Beruflich Dokumente

Kultur Dokumente

Weekly Market Commentary 3-18-13

Hochgeladen von

Stephen GierlCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Weekly Market Commentary 3-18-13

Hochgeladen von

Stephen GierlCopyright:

Verfügbare Formate

Weekly Market Commentary March 18, 2013

The Markets Like winded runners, stock markets slowed at the end of last week. Since the start of the year, the Dow Jones Industrials Index has risen by almost 11 percent, hurdling past new highs several times. The S&P 500 Index gained 9.4 percent over the same period. The index moved higher in 10 of the past 11 weeks and finished last week just shy of its all-time high. However, the Dow and the S& Ps momentum and that of some other U.S. stock markets slowed on Friday as stronger economic data was offset by an unexpected slump in consumer sentiment. Economists expected the Thomson Reuters/University of Michigan consumer sentiment index which gauges Americans feelings about their current financial health, the health of the economy over the shorter-term, and growth prospects for the economy over the longer-term to move higher in March. Instead, the index fell from 77.6 to 71.8, reaching its lowest level since December 2011. Markets fell on the news even though the negative results contradicted those of other consumer confidence measures, such as Bloombergs Consumer Comfort Index which has moved higher for six consecutive weeks. The consumer sentiment surprise also pushed Treasury yields down. Yields on benchmark 10-year Treasury notes fell to 2 percent. The Treasury market remains concerned that stronger economic data could lead the Federal Reserve to change its policy on quantitative easing. The Federal Reserves next Open Market Committee meeting is next week, and may provide further insight to the matter.

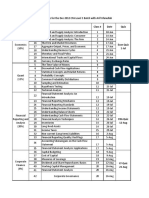

Data as of 3/15/13 Standard & Poor's 500 (Domestic Stocks) 10-year Treasury Note (Yield Only) Gold (per ounce) DJ-UBS Commodity Index DJ Equity All REIT TR Index 1-Week 0.6% 2.0 0.9 0.8 0.5 Y-T-D 9.4% N/A -5.8 -0.5 6.7 1-Year 11.3% 2.3 -3.2 -5.0 17.6 3-Year 10.7% 3.7 13.1 1.8 17.8 5-Year 4.1% 3.3 9.6 -7.7 8.0 10-Year 6.1% 3.8 16.7 1.7 12.6

Notes: S&P 500, Gold, DJ-UBS Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT TR Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods. Sources: Yahoo! Finance, Barrons, djindexes.com, Lon don Bullion Market Association. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

THE MIDDLE CLASS IS GROWING. In the United States, households that earn between $35,600 a year and $94,600 a year are considered to be middle class. Thats about 40 percent of U.S. households (another 40 percent earn less than the middle class and 20 percent earn more). Scholars and pundits have noted that job insecurity and stagnant income levels have weakened the middle class in the United States during the past few years, but thats not whats happening in the rest of the world. The global middle class has been growing and is expected to continue to grow over the next few decades. The Organization for Economic Development defines the global middle class as including people earning between $10 and $100 a day with purchasing power parity. (Purchasing power parity is the theory that currency exchange rates should adjust so the same goods cost the same in different countries. Its what the Big Mac Index measures.) By 2030, according to Ernst & Young, the global middle class is expected to more than double, adding three billion new members. These up-and-comers primarily will live and work in rapidly-growing countries. As the global middle class grows so should its spending power. Between 2011 and 2030, middle class demand for goods and services is expected to increase from $21 trillion to $56 trillion. Forty percent of that spending will be done by the burgeoning middle class in Asia, including China and India. According to Forbes, these consumers are creating demand for all kinds of goods and services including cosmetics, automobiles, cell phone minutes, personal banking, and retirement planning. For many decades, consumer spending has been an important driver behind economic growth in the United States. Its likely to play a significant role in the economic growth of emerging countries, too. As developing countries become developed countries, interesting opportunities for investment are likely to emerge. Weekly Focus Think About It A man who carries a cat by the tail learns something he can learn in no other way. --Mark Twain, American author and humorist Best regards, Steve

Steve Gierl Gierl Augustine Investment Management, Inc. 344 N. Pike Road Sarver, PA 16055 724-353-1800 877-979-1800 Fax number 724-353-1832 We appreciate it when you refer our business to others and invite you to forward your email to 1 or 2 other people who might find the content interesting.

