Beruflich Dokumente

Kultur Dokumente

Accounting For Leases Notes

Hochgeladen von

DominickdadOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting For Leases Notes

Hochgeladen von

DominickdadCopyright:

Verfügbare Formate

The standard for accounting for leases is found in FASB 13.

Key Definitions in Leasing

The lessor is the one who owns the property (examples: medical equipment, computer equipment, manufacturing equipment, or real estate) being leased out. The lessor receives the rent. (One easy way to remember which is which: Owner = LessOr!) The lessee is the one who is using the property and pays the rent. The residual value represents an estimate of what the property being leased will be worth at the end of the lease term. This is a key concept in leasing and in lease accounting. Reflect on how the residual value will vary depending on whether an asset being leased quickly becomes obsolete (like computer hardware does) or retains much of its value over time, or even ends up appreciating, such as real estate. The lessor's implicit interest rate is the rate of return that the lessor uses in computing the rent that it will be charging over the lease term. The lessee's incremental borrowing rate is the interest rate that the lessee would be required to pay over the lease term if it obtained outside financing of the property being leased.

Accounting Possibilities to the Lessee and to the Lessor The lessee has two accounting possibilities. 1. Under operating lease accounting, the lessee books neither the equipment leased nor a debt obligation. The lessee just records the rent paid as rental expense on its income statement. There is one interesting twist here. The FASB requires the rent expense to be booked over the lease period based upon the benefit derived from the use of the asset being leased. In practice, this usually means the same amount of rent expense being recorded each year over the lease term, even though the rent paid is in uneven amounts (usually stepped up) over the lease term. 2. Under capital lease accounting, at the inception of the lease, the lessee records both an asset and a debt (liability) on its balance sheet, just as if it had purchased the equipment. Thus the balance sheet is grossed up. On the lessee's income statement, there is no rental expense; however, the interest portion of the rental payments is booked as interest expense in the income statement. The principal portion of the rental payment is recorded as a reduction of the lease debt on the balance sheet. Further, the equipment is depreciated by the lessee and thus the income statement also includes a depreciation expense charge. (This is very similar to recording a mortgage payment.) The lessor has three accounting possibilities. 1. Under operating lease accounting, the lessor (who owns the equipment being leased out) records rental income for the lease payments received.

In addition, the equipment is depreciated, and thus the income statement includes a depreciation expense charge. Then on the balance sheet, there is a clear description of assets under operating lease. 2. Under direct financing lease accounting, at the inception of the lease, the lessor switches the hard asset (equipment) on its books to a soft asset (a lease receivable or officially called its "net investment in a direct financing lease"). Its income statement will not show rental income for this lease, but instead will show interest income for the portion of the rental payments received that represent interest. 3. Under sales-type lease accounting, at the inception of the lease, the lessor marks up the hard asset (inventory) and records a gross profit for the excess of sales price over the cost of the inventory. Thus, its income statement includes both sales revenue and cost of goods sold expense. Further, just as in the case of direct financing lease accounting, the income statement will not include rental income but will instead include interest income for the portion of the rental payments received that represent interest. Then on the balance sheet, the lessor would have a lease receivable officially called "net investment in sales-type leases." How to Decide the Proper Lease Accounting The FASB has issued rules for determining the appropriate accounting for leases. The FASB's Group I and Group II lease capitalization criteria are both shown in detail below. The lessee needs to focus on only the Group I capitalization criteria; however, the lessor needs to consider both the Group I and the Group II lease capitalization criteria. The lessee's accounting is straightforwardif the lease meets one or more of the Group I criteria, then the lessee has a capital lease. On the other hand, if the lessee meets none of the Group I criteria, then it has an operating lease. The Group I criteria are evaluated as follows, and only one of them has to be met in order to record a capital lease.

For the lessor, treating a lease as capital requires two steps. Once one of the above Group I criteria has been met, the lessor must meet one of the following Group II criteria. Group II 1. It is reasonably predictable as to the collectibility of the payments required from the lessee. 2. There are no important uncertainties surrounding the amount of unreimbursable costs yet to be incurred by the lessor under the lease. The lessor's performance is also substantially complete or future costs are reasonably predictable. To make sure you have mastered whether the lessee has an operating lease or a capital lease, let's try this one. Noncancelable Lease A: Does not transfer ownership to the lessee Has a purchase option at fair market value Has a lease term of 5 years with the option to lease for another 3 years at market rental rates The economic life of the equipment being leased is 8 years The minimum lease payments are equal to 90% of the value of the equipment being leased Do you think this lease should be capitalized by the lessee? Well, you have to be very careful about the wording, don't you? Clearly, you don't meet Criterion 1. But what about Criteria 2, 3, and 4? You don't meet Criterion 2, because there is no bargain purchase option. On Criterion 3, you want to include only the noncancelable lease life unless there are bargain lease rental periods (which there are not) and thus the lease life would be 5/8 or 62.5% of the economic life of the equipment being leased. Thus,

