Beruflich Dokumente

Kultur Dokumente

SCB Banking Growth 2005-11

Hochgeladen von

Amol GadeOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SCB Banking Growth 2005-11

Hochgeladen von

Amol GadeCopyright:

Verfügbare Formate

Headline

Business of SCB's registered a healthy growth from 2005-06 to 2010-11

Published On

Jun 01, 2012

Abstract

The business of all scheduled commercial banks (SCBs) grew at a CAGR of 22 per cent, from Rs 36,810 billion in 2005-06 to Rs 99,151 billion in 2010-11. Public sector banks, which includes State Bank of India (SBI) and associates and Nationalised banks, have been the major driver behind the overall growth of SCBs business for the past five years registering a CAGR of 24.5 per cent.

Key Issues

- What has been the growth in banking business in the past for all SCBs and across player-groups? -

1 of 4

No part of this Report may be published/reproduced/distributed in any form without CRISILs prior written approval.

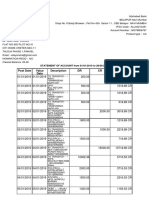

Bank group-wise performance

The business of all scheduled commercial banks (SCBs) grew at a CAGR of around 22 per cent, from Rs 36,810 billion in 2005-06 to Rs 99,151 billion in 2010-11. Public sector banks, which includes State Bank of India (SBI) and associates and Nationalised banks continued to remain major driver behind the overall growth of SCBs business constituting around 77 per cent share in total business in 2010-11. Investments of the banking sector in Government securities held in India recorded lower growth in 2010-11 as compared with the previous year in tune with the reduction in SLR requirements from 25 per cent to 24 per cent with effect from December 18, 2010.

Public sector banks

The business of public sector banks grew at a CAGR of 23 per cent from Rs 27,286 billion in 2005-06 to Rs 76,786 billion in 2010-11, driven by a CAGR of 24 per cent in advances and 22 per cent in deposits during the same period. The share of advances in funds deployed remained almost flat at 62.4 per cent in 2010-11 (62.8 per cent in 2009-10), while the proportion of investments in funds deployed declined to 25 per cent in 2010-11 from around 28 per cent in 2009-10, due to the accommodation of higher credit growth.

Private sector banks

The business of private sector banks grew at a CAGR of 19.4 per cent, from Rs 7,411 billion in 2005-06 to Rs 18,003 billion in 2010-11, driven by a CAGR of 21 per cent in advances and 18.5 per cent growth in deposits for the same period. The share of advances in funds deployed increased to 59.6 per cent in 2010-11 from 57.4 per cent in 2009-10, while the share of investments in funds deployed declined marginally to 31.6 per cent in 2010-11 from 32.2 per cent in 2009-10. The segment stood second in terms of the share in total business at 18 per cent in 2010-11.

Foreign banks

The business of foreign banks grew at a CAGR of 15.6 per cent over the past five years, the lowest amongst all bank groups, from Rs 2,113 billion in 2005-06 to Rs 4,362 billion in 2010-11, driven by a CAGR growth of 16.2 per cent in deposits between 2005-06 and 2010-11. Advances grew at a CAGR of 15 per cent during the same period. The group had the lowest share of around 4 per cent in the total business of SCBs in 2010-11.

Share of bank groups in SCBs - Total business 2005-06

2 of 4

No part of this Report may be published/reproduced/distributed in any form without CRISILs prior written approval.

2010-11

Source: CRISIL Research and RBI

3 of 4

No part of this Report may be published/reproduced/distributed in any form without CRISILs prior written approval.

4 of 4

Das könnte Ihnen auch gefallen

- Headline Published OnDokument8 SeitenHeadline Published OnAmol GadeNoch keine Bewertungen

- Analysis of Banking Industry Using Michael Porter'S Five Forces ModelDokument16 SeitenAnalysis of Banking Industry Using Michael Porter'S Five Forces ModelSumit ThomasNoch keine Bewertungen

- Roadmap for ABC Bank's Growth as an NBFC-to-BankDokument13 SeitenRoadmap for ABC Bank's Growth as an NBFC-to-BankSohini BanerjeeNoch keine Bewertungen

- Size of The Sector NBFCDokument14 SeitenSize of The Sector NBFCniravthegreate999Noch keine Bewertungen