If you would like to be removed from our email list please respond to this email with "Unsubscribe" in the subject line.

Steve@GierlAugustine.com visit our website @ http://www.gierlaugustine.com/

Securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Investment Advisor Representative. Gierl Augustine Investment Management, Inc., a Registered Investment Advisor. Gierl Augustine Investment Management, Inc., and Camb ridge are not affiliated. Cambridge Investment Research, Inc does not accept orders and/or instructions regarding your account by e-mail, voice mail, fax or any alternate method. If you would like to execute a trade or if you have time-sensitive information for me, please call my office at 724-353-1800. Transactional details do not supersede normal trade confirmations or statements. E-mail sent through the Internet may be viewed by others and is not confidential. Cambridge Investment Research, Inc reserves the right to monitor all e-mail. Any information provided in this e-mail has been prepared from sources believed to be reliable, but is not guaranteed by Cambridge Investment Research, Inc and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational pu rposes only and does not constitute a recommendation. Cambridge Investment Research, Inc and its employees may own options, rights or warrants to purchase any of the securities mentioned in e-mail. Cambridge does not offer tax advice. This e-mail is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you did not intend to receive this message, please contact the sender immediately and delete the material from your computer. * This newsletter was prepared by Peak Advisor Alliance. Peak Advisor Alliance is not affiliated with the named broker/dealer. * The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. * The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market. * Gold represents the London afternoon gold price fix as reported by the London Bullion Market Association. * The DJ Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998. * The DJ Equity All REIT TR Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones. * Yahoo! Finance is the source for any reference to the performance of an index between two specific periods. * Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. * Past performance does not guarantee future results. * You cannot invest directly in an index. * Consult your financial professional before making any investment decision. Sources: http://finance.yahoo.com/news/wall-st-week-ahead-big-010307323.html http://www.bloomberg.com/news/2013-03-15/michigan-consumer-sentiment-decreased-to-71-8-in-march-from-77-6.html http://www.investopedia.com/terms/c/consumer-sentiment.asp#ixzz2NoAVhyIC http://www.nasdaq.com/article/bond-report-treasurys-gain-after-consumer-sentiment-surprise-20130315-00494#ixzz2NoE2cuQH http://consumerfed.org/news/594target=_blank http://siteresources.worldbank.org/EXTABCDE/Resources/7455676-1292528456380/7626791-1303141641402/7878676-1306699356046/ParallelSesssion-6-Homi-Kharas.pdf (Page 2) http://www.oecd.org/dev/44457738.pdf (Page 6, Abstract section and Page 27) http://www.economist.com/blogs/freeexchange/2012/06/purchasing-power-parity http://www.ey.com/GL/en/Newsroom/News-releases/Press-Release_Middle-class-purchasing-power-set-to-triple-by-2030-world-wide-due-torapid-growth-in-emerging-markets http://www.forbes.com/sites/investopedia/2012/12/06/the-finances-of-the-global-middle-class/ (Last paragraph) http://www.stlouisfed.org/publications/re/articles/?id=2201 http://www.brainyquote.com/quotes/authors/m/mark_twain.html#TvIMjBVkLGIr23fr.99

Das könnte Ihnen auch gefallen

- Financial Management Week 1 HomeworkDokument6 SeitenFinancial Management Week 1 HomeworkF4ARNoch keine Bewertungen

- Delta Neutral StrategiesDokument50 SeitenDelta Neutral Strategiesjainvivek0% (2)