Criterion 3 is not met. Lastly, Criterion 4 is not met, because the test is on the present value of minimum lease payments, which have to be lower than the minimum lease payments, which are only 90% of the fair value of the property being leased. The end result is that you should have concluded that Lease A is not a capital lease. This exercise is worked through by companies all the time, and there is so much effort placed in the avoidance of lease capitalization by skirting each of the four criteria. Most of the time, the focus is on Criterion 4 because it is the toughest to avoid, because the lessor logically is going to want to get as much rent as it can. The higher the rent in the lease agreement, the higher the present value of minimum lease payments. It could well be that the FASB will eventually revisit FAS 13 and its many subsequent pronouncements on lease accounting. What has happened is that the overwhelming majority of leases have been treated as operating leases by lessee companies by just skirting the lease capitalization rules. (These issues are some of the primary reasons that the FASB and IASB are working to revise lease rules with the convergence project.) The mental gymnastics for determining the proper accounting by the lessor are much more intricate than they are for the lessee. I think a good way to understand how it works is shown in the following illustration, which addresses every possible scenario. Group 1 and 2 Criteria How Many of the Four Group I Criteria Are Met? One or more One or more One or more None How Many of the Two Group II Criteria Are Met? Two Two None or one None, one or two Is Asset Being GAAP Accounting Leased MarkedThat Results? Up? No Yes No or Yes No or Yes Direct Financing Lease Sales-type Lease Operating Lease Operating Lease

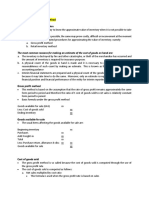

The following example explains the income statement differences to a lessee between a capital lease and an operating lease. Because the interest expense is higher in the earlier years than it is in later years, the total expenses under capital lease are higher than under operating lease in the earlier years; this pattern then reverses in later years. Note that over the entire term of the lease, the total expenses reported on the income statement are the same.

WE-CAN-DO-IT CONSTRUCTION CO. SCHEDULE OF CHARGES TO OPERATIONS OPERATING LEASE VS. CAPITAL LEASE Capital Lease Executory Total Operating Year Interest Costs Depreciation Charges Lease 2011 2012 2013 2014 2015 7,602.84 5,963.86 4,162.08 2,180.32 19,908.10 2,000.00 2,000.00 2,000.00 2,000.00 2,000.00 10,000.00 20,000.00 29,601.84 20,000.00 27,963.86 20,000.00 26,162.08 20,000.00 24,180.32 20,000.00 22,000.00 100,000.00 129,908.10 25,981.62 25,981.62 25,981.62 25,981.62 25,981.62 129,908.10

Difference (3,620.22) (1,982.24) (180.46) 1,801.30 3,981.62 (0.00)

One item that sometimes perplexes learners is the proper handling by the lessee of executory costs such as property tax and insurance on the asset being leased. The key takeaway here is that you must first determine whether the executory costs are being passed through to the lessee and are included in the rent being charged. If so, then the lessee would back them out of the lease payment to determine true rent in deriving its lease amortization schedule. On the other hand, if the lessee pays the executory costs directly to the outside party, then you would not reverse the executory costs from the lease payments because these lease payments are already true rent. For example, rent is $2,500 per month with $500 for taxes and insurance. The true rent would be $2,000 per month. In the above schedule, the executor costs (insurance, taxes, etc.) were in addition to the lease payment. Lessor Accounting for Direct Financing Versus Sales-Type Lease Let's now compare the lessor's accounting for direct financing leases versus sales-type leases. The only difference in the accounting template between direct financing leases and sales-type leases is in the initial entry. In direct financing leases, the lessor has equipment that gets removed from the books and a net investment established (a lease receivable). In sales-type leases, the lessor has inventory that gets sold. Therefore, in sales-type leases, the inventory is written off, sales revenue is recorded, and the resultant gross profit is recognized. And just as was the case in the direct financing lease, a net investment (or lease receivable) is established for the sales-type lease. Below are the skeleton lessor entries at the inception of the lease for direct

financing leases versus sales-type leases. Direct Financing Lease Dr. Lease Receivable Cr. Equipment Sales-Type Lease Dr. Lease Receivable Dr. Cost of Goods Sold Expense Cr. Sales Revenue Cr. Inventory