- Indian Economic Survey 2012Dokument10 SeitenIndian Economic Survey 2012Krunal KeniaNoch keine Bewertungen

- Indian Banking Industry-1253Dokument37 SeitenIndian Banking Industry-1253ch.nagarjunaNoch keine Bewertungen

- Crisil Yearbook On The Indian Debt Market 2015.unlockedDokument114 SeitenCrisil Yearbook On The Indian Debt Market 2015.unlockedPRATIK JAINNoch keine Bewertungen

- Fundamental Analysis of Hero HondaDokument20 SeitenFundamental Analysis of Hero Hondasanjayrammfc100% (2)

- Analysis of Q4 2011 Banking CompanysDokument7 SeitenAnalysis of Q4 2011 Banking CompanysparmardhawalNoch keine Bewertungen

- 6 Banking and Financial ServicesDokument5 Seiten6 Banking and Financial ServicesSatish MehtaNoch keine Bewertungen

- (Kotak) ICICI Bank, January 31, 2013Dokument14 Seiten(Kotak) ICICI Bank, January 31, 2013Chaitanya JagarlapudiNoch keine Bewertungen

- ICICI Group: Strategy & PerformanceDokument51 SeitenICICI Group: Strategy & PerformanceJason SanchezNoch keine Bewertungen

- Financials: State-Owned Banks: FY12 Annual Report AnalysisDokument32 SeitenFinancials: State-Owned Banks: FY12 Annual Report AnalysisCarla TateNoch keine Bewertungen

- Banking Finance and Insurance: A Report On Financial Analysis of IDBI BankDokument8 SeitenBanking Finance and Insurance: A Report On Financial Analysis of IDBI BankRaven FormourneNoch keine Bewertungen

- RBI Bulletin Sept 2011Dokument5 SeitenRBI Bulletin Sept 2011Ashwinkumar PoojaryNoch keine Bewertungen

- The State Bank of IndiaDokument4 SeitenThe State Bank of IndiaHimanshu JainNoch keine Bewertungen

- ICICI Bank Reports 18% Credit Growth in 2010-11Dokument5 SeitenICICI Bank Reports 18% Credit Growth in 2010-11arshsing143Noch keine Bewertungen

- Q3 and 9M, FY2012 Performance Review and OutlookDokument19 SeitenQ3 and 9M, FY2012 Performance Review and OutlookpvinayakamNoch keine Bewertungen

- Banking Industry AnalysisDokument29 SeitenBanking Industry AnalysisshankygoyalNoch keine Bewertungen

- Growth Developnment of NBFC in India 1Dokument7 SeitenGrowth Developnment of NBFC in India 1mansiNoch keine Bewertungen

- Fsa 2006 10Dokument880 SeitenFsa 2006 10Mahmood KhanNoch keine Bewertungen

- A Critical Study On Non Performing Assets of Microfinance Institutions in India (With Special Reference To Pre and Post Covid-19)Dokument7 SeitenA Critical Study On Non Performing Assets of Microfinance Institutions in India (With Special Reference To Pre and Post Covid-19)Palak ParakhNoch keine Bewertungen

- Growth Performance Analysis - A Comparative Study Between SBI and HDFC Bank LimitedDokument7 SeitenGrowth Performance Analysis - A Comparative Study Between SBI and HDFC Bank LimitedNitin ParasharNoch keine Bewertungen

- Directors Report Year End: Mar '11: Charts CommentsDokument27 SeitenDirectors Report Year End: Mar '11: Charts CommentsMd IntakhabNoch keine Bewertungen

- Indian Banks Note (Revised)Dokument19 SeitenIndian Banks Note (Revised)zainab bharmalNoch keine Bewertungen

- Icici Bank: CMP: INR396 TP: INR520 (+31%)Dokument22 SeitenIcici Bank: CMP: INR396 TP: INR520 (+31%)saran21Noch keine Bewertungen

- BM Cia 1Dokument21 SeitenBM Cia 1SAHILNoch keine Bewertungen

- Ndian Banking Sector OutlookDokument3 SeitenNdian Banking Sector OutlookvinaypandeychandNoch keine Bewertungen

- Pest Analysis of Banking IndustryDokument8 SeitenPest Analysis of Banking IndustrySandip KumarNoch keine Bewertungen

