Beruflich Dokumente

Kultur Dokumente

Cal Tax

Hochgeladen von

SivaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cal Tax

Hochgeladen von

SivaCopyright:

Verfügbare Formate

Get instructions for 540NR Long Form

For Privacy Notice, get form FTB 1131.

California Nonresident or Part-Year Resident Income Tax Return 2011

Fiscal year filers only: Enter month of year end: month________ year 2012.

Your first name If joint tax return, spouses/RDPs first name

Initial Last name Initial Last name

FORM

Long .Form

Your SSN or ITIN

540NR C1 Side 1

P AC A R

Spouses/RDPs SSN or ITIN

Address (number and street, PO Box, or PMB no.) City (If you have a foreign address, see page 15)

Apt. no./Ste.no. State ZIP Code

PBA Code

RP

Date of Birth

Prior Name

Your DOB (mm/dd/yyyy) ______/______/___________ Spouses/RDPs DOB (mm/dd/yyyy) ______/______/___________

If you filed your 2010 tax return under a different last name, write the last name only from the 2010 tax return . Taxpayer _______________________________________________ Spouse/RDP_____________________________________________

1 . . 2 . . 3 .

Single 4 . Head of household (with qualifying person) . (see page 3) Married/RDP filing jointly . (see page 3) 5 . Qualifying widow(er) with dependent child . Enter year spouse/RDP died _________ Married/RDP filing separately . Enter spouses/RDPs SSN or ITIN above and full name here______________________________________ If your California filing status is different from your federal filing status, fill in the circle here . . . . . . . . . . . 6 . If someone can claim you (or your spouse/RDP) as a dependent, fill in the circle here (see page 15) . . . . 6 .

Filing Status Exemptions

For line 7, line 8, line 9, and line 10: Multiply the amount you enter in the box by the pre-printed dollar amount for that line . Whole .dollars .only . 7 . Personal: If you filled in 1, 3, or 4 above, enter 1 in the box . If you filled in 2 or 5, enter 2 . If you filled in the circle on line 6, see page 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 . X $102 = $ ___________________ . 8 . Blind: If you (or your spouse/RDP) are visually impaired, enter 1; if both are visually impaired, enter 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 . X $102 = $ ___________________ . 9 . Senior: If you (or your spouse/RDP) are 65 or older, enter 1; if both are 65 or older, enter 2 . 9 . X $102 = $ ___________________ 10 . Dependents: Enter name and relationship . Do .not .include .yourself .or .your .spouse/RDP. ._______________________ _______________________ ________________________ Total dependent exemptions 10 . X $315 = $ ___________________ 11 . Exemption .amount: Add line 7 through line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11 . $ ___________________ 12 . 13 . 14 . 15 . 16 . 17 . 18 . . 19 . 31 . 32 . 35 . 36 . 37 . 38 . 39 .

Total Taxable Income

Enter federal AGI from Form 1040, line 37; 1040A, line 21; 1040EZ, line 4; 1040NR, line 36; or 1040NR-EZ, line 10 . . . . 13 .

Total California wages from your Form(s) W-2, box 16 . . . . . . . . . . . . . . . . . . . . . . 12 .

00 14 . 15 . 16 . 17 . 18 . 19 . 00 00 00 00 00 00 00 00 00 00

California adjustments subtractions . Enter the amount from Schedule CA (540NR), line 37, column B . . . . . . Subtract line 14 from line 13 . If less than zero, enter the result in parentheses (see page 16) . . . . . . . . . . . . . . . . . California adjustments additions . Enter the amount from Schedule CA (540NR), line 37, column C . . . . . . . . . Adjusted gross income from all sources . Combine line 15 and line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Enter the larger .of: Your California itemized .deductions .from Schedule CA (540NR), line 43; OR Your California standard .deduction (see page 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Subtract line 18 from line 17 . This is your total .taxable .income . If less than zero, enter -0- . . . . . . . . . . . . . . . . .

Tax . Fill in the circle if from: Tax Table Tax Rate Schedule FTB 3800 FTB 3803 . . . . . . . . . . . . . 31 . CA adjusted gross income from Schedule CA (540NR), Part IV, line 45 . . . . . 32 . 00 CA Taxable Income from Schedule CA (540NR), Part IV, line 49 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35 . CA Tax Rate . Divide line 31 by line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36 . .___ . .. . .___ . .___ . .___ . .___ CA Tax Before Exemption Credits . Multiply line 35 by line 36 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37 . CA Exemption Credit Percentage . Divide line 35 by line 19 . If more than 1, enter 1 .0000 . 38___ . .. . .___ . .___ . .___ . .___ CA Prorated Exemption Credits . Multiply line 11 by line 38 . If the amount on line 13 is more than $166,565 (see page 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .39 . 40 . CA Regular Tax Before Credits . Subtract line 39 from line 37 . If less than zero, enter -0- . . . . . . . . . . . . . . . . . . . . .40 . 41 . Tax (see page 18) . Fill in the circle if from: Schedule G-1 FTB 5870A . . . . . . . . . . . . . . . . . . . . . . . . . 41 . 42 . Add line 40 and line 41 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42 .