Interest revenue on the lease receivable will be higher in the earlier years of the lease than it will be in later years because the lease receivable declines as lease payments are received (and interest is computed on a decreasing balance). A lessor using leasing to market its products usually likes to use sales-type lease accounting rather than operating lease accounting. The total income recorded will be the same for all years combined under both methods; however, there will be much higher earnings in the first year under sales-type lease accounting, because the gross profit from sales is front ended at the inception of the lease. IFRS NOTE: Accounting for leases is defined in IAS 17, which is similar to U.S. GAAP except that "bright-line" criteria are not used. IFRS examines the risks and rewards of ownership. Under U.S. GAAP, the amount initially recorded on a capital lease is the present value of the minimum lease payments. IAS 17 requires the lesser of the fair market value or present value of the minimum lease payments.

Das könnte Ihnen auch gefallen

- IFRS 16 Leases: You Might Want To Check That Out HereDokument10 SeitenIFRS 16 Leases: You Might Want To Check That Out HerekoshkoshaNoch keine Bewertungen

- Accounting For LeasesDokument25 SeitenAccounting For LeasesAnna Lin100% (1)

- Accounting Financial: General LedgerDokument8 SeitenAccounting Financial: General LedgerSumeet KaurNoch keine Bewertungen

- Concepts: Introduction To Financial AccountingDokument30 SeitenConcepts: Introduction To Financial Accountingbmurali37Noch keine Bewertungen

- Topic 03 - Double Entry SystemDokument37 SeitenTopic 03 - Double Entry SystemNorainah Abdul GaniNoch keine Bewertungen

- IFRS 9 and Expected Loss Provisioning - Executive Summary: What's Different About Impairment Recognition Under IFRS 9?Dokument2 SeitenIFRS 9 and Expected Loss Provisioning - Executive Summary: What's Different About Impairment Recognition Under IFRS 9?Adrean Ysmael MapanaoNoch keine Bewertungen

- Main 3 - Claveria, Jenny PDFDokument18 SeitenMain 3 - Claveria, Jenny PDFSheena marie ClaveriaNoch keine Bewertungen

- Revenue Cycle ReportDokument15 SeitenRevenue Cycle ReportKevin Lloyd GallardoNoch keine Bewertungen

- Ifrs 16 LeasesDokument33 SeitenIfrs 16 Leasesesulawyer2001100% (1)

- Basics of Accounting 1 IntroductionDokument38 SeitenBasics of Accounting 1 Introductionjiten zopeNoch keine Bewertungen

- IAS 32 Financial InstrumentDokument6 SeitenIAS 32 Financial InstrumentArem CapuliNoch keine Bewertungen

- Basics of Accounting 3 Double Entry Book Keeping RulesDokument44 SeitenBasics of Accounting 3 Double Entry Book Keeping Rulesjiten zopeNoch keine Bewertungen

- Generally Accepted Accounting Principles A Complete Guide - 2020 EditionVon EverandGenerally Accepted Accounting Principles A Complete Guide - 2020 EditionNoch keine Bewertungen

- Financial Accounting TheoryDokument14 SeitenFinancial Accounting TheoryNimalanNoch keine Bewertungen

- Answers R41920 Acctg Varsity Basic Acctg Level 2Dokument12 SeitenAnswers R41920 Acctg Varsity Basic Acctg Level 2John AceNoch keine Bewertungen

- ACCOUNTING FOR CORPORATES (BBBH233) - 001 Module 1 - 1573561029351Dokument66 SeitenACCOUNTING FOR CORPORATES (BBBH233) - 001 Module 1 - 1573561029351Harshit Kumar GuptaNoch keine Bewertungen

- Terminology Balance SheetDokument3 SeitenTerminology Balance SheetMarcel Díaz AdriàNoch keine Bewertungen

- Account PayablesDokument7 SeitenAccount PayablesswamymerguNoch keine Bewertungen

- Accounting BasicsDokument13 SeitenAccounting BasicskameshpatilNoch keine Bewertungen

- IAS 2 - InventoriesDokument16 SeitenIAS 2 - InventoriesletmelearnthisNoch keine Bewertungen

- DepreciationDokument10 SeitenDepreciationsoumibasuNoch keine Bewertungen

- Company Accounts: - in Law, Company' Is Termed As An Entity Which Is Formed andDokument9 SeitenCompany Accounts: - in Law, Company' Is Termed As An Entity Which Is Formed andAnshul BajpaiNoch keine Bewertungen

