Beruflich Dokumente

Kultur Dokumente

Railways Budget 2013 Analysis

Hochgeladen von

Rajesh NaiduCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Railways Budget 2013 Analysis

Hochgeladen von

Rajesh NaiduCopyright:

Verfügbare Formate

This years railway Budget has emerged like train whose destination is far off and it would long

time to reach there. Hence, many experts believe that there would not be immediate allocation of funds for companies in various sectors that cater to works related to the Railways. Here is a detailed analysis of the measures and its implications: Measures Measures given in this years railway budget are lucrative when considered from a long span of time. This year the railway budget has allocated highest outlay of Rs63363 crore for FY14. This would be met through gross budgetary support of Rs26000 crore, Railway Safety Fund of Rs2000 crore, Internal Resources of Rs14260 crore, market borrowing of Rs15103 crore and East Bengal Railway-Public Private Partnership of Rs6000 crore. In addition to this, the Budget has kept the gross traffic receipts for FY14 at Rs142742 crore. The gross traffic receipts for FY13 were at Rs125680 crore. Interestingly, the railways had several long-term measures which concentrated on improving its operating ratioit is a measure of efficiency in control the operating expenses and is usually used for sectors that require substantial portion of revenues to sustain and maintain operations. In railways, an operating ratio of 80% or lower is considered reasonably well. There are measures, which speak volumes of the commitments of the railways to this financial parameter. Here are a few them: a) Concerning railways The Budget has revised the freight loading target to 1007 MT against 1025 MT in Budget Estimates in FY13. For FY14, freight loading target has been increased by 40 MT to 1047 MT. It proposes to target to improve Operating Ratio to around 87.8% in FY14. The railways had successfully reduced its operating ratio from to 88.8% in FY13 from 94.9% in FY12.

The Budget pointed out at an excess remaining as regards dividend liability for the current year is pegged at Rs 10,409 crore as against the budget amount of Rs 15,557 cr. The Budget hopes to end 2013-14 with a balance of Rs 12,506 crore and with Rs 30,000 crore in 2017. The Budget has estimated freight earning target at RS93554 crore for FY14.,up by 9% on a year on year basis. It is estimated that the number of passengers would increase by 5.2% in FY14. The railways has targeted revenue of Rs42210 crore. It has a target of Rs1000 crore each fixed for Rail Land Development Authority and IR Station Development Corporation. This amount would be raised through Public Private Partnership in FY14 It has proposed a new fund named Debt Service Fund to meet committed liabilities of debt servicing. The Planning Commission has aimed the Railways 12th Plan at Rs5.19 lakh crore with a Gross Budgetary Support of Rs1.94 lakh crore, internal resources of Rs1.05 lakh crore, and market borrowing of Rs1.20 lakh crore, with another Rs1 lakh crore expected to be raised through public private partnership route. b) For commuters There is a proposal formulated for setting up of Railway Tariff Regulatory Authority. It is at inter-ministerial consultation stage. Fuel Adjustment Component (FAC) linked revision for freight tariff to be implemented from 1st April 2013. An across the board hike in freight charges by an average of about 5.8% has been made. Reservation fee for AC first class and executive classes has been raised to Rs60 from Rs 35 and that of first class and AC- 2 doubled to Rs50.

Reservation fee for AC chair car, AC-3 economy and AC-3 tier has been increased to Rs 40 from Rs25. Supplementary charges for superfast trains have been increased between Rs5 and Rs 25. Tatkal charges for sleeper class raised by Rs15 to RS25 and for AC Chair car from RS25 to RS50. Tatkal charges in AC-3 tier increased by Rs50; AC-2 tier and executive class by RS100. Cancellation charges increased for all classes between Rs5 and RsS50. The Budget expects that fare revision would raise the railways revenues by Rs6600 crore in FY14 Implications For major sectors, the railway Budget is nothing to cheer about especially when considered from the point of view of FY14. All proposals have strong advantages in the long-term. One of the chief reasons for this is long-term targets by the Railways Budget is lower revenue growth. The low growth in revenues has compelled the railways minister to set lower targets for the next year. It has focussed on aspects such as safety, up gradation of lines and freight corridors rather than traditional points like wagon procurement and addition of new lines. An economic slowdown has triggered lower than estimated freight loading for the Railways this year. As a result, the railway minister has this time set a realistic 4% rise in freight loading for FY14. In the previous Budget, the railway minister had increased passenger fares and freight-loading target. By taking into account these parameters, the railway minister had targeted for an operating ratio of 84.9%. However, a partial roll back of fares and increase in fuel cost led to a revised operating ratio of 88.8%, which was still better than 94.9% operating ratio in FY12. In the coming financial year, the railway

