Beruflich Dokumente

Kultur Dokumente

Arshiya International - Kotak Morning Insight 21 Nov 2012

Hochgeladen von

didwaniasCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Arshiya International - Kotak Morning Insight 21 Nov 2012

Hochgeladen von

didwaniasCopyright:

Verfügbare Formate

NOVEMBER 21, 2012

Economy News

Giving a boost to key segments such as roads and bridges, liquefied natural gas, oil pipelines, water treatment plants, telecom towers, and three-star hotels, the RBI has accorded them with 'infrastructure status' and paved way for them to avail easier funding from banks. (Mint) Swedish furniture maker IKEA's much talked about entry into India's single-brand retail space was cleared by the Foreign Investment Promotion Board (FIPB). IKEA proposes to bring in Rs 105Bn of foreign direct investment (FDI), the largest in the category so far. (BS) Action is hotting up in the telecom space, with Russian giant Sistema in preliminary discussions with Aircel to pick up an equity stake. Aircel, which has nearly 66.6 million customers in the country, is controlled by Malaysian telco Maxis Communications. Merchant bankers in the know say the Malaysian company has been looking at a valuation of $7 billion. They say it is the high valuation, at a time when the sentiment is not positive in the sector, that has led to problems in finding a new stakeholder (BS)

Equity

% Chg 20 Nov 12 Indian Indices SENSEX Index NIFTY Index BANKEX Index BSET Index BSETCG INDEX BSEOIL INDEX CNXMcap Index BSESMCAP INDEX World Indices Dow Jones Nasdaq FTSE NIKKEI HANGSENG 1 Day 1 Mth 3 Mths

18,329 5,572 12,991 5,636 10,491 7,972 7,714 6,988 12,789 2,917 5,748 9,143 21,228

(0.1) 0.0 (0.1) (0.3) (0.5) (0.9) (0.8) (0.9) (0.1) 0.0 0.2 (0.1) (0.2)

(1.9) (2.0) (1.5) (1.1) (5.2) (5.5) (2.4) (2.5) (4.2) (3.0) (2.5) 2.6 (0.8)

2.5 2.8 8.1 (1.3) 3.6 (6.6) 5.7 5.1 (3.1) (4.9) (1.9) 0.9 6.4

Corporate News

GMR Infrastructure, developing the Male International Airport, has won a breather in its ongoing legal tussle with Maldives Airport Company Limited (MACL). According to a statement from GMR, the High Court of Singapore on Monday dismissed the application by MACL seeking vacation of the injunctive order granted in favour of GMR Male International Airport Limited (GMIAL) on July 23 and made absolute the injunctive relief granted in favour of GMIAL. (BS) The oil ministry has withdrawn a note it had circulated to the members of a ministerial panel opposing hike in price of gas produced by Reliance Industries Ltd (RIL), as the Rangarajan Committee is examining pricing of the fuel. (BS) Hinduja Group flagship firm Ashok Leyland said it has introduced a range of haulage trucks fitted with twin speed rear axles and other modifications for enhanced fuel efficiency of up to 10%. (BS) The Cabinet is likely to consider a proposal to disinvest 9.50% stake in state-run power major NTPC on Thursday. The Centre hopes to cut the fiscal deficit by stake sale in state-owned companies. According to sources in the know, the government will clear sale of about 783.3 million shares, resulting in 9.5% dilution in government stake in NTPC. (BS) The realty arm of telecom major Bharti Group is in talks with DB Realty's hospitality arm to buy 49% stake in the SPV developing at a plot at the Delhi International Airport's new hospitality district, for Rs 3.5Bn. (ET) Media baron Kalanithi Maran and his wife Kavery Kalanithi have resigned from the board of directors of Kal Airways, the holding company of SpiceJet. The move seems to suggest that the promoters may want to rope in an investor by offering a large and perhaps a controlling stake. SpiceJet has been in talks with foreign airlines, including Etihad Airways and Emirates for a stake sale, for some time now. (FE) As part of its corporate debt restructuring (CDR) programme, Kolkatabased steel maker Visa Steel has decided to sell 49% of its stake in its subsidiary Visa Coke (its 400,000-tonne capacity coke oven battery) to New York-listed SunCoke Energy for Rs 3.7Bn. (BS) Construction major Larsen and Toubro (L&T) said it has won new orders worth Rs 2,503 crore across various segments. (BS)

Value traded (Rs cr)

20 Nov 12 Cash BSE Cash NSE Derivatives 1,910 9,659 115,165 % Chg - Day 9.4 6.7 (4.6)

Net inflows (Rs cr)

19 Nov 12 FII Mutual Fund 686 (84) % Chg (12.9) (23.0) MTD YTD 4,822 98,874 (1,070) (16,245)

FII open interest (Rs cr)

19 Nov 12 FII FII FII FII Index Index Stock Stock Futures Options Futures Options 7,825 52,450 29,250 2,798 % Chg (3.0) (0.1) (0.6) 1.7

Advances / Declines (BSE)

20 Nov 12 Advances Declines Unchanged A 64 137 3 B 701 1,333 75 T 275 324 42 Total % total 1,040 1,794 120 35 61 4

Commodity

% Chg

20 Nov 12 1 Day 1 Mth 3 Mths

Crude (NYMEX) (US$/BBL) 87.2 Gold (US$/OZ) 1,725.9 Silver (US$/OZ) 33.0

0.5 (0.4) (0.5)

(3.2) 0.4 3.3

(9.8) 5.4 12.7

Debt / forex market

20 Nov 12 1 Day 1 Mth 3 Mths 10 yr G-Sec yield % Re/US$ 8.3 55.1 8.3 55.1 8.2 53.5 N/A 55.7

Sensex

19,750 18,800 17,850 16,900 15,950

Source: ET = Economic Times, BS = Business Standard, FE = Financial Express, BL = Business Line, ToI: Times of India, BSE = Bombay Stock Exchange

