Beruflich Dokumente

Kultur Dokumente

Accounting Standards

Hochgeladen von

mohanraokp2279Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting Standards

Hochgeladen von

mohanraokp2279Copyright:

Verfügbare Formate

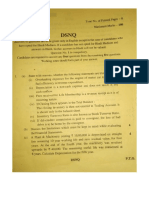

ACCOUNTING STANDARDS

Accounting Standards are the policy documents or written statements issued, from time to time, by an apex expert accounting body in relation to various aspects of measurement, treatment and disclosure of accounting transactions for ensuring uniformity in accounting practices and reporting. These standards are prepared by Accounting Standard Board (ASB). Objectives or Purposes of Accounting Standards: 1. The main purpose of accounting standards id to provide information to the users as to the basis on which the accounts have been prepared and the financial statements have been presented. 2. Another important objective of accounting standards is to serve the statutory purpose of eliminating the impact of diverse accounting policies and practices and to ensure uniformity in accounting policies & practices, ie, to harmonise the diverse accounting policies & practices which are in use the preparation & presentation of financial statements. 3. Another objective of accounting standards is to make the financial statements more meaningful and comparable and to make people place more reliance on financial statements prepared in conformity with the accounting standards. 4. Yet another objective of accounting standards is to guide the judgment of professional accountants in dealing with those items, which are to be followed consistently from year to year. LIST OF ACCOUNTING STANDARDS AS 1 Disclosure of Accounting Policies AS 2 Valuation of Inventories AS 3 Cash Flow Statement AS 4 Contingencies & Events occurring after Balance Sheet date AS 5 Net profit or Loss for the Period, Prior period items & changes in accounting policies AS 6 Depreciation Accounting AS 7 Accounting for Construction Contracts AS 8 Accounting for Research & Development AS 9 Revenue Recognition AS 10 Accounting for Fixed Assets AS11 Accounting for effects in changes in Foreign Exchange Rates AS 12 Accounting for Government Grants AS 13 Accounting for Investments AS 14 Accounting for Amalgamations AS 15 Accounting for Retirement benefits in the Financial Statements of employers AS 16 Borrowing Cost AS 17 Segment Reporting AS 18 Related Party Disclosure 1/2

AS 19 AS 20 AS 21 AS 22 AS 23 AS 24 AS 25 AS 26 AS 27

Leases Earnings Per Share Consolidated Financial Statements Accounting for taxes on income Accounting for Investments in Associates in consolidated financial statements Discontiuning Operations Interim Financial Reporting Intangible Assets Financial Reporting of Interests in Joint Ventures

2/2

Das könnte Ihnen auch gefallen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Capital Structure and LeverageDokument12 SeitenCapital Structure and Leveragemohanraokp2279Noch keine Bewertungen

- Income From Salaries: Solutions To Assignment ProblemsDokument8 SeitenIncome From Salaries: Solutions To Assignment Problemsvineetsharma04Noch keine Bewertungen

- Income From Salaries: Solutions To Assignment ProblemsDokument8 SeitenIncome From Salaries: Solutions To Assignment Problemsvineetsharma04Noch keine Bewertungen

- Capital Gains Notes PDFDokument6 SeitenCapital Gains Notes PDFmohanraokp2279Noch keine Bewertungen

- SUMMARY of PGBP Part of SUMMARY PDFDokument40 SeitenSUMMARY of PGBP Part of SUMMARY PDFmohanraokp2279Noch keine Bewertungen

- Chapter Twelve End of Chapter Useful Questions and SolutionsDokument2 SeitenChapter Twelve End of Chapter Useful Questions and Solutionsmohanraokp2279Noch keine Bewertungen

- Income From Salaries: Solutions To Assignment ProblemsDokument8 SeitenIncome From Salaries: Solutions To Assignment Problemsvineetsharma04Noch keine Bewertungen

- Chapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxDokument28 SeitenChapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxMeenal Luther100% (1)

