Beruflich Dokumente

Kultur Dokumente

Case 01 Complete

Hochgeladen von

ertizashuvoOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Case 01 Complete

Hochgeladen von

ertizashuvoCopyright:

Verfügbare Formate

CASE ANALYSIS-01

On

Comprehensive/Spreadsheet Problem

Submitted To:

Faculty: Riyashad Ahmed (RyA)

Submitted By: Protiva Prova Das Ertiza Akando Shuvo Salma Jebin Md. Nawaz Sharif Tanvir Tanvir Ahmed Oni 1030224030 1030232030 1110122030 1110411030 1110412030

Course: Corporate Finance (FIN 440) Section: 02 Spring 2013

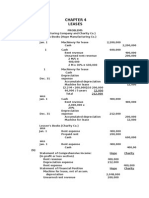

Bartman Industries and Reynolds Inc.s stock prices and dividends, along with the Winslow 5000 Index, are shown here for the period 2003-2011. The Winslow 5000 data are adjusted to include dividends. BARTMAN INDUSTRIES Year Stock Price Dividend REYNOLD INCORPORATED Stock Price Dividend MARKET INDEX Includes Dividends 2011 2010 2009 2008 2007 2006 $ 24.250 20.750 23.500 16.750 18.375 12.625 $ 2.250 2.100 2.000 1.950 1.860 1.800 $ 62.750 68.300 62.750 70.000 72.500 65.750 $ 4.000 3.950 3.850 3.650 3.400 3.000 $ 12,553.98 9,585.70 9,179.98 7,434.03 6,702.28 5,405.97

a.Use

the data given to calculate annual returns for Bartman, Reynolds,

and Market Index, and then calculate average returns over the five-year period. Answer: Annual Rates of Return =

Annual and average Returns of BARTMAN INDUSTRIES Year 2011 2010 2009 2008 2007 Average of Return Rate Calculation and Result = 27.71% = -2.77% = 52.24% = 1.77% = 60.28% = 27.85%

Annual and average Returns of REYNOLDS INCORPORATED Year 2011 2010 2009 2008 2007 Average of Return Rate Calculation and Result = -2.27% = 15.14% = -4.86% = 1.59% = 15.44% = 5.01%

Annual and average Returns of Market Index Year 2011 2010 2009 2008 2007 Average of Return Rate Calculation and Result = 30.97% = 4.42% = 23.49% = 10.92% = 23.98% = 18.76%

b. Calculate the standard deviations of the returns for Bartman, Reynolds, and the Winslow 5000. Answer: Standard Deviation =

Bartman Industries = 28.57% Reynolds Incorporated = 9.66% Market Index =10.79%

c.

Now calculate the coefficients of variation for Bartman, Reynolds, and

the Market Index . Answer:

Coefficient of Variation (CV) =

Bartman Industries, CV =

= 1.03

Reynolds Incorporated, CV =

= 1.93

Market Index, CV =

= 0.58

d) Construct a scatter diagram that shows Bartmans and Reynoldss return on the vertical axis and the market indexes returns on the horizontal axis. Answer:

BARTMAN & WINSLOW 5000 INDEX RETURN

70 60 50 BARTMAN 40 30 20 10 0 -10 0 10 20 WINSLOW 5000 30 40

y = 1.989x - 9.46 R = 0.5645

BARTMAN & WINSLOW 5000 INDEX RETURN Linear (BARTMAN & WINSLOW 5000 INDEX RETURN)

REYNOLDS & WINSLOW 5000 INDEX RETURN

20 15 10 BARTMAN 5 0 0 -5 -10 10 20 30 40 REYNOLDS & WINSLOW 5000 INDEX RETURN Linear (REYNOLDS & WINSLOW 5000 INDEX RETURN)

y = -0.4285x + 13.044 R = 0.2289

Winslow 5000

e) Estimate Bartmans and Reynolds betas by running regressions of their returns against the Market Indexs returns. Are these betas consistent with your graph? Answer: Bartmans Regression analysis:

