Beruflich Dokumente

Kultur Dokumente

International Marketing

Hochgeladen von

Chinmayi HegdeOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

International Marketing

Hochgeladen von

Chinmayi HegdeCopyright:

Verfügbare Formate

INTERNATIONAL MARKETING

KIRAN KUMAR C V

UNIT-1 INTERNATIONAL MARKETING MEANING OF EXPORT MANAGEMENT: Export management means managing export marketing activity efficiently, smoothly and in an orderly manner. DEFINITION: According to B. S. Bathor, Export Marketing includes the management of marketing activities for products across the national boundary or a country. NATURE /FEATURES OF EXPORT MANAGEMENT 1. Large scale operations: Export management involves large scale marketing and production operations of goods and services. Because of large scale business operation the firm gets the benefit of economics of scale and increase profit margin. Import, of other counties also prefer in placing large orders. Exporters get advantage of reduce cost and quoting competitive prices in the increase market. 2. Systematic Process: It is a systematic process became the export manager under takes various marketing activities such as marketing research, product design, branding, packaging, pricing, promotion etc. All these aspects require collection of data, analysis of data, then in perpetration of data in order to take systematic export marketing decisions. 3. Three faced Competition: Foreign trade market is highly competitive in nature. The competition is three dimensional i.e. I. Competition from Indian exporters II. Competition from local producers of importing country. III. Competition from exporter of other nations 4. Trade Barriers: Export trade is subject to trade barriers tariff and nontariff barriers. The trade barriers are the restrictions on free movement of goods between countries. Normally countries impose trade barriers in order to restrict import. The export marketing manager must have a good knowledge of trade barriers imposed by importing counties. 5. Domination of MNC: Multinational Corporation has huge investment and conduct business operation all over the world. Major share of foreign trade is captured by MNCs, and TNCs, (Transnational corporations). THE EXPORT CAN BE CLASSIFIED INTO THE FOLLOWING CATEGORIES. 1) Merchandise Exports: Merchandise exports refer to the export of physical goods, for example, readymade garments, engineering goods, furniture, works of art etc. 2) Service Exports: Services exports refers to the export of goods that dont exist in physical form, that is, professional, technical or general services. Examples of the exports would include export of computer softwares, architectural, entertainment or technical consultancy services etc. 3) Project export: refers to establishment of a project by a business firm in another country. The term Project as been defined as non-routine, non-repetitive and one-off undertaking, normally with discrete time, financial and technical performance goals. It is viewed as scientifically evolved work plan devised to achieve a specific objective wi thin a specific period of time. 4) Deemed Exports: Deemed Exports refer to those transactions in which the goods are made in India, by the recipient of the goods. The essential condition is that such goods are manufactured in India. This category of expor t has been introduced by the Export Import Policy of the Government of India. Some of the examples of goods regarded as Deemed Exports, as given in Export-Import Policy (2002-07) are; a) Supply of goods against duty free licenses b) Supply of goods to projects financed by multilateral or bilateral agencies/Funds notified by the Department of Economic Affairs, Ministry of Finance, Government of India. c) Supply of goods to the power, oil and gas including refineries and so on. NEED / IMPORTANCE / ADVANTAGES OF EXPORT MARKETING AT THE NATIONAL LEVEL: 1) Earning foreign exchange Exports bring valuable foreign exchange to the exporting country, which is mainly required to pay for import of capital goods, raw materials, spares and components as well as importing advance technical knowledge. 2) International Relations Almost all countries of the world want to prosper in a peaceful environment. One way to maintain political and cultural ties with other countries is through international trade.

INTERNATIONAL MARKETING

KIRAN KUMAR C V

3) Balance of payment Large scale exports solve balance of payments problem and enable countries to have favourable balance of payment position. The deficit in the balance of trade and balance of payments can be removed through large-scale exports. 4) Reputation in the world A country which is foremost in the field of exports, commands a lot of respect, goodwill and reputation from other countries. For example, Japan commands international reputation due to its high quality products in the export markets. 5) Employment Opportunities Export trade calls for more production. More production opens the doors for more employment. Opportunities, not only in export sector but also in allied sector like banking, insurance etc. 6) Promoting economic development Exports are needed for promoting economic and industrial development. The business grows rapidly if it has access to international markets. Large-sole exports bring rapid economic development of a nation. 7) Optimum Utilization of Resources There can be optimum use of resources. For example, the supply of oil and petroleum products in Gulf countries is in excess of home demand. So the excess production is exported, thereby making optimum use of available resources. 8) Spread Effect Because of the export industry, other sectors also expand such as banking, transport, insurance etc. and at the same time number of ancillary industries comes into existence to support the export sector. 9) Higher standard of Living Export trade calls for more productions, which in turn increase employment opportunities. More employment means more purchasing power, as a result of which people can enjoy new and better goods, which in turn improves standard of living of the people. NEED / IMPORTANCE / ADVANTAGES OF EXPORT MARKETING AT BUSINESS / FIRM / ENTERPRISE LEVEL 1) Reputation An organization which undertakes exports can bring fame to its name not only in the export markets, but also in the home market. For example, firms like Phillips, HLL, Glaxo, Sony, coca cola, Pepsi, enjoy international reputation. 2) Optimum Production A company can export its excess production after meeting domestic demand. Thus, the production can be carried on up to the optimum production capacity. This will result in economies of large scale production. 3) Spreading of Risk A firm engaged in domestic as well as export marketing can spread its marketing risk in two parts. The loss is one part (i.e. in one area of marketing) can be compensated by the profit earned in the other part / area. 4) Export obligation Some export organization are given certain concessions and facilities only when they accept certain export obligations Large-scale exports are needed to honour such export obligations in India, units operating in the SEZs / FTZs are expected to honor such export obligations against special concessions offered to them. 5) Improvement in organizational efficiency- Research, training and the experience in dealing with foreign markets, enable the exporters to improve the overall organizational efficiency. 6) Improvement in product standards -An export firm has to maintain and improve standards in quality in order to meet international standards. As a result, the consumers in the home market as well as in the international market can enjoy better quality of goods. 7) Liberal Imports-Organizations exporting on a large-scale collect more foreign exchange which can be utilized for liberal import of new technology, machinery and components. This raises the competitive capacity of export organizations. 8) Financial and non-Financial benefits: In India, exporters can avail of a number of facilities from the government. For example, exporters can get DBK, tax exemption etc. They also can get assistance from export promotion organizations such as EPCs IIP, etc. 9) Higher profits Exports enable a business enterprise to earn higher prices for goods. If the exporters offer quality products, they can charge higher prices than those charged in the home market and thereby raise the profit margin. FUNCTIONS OF EXPORT MANAGEMENT: 1) To decide export objectives of the organization and prepare comprehensive short term and long term plans and programmes to achieve such objectives.