- MCQ Module 1Dokument4 SeitenMCQ Module 1mohanraokp2279Noch keine Bewertungen

- Time ValueDokument9 SeitenTime Valuemohanraokp2279Noch keine Bewertungen

- Capital Structure and LeverageDokument12 SeitenCapital Structure and Leveragemohanraokp2279Noch keine Bewertungen

- CORPORATE TAX CALCULATORDokument11 SeitenCORPORATE TAX CALCULATORmohanraokp2279Noch keine Bewertungen

- Financial Management MCQ and ConceptsDokument8 SeitenFinancial Management MCQ and Conceptsmohanraokp2279Noch keine Bewertungen

- Customs Duty Study MaterialDokument2 SeitenCustoms Duty Study Materialmohanraokp2279Noch keine Bewertungen

- Ia04E01 - International Accounting - Elective Course Semester IV Credit - 3 - 1Dokument11 SeitenIa04E01 - International Accounting - Elective Course Semester IV Credit - 3 - 1mohanraokp2279Noch keine Bewertungen

- FM PaperDokument3 SeitenFM Papermohanraokp2279Noch keine Bewertungen

- Mcqs GST ExecprogDokument10 SeitenMcqs GST Execprogsekhag9hNoch keine Bewertungen

- Accountancy SQP PDFDokument21 SeitenAccountancy SQP PDFSuyash YaduNoch keine Bewertungen

- FM PaperDokument3 SeitenFM Papermohanraokp2279Noch keine Bewertungen

- CostDokument8 SeitenCostmohanraokp2279Noch keine Bewertungen

- GST Module 1Dokument7 SeitenGST Module 1mohanraokp2279Noch keine Bewertungen

- Financial ManagementDokument22 SeitenFinancial ManagementSenthil KumarNoch keine Bewertungen

- Capital Budgeting Case StudyDokument2 SeitenCapital Budgeting Case Studymohanraokp2279Noch keine Bewertungen

- Internal Assessment – Portfolio ManagementDokument13 SeitenInternal Assessment – Portfolio Managementmohanraokp2279Noch keine Bewertungen

- Companies Act 2013 Key Highlights and Analysis in MalaysiaDokument52 SeitenCompanies Act 2013 Key Highlights and Analysis in MalaysiatruthosisNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Economics Test Paper II PucDokument11 SeitenEconomics Test Paper II Pucmohanraokp2279Noch keine Bewertungen

- Exchange Ratio - Problems N Solutions PDFDokument26 SeitenExchange Ratio - Problems N Solutions PDFManjunath RameshNoch keine Bewertungen

- Cbcs Economics SyllabusDokument1 SeiteCbcs Economics Syllabusmohanraokp2279Noch keine Bewertungen

- CA Foundation - Accounts Nov 2018Dokument8 SeitenCA Foundation - Accounts Nov 2018mohanraokp2279Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- MARY LOU GETURBOS TORRES - Versus - CORAZON ALMA G. DE LEON G.R. No. 199440Dokument2 SeitenMARY LOU GETURBOS TORRES - Versus - CORAZON ALMA G. DE LEON G.R. No. 199440LawiswisNoch keine Bewertungen

- The Paquete Habana - 175 U.S. 677, 20 S. Ct. 290 (1900)Dokument2 SeitenThe Paquete Habana - 175 U.S. 677, 20 S. Ct. 290 (1900)Alelojo, NikkoNoch keine Bewertungen

- Lesson 4: Origins of The Interstate SystemDokument16 SeitenLesson 4: Origins of The Interstate SystemGillianne Pearl AlianNoch keine Bewertungen

- Ndubuisi, Modester Unoma23 PDFDokument63 SeitenNdubuisi, Modester Unoma23 PDFAnonymous ZuHvnImNoch keine Bewertungen

- 3RD Respondent Supplementary Written SubmissionsDokument16 Seiten3RD Respondent Supplementary Written SubmissionspeeNoch keine Bewertungen

- Foreign Trade Law: The Agreement On Trade-Related Investment Measures (Trims)Dokument15 SeitenForeign Trade Law: The Agreement On Trade-Related Investment Measures (Trims)TanuNoch keine Bewertungen