- Journalizing, Posting and BalancingDokument21 SeitenJournalizing, Posting and Balancinganuradha100% (1)

- Financial Accounting Chapter 3Dokument5 SeitenFinancial Accounting Chapter 3NiraniyaNoch keine Bewertungen

- Corporate Finance Chapter6Dokument20 SeitenCorporate Finance Chapter6Dan688Noch keine Bewertungen

- Wey AP 8e Ch01Dokument47 SeitenWey AP 8e Ch01Bintang RahmadiNoch keine Bewertungen

- Cash and Liquidity Management - Topic 3Dokument47 SeitenCash and Liquidity Management - Topic 3kodeNoch keine Bewertungen

- Financial InstrumentsDokument18 SeitenFinancial InstrumentsAkpomejero EsseogheneNoch keine Bewertungen

- Financial Statements: An OverviewDokument34 SeitenFinancial Statements: An OverviewMUSTAFA KAMAL BIN ABD MUTALIP / BURSAR100% (1)

- True and Fair View of Financial StatementsDokument2 SeitenTrue and Fair View of Financial Statementsbhaibahi0% (1)

- Consolidation GAAPDokument77 SeitenConsolidation GAAPMisganaw DebasNoch keine Bewertungen

- Chapter-3 Managing Cash and Marketable SecuritiesDokument9 SeitenChapter-3 Managing Cash and Marketable SecuritiesSintu TalefeNoch keine Bewertungen

- Ias 12 Income TaxesDokument70 SeitenIas 12 Income Taxeszulfi100% (1)

- Oracle Internet ExpensesDokument12 SeitenOracle Internet ExpensesAli xNoch keine Bewertungen

- Wiley - Chapter 11: Depreciation, Impairments, and DepletionDokument39 SeitenWiley - Chapter 11: Depreciation, Impairments, and DepletionIvan BliminseNoch keine Bewertungen

- Financial InstrumentsDokument29 SeitenFinancial InstrumentsayeshaNoch keine Bewertungen

- Debt (Or Leverage) Management RatiosDokument4 SeitenDebt (Or Leverage) Management RatiosJohn MuemaNoch keine Bewertungen

- Accounting For LeasesDokument3 SeitenAccounting For LeasesAsAd MaanNoch keine Bewertungen

- 10 Depreciation and Income TaxDokument53 Seiten10 Depreciation and Income TaxDyahKuntiSuryaNoch keine Bewertungen

- Legal Environment of BusinessDokument64 SeitenLegal Environment of Businessrohitoberoi11Noch keine Bewertungen

- Financial InstrumentsDokument31 SeitenFinancial InstrumentsP LAVANYANoch keine Bewertungen

- How To Test Solvency With Cash Flow RatiosDokument6 SeitenHow To Test Solvency With Cash Flow RatiospiasoleNoch keine Bewertungen

- Accounting For DepreciationDokument31 SeitenAccounting For DepreciationImran KhanNoch keine Bewertungen

- Underwriting of SecuritiesDokument20 SeitenUnderwriting of Securitiesrahul0105100% (1)

- Generally Accepted Accounting PrinciplesDokument12 SeitenGenerally Accepted Accounting PrinciplesMARIA ANGELICA100% (1)

- Chapter 1: Basics of Insurance: Let's BeginDokument27 SeitenChapter 1: Basics of Insurance: Let's BeginAviNoch keine Bewertungen

- IFRS 9 Theory PDFDokument19 SeitenIFRS 9 Theory PDFAbbas AliNoch keine Bewertungen

- Rules of Debits and CreditsDokument6 SeitenRules of Debits and CreditsJubelle Tacusalme Punzalan100% (1)

- Beginner's Guide To Bonds 1.1-1.4 PDFDokument16 SeitenBeginner's Guide To Bonds 1.1-1.4 PDFAnonymous UserNoch keine Bewertungen

- CS Executive Corporate and Management AccountingDokument17 SeitenCS Executive Corporate and Management AccountingSuraj Srivatsav.SNoch keine Bewertungen

- IAS-1 Presentation of Financial StatementsDokument21 SeitenIAS-1 Presentation of Financial StatementsHafiz Islam aslamNoch keine Bewertungen

- Chapter 8 Dividend Policy and Retained EarningsDokument5 SeitenChapter 8 Dividend Policy and Retained EarningsYut YE50% (2)