- Coca Cola - Portfolio ProjectDokument15 SeitenCoca Cola - Portfolio Projectapi-249694223Noch keine Bewertungen

- Lucara Diamond - Massif CapitalDokument7 SeitenLucara Diamond - Massif CapitalwmthomsonNoch keine Bewertungen

- Market Commentary 3/18/13Dokument3 SeitenMarket Commentary 3/18/13CLORIS4Noch keine Bewertungen

- Weekly Market Commentary 7-15-13Dokument3 SeitenWeekly Market Commentary 7-15-13Stephen GierlNoch keine Bewertungen

- Weekly Commentary January 22, 2013: The MarketsDokument4 SeitenWeekly Commentary January 22, 2013: The MarketsStephen GierlNoch keine Bewertungen

- Weekly Commentary 2-25-13Dokument3 SeitenWeekly Commentary 2-25-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 7-2-13Dokument3 SeitenWeekly Market Commentary 7-2-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 7-22-13Dokument3 SeitenWeekly Market Commentary 7-22-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 4-15-13Dokument3 SeitenWeekly Market Commentary 4-15-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 3-5-13Dokument3 SeitenWeekly Market Commentary 3-5-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 6-17-13Dokument3 SeitenWeekly Market Commentary 6-17-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 6-3-13Dokument3 SeitenWeekly Market Commentary 6-3-13Stephen GierlNoch keine Bewertungen

- Weekly Commentary 11-27-12Dokument4 SeitenWeekly Commentary 11-27-12Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 4-1-13Dokument3 SeitenWeekly Market Commentary 4-1-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 5-6-13Dokument3 SeitenWeekly Market Commentary 5-6-13Stephen GierlNoch keine Bewertungen

- Don't Forget To R.S.V.P. For Our Kevin Elko Event at Cabana On October 8 at 6:00 P.MDokument4 SeitenDon't Forget To R.S.V.P. For Our Kevin Elko Event at Cabana On October 8 at 6:00 P.MmonarchadvisorygroupNoch keine Bewertungen

- Market Commentary 12-31-12Dokument4 SeitenMarket Commentary 12-31-12Stephen GierlNoch keine Bewertungen

- The Markets: Data As of 12/21/12 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearDokument4 SeitenThe Markets: Data As of 12/21/12 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearStephen GierlNoch keine Bewertungen

- Weekly Commentary 11-19-12Dokument4 SeitenWeekly Commentary 11-19-12Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 5-13-13Dokument3 SeitenWeekly Market Commentary 5-13-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 5-27-13Dokument3 SeitenWeekly Market Commentary 5-27-13Stephen GierlNoch keine Bewertungen

- The Monarch Report 3/4/2013Dokument4 SeitenThe Monarch Report 3/4/2013monarchadvisorygroupNoch keine Bewertungen

- UpdateDokument2 SeitenUpdatedwernli1Noch keine Bewertungen

- Weekly Commentary January 14, 2013: The MarketsDokument4 SeitenWeekly Commentary January 14, 2013: The MarketsStephen GierlNoch keine Bewertungen

- The Monarch Report 2/25/2013Dokument3 SeitenThe Monarch Report 2/25/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 6-24-13Dokument3 SeitenWeekly Market Commentary 6-24-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 7-8-13Dokument3 SeitenWeekly Market Commentary 7-8-13Stephen GierlNoch keine Bewertungen

- PEAK Market Commentary 09-08-14Dokument3 SeitenPEAK Market Commentary 09-08-14Income Solutions Wealth ManagementNoch keine Bewertungen

- The Monarch Report 9-26-11Dokument4 SeitenThe Monarch Report 9-26-11monarchadvisorygroupNoch keine Bewertungen

- The Monarch Report 6-18-2012Dokument4 SeitenThe Monarch Report 6-18-2012monarchadvisorygroupNoch keine Bewertungen

