Beruflich Dokumente

Kultur Dokumente

Factor For Customer Retention

Hochgeladen von

Sushant HaritOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Factor For Customer Retention

Hochgeladen von

Sushant HaritCopyright:

Verfügbare Formate

Factors that Affect Repeat Buying Loyalty

Dag Bennett, London South Bank University

Abstract This paper describes repeat brand-buying behavior across a variety of frequently purchased consumer goods categories. The main finding is that overall repeat buying tends to be higher in categories where the market shares of brands are either very stable or the category is very much dominated by a large brand. In contrast, low repeat-buying associates with unstable market shares and competition amongst many smaller brands. In addition, brands that are much bigger than their nearest rivals tend to have higher repeat buyingor loyalty premiums. These repeat buying rates are predictable using the Duplication of Purchase law (DoP).

1. Introduction --Brand Buying Behavior for Individual Brands For many firms, branding is critical, helping establish the firms identity in the marketplace or build a solid customer franchise (Kapferer 1997, Keller 1998). Brand strength also provides a tool to counter growing retailer power (Barwise & Robertson 1992) even as retailers use private-label brands to build store loyalty (Corstjens & Lal 2000). The ongoing academic and industry discussion surrounding branding often focuses on the benefits of brand loyalty and has evolved from how to measure and assess loyalty (e.g., Cunningham 1956, Fader & Schmittlein 1993, Bhattacharya 1997) to building and managing loyalty (e.g. Reichheld & Sasser 1996, Baldinger & Rubinson 1996, Aaker & Joachimsthaler 2002). And yet, there is little research into the underlying market conditions that might affect repeat buying loyalty. Why should one category have high repeat buying and another low? What should marketers reasonably expect repeat buying to be for their brand, and why? If 40% of customers buy a brand twice in a row, is that high, low or just average? While much has been written about loyalty this research draws on well-established empirical generalizations (Ehrenberg 1972) that primarily focus on within category brand buying regularities as described with the NBD-Dirichlet model (Ehrenberg, Uncles & Goodhardt 2004), the Duplication of purchase law (DoP), (Colombo & Morrison 1989) and by the twopurchase technique (Bennett, Ehrenberg & Goodhardt 2000, Bennett 2004). This new research was one of the first attempts to look at brand buying patterns between categories. It did so by examining factors that might be associated with repeat-buying loyalty levels. The first step was to calculate weighted average repeat buying rates over two consecutive purchases drawn from panel data (TNS superpanel with 15,000 UK households) covering 72 FMCG categories. Each buyer who had made two category purchases was counted as either a repeat-buyer or a switcher. Repeat buying levels could then be compared, as could other measures such as, the average interval between purchases in weeks, market share of the largest brand in the category, the number of brands with over 3% share, the HerfindahlHirschman Index (HHI) (www.dti.gov.uk/files/file17173.pd), and the weighted average percentage change in market share between purchases.

669

2. Repeat buying behavior for brands On average, across all categories, 42% of all customers bought the same brand twice in a row when making purchases within a category. Individual category repeat rates ranged from 58% down to 24% as shown in Table 1, column 1 which presents selected categories at the high, middle and low end for repeat buying. These category repeat buying levels were consistent with previous work (e.g. Baldinger & Rubinson 1996, Ehrenberg, Uncles & Goodhardt 2004). One test for whether these data fit with existing theory is the Duplication of Purchase law (Colombo, Ehrenberg & Sabavala 2000), an empirical law-like relationship that says that the proportion of buyers of Brand A who also buy Brand B (denoted bB|A) can be expressed as: bB|A = D x bB In practice, when people buy a brand they are more likely to buy one with high penetration, irrespective of which brand they bought before. The proportionality factor D or Duplication Coefficient reflects the likelihood of switching from the previous brand A to a new brand B, relative to how many people bought B at all. For example if 30% of the population buy brand B, and 45% of brand As buyers buy brand B, the duplication coefficient D, is 45%/30% = 1.5. D is thus a measure of the extent to which individual brands share category buyers and can be used to calculate brand repeat buying with the formula: Repeat Buying Rate = (D * brand penetration) + (1- D) The second column in Table 1 shows predicted average repeat buying rates (labeled T for theoretical) made using the D values calculated for each category.