SUMMARY OUTPUT Regression Statistics Multiple R 0.751352 R Square 0.56453 Adjusted R Square 0.419373 Standard Error 21.76791 Observations 5 ANOVA df 1 3 4 SS 1842.821 1421.526 3264.347 Standard Error MS 1842.821 473.842 F 3.889105 Significance F 0.143156

Regression Residual Total

Coefficients

t Stat

P-value

Lower 95%

Upper 95%

Lower 95.0%

Upper 95.0%

Intercept X Variable 1

-9.46003 1.989019

21.27497 1.008588

-0.44466 1.972081

0.686692 0.143156

-77.1665 58.24643 -1.22076 5.198797

77.1665 58.24643 1.22076 5.198797

RESIDUAL OUTPUT Observation Predicted Y 1 52.13987 2 -0.66857 3 37.26201 4 12.26005 5 38.23663 Residuals -24.4299 -2.10143 14.97799 -10.4901 22.04337

X Variable 1 Line Fit Plot

70 60 50 40 30 20 10 0 -10 0 5 10 15 20 25 30 35 X Variable 1 Y

y = 1.989x - 9.46 R = 0.5645

Y Predicted Y Linear (Y)

Beta for Bartman industries = 1.989

Reynolds regression analysis:

SUMMARY OUTPUT Regression Statistics Multiple R 0.478479 R Square 0.228942 Adjusted R Square -0.02808 Standard Error 9.797969

Observations 5 ANOVA df 1 3 4 SS 85.51291 288.0006 373.5135 Standard Error 9.576092 0.453976 Significance MS F F 85.51291 0.890758 0.4149 96.00019

Regression Residual Total

Coefficients Intercept X Variable 1 13.04425 -0.42846

t Stat

P-value

1.362168 0.266401 -0.9438 0.4149

Lower Upper Lower 95% 95.0% 95.0% -17.4312 43.51965 17.4312 43.51965 -1.87322 1.016293 1.87322 1.016293

Upper 95%

RESIDUAL OUTPUT Standard Observation Predicted Y Residuals Residuals 1 -0.22524 -2.04476 -0.24098 2 11.15044 3.989558 0.470173 3 2.979657 -7.83966 -0.92391 4 8.365434 -6.77543 -0.79849 5 2.769711 12.67029 1.493206

X Variable 1 Line Fit Plot

20 15 10 Y 5 0 0 -5 -10 X Variable 1 5 10 15 20 25 30 35 Y Predicted Y Linear (Y)

Beta for Reynolds Inc.s = -0.428.

Beta for Bartman industry and Beta for Reynolds Inc.s are consistent with the graph.

f) The risk-free return on long-term Treasury bond is 6.04%. Assume that the market risk premium is 5%.What is the expected return on the market? Now use the SML equation to calculate the two companies recquired return. Answer: Here, Risk free return is 6.04% Market risk premium is 5% So, expected return on the market = Market risk premium + Risk free return = (5+6.04) % =11.04% Required return of BARTMAN INDUSTRIES: Required return= risk free return+ (market return risk free return) * Beta = 6.04+ (11.04 6.04)* 1.989 = 6.04 + 9.945 = 15.99%

Required return of REYNOLDS INC.: Required return= risk free return+ (market return risk free return) * Beta = 6.04+ (11.04 6.04)* -0.43 = 6.04 2.15 = 3.89%

g) If you formed a portfolio that consisted of 50% Bartman and 50% Reynolds, what would be its beta and its required return? Answer: Calculating portfolios Beta: Company Bartman industries (50%) 1.99 Reynolds inc. (50%) -0.43

Beta Formula of portfolio Beta =

= (.50 * 1.99) + (.50* - 0.43) = 0.995 + (-0.215) = 0.78

Portfolio required rate of return: Portfolio required return = Risk free return+ (market return risk free return) * Portfolio Beta = 6.04 + (11.04 6.04) * 0.78 = 9.94%

h) Suppose an investor wants to includes Bartman Industries stock in his or her portfolio. Stocks A, B, C are currently in the portfolio; and their betas

are 0.769, 0.985, and 1.423 respectively. Calculate the new portfolios required return if it consists of 25% of Bartman, 15% of stock A, 40% of Stock B, and 20% of Stock C.

