Beruflich Dokumente

Kultur Dokumente

I. Company Profile

Hochgeladen von

Cynthia Jayanti Sarosa PuteraOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

I. Company Profile

Hochgeladen von

Cynthia Jayanti Sarosa PuteraCopyright:

Verfügbare Formate

I.

Company Profile In 1849, cousins Charles Pfizer and Charles Erhart founded Charles Pfizer & Company in a red brick building in Brooklyn, NY. Pfizer Inc. (Pfizer), incorporated on June 2, 1942, is a research-based, global biopharmaceutical company. The Company manages its operations through five segments: Primary Care; Specialty Care and Oncology; Established Products and Emerging Markets; Animal Health and Consumer Healthcare, and Nutrition. The Companys diversified global healthcare portfolio includes human and animal biologic and small molecule medicines and vaccines, as well as nutritional products and consumer healthcare products. The Company's Animal Health business unit discovers, develops and sells products for the prevention and treatment of diseases in livestock and companion animals. Primary Care operating segment includes revenues from human pharmaceutical products primarily prescribed by primary-care physicians, and may include products in the therapeutic and disease areas, such as Alzheimers disease, cardiovascular (excluding pulmonary arterial hypertension), erectile dysfunction, genitourinary, depressive disorder, pain, respiratory and smoking cessation. Examples of products in this segment include Celebrex,

Chantix/Champix, Lipitor, Lyrica, Premarin, Pristiq and Viagra. Revenues from biopharmaceutical products contributed approximately 86% of its total revenues during the year ended December 31, 2011. Established Products and Emerging Markets operating segment comprises the Established Products business unit and the Emerging Markets business unit. Established Products generally includes revenues from human prescription pharmaceutical products that have lost patent protection or marketing in certain countries and/or regions. This business unit also excludes revenues generated in emerging markets. Examples of products in this business unit include Arthrotec, Effexor, Medrol, Norvasc, Protonix, Relpax and Zosyn/Tazocin. Emerging Markets includes revenues from all human prescription pharmaceutical products sold in emerging markets, including Asia (excluding Japan and South Korea), Latin America, Middle East, Africa, Central and Eastern Europe and Turkey. Animal Health and Consumer Healthcare operating segment comprises the Animal Health business unit and the Consumer Healthcare business unit. Animal Health includes worldwide revenues from products and services to prevent and treat disease in livestock and companion

animals, including vaccines, parasiticides and anti-infectives. Consumer Healthcare includes worldwide revenues from non-prescription products in the therapeutic categories, such as dietary supplements, pain management, respiratory and personal care. Products marketed by Consumer Healthcare include Advil, Caltrate, Centrum, ChapStick, Preparation H and Robitussin. Nutrition operating segment includes revenues from a line of infant and toddler nutritional products sold outside the United States and Canada. Examples of products in this segment include the S-26 and SMA product lines, as well as formula for infants. Nutrition products include infant milk formula brands for newborns and toddlers: Gold line includes brands S-26 and/or SMA (brand names vary slightly from country to country), and in 2011, the Company launched its super-premium Illuma brand.

THE LEADERS

William C. Steere 1991-2001 199

Hank McKinnel 2001-2006

Jeff Kindler 2006-2010

Ian C. Read 2011-Now

PFIZERS TIMELINE

2000 Pfizer and Warner-Lambert merge to form the new Pfizer, creating the world's fastestgrowing major pharmaceutical company.

2001

William C. Steere, Jr. announces his retirement as CEO on January 1, 2001. Henry A. McKinnell, Jr., Ph.D. succeeds William C. Steere, Jr. as Chairman and Chief Executive Officer. In June 2001, Hank McKinnell announces a new mission for Pfizerto become the world's most valued company to patients, customers, colleagues, investors, business partners, and the communities where we work and live 2002 Pfizer becomes the first U.S. pharmaceutical company and first top-ten company on the New York Stock Exchange to join the U.N. Global Compact. Pfizer invests an industry leading $5.1 billion in research and development 2003 Pfizer invests more than $7.1 billion in research and development. 2004

On April 16, 2003 Pfizer Inc and Pharmacia Corporation combine operations, bringing together two of the worlds fastest-growing and most innovative companies.

