Beruflich Dokumente

Kultur Dokumente

SBI NPA Synopsis

Hochgeladen von

Don Iz BackOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SBI NPA Synopsis

Hochgeladen von

Don Iz BackCopyright:

Verfügbare Formate

PROJECT SYNOPSIS OF NON PERFORMING ASSETS INTRODUCTION: Non Performing Assets (NPAs) have become a subject of major concern

for Banking Sectors and Financial Institutions in the last few years. It is the crucial factor that decides the performance of the Bank's and Financial Institutions. Non Performing Assets are those loans given by a Hank or Financial Institution where the borrower defaults or delays interest or principal repayment. Thus it negates the effectiveness of the process of the credit cycle. Non-recovery also affects the profitability of a Financial Institution, besides being required to maintain more own funds by way of capital and creation of reserves and provisions to act as cushion for the Joan losses. Even though complete elimination of such losses is not possible, Financial Institutions need to keep the losses at a low level. In Tact, it is the level of n on-per forming assets which, to a great extent, shows the performance and efficiency of a Financial Institution. Mounting NPAs may also have more wide spread repercussions.

What is a performing asset? A Loan /Advance asset is considered to be 'performing1 as long as prompt realization of the interest /installments f i n case of term loans) which are credited to the advance account periodically. What is a Non Performing Asset? Loan/Advance assets will be deemed to be a Non-Performing Asset when there is a) a default in payment of interest amounts OR b) The repayment of principal (in case of Term Loans) has become past due or both remain unpaid for a period of two quarters or more. What is a past due? A Credit facility becomes PAST DUE if any demand is over due after 30 days from the due date, Standard Asset:

Standard asset is one which does not disclose any problem and which does not carry more than normal risk attached to the business, Non Performing Asset: Any credit facility in respect of which interest or installment has remained unpaid for a period of two quarters or more from the date it has become past due is regarded as a non performing asset A Non Performing Asset may be classified as: i) Sub standard asset: It is one which has not completed a period of two years after getting classified as a nun performing asset. Unless there is threat of loss or recoverability of the advance is in doubt a technical or a temporary deficiency in an otherwise standard asset should not lead to the conclusion that the asset is to be treated as a sub standard or a NPA. ii) Doubtful assets: It is one which remains as sub Standard or NPA continuously for more than two years where security cover is available. iii) Loss assets: It is one which is sub standard continuously for more

than two years where: security is nor available.

NEED AND IMPORTANCE OF THE STUDY:

The purpose of the study is to make an analysis of the NPAs in SBI and to know why and how they should be reduced and how they can be efficiently managed.

OBJECTIVES OF THE STUDY:

To study the causes of Non Performing Assets in State bank of India

To study the impact of NPAs on efficiency and profitability of S.B.I

To suggest the ways to reduce NPAs in S.B.I

SCOPE OF THE STUDY:

The scope of the study has been limited to the aspects of NPAs in SBI BANK only for the year 2008-2012 and an attempt was made to suggest the ways and means to improve the position and reduce The level of NPAs in SBI

RESEARCH METHODOLOGY

SOURCERS OF DATA:

The main source of data is secondary data, which is gathered from various sources like.

1) Books

2) Documents of Banks relating ot NPA s

3) Annual reports of Banks

Personal interviews with the staff helped in acquiring some data regarding the corporation and about the subject.

PERIOD OF THE STUDY: The period of the study is confined to six weeks i.e., 45 days.

Das könnte Ihnen auch gefallen

- Regional Rural Banks of India: Evolution, Performance and ManagementVon EverandRegional Rural Banks of India: Evolution, Performance and ManagementNoch keine Bewertungen

- Sip Report On Punjab National BankDokument75 SeitenSip Report On Punjab National BankIshaan YadavNoch keine Bewertungen

- NPA of Jammu and Kashmir BankDokument22 SeitenNPA of Jammu and Kashmir BankE-sabat RizviNoch keine Bewertungen

- A Study On The Financial Performance of Canara BankDokument7 SeitenA Study On The Financial Performance of Canara BankAruna ANoch keine Bewertungen

- Table of Content Title Page NoDokument26 SeitenTable of Content Title Page Nopradeep110Noch keine Bewertungen

- Union Bank of IndiaDokument7 SeitenUnion Bank of IndiamerlinjenniferNoch keine Bewertungen

- Project On Punjab National BankDokument86 SeitenProject On Punjab National BankPrakash Singh100% (1)

- Customer Satisfaction at The Jalgaon People'S Co-Op BANK LTD., JalgaonDokument10 SeitenCustomer Satisfaction at The Jalgaon People'S Co-Op BANK LTD., JalgaonwanipareshdNoch keine Bewertungen

- Project File On H.P State Cooperative BankDokument46 SeitenProject File On H.P State Cooperative BankAshish ShandilNoch keine Bewertungen

