Beruflich Dokumente

Kultur Dokumente

Common Accounting Heads

Hochgeladen von

Premanand ShenoyCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Common Accounting Heads

Hochgeladen von

Premanand ShenoyCopyright:

Verfügbare Formate

Page1of 3

ACCOUNTING HEADS OF

S. NO. INCOME / EXPENSE

I T E M S

C O V E R E D- PROPOSED

1 Basic salary 2 Performance Salary

Basic portion of total salary payable to employees excluding any reimbursement part. Incentive paid to staff over and above their Basic salary on performance

Incentive paid to staff on extraordinary performance for a project

3 Incentive to Staff 4 House Rent Allowance 5 Transport Allowance 6 Site Allowance 7 Site Visit 8 Stipend Account 9 Recruitment Expenses 10 Telephone expenses 11 Telephone expenses reimbursement 12 Medical Expenses reimbursement 13 Staff Welfare (In office) 14 Staff Welfare (Out of office) 15 Staff Insurance 16 Festival Expenses 17 Income Tax 18 Service Tax 19 Office maintenance 20 Conveyance Expenses - Employees 21 Travelling Expenses -Domestic 22 Business Development

House rent allowance portion of total salary payable to employees.

Transport allowance portion of total salary payable to employees.

Allowance portion of total salary payable to employees on Site Duty Allowance portion of total salary payable to employees on Occasional Site Visits other than during office hours, only if we bill the client for such visits Stipend/apprenticeship charges paid to trainees . Charges paid to consultant or for advertisement in newspaper or any other periodical for recruiting new staff or and their interview, screening, induction etc. Telephone expenses reimbursed to office staff with salary on production of monthly telehone bills

Petty telephone expenses incurred by field staff for official purposes Medical expenses reimbursed to office staff with salary on production of monthly medicines bills. Lunch/dinner expenses for staff IN THE OFFICE (on late duty/statement day/ Sunday/Holiday etc.) Lunch/dinner expenses of staff OUTSIDE THE OFFICE PREMISES. Staff insurance premium paid Diwali expenses & other expenses on festivals. Icome Tax paid EXCLUDE Filing fees of Company's Annual Return and Other Forms in Companies Act

Expences for the Maintenance of the Office Premises Conveyance charges paid to staff for going home late night after OFFICIAL duty. Expenses of travelling within India for office purposes including expenses incurred for stay and lunch/dinner Expenses incurred on Brochures/ Web presence, hosting, site development, letters, etc.

Prepared by NAPS

Page2of 3

ACCOUNTING HEADS OF

S. NO. INCOME / EXPENSE

I T E M S

C O V E R E D- PROPOSED

23 Travelling Expenses -Foreign 24 Free/Concessional tkts to staff 25 Cellular Phone Expenses 26 Telephone Expenses 27 Telephone Expenses (Petty) 28 Courier Expenses 29 Postage Expenses 30 Laisoning Expenditure 31 Printing & Stationery 32 Vehicle insurance (Non commercial) 33 Vehicle insurance (Commercial) 34 Lease Rent 35 Rent 36 Guest House Rent 37 Guest House Rent payable 38 Legal & Professional Charges 39 Consultancy Charges 40 Professional Tax 41 Software Expenses 42 Membership fees

Expenses related to travel outside India ,including official expenses incurred outside India. Any amount of concession or free tkts given to Employees will be debited to this account Expenses of mobile phones owned by the company and used by the employees Telephone expenses of landline phones installed in office premises. Telephone expenses incurred by despatch or other staff in the field for official calls made from paid booths etc.(Other than telephone calls charges paid through monthly bills). Sending Drawings, claims,letters, etc. Expenses related to postage stamps purchase, letter post/registered/speed post etc.

