solution June 2021 Call 9025810064Dokument8 SeitenNMIMS Semester 1 Assignment Solution June 2021 Call 9025810064Palaniappan NNoch keine Bewertungen

- A Research Paper On Impact of Goods and Service Tax (GST) On Indian Gross Domestic Product (GDP)Dokument8 SeitenA Research Paper On Impact of Goods and Service Tax (GST) On Indian Gross Domestic Product (GDP)archerselevatorsNoch keine Bewertungen

- Business Law NotesDokument116 SeitenBusiness Law NotesTyler SmallwoodNoch keine Bewertungen

- Basics of Income Tax MBADokument12 SeitenBasics of Income Tax MBAvinay100% (6)

- Unit 4 Profits and Gains of Business or ProfessionDokument119 SeitenUnit 4 Profits and Gains of Business or ProfessionRishikaysh KaakandikarNoch keine Bewertungen

- Business Law 34 Marks Revision - CTC ClassesDokument36 SeitenBusiness Law 34 Marks Revision - CTC ClassesThe Real BNoch keine Bewertungen

- What Is The Meaning of Share?: in Other WordsDokument27 SeitenWhat Is The Meaning of Share?: in Other WordsSIddharth CHoudhary0% (1)

- Basic Concepts of Income TaxDokument14 SeitenBasic Concepts of Income TaxSaraf KushalNoch keine Bewertungen

- Scribd QuoraDokument4 SeitenScribd QuoraAnonymous 06QgpnNoch keine Bewertungen

- Corporate Accounting AssignmentDokument6 SeitenCorporate Accounting AssignmentKarthikacauraNoch keine Bewertungen

- GST Flyers: Central Board of Excise & Customs New DelhiDokument468 SeitenGST Flyers: Central Board of Excise & Customs New DelhiPrerna YadavNoch keine Bewertungen

- Structure of Indian Money Market - and Capital MarketDokument3 SeitenStructure of Indian Money Market - and Capital MarketThanasekaran Tharuman100% (1)

- Central Excise Short NotesDokument27 SeitenCentral Excise Short Notestoprascal0% (1)

- Convert HTML To PDF in PHPDokument4 SeitenConvert HTML To PDF in PHPzandiNoch keine Bewertungen

- 3 Pre - PostDokument7 Seiten3 Pre - PostParul Bhardwaj VaidyaNoch keine Bewertungen

- Basics of Financial StatementDokument16 SeitenBasics of Financial StatementSagar KumarNoch keine Bewertungen

- Maharajkumar Gopal Saran Narain Singh v. CITDokument3 SeitenMaharajkumar Gopal Saran Narain Singh v. CITRonit KumarNoch keine Bewertungen

- Chapter 8 Law DividendDokument39 SeitenChapter 8 Law DividendNOOB GAMER RELOADEDNoch keine Bewertungen

- Business Law Notes UCTDokument86 SeitenBusiness Law Notes UCTLouisNoch keine Bewertungen

- Income Tax AY 18-19 Vol I PDFDokument224 SeitenIncome Tax AY 18-19 Vol I PDFAashish Kumar SinghNoch keine Bewertungen

- Business Law Instructor: Arbab Shujja Notes By: Munir Ahmed: Types of CodesDokument35 SeitenBusiness Law Instructor: Arbab Shujja Notes By: Munir Ahmed: Types of CodesIqra AhmadNoch keine Bewertungen

- Legal Aspects of Business Master NotesDokument44 SeitenLegal Aspects of Business Master NotesJessica Terry75% (4)

- Company LawDokument6 SeitenCompany LawlinyhulyNoch keine Bewertungen

- SEBI Role and FunctionsDokument28 SeitenSEBI Role and FunctionsAnurag Singh100% (4)

- Memorandum of AssociationDokument13 SeitenMemorandum of Associationsagarika915512Noch keine Bewertungen

- TdsDokument22 SeitenTdsFRANCIS JOSEPHNoch keine Bewertungen

- PreliminaryDokument30 SeitenPreliminaryADYASA CHOUDHURY100% (1)

- Syllabus - GST BeginnerDokument4 SeitenSyllabus - GST Beginnernayra khanNoch keine Bewertungen

- Basics of Income Tax of India PDFDokument19 SeitenBasics of Income Tax of India PDFJai VermaNoch keine Bewertungen

- Taxation IIDokument467 SeitenTaxation IItoufiqNoch keine Bewertungen

- Laws Relating To Investor Protection in India and USADokument16 SeitenLaws Relating To Investor Protection in India and USASHREYA KUMARINoch keine Bewertungen

- Money Market InstrumentDokument58 SeitenMoney Market InstrumentNinad PatilNoch keine Bewertungen

- Introduction To Accounting Transcript 0Dokument9 SeitenIntroduction To Accounting Transcript 0mohsrourNoch keine Bewertungen

- Business Law and Ethics Review NotesDokument50 SeitenBusiness Law and Ethics Review NotesMatt EdgarNoch keine Bewertungen

- P.Y Question Paper Income Tax Delhi UniversityDokument5 SeitenP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Vat Act-1991 (English Version)Dokument39 SeitenVat Act-1991 (English Version)enamul100% (2)

- CA Final Financial ReportingDokument27 SeitenCA Final Financial Reportinglipikadas1988Noch keine Bewertungen

- Concept of Asessment Year, Previous Year, Income, Capital and Revenue Receipts, Capital and Revenue ExpenditureDokument15 SeitenConcept of Asessment Year, Previous Year, Income, Capital and Revenue Receipts, Capital and Revenue ExpenditureAnany UpadhyayNoch keine Bewertungen