- 14.08.2023 - Morning Financial News UpdatesDokument5 Seiten14.08.2023 - Morning Financial News UpdatesPratik ChavanNoch keine Bewertungen

- Wealth Management Assignment Idfc: About The CompanyDokument2 SeitenWealth Management Assignment Idfc: About The CompanyManmeet MalikNoch keine Bewertungen

- HDFC Securities Annual Report 11-12 FinalDokument35 SeitenHDFC Securities Annual Report 11-12 Finaljohn_muellorNoch keine Bewertungen

- Bank of BarodaDokument61 SeitenBank of BarodaAnita VarmaNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument9 SeitenNew Microsoft Office Word DocumentgauravgorkhaNoch keine Bewertungen

- 10 Chapter 02Dokument28 Seiten10 Chapter 02Shweta ShindeNoch keine Bewertungen

- HDFC Bank: CMP: INR537 TP: INR600 NeutralDokument12 SeitenHDFC Bank: CMP: INR537 TP: INR600 NeutralDarshan RavalNoch keine Bewertungen

- Challenges and Coners of RbiDokument17 SeitenChallenges and Coners of RbiParthiban RajendranNoch keine Bewertungen

- Financial Intermediation: ANK ReditDokument25 SeitenFinancial Intermediation: ANK ReditPraveen Reddy PenumalluNoch keine Bewertungen

- Management Discussion and AnalysisDokument30 SeitenManagement Discussion and Analysispanditak521Noch keine Bewertungen

- Banking Sector: Presented By:-Nidhi Rachita Shweta Shubhi Priyanka SapnaDokument25 SeitenBanking Sector: Presented By:-Nidhi Rachita Shweta Shubhi Priyanka Sapnamoti009Noch keine Bewertungen

- A Study of Financial Aspects of SIDBIDokument5 SeitenA Study of Financial Aspects of SIDBIInternational Organization of Scientific Research (IOSR)Noch keine Bewertungen

- Summary and ConclusionsDokument19 SeitenSummary and Conclusionsshrikrushna javanjalNoch keine Bewertungen

- AlmDokument5 SeitenAlmNitish JoshiNoch keine Bewertungen

- Banking: Last Updated: July 2011Dokument4 SeitenBanking: Last Updated: July 2011shalini26Noch keine Bewertungen

- RBL Bank IPO ReviewDokument13 SeitenRBL Bank IPO ReviewJilesh PabariNoch keine Bewertungen

- India's Corporate Bond Market Growth and ChallengesDokument6 SeitenIndia's Corporate Bond Market Growth and ChallengesTejeesh Chandra PonnagantiNoch keine Bewertungen

- Crisil Sme Connect Apr12Dokument56 SeitenCrisil Sme Connect Apr12Vidya AdsuleNoch keine Bewertungen

- MBFS Mini ProjectDokument55 SeitenMBFS Mini ProjectMadhav RajbanshiNoch keine Bewertungen

- Pest Analysis of Indian Banking Industry:: Files Without This Message by Purchasing Novapdf PrinterDokument12 SeitenPest Analysis of Indian Banking Industry:: Files Without This Message by Purchasing Novapdf PrinterBhasvanth SrivastavNoch keine Bewertungen

- Monetary Policy: A) Open Market Operations, B) Direct Lending To Banks, C) Bank Reserve RequirementsDokument15 SeitenMonetary Policy: A) Open Market Operations, B) Direct Lending To Banks, C) Bank Reserve RequirementsshaonNoch keine Bewertungen

- Equity Research: (Series IV) 10th August 2012Dokument18 SeitenEquity Research: (Series IV) 10th August 2012kgsbppNoch keine Bewertungen

- NCCC 2004Dokument1 SeiteNCCC 2004waqasg786Noch keine Bewertungen

- ICICI Group Strategy & Performance UpdateDokument45 SeitenICICI Group Strategy & Performance Updateankur9usNoch keine Bewertungen

- BankingDokument10 SeitenBankingShikha MehtaNoch keine Bewertungen

- Growth of Indian Banking Sector: Presented byDokument26 SeitenGrowth of Indian Banking Sector: Presented bylovleshrubyNoch keine Bewertungen

- Vietnam Banking Industry Analysis - V1Dokument10 SeitenVietnam Banking Industry Analysis - V1Khoi NguyenNoch keine Bewertungen