Various agents Forms of all types including passport forms, Paper for printers. Insurance charges paid for cars, scooters, motor bikes and other vehicles used for office.(I.e. vehicles held for other than commercial purpose) Insurance charges paid for vehicles held for commercial purpose (e.g. Qualis etc.) Office Rent Rent of office premises. Rent of flats, guest houses and other accommodation for employees and guests. Guest house rent payable referred in 30B above will come in this account Fee paid to Lawyers/ auditors for audit work Consultancy charges Internal paid to any consultant (e.g. Sales tax / Income tax / Company laws / PF / ESI / Management consultancy,Advisory service).ONLY CONSULATNCY Will be debited by professional tax of employer All expenses related to maintenance and upgradation of software. Membership fee paid to Professional Socities/ bodies

43 Newpapers, Books & Periodicals Expenses Paid for various Magazines/ Periodicals 44 Security Expenses

Charges paid for Security services at office premises

Prepared by NAPS

Page3of 3

ACCOUNTING HEADS OF

S. NO. INCOME / EXPENSE

I T E M S

C O V E R E D- PROPOSED

45 Text / Reference Books 46 Meeting & Conference Expenses 47 Advertisement Expenses

Any books purchased for use at office. Expenses incurred for holding any meeting Expenses incurred for giving any advertisement in any newspaper/magazine/TV or Radio channel/Newsletter/periodical etc.for the purpose of business. Petrol and Diesel for Non commercial vehicles (I.e. Vehicles used by

staff) 48 Vehicle Fuel Expenses- Non commercial

49 Vehicle Fuel l Expenses- Commercial 50 Car Expenses 51 Business Promotion Expenses 52 Sales Promotion Expenses 53 Office Purchases 54 Electricity & Generator Expenses 55 Guest House Charges

Petrol and Diesel for commercial vehicles (Cars- etc.) Payment of hire charges of cars taken on hire and given to Clients as complementary service). Expenses of snacks, lunch, dinner with client/customer. NO ENTRY WILL BE PASSED IN THIS ACCOUNT .(and all entries of this nature will be passed in Business promotion a/c). General Items of office (e.g. crockery, photoframes, small electrical items etc) Monthly or Bi-monthly power/electricity charges (As per electricity bills). Electricity Charges and other maintenance charges for Guest House will be debited to this account

56 Repair & Maintenance- Equip & Machinery Maintenance/AMC and repair charges relating to Plotter 57 Vehicle Maintenance (Non commercial) 58 Repair & Maintenance- Building 59 Repair & Maintenance - Others

Computer maintenance / Computer expenses /

Repair and maintenance charges of vehicles held for other than commercial purpose (i.e. cars, scooters, motor bikes etc.) House keeping charges such office cleaning and maintenance expenses. Repair expenses other than of vehicles, computers, buildings and office equipments.

60 61 Bank Charges 62 Short & Excess expenses 63 Donation 64 Interest on bank loan

Maintenance/AMC and repair charges relating to Computers Amount charged by bank for services rendered (e.g. Cheque-book charges,DD charges, amount debited on dishonour of cheque etc.) Very small expenses or adjustments not classifiable under any other accounting head. Donation made to nay charitable association. Interest paid on Bank Cash credit / Overdraft limits. Interest portion of secured Non commercial vehicle loans repaid

during the year. 65 Interest on Vehicle Loans (Non commercial) Interest portion of secured Commercial vehicle loans repaid during

66 Interest on Vehicle Loans (Commercial) the year. 67 Interest on Other Loan 68 Audit expenses 69 Finance charges

Interest portion of secured/unsecured loans other than vehicle loans, repaid during the year. Expenses for Lunch/dinner/snacks with auditors ( ISO,etc) EXCLUDING Internal auditors. Any charges/commission paid for sanctioning higher Cash credit/OD limit.

Prepared by NAPS

Das könnte Ihnen auch gefallen

- Sample Manufacturing Business Chart of Accounts PDFDokument3 SeitenSample Manufacturing Business Chart of Accounts PDFMamun Kabir73% (15)

- Mechanic Auto Body Income Expense SheetDokument2 SeitenMechanic Auto Body Income Expense SheetCindy100% (1)

- Team 7 - Case 24Dokument15 SeitenTeam 7 - Case 24rNoch keine Bewertungen

- Cost Sheet Format For Sugar IndustryDokument3 SeitenCost Sheet Format For Sugar Industryjeganrajraj100% (3)

- The Tier 4 Microfinance Institutions and Money Lenders Money Lenders RegulationDokument26 SeitenThe Tier 4 Microfinance Institutions and Money Lenders Money Lenders RegulationCHARLES ODOKI OKELLANoch keine Bewertungen

- Interview Question AnswersDokument2 SeitenInterview Question AnswersSushilSinghNoch keine Bewertungen

- CHARGING METHODS FOR CIVIL ENGINEERING SERVICESDokument18 SeitenCHARGING METHODS FOR CIVIL ENGINEERING SERVICESChristian CalayNoch keine Bewertungen