670

Table 1 Weighted Average Repeat Purchase Rates and Other Measures Wtd Ave % Repeat O (T) 58 (60) 56 (58) 56 (56) 55 (57) 54 (56) 43 42 42 41 41 41 29 28 25 25 24 (44) (41) (44) (40) (35) (40) (30) (30) (25) (25) (26) Ave % Share change 9 7 5 8 7 13 10 17 6 10 8 25 26 17 18 24 12% Largest Brand % share 20 24 26 68 55 24 18 26 14 21 11 22 43 24 19 16 24% Purchase Interval (weeks) 8 5 5 3 32 2 1 14 3 15 16 9 13 11 26 12 9 Brands over 3% share 11 9 8 5 8 7 9 12 12 9 13 11 8 11 10 10 9

Product Category Packet Tea Margarine Butter Crisps Thick Brown Sauce Sugar Confectionary Carbonates with lemonade Instant porridge Everyday Biscuits Marmalade Shampoo Premium Ice Cream Body Sprays Child Lollies Cough lozenges Ice-cream filled Cones Overall Average

42% (42%)

At first sight Table 1 shows that observed and theoretical repeat buying levels are close, and in fact the correlation between the two is r = .97. Thus whether a category is characterized by high or low repeat buying, the level is closely predicted by the duplication of purchase law, which is based on the measurement of penetration and so brand share.

3. Factors associated with lower repeat buying rates One question raised by Table 1 is; what accounts for the variation in loyalty? For example, Packet Tea and Margarine have high repeat buying rates, while Ice-Cream filled Cones and Cough Lozenges have low rates. With the information on hand a correlation matrix was constructed to examine what factors might be associated with repeat purchase rates, shown in Table 2 below. Higher positive correlations are outlined, negative ones shaded.

671

Table 2. Correlations between Repeat Purchase and other Category Measures

wt ave rep 1.00 -.73 -.18 .23 .35 -.23 .16 .11 Wt ave % change 1.00 .06 -.03 -.09 .05 .00 .01 Wks/ ints lgst brand HHI no >3% Dom prem

wt ave repeat wt ave % change wks/interval largest brand HHI No. brands >3% Domination Premium

1.00 .18 .17 .04 .19 .16

1.00 .91 -.56 .83 .58

1.00 -.56 .78 .50

1.00 -.38 -.32

1.00 .70

1.00

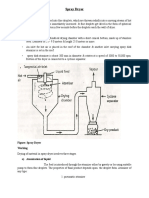

In the first column the only high correlation is between the weighted average repeat rate and weighted average percent change in brand share (r = -.73). This shows that categories in which brand shares are unstable tend to have lower repeat purchase rates. This relationship was hinted at in Table 1, where lower repeat categories also had higher average share changes and can be seen clearly in Graph 1. This negative association between share instability and repeat buying is consistent with other work on dynamics (e.g. Kato & Honjo 2006, Habel & Rungie 2005, Dekimpe et al. 1997) and with meta analysis of survey data (Bennett, 2007). The second and third columns show that weighted average percent share change and weeks per purchase interval have no strong associationsit matters little to FMCG repeat buying whether a customer buys weekly or yearly. Graph 1. Weighted Average Category Repeat Buying Declines with Brand Instability

Weighted Ave Repeat 70 60 50 40 30 20 10 0 0 5 10 15 20 25 30 Weighted Ave % Change in Shares

Repeat Buying and Change in Brand Share

4. Factors Associated with Higher Repeat Rates The largest brand column shows high associations, both positive and negative as does the HHI column (the Herfindahl-Hirschman Index is the sum of the brand shares squared and is used to assess industry concentration, usually to decide whether a merger or acquisition should be allowed). These associations between largest brand and HHI and the number of brands of over 3% share are largely autocorrelation. But there is also a high correlation (r = .83) with 672

