Beruflich Dokumente

Kultur Dokumente

Rabat V Philippine National Bank

Hochgeladen von

Perry RubioOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Rabat V Philippine National Bank

Hochgeladen von

Perry RubioCopyright:

Verfügbare Formate

Rabat v. Philippine National Bank G.R. No. 158755. June 18, 2012. First Division; Bersamin, J.

Facts: In 1980, the spouses Francisco and Merced Rabat (spouses Rabat) was granted a mediumterm loan by the Philippine National Bank (PNB) in the amount of P4M to mature three years from the date of implementation. Subsequently, the spouses Rabat signed a Credit Agreement and executed a Real Estate Mortgage over 12 parcels of land which stipulated that the loan would be subject to interest at the rate of 17% per annum, plus the appropriate service charge and penalty charge of 3% per annum on any amount remaining unpaid or not renewed when due. A few months later, the spouses Rabat executed another document denominated as Amendment to the Credit Agreement purposely to increase the interest rate from 17% to 21% per annum, inclusive of service charge and a penalty charge of 3% per annum to be imposed on any amount remaining unpaid or not renewed when due. They also executed another Real Estate Mortgage over 9 parcels of land as additional security for their medium-term loan of P4 M. The several availments of the loan accommodation on various dates by the spouses Rabat reached the aggregate amount of P3,517,380, as evidenced by several promissory notes. The spouses RABATs failed to pay their outstanding balance on due date. Thus, the PNB filed a petition for the extrajudicial foreclosure of the real estate mortgage executed by the spouses Rabat. After due notice and publication, the mortgaged parcels of land were sold at a public auction held on February 1987 and April 1987. The PNB was the lone and highest bidder with a bid of P3,874,800. As the proceeds of the public auction were not enough to satisfy the entire obligation of the spouses Rabat, the PNB sent demand letters. Upon failure of the spouses Rabat to comply with the demand to settle their remaining outstanding obligation which then stood at P14,745,398.25, including interest, penalties and other charges, PNB eventually filed a complaint for a sum of money before a Regional Trial Court. Issue: Whether or not PNB was entitled to recover any deficiency from the spouses Rabat? Held: Yes. It is settled that if the proceeds of the sale are insufficient to cover the debt in an extrajudicial foreclosure of the mortgage, the mortgagee is entitled to claim the deficiency from the debtor. For when the legislature intends to deny the right of a creditor to sue for any deficiency resulting from foreclosure of security given to guarantee an obligation it expressly provides as in the case of pledges and in chattel mortgages of a thing sold on installment basis. Act No. 3135, which governs the extrajudicial foreclosure of mortgages, while silent as to the mortgagees right to recover, does not, on the other hand, prohibit recovery of deficiency. Accordingly, it has been held that a deficiency claim arising from the extrajudicial foreclosure is allowed. There should be no question that PNB was legally entitled to recover the penalty charge of 3% per annum and attorneys fees equivalent to 10% of the total amount due. The documents relating to the loan and the real estate mortgage showed that the spouses Rabat had expressly conformed to such additional liabilities; hence, they could not now insist otherwise. To be sure, the law authorizes the contracting parties to make any stipulations in their covenants provided the stipulations are not contrary to law, morals, good customs, public order or public policy. Equally axiomatic are that a contract is the law between the contracting parties, and that they have the autonomy to include therein such stipulations, clauses, terms and conditions as they may want to include. Inasmuch as the spouses Rabat did not challenge the legitimacy and efficacy of the additional liabilities being charged by PNB, they could not now bar PNB from recovering the deficiency representing the additional pecuniary liabilities that the proceeds of the forced sales did not cover.

Das könnte Ihnen auch gefallen

- As 1926.1 - 2012 Swimming Pool SafetyDokument49 SeitenAs 1926.1 - 2012 Swimming Pool SafetyrteteNoch keine Bewertungen

- De Baretto V Villanueva Case DigestDokument2 SeitenDe Baretto V Villanueva Case DigestZirk TanNoch keine Bewertungen

- Case Study (DM)Dokument28 SeitenCase Study (DM)Jai - Ho100% (1)

- Digest - Beumer V AmoresDokument3 SeitenDigest - Beumer V AmoresPerry RubioNoch keine Bewertungen

- Morfe V MutucDokument1 SeiteMorfe V MutucPerry Rubio100% (2)

- C - Buenaventura v. Metropolitan Bank and Trust Co.Dokument2 SeitenC - Buenaventura v. Metropolitan Bank and Trust Co.kdcheng100% (1)