- DocxDokument15 SeitenDocxMay RamosNoch keine Bewertungen

- Chapter 5 Percentage TaxDokument11 SeitenChapter 5 Percentage Taxmy miNoch keine Bewertungen

- I: Multiple Choice (30 Points) : These Statements Are True or False? (25 Points/correct Answer)Dokument4 SeitenI: Multiple Choice (30 Points) : These Statements Are True or False? (25 Points/correct Answer)Mỹ Dung PhạmNoch keine Bewertungen

- Finalisation Entries GuideDokument13 SeitenFinalisation Entries GuideRameshKumarMuraliNoch keine Bewertungen

- Financial Planning and AnalysisDokument4 SeitenFinancial Planning and AnalysisSwasti PradipNoch keine Bewertungen

- Accounting HeadsDokument6 SeitenAccounting HeadsTekumani Naveen Kumar100% (11)

- List of Expense AccountsDokument6 SeitenList of Expense AccountsAarajita ParinNoch keine Bewertungen

- Tally Tips - Accounting Heads of Incomes - ExpensesDokument7 SeitenTally Tips - Accounting Heads of Incomes - ExpensesSayed Muntazir Hussain100% (3)

- Cost AccountingDokument36 SeitenCost AccountingNikhil PatelNoch keine Bewertungen

- Employee Expense Report TemplateDokument4 SeitenEmployee Expense Report TemplateTyler Beth VandeWaterNoch keine Bewertungen

- Modül Business Decisions and EconomicsDokument60 SeitenModül Business Decisions and Economicsmuhendis_8900Noch keine Bewertungen

- Chart of Accounts Complete List With Descriptions (For Quickbooks Desktop)Dokument4 SeitenChart of Accounts Complete List With Descriptions (For Quickbooks Desktop)vaddana haisocheatNoch keine Bewertungen

- Manual of Accounts - Caffe La TeaDokument5 SeitenManual of Accounts - Caffe La TeaMichele RogersNoch keine Bewertungen

- Cost and Management Accounting of MITA India Pvt LtdDokument12 SeitenCost and Management Accounting of MITA India Pvt Ltdrahul shuklaNoch keine Bewertungen

- Mitra S.K. Group of Companies: Accounts ManualDokument21 SeitenMitra S.K. Group of Companies: Accounts ManualdebashisdasNoch keine Bewertungen

- List of Expense-WPS OfficeDokument2 SeitenList of Expense-WPS OfficeMary Jescho Vidal AmpilNoch keine Bewertungen

- Expenses That Are Not IncurredDokument10 SeitenExpenses That Are Not Incurredzarfarie aronNoch keine Bewertungen

- Tax PresentationDokument39 SeitenTax Presentationtap4awhileNoch keine Bewertungen

- Accounting NotesDokument3 SeitenAccounting NotesReal SohelNoch keine Bewertungen

- Business Income Expense WorksheetDokument1 SeiteBusiness Income Expense Worksheethoanganh4meNoch keine Bewertungen

- 5 Expense AccountsDokument2 Seiten5 Expense Accountsapi-299265916Noch keine Bewertungen

- Chart of AccountDokument9 SeitenChart of Accountshankar19744619Noch keine Bewertungen

- Chart of AccountDokument10 SeitenChart of AccountDmitry_11Noch keine Bewertungen

- UTTR Presentation - Bucharest 2013 (JM V2)Dokument24 SeitenUTTR Presentation - Bucharest 2013 (JM V2)schilipici2008Noch keine Bewertungen

- Chart Info Georgia Tech Expenditure Account LookupDokument20 SeitenChart Info Georgia Tech Expenditure Account LookupMondejar MercNoch keine Bewertungen

- CA Chap 4 PDFDokument28 SeitenCA Chap 4 PDFmassoud ahadiNoch keine Bewertungen

- UK Common Tax Deductible Business ExpensesDokument1 SeiteUK Common Tax Deductible Business ExpensesJames HarrisonNoch keine Bewertungen

- Detailed Chart of AccountsDokument7 SeitenDetailed Chart of AccountsarthurmathieuNoch keine Bewertungen

- Expense Form FormDokument15 SeitenExpense Form FormEgg EggNoch keine Bewertungen

- Income Statement TemplateDokument4 SeitenIncome Statement TemplateAnonymous gFcnQ4goNoch keine Bewertungen