2005 Pfizer Inc is selected by Dow Jones and Co. to be included in the Dow Jones Industrial Average, which is the best-known stock market barometer in the world. 2006

In July 2006, the Pfizer Board of Directors names Jeffrey B. Kindler Chief Executive Officer. Kindler succeeds Hank McKinnell, who will remain Chairman of the Board until his retirement in February, 2007. 2007 Pfizer launches an online site to provide up-to-date, user-friendly information on the status of its U.S. post-marketing commitments - studies conducted after a medicine receives regulatory approval and designed to provide additional information about the medicine's safety, efficacy or optimal use. This initiative is the first of its kind for a pharmaceutical company. 2008 Jeff Kindler, Chairman and CEO of Pfizer, announces the next step in the company's evolution and outlines the company's plan to establish smaller operating units designed to enhance innovation and accountability, while drawing upon the advantages of Pfizer's scale and resources. These customer-focused business units allow Pfizer to better anticipate and respond to customers' and patients' needs, as well responds to changes in the marketplace.

2009 On October 15, 2009, Pfizer acquires Wyeth, creating a company with a broad range of products and therapies that touch the lives of patients and consumers every day and at every stage of life. 2010 Pfizer announces a diversified R&D platform named Pfizer Worldwide Research and Development, supporting excellence in small molecules, large molecules and vaccine research and development. As apart of the acquisition of Wyeth in 2009, Pfizer initially implemented a two-division structure for research and development (BioTherapeutics and PharmaTherapeutics) to ensure the progress and steady integration of both legacy organizations. Due to the speed and effectiveness of that integration, Pfizer progresses to this new model while maintaining the same breadth and research programs. 2011

On January 31, the Company acquired a 92.5% interest in King Pharmaceuticals, Inc. (King). On February 28, Pfizer acquired the remaining interest in King. On August 1, 2011, the Company completed the sale of its Capsugel business. In October, it acquired Icagen, Inc. In December, the Company acquired the consumer healthcare business of Ferrosan Holding A/S. In December, the Company acquired Excaliard Pharmaceuticals, Inc.

COMPANY ADDRESS Pfizer Inc 235 East 42nd Street NEW YORK NY 10017-5755 P: +1212.7332323 F: +1302.6555049

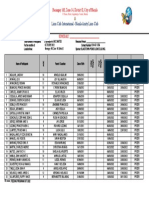

OFFICERS AND EXECUTIVES Name Mr. Ian C. Read Title Chairman & Chief Executive Officer

Dr. Olivier Brandicourt

President & General Manager-Emerging Markets

Mr. Frank A. D'Amelio

Chief Financial Officer & EVP-Business Operations

Mr. Sarma Vadlamani

Senior Scientist-Research & Development

VP-Business Development, Research & Development Ms. Polly Murphy

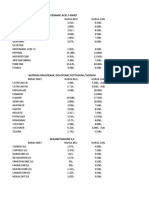

OVERALL Beta: Market Cap (Mil.): Shares Outstanding (Mil.): Dividend: Yield (%): 0.74 $203,281.91 7,185.64 0.24 3.39

FINANCIALS PFE.N P/E (TTM): EPS (TTM): 22.46 1.26 Industry 27.99 -Sector 27.84 --

ROI: ROE:

6.04 11.62

5.89 7.57

5.73 7.22

COMPETITORS COMPETITORS The Procter & Gamble Company (PG.N) Johnson & Johnson (JNJ.N) GlaxoSmithKline plc (GSK.L) Novartis AG (NOVN.VX) Sanofi SA (SASY.PA) Merck & Co., Inc. (MRK.N) AstraZeneca plc (AZN.L) Abbott Laboratories (ABT.N) Eli Lilly & Co. (LLY.N) Bristol Myers Squibb Co. (BMY.N) Price $77.58 $79.45 1,507.00p CHF67.25 77.21 $44.12 3,048.50p $33.81 $55.30 $39.87 Change +0.47 +0.59 -11.50 0.00 -0.61 +0.42 +8.50 +0.27 +0.51 +0.53

II. Case Overview Four previous letters to shareholders are presented in this case study: In the 2000 annual report, former CEO Bill Steere discussed Pfizers rise to industry prominence with the acquisition of Warner-Lambert and his pending retirement. In the 2003 annual report, new CEO Hank McKinnell discussed Pfizers performance goals and its acquisition of Pharmacia, which gave it control of antiarthritis drug Celebrex. In the 2005 annual report, McKinnell discussed his decision to keep Celebrex on the market with black box health warnings. In the 2006 annual report, Kindler, who replaced McKinnell as Pfizers CEO in July that year, wrote his first letter to shareholders. This was a difficult letter. Notwithstanding Pfizers disappointing financial performance, McKinnell had retired with a compensation package of almost $200 million, triggering protests from the media, public interests groups, and shareholders. And In February 2009, Pfizer had agreed to acquire Wyeth for $68 billionan acquisition aimed at building both Pfizers pipeline and shareholder value.