- Acc 106 Account ReceivablesDokument40 SeitenAcc 106 Account ReceivablesAmirah NordinNoch keine Bewertungen

- 201.06 Accounting For Insurance Companies (IAS-1, IfRS-4)Dokument6 Seiten201.06 Accounting For Insurance Companies (IAS-1, IfRS-4)Biplob K. SannyasiNoch keine Bewertungen

- Accounting - Basic Accounting: General LedgerDokument10 SeitenAccounting - Basic Accounting: General LedgerEstelarisNoch keine Bewertungen

- Pfrs 7 Financial Instruments DisclosuresDokument3 SeitenPfrs 7 Financial Instruments DisclosuresR.A.Noch keine Bewertungen

- Ifrs 15: Revenue From Contracts With CustomersDokument8 SeitenIfrs 15: Revenue From Contracts With CustomersAira Nhaira MecateNoch keine Bewertungen

- Bond ValuationDokument50 SeitenBond Valuationrenu3rdjanNoch keine Bewertungen

- Generally Accepted Auditing Standards A Complete Guide - 2020 EditionVon EverandGenerally Accepted Auditing Standards A Complete Guide - 2020 EditionNoch keine Bewertungen

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityVon EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNoch keine Bewertungen

- CPA Exam Prep:Bus Envr & Cncpt-Q2Dokument7 SeitenCPA Exam Prep:Bus Envr & Cncpt-Q2DominickdadNoch keine Bewertungen

- Pension Information-ACCT 557Dokument5 SeitenPension Information-ACCT 557DominickdadNoch keine Bewertungen

- AC557 W7 HW Questions AnswersDokument2 SeitenAC557 W7 HW Questions AnswersDominickdadNoch keine Bewertungen

- ACCT557 Week 7 Quiz SolutionsDokument7 SeitenACCT557 Week 7 Quiz SolutionsDominickdad100% (2)

- ACCT-557-Ambrosia Corporation'sDokument2 SeitenACCT-557-Ambrosia Corporation'sDominickdadNoch keine Bewertungen

- ACCT557 Week 5 Quiz-SolutionsDokument4 SeitenACCT557 Week 5 Quiz-SolutionsDominickdad100% (3)

- Acct557 w7 HW DemarcoDokument8 SeitenAcct557 w7 HW DemarcoDominickdadNoch keine Bewertungen

- A2 - Optional Practice QuestionsDokument5 SeitenA2 - Optional Practice QuestionsDominickdadNoch keine Bewertungen

- Acct557 w6 HWDokument6 SeitenAcct557 w6 HWDominickdadNoch keine Bewertungen

- ACCT557 Week 5 Quiz-SolutionsDokument4 SeitenACCT557 Week 5 Quiz-SolutionsDominickdad100% (3)

- AC557 W5 HW Questions/AnswersDokument5 SeitenAC557 W5 HW Questions/AnswersDominickdad100% (3)

- ACCT551 Week 7 Quiz AnswersDokument3 SeitenACCT551 Week 7 Quiz AnswersDominickdad100% (2)

- ACCT551 - Week 7 HomeworkDokument10 SeitenACCT551 - Week 7 HomeworkDominickdadNoch keine Bewertungen

- ACCT557 W2 AnswersDokument5 SeitenACCT557 W2 AnswersDominickdad86% (7)

- Chapter 17 SolutionsDokument4 SeitenChapter 17 SolutionsDominickdadNoch keine Bewertungen

- Questions 1 Running Head: End-of-Chapter QuestionsDokument5 SeitenQuestions 1 Running Head: End-of-Chapter QuestionsDominickdadNoch keine Bewertungen

- Acc505 Quiz 2 ExampleDokument3 SeitenAcc505 Quiz 2 ExampleDominickdad100% (3)

- Questions 1 Running Head: End-of-Chapter QuestionsDokument5 SeitenQuestions 1 Running Head: End-of-Chapter QuestionsDominickdadNoch keine Bewertungen

- FIN515 Week 2 HomeworkDokument3 SeitenFIN515 Week 2 HomeworkDominickdadNoch keine Bewertungen

- Cost QB PDFDokument300 SeitenCost QB PDFHuzaifa Muhammad75% (4)

- Business Intelligence and Inventory A Case Study of Dicks Sporting Goods 29-06-2007Dokument17 SeitenBusiness Intelligence and Inventory A Case Study of Dicks Sporting Goods 29-06-2007posnirohaNoch keine Bewertungen