15,000 Nov-11

Feb-12

May-12

Aug-12

Nov-12

MORNING INSIGHT

November 21, 2012

RESULT UPDATE

Dipen Shah dipen.shah@kotak.com +91 22 6621 6301

ORACLE FINANCIAL SERVICES LTD (OFSL)

PRICE: RS.2810 TARGET PRICE: RS.2662 RECOMMENDATION: REDUCE FY14E P/E: 21X

We find the stock richly valued. Any de-listing move from the Parent may trigger a further price rise, though. The management maintains that, the uncertain macro scene is keeping clients cautious and has had an impact on the decision making / sales cycle. This was reflected in the relatively lower license bookings in 2Q. The pipeline is encouraging, though. Geographically, the company is seeing potential in smaller but potentially high growth economies. 2QFY13 numbers were also below estimates. The new license signings were at $8.3mn ($19mn in 1Q and $29mn in 4QFY12), which was disappointing. Our FY13 and FY14 earnings estimates stand at Rs.123 per share and Rs.135 per share (impacted by rupee assumptions). Our price target stands at Rs.2662 based on FY14E earnings. At our TP, the valuations will be similar to those accorded by us to TCS. Looking at the potential downside, we maintain REDUCE. However, there can be potential gains from Oracle's offer, if any, to buy-back shares and de-list the company. A delayed recovery / sharp deterioration in user economies and a sharper-than-expected rupee appreciation are key risks to our earnings estimates.

Summary table

(Rs mn) FY12 FY13E 35,342 12.3 12,290 34.8 15,219 10,319 122.9 13.5 129.9 870.0 7.0 15.1 22.3 46,736 84.7 22.9 3.2 5.4 15.4 FY14E 39,151 10.8 13,391 34.2 16,006 11,303 134.7 9.5 142.8 996.4 8.0 14.4 20.4 55,600 84.2 20.9 2.8 4.6 13.5

2QFY13 results

(Rs mns) Revenues Expenditure EBIDTA Depreciation EBIT Interest Other inc PBT Tax PAT Share of Pft / (loss) Adjusted PAT E.O items EPS (Rs) Margins OPM (%) GPM(%) NPM(%)

Source : Company

1QFY13 9,463 5,611 3,852 138 3,714 0 1,724 5,438 1,757 3,681 0 3,681 0 43.9 40.7 39.2 38.9

2QFY13 7,935 5,786 2,149 142 2,007 0 540 2,547 973 1,574 0 1,574 0 18.8 27.1 25.3 19.8

QoQ (%) -16.1 -44.2 -46.0

2QFY12 7,562 5,078 2,484 99 2,385 0 1,393

YoY(%) 4.9 -13.5 -15.8

Sales 31,467 Growth (%) 5.0 EBITDA 11,088 EBITDA margin (%) 35.2 PBT 14,169 Net profit 9,093 EPS (Rs) 108.3 Growth (%) (18.1) CEPS (Rs) 113.6 BV (Rs/share) 754.4 Dividend / share (Rs) 6.0 ROE (%) 16.7 ROCE (%) 25.3 Net cash (debt) 38,117 NW Capital (Days) 88.8 P/E (x) 25.9 P/BV (x) 3.7 EV/Sales (x) 6.3 EV/EBITDA (x) 17.8

-53.2 -57.2 -57.2

3,778 826 2,952 0 2,952 866 35.2 32.8 31.5 39.0

-32.6 -46.7 -46.7

Source: Company, Kotak Securities - Private Client Research

Macro scene uncertain; pipeline better In our recent interaction, the management indicated that, the still-uncertain macro scene continues to impact the decision making / sales cycles. Clients are still cautions and are delaying decision making.

The discretionary spends are the most impacted and have remained so. However, the pipeline is looking good with orders across the geographies. According to the management, the pipeline is better as compared to what was there same period last year.

Kotak Securities - Private Client Research

Please see the disclaimer on the last page

For Private Circulation

MORNING INSIGHT

November 21, 2012

While the pipeline is looking strong across geographies, OFSL has seen good order flows from economies (eg. Mongolia), which are relatively small but potentially fast growing. We view the comments on the pipeline encouraging but would like to see more of it getting converted into firm orders. The license bookings in 2Q were lower as compared to 1Q, reflecting the challenges of an uncertain macro.

Order bookings lower for the second successive quarter Oracle booked new license orders worth $8.3mn ($19mn) during 2Q, which was the second successive quarter of de-growth in bookings.

Due to the lower execution during the quarter, the tank size had increased to around $106mn, we understand. We need to watch the order bookings closely and only further strength in the medium term will add to our confidence. However, we understand that, the volatile nature of the business may result in lower bookings in any quarter.

Product revenues grew by 11% YoY but fell 18% QoQ Product revenues rose by 11% YoY. This was almost in line with our estimates. Within this, license revenues grew by 4% YoY.

On a QoQ basis, revenues fell but we note that, the product revenues, especially license fees, have been volatile on a sequential basis. Hence, we feel that, this performance may not be repeated every quarter. Implementation and AMC revenues grew by about 8% and 22% YoY, respectively, providing support to the overall product revenues growth. AMC revenues formed about 28% of the overall product revenues during the quarter. The rise in AMC revenues is a positive as they are a stable source of revenues and may reduce the volatility in the overall product revenues of the company. We had mentioned in the previous quarter that, while the license fees had witnessed a very high growth, the macro scene and quarterly variations may sober down the growth rates going ahead. A few companies have indicated that, stability and growth are coming back to the BFSI segment. However, we understand that, several spending decisions are being delayed to take into account the constantly changing macro-economic scene. This is a view, which has been echoed by various industry peers and reflects the overall uncertain economic scenario. With discretionary spends also being postponed, the impact on Oracle could be that much higher, we opine. The same is reflected in the subdued license fee bookings made by Oracle. We note that, license revenues (and hence, the product revenues as a whole) are very volatile in nature. These revenues vary based on completion of large product implementations and can fluctuate widely. OFSS is also consolidating its operations in order to create a more customer-focused organization. Oracle added 14 (27 in 1Q) customers for its products business.