- Bcom MGKVP SlybusDokument30 SeitenBcom MGKVP SlybusHoney SrivastavaNoch keine Bewertungen

- SyllabusDokument30 SeitenSyllabusREJITHANoch keine Bewertungen

- CommuniCare InfotechDokument5 SeitenCommuniCare InfotechAbhimanyu SinghNoch keine Bewertungen

- Positive Behavioral Interventions and SupportsDokument32 SeitenPositive Behavioral Interventions and SupportsAbhimanyu SinghNoch keine Bewertungen

- UBI FullStatementDokument1 SeiteUBI FullStatementAbhimanyu SinghNoch keine Bewertungen

- d6395343 133791 7605216553Dokument2 Seitend6395343 133791 7605216553BasavarajBusnurNoch keine Bewertungen

- Twenty19 Smart Student Resume GuideDokument46 SeitenTwenty19 Smart Student Resume GuidePraful ChandraNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- ResumeDokument1 SeiteResumeAbhimanyu SinghNoch keine Bewertungen

- To Whomsoever It May ConcernDokument1 SeiteTo Whomsoever It May ConcernAbhimanyu SinghNoch keine Bewertungen

- Management InformationDokument10 SeitenManagement InformationTanjil AhmedNoch keine Bewertungen

- Isah Makes It With TOPdesk and TFSDokument4 SeitenIsah Makes It With TOPdesk and TFSTOPdeskNoch keine Bewertungen

- HR & Organizational BehaviorDokument38 SeitenHR & Organizational BehaviorMostafa ElghifaryNoch keine Bewertungen

- OB - Unit 1Dokument30 SeitenOB - Unit 1Pranshu MishraNoch keine Bewertungen

- Quali ExamDokument7 SeitenQuali ExamLovenia Magpatoc50% (2)

- TPM in Food IndustryDokument2 SeitenTPM in Food IndustryBrendan CrowleyNoch keine Bewertungen

- Entrepreneurship Diagnostic TestDokument6 SeitenEntrepreneurship Diagnostic TestKathleen GulisNoch keine Bewertungen

- BBA 482-Take Home Exams (5161530010)Dokument12 SeitenBBA 482-Take Home Exams (5161530010)Evans GazyNoch keine Bewertungen

- Enterprise Resource Planning 3rd Edition Monk Test BankDokument22 SeitenEnterprise Resource Planning 3rd Edition Monk Test Bankkieranthang03m100% (24)

- HRBP 2 0 - tcm21 44040Dokument4 SeitenHRBP 2 0 - tcm21 44040fernNoch keine Bewertungen

- Chapter AjhdaoDokument3 SeitenChapter AjhdaoAmanda AnaliaNoch keine Bewertungen

- Bab Vi Master Production Scheduling: A.SummaryDokument1 SeiteBab Vi Master Production Scheduling: A.SummaryHasbi HasanNoch keine Bewertungen

- Software Project ManagementDokument12 SeitenSoftware Project ManagementJenny Sison-Wilson100% (1)

- Binu PPT FinalDokument23 SeitenBinu PPT FinalBinu JosephNoch keine Bewertungen

- Lee Case StudyDokument2 SeitenLee Case StudyRodolfo Mapada Jr.100% (2)

- Department of Education: Republic of The PhilippinesDokument2 SeitenDepartment of Education: Republic of The PhilippinesDandref ReyesNoch keine Bewertungen

- International Case Studies in Asset Management PDFDokument218 SeitenInternational Case Studies in Asset Management PDFV.T. Lien100% (2)

- Asignment2 Thay VuDokument11 SeitenAsignment2 Thay VuTruong Nu Nhat LinhNoch keine Bewertungen

- Audit Checklist-Training and DevelopmentDokument1 SeiteAudit Checklist-Training and Developmentapi-376296375% (8)

- 藥廠&食品業者風險管理之觀念Dokument49 Seiten藥廠&食品業者風險管理之觀念張証評Noch keine Bewertungen

- ISO 19011 2011 Is A Management System Auditing StandardDokument19 SeitenISO 19011 2011 Is A Management System Auditing StandardPrashanthPrashanthNoch keine Bewertungen

- Audit PlanningDokument26 SeitenAudit PlanningHannah AngNoch keine Bewertungen

- Bpo Companys in PhilippineDokument6 SeitenBpo Companys in Philippinehla groupNoch keine Bewertungen

- Certificate Template - 10 Slides - CreativeDokument14 SeitenCertificate Template - 10 Slides - CreativeWordPress QuitoNoch keine Bewertungen

- Introduction HRM (1st)Dokument42 SeitenIntroduction HRM (1st)Tabinda IslamNoch keine Bewertungen

- Industrial Pricing Strategies & PoliciesDokument21 SeitenIndustrial Pricing Strategies & Policiesankitashashi100% (2)

- SCSC Chapter 6 - Network DesignDokument19 SeitenSCSC Chapter 6 - Network Designzukhri zaidiNoch keine Bewertungen

- Case Studies Gati LTDDokument30 SeitenCase Studies Gati LTDbinuNoch keine Bewertungen

- CV-Mushtaque AliDokument8 SeitenCV-Mushtaque AliAnonymous sIQv5MDCzNoch keine Bewertungen

- Gap Analysis Current Status and Action Plan (2) - Matts CommentsDokument8 SeitenGap Analysis Current Status and Action Plan (2) - Matts CommentsSalah ShabanNoch keine Bewertungen