- Creature Loot PDF - GM BinderDokument97 SeitenCreature Loot PDF - GM BinderAlec0% (1)

- MWSS V DawayDokument2 SeitenMWSS V DawayPerry Rubio100% (1)

- MWSS V DawayDokument2 SeitenMWSS V DawayPerry Rubio100% (1)

- Mendoza V VillasDokument1 SeiteMendoza V VillasPerry RubioNoch keine Bewertungen

- Bank not liable for withdrawal due to lack of express trustDokument2 SeitenBank not liable for withdrawal due to lack of express trustPerry RubioNoch keine Bewertungen

- PTA V Metropolitan Bank and Trust CoDokument1 SeitePTA V Metropolitan Bank and Trust CoPerry RubioNoch keine Bewertungen

- 101 Sps. Agbada Vs Inter Urban Developers Inc. GR 144029 Sept. 19 2002 DIGESTfDokument1 Seite101 Sps. Agbada Vs Inter Urban Developers Inc. GR 144029 Sept. 19 2002 DIGESTfjune bayNoch keine Bewertungen

- PAMECA Wood Treatment Plant vs. Court of Appeals | Chattel Mortgage Deficiency ActionDokument1 SeitePAMECA Wood Treatment Plant vs. Court of Appeals | Chattel Mortgage Deficiency ActionRoxanne Avila0% (1)

- Organic Evolution (Evolutionary Biology) Revised Updated Ed by Veer Bala RastogiDokument1.212 SeitenOrganic Evolution (Evolutionary Biology) Revised Updated Ed by Veer Bala RastogiTATHAGATA OJHA83% (6)

- Philippine National Bank vs. Sayo, Jr. 292 SCRA 202 (1998)Dokument2 SeitenPhilippine National Bank vs. Sayo, Jr. 292 SCRA 202 (1998)angelicaNoch keine Bewertungen

- Digest - Locsin II V Mekeni Food CorporationDokument2 SeitenDigest - Locsin II V Mekeni Food CorporationPerry RubioNoch keine Bewertungen

- Pajuyo v. CA, G.R. No. 146364, June 3, 2004Dokument15 SeitenPajuyo v. CA, G.R. No. 146364, June 3, 2004Nadine BediaNoch keine Bewertungen

- ASTRO UserguideDokument1.054 SeitenASTRO UserguideMarwan Ahmed100% (1)

- Astm A182Dokument2 SeitenAstm A182fastenersworldNoch keine Bewertungen

- Allied Bank and Metrobank Liable for ForgeryDokument2 SeitenAllied Bank and Metrobank Liable for ForgeryRubyNoch keine Bewertungen

- Dys and Maxinos Complied with Redemption RulesDokument3 SeitenDys and Maxinos Complied with Redemption RulesNikki Estores GonzalesNoch keine Bewertungen

- Negotiable Instruments Law and Legal Tender in Cebu International Finance Corp. v. CADokument4 SeitenNegotiable Instruments Law and Legal Tender in Cebu International Finance Corp. v. CAMp CasNoch keine Bewertungen

- G.R. No. 170215Dokument2 SeitenG.R. No. 170215'Elainne EncilaNoch keine Bewertungen

- SOCO Vs MilitanteDokument1 SeiteSOCO Vs MilitanteanotenoteNoch keine Bewertungen

- Characteristics of contract guaranty and liability of guarantorsDokument33 SeitenCharacteristics of contract guaranty and liability of guarantorsConcepcion Mallari GarinNoch keine Bewertungen

- People V de VeraDokument2 SeitenPeople V de VeraPerry Rubio80% (10)

- Urot-Bitanga V Pyramid Construction EngineeringDokument3 SeitenUrot-Bitanga V Pyramid Construction EngineeringDave UrotNoch keine Bewertungen

- Osmena JalandoniDokument4 SeitenOsmena JalandoniGIGI KHONoch keine Bewertungen

- Digest - Baltazar V LaxaDokument3 SeitenDigest - Baltazar V LaxaPerry RubioNoch keine Bewertungen

- Allied, Metrobank Liable for Forged IndorsementDokument2 SeitenAllied, Metrobank Liable for Forged IndorsementAnakataNoch keine Bewertungen

- Mico Metals V CADokument2 SeitenMico Metals V CAPerry RubioNoch keine Bewertungen

- Estores V Spouses SupanganDokument3 SeitenEstores V Spouses SupanganZy AquilizanNoch keine Bewertungen

- Belo v. PNBDokument1 SeiteBelo v. PNBMikkoArdina0% (1)

- Habawel V Court of Tax AppealsDokument1 SeiteHabawel V Court of Tax AppealsPerry RubioNoch keine Bewertungen