Domination (share of the largest brand divided by the next largest) and Loyalty Premium (r=.58) (repeat rate of the largest brand divided by the average repeat rate), showing that when categories have very large brands, and therefore high HHI, the categorys largest brand also tends to have a repeat rate higher than its competitors. That larger brands have higher repeat rates was not unexpected. This is a standard Double Jeopardy effect (Ehrenberg, Uncles & Goodhardt 2004). Nor was it surprising that the effect was sometimes higher than predicted, indicating there might be a loyalty premium for very big brands. Fader and Schmittlein (1993) argued that heterogeneity in brand choice is the likely cause of the excess brand loyalty (i.e. greater than double jeopardy predicts) and that this effect is accentuated for larger brands. Most categories however, did not have a huge brand (the mode for largest brand was 24%). The question then focused on whether there was an association between the relative size of the largest brand (domination) and repeat buying. For example if the largest brand was much larger than its rivals. That is, if a 10% brand is twice as big as its nearest rival, as opposed to a 20% share brand with an 18% competitor, what might be expected for category repeat rate. The degree of domination when correlated against the weighted average category repeat rate for each category gave a weak positive correlation of r = .16. So domination was associated with repeat buying, but weakly, and the effect was probably overshadowed by the simple size effect. Highly dominated categories are not necessarily high repeat rate categories.

Graph 2, Brands that Dominate their Rivals Tend to Enjoy Loyalty Premiums

Repeat Rate of largest brand divided by repeat of next largest 2.0 1.8 1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 Share of Largest Brand divided by Share of next largest

Domination and Loyalty Premium

However, there was a strong positive relationship (r = .70) between domination and loyalty premium. In other words, brands that are much bigger than their nearest rivals tend to have above average repeat buying rates, and the higher the dominance, the higher the premium (see Graph 2). Note that the calculations for loyalty premium and dominance are independent of whether the category has high or low overall repeat rate and show that for brands, while it is good to be big, in terms of loyalty premium it is better to be bigger than ones rivals.

673

Multiple regression analysis was performed to examine further the relationship between variables. However, the results were difficult to interpret, except insofar as they confirmed the overall importance of (in)stability of market share in determining overall category repeat purchase rates. This will be explored further in future.

5. Conclusions These brand repurchase findings are new because they compare repeat buying rates across categories. The results show that repeat buying is largely a function of brand size, moderated by the stability of the category. Moreover, they are predictable using the DoP law. The analysis was greatly assisted by the availability of prior knowledge of loyalty and switching patterns and serves to confirm those patterns through differentiated replication. Some categories had average inter-purchase times of two or three days, while others had many weeks between purchases, but this had little affect on repurchasing. Instead, dynamic categories where shares were unstable had lower average repurchase rates, while categories with very large or dominant brands had higher repurchase rates. In addition, dominance was strongly associated with the largest brand obtaining a loyalty premium. The findings have both conceptual and practical significance. Conceptually, the analysis lays out simple descriptive regularities associated with repeat buying. Despite wide academic and practitioner focus on customer retention and loyalty, little had previously been done to analyze factors associated with high or low levels of repeat buying. It also sets the stage for further analysisfor example, it might be possible to explore whether repeat buying rates for brands indicate any market polarization, or the presence of niche brands. In practical terms, the comparative study of widely differing markets or categories may lead to a greater understanding of brand buying behaviour and to broader generalizations about consumer behavior.

