Beruflich Dokumente

Kultur Dokumente

BBRealEstateReport 2013 Canada

Hochgeladen von

Don GoertzCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BBRealEstateReport 2013 Canada

Hochgeladen von

Don GoertzCopyright:

Verfügbare Formate

CANADIAN EDITION

We create Brian Buffinis Real Estate Report to give you a snapshot of todays market and to help you educate your clients on the process of buying or selling a home. I recommend that you lean into this piece when giving a presentationuse it to help set expectations and position yourself as your clients trusted advisor. I hope you enjoy this comprehensive report and put it to use in your business. Its a good life!

Contents

Industry Facts Mortgage Stats Price Information Consumer Stats Todays Buyer First-Time Home Buyer Facts Todays Real Estate Professional Why Working by Referral Works

Page 1 Page 2 Page 3 Page 4 Page 4 Page 5 Page 6 Page 7

2013 Buffini & Company. All rights reserved.

Brian Buffinis Real Estate Report

Page 1 3

industry faCts

By mid-2013, housing starts are expected to fall

more than 17%

HouSINg INvENToRy:

National home sales are expected to remain stable in 2013 In 2011, renovation spending grew

5.8 months December 2011 6.7 months December 2012

In 2012, the number of homes sold is projected to match or exceed 2011 levels in most markets From November to December, the number of newly listed homes dropped

461,500 sales

3%

through the MLS are forecast for 2013

453,372 homes

were sold over the MLS in 2012. This number is 1.4% below the 2002 through 2011 average

At the end of 2012, the Toronto and vancouver markets were cooling, while the housing markets of Saskatchewan and Alberta were taking off

1.3%

From December 2012 to January 2013, the number of newly listed homes rose

1.6% 2%

(the first monthly increase since September 2012) In 2013, the economy is expected to grow

The sales-tonew listings ratio remained balanced in December

SOURCES: REUTERS, RE/MAX, SCOTIABANK, CANADIAN REAL ESTATE ASSOCIATION, CANADA MORTGAGE AND HOUSING CORPORATION

Brian Buffinis Real Estate Report

Page 2

mortgage stats

1/3 32% 72% 81%

of homeowners have a mortgage

CANADIANS AgED 18-34 PLAN To PAy oFF THEIR MoRTgAgE: By age 35

Since June 2012, the five-year posted mortgage interest rate has been stable and stands at

of Canadians say they will carry their mortgage into retirement are trying to become mortgage-free faster

12% 26%

of buyers who used a lender, said that their lender was the single most influential person in their mortgage decision

By age 45

56%

feel it is important to become mortgage-free as soon as possible Prior to meeting with their mortage professional, the majority of recent buyers: prepared a list of questions organized their personal information prepared a list of their assets

CANADIANS AgED 35-54 PLAN To PAy oFF THEIR MoRTgAgE: By age 55

In 2013, home sales are expected to decrease by 5% because of Canadas new mortgage rules

39% 39%

45%

By age 65

of buyers who used a broker indicated that their broker was the single most influential person

29%

of homeowners increase the frequency of their payments in order to pay off their mortgage faster

oF HoMEoWNERS WNERS WITH A M MoRTgAgE:

79%

10%

have a fixed rate mortgage

have a variable rate mortgage

SOURCES: LONDON FREE PRESS, SCOTIABANK, CBC NEWS, CANADA MORTGAGE AND HOUSING CORPORATION, TD ECONOMICS, ROYAL BANK OF CANADA

Brian Buffinis Real Estate Report

Page 3

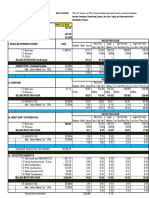

PriCe information

yEAR-ovER-yEAR PRICE CHANgE By HoME TyPE: By REgIoN, SHARE oF MoNTHLy INCoME SPENT oN HouSINg:

one-storey single family homes

two-storey single family homes

town homes

apartments

83%

38% 40% 52%

Home prices are than their low in March 2009

23% higher

Vancouver

Calgary

NATIoNAL AvERAgE PRICE By HoME TyPE (Q2 2012): AvERAgE HoME PRICE By REgIoN: vancouver

Toronto

Montreal

$914,500

Detached bungalow

$365,200

(up 5% from Q2 2011)

$412,600

(up 5% from Q2 2011)

Standard two-storey

Standard Condo

$237,300

Calgary

(up 3.2% from Q2 2011)

$488,304

Toronto

7.1%

In 2011, the average resale price of a home in Canada increased

47% of Canadians

to remain stable

30% expect prices

believe housing prices will be higher in 2013

National housing affordability has remained the same or is better than 20 years ago In 2013, the average price of a Canadian home is forecast to rise to

$608,672

Montreal

In 2013, the national average home price is expected to increase 0.3% to

$366,500

$277,000

SOURCES: ??