- Mercado V EspinocillaDokument1 SeiteMercado V EspinocillaPerry RubioNoch keine Bewertungen

- China Banking vs. Sps. OrdinarioDokument2 SeitenChina Banking vs. Sps. OrdinarioJessa F. Austria-CalderonNoch keine Bewertungen

- Supreme Court rules no duress in mortgage contractsDokument2 SeitenSupreme Court rules no duress in mortgage contractsRhenz ToldingNoch keine Bewertungen

- Yuliongsiu Vs PNBDokument2 SeitenYuliongsiu Vs PNBMXKatNoch keine Bewertungen

- Commercial Lease Dispute Between Sub-Lessee and LessorDokument2 SeitenCommercial Lease Dispute Between Sub-Lessee and LessorEiren QuimsonNoch keine Bewertungen

- Digest - Vda de Cabalu V TabuDokument2 SeitenDigest - Vda de Cabalu V TabuPerry RubioNoch keine Bewertungen

- Metropolitan Bank & Trust Company Vs Asb Holdings, Inc. Case DigestDokument3 SeitenMetropolitan Bank & Trust Company Vs Asb Holdings, Inc. Case DigestNullus cumunisNoch keine Bewertungen

- Dejuras V VillaDokument1 SeiteDejuras V VillaPerry RubioNoch keine Bewertungen

- Dejuras V VillaDokument1 SeiteDejuras V VillaPerry RubioNoch keine Bewertungen

- Rural Bank of Sta Barbara Vs CentenoDokument1 SeiteRural Bank of Sta Barbara Vs CentenoBryan Jay Nuique100% (1)

- Ibaan Rural Bank Inc Vs CADokument4 SeitenIbaan Rural Bank Inc Vs CAGlutton ArchNoch keine Bewertungen

- Republic of The Phillipines V Rural Bank of KabacanDokument1 SeiteRepublic of The Phillipines V Rural Bank of KabacanPerry RubioNoch keine Bewertungen

- Digest - Pabalan V Heirs of MaamoDokument2 SeitenDigest - Pabalan V Heirs of MaamoPerry RubioNoch keine Bewertungen

- Digest of Sps Yap Vs Dy (2011)Dokument2 SeitenDigest of Sps Yap Vs Dy (2011)Racquel LevNoch keine Bewertungen

- Presumption That Writing Is Truly Dated Prevails In Workmen's Compensation CaseDokument7 SeitenPresumption That Writing Is Truly Dated Prevails In Workmen's Compensation CaseJay Mark Albis SantosNoch keine Bewertungen

- Sps. Biesterbos v. CA de LUNADokument1 SeiteSps. Biesterbos v. CA de LUNAJohn Henry ValenciaNoch keine Bewertungen

- RULE 6-Lafarge Vs CCCDokument3 SeitenRULE 6-Lafarge Vs CCCErika Al100% (3)

- FEATI Bank V CADokument2 SeitenFEATI Bank V CAPerry RubioNoch keine Bewertungen

- Sales Digested CasesDokument20 SeitenSales Digested CasesNa-eehs Noicpecnoc Namzug100% (1)

- G.R. No. 206343, February 22, 2017 - Land Bank of The Philippines, vs. Lorenzo Musni Et Al.Dokument2 SeitenG.R. No. 206343, February 22, 2017 - Land Bank of The Philippines, vs. Lorenzo Musni Et Al.Francis Coronel Jr.Noch keine Bewertungen

- People's Trans East v. Doctors of New MillenniumDokument3 SeitenPeople's Trans East v. Doctors of New MillenniumJayson RacalNoch keine Bewertungen

- Estores v. Spouses SupanganDokument1 SeiteEstores v. Spouses SupanganHazel Grace AbenesNoch keine Bewertungen

- Prudential Bank v. Martinez - DigestDokument3 SeitenPrudential Bank v. Martinez - DigestcinfloNoch keine Bewertungen

- BPI Family Savings Bank v. Avenido - Mortgage Deficiency Collection AllowedDokument1 SeiteBPI Family Savings Bank v. Avenido - Mortgage Deficiency Collection Alloweddexter lingbananNoch keine Bewertungen

- Del Rosario V Gerry Roxas FoundationDokument1 SeiteDel Rosario V Gerry Roxas FoundationPerry Rubio100% (1)

- Investors Finance Corporation vs. Autoworld Sales CorporationDokument3 SeitenInvestors Finance Corporation vs. Autoworld Sales CorporationMike E DmNoch keine Bewertungen