Kotak Securities - Private Client Research

Please see the disclaimer on the last page

For Private Circulation

MORNING INSIGHT

November 21, 2012

and services revenues also fell by 15% QoQ One of the surprising parts of Oracle's revenues has been the volatile services revenues. Services revenues fell by 15% QoQ, after growing by 27% QoQ in 1Q. Oracle attributes this to the project-based nature of the business.

The number of employees in the services business grew marginally, after a fall in the past few quarters. We believe that, the consistent reduction in employees over the past few quarters could be due to the higher focus of the company on its products business and lack of scale up in the services business.

EBIDTA margins On an overall basis, margins were lower YoY and QoQ. This was on the back of lower proportion of product revenues and the sharp fall in products / services revenues.

License revenues formed about 6% of product revenues. The margins in products business fell by about 380bps YoY, those in services business were at 13.3% v/s 33.2% in 2QFY12. Oracle's margins in the services business have been surprisingly erratic, making it difficult to estimates the future trend. We believe that, a higher proportion of license revenues will be a key determinant of margins going forward.

Financial projections and Recommendation We have made changes to our FY13 and FY14 estimates. We expect the rupee to average 54 / USD in FY13 and 51.5 / USD in FY14.

We expect product revenues to grow by 15% in FY13 and 11% in FY14. Services revenues are expected to grow by 2% in FY13 and 11% in FY14. EBIDTA margins are expected to fall marginally YoY in both fiscals, largely due to salary hikes, change in mix and expected rupee appreciation in FY14. Consequently, PAT is expected to rise by about 13% in FY13E and 10% in FY14, leading to an EPS of Rs.135 in FY14.

Recommendation We see the Oracle relationship as a key differentiator for OFSL and believe this could open up significant business opportunities for the company in addition to having endowed it with an MNC parentage.

The stock has moved up in the past few months on expectations of an open offer from the parent with a view to de-list the shares. The valuations are, thus, not undemanding now.

We maintain REDUCE on Oracle Financial Services with a price target of Rs.2662

Thus, we maintain REDUCE with a PT of Rs.2662 (Rs.2693 earlier). At our TP, the stock will quote at about 20x FY14 earnings estimates, similar to that accorded by us to TCS. We note that, the quarterly earnings are very volatile and may surprise on either side. An open offer by Oracle, if any, with a view to increase its stake further and delist the stock from the bourses, will be an upside trigger.

Risks A delayed recovery / sharp deterioration in major user economies may impact our projections.

A sharp acceleration in the rupee beyond our estimates may impact our earnings estimates for the company.

Kotak Securities - Private Client Research

Please see the disclaimer on the last page

For Private Circulation

MORNING INSIGHT

November 21, 2012

RESULT UPDATE

Amit Agarwal agarwal.amit@kotak.com +91 22 6621 6222

ARSHIYA INTERNATIONAL LIMITED (AIL)

PRICE: RS.120 TARGET PRICE: RS.188 RECOMMENDATION: BUY FY14E P/E: 4.3X

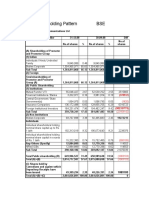

Summary table

(Rs mn) FY12 FY13E FY14E

Sales 10,574 12,962 16,409 Growth (%) 28.7 22.6 26.6 EBITDA 7,857 9,423 11,605 EBITDA margin (%) 25.7 27.3 29.3 PBT 1,419 1,785 2,431 Net profit 1,209 1,425 1,973 EPS (Rs) 20.5 24.2 33.4 Growth (%) 46.4 17.9 38.5 CEPS (Rs) 27.3 36.1 50.0 BV (Rs/share) 150.8 175.2 209.5 Dividend / share (Rs) 1.2 1.5 1.5 ROE (%) 13.6 13.7 15.9 ROCE (%) 8.0 8.4 9.7 Net cash (debt) (21,266) (24,623) (28,368) NW Capital (Days) 53.6 58.4 52.8 EV/EBITDA (x) 10.8 9.2 7.6 P/E (x) 7.1 6.0 4.3 P/Cash Earnings 5.3 4.0 2.9 P/BV (x) 1.0 0.8 0.7 Source: Company, Kotak Securities - Private Client Research

Strong operational performance in Q2FY13 - FTWZ and container rail grows at healthy pace Arshiya has reported its Q2FY13 net profit at Rs 354 million (+11% YoY). This was on account of increased share of FTWZ revenues in the overall revenues which has increased from 16% in Q2FY12 to 24% in Q2FY13. FTWZ revenues have grown from Rs 387 mn in Q2FY12 to Rs 893 mn in Q2FY13. As FTWZ is a high margin business, the increased share has helped the overall margins expand from 25.6% in Q2FY12 to 29% in Q2FY13. The company currently operates 4 warehouses at Panvel FTWZ and we estimate the company to ramp it up to 8 warehouses by end of FY13E. ARST has also started its Khurja FTWZ in Q4FY12 with 2 warehouses and we estimate the company to ramp it up to 4 by end of FY13E. The VAS to rental ratio has improved from 1.25 x to 1.4 x sequentially and we estimate it to improve from to 1.5 x by FY13E and further to 2x by FY14E. In the rail segment the company operates 20 rakes currently and we estimate the company to ramp it upto 24 by end of FY13E. Rail segment has reported 55% YoY growth in revenues with EBIT margins expanding to 16.5%. The company wants to integrate its entire rail operations with its logistics business and FTWZ business and run these rakes primarily on the domestic segment. The company continues to grow steadily in its core third party logistics (3PL) businesses. Total revenues have grown to Rs 3.72bn (+50% YoY).