INTERNATIONAL MARKETING

KIRAN KUMAR C V

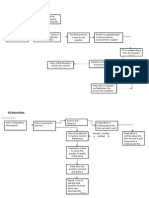

2) To conduct marketing research so that export efforts will be concentrated on certain commodities and on foreign markets which are highly promising. 3) To introduce product development and to produce quality goods as Per specific needs of foreign markets/buyers. 4) To execute long-term export promotion programmes for the Products with promising overseas demand. 5) To fix up the prices of exportable items with proper care. 6) To find out new designs for packaging of export items. 7) To look after the advertising and publicity abroad and to maintain Effective communication with prospective buyers. 8) To look after prompt execution of export orders so as to avoid Inconvenience to foreign buyers. 9) To analyze the EXIM policy of the government and the current Export regulations and procedures. 10) To look after the opening of new branches/offices aboard. 11) To face the challenges of international competition and changing Marketing environment. 12) To evaluate export incentives/facilities offered by the government And to secure benefits from them. 13) To look after the accounting and financial aspects of export Transactions. 14) To look after the training of staff working in the export division, to Motivate them and to develop human relations. EXPORT PROCEDURES- PRELIMINARIES IN BRIEF 1) Organizing The exporter should have an organization to look after exports. Exporters may set up a complete new organization or add on export section to an existing one. At this stage the exporter may take a decision to select the right product sell abroad. 2) Registering with various Authorities The exporter should register his organizations with various authorities. These are as follows. a) Income Tax Authorities to obtain permanent Account Number (PAN). b) Jt. DGFT to obtain Importers exporters code Number (IEC No.) Stage IV Post-shipment Stage Stage II Pre-shipment stage Stage III Shipment Stage EXPORT PROCEDURE Stage I Preliminary Stage c) EPC to obtain Registration cum membership certificate (RCMC) d) Other authorities, such as FIEO, sales Tax authorities, chambers of commerce etc. 3) Appointing Agent / Distributors It is advisable to appoint agents or distributors in the selected overseas markets. The exporter may also open branches or sales divisions or depute permanent representative abroad. 4) Approaching Foreign Buyers The overseas agents / representatives approach foreign buyers with a quotation. The foreign buyer, if satisfied with the quotation and after clarifications, if any, will place an order with the exporter. PRE-SHIPMENT STAGE 1) Confirmation of order When the buyer is satisfied with the terms and conditions of the seller, he will place either a formal or confirmed order along with a signed copy of the contract. The exporter should acknowledge and confirm the receipt of such order. 2) Obtaining Letter of credit Together with the acknowledgement letter confirming the receipt of an export order, the exporter may send a formal request to the importer to open a letter of credit in his favour. 3) Obtaining pre-shipment Finance As soon as the exporter receives a confirmed order and the L/C, he should approach his bank for securing pre-shipment finance to meet his working capital requirements. 4) Obtaining Export License, if necessarys Export control is exercised to a limited extent in India. The problem of obtaining export license arises only in the case of a few controlled items. Otherwise, export business has been declined.

INTERNATIONAL MARKETING

KIRAN KUMAR C V

5) Production and Procurement of goods Soon after securing the pre-shipment advance from bank, the exporter has to arrange for production and procurement of goods for shipment. A manufacturer exporter himself undertakes the entire process of production. 6) Packing and Marketing After procuring the goods meant for export, the exporter has to arrange for proper packing and marking of the goods. Packaging must ensure proper protection of the goods. The packing material171 should be selected after considering the distance to be covered, mode of transportation, types of handling of the goods at ports etc. 7) Pre-shipment Inspection If the export cargo is subject to qualify control and preshipment inspection, the exporter should get in touch with EIA to obtain Inspection certificate. 8) Central Excise Clearance Goods meant for export are exempted from the payment of excise duty. Excise clearance is obtained by two methods a)Export Under Rebate and b) Export Under Bond. 9) ECGC cover The exporter must take appropriate policy to protect him from credit risk. 10) Marine Insurance policy In order to protect the cargo from perils on high sea, the exporter has to obtain marine insurance policy. Payment of insurance premium depends on the type of price quotation accepted by the importer. 11) Appointment of clearing and Forwarding Agent It is always advisable to appoint C & F agent to look after forwarding work which includes booking of shipping space, preparing and submitting various documents to customs. SHIPMENT STAGE 1) Reservation of space in the ship The exporter has to contact the shipping company well in advance for booking the required space in the vessel for shipment of his consignment. He has to provide necessary information as regards date of shipment, gross and net weight of each package, particulars of the importer and that of his own, arrival and departure date of the vessel etc. when shipping company accepts the exporters request, the company or its agent issues ship ping order. 2) Preparation and processing of shipping documents When goods reach the port of shipment, the exporter has to arrange for preparation of a complete set of documents to be passed on to the forwarding agent. 3) Physical Examination of goods at the port The C & F agent obtains the carting order from the Port Trust to Cart the goods inside the docks. He then approaches the172 custom Examiner, who may physically inspect the goods. The custom Examiner then given Let Export order. 4) Loading of goods The duplicate copy of shipping bill which is endorsed by the custom Examiner is handed over to the custom preventive officer, who endorses it with Let ship order. The goods are then loaded on board the ship, for which Mates Receipt is issued by the mate of the ship. The Mates Receipt is handed over to the shipping company to obtain Bill of Lading. POST-SHIPMENT STAGE 1) Dispatch of Documents Dispatch of documents by C & F Agent to the exporter the details and the mode of dispatch of the shipping documents are specified in the L/C. negotiating, in this sense, implies mailing of dispatching a set of documents to ensure that the importer or his agent receives the same in time so that he can delivery of the exported goods. 2) Shipmen advice to importer After the shipment of goods, the exporter has to send suitable intimation to the importer for his information. By this intimation, the date of shipment, the name of the vessel, date on which the goods will reach the destination should be informed to the importer. A copy of non-negotiable bill of lading is also sent for information. The importer gets the remaining documents through his bank. 3) Presentation of Documents to the Bank A complete set of documents is submitted by the exporter to his bank for the purpose of negotiating the same and obtaining export proceeds in time. The bank then sends the same documents to the exporter. 4) Realization of export proceeds The exporter then proceeds to claim export incentives on the basis of bank certificate. The bank certificate gives description of he product, its value, the rate of conversion, the details of invoice etc. The exporter is entitled to various incentives such as IPRS, DBK and other incentives, it applicable. 5) Follow-up of Export sales A good exporter should always have a follow-up after sales i.e. he should provide necessary after sale service, find out buyers opinion towards the product and so an, which will help to generate more sales in the international market.