SOURCES: CANADIAN REAL ESTATE ASSOCIATION, REUTERS, ROYAL BANK OF CANADA, GLOBE AND MAIL, RE/MAX, MACLEANS, CANADIAN MORTGAGE AND HOUSING CORPORATION

Brian Buffinis Real Estate Report

Page 4

Consumer stats

todays Buyer

HoME BuyERS By AgE: WHy HoMEoWNERS ARE DECIDINg To MovE: 50% wanting a change

Age 25-34

28%

of consumers get the urge to move every five years

14%

of consumers get the urge at least once a year

18% retirement 14% came into money 14% home needed renovating

CoNSuMERS WHo FEEL A HoME IS AN INvESTMENT RATHER THAN AN ExPENSE:

25%

Age 35-44

28%

Age 45-54

62% change in family size 37% job relocation

80%

Women

73%

Men

The largest source of savings for Canadians is their home, which accounts for almost 70% of household assets

25% 19%

Age 55+

Most families move within the same province, however 13% move to another province and 4% move outside the country It is expected that repeat buyers will drive homebuying activity in 2013

housing as a good investment, up 2% from 2011 believe the value of their home has increased over the past two years

88% see 68%

PERCENTAgE oF BuDgET FoR gooDS & SERvICES SPENT oN SHELTER:

6% of

households bought a home in 2011

ToP REASoNS FoR A MovE: work-related upgrading their home family

SOURCES: HOMES-EXTRA.CA, ROYAL BANK OF CANADA, SCOTIABANK, TD ECONOMICS, STATISTICS CANADA, LONDON FREE PRESS, RE/MAX

26.7%

Homeowners

30.4%

Renters

Brian Buffinis Real Estate Report

Page 5

first-time home Buyer faCts

WHAT FIRST-TIME BuyERS WouLD HAvE DoNE DIFFERENTLy:

60% 1/3 of buyers in

be more thorough when budgeting for all costs of homeownership

60%

make a bigger down payment

55%

buy a home sooner

Many potential buyers who stayed on the sidelines in 2012 will likely enter the marketplace over the next year of consumers who dont own a home plan to buy within the next year

2011 were first-time buyers

55%

12%

oF FIRST-TIME BuyERS:

of first-time home buyers with a mortgage were worried about affording the home if interest rates were to increase

29%

didnt budget for on-going costs (maintenance and utilities)

FIRST-TIME BuyER HoME PREFERENCES: 54% a detached home 18% a condo 15% a townhome 13% a semi-detached home WHy FIRST-TIME BuyERS PuRCHASED A HoME: 48% tired of paying rent 31% got a full-time job 31% wanted to start a family and needed more space BuyERS MoST IMPoRTANT CoNSIDERATIoNS: price layout number of bedrooms features size of backyard or garden

13% 29%

6% 13% 29% overlooked one-time fees associated with buying 6% a home (e.g., inspection fees13% and land transfer costs) 6%

didnt budget for anything other than the down payment and monthly mortgage payment

40%

of buyers have withdrawn money from their RRSP to buy their first home

SOURCES: LONDON FREE PRESS, TD CANADA TRUST, SCOTIABANK, BRITISH COLUMBIA REAL ESTATE ASSOCIATION

Brian Buffinis Real Estate Report

Page 6

todays reaL estate ProfessionaL

The majority of agents are between 40 & 60 years old

32% 29%

complete between 20-39 transactions per year

46%

complete between 10-19 transactions per year

of agents use a combination of traditional marketing with social media

27%

are only using social media tools for their marketing

have a personal website

44% 78%

use a smartphone

7%

The amount of gross commissions spent on an annual marketing budget

42%

of agents take additional training and further education outside of whats required for licensing In 2012, Buffini & Company Canadian one2one Coaching Members earned an average gross commission of

Nearly 44% 51% of agents charge 2.5% commission on average

claim they never reduce commissions

In 2012, the average Canadian real estate professional earned

$44,182

in commissions

$206,822

SOURCES: BUFFINI & COMPANY, PROPERTY WIRE, LIvING IN CANADA

Brian Buffinis Real Estate Report

Page 7

Why Working By referraL Works

WoRkINg WITH THE SAME PRoFESSIoNAL AgAIN:

60%

of mortgage consumers totally agreed they would use their lender or broker again

83%

of broker clients and 82% of lender clients totally agreed they will use the same professional again

90%

of those who renewed their mortgage worked with a lender they used in a previous transaction

There is no lead more powerful than one referred from someone you knowsomeone who knows you, trusts you and will put their name to you.

