Beruflich Dokumente

Kultur Dokumente

The European Monetary Union and The Current Debt Crisis

Hochgeladen von

Marianna RetziOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The European Monetary Union and The Current Debt Crisis

Hochgeladen von

Marianna RetziCopyright:

Verfügbare Formate

The European monetary union

the current debt crisis: developments, trends, policy responses and future prospects

1/23/2012 Prof. P. Aganidis

European Institutions

Marianna Retzi

The European monetary union and the current debt crisis: developments, trends, policy responses and future prospects.

The idea of the European Monetary Union (EMU) did not start just a couple of years before the introduction of the Euro. On the contrary, it existed as a vision since the 1960ies. In 1970 a committee was set up, headed by Luxemburgs Prime Minister Pierre Werner, in order to figure out how the EMU could be formed by 1980. Finally, the European Monetary System (EMS) was created in 1979 together with the European Currency Unit (ECU) which was nothing more than the weighted average of all the countries participating in the EMS. This was one of the step stones into looking further into how a monetary union could also be achieved. In December 1991 the Maastricht convergence criteria were agreed upon, namely: a) inflation rate no higher than 1.5%, b) maximum percentages on government deficit (3%) and debt (60%), c) members of the EMS and the exchange rate mechanism for at least two years and d) interest rates no higher than 2%. In 1998 the European Central Bank is created and on January 1999 the Euro is introduced into the Central Bank system (in a non-physical form). This is when the European Union further established itself as a new global player. The new Euro coins and notes were introduced on January 1st 2002 .1 The creation of a common currency signified the beginning of a unified monetary policy for the participating countries. By joining the Euro a country is privy to many advantages but also disadvantages. The elimination of currency exchange rate costs is greatly advantageous to businesses since they do no longer face the risk of exchange rate fluctuation, thus making investments much easier for them. With price transparency businesses can become more competitive and consumers can compare prices of products across the countries of the euro-zone. The common currency also provided a

ECFIN

European Institutions

Marianna Retzi

boost to tourism since crossing the border does no longer mean incurring the cost of exchanging currency. Combining all of the above, it is apparent that the Euro is a currency strong enough to compete against the US dollar and the Japanese Yen. Currently, the Euro-zone, with population of 331.9 million2 people, is the area with the largest population that has a common currency, closely followed by the US and the dollar with a population of 312.8 million3 and Japan with 127.08 million4. The Euro is a new hard currency with high bargaining power. However, the main disadvantage of the common currency is that the countries participating had to give up control of their monetary policy. Adjusting ones interest rate in order to attract investments, for instance, is no longer an option since interest rates are set by the European Central Bank. Needless to say, devaluating ones currency in order to adjust the exchange rate is out of the question. Apart from the common monetary policy, the control of over the individual countries fiscal po licy imposed by the Stability and Growth Pact5 makes it more difficult for governments to be flexible with their budgets when they need to spend money in order to overcome economic difficulties (feed their economy with money through government spending in order to encourage spending). Governments have no longer in their policy toolkit any stabilization tools resulting in weak economic governanance. But did we, with the creation of the European Monetary Union, forget the goal of political integration? A year before the creation of the European Central Bank, in 1997, Giscard d Estaing and Helmut Schmidt were quoted saying in the International Herald Tribune: One must never forget that monetary union, which the two of us were the first to propose more than a decade ago is ultimately a political project. It aims to give a new impulse to the historic movement towards union of the European states. Monetary union is a federative project that needs to be accompanied and followed by other

2 3

TGM US & World Population Clock 4 Japan 5 ECFIN

European Institutions

Marianna Retzi

steps.6 Europes Monetary Union is something that aims to bring the members of the EU a step closer to their political union. A future common fiscal policy (which seems to be becoming more and more likely) will bring the countries even closer to this goal. A common currency means giving up part of the member-countries national sovereignty. In order to achieve political convergence the EU nations will need to give up an even bigger part of their national sovereignty. In a matter of speaking, the monetary union is preparing the EU countries for giving up a greater part of their sovereignty in the future. The last couple of years though, things do not seem that optimistic. The European Monetary Union has been lately facing maybe its biggest crisis of all times. It is not only the biggest but a unique crisis, since it is sort of a triple crisis because it is financial (banks), economic (affects GDP and unemployment) and debt (inability to refinance a countrys debt). There have been hints of a debt crisis since 2009, maybe as early as September 2008 when the Irish government announced its first recession since the 80ies.7 Then followed Greece in 2009 with its inability to be consistent with its debt obligations, because of increased government spending. And things followed from there like a domino effect. Next up was Portugal with its own sovereign debt crisis. Things are bound to go south in other European countries as well. Italy, a member of G8 and G30 has been facing problems since the mid of 2011. There is a problem and it seems to be quickly spreading and affecting not only the smaller countries of the European Union, but also countries such as France. (Figures 2, 3, 4) Was Henry Kissinger right in saying in The Sun in 1998 that It is difficult to see how monetary union can succeed?8 Is the contagious effect of the current debt crisis going to bring the European Monetary Union to its knees? It might not have a devastating effect on the EMU but it will certainly bring many changes to the countries individually and the European Union itself. We have been observing that in Greece and Italy there has a been a new type of governance with interim presidents and prime ministers in order for