We expect the company to deliver revenue CAGR of 24% over FY12 to FY14E to ~ Rs 16.4 bn with improvement in operating margins from 25.7% in FY12 to 27.3% in FY13E and 29.3% in FY14E. With improvement in margins and benefits of aggressive capex accruing to the company going ahead, we expect the return ratios of the company to improve. High leverage, execution delays and poor acceptability of the key FTWZ concept are some of the pitfalls and can be a drag for the company. Consequently we value the company at 30% discount to the one year forward multiple of 8 x of peer group companies in the Logistics space which comes at Rs 188. The discount captures the risks on account of the high leverage position of the company. We re-iterate BUY with a price target of Rs 188.

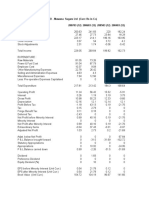

Quarterly snapshot (Consolidated)

(Rs mn) Logistics FTWZ Container Rail Others Total Revenues Cost of operations Employee cost Other expenses Total EBIDTA EBIDTA % Depreciation Other income Interest Taxation PAT Minority interest/ JV Extraordinary Adjusted PAT Equity EPS

Source: Company

Q4FY11 Q1FY12 Q2FY12 Q3FY12 Q4FY12 Q1FY13 Q2FY13 1625 207 498 14 2344 1542 129 132 1803 541 23.1 67 2 228 33 215 -1 -22 192 118 3.3 1425 309 485 7 2226 1,419 147 121 1687 539 24.2 66 3 189 50 237 0 0 237 118 4.0 1497 387 592 4 2480 1,578 145 121 1844 636 25.6 73 40 216 68 319 0 0 319 118 5.4 1491 443 796 4 2734 1,708 174 150 2,032 702 25.7 81 76 286 66 345 0 0 345 118 5.8 1690 575 843 0 3108 1,957 186 170 2,313 795 25.6 93 -42 339 44 277 0 0 277 118 4.7 1842 722 853 0 3418 2,120 218 145 2,483 935 27.4 120 74 500 42 347 0 0 347 118 5.9 1941 893 917 0 3751 2,271 214 159 2,644 1,082 29.0 121 -67 449 91 354 0 0 354 118 6.0

Kotak Securities - Private Client Research

Please see the disclaimer on the last page

For Private Circulation

MORNING INSIGHT

November 21, 2012

Key Highlights Total revenues have grown to Rs 3.72bn (+50% YoY).

EBIDTA margins have expanded from 25.6% in Q2FY12 to 29% in Q2FY13 with increased share of high margin FTWZ business in the total revenues. Company continues to pay tax rate which is near MAT PAT came at Rs 354 mn (+32% YoY and +25% QoQ) The quarter witnessed significant customer additions and an increased scope of Value Optimizing Services (VOS) offered to clients in the FTWZ. The VOS to rental ratio has improved to 1.4 x from 1.2 x QOQ. After successfully commissioning its Mumbai FTWZ in 3Q FY11, the company has commissioned its Khurja FTWZ in January, 2012. The company now plans to start a FTWZ in Chennai. Arshiya Rail has scaled up to 20 rakes in this year with plans to add another 10 (we estimate 4) by FY13E Arshiya Rail Infrastructure Ltd (ARIL) has signed a long term deal with GATX India Private Limited, a subsidiary of GATX Corporation, to lease its rakes to ARIL. GATX globally is one of the world's leading railcar leasing companies The integrated business added customers across industries such as Engineering, Pharma, Solar Energy, Wind Energy, Industrial Safety, Chemicals, Power Systems, FMCG, Retail, etc.

Panvel FTWZ Free Trade Warehousing Zone (FTWZ) at Panvel, Mumbai is spread on 165 acres of land

Currently it operates 4 warehouses and we expect the company to ramp it up to 8 warehouses by end of FY13E and 11 by end of FY14E. The company has been continuously adding new clients at its Panvel FTWZ and these clients are making Arshiya's Free Trade and Warehousing Zone (FTWZ) as their regional distribution hub for e.g.: Broekman Logistics India Private Limited, Soilmec India etc. Company is also working towards creating multi-tiered area for Value Optimizing Services (VOS) within Warehouses that improves productivity and efficiency of VOS activities. Management mentioned that the company had started performing high end Value Optimizing Services such as Kitting, Export and Import Consolidation, Sorting and Quality Control for various products including temperature sensitive and hazardous cargo

Khurja FTWZ Arshiya has now launched its second FTWZ at Khurja near Delhi in an area of 135 acres.

This FTWZ is expected to help manufacturers bring down transactional cost and boost EXIM, facilitate imports through implementation of vendor managed inventory and encourage exports by enabling quality check & consolidation before organized shipment. This facility has been inaugurated with 2 warehouses and we estimate the company to ramp it up to 4 by end of FY13E and 7 warehouses by end of FY14E The Khurja FTWZ would be complemented by a Domestic Distriparks (DDP) and a rail siding and would cater to northern manufacturing belt through service s like warehousing, value optimizing and distribution of EXIM and domestic cargo.

Kotak Securities - Private Client Research

Please see the disclaimer on the last page

For Private Circulation

MORNING INSIGHT

November 21, 2012

Near term FTWZ plan of AIL

No of Warehouses Mumbai (165 acres) Khurja (315 acres) Total Capex in FTWZ (Rs Mn) FY12 4 2 6 4000 FY13E 8 4 12 5100 FY14E 11 7 18 4600

Source: Company, Kotak Securities - Private Client Research

We expect the Value Optimization Service (VOS) to Rental ratio to improve for the company AIL currently earns nearly 55% (1.4 x rentals) of its total revenue from Mumbai FTWZ through VOS. Company aims to increase the same to 80% (4x rentals) over the years as it moves up the value chain of VAS. As cost of providing these services is less capital intensive, the return on capital will increase at a much higher rate with the change in VOS contribution to total revenue