III. Analysis of 2000 Annual Report Several years earlier, Pfizer made a deal to co-market Lipitor, a blockbuster new anticholesterol drug developed by Warner-Lambert. Lipitor played a crucial role in Pfizers progression from a small chemicals company to a global pharmaceutical powerhouse. Pfizer reaped 40% of Lipitor profits and Lipitors sales estimated would pass $10 billion. In November 1999, American Home Products announced $72 billion merger with WarnerLambert. Pfizer immediately countered with a higher offer and after months of intense negotiation Pfizer prevailed with an acquisition price of $90 billion. The New York Times called it one of the drug industrys nastiest takeover battles.

Why did Pfizer acquire Warner-Lambert?

When American Home Products announced $72 billion merger with Warner-Lambert, Pfizers revenue from Lipitor was threatened. According to analysts statements Pfizer immediately acquired Warner-Lambert mainly for the cholesterol-lowering drug Lipitor, which went on to become the world's best-selling drug. But according to Pfizers judgment, the acqusition will accelerate Pfizers growth and pfizers post-merger pipeline not only benefited from full control of Lipitor, but also from Warner-Lamberts chest of successful consumer products, including well-known brands such as Benadryl, Halls, Listerine, Lubriderm, Schick, Sudafed, and Visine. Pfizer accounted for the Warner-Lambert acquisition using the pooling-of-interests method. But on April 21, 1999, the Financial Accounting Standards Board banned the pooling-of-interests method.

Pfizer achieved total reported revenues of $29.6 billion, representing 8% growth over 1999. Revenue increases becase of sales volume growth of Pfizer in-line products and revenue generated from product alliances. Net income grew 25% to $6.5 billion, excluding certain significant items and merger-related costs.

Pfizers 2000 human pharmaceuticals revenues increased 10% to $24.027 billion, inluding the effects of foreign exchange and the withdrawals. And Pfizers 2000 consumen products increased 1% to $5.547 billion.

Eight of Pfizer products achieved global revenues of at least $1 billion each. The eight billion- dollar productsLipitor, Norvasc, Celebrex, Zoloft, Zithromax, Neurontin, Viagra, and Diflucanrepresent 74% of Pfizers human pharmaceutical revenues. Celebrex, one discovered and developed by Pharmacia and copromoted by Pfizer, remained the number one branded antiarthritic medicine in the world. But still, Lipitor remained the largest-selling medication in the world for cholesterol reduction with 2000 sales exceeding $5 billion.

In 2000, Pfizer invested $4.4 billion in research and development, and this year Pfizer expected to boost that total to approximately $5 billionmore than any other company in any industry.

Eventhough 2000 was the worst year for stocks since 1981, Pfizer ended the year with a market capitalization of $290 billion, representing a 44% increase over 1999.

Pfizer accounted for the Warner-Lambert acquisition using the pooling-of-interests method. It would be much different with the more common purchase method. Pfizer would have been required to record the full purchase price of $90 billion as an asset and charge the excess of purchase price over assets acquired (goodwill) as an expense in future accounting periods. By avoiding goodwill write-downs, the pooling method would allow Pfizer to show higher profits in future years. In addition, return-on-asset and return-on-equity ratios would be calculated with a deflated denominator. Net Income/Shareholders Equity $3.726 billion/$16.076 billion 24,8% Net Income/Total Asset $3.726 billion/$33.150 billion 11,11%

Return On Equity

= = =

Return On Asset

= = =

Some analysts expressed concern on Pfizers Warner-Lambert acqusition. They said while the merger will allow Pfizer to extend its high-growth period, adding Warner-Lambert has done little to address the underlying pipeline concerns.