- 10 - Chapter 3 KVB ShodhgangaDokument50 Seiten10 - Chapter 3 KVB ShodhgangaPankaj SinghNoch keine Bewertungen

- Summer Report On H.P. State Cooperative BankDokument61 SeitenSummer Report On H.P. State Cooperative BankVIKAS DOGRA71% (7)

- Bank of Maharashtra PDFDokument76 SeitenBank of Maharashtra PDFPRATIK BhosaleNoch keine Bewertungen

- FINANCIAL ANALYSIS-HDFC-BankDokument112 SeitenFINANCIAL ANALYSIS-HDFC-BankAbhijith V Ashok100% (1)

- A Summer Training Project Report On: "Financial Statement Analysis" OF Orissa State Co-Operative Bank Ltd. BhubaneswarDokument74 SeitenA Summer Training Project Report On: "Financial Statement Analysis" OF Orissa State Co-Operative Bank Ltd. BhubaneswarNaman JainNoch keine Bewertungen

- ProjectDokument70 SeitenProjectnramkumar00775% (4)

- Bhagat Co BankDokument57 SeitenBhagat Co BankSyaape100% (1)

- The BirthDokument51 SeitenThe BirthSantosh BarikNoch keine Bewertungen

- Pooja MishraDokument7 SeitenPooja MishrasmsmbaNoch keine Bewertungen

- Project Report On Impact of NPA in The Performance of Financial InstitutionDokument96 SeitenProject Report On Impact of NPA in The Performance of Financial InstitutionManu Yuvi100% (1)

- Non-Performing Asset of Public and Private Sector Banks in India A Descriptive Study SUSHENDRA KUMAR MISRADokument5 SeitenNon-Performing Asset of Public and Private Sector Banks in India A Descriptive Study SUSHENDRA KUMAR MISRAharshita khadayteNoch keine Bewertungen

- Mba ProjeactDokument39 SeitenMba Projeactkurapati AdiNoch keine Bewertungen

- Retail Banking and Its Pdts Service QuestionnaireDokument3 SeitenRetail Banking and Its Pdts Service QuestionnaireKiruthika SubramaniNoch keine Bewertungen

- A Project Report On Non-Performing Assets of Bank of MaharashtraDokument80 SeitenA Project Report On Non-Performing Assets of Bank of MaharashtraBabasab Patil (Karrisatte)Noch keine Bewertungen

- Project Report: Evaluating The Performance of Canara Bank at Branch LevelDokument40 SeitenProject Report: Evaluating The Performance of Canara Bank at Branch Leveldonshri1989Noch keine Bewertungen

- Bank of IndiaDokument49 SeitenBank of IndiaJasmeet Singh100% (1)

- Project Report On Regional Rural Banks (RRBS)Dokument14 SeitenProject Report On Regional Rural Banks (RRBS)Dhairya JainNoch keine Bewertungen

- Comparative Analysis On Non Performing Assets of Private and Public Sector BanksDokument32 SeitenComparative Analysis On Non Performing Assets of Private and Public Sector Bankssai thesis33% (3)

- Review of LiteratureDokument8 SeitenReview of LiteratureFurkan BelimNoch keine Bewertungen

- CAMELS Project of Axis BankDokument47 SeitenCAMELS Project of Axis Bankjatinmakwana90Noch keine Bewertungen

- Fanancial Analysis F Icici BankDokument78 SeitenFanancial Analysis F Icici BankPaul DiazNoch keine Bewertungen

- "Consumer'S Perceptions On KCC Bank LTD.": A Summer Training Project ONDokument56 Seiten"Consumer'S Perceptions On KCC Bank LTD.": A Summer Training Project ONAbhinav Gupta80% (5)

- Project On NPA 27032013.Dokument85 SeitenProject On NPA 27032013.BasappaSarkarNoch keine Bewertungen

- A Study On Retail Loans, at UTI Bank Retail Asset CentreDokument74 SeitenA Study On Retail Loans, at UTI Bank Retail Asset CentreBilal Ahmad LoneNoch keine Bewertungen

- A Study On Financial Progress at SUBCO BankDokument79 SeitenA Study On Financial Progress at SUBCO BankAnushree AnuNoch keine Bewertungen

- Summer Internship Project - PGFB1622Dokument60 SeitenSummer Internship Project - PGFB1622Mohammad ShoebNoch keine Bewertungen

- Andhra Pradesh Grameena Vikas Bank (Apgvb)Dokument36 SeitenAndhra Pradesh Grameena Vikas Bank (Apgvb)Krishnamohan VaddadiNoch keine Bewertungen

- NPA Project ReportDokument78 SeitenNPA Project ReportAman RajputNoch keine Bewertungen

- TYBBA Fin ProjectDokument30 SeitenTYBBA Fin ProjectShaikh FarheenNoch keine Bewertungen