- Bank TypesDokument11 SeitenBank TypesSujon SahaNoch keine Bewertungen

- The Financial Services Sector in IndiaDokument4 SeitenThe Financial Services Sector in IndiaKhyati PatelNoch keine Bewertungen

- Financial Soundness Indicators for Financial Sector Stability in Viet NamVon EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamNoch keine Bewertungen

- Presentation 1Dokument47 SeitenPresentation 1Amol GadeNoch keine Bewertungen

- Presentation 1Dokument47 SeitenPresentation 1Amol GadeNoch keine Bewertungen

- 1 2 MazumdarDokument28 Seiten1 2 MazumdarAmol GadeNoch keine Bewertungen

- CRISIL Post Sales JobDokument2 SeitenCRISIL Post Sales JobAmol GadeNoch keine Bewertungen

- JabongDokument1 SeiteJabongAmol GadeNoch keine Bewertungen

- MCX Commodity AnalysisDokument449 SeitenMCX Commodity AnalysisAmol GadeNoch keine Bewertungen

- QDokument2 SeitenQAmol GadeNoch keine Bewertungen

- Presentation 1Dokument47 SeitenPresentation 1Amol GadeNoch keine Bewertungen

- JabongDokument1 SeiteJabongAmol GadeNoch keine Bewertungen

- Share Khan Summer ProjectDokument113 SeitenShare Khan Summer Projectakash01190% (20)

- Name: Priyanka Iyer Roll No.: 24 Sub.: Business Ethics and Corporate Governance Topic: Wipro and Its GovernanceDokument4 SeitenName: Priyanka Iyer Roll No.: 24 Sub.: Business Ethics and Corporate Governance Topic: Wipro and Its GovernanceAmol GadeNoch keine Bewertungen

- 1 2 MazumdarDokument28 Seiten1 2 MazumdarAmol GadeNoch keine Bewertungen

- E MarketingDokument31 SeitenE MarketingShireen QaiserNoch keine Bewertungen

- MCX Commodity AnalysisDokument449 SeitenMCX Commodity AnalysisAmol GadeNoch keine Bewertungen

- Goat Farming As A Business - A Farmers ManualDokument56 SeitenGoat Farming As A Business - A Farmers Manualqfarms89% (9)

- www.4qs - in 4 Quadrant Solutions Pvt. LTDDokument22 Seitenwww.4qs - in 4 Quadrant Solutions Pvt. LTDAmol GadeNoch keine Bewertungen

- 1105 Mba RegulationDokument25 Seiten1105 Mba RegulationAnanyaRoyPratiharNoch keine Bewertungen

- Copper BrokerageDokument68 SeitenCopper BrokerageAmol GadeNoch keine Bewertungen

- Headline Published OnDokument5 SeitenHeadline Published OnAmol GadeNoch keine Bewertungen

- Tie Er 2 Cities More Attr Ractive Fo or Retail Lo Oan Produ UctsDokument2 SeitenTie Er 2 Cities More Attr Ractive Fo or Retail Lo Oan Produ UctsAmol GadeNoch keine Bewertungen

- Headline Published OnDokument3 SeitenHeadline Published OnAmol GadeNoch keine Bewertungen

- Tie Er 2 Cities More Attr Ractive Fo or Retail Lo Oan Produ UctsDokument2 SeitenTie Er 2 Cities More Attr Ractive Fo or Retail Lo Oan Produ UctsAmol GadeNoch keine Bewertungen

- Headline Published OnDokument3 SeitenHeadline Published OnAmol GadeNoch keine Bewertungen

- He Real Estate Boom: A Genuine EuphoriaDokument5 SeitenHe Real Estate Boom: A Genuine EuphoriaAmol GadeNoch keine Bewertungen

- Headline Published OnDokument5 SeitenHeadline Published OnAmol GadeNoch keine Bewertungen

- NBFCs PDFDokument22 SeitenNBFCs PDFManpreet Kaur SekhonNoch keine Bewertungen

- JD Home India HomeDokument1 SeiteJD Home India HomeAmol GadeNoch keine Bewertungen

- PCE Practice Questions 1Dokument31 SeitenPCE Practice Questions 1De ZulNoch keine Bewertungen

- Truist Bank in New Jersey (NJ) - Locations Branches Contact DetailsDokument1 SeiteTruist Bank in New Jersey (NJ) - Locations Branches Contact Detailselton georgeNoch keine Bewertungen