We have assumed taken 1.5x VOS-to-Rental in our estimation in FY13E and 2 x in FY14E for FTWZ business versus the current ratio of 1.4x. Considering that these services are labour intensive rather than capital intensive, their sensitivity to the financials, return ratios and valuations is huge. That is higher revenues will translate into much higher return and asset to- turnover ratios. As company moves up the value chain of VOS the capital employment towards the service would increase due to higher customization of the clients' requirement. But, at the same time, clients' dependence on AIL and revenue visibility would also increase

Key VOS activities include:

VOS ON CONTAINER Customs Documentation Handling / Loading & Unloading Survey of Cargo/Containers Scanning of Containers VOS ON PALLETS Carting & Shifting of the Pallets Palletization Carbonization Strapping Packaging / Re-packaging Labeling / Re-Labeling Bar-Coding Tagging

Source: Company

HIGH END VOS Quality Contol Assembling Consolidation Repairs and Maintenance Cutting Polishing/Painting Resizing etc

FTWZ Assumptions

FY12 Rent per month VOS to rental income VOS income per container per month VOS containers per annum VOS income Total FTWZ revenue (Rs mn)

Source: Kotak Securities - Private Client Research

FY13E 16,000 1.5 24,000 80640 1,935 3,226

FY14E 16,000 2 32,000 113400 3,629 5,443

16,000 1 16,000 49980 800 1,599

Kotak Securities - Private Client Research

Please see the disclaimer on the last page

For Private Circulation

MORNING INSIGHT

November 21, 2012

Container rail business - 5 more rakes to be added by end of FY13E Arshiya Rail is currently operating 20 rakes and intends to add another 5 rakes by end of FY13E to support its rail business and also to complement its FTWZ and Logistics business. The addition of rakes would be through lease basis .Arshiya Rail Infrastructure Ltd has signed a long-term deal with Gatx India Pvt Ltd, a subsidiary of Gatx Corp, to lease rakes. Also company has already spent more than Rs 4 bn on rail license, rakes and Khurja Distriparks and would be spending another Rs 1 bn. We estimate the rail business to effectively complement the FTWZ and Logistics business with revenues for the segment growing from ~Rs 1.7 bn in FY11 to ~Rs 3.2 bn in FY13E and further to ~ Rs 4 bn in FY14E. Indian railways to increase rail haulage in 2 phases - by an average of 10% across categories in phase 1 Indian Railways (IR) would yet again increase the haulage rates by an average of 10% across categories in phase 1 from December 2012 and would be increasing the same by an unknown percentage in phase 2 from February 2013. This step by Indian Railways would negatively impact the volumes (both domestic and Exim) for container rail companies as customers may stop using this as preferred mode of transport based on high cost of transportation. Business may shift to roadways, coastal shipping, or even Indian railways. We are not changing the rail assumptions for Arshiya for the time being as: 1) AIL is primarily present in the domestic segment and the impact would be felt more in the Exim segment, 2) AIL primarily operates in the +20 tonne per TEU segment where rail is always the preferred mode and 3) AIL provides end to end Logistics service which acts as an incentive for the customer to do business with AIL. Heavy capex funding - primarily in FTWZ and container rail business FTWZ is a very capital intensive business. It involves purchase of land near the port or close to industrial hubs (minimum 100 acres), ground leveling, construction of warehouses and purchase of equipment and so on. While success of rail business depends on purchase of rakes and creation of demand creating hubs known as Inland container depots (ICDs). Arshiya has already spent ~Rs 24 bn till date primarily on the above two businesses and intends to spend another Rs 10.35 bn in FY13E and FY14E to complete phase one of its capex programme.

First Phase of Capex by Arshiya

(Rs mn) FTWZ Container rail business Others Total capex

Source: Kotak Securities - Private Client Research

FY13E 4,250 500 250 5,000

FY14E 4,600 500 250 5,350

High margin FTWZ business has positively impacted the margins With the company focusing on the FTWZ business, the share of high margin FTWZ business (70% Ebidta margin) in the revenues has expanded from 13.9% in Q1FY12 to 21.1% in Q1FY13 which has helped the margin improve from ~24.2% in Q1FY12 to 27.4% in Q1FY13. We further expect the share of FTWZ business to expand to 25% in FY13E and 33% in FY14E which would expand the margin from ~19% in FY11 to ~27% in FY13E and ~29% in FY14E.

Kotak Securities - Private Client Research

Please see the disclaimer on the last page

For Private Circulation

MORNING INSIGHT

November 21, 2012

Segmental share of revenues

(Rs mn) Logistics operations Rail freight FTWZ Others Total % share Logistics operations Rail freight FTWZ Others 87.3 9.2 0.0 3.5 75.5 20.6 3.1 0.8 58.0 25.7 16.2 0.1 50.1 24.9 24.9 0.1 42.2 24.6 33.2 0.1 FY10 4591 482 0 186 5,259 FY11 6204 1692 256 64 8,216 FY12E 6,134 2,716 1,714 10 10,574 FY13E 6,500 3,227 3,226 10 12,962 FY14E 6,922 4,034 5,443 10 16,409

Source: Company, Kotak Securities - Private Client Research

Return ratios to improve as benefits of aggressive capex will accrue from FY13E As the company has been on an aggressive expansion spree in the past few years, free cashflows have remained negative and are likely to remain in the negative until FY14E (end of capex for Phase 1) as positive operating cashflow of about Rs 4.5 bn will be inadequate to fund capex of Rs 10.35 bn, resulting in a substantial increase in debt. Post that we expect improvement in asset turnover and improvement in margin which will increase the ROCE, which has been in the low single-digits for the past two years, to improve. For FY14E we expect the ROCE to improve to ~10% from 7% in FY11. With improvement in margins we also expect ROE to improve to ~16% in FY14E from 11% in FY11.

