Beruflich Dokumente

Kultur Dokumente

FA

Hochgeladen von

Kanishka Darshana Bandara WeerasingheCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FA

Hochgeladen von

Kanishka Darshana Bandara WeerasingheCopyright:

Verfügbare Formate

Company ABC PLC

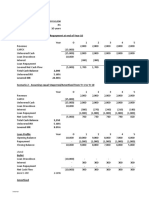

Profitability Ratio Gross Profit Margin Ratio 2011 Gross Profit Margin Ratio = Gross Profit X 100 Sales = 290, 000 X 100 400, 000 = 72.5 % 2012 Gross Profit Margin Ratio = Gross Profit X 100 Sales = 316, 000 X 100 444, 000 = 71.2 %

Operating Profit Ratio Gross Profit (-) Operating Expenses Operating Profit Operating Profit Margin Ratio 2011 Operating Profit Margin Ratio = Operating Profit X 100 Sales = 50, 000 X 100 400, 000 = 12.5 % 2012 Operating Profit Margin Ratio = Operating Profit X 100 Sales = 52, 000 X 100 444, 000 = 11.7 % 2011 290,000 (240,000) 50,000 2012 316,000 (264,000) 52,000

Return On Capital Employed 2011 Return on Capital Employed = PBIT X 100 Capital Employed = 50, 000 12,000, 000 = 0.416% X 100 2012 Return on Capital Employed = PBIT Capital Employed = 52, 000 7,000, 000

X 100

X 100

= 0.742 %

Efficiency Ratio Stock turnover period 2011 Stock turnover = 2012 Stock turnover =

Average Stock X 365 Cost of Sales = 100, 000 110, 000 X 365

Average Stock X 365 Cost of Sales = 110, 000 128, 000 X 365

= 331.818 = 332 days

= 313.671 = 314 days

Debtors collection period 2011 Debtors collection period = = 365 400, 000 = 456.25 = 456 days 2012 Debtors collection period = = 365 444, 000 = 287.72 = 288 days

Debtors X 365 Sales 500, 000 X

Debtors X 365 Sales 350, 000 X

Creditors payment period 2011 Creditors payment period = = 365 110, 000 = 570.31 = 995.45 = 570 days = 995 days 2012 Creditors payment period = =

creditors X 365 Purchase 300, 000 X

creditors X 365 Purchase 200, 000 128, 000 X 365

Cash cycle / working capital cycle stock turnover days (+) debtors collection period ( - ) creditors payment cash cycle Liquidity ratios Current Asset Ratio 2011 Current asset ratio= current asset : current liability = 760, 000 : 500, 000 = 1.52 : 1 2012 Current asset ratio= current asset : current liability = 600, 000 : 400, 000 = = 3 : 2 1 2011 332 days 456 days 788 days (995) days (207) days 2012 314 days 288 days 602 days (570) days 32 days

1.5 :

Quick Asset Ratio 2011 Quick asset ratio= current - stock : current asset liability = 760, 000 100,000 : 500, 000 = = 660, 000 : 500, 000 1.32 : 1 2012 Quick asset ratio= current - stock : current asset liability = 600, 000 110,000 : 400, 000 = = 490, 000 : 400, 000 1.22 : 1

Capital Structure Ratio Gearing Ratio 2011 Gearing Ratio = = 100 1,800, 000 + 1, 000,000 = = 1,800, 000 3,400, 000 X 100 960, 000 1,780, 000 X 100 2012s Gearing Ratio = =

Debt Debt + Equity 1,800, 000

X 100 X

Debt Debt + Equity 960, 000 960, 000 + 820,000

X 100 X 100

= 53.93% = 52.94%

Interest Cover Ratio 2011 Interest Cover Ratio = PBIT Interest = 2012 Interest Cover Ratio = PBIT Interest . = 52, 000 18, 000

. .

50, 000 32, 000

= 1.5625

= 2.8889

Company XYZ PLC

Profitability ratio Gross profit ratio = ( Gross profit / sales) x 100 2011 (1850/ 2500) x 100 = 66% 2012 (2550/3500) x 100 = 72.86%

Therefore the change is 6.86%

Net profit ratio = (PBIT/Sales) X 100 2011 (1000/2500) X 100 = 40% 2012 (1800/3500) X 100 = 51.43%

Therefore change is 11.43%

Return on capital employed = (PBIT/ capital employed) x 100 2011 (1000/3200) x 100 = 31.25% 2012 (1800/7000) x 100= 25.71% Therefore change is 5.54%