CA Taxable Income

00 00 00 00

3131113

Your name: ______________________________________Your SSN or ITIN: ______________________________

49 . Enter the amount from Side 1, line 42 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49 . 50 . Nonrefundable .Child and Dependent Care Expenses Credit (see page 18) . Attach form FTB 3506 . . . . . . . . . . . 51 . 52 . 53 . 54 . 00 Credit for joint custody head of household (see page 18) . . . . . . . . . . . . . . . 51 . Credit for dependent parent (see page 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . 52 . 00 Credit for senior head of household (see page 19) . . . . . . . . . . . . . . . . . . . . . 53 . 00 Credit percentage . Divide line 35 by line 19 . If more than 1, enter 1 .0000 (see page 19) . . . . . . . . . . . . . . . . . . . . . . . . . . 54 ____ .____ ____ ____ ____

00 00

50 .

55 . Credit amount (see page 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Special Credits 56 . New jobs credit, amount generated (see page 19) . . . . . . . . . . . . . . . . . . . . . 56 . 00

. 55 .

57 .

00

57 . New jobs credit, amount claimed (see page 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00 00 00 00 00 00 00

58 . Enter credit name__________________________________________code number ________and amount . . 58 . 59 . Enter credit name__________________________________________code number ________and amount . . 59 . 60 . To claim more than two credits (see page 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61 . Nonrefundable renters credit (see page 57) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

60 . 61 .

62 . Add line 50, line 55, and line 57 through 61 . These are your total credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62 . 63 . Subtract line 62 from line 49 . If less than zero, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63 .

Other Taxes

71 . Alternative minimum tax . Attach Schedule P (540NR) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72 . Mental Health Services Tax (see page 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73 . Other taxes and credit recapture (see page 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74 . Add line 63, line 71, line 72, and line 73 . This is your total tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. 71 . . 72 . . 73 . . 74 .

00 00 00 00

81 . 82 . 83 . 84 . 85 .

California income tax withheld (see page 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81 . 2011 CA estimated tax and other payments (see page 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82 . Real estate and other withholding (see page 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 83 . Excess SDI (or VPDI) withheld . (see page 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84 . Add line 81, line 82, line 83, and line 84 . These are your total payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85 .

00 00 00 00 00

Payments

Overpaid Tax/Tax Due

101 . Overpaid tax . If line 85 is more than line 74, subtract line 74 from line 85 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 101 . 102 . Amount of line 101 you want applied to your 2012 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 102 . 103 . Overpaid tax available this year . Subtract line 102 from line 101 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 103 . 104 . Tax due . If line 85 is less than line 74, subtract line 85 from line 74 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 104 .

00 00 00 00

Side .2 . Long Form 540NR 2011

3132113

Your name: ______________________________________Your SSN or ITIN: ______________________________

Code . California Seniors Special Fund (see page 21) . . . . 400 Alzheimers Disease/Related Disorders Fund . . . . . 401 California Fund for Senior Citizens . . . . . . . . . . . . . 402 Rare and Endangered Species Preservation Program . . . . . . . . . . . . . . . . . . . . . 403 State Childrens Trust Fund for the Prevention of Child Abuse . . . . . . . . . . . . . . . . . . . . . . . . . . . 404 California Breast Cancer Research Fund . . . . . . . . . 405 California Firefighters Memorial Fund . . . . . . . . . . 406 Emergency Food for Families Fund . . . . . . . . . . . . . 407 California Peace Officer Memorial Foundation Fund . . . . . . . . . . . . . . . . . . . . . . . . . 408

Amount 00 00 00 00 00 00 00 00 00

Code . California Sea Otter Fund . . . . . . . . . . . . . . . . . . . . 410 Municipal Shelter Spay-Neuter Fund . . . . . . . . . . . . 412 California Cancer Research Fund . . . . . . . . . . . . . . 413 ALS/Lou Gehrigs Disease Research Fund . . . . . . . . 414 Arts Council Fund . . . . . . . . . . . . . . . . . . . . . . . . . . 415 California Police Activities League (CALPAL) Fund . . . . . . . . . . . . . . . . . . . . . . . . . . 416 California Veterans Homes Fund . . . . . . . . . . . . . . . 417 Safely Surrendered Baby Fund . . . . . . . . . . . . . . . . 418 Child Victims of Human Trafficking Fund . . . . . . . . 419