DuPont Analysis

Parameter EBIT margin Asset Turn over Financial Leverage Interest Burden Tax burden ROE (%) EBIT Margin Capital Turnover ROCE (%) Ratio EBIT/ Revenue Revenue /Capital employed Capital Employed/ Equity PBT/EBIT PAT/PBT PAT/Equity EBIT/ Revenue Revenue/ Capital Employed EBIT/Capital Employed FY10 0.23 0.42 1.83 0.89 0.93 14.24 0.23 0.42 9.40 FY11 0.18 0.37 2.88 0.67 0.86 10.78 0.18 0.37 6.52 FY12 FY13E FY14E 0.23 0.34 3.47 0.57 0.85 13.59 0.23 0.34 8.03 0.23 0.36 3.47 0.59 0.80 13.73 0.23 0.36 8.40 0.25 0.40 3.36 0.60 0.81 15.92 0.25 0.40 9.72

Source: Company, Kotak Securities - Private Client Research

We recommend BUY on Arshiya International with a price target of Rs.188

Valuation and recommendation AIL is getting transformed from a 3PL player to becoming an integrated service provider, and its Free Trade Warehousing Zone (FTWZ) foray, if successful, can lead to a significant re-rating. We expect 24% sales growth over FY12 to FY14E driven by FTWZ segment and an increasing presence in container haulage and 3PL logistics. Adjusted PAT is expected to increase over FY12 to FY14E driven by a 170 bps expansion in EBITDA margin as high margin FTWZ expands and contributes about 25% to revenues in FY13E and 33% in FY14E. We expect sizeable value accretion from the FTWZ business from FY13E. Consequently we value the company at 1/3rd discount to the one year forward multiple of 8x of peer group companies in the Logistics space which comes at Rs 188. The discount captures the risks on account of the high leverage position of the company, nascent FTWZ concept and slowdown in the economy. We rate the stock BUY with a price target of Rs 188. Risk High leverage, Execution delays and Poor acceptability of the key FTWZ concept

Kotak Securities - Private Client Research

Please see the disclaimer on the last page

For Private Circulation

MORNING INSIGHT

November 21, 2012

Bulk deals

Trade details of bulk deals

Date Scrip name Name of client Buy/ Sell Quantity of shares Avg. price (Rs) 149.4 150.2 19.3 19.3 50.9 40.8 40.8 40.9 41.0 41.0 20.6 20.6 85.3 85.2 3.4 3.4 3.4 3.4 3.4 3.4 13.3 5.9 6.2 6.0 1.8 25.0 2.4 2.4 29.5 26.1 33.9 33.7 38.4 36.5 36.5 36.5 69.0 66.1 67.7 66.2 67.2 70.7

20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov 20-Nov

20 Microns 20 Microns Ankit Metal Ankit Metal Ashutosh Paper Associated Fin Associated Fin Associated Fin Associated Fin Associated Fin Bilpower Bilpower Cubical Fin Cubical Fin Diamant Diamant Diamant Diamant Diamant Diamant Edserv Soft Fact Enterprise Fact Enterprise Fact Enterprise GCV Serv Mathew Easow Northgate Tech Northgate Tech Ortin Lab-$ PFL Infotech PM Telelinnks PM Telelinnks Pradipovers Residency Proj Residency Proj Residency Proj Zylog Systems Zylog Systems Zylog Systems Zylog Systems Zylog Systems Zylog Systems

Rameshbhai Parshotambhai Bodar Jayneel Securities Pvt Ltd Dhara Dealers Pvt Ltd Concast Ispat Limited Ritu Raj Kalu Singh Ji Chauhan Shimla Jain Radhey Shyam Agarwal HUF Parsoon Agarwal HUF Kashmir Arts Chander Pal Chawla Vidhi Choudhary Radiance Exim Pvt Ltd Ritu Jain Alka Agarwal Jigar Praful Ghoghari Tripurari Properties Pvt Ltd G R D Securities Limited Mono Herbicides Pvt. Ltd. Subhash B Jain S Praveen Kumar Sagar Rajeshbhai Jhaveri Atash Transport Pvt Ltd Navgia Sales Pvt Ltd Darshik Milan Desai Akash B Patava Anjana Projects Limited Vishal Gurnani Leena Investments Consultancy Llp Satyanarayan Saboo Nikunj Gupta Vijay Babulal Shah Shah Daivik Jatin Blackhorsemedia & entertainment Manish Uppal Bushan Kumar Uppal Valuemart Retail (India) Ltd Anupama Shukla IFCI Ltd. Kare Ramanarasimhasetty Pradeep Sripriya S Birla Global Finance Co Ltd JM Financial Products Pvt Ltd

B S B S B S S S B S B S S B S S S S B B B S S B B S S B B B B S B B B S S S B S S S

108,187 72,101 675,000 935,000 49,000 26,500 26,426 26,500 50,000 50,000 150,000 150,010 83,286 125,000 553,938 597,794 489,814 500,000 832,240 2,000,000 166,564 100,000 200,000 100,000 541,400 50,000 452,900 324,000 31,834 70,000 78,562 61,029 216,526 50,000 50,000 100,000 191,000 400,000 350,000 174,134 300,000 482,869

Source: BSE

Kotak Securities - Private Client Research

Please see the disclaimer on the last page

For Private Circulation

10

MORNING INSIGHT

November 21, 2012

Gainers & Losers

Nifty Gainers & Losers

Price (Rs) Gainers HDFC M&M HDFC Bank Losers Infosys Ltd Reliance Ind SBI

Source: Bloomberg

chg (%)

Index points

Volume (mn)

782 939 654 2,325 765 2,067

2.3 3.3 1.1 (1.4) (1.2) (1.3)

8.3 4.3 4.1 (5.1) (4.7) (2.2)