minister has targeted an operating ratio of 87.8%. This seems to be realistic and can be achieved given the fact that the minister has taken into account modest calculations. For FY13, in the wake of high operating ratio, the railways had to bring down its targets for laying new lines from 700 kms to 470 kms. In the current Budget, it has pegged a more realistic target of 500 kms of new lines. Interestingly, this time, the railway minister proposed one of its kind initiatives this year. He has introduced Fuel Adjustment component for freight traffic. This initiative would mean that any change in fuel price (going up or down) would be passed on to the travellers. For cement companies, this would mean that their margins would be volatile given the fact that logistics form an important part of their business. For sectors such as metals and fertilizers, the impact of these measures would be marginal. The Budget has allocated small amount of funds for rolling stock. Rolling stock means procurement of wagon, locomotives and coaches. In the current Budget, only Rs 44 crore is pegged for new orders of wagons. This is a big negative for wagon procurement companies. Construction companies on the other hand have reasons to be upbeat about the railway Budget. The government would award construction contracts of up to 1,500 km lines on both the dedicated freight corridors in this financial year. In addition to this, to tap into the lucrative freight income from coal, port and iron ore, it plans to investment of nearly Rs 9000 crore through public private partnership. Besides, the Budget has planned 60 more stations, which would be developed as Adarsh stations. This target is lower than the last years Budget target of upgrading 84 stations. For construction companies, which have been battling with fewer orders as orders from various sectors have depleted, this would be a breather. On the whole, the measures mentioned in the railway Budget are longterm. Hence, an immediate benefit on the corporate side of the railways business would not be seen. However, measures related to travellers, as usually observed, would be implemented without fail.

Das könnte Ihnen auch gefallen

- Herr Lubitsch Comes To HollywoodDokument221 SeitenHerr Lubitsch Comes To Hollywoodpovilunas100% (1)

- Aviation - Survival of The Richest - Edel PDFDokument9 SeitenAviation - Survival of The Richest - Edel PDFRajesh NaiduNoch keine Bewertungen

- Emily Dickinson ExistentialismDokument3 SeitenEmily Dickinson ExistentialismRajesh NaiduNoch keine Bewertungen

- What Is An Author by FoucaultDokument5 SeitenWhat Is An Author by FoucaultRajesh NaiduNoch keine Bewertungen

- J M Coetzee Foe and ConclusionDokument21 SeitenJ M Coetzee Foe and ConclusionRajesh NaiduNoch keine Bewertungen

- AntonyDokument4 SeitenAntonyRajesh NaiduNoch keine Bewertungen

- Coffee IndustryDokument7 SeitenCoffee IndustryRajesh NaiduNoch keine Bewertungen

- Mumbai Metro StoryDokument5 SeitenMumbai Metro StoryRajesh NaiduNoch keine Bewertungen

- Andrei Tarkovsky The Winding QuestDokument90 SeitenAndrei Tarkovsky The Winding Questvirendhemre100% (2)

- Ship of Theseus Some ObservationsDokument6 SeitenShip of Theseus Some ObservationsRajesh NaiduNoch keine Bewertungen

- S S Rajamouli The Epic StorytellerDokument6 SeitenS S Rajamouli The Epic StorytellerRajesh NaiduNoch keine Bewertungen

- Beyond Market - Issue 81Dokument51 SeitenBeyond Market - Issue 81Rajesh NaiduNoch keine Bewertungen

- The Apu Trilogy-Satyajit Ray and The Making of An Epic - Andrew RobinsonDokument225 SeitenThe Apu Trilogy-Satyajit Ray and The Making of An Epic - Andrew RobinsonTathagata Mandal100% (2)

- Ancillary Revenues AirlinesDokument5 SeitenAncillary Revenues AirlinesRajesh NaiduNoch keine Bewertungen

- Credit VidyaDokument2 SeitenCredit VidyaRajesh NaiduNoch keine Bewertungen

- EMI CalculationDokument5 SeitenEMI CalculationRajesh NaiduNoch keine Bewertungen

- Cement IndustryDokument4 SeitenCement IndustryRajesh NaiduNoch keine Bewertungen

- New Check List Latest SBIDokument2 SeitenNew Check List Latest SBIRajesh NaiduNoch keine Bewertungen

- Beyond Market - Issue 82Dokument48 SeitenBeyond Market - Issue 82Rajesh NaiduNoch keine Bewertungen

- IGNOU Prospectus 2013-14Dokument207 SeitenIGNOU Prospectus 2013-14Rama NathanNoch keine Bewertungen

- Q1 FY2013 InvestorsDokument28 SeitenQ1 FY2013 InvestorsRajesh NaiduNoch keine Bewertungen

- Beyond Market - Issue 81Dokument51 SeitenBeyond Market - Issue 81Rajesh NaiduNoch keine Bewertungen

- Beyond Market - Issue 82Dokument48 SeitenBeyond Market - Issue 82Rajesh NaiduNoch keine Bewertungen

- Banking SectorDokument4 SeitenBanking SectorRajesh NaiduNoch keine Bewertungen

- DirectorsDokument2 SeitenDirectorsRajesh NaiduNoch keine Bewertungen

- Ship of Theseus: Some Observations by Rajesh NaiduDokument4 SeitenShip of Theseus: Some Observations by Rajesh NaiduRajesh NaiduNoch keine Bewertungen

- 1000 Names of ShivaDokument92 Seiten1000 Names of ShivaVivek KhajuriaNoch keine Bewertungen

- History of Marathi CinemaDokument48 SeitenHistory of Marathi CinemaRajesh NaiduNoch keine Bewertungen