- PNB Recovers Deficiency from Rabats Despite Foreclosure SaleDokument22 SeitenPNB Recovers Deficiency from Rabats Despite Foreclosure Salenaomi_mateo_4Noch keine Bewertungen

- Ang Vs Court of Appeals G.R. No. 177874 September 29, 2008Dokument5 SeitenAng Vs Court of Appeals G.R. No. 177874 September 29, 2008KidMonkey2299Noch keine Bewertungen

- SEC v Mendoza JurisdictionDokument1 SeiteSEC v Mendoza JurisdictionPerry RubioNoch keine Bewertungen

- MONTECALVO HEIRS PRIMERODokument3 SeitenMONTECALVO HEIRS PRIMEROfafa_mhedzNoch keine Bewertungen

- Santos Vs SibugDokument2 SeitenSantos Vs SibugMaricar Corina CanayaNoch keine Bewertungen

- 13.G.R. No. L-24772 May 27, 1968Dokument2 Seiten13.G.R. No. L-24772 May 27, 1968Nanz JermaeNoch keine Bewertungen

- Case 93 So Vs FoodFest DigestDokument2 SeitenCase 93 So Vs FoodFest DigestMarichu Castillo Hernandez75% (4)

- Court Upholds Guarantor Liability in Loan Collection CaseDokument2 SeitenCourt Upholds Guarantor Liability in Loan Collection Casejust wafflesNoch keine Bewertungen

- Land Lease Dispute Over Fishpond RulingDokument2 SeitenLand Lease Dispute Over Fishpond RulingVirgil Kit Augustin AbanillaNoch keine Bewertungen

- Mahinay V Duratire. DigestDokument3 SeitenMahinay V Duratire. DigestRaff GonzalesNoch keine Bewertungen

- Generoso Alano vs. EccDokument1 SeiteGeneroso Alano vs. EccKIERSTINE MARIE BARCELONoch keine Bewertungen

- Belo VS PNBDokument6 SeitenBelo VS PNBRap PatajoNoch keine Bewertungen

- Case Digest GR 117660Dokument2 SeitenCase Digest GR 117660Zarina PemblingNoch keine Bewertungen

- Boy v. Court of AppealsDokument1 SeiteBoy v. Court of AppealsHoward ChanNoch keine Bewertungen

- SPS Litonjua vs L&R Corp Right of First RefusalDokument2 SeitenSPS Litonjua vs L&R Corp Right of First RefusalVanya Klarika NuqueNoch keine Bewertungen

- 2 UnionDokument3 Seiten2 UnionvivivioletteNoch keine Bewertungen

- Injunction Cases - Full DescriptionDokument71 SeitenInjunction Cases - Full DescriptionJane Cuizon0% (1)

- Novation Extinguishes Judgment LiabilityDokument1 SeiteNovation Extinguishes Judgment LiabilityAC De Vera100% (2)

- BPI Employees Union vs. BPI G.R. No. 137863 March 31, 2005 FactsDokument3 SeitenBPI Employees Union vs. BPI G.R. No. 137863 March 31, 2005 FactsRey Almon Tolentino AlibuyogNoch keine Bewertungen

- Alyansa para Sa Bagong Pilipinas V. Energy Regulatory Commission GR No. 227670, May 03, 2019Dokument22 SeitenAlyansa para Sa Bagong Pilipinas V. Energy Regulatory Commission GR No. 227670, May 03, 2019knicky FranciscoNoch keine Bewertungen

- Liability of guarantor for loans obtained by principal (35 charactersDokument29 SeitenLiability of guarantor for loans obtained by principal (35 charactersKristineSherikaChyNoch keine Bewertungen

- Golangco SyllabusDokument3 SeitenGolangco SyllabusMaria Cresielda EcalneaNoch keine Bewertungen

- Land Titles and Deeds GuideDokument3 SeitenLand Titles and Deeds GuideReah CrezzNoch keine Bewertungen

- Case #3 BPI V SPS ROYECADokument2 SeitenCase #3 BPI V SPS ROYECApistekayawaNoch keine Bewertungen

- National Union of Workers in Hotel Restaurant v. Philippine Plaza HoldingsDokument19 SeitenNational Union of Workers in Hotel Restaurant v. Philippine Plaza HoldingsChatNoch keine Bewertungen

- Real Estate Mortgage DisputeDokument3 SeitenReal Estate Mortgage DisputeMae SampangNoch keine Bewertungen

- Digest - Spouses Soller V Heirs of UlayaoDokument2 SeitenDigest - Spouses Soller V Heirs of UlayaoPerry RubioNoch keine Bewertungen