Return on equity = (PAIT/ equity) x 100 2011

(630/1400) x 100 = 45% 2012 (1990/ 6040) x 100 = 32.95% Therefore change is 12.08%

Short term liquidity ratio Current ratio = Current assets : current liability 2011 760 : 500 = 1.52 : 1 2012 600 : 400 = 1.5 : 1

Quick asset ratio = (current asset short term investment) : current liability 2011 (760 100) : 500 = 1.32 : 1 2012 (600 110) : 400 = 1.23 : 1

Efficiency ratio Credit payment period = (creditors /sales) x 365 days 2011 (300 / 2500 ) x 365 = 44 days 2012 (200 / 3500) x 365 = 21 days

Debtors collection period = (Debtors / sales ) x 365 2011 ( 500 / 2500 ) x 100 = 73 days 2012 ( 350 / 3500 ) x 100 = 37 days Capital structure ratio Gearing ratio = ( debt / ( debt + equity) x 100

2011 (1800 / ( 1800 + 1400)) x 100 = 56.25% 2012 ( 960 / ( 960 + 6040)) x 100 = 13.71%

Interest cover = PBIT / interest cost 2011 630 / 100 = 6.3 times 2012 1990 / 100 = 19.9 times

Company ABC PLC

If we look into the profitability ratio, we know it is used to understand whether an organization is performing in a satisfactory level or not. In addition to that is ratio is used to measure the performance of management, to identify whether an organization is profitable or not to make an investment. Based on the theory and based on the calculations we made above it is clear that overall this organization is performing in satisfactory level. If we look in detail Gross Profit Margin Ratio indicates the profit margin which is maintained by the organization. GP ratio in 2011 is 72.5% has been decreased to 71.2% by 2012. This has caused because of increasing cost of sales and I think there should be changes in prices. As opposed to GP margin operating profit margin has been reduced by 0.8%. This indicate that the operational inefficiency of the organization. As we can see only the summarized value of operating expenses I suggest management to look in to the in detail analyze of the operational expenses in order to find out the most inefficient operational area of the business. However, organization has increased ROCE of 0.326%. Even though capital employed has been reduced operating profit has been increased. It is oblivious shareholders always expect a high Return and comparing the return with 2011, in 2012 ROCE has been increased therefore, effectiveness and efficiency of using capital has been increased and it makes shareholders, management, employees, creditors, and satisfied. At the same time it has motivated potential investors to show an interest toward this organization also. We know profitability is affected by the way that assets of a business have been used. If plant and machinery are used only for few hours a day then the business is failing to utilize the assets efficiently. This may be because of limited demand for the produced or there might be a lack of skilled labor and there is no one to operate the machinery in the rest of the time. Based on the calculations we can see that in 2011 Stock turnover period is 332 days and in 2012 Stock turnover period is 314 days. So number of Stock turnover days has been decreased by 18 days. This explains us that comparing Stock turnover period with 2011; in 2012 stocks are moving quickly. Based on the calculation we can see that in 2011 it takes 456 days to collect money from the debtors and in 2012 it takes 288 days to collect money from the debtors. Debtors collection period has been reduced by 168 days. So, it is obvious that in the year of 2012 it is favorable for an organization as they can collect money from the debtors soon comparing the debtors collection period with 2011. Based on the Creditors payment period we can see in 2011 it takes 995 days to pay the creditors and in 2012 it takes 570 days to pay the creditors. So, creditors payment period has been reduced by 425 days. This explains that comparing the