- Audcap1 Final OutputDokument7 SeitenAudcap1 Final OutputIvan AnaboNoch keine Bewertungen

- Reserve Bank of India and Credit ControlDokument57 SeitenReserve Bank of India and Credit ControlDrashti IntwalaNoch keine Bewertungen

- TransNum Jun 28 100629Dokument24 SeitenTransNum Jun 28 100629Udayraj VarmaNoch keine Bewertungen

- PGP37235 BDC Assignment 8Dokument1 SeitePGP37235 BDC Assignment 8mavin avengersNoch keine Bewertungen

- Banking System in India: Chapter TwoDokument24 SeitenBanking System in India: Chapter Twokaushik168Noch keine Bewertungen

- Managerical Economics Web VersionDokument229 SeitenManagerical Economics Web VersionBHUVANA SUNDARNoch keine Bewertungen

- Beginners Guide To Stock MarketDokument9 SeitenBeginners Guide To Stock MarketAseem BajajNoch keine Bewertungen

- The Sammons Associates Annual Heads of Equity Research SurveyDokument4 SeitenThe Sammons Associates Annual Heads of Equity Research SurveytcawarrenNoch keine Bewertungen

- SB 3485.Dokument21 SeitenSB 3485.Vijay KasinadhuniNoch keine Bewertungen

- Day 1 (Sole Trader Final Account)Dokument7 SeitenDay 1 (Sole Trader Final Account)Han Thi Win KoNoch keine Bewertungen

- Form 12BBDokument3 SeitenForm 12BBAnonymous Gg6z0u9IBzNoch keine Bewertungen

- Assignment 9Dokument17 SeitenAssignment 9Beenish JafriNoch keine Bewertungen

- Ir & PD Course Registration Form 2018 0% SST PDFDokument1 SeiteIr & PD Course Registration Form 2018 0% SST PDFPais SaedinNoch keine Bewertungen

- Banking Theory Law and PracticesDokument67 SeitenBanking Theory Law and PracticesJESUINE J BBAENoch keine Bewertungen

- GSU788569420 Auth LetterDokument2 SeitenGSU788569420 Auth LetterRock RoseNoch keine Bewertungen

- Chapter Two Financial Institutions in The Financial SystemDokument75 SeitenChapter Two Financial Institutions in The Financial Systemhasenabdi30Noch keine Bewertungen

- B. A. Part-I Economics Marathi Sem. I Unit-3Dokument27 SeitenB. A. Part-I Economics Marathi Sem. I Unit-3PAVAN VAIRALNoch keine Bewertungen

- Underwriting Shares and Debentures GuideDokument26 SeitenUnderwriting Shares and Debentures GuideDeathRayShot -Noch keine Bewertungen

- Test Questions in Fabm2 4th Qtr333Dokument3 SeitenTest Questions in Fabm2 4th Qtr333Rosanno DavidNoch keine Bewertungen

- Annual-Report-FY2019-20 - Bandhan Bank PDFDokument188 SeitenAnnual-Report-FY2019-20 - Bandhan Bank PDFVAIBHAV WADHWANoch keine Bewertungen

- Cfa 1Dokument16 SeitenCfa 1Beatriz DiasNoch keine Bewertungen

- Capital Structure: Unit Iii Financial ManagementDokument17 SeitenCapital Structure: Unit Iii Financial ManagementsaiNoch keine Bewertungen

- The Ananda Co-Operative BankDokument97 SeitenThe Ananda Co-Operative BankPrashanth PB100% (1)

- Calculate Simple Interest and Compare MethodsDokument51 SeitenCalculate Simple Interest and Compare MethodsFrances Glei FaminialNoch keine Bewertungen

- Nis Registered OfficeDokument2 SeitenNis Registered OfficeSamim AktarNoch keine Bewertungen

- Loans and Discount FunctionDokument37 SeitenLoans and Discount Functionrojon pharmacy80% (5)

- Nguyen Hong Chau - Hwchapter1,2 - PA1Dokument6 SeitenNguyen Hong Chau - Hwchapter1,2 - PA1Châu NguyễnNoch keine Bewertungen

- Lecture 5Dokument28 SeitenLecture 5Dalia SamirNoch keine Bewertungen