INTERNATIONAL MARKETING

KIRAN KUMAR C V

GOODS SHIPMENT PROCEDURE 1) Submission of Documents For customs clearance of cargo, the exporter or his agent has to submit five copies of shipping bill along with necessary documents such as Letter of credit or confirmed export order. Commercial invoice. Packing list. Certificate of origin. G. R. Form ARE -1 Form. Original copy of certification inspection.(Wherever necessary) Marine insurance policy. 2) Verification of documents The customs appraiser verifies the details mentioned in each document and ensures that all formalities have been complied with by the exporter. It satisfied; he issues A Shipping Bill Number which is very important from the exporters point of view. 3) Carting order The custom house agent of the exporter approaches the superintendent of the concerned port trust for obtaining a carting order. After obtaining the carting order, the cargo is physically moved inside the docks, which is basically the permission to move cargo inside the docks. The carting order is issued by means of an endorsement on the duplicate copy of the shipping bill. 4) Storing the goods in the sheds After securing the carting order, the goods are moved inside the docks. The goods are then stored in the sheds at the docks. PRINCIPAL EXPORT DOCUMENTS. 1. Commercial Invoice, 2. Packing List , 3. Marine Insurance Policy/Certificate ,4. Bill of Exchange , 5. Letter of Credit 6. Bill of Lading ,7. Airway Bill , 8. Combined Transport Document , 9. GR/PPNPP/COD/SOFTEX Forms 10. Export Inspection Certificate ,11. AR4/AR5 Forms ,12. Shipping Bill,13. Certificate of Origin ,14. Shipment Advice , 15. Consular Invoice

INTERNATIONAL MARKETING

KIRAN KUMAR C V

Unit-2 INTERNATIONAL MARKETING ENVIRONMENT AND MARKETING STRATEGY ACCORDING TO THE AMERICAN MARKETING ASSOCIATION (AMA) "international marketing is the multinational process of planning and executing the conception, pricing, promotion and distribution of ideas, goods, and services to create exchanges that satisfy individual and organizational objectives." INTERNATIONAL MARKETING is the performance of business activities designed to plan, price, promote, and direct the flow of companys goods & services to consumers in more than one nation for profit. SOCIAL AND CULTURAL ENVIRONMENT:- The biggest environment is the social environment because business is carried on by the people (businessmen), for the people(consumers) ,and through the people (executives and workers). Social and cultural factors in various countries of the globe which affect the international business environment are :Attitude of the consumers and management; Changes in the population pattern. Influence of religion and tradition. Spread of education and its quality. Role of social and cultural institutions. General standard of living. TECHNOLOGICAL ENVIRONMENT:- Nothing ever is permanent except change. Technological improvement brings about new techniques of production, new products, automation and modernization. Technology changes rapidly and the firm, which cannot adjust to such a changing technological environment, may not survive. The technological environment consists of:State of indigenous technology. Intermediate or appropriate technology. Transfer of technology. Technological collaborations. Policy and legal framework for research and development. Fiscal incentive for research and development. These technological changes enabled international businessto take the shape of multinational and tr ansnational business ECONOMIC ENVIRONMENT:- International business is mainly affected by the economic policies adopted by the governments of various countries. The global economic environment has become favorable due to the establishment of the WTO and emergence of the global market. The changes in the international economic environment have been revolutionary after 1990. The following factors determine international economic environment:Type of economic system adopted by the country. Continuous growth in quality and quantity of industrialoutput. Liberal and progressive policies of government. Rising levels of income and employment. Just and equitable distribution of wealth in theeconomy. Check over monopolies. POLITICAL ENVIRONMENT:- Change in the government policies or government itself, many times bring about practical difficulties in carrying on business operations. Sometimes, the government takes over some key units inthe interest of the nation. Political environment in the country is created by the following factors :-Political system accepted by the country, viz., capitalism orsocialism. Existence of political parties, i.e., dual party or multi partysystem. Parties in power, i.e., ideologies and policies of thegovernment. Legislative and judiciary systems. External affairs and relationship. INTERNATIONAL ENVIRONMENT:- International marketing environment is also affected by the international environment. The factors which make up the international environment are :International socio-economic and political changes. Contribution of foreign capital. Import and export trade. Functioning of multinationals and transnationals. International trade cycles. International relations and agreements. War and peace conditions. LEGAL ENVIRONMENT: - In every economy, whether socialistic or capitalistic, private sector is subject to government control. Government controls the functioning of private sector through its various policies and legislation. The factors which determine regulatory environment are :-

INTERNATIONAL MARKETING

KIRAN KUMAR C V

Industrial planning and policies. Tax structure and subsidies. Import controls, tariff and duties. Licensing system. Policy regarding Foreign Direct Investment (FDI). Policy decisions on joint ventures and foreign collaborations ECOLOGICAL ENVIRONMENT :- Ecological degradation and its protection have become a major issue in most of the developed and developing countries of the world. In order to protect our precious environment, series of acts and regulations have .been made by the government. These acts and regulations also affect the international marketing: environment. MARKET ENTRY STRATEGIES. Management emphasis Focus Marketing strategy Structure Management style Manufacturing stance Investment policy Performance evaluation Stage one Domestic Domestic Domestic Domestic Domestic Mainly domestic Domestic Domestic market share Stage two International Ethnocentric Extension International Centralized top down Mainly domestic Domestic used worldwide Against home country market share Stage three Multinational Polycentric Adaption Worldwide area Decentralized bottom up Host country Mainly in each host country Each host country market share Stage four Global Geocentric Extension Adaption creation matrix/mixed Integrated Lowest cost worldwide Cross subsidization Worldwide