6 7

Excerpt CSO 8 Page 10

European Institutions

Marianna Retzi

measures against the current debt crisis to be enforced. Appointing a prime minister without election in democratic states was unheard of before the current situation. Another change is that through loans and other types of financial aid from third parties, such as the International Monetary Fund, countries are bound by contracts to form their policies according to guidelines named in said contracts. In essence, there is a direct involvement of third parties (whether they are countries or international organizations) in the governance of sovereign nations. Apart from the changes that have taken place affecting individual countries the current debt crisis is bound to have a profound effect on the structure of the European Union itself as well as the laws and policies governing it. There have been talks and rumors about the creation of a multi-speed Europe or two-speed Europe, namely the northern and the southern members of the EU, based on the strength of their economies. Apart from the political part of the EU, the structure of the Europes monetary union will most likely change. Having a common monetary policy (which as mentioned before severely limits state members reactions to crises such as the current one) which is has proven to be highly rigid and unable to react to the debt crisis, accentuates the need of a common fiscal policy too. Since such a change cannot happen overnight though, the first crucial step would be to strictly enforce the Stability and Growth Pact according to which budget deficits need to be less than 3% and debt should not exceed 60% of GDP. Even though the Pact exists a big number of countries (Figure 2) does not abide by it and there have been no consequences. Strict enforcement of the Stability Growth Pact, together with some complimentary rules and regulations, could eventually bring the European Union closer to a common fiscal policy. As it was previously mentioned the convergence of the EU member states on both financial and monetary policies will eventually bring political integration. The current debt crisis is now said to be of equal magnitude with that of 1932. Still, nobody was prepared for such a shock of such magnitude in the European economy and consequently there was an

European Institutions

Marianna Retzi

absence of any defense mechanism to prevent such an occurrence or of support system in order to aid countries of the European Union found in such a situation. The first signs of structuring such systems were seen when the debt crisis in Greece took place. Even though it took some experimentation, it seems that there is currently a clearer picture on what needs to be done in the future in cases like the one we are currently facing. It is certain that in the near future safeguards will be put into place in order to avoid future occurrences of the same issue, through regulatory reforms. Unfortunately, it seems that such a debt crisis was needed in order to undermine the architecture of European Monetary Union and bring forward both short- and long-term changes in the European Union and European Monetary Union. It is certain that Europe will come out stronger out of this situation. In the same manner that diamonds are formed in areas of immense temperature and pressure, will the member states of Europe and the European Union itself come out unified and become an even more formidable player in the worldwide economic and political scene.

European Institutions

Marianna Retzi

Appendix

Figure 1

Which countries have adopted the euro and when? 1999 2001 2002 2007 2008 2009 2011 Belgium, Germany, Ireland, Spain, France, Italy, Luxembourg, the Netherlands, Austria, Portugal and Finland Greece Introduction of euro banknotes and coins Slovenia Cyprus, Malta Slovakia Estonia

Source: http://ec.europa.eu/economy_finance/euro/index_en.htm9

ECFIN

European Institutions

Marianna Retzi

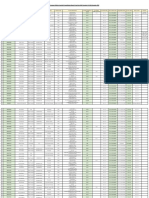

Figure 2

General Government Deficit (-) / Surplus (+), % 2004

Belgium Germany Ireland Spain France Italy Luxemburg Netherlands Austria Portugal Finland Greece Cyprus Malta Slovakia Estonia -0.3 -3.8 1.4 -0.1 -3.6 -3.5 -1.1 -1.7 -4.4 -3.4 2.5 -7.5 -4.1 -4.7 -2.4 1.6

General Government Gross Debt, % 2004 2005 2006 2007 2008 2009 2010

94.0 66.3 29.4 46.3 64.9 6.3 52.4 64.7 57.6 44.4 98.6 70.9 71.7 41.5 5.0 92.0 68.6 27.2 43.1 66.4 6.1 51.8 64.2 62.8 41.7 69.4 69.7 34.2 4.6 88.0 68.1 24.7 39.6 63.7 6.7 47.4 62.3 63.9 39.6 64.7 64.1 30.5 4.4 84.1 65.2 24.8 36.2 64.2 6.7 45.3 60.2 68.3 35.2 58.8 62.1 29.6 3.7 89.3 66.7 44.2 40.1 68.2 13.7 58.5 63.8 71.6 33.9 48.9 62.2 27.8 4.5 95.9 74.4 65.2 53.8 79.0 14.8 60.8 69.5 83.0 43.3 58.5 67.8 35.5 7.2 96.2 83.2 92.5 61.0 82.3 19.1 62.9 71.8 93.3 48.3 61.5 69.0 41.0 6.7