Answer: Stock Bartman A B C Now, New portfolio Beta = * 25% 15% 40% 20% 1.989 0.769 0.985 1.423

= (.25*1.989) + (.15*0.769) + (.40*0.985) + (.20*1.423) = 1.29%

Portfolio required return = Risk free return+ (market return risk free return) * Portfolio Beta = 6.04 + (11.04 6.04) * 1.29 =12.49%

Das könnte Ihnen auch gefallen

- Additional topics in variance analysisDokument33 SeitenAdditional topics in variance analysisAnthony MaloneNoch keine Bewertungen

- 1-3-Ulo D ExerciseDokument5 Seiten1-3-Ulo D ExerciseJames Darwin TehNoch keine Bewertungen

- Pricing Decision and Cost MGMNT QuizDokument2 SeitenPricing Decision and Cost MGMNT QuizEwelina ChabowskaNoch keine Bewertungen

- FIN 4610 HW 3Dokument19 SeitenFIN 4610 HW 3Michelle Lam50% (2)

- COST OF CAPITAL PROBLEMS AND SOLUTIONSDokument12 SeitenCOST OF CAPITAL PROBLEMS AND SOLUTIONSAlvin AgullanaNoch keine Bewertungen

- Assignment Chapter 9Dokument4 SeitenAssignment Chapter 9Anis Trisna PutriNoch keine Bewertungen

- Calculate Basic and Diluted EPSDokument12 SeitenCalculate Basic and Diluted EPSJoey WassigNoch keine Bewertungen

- CHAPTER 9 Without AnswerDokument6 SeitenCHAPTER 9 Without AnswerlenakaNoch keine Bewertungen

- (Solved) Chapter 14, Problem 14-9 - Fundamentals of Financial Management (15th Edition) - ADokument2 Seiten(Solved) Chapter 14, Problem 14-9 - Fundamentals of Financial Management (15th Edition) - AAli Hussain Al SalmawiNoch keine Bewertungen

- TVM Activity 4 SolutionsDokument2 SeitenTVM Activity 4 SolutionsAstrid BuenacosaNoch keine Bewertungen

- CH 14Dokument31 SeitenCH 14Bui Thi Thu Hang (K13HN)Noch keine Bewertungen

- Management Science - Chapter 7 - Test ReveiwerDokument10 SeitenManagement Science - Chapter 7 - Test ReveiwerAuroraNoch keine Bewertungen

- Supplemental Homework ProblemsDokument64 SeitenSupplemental Homework ProblemsRolando E. CaserNoch keine Bewertungen

- Financial Management - Stock Valuation Assignment 2 - Abdullah Bin Amir - Section ADokument3 SeitenFinancial Management - Stock Valuation Assignment 2 - Abdullah Bin Amir - Section AAbdullah AmirNoch keine Bewertungen

- KidsTravel Produces Car Seats For Children From Newborn To 2 Years OldDokument2 SeitenKidsTravel Produces Car Seats For Children From Newborn To 2 Years OldElliot Richard0% (1)

- Working Capital Problem SolutionDokument10 SeitenWorking Capital Problem SolutionMahendra ChouhanNoch keine Bewertungen

- Module 3 Management ScienceDokument10 SeitenModule 3 Management ScienceGenesis RoldanNoch keine Bewertungen

- Ss 2Dokument6 SeitenSs 2Lim Kuan YiouNoch keine Bewertungen

- ACCT551 - Week 7 HomeworkDokument10 SeitenACCT551 - Week 7 HomeworkDominickdadNoch keine Bewertungen

- Tugas ME Chapter 7 - 9 (Satrio)Dokument6 SeitenTugas ME Chapter 7 - 9 (Satrio)Ryan Hegar SuryadinathaNoch keine Bewertungen

- Unequal cash flows project selectionDokument3 SeitenUnequal cash flows project selectionSulistyonoNoch keine Bewertungen