- Market Commentary 2/25/13Dokument3 SeitenMarket Commentary 2/25/13CLORIS4Noch keine Bewertungen

- The Monarch Report 6/3/2013Dokument4 SeitenThe Monarch Report 6/3/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Commentary 12-10-12Dokument3 SeitenWeekly Commentary 12-10-12Stephen GierlNoch keine Bewertungen

- Market Commentary 11-26-12Dokument3 SeitenMarket Commentary 11-26-12CLORIS4Noch keine Bewertungen

- The Monarch Report 10/28/2013Dokument4 SeitenThe Monarch Report 10/28/2013monarchadvisorygroupNoch keine Bewertungen

- Market Commentary1!14!13Dokument3 SeitenMarket Commentary1!14!13CLORIS4Noch keine Bewertungen

- PEAK Market Commentary 01-20-2014Dokument4 SeitenPEAK Market Commentary 01-20-2014Income Solutions Wealth ManagementNoch keine Bewertungen

- Weekly Commentary 12-3-12Dokument4 SeitenWeekly Commentary 12-3-12Stephen GierlNoch keine Bewertungen

- Market Commentary 8-13-12Dokument3 SeitenMarket Commentary 8-13-12CLORIS4Noch keine Bewertungen

- The Monarch Report 4/1/2013Dokument3 SeitenThe Monarch Report 4/1/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 4-29-13Dokument3 SeitenWeekly Market Commentary 4-29-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 4-22-13Dokument3 SeitenWeekly Market Commentary 4-22-13Stephen GierlNoch keine Bewertungen

- The Monarch Report 1/22/2013Dokument3 SeitenThe Monarch Report 1/22/2013monarchadvisorygroupNoch keine Bewertungen

- The Monarch Report 8-15-11Dokument4 SeitenThe Monarch Report 8-15-11monarchadvisorygroupNoch keine Bewertungen

- Market Commentary 12-17-12Dokument4 SeitenMarket Commentary 12-17-12Stephen GierlNoch keine Bewertungen

- Monarch Report 10/15/2012Dokument4 SeitenMonarch Report 10/15/2012monarchadvisorygroupNoch keine Bewertungen

- Monarch Report 4/8/2013Dokument3 SeitenMonarch Report 4/8/2013monarchadvisorygroupNoch keine Bewertungen

- JPM Weekly MKT Recap 8-13-12Dokument2 SeitenJPM Weekly MKT Recap 8-13-12Flat Fee PortfoliosNoch keine Bewertungen

- Weekly Market Commentary 11/18/2013Dokument3 SeitenWeekly Market Commentary 11/18/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Commentary January 28, 2013: The MarketsDokument4 SeitenWeekly Commentary January 28, 2013: The MarketsStephen GierlNoch keine Bewertungen

- The Monarch Report 7-9-2012Dokument4 SeitenThe Monarch Report 7-9-2012monarchadvisorygroupNoch keine Bewertungen

- Market Commentary 1.28.2013Dokument3 SeitenMarket Commentary 1.28.2013CLORIS4Noch keine Bewertungen

- The Monarch Report 7-2-2012Dokument4 SeitenThe Monarch Report 7-2-2012monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Update June 17thDokument2 SeitenWeekly Market Update June 17thmike1473Noch keine Bewertungen

- 2011-11-07 Horizon CommentaryDokument3 Seiten2011-11-07 Horizon CommentarybgeltmakerNoch keine Bewertungen

- Market Commentary 06-27-11Dokument3 SeitenMarket Commentary 06-27-11monarchadvisorygroupNoch keine Bewertungen

- The Monarch Report 8-6-2012Dokument4 SeitenThe Monarch Report 8-6-2012monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 3-19-2012Dokument4 SeitenWeekly Market Commentary 3-19-2012monarchadvisorygroupNoch keine Bewertungen

- The Monarch Report 10/22/2012Dokument4 SeitenThe Monarch Report 10/22/2012monarchadvisorygroupNoch keine Bewertungen