INTERNATIONAL MARKETING

KIRAN KUMAR C V

UNIT-3 EXPORT PRICING EXPORT PRICING: The right pricing and the way you provide quotes for your goods or services are both crucial for a successful and ongoing export business. OBJECTIVES: (i)Market Penetration: Market penetration may be a very important objective, particularly for new exporters.A firm may attempt to penetrate the market with a low price. (ii)Market Share: The price may be manipulated to increase the market share. (iii) Market Skimming: This is often the case with innovative products. The product is introduced with a high initial price to skim the cream of the market. The price may be subsequently reduced to achieve greater market penetration. (iv)Fighting Competition: Sometimes price is a tool to fight competition. A price reduction by the competitor may have to be countered by price cuts. Sometimes price cuts may be affected to discipline the competitor or to compel the competitor to reduce prices so that his cash flows will be affected. (v)Preventing New Entry: A firm may charge a low price even when there is scope for high price so that the industry does not look very attractive to new entrants. (vi)Shorten Pay-back Period: When the market is uncertain and risky because of factors like swift technological changes, short product life cycles, political reasons, threat of potential competition etc., recouping the investment as early as possible would be an important objective. (vii)Early Cash Recovery: A firm with liquidity problem might give priority to generate a better cash flow. Hence, it would adopt a pricing that might help it to liquidate the stock and/or encourage prompt payment by the channel members or buyers. (viii) Meeting Export Obligation: A company with specific export obligation may becompelled to adopt a pricing policy that enables it to discharge its export obligation. Sometimes it may even imply a price lower than the cost. (ix)Disposal of Surplus: A company confronted with a surplus stock may resort to exporting to dispose of the surplus. (x) Optimum Capacity Utilization: Exporting is sometimes resorted to enable the firm to achieve optimum capacity utilization so as to minimize the unit cost of production. In such a case, achieving the required quantity of exports could be the objective of export pricing. (xi)Return on Investment: Achieving the target rate of return is the most important pricing objective in a number of cases. (xii) Profit Maximization: In many cases, the primary pricing objective is maximization of profits. IMPORTANCE: A)FROM VIEW POINT OF NATION 1)Foreign exchange: Export bring valuable foreign exchange to the exporting country which is mainly required to pay for import of capital goods raw material spares and components , also foreign exchange is required to pay for the import of techniques how and service external debts 2) International relation All countries of the world want to proposer in a peace full environment, one way to maintain political and cultural .it make relation with other countries is through international trade 3) Balance of payment-A country external economic strength depends upon its balance of payments position. Since export brings foreign exchange, it helps a country to solve and improve its balance of payments position. 4) Reputation in the world A country which Is fore most in the fields of export, commands a lot of respect, goodwill and reputation from other countries for instance, Japan commands international reputation due to its high quality product and in the export markets. 5) Employment Opportunities: Export trade calls for more production more production opens the doors for more employment opportunities not only in the export sectors but also in allied sectors like banking, insurance etc.

INTERNATIONAL MARKETING

KIRAN KUMAR C V

6) Financing of development plans: Export earnings can be a source of financing development plans through the import of capital goods and sophisticated technology, thus the foreign exchange generated through exports can be utilized for planned economic development of the country. 7) Research and development: There is a continuous pressure on the export industry to improve technology and production system to retain its competitive edge in foreign markets. The fruits of Rs D would benefit the consumers not only in the overseas markets but also in the domestic market. 8) Optimum utilization of resources: A country which passes a abundant resources in form of Raw Material or finished goods in exports of domestic requirements can be effectively export as much as there can be optimum use of resources. 9) Spread effect: Because of export industry , other sectors also expands such as banking, transport, insurance, consultancies at the same number of ancillary industry come into existence to support the export sector 10) Higher Stander of living: Export trade calls for more production which in turn increases thus employment opportunities. More employment means more power as results of which people can enjoy better goods, which in turn improve standard of living of people B) FROM VIEW POINT OF BUSINESS ORGANIZATION 1) Reputation: A business organization which undertakes export business can bring from to its name not only in the export market and but also in the home market i.e Sony , Glaxo, Tata etc . enjoy international reputation . 2) Optimum Production : It may be possible that the demand for a company s product falls short of its optimum production capacity in the home country however the company can exported its excess production there by the production can be carried on up to the optimum production capacity and the company benefited from the economies of large scale production . 3) Spreading of risk : When a business organization face depression in the domestic market (low demand) it will be naturally suffer losses .However the company can spread its risk of losses by selling products of good price in the export market . 4) Export Obligation: Certain company need to import machinery and other requirement to compensate for imports the government of India, has imposed compulsory export obligation so as to narrow down the gap between rising imports and slowing moving export. Therefore such companies need to export to honor export obligation imposed on them. 5) Keeping alive old brand: A product brand may have reached the stage of declined in the home market but the same product may have good demand in the foreign market so in that case the exporters would benefits by exports. 6) Improvement in organization efficiency: Export marketing requires consent improvement in skills and technique not only in marketing aspects, but also production aspects thus research, training and experiences in dealing with foreign market unable the export to improve the overall organization efficiencies . 7) Improvement in product standards: An export firm has to maintain and improve standards in quality unable to international standards as a result of which consumer in the home market as well as in the international market can better quality of goods. 8) Liberal imports: Export organization can import capital goods spares components and raw materials liberally against export obligation .Such import not only improve the quality of goods produced but also lower down the cost of production. 9) Higher prices: Export can fetch higher prices as compared to domestic markets for instance, prices of old and petroleum product in the home markets of gulf countries are comparatively less than what they earn from the foreign markets, and as a result of this exporters can earn higher profits. 10) Financial and non financial benefits: India exporters can avail of a number of facilities from the government and from banks to enhance exports

INTERNATIONAL MARKETING

KIRAN KUMAR C V

TERMS OF PAYMENT

METHODS OF PRICING EXPORT FINANCE Flexible pricing adjusting prices for different types of customers. Full cost-based pricing covering both fixed and variable costs of the export sale. Marginal cost covering only the variable costs of production and exporting, while you pay overhead and other fixed costs out of domestic sales. Penetration pricing keeping your price low to attract more customers, discourage competitors and gain quick market share. Market skimming pricing the product high to make optimum profit among high-end consumers while there is little competition. Pre-Export Finance: Pre Shipment Finance is issued by a financial institution when the seller want the payment of the goods before shipment. The main objectives behind pre shipment finance or pre export finance is to enable exporter to: Procure raw materials. Carry out manufacturing process. Provide a secure warehouse for goods and raw materials. Process and pack the goods. Ship the goods to the buyers. Meet other financial cost of the business. Export Post Shipment Finance. Post Shipment Finance is a kind of loan provided by a financial institution to an exporter or seller against a shipment that has already been made. This type of export finance is granted from the date of extending the credit after shipment of the goods to the realization date of the exporter proceeds. Exporters dont wait for the importer to d eposit the funds. TYPES OF POST SHIPMENT FINANCE 1. Export Bills purchased/discounted. 2. Export Bills negotiated 3. Advance against export bills sent on collection basis. 4. Advance against export on consignment basis 5. Advance against undrawn balance on exports 6. Advance against claims of Duty Drawback.