- ESAMI 2019 Calendar PDFDokument16 SeitenESAMI 2019 Calendar PDFEdward AmanyireNoch keine Bewertungen

- From Aspiration To Reality: Unpacking The Africa Mining VisionDokument40 SeitenFrom Aspiration To Reality: Unpacking The Africa Mining VisionOxfamNoch keine Bewertungen

- Cyber Security Risk Assessment Report Reflective PracticeDokument4 SeitenCyber Security Risk Assessment Report Reflective Practiceapi-672832076Noch keine Bewertungen

- PLANNING FUNCTION OF MANAGEMENT To The MAPPM 9TH MARCH 2020Dokument36 SeitenPLANNING FUNCTION OF MANAGEMENT To The MAPPM 9TH MARCH 2020Hassan Mohamed EgehNoch keine Bewertungen

- Chapter 10 Understanding Labour Relations and Collective Bargaining PDFDokument24 SeitenChapter 10 Understanding Labour Relations and Collective Bargaining PDFSung-il LeeNoch keine Bewertungen

- First Amendment StatementDokument2 SeitenFirst Amendment StatementTialena EvansNoch keine Bewertungen

- Ch03.Ppt-Event As A StrategyDokument26 SeitenCh03.Ppt-Event As A StrategyAnkita T. Moore100% (1)

- The 1987 Constitution - SummaryDokument11 SeitenThe 1987 Constitution - SummaryJaimy SchoolNoch keine Bewertungen

- Executive Branch and Local GovernmentDokument3 SeitenExecutive Branch and Local GovernmentSichayra GamotiaNoch keine Bewertungen

- Contemporary World-Final Exam: Topic: Global DemographyDokument12 SeitenContemporary World-Final Exam: Topic: Global DemographyDanica VetuzNoch keine Bewertungen

- The State LegislatureDokument8 SeitenThe State LegislatureGurpreet SinghNoch keine Bewertungen

- Parag Khanna - Technocracy in America - Rise of The Info-State (2017, CreateSpace) PDFDokument109 SeitenParag Khanna - Technocracy in America - Rise of The Info-State (2017, CreateSpace) PDFAleja PardoNoch keine Bewertungen

- Teaching PowerPoint Slides - Chapter 13Dokument20 SeitenTeaching PowerPoint Slides - Chapter 13Seo ChangBinNoch keine Bewertungen

- Administrative DecentralizationDokument20 SeitenAdministrative DecentralizationInzamamul HaqueNoch keine Bewertungen

- Foreign Tax Form W-8BEN GuideDokument1 SeiteForeign Tax Form W-8BEN Guidehector100% (1)

- Arrow Conflict Minerals Policy 052017Dokument2 SeitenArrow Conflict Minerals Policy 052017shilpaNoch keine Bewertungen

- Chapter 6 English Other LanguagesDokument62 SeitenChapter 6 English Other LanguagesMohd HaniNoch keine Bewertungen

- Do Electric Vehicles Need Subsidies - A Comparison of Ownership Costs For Conventional, Hybrid, and Electric VehiclesDokument40 SeitenDo Electric Vehicles Need Subsidies - A Comparison of Ownership Costs For Conventional, Hybrid, and Electric VehiclesNikos KasimatisNoch keine Bewertungen

- Rights of the Child ExplainedDokument3 SeitenRights of the Child ExplainedSherelyn Flores VillanuevaNoch keine Bewertungen

- Client Risk Policy and Procedures Apr 2012Dokument27 SeitenClient Risk Policy and Procedures Apr 2012RevolutiaNoch keine Bewertungen

- BSc3 Politology enDokument8 SeitenBSc3 Politology enJessareth Atilano CapacioNoch keine Bewertungen

- Creating CompetitivenessDokument232 SeitenCreating CompetitivenessRahul NadkarniNoch keine Bewertungen

- 2019 SGLG IndicatorsDokument73 Seiten2019 SGLG IndicatorsCarlito F. Faina, Jr.Noch keine Bewertungen

- International Environments and Business Operations Part 4Dokument4 SeitenInternational Environments and Business Operations Part 4joshua lopezNoch keine Bewertungen