- JPM Weekly MKT Recap 5-21-12Dokument2 SeitenJPM Weekly MKT Recap 5-21-12Flat Fee PortfoliosNoch keine Bewertungen

- Bumps On The SlopeDokument2 SeitenBumps On The SlopeJanet BarrNoch keine Bewertungen

- Summary of Simon Constable & Robert E. Wright's The WSJ Guide to the 50 Economic Indicators That Really MatterVon EverandSummary of Simon Constable & Robert E. Wright's The WSJ Guide to the 50 Economic Indicators That Really MatterNoch keine Bewertungen

- Weekly Market Commentary 7-8-13Dokument3 SeitenWeekly Market Commentary 7-8-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 7-22-13Dokument3 SeitenWeekly Market Commentary 7-22-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 6-3-13Dokument3 SeitenWeekly Market Commentary 6-3-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 6-10-13Dokument4 SeitenWeekly Market Commentary 6-10-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 6-24-13Dokument3 SeitenWeekly Market Commentary 6-24-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 4-22-13Dokument3 SeitenWeekly Market Commentary 4-22-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 6-17-13Dokument3 SeitenWeekly Market Commentary 6-17-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 4-29-13Dokument3 SeitenWeekly Market Commentary 4-29-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 4-15-13Dokument3 SeitenWeekly Market Commentary 4-15-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 5-6-13Dokument3 SeitenWeekly Market Commentary 5-6-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 5-27-13Dokument3 SeitenWeekly Market Commentary 5-27-13Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 5-13-13Dokument3 SeitenWeekly Market Commentary 5-13-13Stephen GierlNoch keine Bewertungen

- Weekly Commentary January 14, 2013: The MarketsDokument4 SeitenWeekly Commentary January 14, 2013: The MarketsStephen GierlNoch keine Bewertungen

- Weekly Commentary January 28, 2013: The MarketsDokument4 SeitenWeekly Commentary January 28, 2013: The MarketsStephen GierlNoch keine Bewertungen

- Weekly Market Commentary 4-1-13Dokument3 SeitenWeekly Market Commentary 4-1-13Stephen GierlNoch keine Bewertungen

- Market Commentary 12-31-12Dokument4 SeitenMarket Commentary 12-31-12Stephen GierlNoch keine Bewertungen

- Weekly Commentary 12-3-12Dokument4 SeitenWeekly Commentary 12-3-12Stephen GierlNoch keine Bewertungen

- Weekly Market Commentary 3-5-13Dokument3 SeitenWeekly Market Commentary 3-5-13Stephen GierlNoch keine Bewertungen

- Weekly Commentary 4-30-12Dokument3 SeitenWeekly Commentary 4-30-12Stephen GierlNoch keine Bewertungen

- Weekly Commentary 12-10-12Dokument3 SeitenWeekly Commentary 12-10-12Stephen GierlNoch keine Bewertungen

- Weekly Commentary 11-27-12Dokument4 SeitenWeekly Commentary 11-27-12Stephen GierlNoch keine Bewertungen

- Weekly Commentary 5-21-12Dokument3 SeitenWeekly Commentary 5-21-12Stephen GierlNoch keine Bewertungen

- The Markets: Data As of 12/21/12 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearDokument4 SeitenThe Markets: Data As of 12/21/12 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearStephen GierlNoch keine Bewertungen

- Market Commentary 12-17-12Dokument4 SeitenMarket Commentary 12-17-12Stephen GierlNoch keine Bewertungen

- Weekly Commentary 11-19-12Dokument4 SeitenWeekly Commentary 11-19-12Stephen GierlNoch keine Bewertungen

- Weekly Commentary 5-7-12Dokument2 SeitenWeekly Commentary 5-7-12Stephen GierlNoch keine Bewertungen

- Tutorial For UT Exam PDFDokument62 SeitenTutorial For UT Exam PDFHanafi MansorNoch keine Bewertungen