- A Study On Financial Performance Analysis With Reference To TNSC Bank Chennai Ijariie10138Dokument7 SeitenA Study On Financial Performance Analysis With Reference To TNSC Bank Chennai Ijariie10138Jeevitha MuruganNoch keine Bewertungen

- Comparative Analysis of Bank of BarodaDokument5 SeitenComparative Analysis of Bank of BarodaArpita ChristianNoch keine Bewertungen

- Summer Internship Project Report Axis Bank For Mba StudentDokument80 SeitenSummer Internship Project Report Axis Bank For Mba Studentramchandramanja100% (1)

- Organisational Setup and Management of The State Bank of IndiaDokument6 SeitenOrganisational Setup and Management of The State Bank of IndiapandisivaNoch keine Bewertungen

- Corporate Identificatio and Competition Analysis: A Project Report ONDokument77 SeitenCorporate Identificatio and Competition Analysis: A Project Report ONmustkeem_qureshi7089Noch keine Bewertungen

- Financial Assistance by The Cbs Bank Mba Finance Project ReportDokument69 SeitenFinancial Assistance by The Cbs Bank Mba Finance Project ReportBabasab Patil (Karrisatte)50% (2)

- A Study On Working Capital Management in STATE BANK OF IndiaDokument4 SeitenA Study On Working Capital Management in STATE BANK OF Indiaarijit2422Noch keine Bewertungen

- Final ReportDokument111 SeitenFinal ReportLakshmi NagurNoch keine Bewertungen

- A Study On HDFCDokument39 SeitenA Study On HDFCBhavik Waghela100% (1)

- Pre Issue ManagementDokument19 SeitenPre Issue Managementbs_sharathNoch keine Bewertungen

- An Analytical Study of "Financial Performance of Housing Development Financial Corporation (HDFC) "Dokument8 SeitenAn Analytical Study of "Financial Performance of Housing Development Financial Corporation (HDFC) "Kunal BagdeNoch keine Bewertungen

- Chapter 4 - Post Merger ReorganisationDokument16 SeitenChapter 4 - Post Merger ReorganisationAbhishek SinghNoch keine Bewertungen

- A Project Report On CAPITAL BUDGETING AT GODAVARI SUGAR MILLS LTDDokument66 SeitenA Project Report On CAPITAL BUDGETING AT GODAVARI SUGAR MILLS LTDVinay Manchanda0% (1)

- Non Performing Assets (NPAs) : A Comparative Analysis of Selected Private Sector BanksDokument7 SeitenNon Performing Assets (NPAs) : A Comparative Analysis of Selected Private Sector BanksinventionjournalsNoch keine Bewertungen

- Impact of Non-Performing Assets On Banking Industry: The Indian PerspectiveDokument8 SeitenImpact of Non-Performing Assets On Banking Industry: The Indian Perspectiveshubham kumarNoch keine Bewertungen

- Chapter1: Introduction: Nonperforming Asset in BankDokument35 SeitenChapter1: Introduction: Nonperforming Asset in BankMaridasrajanNoch keine Bewertungen

- Non Performing Assets 111111Dokument23 SeitenNon Performing Assets 111111renika50% (2)

- NPA AnalysisDokument61 SeitenNPA AnalysisSabyasachi PandaNoch keine Bewertungen

- A Study On Npa of Public Sector Banks in India: Sulagna Das, AbhijitduttaDokument9 SeitenA Study On Npa of Public Sector Banks in India: Sulagna Das, AbhijitduttaSunil Kumar PalikelaNoch keine Bewertungen

- A Study On Non Performing Assets of Sbi and Canara BankDokument75 SeitenA Study On Non Performing Assets of Sbi and Canara BankeshuNoch keine Bewertungen

- Npa in SbiDokument96 SeitenNpa in SbiApoorva M V100% (2)

- Mba Project TopicDokument78 SeitenMba Project TopicHardik PatelNoch keine Bewertungen

- Andhra Bank 2009-2010Dokument7 SeitenAndhra Bank 2009-2010Don Iz BackNoch keine Bewertungen

- Submitted by - : Gautam Gulati, Kapil Manwani, Rashmi Sharma, Mohit Motwani, Ankitha SingaviDokument36 SeitenSubmitted by - : Gautam Gulati, Kapil Manwani, Rashmi Sharma, Mohit Motwani, Ankitha SingaviDon Iz BackNoch keine Bewertungen

- Consumer Attitude Towards Gold OrnamentsDokument34 SeitenConsumer Attitude Towards Gold OrnamentsDon Iz BackNoch keine Bewertungen

- Post Dated ChequesDokument2 SeitenPost Dated Chequestreddy249Noch keine Bewertungen

- Report On MSMEDokument27 SeitenReport On MSMERohit Gupta50% (2)

