Beruflich Dokumente

Kultur Dokumente

Jaya Jeevan Suraksha

Hochgeladen von

Hiren ShahOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Jaya Jeevan Suraksha

Hochgeladen von

Hiren ShahCopyright:

Verfügbare Formate

SHAH INSURANCE CONSULTANCY

Insurance & Investment Consultants

A/603, Gokul Bldg, VrajBhoomi Complex, 120 Ft New Link Road, Kandivali ( W) Mumbai-67 E-mail : hir1979@gmail.com Hiren : 9820475201, Umed : 9819404377

New Jeevan Suraksha - 1

. . . . for a joyful retired life !

Date : 26/11/2011 Illustration specially customized for Mrs. Jaya Modi aged 41 Years. Planning for retirement is as essential as planning for your current needs to ensure a happy retired life. New Jeevan Suraksha 1 is a deferred annuity (pension) plan from L.I.C. of India. Under this plan you can invest your savings today and for number of years to get pension on retirement. It is particularly suitable for young professionals, businessmen and salaried people whose retirement is not supported by any government pension schemes. This plan provides a lot of flexibility in terms of various pension options for you to choose from. Additionally you can also opt for an insurance cover during the deferment period by taking the Term Rider add on. At the end of the deferment period when the premiums ceases, this policy can, at your option, pay you a lumpsum amount and a suitable pension for your lifetime. You will also benefit from a saving upto Rs. 10000 per annum from the tax burden, during the premium paying period, under Sec. 80ccc(i) of Income Tax Act.

General Terms of this Plan

Age at Entry qualification Deferment Period range Earliest Annuity Starting Age Term Insurance Rider Annuity Options Available

18 to 65 years (completed) 2 to 35 years 50 years (completed) Available for 10 to 35 years - Annuity for Life - Annuity for Life with guaranteed period of 5, 10, 15, 20 years - Joint Life / Last Survivor Annuity - Life Annuity with return of Purchase Price - Life Annuity with annuities increasing @ 3 % p.a.

SHAH INSURANCE CONSULTANCY

Insurance & Investment Consultants

A/603, Gokul Bldg, VrajBhoomi Complex, 120 Ft New Link Road, Kandivali ( W) Mumbai-67 E-mail : hir1979@gmail.com Hiren : 9820475201, Umed : 9819404377

A New Jeevan Suraksha - 1 Proposal for yourself

Annuity to Start at Age Proposed Notional Cash Option Estimated Bonus Accumulation * Premium Payable For Basic Premium

: 56.00 : 1760139.00 : 897671.00 : 15 Years : 100000.00

Total Premium

Annuity will be paid Estimated Target NCO Estimated Final Addition Bonus* Premium Payable Rider Premium

: Yearly

: 2904229.00 : 246419.00 : Yearly : 0.00

: 100000.00

Risk Cover upto Age 56

Death during : Rate of interest for accumulation of premiums: 3 % compounded yearly 4 % compounded yearly 5 % compounded yearly

the first 10 policy years 11 - 19 policy years 20 policy years and above

Benefits from Age 56 onwards **

Lumpsum Cash at Age 56 Annuity F-For life with return of purchase price on death Free Whole Life Risk Cover Rs.726057 Rs.167517 Rs.2178172 OR Annuity F-For life with return of purchase price on death Free Whole Life Risk Cover Rs.223356 Rs.2904229

* Not Guaranteed. Based on assumed bonus rate of Rs. 34.00 per 1000 NCO per deferment year and final bonus rate of Rs. 140.00 per 1000 NCO ** Not Guaranteed. Calculated @ current Annuity purchase price prevelant under Jeevan Akshay - VI plan 189 of L.I.C. In case of an unfortunate death during the deferment period, nominee will be eligible for term rider sum in addition to risk cover as per the rate of interest for accumulation of premiums mentioned above.