- Capital Market Regulations (LW 4411)Dokument9 SeitenCapital Market Regulations (LW 4411)Aayushi PriyaNoch keine Bewertungen

- Korteweg FBE 432: Corporate Financial Strategy Spring 2019Dokument6 SeitenKorteweg FBE 432: Corporate Financial Strategy Spring 2019PeterNoch keine Bewertungen

- Kalkulator SahamDokument16 SeitenKalkulator SahamAkbar Hidayatullah ZainiNoch keine Bewertungen

- F2 một số dạng BTDokument15 SeitenF2 một số dạng BTdohanh0512Noch keine Bewertungen

- Year Cash Flow PV of Future Cash Flows: Initial Investment 10,000 Cost of Capital 10%Dokument1 SeiteYear Cash Flow PV of Future Cash Flows: Initial Investment 10,000 Cost of Capital 10%motalebyNoch keine Bewertungen

- Eva DisneyDokument4 SeitenEva DisneyherybertoNoch keine Bewertungen

- The Treynor Ratio and Jensens Alpha 1Dokument3 SeitenThe Treynor Ratio and Jensens Alpha 1mutuamutisya306Noch keine Bewertungen

- Module 1-Introduction To FMO-newDokument41 SeitenModule 1-Introduction To FMO-newjav1965Noch keine Bewertungen

- Statement of Changes in Equity SCEDokument34 SeitenStatement of Changes in Equity SCEDianeNoch keine Bewertungen

- RBI Guidelines On Stress TestingDokument29 SeitenRBI Guidelines On Stress TestingbankamitNoch keine Bewertungen

- 71810bos57772 Inter p2qDokument9 Seiten71810bos57772 Inter p2qSakshi KhandelwalNoch keine Bewertungen

- Tally - ERP 9 ProjectDokument106 SeitenTally - ERP 9 ProjectAbhinandan PahadiNoch keine Bewertungen

- Preserbasyon Kulturang Tradisyon at WikaDokument9 SeitenPreserbasyon Kulturang Tradisyon at Wikamarianne capina de jesus100% (1)

- Retirement of Partners Cbse Question BankDokument6 SeitenRetirement of Partners Cbse Question Bankabhayku1689Noch keine Bewertungen

- Literature Review SalmanDokument3 SeitenLiterature Review SalmanvdocxNoch keine Bewertungen

- Taxonomy of Finance TheoriesDokument16 SeitenTaxonomy of Finance TheoriesDr. Vernon T Cox0% (1)

- Breaking Into WS 1-HR LBO-Modeling-Test-AnswDokument3 SeitenBreaking Into WS 1-HR LBO-Modeling-Test-AnswANoch keine Bewertungen

- Audit of The Capital Acquisition and Repayment CycleDokument32 SeitenAudit of The Capital Acquisition and Repayment CycleCyndi SyifaaNoch keine Bewertungen

- PROJECT REPORT Merger and DemergerDokument42 SeitenPROJECT REPORT Merger and Demergeryash jain0% (1)

- Hershey Company - Form - 10-Q (June-30-2021)Dokument96 SeitenHershey Company - Form - 10-Q (June-30-2021)Mince 0607qqNoch keine Bewertungen

- Dec 2017 CFA Level 1 ScheduleDokument2 SeitenDec 2017 CFA Level 1 ScheduleSyed AhmadNoch keine Bewertungen

- CH04 Interest RatesDokument30 SeitenCH04 Interest RatesJessie DengNoch keine Bewertungen

- C 12 LCNRV - Problem SolvingDokument1 SeiteC 12 LCNRV - Problem Solvingkyle mandaresioNoch keine Bewertungen

- Bnpparibas Eds Derivatives Lens 20 Oct 2011 EuroDokument4 SeitenBnpparibas Eds Derivatives Lens 20 Oct 2011 Eurobaburavula4756Noch keine Bewertungen