- Charging Engineering ServicesDokument11 SeitenCharging Engineering ServicesWin AsuncionNoch keine Bewertungen

- Final Account BBADokument37 SeitenFinal Account BBAgrivand100% (1)

- Malaysia Corporate Income Tax Guide - Tax DeductionsDokument2 SeitenMalaysia Corporate Income Tax Guide - Tax DeductionsMuhammad Syazwan AhmadNoch keine Bewertungen

- Purpose CodeDokument3 SeitenPurpose CodeRavi KumarNoch keine Bewertungen

- Qualifying CostsDokument5 SeitenQualifying CostsRoshniMalikNoch keine Bewertungen

- Vdocuments - MX - Charging For Civil Engineering Services 5640c284b263cDokument19 SeitenVdocuments - MX - Charging For Civil Engineering Services 5640c284b263cKevin ManalastasNoch keine Bewertungen

- Charging For Civil Engineering Services: Section 4Dokument19 SeitenCharging For Civil Engineering Services: Section 4Timothy James S ReyesNoch keine Bewertungen

- 5 Income Tax Return OrganizerDokument6 Seiten5 Income Tax Return OrganizerwburgpnoNoch keine Bewertungen

- Accounting Standard (AS) 10Dokument16 SeitenAccounting Standard (AS) 10Priyanka MishraNoch keine Bewertungen

- Assingnment Principle of AccountingDokument3 SeitenAssingnment Principle of AccountingTaufiq Mt100% (1)

- Business Startup CostsDokument11 SeitenBusiness Startup CostsZafar AhmedNoch keine Bewertungen

- Business Startup CostsDokument11 SeitenBusiness Startup CostsCare2befriends MagicmanNoch keine Bewertungen

- Business Startup CostsDokument11 SeitenBusiness Startup CostsHadee SaberNoch keine Bewertungen

- Bisnis Cost StartupDokument11 SeitenBisnis Cost StartupRomi RobertoNoch keine Bewertungen

- Business Startup CostsDokument11 SeitenBusiness Startup CostsRaul CollazziNoch keine Bewertungen

- FS - Auto Workshop FeasibilityDokument45 SeitenFS - Auto Workshop Feasibilitywaqas_baloch_10% (1)

- Tax Cheatsheet LandscapeDokument2 SeitenTax Cheatsheet LandscapeEeLin Chan100% (1)

- Statement of Cash FlowsDokument7 SeitenStatement of Cash FlowsratihNoch keine Bewertungen

- Automobile Care & Repair ServicesDokument18 SeitenAutomobile Care & Repair ServicesashishNoch keine Bewertungen

- Financial Projection Template - NewDokument5 SeitenFinancial Projection Template - NewNorhisham DaudNoch keine Bewertungen

- Tax Return DocsDokument3 SeitenTax Return DocsBaljeet SinghNoch keine Bewertungen

- Revenue and Cost StreamsDokument44 SeitenRevenue and Cost StreamsAniket ChatterjeeNoch keine Bewertungen

- Direct and Indirect Cost Classification GuideDokument10 SeitenDirect and Indirect Cost Classification GuideNeelNoch keine Bewertungen

- Business Case: Total Cost of Ownership and Return On InvestmentDokument21 SeitenBusiness Case: Total Cost of Ownership and Return On Investmentdxa00145Noch keine Bewertungen

- Project Budget Template Excel Free Download - vF3O7wS7R6arcHyDokument20 SeitenProject Budget Template Excel Free Download - vF3O7wS7R6arcHymulugetaNoch keine Bewertungen

- Account TitlesDokument1 SeiteAccount TitlesJoanna May EspinosaNoch keine Bewertungen

- Business Startup Costs TemplateDokument10 SeitenBusiness Startup Costs TemplatePatrick OppongNoch keine Bewertungen

- 1040 Exam Prep Module X: Small Business Income and ExpensesVon Everand1040 Exam Prep Module X: Small Business Income and ExpensesNoch keine Bewertungen

- Pavitra Reddy IJCIET - 09!03!020Dokument9 SeitenPavitra Reddy IJCIET - 09!03!020Premanand ShenoyNoch keine Bewertungen

- Roy & Shenoy- ISO 9001 Certified Project Management ConsultantsDokument1 SeiteRoy & Shenoy- ISO 9001 Certified Project Management ConsultantsPremanand ShenoyNoch keine Bewertungen