creditors payment period 2011 with 2012; in 2012 we have to pay the creditors within 570 days so; it is unfavorable for us as we have to pay the creditors within less days in 2012. Based on the cash cycle it is clear that 2012 is having excessive days which favorable for the organization. If we look in to the stock turnover days it also has been reduced by significant days. So, it is clear that stocks are moving quickly in the year of 2012 comparing it with the previous year. As debtors collection period has been decreased in 2012 by 168 days it is favorable for the organization to get the money quickly from the debtors comparing to the previous year of 2011. If we look in to the creditors payment period in 2011; creditors payment period is 995 days and in 2012 creditors payment period is 570 days. Comparing 2012 with 2011 organization have to pay the creditors before425 days which is not really favorable for an organization. However, cash cycle shows excessive days therefore, the organizations efficiency level is in a satisfactory level for the shareholders, potential purchasers, and competitors. Based on the calculations we can see that in 2011 current asset ratio is 1.52: 1 and in 2012 current asset ratio is 1.5: 1. In both the financial year current asset ratio is similar and there are no differences. So, we can clearly understand current asset ratio is maintained same by the organization but, it is not in a satisfactory level. We know current asset ratio is should be 2:1 in order to creditors get their investment back. Based on the calculation it is not in a satisfactory level in the both financial year therefore, creditors are not 100% guaranteed to get their investment back. If we look in to the quick asset ratio in 2011 it is 1.32: 1 and in 2012 quick asset ratio is 1.22: 1. Based on the calculation we can see that in the financial year quick asset ratio has been decreased by a significant value but, it doesnt has a high major impact on the business as it has been decreased by a small value. As I have mentioned above quick asset ratio should be 1:1 to get benefit for any business this quick asset ratio also shows the similar value of quick asset ratio even though the value is low therefore, quick liquidity of the organization is low. Based on the calculation gearing ratio for the year of 2011 is 52.94 and in the year of 2012 is gearing ratio 53.93%. Comparing the gearing ratio 2012 with 2011; in 2012 gearing ratio has been increased by 0.99%. We can see that gearing ratio has been increased by a significant value. We know if an organization has more than 50% of gearing ratio means it is a high geared company therefore, it has high financial risk. According to the above calculation above organization has increased financial risk. Interest covers ratio measures the ability of the organizations to service interest charge of the long term creditors such as bank loan and debenture holders. In other words this identifies security of long term debt providers in the organization. If the interest cover ratio is increasing it will be good sign to the long term debit

providers. This also indicates high liquidity level of the organization. If the ratio goes don gradually it may not be a good indicator for the long term debt provider as the possibility of servicing debt is low. So, based on the theory if we look into the calculation we can see that in 2011 Interest cover ratio is 1.5625 and in 2012 Interest cover is 2.8898. So, in the financial year of 2012 we can see that Interest cover ratio has been increased by 1.3265. As interest cover ratio is increasing it will be good sign to the long term debit providers. This also indicates high liquidity level of the organization.

Company XYZ PLC

6.89% increase in gross profit margin indicates that a downward trend in the cost of production due to the reasons such as decrease in exchange rates, government duties and tax however decrease In cost of production has a positive impact to the gross profit margin of the company. 11.43% increase in Operating profit margin/ net profit ratio measures the companys operational efficiency in controlling the overhead cost. Lower overhead cost would increase the net profit margin by a larger percentage. Return on capital employed measures how far companies are utilizing total capital effectively to make a better return to the shareholders and the borrowing holders. Downward trend in ROCE 31.25% to 25.71% indicates that the funding utilization rate is comparatively low. Return on equity ratio is more meaningful to the equity shareholders who are interested to know profits earned by the company and those profits which can be made available to pay dividends to them. Interpretation of the ratio is similar to the interpretation of return on shareholder's investments and higher the ratio better is. As you can see, there is a drop in the ROE. Therefore we should keep in mind that the only way this ratio can stay high or increase is by maintaining or increasing the bottom line net income through good management. If executives try to hose investors by sucking profit away issuing more shares through a seasoned equity offering youll catch them by the drop in this ratio. Current ratio measures the company capacity to meet its short term liabilities such as creditors, bank overdraft. Current liabilities are met after converting stocks and debtors in to cash. Company current ratio in both 2011 and 2012 is below the standard current ratio 2:1, however the drop in the current ratio from 2011 to so12 indicates a downward trend in liquidity. Quick asset ratio measures the company capacity to meet short term liability using quick assets. Quick asset ratio excludes stocks and short term investments from the current assets. Because its not highly liquid asset such as debtors and cash.

However the quick asset ratio in 2011 and 2012 is well above the standard ratio of 1:1. But the downward trend of QAR may indicate poor liquidity position in 2012. The credit payment period shows how quickly your business pays its bills and how often payables turn over during the year. Trends in the credit payment period demonstrate how your business handles its outgoing payments and can help you assess the cash situation of your business. A high ratio means there is a relatively short time period between purchasing inventory or materials and paying for them. A low ratio may indicate that your business has a problem with cash shortages. Debtors collection period measures the efficiency of the debtors. Credit period of the customer is determined by the credit policy of the company. Average credit period in any industry is 30 days. However this company is exceeding the 30 days credit period in both the years. This might not be a better indicator for the company as it leads to working capital issues and the bad debts. GR measures the company borrowings as a percentage of total capital. The company can be funded either by long term debt or equity. A higher gearing ratio increases the financial risk as it reduces the company profit. In addition to that borrowing holders are given priority over the shareholders at the point of liquidation of the company. However the GR for this company has decreased up to 13.71% which means that its low geared and financial risk is less. Interest cover measures the company capacity to pay its interest costs. Higher the interest cover, its a better indicator for the company. However 6.3 times interest cover in 2011 may not be a good impact. But 19.9 times interest cover in 2012 is a better indicator that in 2011 for the long term creditors such as banks