Das könnte Ihnen auch gefallen

- Pfizer's Global Strategy and Future GrowthDokument3 SeitenPfizer's Global Strategy and Future GrowthSajid Ali MaariNoch keine Bewertungen

- Pfizer SWOT FullDokument2 SeitenPfizer SWOT FullRachelNoch keine Bewertungen

- Pfizer Business Report - Aileen MarshallDokument28 SeitenPfizer Business Report - Aileen MarshallAileen100% (1)

- Pfizer Case AnalysisDokument113 SeitenPfizer Case Analysisermin0867% (6)

- Pfizer's Strategic Plan to Recover from Declining RevenuesDokument56 SeitenPfizer's Strategic Plan to Recover from Declining Revenuesinzebat khalid75% (8)

- PFIZERDokument40 SeitenPFIZERAkshay Nahar100% (1)

- Pfizer Case AnalysisDokument56 SeitenPfizer Case Analysisermin0891% (57)

- Pfizer India Distribution ChannelsDokument15 SeitenPfizer India Distribution ChannelsRudro MukherjeeNoch keine Bewertungen

- Pfizer - Robin Business SchoolDokument20 SeitenPfizer - Robin Business SchoolMade Wikananda Supartha100% (1)

- Strat Analysis Report PfizerDokument46 SeitenStrat Analysis Report PfizerLaura GmlNoch keine Bewertungen

- PfizerDokument18 SeitenPfizerCamen E. Bristena50% (2)

- Pfizer Case StudyDokument10 SeitenPfizer Case Studysb73_617100% (1)

- Pfizer Case FinalDokument13 SeitenPfizer Case FinalMartin MulvihillNoch keine Bewertungen

- Pfizer Strategic PlanDokument15 SeitenPfizer Strategic Plans4sabrin100% (1)

- An Introduction To Pfizer: 1. Pfizer Global Research & Development - PGRDDokument67 SeitenAn Introduction To Pfizer: 1. Pfizer Global Research & Development - PGRDsarahzaidia50% (2)

- Case Study Pfizer 4Dokument17 SeitenCase Study Pfizer 4Veba ReksadirajaNoch keine Bewertungen

- Strategic Audit of PfizerDokument6 SeitenStrategic Audit of PfizerKairos Le50% (2)

- Strama2 Case 1 PFIZERDokument23 SeitenStrama2 Case 1 PFIZERAdonis PajarilloNoch keine Bewertungen

- 03 Krispy KremeDokument14 Seiten03 Krispy Kreme84112213Noch keine Bewertungen

- Pfizer's Strategic Management Case AnalysisDokument8 SeitenPfizer's Strategic Management Case AnalysisRosalie RodelasNoch keine Bewertungen

- Pfizer Wyeth Case StudyDokument23 SeitenPfizer Wyeth Case StudyNilesh Kakadiya100% (2)

- Mergers and acquisitions drive pharmaceutical industry consolidationDokument27 SeitenMergers and acquisitions drive pharmaceutical industry consolidationtito khanNoch keine Bewertungen

- Pfizer Inc.: Syed Owais MohiuddinDokument22 SeitenPfizer Inc.: Syed Owais MohiuddinSyed Owais MohiuddinNoch keine Bewertungen

- Recomendations Report PfizerDokument14 SeitenRecomendations Report PfizerMartin Bammes100% (1)

- Pfizer and Lilly Case StudyDokument35 SeitenPfizer and Lilly Case StudyAbdul Hameed Khan100% (2)

- Assignment On Pfizer: Submitted To: Shahnawaz Adil by Group MembersDokument14 SeitenAssignment On Pfizer: Submitted To: Shahnawaz Adil by Group MembersJahanzaib SheikhNoch keine Bewertungen

- Pfizer SWOTDokument61 SeitenPfizer SWOTFarhan AmeenNoch keine Bewertungen

- STRAMADokument58 SeitenSTRAMAKaithe Wenceslao100% (4)

- Comprehensive Exam Case Analysis Lester Limheya FinalDokument36 SeitenComprehensive Exam Case Analysis Lester Limheya FinalXXXXXXXXXXXXXXXXXXNoch keine Bewertungen

- Global Pharmaceutical Industry-OverviewDokument6 SeitenGlobal Pharmaceutical Industry-OverviewNaveen Reddy50% (4)

- PfizerDokument10 SeitenPfizerCamilleNoch keine Bewertungen

- Analysis of Pfizer-Hospira and Facebook-WhatsApp AcquisitionsDokument35 SeitenAnalysis of Pfizer-Hospira and Facebook-WhatsApp Acquisitionsমোঃ মাসুদNoch keine Bewertungen