10

INTERNATIONAL MARKETING

KIRAN KUMAR C V

EXIM BANKThe EXIM Bank was set up in January 1982 with the main object of giving a boost to the countrys export promotion drive and to pay for the increased imports. It took over the operations of the International Finance Wing of the IDBI. It acts as the apex agency in coordinating the activities of the other institutions engages in the financing of exports and imports of goods and services. OBJECTIVES: Provision of financial technical and administrative assistance in the export import sectors; planning promotion development and financing of export oriented concerns; undertaking and financing research surveys and techno economic studies in connection with the promotion and development of foreign trade; Collection compilation and dissemination of market and credit information in respect of international trade. FUNCTIONS: 1. Provision of financial for the export and import of goods and servic es not only of India but also of third world countries. 2. provision of financial help for the exports and imports of machinery and equipment on lease basis; 3. Provision of financial help for facilitating joint ventures in foreign countries. 4. undertaking of limited merchant banking activities such as underwriting of stocks shares debentures etc of companies engaged in the export import sectors; 5. Provision of financial technical and administrative assistance to parties engaged in the export - import sectors. EXPORT CREDIT GUARANTEE CORPORATION OF INDIA LIMITED (ECGC) The Export Credit Guarantee Corporation of India Limited (ECGC) is a company wholly owned by the Government of India based in Mumbai, Maharashtra.[1] It provides export credit insurance support to Indian exporters and is controlled by the Ministry of Commerce. Government of India had initially set up Export Risks Insurance Corporation (ERIC) in July 1957. It was transformed into Export Credit and Guarantee Corporation Limited (ECGC) in 1964 and to Export Credit Guarantee of India in 1983. ROLE OF ECGC Provides a range of credit risk insurance covers to exporters against loss in export of goods and services Offers guarantees to banks and financial institutions to enable exporters to obtain better facilities from them Provides Overseas Investment Insurance to Indian companies investing in joint ventures abroad in the form of equity or loan FUNCTIONS OF ECGC TO EXPORTERS: Offers insurance protection to exporters against payment risks Provides guidance in export-related activities Makes available information on different countries with its own credit ratings Makes it easy to obtain export finance from banks/financial institutions Assists exporters in recovering bad debts Provides information on credit-worthiness of overseas buyers FOREIGN EXCHANGE MANAGEMENT ACT (1999) The Foreign Exchange Management Act (1999) or in short FEMA has been introduced as a replacement for earlier Foreign Exchange Regulation Act (FERA). FEMA became an act on the 1st day of June, 2000. FEMA was introduced because the FERA didnt fit in with post-liberalization policies. A significant change that the FEMA brought with it was that it made all offenses regarding foreign exchange civil offenses, as opposed to criminal offenses as dictated by FERA.

11

INTERNATIONAL MARKETING

KIRAN KUMAR C V

FEATURES OF FOREIGN EXCHANGE MANAGEMENT ACT (1999) 1. Activities such as payments made to any person outside India or receipts from them, along with the deals in foreign exchange and foreign security is restricted. It is FEMA that gives the central government the power to impose the restrictions. 2. Restrictions are imposed on people living in India who carry out transactions in foreign exchange, foreign security or who own or hold immovable property abroad. 3. Without general or specific permission of the Reserve Bank of India, FEMA restricts the transactions involving foreign exchange or foreign security and payments from outside the country to India the transactions should be made only through an authorized person. 4. Deals in foreign exchange under the current account by an authorized person can be restricted by the Central Government, based on public interest. 5. Although selling or drawing of foreign exchange is done through an authorised person, the RBI is empowered by this Act to subject the capital account transactions to a number of restrictions. 6. People living in India will be permitted to carry out transactions in foreign exchange, foreign security or to own or hold immovable property abroad if the currency, security or property was owned or acquired when he/she was living outside India, or when it was inherited to him/her by someone living outside India. 7. Exporters are needed to furnish their export details to RBI. To ensure that the transactions are carried out properly, RBI may ask the exporters to comply to its necessary requirements.

12

INTERNATIONAL MARKETING

KIRAN KUMAR C V

UNIT-4 EXPORT PROMOTION Incentive programs designed to attract more firms into exporting by offering help in product and market identification and development, pre-shipment and post-shipment financing, training, payment guaranty schemes, trade fairs, trade visits, foreign representation, etc. OBJECTIVES OF EXPORT PROMOTION To promote exports from India and to earn more foreign exchange for the country. To facilitate interaction between the exporting community and government both at the Central and State level. To canalize financial assistance rendered by the Central Government to members for assisting their export market development efforts. To collaborate with other Export Promotion Councils/Export Promotion Organisations in India and similar bodies in foreign countries as well as with international organizations working in the field. INCENTIVES OF EXPORT PROMOTION 1. Marketing and Development Assistance (MDA) 2. Spices Export Promotion schemes 3. Air freight subsidy on Horticulture and Floriculture Exports 4. New External Marketing Assistance Scheme for Jute 5. Financial Assistance scheme for Agricultural, Horticulture and meat exports 6. Financial assistance for marine products exports 7. Market Access Initiative (MAI) 8. Towns of Export Excellence 9. Special Focus on Cottage and Handicraft sector: MARKETING ASSISTANCE TO EXPORTERS Opening of showrooms; Opening of warehouses; Display in international Dept. stores; Publicity campaign and Brand promotion; Participation in trade fair etc. abroad; Research & Product development; Reverse visits of the prominent buyers from project focus countries; Export potential survey of the states; Registration charges for product registration abroad for pharmaceuticals, bio- technology and agro-chemicals; Testing charges for engineering products abroad; Support cottage and handicrafts units; Support recognised associations in industrial clusters for marketing aborad; Export houses Export House is defined as a registered exporter holding a valid Export House Certificate issued by the Director general of Foreign Trade in India. 1. They can avail themselves of the various economies of scale in transportation, warehousing and other areas related to physical distribution 2. They can avail themselves of export finance available at confessional rates. 3. They are in a position to employ qualified and specialized staff to look after the complicated work relating to customs, legal problems, procedures and documentation. 4. They can bargain with large adding companies in foreign countries on an equal footing 5. They can achieve economies in export promotion by using the most effective advertising and publicity media as also by participating in many trade fairs and exhibitions. 6. They can very often profit by taking a position on exchange rates. 7. They are able to absorb many of the risks inherent in International trade because of the wide range of products handled by them. STATE TRADING CORPORATION (STC) In India, the State Trading Corporation (STC) was set up in May 1956 as an entirely state- owned organisation. Its basic aim is to stimulate India's foreign trade, by enlarging the scope of Indian exports and facilitating essential imports. OBJECTIVES OF STC: Following are the important objectives of State Trading Corporation: 1. To enlarge exports, 2. To facilitate trade (imports) in specific commodities, 3. To augment the revenue of the State, 4. To bring about greater economic equality,