- Blood: Causes of Internal Bleeding Due To TraumaDokument2 SeitenBlood: Causes of Internal Bleeding Due To TraumaPremanand ShenoyNoch keine Bewertungen

- Pavitra Reddy IJCIET - 09!03!020Dokument9 SeitenPavitra Reddy IJCIET - 09!03!020Premanand ShenoyNoch keine Bewertungen

- Roy & Shenoy- ISO 9001 Certified Project Management ConsultantsDokument1 SeiteRoy & Shenoy- ISO 9001 Certified Project Management ConsultantsPremanand ShenoyNoch keine Bewertungen

- Fabrication CodeDokument45 SeitenFabrication CodeJitendra KumarNoch keine Bewertungen

- Engineering of Spine PDFDokument12 SeitenEngineering of Spine PDFPremanand ShenoyNoch keine Bewertungen

- Bio MimeticsDokument89 SeitenBio MimeticsSantosh VemulaNoch keine Bewertungen

- Engineering of Spine PDFDokument12 SeitenEngineering of Spine PDFPremanand ShenoyNoch keine Bewertungen

- High Performance Epoxy Coating SpecificationDokument12 SeitenHigh Performance Epoxy Coating SpecificationDanny SeeNoch keine Bewertungen

- Kerala Cinema Regulation RulesDokument33 SeitenKerala Cinema Regulation RulesHari SomanathNoch keine Bewertungen

- Civil InternshipDokument11 SeitenCivil InternshipPremanand Shenoy100% (1)

- Kerala Municipal Building RuleDokument105 SeitenKerala Municipal Building RuleSharath Kumar KNoch keine Bewertungen

- Fabrication, supply and erection of Pre-Engineered BuildingDokument119 SeitenFabrication, supply and erection of Pre-Engineered BuildingRavi TilaganjiNoch keine Bewertungen

- Crystal Arc Building OwnersDokument2 SeitenCrystal Arc Building OwnersPremanand ShenoyNoch keine Bewertungen

- CRYSTAL ARC BUILDING Letter HeadDokument1 SeiteCRYSTAL ARC BUILDING Letter HeadPremanand ShenoyNoch keine Bewertungen

- Roy & Shenoy- ISO 9001 Certified Project Management ConsultantsDokument1 SeiteRoy & Shenoy- ISO 9001 Certified Project Management ConsultantsPremanand ShenoyNoch keine Bewertungen

- CRYSTAL ARC BUILDING Letter HeadDokument1 SeiteCRYSTAL ARC BUILDING Letter HeadPremanand ShenoyNoch keine Bewertungen

- R&S SIP FormatsDokument3 SeitenR&S SIP FormatsPremanand ShenoyNoch keine Bewertungen

- Profile of Dr. Premanand Shenoy, Civil Engineer and ProfessorDokument1 SeiteProfile of Dr. Premanand Shenoy, Civil Engineer and ProfessorPremanand ShenoyNoch keine Bewertungen

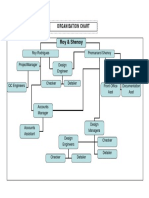

- Organisation Chart: Roy Rodrigues Premanand Shenoy ProjectmanagerDokument1 SeiteOrganisation Chart: Roy Rodrigues Premanand Shenoy ProjectmanagerPremanand ShenoyNoch keine Bewertungen

- Premanand Shenoy-2019Dokument1 SeitePremanand Shenoy-2019Premanand ShenoyNoch keine Bewertungen

- ISO2018Dokument1 SeiteISO2018Premanand ShenoyNoch keine Bewertungen

- Student Internship Programme RolesDokument5 SeitenStudent Internship Programme RolesPremanand ShenoyNoch keine Bewertungen

- DR Premanand ShenoyDokument2 SeitenDR Premanand ShenoyPremanand ShenoyNoch keine Bewertungen

- The Student Internship Programme - Concept and RolesDokument5 SeitenThe Student Internship Programme - Concept and RolesPremanand ShenoyNoch keine Bewertungen

- Classification of BridgesDokument2 SeitenClassification of BridgesPremanand ShenoyNoch keine Bewertungen

- My Sore Water SupplyDokument6 SeitenMy Sore Water SupplyPremanand ShenoyNoch keine Bewertungen

- Classification of BridgesDokument2 SeitenClassification of BridgesPremanand ShenoyNoch keine Bewertungen