- Pfizer Strategy ReportDokument33 SeitenPfizer Strategy Reportdhitinanavati100% (1)

- Case 14 Yahoo!Dokument17 SeitenCase 14 Yahoo!Kad Saad100% (1)

- Competitive Intelligence - An Overview: What Is Ci?Dokument14 SeitenCompetitive Intelligence - An Overview: What Is Ci?Hector OliverNoch keine Bewertungen

- Stage One (Where Are We Now?) : A. Environment AuditDokument59 SeitenStage One (Where Are We Now?) : A. Environment AuditmzakifNoch keine Bewertungen

- 23 DrPepperDokument12 Seiten23 DrPeppermialoves160579Noch keine Bewertungen

- Master in Business Administration Managerial Economics Case StudyDokument7 SeitenMaster in Business Administration Managerial Economics Case Studyrj carrera100% (1)

- Pfizer MarketingDokument28 SeitenPfizer MarketingAbhishek Jaiswal75% (16)

- Nike Case Study Analysis: by Ahmed Samir Haitham Salah Magdy Essmat Magdy Mohamed SherifDokument23 SeitenNike Case Study Analysis: by Ahmed Samir Haitham Salah Magdy Essmat Magdy Mohamed SherifZin Min HtetNoch keine Bewertungen

- Hershey Case StudyDokument16 SeitenHershey Case StudyJad FakhryNoch keine Bewertungen

- PfizerDokument5 SeitenPfizerrizvimurad100% (1)

- Case Study 1 - Fall 2020Dokument2 SeitenCase Study 1 - Fall 2020Gianna DeMarcoNoch keine Bewertungen

- Johnson & JohnsonDokument20 SeitenJohnson & JohnsonHarsh Sharma50% (2)

- Team 7 PfizerDokument27 SeitenTeam 7 PfizerSrinath Smart100% (3)

- Nike CaseDokument19 SeitenNike CaseKashif E. Smiley-Clark100% (1)

- Market Analysis Techniques 3CsDokument3 SeitenMarket Analysis Techniques 3CsaffanNoch keine Bewertungen

- Pfizer Inc.: United States Securities and Exchange CommissionDokument66 SeitenPfizer Inc.: United States Securities and Exchange CommissionAllan SantizoNoch keine Bewertungen

- 23 DrPepperDokument12 Seiten23 DrPeppermskrier0% (1)

- YahooDokument41 SeitenYahooPriya Darshini100% (2)

- Case Study PfizerDokument3 SeitenCase Study PfizerpeeihNoch keine Bewertungen

- David Sm15 Case Im 18Dokument17 SeitenDavid Sm15 Case Im 18Mia100% (1)

- Presentation 2Dokument18 SeitenPresentation 2ritikarrsNoch keine Bewertungen

- Company and Industry BackgroundDokument4 SeitenCompany and Industry BackgroundVũ SơnNoch keine Bewertungen

- Pfizer 1Dokument23 SeitenPfizer 1Anuraag sainiNoch keine Bewertungen

- Raj Sekhar PfizerDokument53 SeitenRaj Sekhar PfizerRaj Sekhar67% (3)

- Abbot Internship ReportDokument35 SeitenAbbot Internship Reportroohan Adeel100% (1)

- Pfizer ThesisDokument9 SeitenPfizer Thesisicatryhig100% (2)

- PFIZER INC - Group ProjectDokument5 SeitenPFIZER INC - Group ProjectJack TraderNoch keine Bewertungen

- Abbott India LimitedDokument21 SeitenAbbott India LimitedCharan Raj100% (1)

- Financial 2012 PfizerDokument121 SeitenFinancial 2012 PfizerCynthia Jayanti Sarosa PuteraNoch keine Bewertungen

- Item Purchase Method Pooling of Interests MethodDokument1 SeiteItem Purchase Method Pooling of Interests MethodCynthia Jayanti Sarosa PuteraNoch keine Bewertungen

- Pfizer 2001 ArDokument68 SeitenPfizer 2001 ArCynthia Jayanti Sarosa PuteraNoch keine Bewertungen

- Pfizer 00 ArDokument76 SeitenPfizer 00 ArCynthia Jayanti Sarosa PuteraNoch keine Bewertungen

- New Prescription For Drug Makers - Update The Plants - WSJDokument5 SeitenNew Prescription For Drug Makers - Update The Plants - WSJStacy Kelly100% (1)