- Pixley Emotions in Finance PDFDokument246 SeitenPixley Emotions in Finance PDFNur Rahmah Yunita100% (2)

- Financial Accounting Punjab University: Question Paper 2018Dokument4 SeitenFinancial Accounting Punjab University: Question Paper 2018aneebaNoch keine Bewertungen

- Picpa Ancon 2019Dokument2 SeitenPicpa Ancon 2019sanglay99Noch keine Bewertungen

- Personal Financial StatementDokument4 SeitenPersonal Financial StatementKent WhiteNoch keine Bewertungen

- Republic v. Sandiganbayan (G.R. No. 92594)Dokument2 SeitenRepublic v. Sandiganbayan (G.R. No. 92594)midnightbottleNoch keine Bewertungen

- Fintech - Threat and Challenges - William Edward SibaraniDokument11 SeitenFintech - Threat and Challenges - William Edward SibaraniWilliam EdwardNoch keine Bewertungen

- 6-Two Faces of DebtDokument29 Seiten6-Two Faces of DebtscottyupNoch keine Bewertungen

- CAT Accelerated Level 1Dokument4 SeitenCAT Accelerated Level 1aliciarigonan100% (1)

- Italy 8 TuscanyDokument86 SeitenItaly 8 TuscanyAnonymous e5eIzKYBmxNoch keine Bewertungen

- First Flight LogisticsDokument7 SeitenFirst Flight Logisticsmahato28Noch keine Bewertungen

- MGL Registration Form PDFDokument2 SeitenMGL Registration Form PDFAnonymous mDQiXa4Noch keine Bewertungen

- College Admission Fee ChallanDokument1 SeiteCollege Admission Fee ChallanlubnaNoch keine Bewertungen

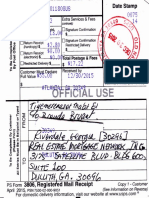

- Acceptance&Discharge-REAL ESTATE MORTGAGE NETWORKDokument13 SeitenAcceptance&Discharge-REAL ESTATE MORTGAGE NETWORKTiyemerenaset Ma'at El86% (22)

- TVS Case Study Personal LoanDokument4 SeitenTVS Case Study Personal LoanBhavya PopliNoch keine Bewertungen

- Banking Sector in CambodiaDokument44 SeitenBanking Sector in CambodiaChanrithy Sok100% (1)

- Banks and Banking System-1Dokument13 SeitenBanks and Banking System-1polmulitriNoch keine Bewertungen

- A Case Study in Ethical Approaches To BankingDokument15 SeitenA Case Study in Ethical Approaches To BankingLeonardo LealNoch keine Bewertungen

- March 2024 StatementDokument4 SeitenMarch 2024 Statementsophiaantoine046Noch keine Bewertungen

- AAU On Tele BirrDokument72 SeitenAAU On Tele BirrNatinael AbebeNoch keine Bewertungen

- Effect of Borrowers Capacity and Capital Information On Credit Risk Management: A Case of Microfinance Institutions in Nakuru TownDokument20 SeitenEffect of Borrowers Capacity and Capital Information On Credit Risk Management: A Case of Microfinance Institutions in Nakuru Townabey.mulugetaNoch keine Bewertungen

- For Conversation, Press #1 By: Michael Alvear: Project in English Christel Joy Canta Kristel Mae PaazDokument20 SeitenFor Conversation, Press #1 By: Michael Alvear: Project in English Christel Joy Canta Kristel Mae PaazChristel Joy CantaNoch keine Bewertungen

- Industry Profile Banking Industry in India:: Study On Agricultural Credit Facility of Canara BankDokument66 SeitenIndustry Profile Banking Industry in India:: Study On Agricultural Credit Facility of Canara BankGoutham BindigaNoch keine Bewertungen

- SMIC - Quarterly Report (Q2 2016)Dokument73 SeitenSMIC - Quarterly Report (Q2 2016)mikhail_flores_2Noch keine Bewertungen

- Landbank Vs PobleteDokument3 SeitenLandbank Vs PobletejessapuerinNoch keine Bewertungen

- Choose The Right Answer!Dokument2 SeitenChoose The Right Answer!Azmi WijaksonoNoch keine Bewertungen

- Standard Accounts: IntroducingDokument24 SeitenStandard Accounts: IntroducingsathishNoch keine Bewertungen

- Knowledge Management at Icici Bank: Akshay Hemanth A023Dokument30 SeitenKnowledge Management at Icici Bank: Akshay Hemanth A023Akshay HemanthNoch keine Bewertungen

- Mawdsley - Development Geography 1 - Cooperation, Competition and Convergence Between North' and South'Dokument11 SeitenMawdsley - Development Geography 1 - Cooperation, Competition and Convergence Between North' and South'lucas antonelliNoch keine Bewertungen