Amount 00 00 00 00 00 00 00 00 00

Contributions

120 . Add code 400 through code 419 . This is your total contribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 120 . Amount You Owe 121 . AMOUNT .YOU .OWE. .Add line 104 and line 120 (see page 21) . Do .not .send .cash . Mail to: FRANCHISE .TAX .BOARD, .PO .BOX .942867, .SACRAMENTO .CA .94267-0001 . . . . . . . . . Pay Online Go to ftb.ca.gov .and search for .web .pay.

00

121 .

. 00

00 00 00

Interest and Penalties

122 . Interest, late return penalties, and late payment penalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 122 . 123 . Underpayment of estimated tax . Fill in the circle: FTB .5805 .attached FTB .5805F .attached . . . . . 123 . 124 . Total amount due (see page 23) . Enclose, but do .not staple, any payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 124 . 125 . REFUND .OR .NO .AMOUNT .DUE. .Subtract line 120 from line 103 . Mail to: FRANCHISE .TAX .BOARD, .PO .BOX .942840, .SACRAMENTO .CA .94240-0002 . . . . . . . . . .

Refund and Direct Deposit

125

. 00

Fill in the information to authorize direct deposit of your refund into one or two accounts . Do .not attach a voided check or a deposit slip (see page 23) . Have .you .verified .the .routing .and .account .numbers? Use whole dollars only . All or the following amount of my refund (line 125) is authorized for direct deposit into the account shown below: Checking Savings , , Routing number Type Account number 126 .Direct deposit amount The remaining amount of my refund (line 125) is authorized for direct deposit into the account shown below: Checking Savings Routing number Type Account number

. 00

127 .Direct deposit amount

. 00

IMPORTANT: Attach a copy of your complete federal return. Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Your signature

Sign Here

It is unlawful to forge a spouses/RDPs signature . Joint tax return? (see page 23)

Spouses/RDPs signature (if a joint tax return, both must sign)

Daytime phone number (optional)

(

Date

X

Your email address (optional) . Enter only one email address .

Paid preparers signature (declaration .of .preparer .is .based .on .all .information .of .which .preparer .has .any .knowledge) Firms name (or yours, if self-employed) Firms address

PTIN FEIN

Do you want to allow another person to discuss this tax return with us? (see page 23) . . . . . . . . . Yes No ( ) __________________________________________________________________ __________________________________ Print Third Party Designees Name Telephone Number

3133113

Long Form 540NR C1 2011 Side .3

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Path2usa Travel Guide To UsaDokument17 SeitenPath2usa Travel Guide To UsaSivaNoch keine Bewertungen

- Dallas Police and Fire Pension BriefingDokument85 SeitenDallas Police and Fire Pension BriefingTristan HallmanNoch keine Bewertungen

- BSBFIA412 Formative AssessmentDokument13 SeitenBSBFIA412 Formative AssessmentLAN L100% (1)

- Brahma SutraDokument575 SeitenBrahma SutraAnurag ShivranNoch keine Bewertungen

- S&OP - Production Planning PDFDokument24 SeitenS&OP - Production Planning PDFfusocNoch keine Bewertungen

- Utilization of ABC/XYZ analysis in stock planningDokument8 SeitenUtilization of ABC/XYZ analysis in stock planningSivaNoch keine Bewertungen

- Teradata Mining ServicesDokument4 SeitenTeradata Mining ServicesSivaNoch keine Bewertungen

- BilwashtakamDokument1 SeiteBilwashtakamSivaNoch keine Bewertungen

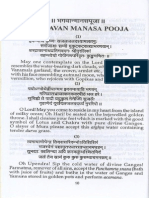

- Bhagwan Manasa Pooja PDFDokument3 SeitenBhagwan Manasa Pooja PDFSivaNoch keine Bewertungen

- Understanding the essence of life through spiritual wisdomDokument14 SeitenUnderstanding the essence of life through spiritual wisdomRonJamsNoch keine Bewertungen

- Understanding Vedanta Philosophy Through The UpanishadsDokument451 SeitenUnderstanding Vedanta Philosophy Through The UpanishadsJogendra BeheraNoch keine Bewertungen

- Best of Quora - 2012Dokument442 SeitenBest of Quora - 2012Arda KutsalNoch keine Bewertungen