13

INTERNATIONAL MARKETING

KIRAN KUMAR C V

5. To regulate trade (imports and exports) in certain commodities, and 6. To regulate and overcome difficulties of trade with communist countries. Functions of STC: 1. Improving overall trade, domestic as well as international. 2. Augmenting the national resources of the country for promoting trade. 3. Undertaking of trading generally with State trading countries and private foreign traders too. 4. Exploring of new markets for traditional export items and developing exports of new items. 5. Stabilisation of price and traditional distribution by importing at the Government's instance any commodity in short supply. 6. Handling of such internal trade as promotes foreign trade. 7. Ensuring the quantity and quality of various commodities to foreign buyers at competitive rates. 8. Assisting in the settlement of trade disputes between exporters and importers in different countries wherever, India is directly concerned. 9. Implementation of all trade agreements entered into by the Government of India with other nations. SPECIAL ECONOMIC ZONES (SEZS) India was one of the first in Asia to recognize the effectiveness of the Export Processing Zone (EPZ) model in promoting exports, with Asia's first EPZ set up in Kandla in 1965. With a view to overcome the shortcomings experienced on account of the multiplicity of controls and clearances; absence of world-class infrastructure, and an unstable fiscal regime and with a view to attract larger foreign investments in India, the Special Economic Zones (SEZs) Policy was announced in April 2000. The category SEZ covers, including free trade zones (FTZ), export processing Zones (EPZ), free Zones (FZ), industrial parks or industrial estates (IE), free ports, free economic zones, urban enterprise zones and others.. FREE TRADE ZONES (FTZ) Several FTZs have been established at various places in India like Kandla, Noida, Cochin, etc. No excise duties are payable on goods manufactured in these zones provided they are made for export purpose. THE EXPORT ORIENTED UNITS (EOUS) Introduced in early 1981, is complementary to the SEZ scheme. It adopts the same production regime but offers a wide option in locations with reference to factors like source of raw materials, ports of export, hinterland facilities, availability of technological skills, existence of an industrial base and the need for a larger area of land for the project. As on 31st December 2005, 1924 units are in operation under the EOU scheme. INCENTIVES AND FACILITIES OFFERED TO THE SEZS Duty free import/domestic procurement of goods for development, operation and maintenance of SEZ units 100% Income Tax exemption on export income for SEZ units under Section 10AA of the Income Tax Act for first 5 years, 50% for next 5 years thereafter and 50% of the ploughed back export profit for next 5 years. Exemption from minimum alternate tax under section 115JB of the Income Tax Act. External commercial borrowing by SEZ units upto US $ 500 million in a year without any maturity restriction through recognized banking channels. Exemption from Central Sales Tax. Exemption from Service Tax. Single window clearance for Central and State level approvals. Exemption from State sales tax and other levies as extended by the respective State Governments. Exemption from customs/excise duties for development of SEZs for authorized operations approved by the BOA. Income Tax exemption on income derived from the business of development of the SEZ in a block of 10 years in 15 years under Section 80-IAB of the Income Tax Act. Exemption from minimum alternate tax under Section 115 JB of the Income Tax Act.

14

INTERNATIONAL MARKETING

KIRAN KUMAR C V

Exemption from dividend distribution tax under Section 115O of the Income Tax Act. Exemption from Central Sales Tax (CST). Exemption from Service Tax (Section 7, 26 and Second Schedule of the SEZ Act).

GRAY MARKET channel refers to the legal export/import transaction involving genuine products into a country by intermediaries other than the authorized distributors. From the importer side, it is also known as parallel imports. Three conditions are necessary for gray markets to develop: 1. Products must be available in other markets. 2. Trade barriers must be low enough for parallel importers. PRICE DIFFERENTIALS among various markets must be great enough to provide the basic motivation for gray marketers. Such price differences arise for various reasons: Currency fluctuations Differences in market demand Legal differences Opportunistic behavior Segmentation strategy

15

INTERNATIONAL MARKETING

KIRAN KUMAR C V

UNIT-5 IMPORT MANAGEMENT Effectively managing imports three flows that are involved in the process: 1. Information flow. Managing imports depends on effectively managing information. "Logisticians must understand what data needs to move when and where in order to make international transactions happen effectively," says Gould. Information flow also involves understanding taxes, tariffs, and other elements of trade compliance, as well as security regulations. 2. Fiscal flow. Understanding fiscal flow means knowing who needs to be paidincluding suppliers, customs and tax authorities, 3PLs, packers and othersas well as when and how they need to be paid. 3. Physical flow. Understanding the physical movement of goods means accurately knowing how and where your goods will move, how they'll be handled, where they'll be stored, and the costs associated with this. TYPES OF IMPORTERS1. Direct Import: Direct-import refers to a type of business importation involving a major retailer (e.g. Wal-Mart) and an overseas manufacturer. A retailer typically purchases products designed by local companies that can be manufactured overseas. 2. Indirect Import: In a direct-import program, the retailer bypasses the local supplier (colloquial middle-man) and buys the final product directly from the manufacturer, possibly saving in added costs. This type of business is fairly recent and follows the trends of the global economy. STEPS FOR IMPORTING Step 1. Obtaining import license and quota: In all countries there are many government regulations to be followed. Sanction of government is necessary. Importer has to apply to the controller of imports for getting necessary permission. Step 2. Obtaining foreign exchange: Before placing any order, the importer must apply to the Exchange Control Department (ECD) of RBI (India's Central Bank) for the release of requisite foreign exchange. The importer should forward the application through his bank. The ECD verifies the application of the importer, and if found valid, sanctions the foreign exchange for the particular transaction. Step 3. Placing an order: The importer may either place the order directly or through the indent house (Agent). In case of canalised items, he obtains the imports through the canalizing agency. (Canalisation means channelisation of goods through a government agency like MMTC). The importer cannot directly import such canalized items. They have to place an order with the canalizing agency who shall import and supply the same. Step 4. Despatching letter of credit: After getting the confirmation from the supplier regarding the supply of goods, the importer requests his bank to issue a Letter of credit in favour of supplier. It can be defied as "an undertaking by importer's bank stating that payment will be made to the exporter if the required documents are presented to the bank". Step 5. Appointing clearing and forwarding agents: The importer makes arrangement to appoint clearing and forwarding agents to clear the goods from the customs. Since clearing of goods is a specialized job, it is better to appoint C & F agents. Step 6. Receipt of shipment device: The importer receives the shipment advice from the exporter. The shipment advice states the date on which the goods are loaded on the ship. The shipment advice helps the importer to make arrangement for clearance of goods. Step 7. Receipts of documents: The importer's bank receives the documents from the exporter's bank. The documents include bill of exchange, a copy of bill of lading, certificate of origin, commercial invoice, consular invoice, packing list, and other relevant documents. The importer makes payment to the bank (if not paid earlier) and collects the documents. Step 8. Bill of entry: This is a document required in case of import of goods. It is like shipping bill in case of exports. A Bill of Entry is the document testifying the fact that goods of the stated value and description in specified quantity are entering into the country from abroad. The customs office supplies this form which is prepared in triplicate. Three different colours are used to prepare bill of entry.One copy is retained by custom department, other is retained by port trust and the third is kept by the importer.

16

INTERNATIONAL MARKETING

KIRAN KUMAR C V

Step 9. Delivary order: The clearing agents obtains the delivery order from the office of the shipping company. The shipping company gives the delivery order only after payment of freight, if any. Step 10. Clearing of goods: The clearing agent pays the necessary dock or port trust dues and obtains the port Trust Receipt in two copies. He then approaches the Customs House and presents one copy of Port Trust Receipt, and two copies of Bill of. Entry to the customs authorities. The customs officer endorses the Bill of Entry Forms and one copy of Bill of Entry is handed back to the importer. The importer then pays the customs duty and clears the goods. In case, the customs duty is not paid, then the goods are stored in the bonded warehouses. As and when the duty is paid, the goods are cleared from the docks. Step 11. Payment to clearing and forwarding agent: The importer then makes the necessary payment to the clearing agent for his various expenses and fees. Step 12. Payment to exporter: The importer has to make payment to exporter. Usually, the exporter draws a bill of exchange. The importer has to accept the bill and make payment. Step 13. Follow up: The importer then informs the exporter about the receipt of goods. If there are any discrepancies or damages to the goods, he should inform the exporter. IMPORT FINANCE: export financing describes the activity of governments helping companies by financing their export activities. they offer low interest rate loans that the company could otherwise not obtain at a rate lower than market price. export financing promotes trade as it provides an opportunity for those organisations who would otherwise not have been able to participate in trade activities because of financial constraints. IMPORT CLEARANCE PROCEDURE. 1. Bill of Entry: A Bill of Entry also known as Shipment Bill is a statement of the nature and value of goods to be imported or exported, prepared by the shipper and presented to a customhouse. The importer clearing the goods for domestic consumption has to file bill of entry in four copies; original and duplicate are meant for customs, third copy for the importer and the fourth copy is meant for the bank for making remittances. 2. Amendment of Bill of Entry: Whenever mistakes are noticed after submission of documents, amendments to the bill of entry is carried out with the approval of Deputy/Assistant Commissioner. 3. Green Channel facility: Some major importers have been given the green channel clearance facility. It means clearance of goods is done without routine examination of the goods. They have to make a declaration in the declaration form at the time of filing of bill of entry. The appraisement is done as per normal procedure except that there would be no physical examination of the goods. 4. Payment of Duty: Import duty may be paid in the designated banks or through TR-6 challans. Different Custom Houses have authorised different banks for payment of duty and is necessary to check the name of the bank and the branch before depositing the duty. 5. Prior Entry for Shipping Bill or Bill of Entry: For faster clearance of the goods, provision has been made in section 46 of the Act, to allow filing of bill of entry prior to arrival of goods. This bill of entry is valid if vessel/aircraft carrying the goods arrive within 30 days from the date of presentation of bill of entry. 6. Specialized Schemes: Import of goods under specialized scheme such as DEEC and EOU etc is required to execute bonds with the custom authorities. In case failure of bond, importer is required to pay the duty livable on those goods. The amount of bond would be equal to the amount of duty livable on the imported goods. The bank guarantee is also required along with the bond. However, the amount of bank guarantee depends upon the status of the importer like Super Star Trading House/Trading House etc. 7. Bill of Entry for Bond/Warehousing: A separate form of bill of entry is used for clearance of goods for warehousing. Assessment of this bill of entry is done in the same manner as the normal bill of entry and then the duty payable is determined.