The above statement is based on certain assumptions which are liable to change according to Government/Corporation's policies.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Valve Material SpecificationDokument397 SeitenValve Material Specificationkaruna34680% (5)

- Electrical Data: PD2310 ApplicationsDokument1 SeiteElectrical Data: PD2310 ApplicationsKSNoch keine Bewertungen

- EXP 2 - Plug Flow Tubular ReactorDokument18 SeitenEXP 2 - Plug Flow Tubular ReactorOng Jia YeeNoch keine Bewertungen

- Conference Version of SB 1Dokument486 SeitenConference Version of SB 1Paul MastersNoch keine Bewertungen

- Recruitement Process - Siemens - Sneha Waman Kadam S200030047 PDFDokument7 SeitenRecruitement Process - Siemens - Sneha Waman Kadam S200030047 PDFSneha KadamNoch keine Bewertungen

- Model Probabilistik: "Variable Demand and Variable Lead Time" & Konsep Service LevelDokument30 SeitenModel Probabilistik: "Variable Demand and Variable Lead Time" & Konsep Service LevelVladimir Hery WijannarkoNoch keine Bewertungen

- 6 Kuliah Liver CirrhosisDokument55 Seiten6 Kuliah Liver CirrhosisAnonymous vUEDx8100% (1)

- WWW Spectrosci Com Product Infracal Model CVH PrinterFriendlDokument3 SeitenWWW Spectrosci Com Product Infracal Model CVH PrinterFriendlather1985Noch keine Bewertungen

- TC 10 emDokument7 SeitenTC 10 emDina LydaNoch keine Bewertungen

- Goals in LifeDokument4 SeitenGoals in LifeNessa Layos MorilloNoch keine Bewertungen

- Not Really A StoryDokument209 SeitenNot Really A StorySwapnaNoch keine Bewertungen

- Plica PDFDokument7 SeitenPlica PDFIVAN VERGARANoch keine Bewertungen

- 17-003 MK Media Kit 17Dokument36 Seiten17-003 MK Media Kit 17Jean SandiNoch keine Bewertungen

- D6228 - 10Dokument8 SeitenD6228 - 10POSSDNoch keine Bewertungen

- Pengaruh Kualitas Anc Dan Riwayat Morbiditas Maternal Terhadap Morbiditas Maternal Di Kabupaten SidoarjoDokument9 SeitenPengaruh Kualitas Anc Dan Riwayat Morbiditas Maternal Terhadap Morbiditas Maternal Di Kabupaten Sidoarjohikmah899Noch keine Bewertungen

- Solar Refrigeration: Prepared by M.DevakumarDokument21 SeitenSolar Refrigeration: Prepared by M.DevakumarEasy StudyNoch keine Bewertungen

- Report On Analysis of TSF Water Samples Using Cyanide PhotometerDokument4 SeitenReport On Analysis of TSF Water Samples Using Cyanide PhotometerEleazar DequiñaNoch keine Bewertungen

- Method StatementDokument29 SeitenMethod StatementZakwan Hisyam100% (1)

- Mushrooms and Religion: Amanita MuscariaDokument8 SeitenMushrooms and Religion: Amanita MuscariaGummyCola50% (2)

- Soil Biotechnology (SBT) - Brochure of Life LinkDokument2 SeitenSoil Biotechnology (SBT) - Brochure of Life Linkiyer_lakshmananNoch keine Bewertungen

- Comprehensive Safe Hospital FrameworkDokument12 SeitenComprehensive Safe Hospital FrameworkEbby OktaviaNoch keine Bewertungen

- Pe 3 Syllabus - GymnasticsDokument7 SeitenPe 3 Syllabus - GymnasticsLOUISE DOROTHY PARAISO100% (1)

- Bedwetting TCMDokument5 SeitenBedwetting TCMRichonyouNoch keine Bewertungen

- How To Do Banana Milk - Google Search PDFDokument1 SeiteHow To Do Banana Milk - Google Search PDFyeetyourassouttamawayNoch keine Bewertungen

- Reaction Paper-RprDokument6 SeitenReaction Paper-Rprapi-543457981Noch keine Bewertungen

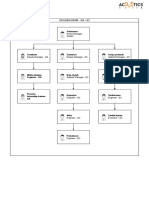

- Organogram - Qa / QC: Srinivasan SrinivasanDokument4 SeitenOrganogram - Qa / QC: Srinivasan SrinivasanGowtham VenkatNoch keine Bewertungen

- NG Teng Fong Discharge DocumentsDokument14 SeitenNG Teng Fong Discharge DocumentsAnonymous yGwMIPJRawNoch keine Bewertungen

- Fast FashionDokument9 SeitenFast FashionTeresa GonzalezNoch keine Bewertungen

- High Speed DoorsDokument64 SeitenHigh Speed DoorsVadimMedooffNoch keine Bewertungen

- Notes Marriage and Family in Canon LawDokument5 SeitenNotes Marriage and Family in Canon LawmacNoch keine Bewertungen