- General Information: Price List/Terms of Sale/Return Goods PolicyDokument6 SeitenGeneral Information: Price List/Terms of Sale/Return Goods PolicyReno Gazette JournalNoch keine Bewertungen

- Resume of Sangeetha RadhakrishnanDokument9 SeitenResume of Sangeetha Radhakrishnansangee_radharishnanNoch keine Bewertungen

- Culture InsightDokument20 SeitenCulture InsightAvik Kundu100% (1)

- Medications Guide with Brand and Generic NamesDokument18 SeitenMedications Guide with Brand and Generic NamesDany DidiNoch keine Bewertungen

- Baixareu - Odeio - Cozinhar - 384730.zip - Uploadbox - SpaceDokument8 SeitenBaixareu - Odeio - Cozinhar - 384730.zip - Uploadbox - SpaceJamile NascimentoNoch keine Bewertungen

- Pfizer Case Study: Accelerating New Hire Training To Increase Sales and ProductivityDokument2 SeitenPfizer Case Study: Accelerating New Hire Training To Increase Sales and ProductivitySumTotal Talent ManagementNoch keine Bewertungen

- Pharma Industry For Beginners Deutsche BankDokument327 SeitenPharma Industry For Beginners Deutsche BankSiddharth Tiwari0% (1)

- Rekam MedikDokument4 SeitenRekam MedikRusmin NoryadinNoch keine Bewertungen

- Strategic Audit of PfizerDokument6 SeitenStrategic Audit of PfizerKairos Le50% (2)

- Pfizer PortfolioDokument16 SeitenPfizer PortfolioPriyanka NNoch keine Bewertungen

- Abdullahi V Pfizer Inc PDFDokument44 SeitenAbdullahi V Pfizer Inc PDFBevs DomingoNoch keine Bewertungen

- Strama 1Dokument13 SeitenStrama 1Rebecacel PalattaoNoch keine Bewertungen

- Liste Des Medicaments Classes en V e I Couverts Par Le Regime de Base23-08-2021Dokument178 SeitenListe Des Medicaments Classes en V e I Couverts Par Le Regime de Base23-08-2021Elayeb MaherNoch keine Bewertungen

- CAO Pfizer FinalDokument53 SeitenCAO Pfizer Finalsubhalaxmi nathNoch keine Bewertungen

- Lions Club vaccinates 25 childrenDokument1 SeiteLions Club vaccinates 25 childrenDhaniel PactolNoch keine Bewertungen

- Cityam 2012-04-24Dokument32 SeitenCityam 2012-04-24City A.M.Noch keine Bewertungen

- 1Dokument2 Seiten1rishiNoch keine Bewertungen

- PfizerDokument10 SeitenPfizerNayan ShuklaNoch keine Bewertungen

- OCRPfizer 1 RedactedDokument46 SeitenOCRPfizer 1 RedactedJamie WhiteNoch keine Bewertungen

- Mefenamic Acid / AsmefDokument9 SeitenMefenamic Acid / AsmefaydhoooNoch keine Bewertungen

- Stok ObatDokument2 SeitenStok Obatsanty daraNoch keine Bewertungen

- Pfizer MLSDokument2 SeitenPfizer MLSbrazil213Noch keine Bewertungen

- Company and Industry BackgroundDokument4 SeitenCompany and Industry BackgroundVũ SơnNoch keine Bewertungen

- Register Ibu Nifas 2017Dokument6 SeitenRegister Ibu Nifas 2017jkn rsiampNoch keine Bewertungen

- 2022 VaccineInjuryTreatmentGuide 4-29-22 FINALDokument26 Seiten2022 VaccineInjuryTreatmentGuide 4-29-22 FINALYonathan Rojas100% (1)

- QuestionnaireDokument2 SeitenQuestionnaireapi-2448395740% (1)

- Managing Subsidiary Divestment Through Time-Puerto Rico's Pharmaceutical Industry Experience 1960-2016Dokument34 SeitenManaging Subsidiary Divestment Through Time-Puerto Rico's Pharmaceutical Industry Experience 1960-2016Brave ExviusNoch keine Bewertungen

- VisionDokument5 SeitenVisionArlynNoch keine Bewertungen

- Accenture A Strategy For Focused GrowthDokument16 SeitenAccenture A Strategy For Focused GrowthSayan DasNoch keine Bewertungen