- Ak Sharaman A Mala IDokument23 SeitenAk Sharaman A Mala ISivaNoch keine Bewertungen

- Obsessed With The ImageDokument5 SeitenObsessed With The ImageSivaNoch keine Bewertungen

- Unit 1. Fundamentals of Managerial Economics (Chapter 1)Dokument50 SeitenUnit 1. Fundamentals of Managerial Economics (Chapter 1)Felimar CalaNoch keine Bewertungen

- PTCL Withholding Tax Statement for Aftab QuershiDokument1 SeitePTCL Withholding Tax Statement for Aftab QuershiAbdullah EjazNoch keine Bewertungen

- Grizzly Community Hospital in Central Wyoming Provides Health Care ServicesDokument1 SeiteGrizzly Community Hospital in Central Wyoming Provides Health Care ServicesAmit PandeyNoch keine Bewertungen

- Scenario Analyzer Mountain Man StudentDokument6 SeitenScenario Analyzer Mountain Man StudentCarlos Romani PolancoNoch keine Bewertungen

- Formal Letter Opf DemandDokument8 SeitenFormal Letter Opf DemandrcpanganibanNoch keine Bewertungen

- IAS 41 Accounting for Agricultural ActivityDokument5 SeitenIAS 41 Accounting for Agricultural ActivityArney GumbleNoch keine Bewertungen

- Principles of AccountingDokument13 SeitenPrinciples of AccountingRoe BelleNoch keine Bewertungen

- Manual of Cost Accounting in The Ordnance and Ordnance Equipment Factories Section - I General ObjectsDokument73 SeitenManual of Cost Accounting in The Ordnance and Ordnance Equipment Factories Section - I General ObjectsSachin PatelNoch keine Bewertungen

- Partnership Fundamentals 2Dokument6 SeitenPartnership Fundamentals 2sainimanish170gmailcNoch keine Bewertungen

- Ang & Bekaert - 2007 - RFS - Stock Return Predictability Is It ThereDokument58 SeitenAng & Bekaert - 2007 - RFS - Stock Return Predictability Is It ThereẢo Tung ChảoNoch keine Bewertungen

- Corporate InformationDokument118 SeitenCorporate InformationAmit NisarNoch keine Bewertungen

- Accelerator and Super MultiplierDokument11 SeitenAccelerator and Super MultiplierPujitha GarapatiNoch keine Bewertungen

- FI504 Case Study 1 The Complete Accounting CycleDokument16 SeitenFI504 Case Study 1 The Complete Accounting CycleElizabeth Hurtado-Rivera0% (1)

- CHAPTER 5 ADJUSTING PROCESS - AssignmentDokument1 SeiteCHAPTER 5 ADJUSTING PROCESS - AssignmentjepsyutNoch keine Bewertungen

- Commercial Law HighlightsDokument30 SeitenCommercial Law Highlightsเจียนคาร์โล การ์เซียNoch keine Bewertungen

- AggrivateDokument14 SeitenAggrivatemvtharish138Noch keine Bewertungen

- TIffany and Co.Dokument52 SeitenTIffany and Co.tmltanNoch keine Bewertungen

- LSW/ValuTeachers DeceitDokument6 SeitenLSW/ValuTeachers DeceitScott DauenhauerNoch keine Bewertungen

- Lecture 2Dokument24 SeitenLecture 2Bình MinhNoch keine Bewertungen

- Pub B in B 2011 06 enDokument174 SeitenPub B in B 2011 06 enfilipandNoch keine Bewertungen

- Corporate Finance: Topic: Company Analysis "Infosys"Dokument6 SeitenCorporate Finance: Topic: Company Analysis "Infosys"Anuradha SinghNoch keine Bewertungen

- Joint Stock CompanyDokument26 SeitenJoint Stock CompanyPratik ShahNoch keine Bewertungen

- Strategic Management Case StudyDokument14 SeitenStrategic Management Case StudysufiroslanNoch keine Bewertungen

- Chapter 6-Cost TheoryDokument28 SeitenChapter 6-Cost TheoryFuad HasanNoch keine Bewertungen

- Mineral Water Enterprises - SpainDokument23 SeitenMineral Water Enterprises - SpainGill Wallace HopeNoch keine Bewertungen

- Interest. 22.03.18Dokument7 SeitenInterest. 22.03.18Tushar Mahmud SizanNoch keine Bewertungen

- URC 2011 Annual Report HighlightsDokument146 SeitenURC 2011 Annual Report HighlightsMelan YapNoch keine Bewertungen