- Andrey Tarkovsky - Time Within Time (The Diaries 1970-1986)Dokument434 SeitenAndrey Tarkovsky - Time Within Time (The Diaries 1970-1986)Noémi Kruppa100% (3)

- Indian Road Sector Report - 11th March'2013Dokument44 SeitenIndian Road Sector Report - 11th March'2013Rajesh NaiduNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- EnDokument196 SeitenEnAliTronic1972100% (2)

- Portsmouth City Wages 2017Dokument18 SeitenPortsmouth City Wages 2017portsmouthheraldNoch keine Bewertungen

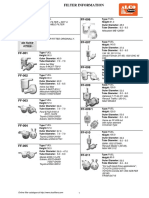

- Filter InformationDokument255 SeitenFilter InformationHari NotoNoch keine Bewertungen

- Indian RailwayDokument44 SeitenIndian RailwayamarkondekarNoch keine Bewertungen

- Solution Manual For Traffic and Highway Engineering 5th Edition Nicholas J Garber Lester A HoelDokument27 SeitenSolution Manual For Traffic and Highway Engineering 5th Edition Nicholas J Garber Lester A HoelPaulPaynermyd98% (40)

- Wheel Loaders-Integrated Tool Carriers-Section 12Dokument170 SeitenWheel Loaders-Integrated Tool Carriers-Section 12pmcisissengueNoch keine Bewertungen

- Catalogo JoinMasterDokument64 SeitenCatalogo JoinMasterAyubkhan2Noch keine Bewertungen

- Booking Confirmation Jetblu 01 SepDokument2 SeitenBooking Confirmation Jetblu 01 SepFreddy Gustavo GallardoNoch keine Bewertungen

- Tad740-1032-1630-1631 & TWD740-1210-1232-1630Dokument68 SeitenTad740-1032-1630-1631 & TWD740-1210-1232-1630Rath Asypaden100% (1)

- ALTO PS4HA-AMP DiagramDokument1 SeiteALTO PS4HA-AMP DiagramMarco Pedrosa100% (3)

- AY0011200Rd MANUAL MULTICLEAN 2.2Dokument7 SeitenAY0011200Rd MANUAL MULTICLEAN 2.2Jebi SeNoch keine Bewertungen

- IbrahimDokument1 SeiteIbrahimرضوان بن فروقNoch keine Bewertungen

- Price ListDokument14 SeitenPrice ListRavi MakhijaNoch keine Bewertungen

- Power Amplifier PDFDokument2 SeitenPower Amplifier PDFIordan Dan FfnNoch keine Bewertungen

- Focus Group DiscussionDokument4 SeitenFocus Group DiscussionUsman LatifNoch keine Bewertungen

- 21 Useful Charts For Service TaxDokument35 Seiten21 Useful Charts For Service TaxSonali SarkarNoch keine Bewertungen

- English Test For Marine EngineerDokument9 SeitenEnglish Test For Marine EngineerMarineroad Vallen AngkasaNoch keine Bewertungen

- Gandhinagar Thermal PowerplantDokument46 SeitenGandhinagar Thermal PowerplantniravNoch keine Bewertungen

- Mad Max 2 ScriptDokument101 SeitenMad Max 2 Scriptcristian.bojan8201Noch keine Bewertungen

- 18 - 1the Malaysian Grid CodeDokument1 Seite18 - 1the Malaysian Grid CodezohoNoch keine Bewertungen

- A Study of The Relative Importance of JIT Implementation Techniqu PDFDokument90 SeitenA Study of The Relative Importance of JIT Implementation Techniqu PDFRAJA RAMNoch keine Bewertungen

- Delivery Challan For 2 Nos Battery BoxDokument1 SeiteDelivery Challan For 2 Nos Battery BoxAbuAbdullah KhanNoch keine Bewertungen

- Diferencial Mack CRD (150 151)Dokument192 SeitenDiferencial Mack CRD (150 151)Patricio Alejandro Castro Lopez86% (7)

- WH Service Parts For SL-K Wider Boost 148 20180507Dokument2 SeitenWH Service Parts For SL-K Wider Boost 148 20180507PippoNoch keine Bewertungen

- ParkerDokument167 SeitenParkerSamuel Lopez BenitesNoch keine Bewertungen

- PSB - List of Accredited DFFs - 31dec2012Dokument29 SeitenPSB - List of Accredited DFFs - 31dec2012ofwwatchNoch keine Bewertungen

- 17 Special Tools-N900 Series JMCDokument16 Seiten17 Special Tools-N900 Series JMCRusonegroNoch keine Bewertungen

- Website Who We Are: A.C.I. - Agency of Cooperation and Investment of Medellin and The Metropolitan AreaDokument19 SeitenWebsite Who We Are: A.C.I. - Agency of Cooperation and Investment of Medellin and The Metropolitan AreaACI Medellín (Inversión y Cooperación)Noch keine Bewertungen

- 2023 CSW BrochureDokument2 Seiten2023 CSW BrochureWNDUNoch keine Bewertungen

- Module 3Dokument23 SeitenModule 3Nicole CraigNoch keine Bewertungen