17

INTERNATIONAL MARKETING

KIRAN KUMAR C V

UNIT-6 TRADE BARRIERS: Trade barriers are the artificial restrictions imposed by the governments on free flow of goods and services between countries. Tariffs, quotas, taxes, duties, foreign exchange restrictions, trade agreements. and trading blocs are the tech-niques used for restricting free movement of goods from one country to the other. TARIFF Tariffs can be defined as duties or forms of taxes levied on goods for revenue and protective purposes when they are transported from one customs area to another. They can also be defined as a comprehensive schedule or list of merchandise along with their rates which have to be paid for each article according to the rules and regulations of the government. QUOTA Quotas are the limitations imposed by the government on what can be traded, the quantity that can be traded, how much needs to be paid for each item, and where the goods are being traded. They do not deal with limitations on how much is paid for the goods; thus, they have a neutral effect on the GDP of the country. When there is a loss in a consumer and producer surplus, the quota holders are benefited. It does not bring any revenue to the government and also encourages administrative corruption and smuggling. Everyone wants to have more quotas for trading. If they are not obtained, it can give rise to many evils. NON-TARIFF BARRIERS Technical standards Regulatory standards Administrative standards Domestic-content requirements Rules of origin Government-procurement policies VOLUNTARY EXPORT RESTRAINTS (VERS) These restraints limit the quantity of goods that can be exported from the country to one or more of its trading partners. They are usually "voluntarily" negotiated so that quotas or tariffs are not imposed. EXCHANGE RATE CONTROLS Exchange rate controls set the exchange rate of a nation's currency above the market rate. This makes the nation's exports artificially expensive, which reduces the quantities of the nation's goods that foreigners are willing to buy. This means that the country's citizens have little foreign currency available to buy imported goods. With exchange rate controls, black markets usually exist where currency exchange occurs at a market rate. Exchange rate controls are declining in popularity, although some developing nations still use them. "HIDDEN" METHODS Hidden methods of limiting imports include special regulations and licensing requirements that restrict imports. For instance, the Japanese government imposes special quality requirements on food to restrict food imports and protect Japanese farmers. TARIFFS V/S QUOTAS. 1) Tariff revenues accrue to the government, while gains from import quotas accrue to importers. 2) Tariffs promote international trade, while import quotas restrict international trade. 3) Tariffs restrict international trade, while import quotas increase international trade. 4) Gains from tariffs accrue to importers, while import quota revenues accrue to the government.

18

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Fashion Process Flow:: Purchasing: PO CreationDokument4 SeitenFashion Process Flow:: Purchasing: PO CreationAnonymous h14iHG1Noch keine Bewertungen

- Ilovepdf MergedDokument10 SeitenIlovepdf Mergedjeeson thekkekaraNoch keine Bewertungen

- SAP SD Sales IntegrationDokument49 SeitenSAP SD Sales Integrationakrmba100% (5)

- Accounting Basics-Automatic Journal EntriesDokument12 SeitenAccounting Basics-Automatic Journal EntriesAdham AghaNoch keine Bewertungen

- MOV EIL Spec 2 PDFDokument134 SeitenMOV EIL Spec 2 PDFpl_arunachalam79Noch keine Bewertungen

- Claim Form Ihealthcare PDFDokument5 SeitenClaim Form Ihealthcare PDFJayarama RamNoch keine Bewertungen

- LargeDokument1 SeiteLargeAbhishek IyerNoch keine Bewertungen

- Combine For Print Part TwoDokument13 SeitenCombine For Print Part TwoEloiza Lajara RamosNoch keine Bewertungen

- VAT Guideline - Government BodiesDokument52 SeitenVAT Guideline - Government BodiesbevinonlineNoch keine Bewertungen

- ATC Proposal JUNDokument36 SeitenATC Proposal JUNReshmi R NairNoch keine Bewertungen

- Isupplier User ManualDokument29 SeitenIsupplier User ManualMarwan AladarbehNoch keine Bewertungen

- Importing ProcedureDokument6 SeitenImporting ProcedureKaleem KhanNoch keine Bewertungen

- Oracle Ebusiness Financials R12 Oracle Receivables Functional OverviewDokument37 SeitenOracle Ebusiness Financials R12 Oracle Receivables Functional OverviewbksidhuNoch keine Bewertungen

- Assignment 21 - EXERCISE 4.0Dokument2 SeitenAssignment 21 - EXERCISE 4.0Ravi TNoch keine Bewertungen

- Memorendum of UnderstandingDokument2 SeitenMemorendum of UnderstandingSaurabh YaduvanshiNoch keine Bewertungen

- Invoice Artech010723 Artech Alliance Owners Association Artech RealtorsDokument2 SeitenInvoice Artech010723 Artech Alliance Owners Association Artech RealtorsPrasad SNoch keine Bewertungen

- New Sco Current Price South RefineryDokument14 SeitenNew Sco Current Price South RefineryJosue Ortega100% (1)

- Procurement Fraud Red Flags & Investigative TechniquesDokument32 SeitenProcurement Fraud Red Flags & Investigative TechniquesNdumiso ShokoNoch keine Bewertungen

- Honda Procurment Policy AnalysisDokument19 SeitenHonda Procurment Policy AnalysisHira Naeem100% (1)

- 2023 LAST MINUTE - HO 2 - Taxation LawDokument13 Seiten2023 LAST MINUTE - HO 2 - Taxation LawHannahQuilangNoch keine Bewertungen

- P To P CycleDokument5 SeitenP To P CycleJaved AhmadNoch keine Bewertungen

- C - TS460 - 1610 SAP Certified Application Associate SAP S-2F4HANA Sales (1610) !! PDFDokument43 SeitenC - TS460 - 1610 SAP Certified Application Associate SAP S-2F4HANA Sales (1610) !! PDFSabrina Pattini100% (3)

- Hindustan Hydraulics PVT LTD: Dear SirDokument9 SeitenHindustan Hydraulics PVT LTD: Dear SirSitaram TilekarNoch keine Bewertungen

- Draft Agreement For Long Grain Indian Creamy Pusa Sella 1121 RiceDokument7 SeitenDraft Agreement For Long Grain Indian Creamy Pusa Sella 1121 RiceHarish PurohitNoch keine Bewertungen

- BoniDokument2 SeitenBoniNics CruzNoch keine Bewertungen

- All Are Proper Segregation of Functions Except DDokument3 SeitenAll Are Proper Segregation of Functions Except DSai AlviorNoch keine Bewertungen

- 2945 Emco Pug Mill 500MM - 20 - 2 - 2018 PDFDokument25 Seiten2945 Emco Pug Mill 500MM - 20 - 2 - 2018 PDFsamar209Noch keine Bewertungen

- HSBC Globle InvoiceDokument2 SeitenHSBC Globle Invoicedesaib6189Noch keine Bewertungen

- Tax Invoice Shubhojeet Mazumdar: Pay BillDokument1 SeiteTax Invoice Shubhojeet Mazumdar: Pay BillShubhojeet MazumdarNoch keine Bewertungen

- AR Deductions Settlement - User Guide PDFDokument116 SeitenAR Deductions Settlement - User Guide PDFSandeep KavuriNoch keine Bewertungen