Brian Buffini

Family member

Financial Planner

58%

29%

oF BuyERS:

of consumers will pay more to buy from a trusted company or service provider

Real estate agent

THE MOST COMMON REFERRAL SOURCES:

Friend

reported receiving a recommendation to use a specific lender

46% 55% 42%

of mortgage customers were contacted by their mortgage professional after the transaction

of consumers who used a broker were contacted after the transaction of consumers who worked directly with a lender reported being contacted after the transaction

reported receiving a recommendation to use a specific mortgage broker

25%

SOURCES: BUFFINI & COMPANY, CANADA MORTGAGE AND HOUSING CORPORATION

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Business Case ROI Workbook For IT Initiatives: On This WorksheetDokument33 SeitenBusiness Case ROI Workbook For IT Initiatives: On This WorksheetMrMaui100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Kevin Klinger PDFDokument226 SeitenKevin Klinger PDFfernandowfrancaNoch keine Bewertungen

- Str. Poieni Nr. 1 Wernersholmvegen 5 5232 Paradis NORWAY: Seatrans Crewing A/S Constanta Filip, Dumitru IulianDokument1 SeiteStr. Poieni Nr. 1 Wernersholmvegen 5 5232 Paradis NORWAY: Seatrans Crewing A/S Constanta Filip, Dumitru Iuliandumitru68Noch keine Bewertungen

- Scope and Methods of EconomicsDokument4 SeitenScope and Methods of EconomicsBalasingam PrahalathanNoch keine Bewertungen

- Classification and Formation of Company ActDokument22 SeitenClassification and Formation of Company ActChetan AkabariNoch keine Bewertungen

- MFRS11 Joint Arrangements MFRS12 Disclosure of Interests in Other Entities MFRS5 Non-Current Assets Held For Sale &Dokument20 SeitenMFRS11 Joint Arrangements MFRS12 Disclosure of Interests in Other Entities MFRS5 Non-Current Assets Held For Sale &cynthiama7777Noch keine Bewertungen

- The Venture Capitalist With A Silicon Valley Solution For Minority Owned BusinessesDokument4 SeitenThe Venture Capitalist With A Silicon Valley Solution For Minority Owned BusinessesAngel AlijaNoch keine Bewertungen

- Group8 - Swatch Case RevisedDokument15 SeitenGroup8 - Swatch Case RevisedAnand ShankarNoch keine Bewertungen

- JollibeeDokument5 SeitenJollibeeDaphane Kate AureadaNoch keine Bewertungen

- Edms ErmsDokument1 SeiteEdms Ermsprsiva2420034066Noch keine Bewertungen

- Hill and Jones Chapter 4 SlidesDokument32 SeitenHill and Jones Chapter 4 Slidesshameless101Noch keine Bewertungen

- Zimbawe Law Journal.... Duties of DirectorsDokument13 SeitenZimbawe Law Journal.... Duties of DirectorsEng Tennyson SigaukeNoch keine Bewertungen

- AR JBN JANUARY 03 and JANUARY 10, 2023Dokument1 SeiteAR JBN JANUARY 03 and JANUARY 10, 2023h3ro007Noch keine Bewertungen

- Exploring Supply Chain Collaboration of Manufacturing Firms in ChinaDokument220 SeitenExploring Supply Chain Collaboration of Manufacturing Firms in Chinajuan cota maodNoch keine Bewertungen

- Purchase Order: Pt. Prastiwahyu Tunas EngineeringDokument1 SeitePurchase Order: Pt. Prastiwahyu Tunas EngineeringBowoNoch keine Bewertungen

- Reeengineering MethodologyDokument87 SeitenReeengineering MethodologyMumbi NjorogeNoch keine Bewertungen

- Calculate Market Price and Amortization of Bonds Issued at a DiscountDokument5 SeitenCalculate Market Price and Amortization of Bonds Issued at a DiscountKris Hazel RentonNoch keine Bewertungen

- ENT300 - Module10 - ORGANIZATIONAL PLANDokument34 SeitenENT300 - Module10 - ORGANIZATIONAL PLANnaurahimanNoch keine Bewertungen

- Security agency cost report for NCRDokument25 SeitenSecurity agency cost report for NCRRicardo DelacruzNoch keine Bewertungen

- MTAP Saturday Math Grade 4Dokument2 SeitenMTAP Saturday Math Grade 4Luis SalengaNoch keine Bewertungen

- Commacc SaicaDokument1 SeiteCommacc SaicaHenry Sicelo NabelaNoch keine Bewertungen

- MGT602 Finalterm Subjective-By KamranDokument12 SeitenMGT602 Finalterm Subjective-By KamranKifayat Ullah ToheediNoch keine Bewertungen

- Ghani GlassDokument75 SeitenGhani GlassAftabMughal100% (1)

- Economy in Steel - A Practical GuideDokument30 SeitenEconomy in Steel - A Practical Guidechandabhi70Noch keine Bewertungen

- HGHGKJDokument66 SeitenHGHGKJHuyenDaoNoch keine Bewertungen

- Township Solicitor Chosen at Meeting: Running For A CauseDokument15 SeitenTownship Solicitor Chosen at Meeting: Running For A CauseelauwitNoch keine Bewertungen

- Odb 3Dokument4 SeitenOdb 3Onnatan DinkaNoch keine Bewertungen

- IAQG Standards Register Tracking Matrix February 01 2021Dokument4 SeitenIAQG Standards Register Tracking Matrix February 01 2021sudar1477Noch keine Bewertungen

- Ihrm GPDokument24 SeitenIhrm GPMusa AmanNoch keine Bewertungen

- Special Meeting TonightDokument48 SeitenSpecial Meeting TonightHOA_Freedom_FighterNoch keine Bewertungen