674

References Aaker, D., Joachimsthaler, E., 1999. The Lure of Global Branding, Harvard Business Review, 77 (November/December): 137-144. Baldinger, AL., Rubinson, J., 1996. Brand Loyalty: the Link Between Attitude and Behaviour, Journal of Advertising Research, 36(6) pp22-34 Barwise, P., Robertson, T., 1992. Brand Portfolios, European Management Journal, 10(3): 277-285. Bennett, DR., 2004. The Taiwanese are Just Like Australians in their Loyalty to Fast Food Outlets, Australasian Marketing Journal, Vol 12, No. 3 pp97-103 Bennett, DR., 2007. Meta Analysis of Repeat Buying Loyalty, Academy of Marketing, UK, Conference 2007, Kingston University, 3l-6 July Bennett, DR, Ehrenberg, ASC., Goodhardt, G., 2000. Two Purchase Analysis of Brand Loyalty Among Petrol Buyers, ANZMAC, Gold Coast, Australia, 29 Nov- 2 Dec. Bhattacharya, CB., 1997. Is your brands loyalty too much, too little, or just right? Explaining deviations in loyalty from the Dirichlet norm, International Journal of Research in Marketing, 14, 421-435 Colombo R, Ehrenberg, ASC., Sabavala., D., 2000. Diversity in Analyzing Brand Switching Tables: The Car Challenge, Canadian Journal of Marketing Research, 19 pp23-26 Colombo R., Morrison, D., 1989. A Brand Switching Model with Implications for Marketing Strategies, Marketing Science, 8 (1) pp89-99 Corstjens, M., Lal, R., 2000. Building store loyalty through store brands, Journal of Marketing Research, 37, 281-291 Cunningham, RM., 1956. Brand Loyalty what, where, how much? Harvard Business Review, 34, January-February, pp. 116-128. Dekimpe, MG, Steenkamp, J-B, Mellens, M., Abeele, P., 1997. Decline and Variability in Brand Loyalty, International Journal of Research in Marketing, Vol 14, Issue 5, pp405-420 Ehrenberg, ASC., 1972. Repeat Buying, North Holland Publishing Company, London Ehrenberg, ASC, Uncles, MD., Goodhardt, G., 2004. Understanding brand performance measures: using Dirichlet benchmarks, Journal of Business Research, 57 (12), pp1307-1325 Fader, PS., Schmittlein, DC., 1993. Excess Behavioral Loyalty for High-Share Brands: Deviations from the Dirichlet Model for Repeat Purchasing, Journal of Marketing Research, 30 (November), pp478-493. Habel, C., Rungie C., 2005. Investigating market Dynamics using the double jeopardy line, ANZMAC 2005 conference proceedings, December

675

Kato, M., Honjo, Y., 2006. Market Share Instability and the Dynamics of Competition: a Panel Data Analysis of Japanese Manufacturing Industries, Review of Industrial Organization, March, vol. 28, Issue 2, p165-182 Kapferer, N., 1997. Strategic Brand Management, 2nd edition,: Kogan Page, London Keller, K., 1998. Strategic Brand Management, Prentice Hall, Upper Saddle River, New Jersey, USA Reichheld, FF., Sasser, WE., 1996. The Loyalty Effect: The Hidden Force Behind Growth, Profits and Lasting Value, Harvard Business School Press, Boston MA. www.dti.gov.uk/files/file17173.pd, UK Department of Trade and Industry, reference site for the DTIs use of the Herfindahl-Hirschman Index. For a useful explanation and calculator, see http://www.unclaw.com/chin/teaching/antitrust/herfindahl.htm

676

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- 7 Retail TrendsDokument26 Seiten7 Retail TrendsSushant HaritNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Chapter 2Dokument6 SeitenChapter 2sujithamohanNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- TJX Companies - Company OverviewDokument7 SeitenTJX Companies - Company OverviewSushant HaritNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Ethics Values Leadership Business ManagersDokument11 SeitenEthics Values Leadership Business ManagersSushant HaritNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Constitution of IndiaDokument15 SeitenConstitution of IndiaSushant HaritNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- 04-A Perspective of Business EthicsDokument17 Seiten04-A Perspective of Business EthicsSushant HaritNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- 05-The Manager As An Ethical IndividualDokument8 Seiten05-The Manager As An Ethical IndividualSushant HaritNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- 07 - Why CSRDokument3 Seiten07 - Why CSRSushant HaritNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Iift GK Questions Bank - 2010: MBA Test Prep MBA Test PrepDokument9 SeitenIift GK Questions Bank - 2010: MBA Test Prep MBA Test Prepprabna1Noch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- STS Syllabus 2020Dokument27 SeitenSTS Syllabus 2020AndreaDimaculangan100% (1)

- Automotive E-Coat Paint Process Simulation Using FEADokument20 SeitenAutomotive E-Coat Paint Process Simulation Using FEAflowh_100% (1)