- Accounting and Finance Tugas Kelompok #3 Chapter 6 Financial Planning and ForecastingDokument10 SeitenAccounting and Finance Tugas Kelompok #3 Chapter 6 Financial Planning and Forecastingbudiman100% (1)

- Plan Your Cash Flow and Finances with These ToolsDokument4 SeitenPlan Your Cash Flow and Finances with These Toolscialee100% (2)

- Costassign JoDokument4 SeitenCostassign Jokishi8mempinNoch keine Bewertungen

- What-If Analysis for Linear Programming Solution to Solved ProblemsDokument4 SeitenWhat-If Analysis for Linear Programming Solution to Solved ProblemsRamya KosarajuNoch keine Bewertungen

- 6 BudgetingDokument2 Seiten6 BudgetingClyette Anne Flores BorjaNoch keine Bewertungen

- Case Problem R.C. ColemanDokument5 SeitenCase Problem R.C. ColemanSomething ChicNoch keine Bewertungen

- CH 13#6Dokument13 SeitenCH 13#6jjmaducdoc100% (1)

- Gitman CH 14 15 QnsDokument3 SeitenGitman CH 14 15 QnsFrancisCop100% (1)

- Exercise Stock ValuationDokument2 SeitenExercise Stock ValuationUmair ShekhaniNoch keine Bewertungen

- Tuff Wheels Was Getting Ready To Start Its Development ProjectDokument1 SeiteTuff Wheels Was Getting Ready To Start Its Development ProjectAmit PandeyNoch keine Bewertungen

- Quiz#1 MaDokument5 SeitenQuiz#1 Marayjoshua12Noch keine Bewertungen

- Class Participation 9 E7-18: Last Name - First Name - IDDokument2 SeitenClass Participation 9 E7-18: Last Name - First Name - IDaj singhNoch keine Bewertungen

- FM Assignment 7 - Group 4Dokument7 SeitenFM Assignment 7 - Group 4Puspita RamadhaniaNoch keine Bewertungen

- Quiz 1Dokument2 SeitenQuiz 1Abdul Wajid Nazeer CheemaNoch keine Bewertungen

- Lease Accounting ProblemsDokument27 SeitenLease Accounting ProblemsElijah Lou ViloriaNoch keine Bewertungen

- FIN5FMA Tutorial 2 SolutionsDokument7 SeitenFIN5FMA Tutorial 2 SolutionsSanthiya MogenNoch keine Bewertungen

- Financial planning & forecasting assignmentDokument3 SeitenFinancial planning & forecasting assignmentAhmedNoch keine Bewertungen

- Reviewer Mid FinDokument108 SeitenReviewer Mid FinIrish Mae DesoyoNoch keine Bewertungen

- 2.carbide Chemical Company-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczDokument1 Seite2.carbide Chemical Company-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczRajib DahalNoch keine Bewertungen

- Investasi Bisnis LogamDokument3 SeitenInvestasi Bisnis LogamCarihunian DepokNoch keine Bewertungen

- Emba55a s9 Problem1&15Dokument5 SeitenEmba55a s9 Problem1&15Senna El0% (1)

- Chapter 9 Exercise SolutionsDokument24 SeitenChapter 9 Exercise SolutionsQasim Ali100% (2)

- Michael Roberts Is A Cost Accountant and Business Analyst ForDokument1 SeiteMichael Roberts Is A Cost Accountant and Business Analyst ForAmit PandeyNoch keine Bewertungen

- Central Plain University income tax calculationDokument3 SeitenCentral Plain University income tax calculationLFGS Finals0% (1)

- Jarlsberg Cheese Company Has Developed A New Cheese Slicer Called Slim SlicerDokument5 SeitenJarlsberg Cheese Company Has Developed A New Cheese Slicer Called Slim SlicerDeniseNoch keine Bewertungen

- 310 CH 10Dokument46 Seiten310 CH 10Cherie YanNoch keine Bewertungen

- Answer 2269 17Dokument10 SeitenAnswer 2269 17Syed Salman Abbas100% (2)

- Chapter 3 AnswersDokument2 SeitenChapter 3 AnswersMac b IBANEZNoch keine Bewertungen