2005

-2.7 -3.3 1.7 1.3 -2.9 -4.4 0.0 -0.3 -1.7 -5.9 2.8 -5.2 -2.4 -2.9 -2.8 1.6

2006

0.1 -1.6 2.9 2.4 -2.3 -3.4 1.4 0.5 -1.5 -4.1 4.1 -5.7 -1.2 -2.8 -3.2 2.5

2007

-0.3 0.2 0.1 1.9 -2.7 -1.6 3.7 0.2 -0.9 -3.1 5.3 -6.5 3.5 -2.4 -1.8 2.4

2008

-1.3 -0.1 -7.3 -4.5 -3.3 -2.7 3.0 0.5 -0.9 -3.6 4.3 -9.8 0.9 -4.6 -2.1 -2.9

2009

-5.8 -3.2 -14.2 -11.2 -7.5 -5.4 -0.9 -5.6 -4.1 -10.1 -2.5 -15.8 -6.1 -3.7 -8.0 -2.0

2010

-4.1 -4.3 -31.3 -9.3 -7.1 -4.6 -1.1 -5.1 -4.4 -9.8 -2.5 -10.6 -5.3 -3.6 -7.7 0.2

103.4 105.4 106.1 103.1 105.8 115.5 118.4

100.0 106.1 107.4 113.0 129.3 144.9

Source : Eurostat Statistical- 2012 Edition Eurostat European Commission

European Institutions Figure 3

Marianna Retzi

General Government Deficit (-) / Surplus (+), %

2010

2009

2008

2007

2006

2005

2004

-35

-30 Estonia Netherlands

-25 Slovakia Luxemburg

-20 Malta Italy

-15 Cyprus France

-10 Greece Spain

-5 Finland Ireland Portugal Germany

0 Austria Belgium

10

European Institutions Figure 4

Marianna Retzi

General Government Gross Debt, %

2010

2009

2008

2007

2006

2005

2004

20 Estonia Netherlands

40 Slovakia Luxemburg Malta Italy

60 Cyprus France

80 Greece Spain

100 Finland Ireland

120 Portugal Germany Austria Belgium

140

160

10

European Institutions

Marianna Retzi

Bibliography

2008 Press Releases CSO Central Statistics Office Ireland. [Online]. Available: http://www.cso.ie/en/newsandevents/pressreleases/2008pressreleases/. [20.01.2012]

Economic and Monetary Union ECFIN European Commission. [Online] Available: http://ec.europa.eu/economy_finance/euro/emu/index_en.htm. [08.01.2012]

Eurostat Tables, Maps and Graphs Interface (TGM) Table. [Online]. Available: http://epp.eurostat.ec.europa.eu/tgm/table.do?tab=table&language=en&pcode=tps00001&ta bleSelection=1&footnotes=yes&labeling=labels&plugin=1. [08.01.2012]

Eurostat Statistical Books Eurostatistics Data for Short-Term Economic Analysis. 01.2012. 2012

Excerpt Council on Foreign Relations. [Online]. Available: http://www.cfr.org/us-strategy-andpolitics/future-transatlantic-relations/p3066?excerpt=1. [09.01.2012]

Japan. [Online]. Available : http://www.state.gov/r/pa/ei/bgn/4142.htm. [20.01.2012]

Page 10. [Online]. Available : http://www.silentmajority.co.uk/Eurorealist/lfa10.html. [20.01.2012]

U.S. & World Population Clock. [Online]. Available: http://www.census.gov/population/www/popclockus.html. [20.01.2012]

11

European Institutions

Marianna Retzi

12

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- BS EN 50365 - 2002 Insulating HelmetsDokument18 SeitenBS EN 50365 - 2002 Insulating HelmetsmetropodikasNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Eastern E. Today - EuroDokument4 SeitenEastern E. Today - Euromariana martinezNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- European Currency UnitDokument13 SeitenEuropean Currency UnitSoorya HaridasanNoch keine Bewertungen

- Mata Wang DuniaDokument12 SeitenMata Wang DuniaNor Adibah AbdullahNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Hist Panel EURIBOR Jul 2010Dokument12 SeitenHist Panel EURIBOR Jul 2010JaphyNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Fakture - Obracuni 2014Dokument78 SeitenFakture - Obracuni 2014svetlanaNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Def Exp 2022 enDokument16 SeitenDef Exp 2022 enDamjanoskiNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Din en Iso 6270-2Dokument10 SeitenDin en Iso 6270-2Santaj TechnologiesNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Release Strategy For Multiple Countries With Respective CurrencyDokument7 SeitenRelease Strategy For Multiple Countries With Respective CurrencySrinivas VemulapalliNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- 06 Axis BankDokument48 Seiten06 Axis BankClint BanksNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- How George Soros Broke The Bank of EnglandDokument4 SeitenHow George Soros Broke The Bank of EnglandIrin200Noch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Coins - September 2019Dokument70 SeitenCoins - September 2019Ghost RiderNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- World Countries - Country Capitals and Currency PDFDokument6 SeitenWorld Countries - