Beruflich Dokumente

Kultur Dokumente

Mobile Payment Readiness Index: Canada

Hochgeladen von

Sumit RoyOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Mobile Payment Readiness Index: Canada

Hochgeladen von

Sumit RoyCopyright:

Verfügbare Formate

Mobile Payments Readiness Index

mobilereadiness.mastercard.com/canada

CANADA

Mobile Commerce Clusters Consumer Readiness

Environment

42.0

Financial Services

Infrastructure

Regulation

Country Score

Index Average

SUMMARY

WHAT YOU NEED TO KNOW

Canadians are extremely ready and willing to engage in mobile payments, but they may not have all the tools they need to make them able. Nevertheless, high

consumer readiness, a very advanced infrastructure at POS, and a proactive government gave Canada a score of 42.0, second place on the MasterCard Mobile Payments Readiness Index.

Canadians are familiar with and ready to use m-commerce Canada has very high levels of NFC penetration at the POS Canadas mobile device penetration rate is 100%, compared to Germanys 192%

COUNTRY OVERVIEW

Market Forces

In Canada, mobile phone subscriptions as a percentage of the population aged 15 to 64 is 100 percent, as compared with the United States at 134 percent, the United Kingdom at 197 percent, and Germany at 192 percent. In addition, annual investment in telecom infrastructure is substantially less than in the United States, on the one hand, and in India, on the other. The disconnect between these Canadian phone penetration numbers and the strong penetration at POS This needs to be assessed in light of the very strong showing Canada delivers in Mobile Commerce Clustersthe Indexs measure of integration among all the players needed to execute mobile payments. Test2Pay has opened its mobile billing platform to major Canadian telcos, including Rogers and

Germany

MOBILE PHONE SUBSCRIPTIONS PER CAPITA

for EMV payments points to an opportunity for improvement in Canada.

Canada

United States

United Kingdom

50% 100% 150% 200%

Bell; BOKU offers 1-Tap mobile billing for Android; and Bank of Montreal has commercialized mobile PayPass tags.

In spite of these collaborations, there is a disconnect at both ends: Consumers are willing, the network infrastructure is

ready (or being readied), but the device penetration lags Index averages.

Consumer Sentiment

In some ways, Canada is the mirror image of Singapore. The latter has probably the most advanced infrastructure and environment globally for mobile payments readiness, but a consumer base that, while highly motivated and highly banked, lags behind In Canada, by contrast, consumers score extremely high, with 27 percent professing familiarity with using mobile devices to shop the Internet, compared with an Index average of 20 percent. Twenty-five others in actual mobile payment use. percent are willing to use mobile devices to make Internet purchases compared with an Index average of 21 percent. And 15 percent of Canadian consumers profess willingness to use a mobile device to buy merchandise at POS, two percentage points behind the Index average.

GLOBAL PERSPECTIVE ON CONSUMER SENTIMENT IN CANADA

100%

75%

50%

27% 20%

25%

16% 13%

11% 11%

19% 14%

17% 15%

25% 21% 8% 3% 9% 8%

5% 4%

0%

P2P

POS m-comm FAMILIAR

Country Score

P2P

POS m-comm WILLING

Index Average

P2P

POS

m-comm

USING

Leading Country Score

To view this data in more detail, visit mobilereadiness.mastercard.com/canada

MASTERCARD CONCLUSION According to the MasterCard Mobile Payments Readiness Index, Canada, like the United States, is very strong in propensity and usage in m-commerce, and it is there the market will likely have its greatest success. Internet shopping holds no terrors for Canadian consumers, and the current boom in tablet sales can only fuel their desire to conduct the familiar form of commerce from wireless media. Until then, the financial services community, telcos, and device makers need to figure out why Canadians have fewer subscriptions than the developed world and partner together to do something about it.

View Data Sources at mobilereadiness.mastercard.com/about

CANADA

42.0

IN

DE

X AVG 33

.2

Mobile Payments Readiness Index

mobilereadiness.mastercard.com/canada

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Step by Step Failover ClusterDokument53 SeitenStep by Step Failover ClusterAtul SharmaNoch keine Bewertungen

- 10 Historical Speeches Nobody Ever HeardDokument20 Seiten10 Historical Speeches Nobody Ever HeardSumit Roy100% (1)

- 2012 - DVB-T and DVB-T2 Performance in Fixed Terrestrial TV ChannelsDokument5 Seiten2012 - DVB-T and DVB-T2 Performance in Fixed Terrestrial TV ChannelsLương Xuân DẫnNoch keine Bewertungen

- Nightingales - Philips Healthcare Tie UpDokument3 SeitenNightingales - Philips Healthcare Tie UpSumit RoyNoch keine Bewertungen

- TRAI Data Till 31st March, 2014Dokument19 SeitenTRAI Data Till 31st March, 2014Tamanna Bavishi ShahNoch keine Bewertungen

- World Health Days 2014: JanuaryDokument2 SeitenWorld Health Days 2014: JanuaryIvy Jorene Roman RodriguezNoch keine Bewertungen

- Wereldleiders Op TwitterDokument24 SeitenWereldleiders Op TwitterHerman CouwenberghNoch keine Bewertungen

- Hepatitis A eDokument1 SeiteHepatitis A eSumit RoyNoch keine Bewertungen

- The State of Mobile Advertising in Emerging Countries TLS EmergingMarketsDokument8 SeitenThe State of Mobile Advertising in Emerging Countries TLS EmergingMarketsSumit RoyNoch keine Bewertungen

- NokiaDokument1 SeiteNokiaSumit RoyNoch keine Bewertungen

- Hepatitis A eDokument1 SeiteHepatitis A eSumit RoyNoch keine Bewertungen

- Global Top 100 Most Valueable Brands Brandz2014 - Infographic PDFDokument1 SeiteGlobal Top 100 Most Valueable Brands Brandz2014 - Infographic PDFSumit RoyNoch keine Bewertungen

- Risk Factors From Hepatitis BCDDokument1 SeiteRisk Factors From Hepatitis BCDSumit RoyNoch keine Bewertungen

- The State of Airline Marketing Airlinetrends Simpliflying April2013Dokument21 SeitenThe State of Airline Marketing Airlinetrends Simpliflying April2013Sumit RoyNoch keine Bewertungen

- Calendário de Jogos Do Mundial de Futebol-Brasil 2014Dokument0 SeitenCalendário de Jogos Do Mundial de Futebol-Brasil 2014Miguel RodriguesNoch keine Bewertungen

- Mobile Advertising Research Trends and InsightsDokument15 SeitenMobile Advertising Research Trends and InsightsSumit RoyNoch keine Bewertungen

- The State of Maternal Health, D Nutrition in Asia " World Vision DataDokument4 SeitenThe State of Maternal Health, D Nutrition in Asia " World Vision DataSumit RoyNoch keine Bewertungen

- Mediamind Comscore Research Dwelling On EntertainmentDokument20 SeitenMediamind Comscore Research Dwelling On EntertainmentSumit RoyNoch keine Bewertungen

- World Health Statisitics FullDokument180 SeitenWorld Health Statisitics FullClarice SalidoNoch keine Bewertungen

- Gender and Social Networking Activity :facebook Vs OthersDokument18 SeitenGender and Social Networking Activity :facebook Vs OthersSumit RoyNoch keine Bewertungen

- FINAL - Mobile Advertising DeckDokument73 SeitenFINAL - Mobile Advertising DecksumitkroyNoch keine Bewertungen

- MGI China E-Tailing Executive Summary March 2013Dokument18 SeitenMGI China E-Tailing Executive Summary March 2013Sumit RoyNoch keine Bewertungen

- Calendar 14Dokument57 SeitenCalendar 14Hanan AhmedNoch keine Bewertungen

- 2014 Bill and Melinda Gates Foundation Report On Global PovertyDokument28 Seiten2014 Bill and Melinda Gates Foundation Report On Global PovertySumit RoyNoch keine Bewertungen

- The Evolution of Digital Advertising 3.0: Adobe Research InsightsDokument1 SeiteThe Evolution of Digital Advertising 3.0: Adobe Research InsightsSumit RoyNoch keine Bewertungen

- The 5 Free Alternatives To Microsoft WordDokument60 SeitenThe 5 Free Alternatives To Microsoft WordSumit RoyNoch keine Bewertungen

- The 5 Free Alternatives To Microsoft WordDokument60 SeitenThe 5 Free Alternatives To Microsoft WordSumit RoyNoch keine Bewertungen

- CEO Survey On Hiring, Profitability and PeopleDokument36 SeitenCEO Survey On Hiring, Profitability and PeopleSumit RoyNoch keine Bewertungen

- CVD Atlas 16 Death From Stroke PDFDokument1 SeiteCVD Atlas 16 Death From Stroke PDFRisti KhafidahNoch keine Bewertungen

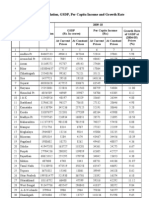

- Statewise GSDP PCI and G.RDokument3 SeitenStatewise GSDP PCI and G.RArchit SingalNoch keine Bewertungen

- India InfographicsDokument3 SeitenIndia InfographicsSumit RoyNoch keine Bewertungen

- IT Freedom Seminar TopicsDokument13 SeitenIT Freedom Seminar Topics121 Kanani AjayNoch keine Bewertungen

- Electronic Commerce SystemsDokument51 SeitenElectronic Commerce SystemsChandra MaullanaNoch keine Bewertungen