- Supply Chain Performance ManagementDokument33 SeitenSupply Chain Performance ManagementDebashishDolon100% (1)

- KPMG Advisory Ifrs Production Stripping CostDokument24 SeitenKPMG Advisory Ifrs Production Stripping CostGiovanni De GirolamoNoch keine Bewertungen

- NAS 2 Inventories - UnlockedDokument33 SeitenNAS 2 Inventories - UnlockedAviTvNoch keine Bewertungen

- QuizletDokument6 SeitenQuizletNam LêNoch keine Bewertungen

- Question BankDokument18 SeitenQuestion BankTitus ClementNoch keine Bewertungen

- Accounting Conservatism, The Quality of Earnings, and Stock ReturnsDokument39 SeitenAccounting Conservatism, The Quality of Earnings, and Stock ReturnsN Shraveen RajNoch keine Bewertungen

- Ichapter 6-The Expenditure Cycle Part Ii: Payroll Processing and Fixed Asset ProceduresDokument14 SeitenIchapter 6-The Expenditure Cycle Part Ii: Payroll Processing and Fixed Asset ProceduresJessalyn DaneNoch keine Bewertungen

- Cold Chain Equipment Inventory Data ModelDokument6 SeitenCold Chain Equipment Inventory Data ModelXYZNoch keine Bewertungen

- MY Research ProposalDokument7 SeitenMY Research ProposalAnupa De Silva0% (1)

- A Case Study of Just-In-Time System in Service IndustryDokument5 SeitenA Case Study of Just-In-Time System in Service IndustrylalsinghNoch keine Bewertungen

- Sample Case AnalysisDokument16 SeitenSample Case AnalysisAlthon JayNoch keine Bewertungen

- 2023 Top 10 Field Service Software Systems Report Panorama ConsultingDokument26 Seiten2023 Top 10 Field Service Software Systems Report Panorama Consultingnhiphan.31221023658Noch keine Bewertungen

- Production Planning and Control I PDFDokument25 SeitenProduction Planning and Control I PDFTushar SavdekarNoch keine Bewertungen

- Intermediate-Accounting Handout Chap 13Dokument2 SeitenIntermediate-Accounting Handout Chap 13Joanne Rheena BooNoch keine Bewertungen

- Study Material-Cost Module, GMPDokument15 SeitenStudy Material-Cost Module, GMPBrajesh SinghNoch keine Bewertungen

- Sap Integrated Business Planning Ibp Sap Integrated Business Planning Ibp 3Dokument7 SeitenSap Integrated Business Planning Ibp Sap Integrated Business Planning Ibp 3Narasimha Prasad BhatNoch keine Bewertungen

- Distribution and Replenishment ProcessesDokument3 SeitenDistribution and Replenishment ProcessesSoviljot SinghNoch keine Bewertungen

- Dock Door Shipment Without OTMDokument13 SeitenDock Door Shipment Without OTMArun BalajiNoch keine Bewertungen

- Vidhey Patel ResumeDokument2 SeitenVidhey Patel ResumeadelaideglxNoch keine Bewertungen

- Using System Dynamics in Warehouse Management: A Fast Fashion Case StudyDokument41 SeitenUsing System Dynamics in Warehouse Management: A Fast Fashion Case StudyShubham KhattriNoch keine Bewertungen

- Periodic Inventory System Journal EntriesDokument16 SeitenPeriodic Inventory System Journal EntriesAnonymous 2k0o6az6l50% (2)

- Working Capital Management (A Lecture)Dokument9 SeitenWorking Capital Management (A Lecture)Anupam DeNoch keine Bewertungen

- A Framework For The Design of Warehouse Layout: Mohsen M.D. HassanDokument9 SeitenA Framework For The Design of Warehouse Layout: Mohsen M.D. HassanBangYongGukNoch keine Bewertungen

- Col For ModuleDokument26 SeitenCol For ModuleIfaNoch keine Bewertungen

- CHP 15. Budget Costing - CAPRANAVDokument21 SeitenCHP 15. Budget Costing - CAPRANAVAYUSH RAJNoch keine Bewertungen

- Blcok-5 MCO-7 Unit-4Dokument16 SeitenBlcok-5 MCO-7 Unit-4Tushar SharmaNoch keine Bewertungen

- Supply Sergeant Initial.Dokument6 SeitenSupply Sergeant Initial.Russell D Gordon100% (1)

- AE22 Lesson 4 - Job Order Cost SystemDokument31 SeitenAE22 Lesson 4 - Job Order Cost SystemMama MiyaNoch keine Bewertungen