3.0 2.5 2.3 0.7 2.2 1.9

Fundamental Research Team

Dipen Shah IT, Media dipen.shah@kotak.com +91 22 6621 6301 Sanjeev Zarbade Capital Goods, Engineering sanjeev.zarbade@kotak.com +91 22 6621 6305 Teena Virmani Construction, Cement, Mid Cap teena.virmani@kotak.com +91 22 6621 6302 Saurabh Agrawal Metals, Mining agrawal.saurabh@kotak.com +91 22 6621 6309 Saday Sinha Banking, NBFC, Economy saday.sinha@kotak.com +91 22 6621 6312 Arun Agarwal Auto & Auto Ancillary arun.agarwal@kotak.com +91 22 6621 6143 Ruchir Khare Capital Goods, Engineering ruchir.khare@kotak.com +91 22 6621 6448 Ritwik Rai FMCG, Media ritwik.rai@kotak.com +91 22 6621 6310 Sumit Pokharna Oil and Gas sumit.pokharna@kotak.com +91 22 6621 6313 Amit Agarwal Logistics, Transportation agarwal.amit@kotak.com +91 22 6621 6222 Jayesh Kumar Economy kumar.jayesh@kotak.com +91 22 6652 9172 K. Kathirvelu Production k.kathirvelu@kotak.com +91 22 6621 6311

Technical Research Team

Shrikant Chouhan shrikant.chouhan@kotak.com +91 22 6621 6360 Amol Athawale amol.athawale@kotak.com +91 20 6620 3350 Premshankar Ladha premshankar.ladha@kotak.com +91 22 6621 6261

Derivatives Research Team

Sahaj Agrawal sahaj.agrawal@kotak.com +91 22 6621 6343 Rahul Sharma sharma.rahul@kotak.com +91 22 6621 6198 Malay Gandhi malay.gandhi@kotak.com +91 22 6621 6350 Prashanth Lalu prashanth.lalu@kotak.com +91 22 6621 6110

Disclaimer

This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is for the general information of clients of Kotak Securities Ltd. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither Kotak Securities Limited, nor any person connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions -including those involving futures, options and other derivatives as well as non-investment grade securities - involve substantial risk and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stocks price movement and trading volume, as opposed to focusing on a companys fundamentals and as such, may not match with a report on a companys fundamentals. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. Kotak Securities Limited has two independent equity research groups: Institutional Equities and Private Client Group. This report has been prepared by the Private Client Group . The views and opinions expressed in this document may or may not match or may be contrary with the views, estimates, rating, target price of the Institutional Equities Research Group of Kotak Securities Limited. We and our affiliates, officers, directors, and employees world wide may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (ies) discussed herein or act as advisor or lender / borrower to such company (ies) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. No part of this material may be duplicated in any form and/or redistributed without Kotak Securities prior written consent. Registered Office: Kotak Securities Limited, Bakhtawar, 1st floor, 229 Nariman Point, Mumbai 400021 India.

Correspondence address: Infinity IT Park, Bldg. No 21, Opp Film City Road, A K Vaidya Marg, Malad (East), Mumbai 400097. Tel No : 66056825. Securities and Exchange Board Of India: Registration No's: NSE INB/INF/INE 230808130, BSE INB 010808153/INF 011133230/ INE 011207251, OTC INB 200808136, MCXSX INE 260808130. AMFI No: 0164. Investment in securities market is subject to market risk, please read the combined risk disclosure document prior to investing.

Kotak Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation

11

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- New World Order A Cup of TeaDokument48 SeitenNew World Order A Cup of Teaapi-19972088100% (3)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Andrew Jackson - Where Does Money Come From - Positive Money PDF FromDokument374 SeitenAndrew Jackson - Where Does Money Come From - Positive Money PDF FromLocal Money86% (7)

- Scalping Option GammasDokument4 SeitenScalping Option Gammasemerzak100% (2)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Forex Secrets FelixDokument92 SeitenForex Secrets FelixEduardo DutraNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Pre Webinar Presentation - DetailsDokument13 SeitenPre Webinar Presentation - DetailsJayaprakash Muthuvat100% (1)

- RBI and Commercial Banking: By: Gaurang Badheka FSM, Sem - 3Dokument30 SeitenRBI and Commercial Banking: By: Gaurang Badheka FSM, Sem - 3Gaurang BadhekaNoch keine Bewertungen

- Proven VIX Sniper StrategyDokument22 SeitenProven VIX Sniper StrategyDulika Shinana94% (171)

- RngerDokument5 SeitenRngerLeon Heart100% (1)

- Capital Markets Explained: Key Terms and Major PlayersDokument12 SeitenCapital Markets Explained: Key Terms and Major Playerschmon100% (1)

- List of MCOM and MIB Project TopicsDokument18 SeitenList of MCOM and MIB Project TopicsGovindaGowda50% (4)

- Industry Report Card April 2018Dokument16 SeitenIndustry Report Card April 2018didwaniasNoch keine Bewertungen

- Rbi Allowed Banks To Increase Limit From 10 To 15 PercentDokument10 SeitenRbi Allowed Banks To Increase Limit From 10 To 15 PercentdidwaniasNoch keine Bewertungen

- 0hsie F PDFDokument416 Seiten0hsie F PDFchemkumar16Noch keine Bewertungen

- Rain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImproveDokument8 SeitenRain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImprovedidwaniasNoch keine Bewertungen

- Information Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsDokument8 SeitenInformation Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsdidwaniasNoch keine Bewertungen

- Idfc QTR FinancialsDokument2 SeitenIdfc QTR FinancialsdidwaniasNoch keine Bewertungen

- BandhanBank 15 3 18 PLDokument1 SeiteBandhanBank 15 3 18 PLdidwaniasNoch keine Bewertungen

- Weekly Technical PicksDokument4 SeitenWeekly Technical PicksMaruthee SharmaNoch keine Bewertungen

- Financials 7-11-08Dokument6 SeitenFinancials 7-11-08didwaniasNoch keine Bewertungen

- APL Apollo Antique Stock Broking Coverage Aprl 17Dokument17 SeitenAPL Apollo Antique Stock Broking Coverage Aprl 17didwaniasNoch keine Bewertungen

- Sensex AnalysisDokument2 SeitenSensex AnalysisdidwaniasNoch keine Bewertungen

- Bandhan Bank Building Strong Franchise Through Retail FocusDokument13 SeitenBandhan Bank Building Strong Franchise Through Retail FocusdidwaniasNoch keine Bewertungen

- MARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodayDokument2 SeitenMARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodaydidwaniasNoch keine Bewertungen

- Sponge Iron Industry B K Oct 06 PDFDokument30 SeitenSponge Iron Industry B K Oct 06 PDFdidwaniasNoch keine Bewertungen

- Shareholding Pattern BSEDokument3 SeitenShareholding Pattern BSEdidwaniasNoch keine Bewertungen

- Mawana FinancialsDokument8 SeitenMawana FinancialsdidwaniasNoch keine Bewertungen

- Income & Growth One Pager 06302008Dokument2 SeitenIncome & Growth One Pager 06302008didwaniasNoch keine Bewertungen

- IDEA One PagerDokument6 SeitenIDEA One PagerdidwaniasNoch keine Bewertungen

- 'A' Grade Turnaround: Associated Cement CompaniesDokument3 Seiten'A' Grade Turnaround: Associated Cement CompaniesdidwaniasNoch keine Bewertungen

- BHEL One PagerDokument1 SeiteBHEL One PagerdidwaniasNoch keine Bewertungen

- IFLEX One PagerDokument1 SeiteIFLEX One PagerdidwaniasNoch keine Bewertungen

- IAG+ +India+Strategy+ (June+08)Dokument17 SeitenIAG+ +India+Strategy+ (June+08)api-3862995Noch keine Bewertungen

- Citizens Guide 2008Dokument12 SeitenCitizens Guide 2008DeliajrsNoch keine Bewertungen

- 24 Jun 08 - BHELDokument4 Seiten24 Jun 08 - BHELdidwaniasNoch keine Bewertungen

- The Subprime Meltdown: Understanding Accounting-Related AllegationsDokument7 SeitenThe Subprime Meltdown: Understanding Accounting-Related AllegationsdidwaniasNoch keine Bewertungen

- HSBC Private Bank Strategy MattersDokument4 SeitenHSBC Private Bank Strategy MattersdidwaniasNoch keine Bewertungen

- IAG+ +India+Strategy+ (June+08)Dokument17 SeitenIAG+ +India+Strategy+ (June+08)api-3862995Noch keine Bewertungen

- CKP PresentationDokument39 SeitenCKP PresentationdidwaniasNoch keine Bewertungen

- Sanjiv KaulDokument18 SeitenSanjiv KaulsdNoch keine Bewertungen

- Kpo VsbpoDokument3 SeitenKpo VsbposdNoch keine Bewertungen

- Total Return SwapDokument3 SeitenTotal Return Swapapi-3748391100% (1)

- A Study On Financial Statement Analysis On Pondicherry Industrial Promotion Development and Investment Corporation Limited PIPDIC, PondicherryDokument4 SeitenA Study On Financial Statement Analysis On Pondicherry Industrial Promotion Development and Investment Corporation Limited PIPDIC, PondicherryEditor IJTSRDNoch keine Bewertungen

- IPER ProfileDokument3 SeitenIPER ProfileDharmsurya TomarNoch keine Bewertungen

- OV 2019 0508 Sec Definitive Is 2019 Final PDFDokument437 SeitenOV 2019 0508 Sec Definitive Is 2019 Final PDFLhei LanadoNoch keine Bewertungen

- Black Money-Ii-8Dokument6 SeitenBlack Money-Ii-8silvernitrate1953Noch keine Bewertungen

- PhillipCapital India Corporate Profile 2019Dokument25 SeitenPhillipCapital India Corporate Profile 2019BKSPCNoch keine Bewertungen

- Saral Gyan Stocks Past Performance 050113Dokument13 SeitenSaral Gyan Stocks Past Performance 050113saptarshidas21Noch keine Bewertungen

- Introduction To Money and Interest: Rajneesh MishraDokument27 SeitenIntroduction To Money and Interest: Rajneesh MishraAritra SilNoch keine Bewertungen

- BFM Course Syllabus 1Dokument8 SeitenBFM Course Syllabus 1Nainisha Sawant0% (1)

- FOREX - Point and Figure Charts (TAS&C) PDFDokument3 SeitenFOREX - Point and Figure Charts (TAS&C) PDFguiness_joe9154Noch keine Bewertungen

- 2233 AnnualRpt PDFDokument396 Seiten2233 AnnualRpt PDFWilliam O OkolotuNoch keine Bewertungen

- Stock Exchange Case StudyDokument15 SeitenStock Exchange Case StudyNitish Chauhan100% (3)

- Dennis Odife Panel Report On The Review of The NCM by MoF Sept 1996 - AbridgedDokument143 SeitenDennis Odife Panel Report On The Review of The NCM by MoF Sept 1996 - AbridgedProshare100% (1)

- Investment Banking and Opportunities in ChinaDokument576 SeitenInvestment Banking and Opportunities in ChinaAdam GellenNoch keine Bewertungen

- Edelweiss Mutual Funds vs ULIPs: A Comparative AnalysisDokument92 SeitenEdelweiss Mutual Funds vs ULIPs: A Comparative AnalysisSadhanaNoch keine Bewertungen

- Altius IV Income Notes - Irish Stock ExchangeDokument193 SeitenAltius IV Income Notes - Irish Stock Exchangeabenson8Noch keine Bewertungen

- Rakesh Jhunjhunwala PDFDokument6 SeitenRakesh Jhunjhunwala PDFMaruthee SharmaNoch keine Bewertungen

- Ch19 Performance Evaluation and Active Portfolio ManagementDokument29 SeitenCh19 Performance Evaluation and Active Portfolio ManagementA_StudentsNoch keine Bewertungen

- Derivatives: The Important Categories of DerivativesDokument10 SeitenDerivatives: The Important Categories of DerivativesShweta AgrawalNoch keine Bewertungen

- Foreign Currency Translation: Learning ObjectiveDokument24 SeitenForeign Currency Translation: Learning ObjectiveJohn Rashid HebainaNoch keine Bewertungen