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Babe 1 Time Value QuestionsDokument9 SeitenBabe 1 Time Value QuestionsCatherine LegaspiNoch keine Bewertungen

- Chapter 6 Agricultural Lending RevisedDokument25 SeitenChapter 6 Agricultural Lending RevisedMikeNoch keine Bewertungen

- 90 Fa 5 D 62071 D 65 C 8Dokument23 Seiten90 Fa 5 D 62071 D 65 C 8racha saNoch keine Bewertungen

- Outline1252 1304Dokument21 SeitenOutline1252 1304Mrij KyzerNoch keine Bewertungen

- Intermediate Accounting ReviewerDokument5 SeitenIntermediate Accounting ReviewerBroniNoch keine Bewertungen

- A History of The Credit Rating AgenciesDokument30 SeitenA History of The Credit Rating Agenciesrwilson66Noch keine Bewertungen

- Fall of Lehman BrothersDokument3 SeitenFall of Lehman BrothersFrFlordianNoch keine Bewertungen

- 3 HSBC Vs AldecoaDokument3 Seiten3 HSBC Vs AldecoaAndrewNoch keine Bewertungen

- Bullet Vs AmortisationDokument4 SeitenBullet Vs Amortisationsalih jaaparNoch keine Bewertungen

- 8 - Ratio Analysis AnswerDokument49 Seiten8 - Ratio Analysis AnswerDj babuNoch keine Bewertungen

- 12th Accountancy Study Material English MediumDokument41 Seiten12th Accountancy Study Material English Mediumsubashsb903Noch keine Bewertungen

- Using The Swap To Transform A LiabilityDokument2 SeitenUsing The Swap To Transform A LiabilityThuỷ TrìnhNoch keine Bewertungen

- Pakistan InfoDokument227 SeitenPakistan InfoUroosha IsmailNoch keine Bewertungen

- Atty. S. C. Madrona, JR.: Juris Doctor College of Law University of The Philippines Diliman, Quezon CityDokument17 SeitenAtty. S. C. Madrona, JR.: Juris Doctor College of Law University of The Philippines Diliman, Quezon Citydarren chenNoch keine Bewertungen

- Chapter Exam - ERM Topic1Dokument1 SeiteChapter Exam - ERM Topic1Dan Andrei BongoNoch keine Bewertungen

- Capital Structure Decision: An Overview: Kennedy Prince ModuguDokument14 SeitenCapital Structure Decision: An Overview: Kennedy Prince ModuguChaitanya PrasadNoch keine Bewertungen

- Afm June 2005 QT AnsDokument25 SeitenAfm June 2005 QT AnsBijay AgrawalNoch keine Bewertungen

- DuPont System of Analysis-HODokument1 SeiteDuPont System of Analysis-HOSyed Noman AhmedNoch keine Bewertungen

- Aheza BerheDokument64 SeitenAheza BerheOnnatan DinkaNoch keine Bewertungen

- Delphos St. John's Blue Jays A SectionDokument12 SeitenDelphos St. John's Blue Jays A SectionThe Delphos HeraldNoch keine Bewertungen

- AnswerDokument3 SeitenAnswerNiranjana Arul100% (1)

- Latest Memo From Howard Marks: Which Way Now?: Archived MemosDokument16 SeitenLatest Memo From Howard Marks: Which Way Now?: Archived MemoscoolchadsNoch keine Bewertungen

- Case Study Cera SanitDokument34 SeitenCase Study Cera SanitGrim ReaperNoch keine Bewertungen

- Business FinanceDokument7 SeitenBusiness FinanceMaria Veronica BubanNoch keine Bewertungen

- General Banking Law of 2000Dokument14 SeitenGeneral Banking Law of 2000Eugene Albert Olarte JavillonarNoch keine Bewertungen

- MatbisDokument8 SeitenMatbisAditya DzikirNoch keine Bewertungen

- Third World CountryDokument3 SeitenThird World Countryapi-285429731Noch keine Bewertungen

- A1 Financial Statements PDFDokument30 SeitenA1 Financial Statements PDFattiva jadeNoch keine Bewertungen

- Tài liệu không có tiêu đềDokument24 SeitenTài liệu không có tiêu đềVũ Minh HoàngNoch keine Bewertungen

- Sbi Home Loan InfoDokument4 SeitenSbi Home Loan InfoBhargavaSharmaNoch keine Bewertungen