- Digest - Spouses Soller V Heirs of UlayaoDokument2 SeitenDigest - Spouses Soller V Heirs of UlayaoPerry RubioNoch keine Bewertungen

- Team Pacific Corporation V DazaDokument1 SeiteTeam Pacific Corporation V DazaPerry RubioNoch keine Bewertungen

- Team Pacific Corporation V DazaDokument1 SeiteTeam Pacific Corporation V DazaPerry RubioNoch keine Bewertungen

- Andal v. Sandiganbayan Ruling on Self-Defense ClaimDokument2 SeitenAndal v. Sandiganbayan Ruling on Self-Defense ClaimPerry RubioNoch keine Bewertungen

- IPIECA - IOGP - The Global Distribution and Assessment of Major Oil Spill Response ResourcesDokument40 SeitenIPIECA - IOGP - The Global Distribution and Assessment of Major Oil Spill Response ResourcesОлегNoch keine Bewertungen

- Ipaspro Co PPP ManualDokument78 SeitenIpaspro Co PPP ManualCarlos Alberto Mucching MendozaNoch keine Bewertungen

- Viviana Rodriguez: Education The University of Texas at El Paso (UTEP)Dokument1 SeiteViviana Rodriguez: Education The University of Texas at El Paso (UTEP)api-340240168Noch keine Bewertungen

- LEONI Dacar® 110 enDokument1 SeiteLEONI Dacar® 110 engshock65Noch keine Bewertungen

- Blackmagic RAW Speed TestDokument67 SeitenBlackmagic RAW Speed TestLeonardo Terra CravoNoch keine Bewertungen

- Mod. 34 Classic Compact T06Dokument4 SeitenMod. 34 Classic Compact T06Jaime Li AliNoch keine Bewertungen

- Alice in ChainsDokument18 SeitenAlice in ChainsmexicolaNoch keine Bewertungen

- Pantone and K100 Reverse White MedicineDokument16 SeitenPantone and K100 Reverse White MedicinepaanarNoch keine Bewertungen

- M Audio bx10s Manuel Utilisateur en 27417Dokument8 SeitenM Audio bx10s Manuel Utilisateur en 27417TokioNoch keine Bewertungen

- Canberra As A Planned CityDokument12 SeitenCanberra As A Planned Citybrumbies15100% (1)

- Doohap supplier and customer segmentationDokument2 SeitenDoohap supplier and customer segmentationPriyah RathakrishnahNoch keine Bewertungen

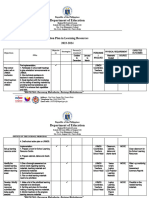

- aCTION PLAN IN HEALTHDokument13 SeitenaCTION PLAN IN HEALTHCATHERINE FAJARDONoch keine Bewertungen

- Nistha Tamrakar Chicago Newa VIIDokument2 SeitenNistha Tamrakar Chicago Newa VIIKeshar Man Tamrakar (केशरमान ताम्राकार )Noch keine Bewertungen

- UEME 1143 - Dynamics: AssignmentDokument4 SeitenUEME 1143 - Dynamics: Assignmentshikai towNoch keine Bewertungen

- Chapter 5Dokument11 SeitenChapter 5XDXDXDNoch keine Bewertungen

- EMB 690-1 SM Course Outline Spring 21Dokument8 SeitenEMB 690-1 SM Course Outline Spring 21HasanNoch keine Bewertungen

- Subtracting-Fractions-Unlike DenominatorsDokument2 SeitenSubtracting-Fractions-Unlike Denominatorsapi-3953531900% (1)

- Chiller Carrier - 30gn-9siDokument28 SeitenChiller Carrier - 30gn-9siZJ Limited (ZJLimited)Noch keine Bewertungen

- All Paramedical CoursesDokument23 SeitenAll Paramedical CoursesdeepikaNoch keine Bewertungen

- DISADVANTAGESDokument3 SeitenDISADVANTAGESMhd MiranNoch keine Bewertungen

- Phenolic Compounds in Rice May Reduce Health RisksDokument7 SeitenPhenolic Compounds in Rice May Reduce Health RisksMuhammad Usman AkramNoch keine Bewertungen

- Building MassingDokument6 SeitenBuilding MassingJohn AmirNoch keine Bewertungen

- Communication Networks Chapter 1 SolutionsDokument10 SeitenCommunication Networks Chapter 1 SolutionsJ PrakashNoch keine Bewertungen

- Writing Lesson Plan LMDokument6 SeitenWriting Lesson Plan LMapi-457032696Noch keine Bewertungen