- Sahyaware WUDokument1 SeiteSahyaware WUPremanand ShenoyNoch keine Bewertungen

- Liabilities by Valix: Intermediate Accounting 2Dokument34 SeitenLiabilities by Valix: Intermediate Accounting 2Trisha Mae AlburoNoch keine Bewertungen

- Sbi Rar 2013Dokument91 SeitenSbi Rar 2013Moneylife Foundation100% (1)

- Creation of Series Using List, Dictionary & NdarrayDokument65 SeitenCreation of Series Using List, Dictionary & Ndarrayrizwana fathimaNoch keine Bewertungen

- LO4194 PayrollDokument431 SeitenLO4194 Payrollhammad016Noch keine Bewertungen

- Loan Restructuring Rejected Due to No Absolute AcceptanceDokument2 SeitenLoan Restructuring Rejected Due to No Absolute AcceptancefranzadonNoch keine Bewertungen

- If 3Dokument4 SeitenIf 3Abdul Aziz WadiwalaNoch keine Bewertungen

- DokumenDokument6 SeitenDokumenZeris TheniseoNoch keine Bewertungen

- Customs of The TagalogsDokument10 SeitenCustoms of The TagalogsDarryl Mae BaricuatroNoch keine Bewertungen

- Wirc of Icai Seminar On Direct Taxes Recent Landmark Judgements Recent Landmark JudgementsDokument31 SeitenWirc of Icai Seminar On Direct Taxes Recent Landmark Judgements Recent Landmark JudgementsjhaverirajivNoch keine Bewertungen

- SLF065 MultiPurposeLoanApplicationForm V06Dokument2 SeitenSLF065 MultiPurposeLoanApplicationForm V06izze veraniaNoch keine Bewertungen

- Debt Consolidation TipsDokument6 SeitenDebt Consolidation TipsKrittiNoch keine Bewertungen

- SC Act 432 - Compiled As of April 1, 2021Dokument12 SeitenSC Act 432 - Compiled As of April 1, 2021Marcus Navarro100% (1)

- Prepayments (Prepaid Expenses)Dokument3 SeitenPrepayments (Prepaid Expenses)Eat ChalkNoch keine Bewertungen

- FSD Kenya, SACCO CIS Capacity Review Report May 2015Dokument66 SeitenFSD Kenya, SACCO CIS Capacity Review Report May 2015SNoch keine Bewertungen

- BR - Case Compilation - A K NandanDokument40 SeitenBR - Case Compilation - A K Nandansonup9007Noch keine Bewertungen

- AKPK - Financial Behaviour and State of Finanical Well-Being of Malaysian Working Adult PDFDokument70 SeitenAKPK - Financial Behaviour and State of Finanical Well-Being of Malaysian Working Adult PDFBazli HashimNoch keine Bewertungen

- 041123-SBI Analyst Presentation Q2FY24Dokument58 Seiten041123-SBI Analyst Presentation Q2FY24Madem Soma Sundara PrasadNoch keine Bewertungen

- Job Advert - Credit OfficerDokument3 SeitenJob Advert - Credit OfficerRashid BumarwaNoch keine Bewertungen

- Chapter 07-Bank Loans: Name: Class: DateDokument11 SeitenChapter 07-Bank Loans: Name: Class: DateLê Đặng Minh ThảoNoch keine Bewertungen

- PSBank Home Loan Application Form - Properties For SaleDokument2 SeitenPSBank Home Loan Application Form - Properties For SaleLeane Leandra SNoch keine Bewertungen

- Roadmap To Freedom Ebook Access Your Secret Trust and Become Financially Abundant260822Dokument16 SeitenRoadmap To Freedom Ebook Access Your Secret Trust and Become Financially Abundant260822Edis Mendoza100% (13)

- MCQ - Government Sponsored SchemesDokument4 SeitenMCQ - Government Sponsored SchemesClassicaverNoch keine Bewertungen

- Application Form For Agriculture Credit Rs.2lto10lDokument12 SeitenApplication Form For Agriculture Credit Rs.2lto10lAnitakurmaNoch keine Bewertungen

- Salary Slip (20267635 July, 2019)Dokument1 SeiteSalary Slip (20267635 July, 2019)anon_123683840Noch keine Bewertungen

- 1 Investment F PDFDokument35 Seiten1 Investment F PDFShrikant Mahajan100% (2)