- Finance Quiz 1Dokument3 SeitenFinance Quiz 1brnycNoch keine Bewertungen

- Chapter 10 Intermediate Final RevisionDokument8 SeitenChapter 10 Intermediate Final Revisionmagdy kamelNoch keine Bewertungen

- Problem 13-1 - Chapter 13 - SolutionDokument6 SeitenProblem 13-1 - Chapter 13 - Solutionppdisme100% (1)

- AssignmentDokument2 SeitenAssignmentLois JoseNoch keine Bewertungen

- Complete C7Dokument15 SeitenComplete C7tai nguyenNoch keine Bewertungen

- Medical Clinic Market Analysis Decision TreeDokument3 SeitenMedical Clinic Market Analysis Decision TreesafwanNoch keine Bewertungen

- Assignment 01-Fin421Dokument11 SeitenAssignment 01-Fin421i CrYNoch keine Bewertungen

- #4 - Soluition To Essay Question #5 (Bonus Question)Dokument2 Seiten#4 - Soluition To Essay Question #5 (Bonus Question)DionizioNoch keine Bewertungen

- Capacity Planning InsightsDokument13 SeitenCapacity Planning InsightsSarsal6067Noch keine Bewertungen

- Bank Overdrafts, Bank Loans and Ordinary Shares AnalysisDokument6 SeitenBank Overdrafts, Bank Loans and Ordinary Shares AnalysissyddrazNoch keine Bewertungen

- Topic 11 ReplacementDokument8 SeitenTopic 11 Replacementsalman hussainNoch keine Bewertungen

- Casddfover Page - A2Dokument1 SeiteCasddfover Page - A2ertizashuvoNoch keine Bewertungen

- Bangladesh Inflation RateDokument1 SeiteBangladesh Inflation RateertizashuvoNoch keine Bewertungen

- Economy of BangladeshDokument13 SeitenEconomy of BangladeshertizashuvoNoch keine Bewertungen

- Bangladesh EconomydfgDokument8 SeitenBangladesh EconomydfgertizashuvoNoch keine Bewertungen

- Bangladesh Economy Profile 2012Dokument11 SeitenBangladesh Economy Profile 2012ertizashuvoNoch keine Bewertungen

- Fin 440Dokument1 SeiteFin 440ertizashuvoNoch keine Bewertungen

- 6 Ethics for Living Well in Few WordsDokument1 Seite6 Ethics for Living Well in Few WordsertizashuvoNoch keine Bewertungen

- HRM 380 2013 Spring Case Analysis DiscriptionDokument3 SeitenHRM 380 2013 Spring Case Analysis DiscriptionertizashuvoNoch keine Bewertungen

- North South University: School of Business Spring-2013 HRM 380Dokument2 SeitenNorth South University: School of Business Spring-2013 HRM 380ertizashuvoNoch keine Bewertungen

- HRM 380 2013 Spring Case Analysis DiscriptionDokument3 SeitenHRM 380 2013 Spring Case Analysis DiscriptionertizashuvoNoch keine Bewertungen

- HRM 380 2013 Spring Course SyllabusDokument2 SeitenHRM 380 2013 Spring Course SyllabusertizashuvoNoch keine Bewertungen

- InntroDokument1 SeiteInntroertizashuvoNoch keine Bewertungen

- Tax Invoice for Herbalife ProductsDokument1 SeiteTax Invoice for Herbalife ProductsKranti.R.BandiNoch keine Bewertungen

- 2023-24 SSR Rates SimplifiedDokument93 Seiten2023-24 SSR Rates SimplifiedpardhivNoch keine Bewertungen

- Gotec Catalogue Clim en 1Dokument13 SeitenGotec Catalogue Clim en 1Asesoria TécniaNoch keine Bewertungen

- ElasticityDokument4 SeitenElasticityUnicorn ProjectNoch keine Bewertungen

- Creditcard Payoff CalculatorDokument6 SeitenCreditcard Payoff CalculatorMohd Jamal Mohd MoktarNoch keine Bewertungen