- APM200 Outdoor Power Supply System User Manual-20060628-B-1.0Dokument52 SeitenAPM200 Outdoor Power Supply System User Manual-20060628-B-1.0Andrés MarroquínNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- AD 251 - Equivalent Uniform Moment Factor, M (Italic)Dokument1 SeiteAD 251 - Equivalent Uniform Moment Factor, M (Italic)symon ellimacNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- 04 LimeDokument32 Seiten04 LimeGoogle user100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Falling Weight Deflectometer Bowl Parameters As Analysis Tool For Pavement Structural EvaluationsDokument18 SeitenFalling Weight Deflectometer Bowl Parameters As Analysis Tool For Pavement Structural EvaluationsEdisson Eduardo Valencia Gomez100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- 1651 EE-ES-2019-1015-R0 Load Flow PQ Capability (ENG)Dokument62 Seiten1651 EE-ES-2019-1015-R0 Load Flow PQ Capability (ENG)Alfonso GonzálezNoch keine Bewertungen

- Assignment 2Dokument4 SeitenAssignment 2maxamed0% (1)

- Digital MarketingDokument70 SeitenDigital MarketingTarun N. O'Brain Gahlot0% (2)

- Product Manual 82434 (Revision C) : Generator Loading ControlDokument26 SeitenProduct Manual 82434 (Revision C) : Generator Loading ControlAUGUSTA WIBI ARDIKTANoch keine Bewertungen

- How 50 Million People Are Changing the WorldDokument5 SeitenHow 50 Million People Are Changing the WorldCTRCTR0% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Ownership and Governance of State Owned Enterprises A Compendium of National Practices 2021Dokument104 SeitenOwnership and Governance of State Owned Enterprises A Compendium of National Practices 2021Ary Surya PurnamaNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- YSUUSYs NiCd Battery RepairDokument6 SeitenYSUUSYs NiCd Battery Repairrwesseldyk50% (2)

- Detailed Lesson Plan in MAPEH III I. ObjectivesDokument19 SeitenDetailed Lesson Plan in MAPEH III I. ObjectivesJenna FriasNoch keine Bewertungen

- List of PEGA Interview Questions and AnswersDokument33 SeitenList of PEGA Interview Questions and Answersknagender100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Design of Self - Supporting Dome RoofsDokument6 SeitenDesign of Self - Supporting Dome RoofszatenneNoch keine Bewertungen

- GuideDokument2 SeitenGuideMaissyNoch keine Bewertungen

- D2DDokument2 SeitenD2Dgurjit20Noch keine Bewertungen

- Teaching TrigonometryDokument20 SeitenTeaching Trigonometryapi-21940065Noch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- OTGNNDokument13 SeitenOTGNNAnh Vuong TuanNoch keine Bewertungen

- GSMA Moile Money Philippines Case Study V X21 21Dokument23 SeitenGSMA Moile Money Philippines Case Study V X21 21davidcloud99Noch keine Bewertungen

- Bolt Jul 201598704967704 PDFDokument136 SeitenBolt Jul 201598704967704 PDFaaryangargNoch keine Bewertungen

- Bahasa InggrisDokument8 SeitenBahasa InggrisArintaChairaniBanurea33% (3)

- The Clàsh The 0nly Band That MatteredDokument255 SeitenThe Clàsh The 0nly Band That MatteredNikos VaxevanidisNoch keine Bewertungen

- Technology & Livelihood Education: WEEK 6-7Dokument28 SeitenTechnology & Livelihood Education: WEEK 6-7my musicNoch keine Bewertungen

- Indian ChronologyDokument467 SeitenIndian ChronologyModa Sattva100% (4)

- SPSS-TEST Survey QuestionnaireDokument2 SeitenSPSS-TEST Survey QuestionnaireAkshay PatelNoch keine Bewertungen

- Potato Peroxidase LabDokument2 SeitenPotato Peroxidase LabKarla GutierrezNoch keine Bewertungen

- Dryers in Word FileDokument5 SeitenDryers in Word FileHaroon RahimNoch keine Bewertungen

- Serto Up To Date 33Dokument7 SeitenSerto Up To Date 33Teesing BVNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)