- MatrrixComSec SETU VTEP Gateway SetupGuideDokument21 SeitenMatrrixComSec SETU VTEP Gateway SetupGuidekali100% (1)

- DCI Using VXLAN EVPN Multi-Site W/ VPC BGWDokument16 SeitenDCI Using VXLAN EVPN Multi-Site W/ VPC BGWAdeboye AdeosoNoch keine Bewertungen

- Establishing Remote Networks For ROS Applications Via Port Forwarding: A Detailed TutorialDokument13 SeitenEstablishing Remote Networks For ROS Applications Via Port Forwarding: A Detailed TutorialDavut Can AkbaşNoch keine Bewertungen

- Services Provided by The InternetDokument29 SeitenServices Provided by The InternetSahil NagpalNoch keine Bewertungen

- ZXWN MSC Server System Structure and Realization (ATCA)Dokument27 SeitenZXWN MSC Server System Structure and Realization (ATCA)Iyesusgetanew100% (1)

- Different Types of SFPDokument4 SeitenDifferent Types of SFPReza BordbarNoch keine Bewertungen

- TV Turk Live Business Plan ENGDokument13 SeitenTV Turk Live Business Plan ENGminervadeaNoch keine Bewertungen

- Global 48V Switch Block Diagram GuideDokument1 SeiteGlobal 48V Switch Block Diagram GuidegiovanniricciardiNoch keine Bewertungen

- Bca 503 PDFDokument3 SeitenBca 503 PDFDARK ViSIoNNoch keine Bewertungen

- Choosing an antenna from Antenna Magus databaseDokument21 SeitenChoosing an antenna from Antenna Magus databasePho Duc NamNoch keine Bewertungen

- TV and movie streaming guideDokument2 SeitenTV and movie streaming guideAlina IoanaNoch keine Bewertungen

- Robojax Bluetooth Relay12V BK3231 Blueooth ChipDokument24 SeitenRobojax Bluetooth Relay12V BK3231 Blueooth ChipAliHasanNoch keine Bewertungen

- Design and Analysis of High-Gain and Compact Single-Input Differential-Output Low Noise Amplifier For 5G ApplicationsDokument4 SeitenDesign and Analysis of High-Gain and Compact Single-Input Differential-Output Low Noise Amplifier For 5G Applicationskarthik srivatsa mbNoch keine Bewertungen

- Major Project (Final)Dokument8 SeitenMajor Project (Final)Barun DhimanNoch keine Bewertungen

- Ovn-Architecture 7 Openvswitch-ManualDokument16 SeitenOvn-Architecture 7 Openvswitch-ManualЛиля БуторинаNoch keine Bewertungen

- Sending Email in C IsharuyeDokument45 SeitenSending Email in C IsharuyeMbanzabugabo Jean BaptisteNoch keine Bewertungen

- Temetra Meter Management & Reading Cloud ServiceDokument4 SeitenTemetra Meter Management & Reading Cloud ServicePunya GadgetNoch keine Bewertungen

- Abit - M621 Schematics: Title Sheet ModifyDokument33 SeitenAbit - M621 Schematics: Title Sheet Modify775i945GZ100% (1)

- ICT Laws ReportDokument7 SeitenICT Laws ReportJoshua Marcaida BarbacenaNoch keine Bewertungen

- Ece-V-Information Theory & Coding (10ec55) - AssignmentDokument10 SeitenEce-V-Information Theory & Coding (10ec55) - AssignmentLavanya Vaishnavi D.A.Noch keine Bewertungen

- Presentation On Li-Fi (Light Fidelity) The Future Technology in Wireless CommunicationDokument28 SeitenPresentation On Li-Fi (Light Fidelity) The Future Technology in Wireless CommunicationJinal Dhobi33% (3)

- Is Called A Protocol.: Protocol Is A Standard Procedure and Format That Two Data Communication DevicesDokument7 SeitenIs Called A Protocol.: Protocol Is A Standard Procedure and Format That Two Data Communication DevicesHeta DesaiNoch keine Bewertungen

- Brekeke WikiDokument2 SeitenBrekeke WikitranthinhamNoch keine Bewertungen

- Quick Installation Guide: Set UpDokument2 SeitenQuick Installation Guide: Set UpMarcello BenucciNoch keine Bewertungen

- SJ-20130929085856-001-ZXSDR R8862 (HV1.0) Product Description - 581872Dokument28 SeitenSJ-20130929085856-001-ZXSDR R8862 (HV1.0) Product Description - 581872Nouvric Int100% (3)

- Smartclass™ E1: Service Installation and Maintenance TesterDokument4 SeitenSmartclass™ E1: Service Installation and Maintenance TesterAghil Ghiasvand MkhNoch keine Bewertungen