- 33DEI20F1003 Johan Azman Fibal ReportDokument61 Seiten33DEI20F1003 Johan Azman Fibal ReportJohan RamliNoch keine Bewertungen

- Postpaid Bill 9433041823 BM2307I005193074Dokument5 SeitenPostpaid Bill 9433041823 BM2307I005193074Surajit BanerjeeNoch keine Bewertungen

- Walmart Pay Stub Online VersionDokument5 SeitenWalmart Pay Stub Online VersionLily NguyenNoch keine Bewertungen

- CSI Custodial Service Quality AnalysisDokument2 SeitenCSI Custodial Service Quality AnalysisAna FloreaNoch keine Bewertungen

- SOP for Laundry Collection and Delivery TrainingDokument14 SeitenSOP for Laundry Collection and Delivery Trainingsabeerssr75% (4)

- Signature Name & Mobile No of Person/Party Who Is Receiving The Material With Rubber StampDokument2 SeitenSignature Name & Mobile No of Person/Party Who Is Receiving The Material With Rubber StampRitesh kumarNoch keine Bewertungen

- Contingent Bill TR 30 Mg6yanDokument2 SeitenContingent Bill TR 30 Mg6yanDeputy DirectorNoch keine Bewertungen

- Print - Udyam Registration CertificateDokument4 SeitenPrint - Udyam Registration CertificateVishal IndjyotiNoch keine Bewertungen

- MK Options Trader for NIFTY OptionsDokument4 SeitenMK Options Trader for NIFTY Optionsnarendra bholeNoch keine Bewertungen

- P.W.D. Procedure To Execute The WorkDokument3 SeitenP.W.D. Procedure To Execute The WorkThjnn ErrNoch keine Bewertungen

- Market Demand & Elasticity: © 2004 Thomson Learning/South-WesternDokument68 SeitenMarket Demand & Elasticity: © 2004 Thomson Learning/South-WesternAsif Islam SamannoyNoch keine Bewertungen

- Features of ICICI Pru Saral Jeevan BimaDokument2 SeitenFeatures of ICICI Pru Saral Jeevan BimaKriti KaNoch keine Bewertungen

- ANOVA ExamplesDokument5 SeitenANOVA Examplestomar_muditNoch keine Bewertungen

- WIND GIRDER-Bill of Material: ProfileDokument3 SeitenWIND GIRDER-Bill of Material: ProfileKarthimeena MeenaNoch keine Bewertungen

- Sample 3Dokument17 SeitenSample 3Shubhajit GhoshNoch keine Bewertungen

- SEPCO Air SealDokument4 SeitenSEPCO Air SealAlejandro BorsaniNoch keine Bewertungen

- BBA & MBA Marketing Curriculum at BSSTUDokument59 SeitenBBA & MBA Marketing Curriculum at BSSTUami habib0% (1)

- Lecture 5Dokument22 SeitenLecture 5sanjana dasaNoch keine Bewertungen

- Future of Business Canadian 5th Edition Althouse Solutions ManualDokument24 SeitenFuture of Business Canadian 5th Edition Althouse Solutions ManualAmySavagegrms100% (30)

- ITS IenablerDokument1 SeiteITS IenablerPenehupitho UusikuNoch keine Bewertungen

- ImpactDokument7 SeitenImpactMyat KhantNoch keine Bewertungen

- Mansions of Australia Home and Contents Insurance: Online Quote Request Form Temporary RemovalDokument1 SeiteMansions of Australia Home and Contents Insurance: Online Quote Request Form Temporary RemovalFilipNoch keine Bewertungen

- Moneyball For Modern Portfolio Theory - The Sharpe Ratio Problem and Cole Wins Above Replacement Portfolio SolutionDokument14 SeitenMoneyball For Modern Portfolio Theory - The Sharpe Ratio Problem and Cole Wins Above Replacement Portfolio SolutionpiwipebaNoch keine Bewertungen

- Transaction HistoryDokument2 SeitenTransaction HistoryMuhammad Johari Noor AzharNoch keine Bewertungen

- Grammar and vocabulary practiceDokument2 SeitenGrammar and vocabulary practiceЛевNoch keine Bewertungen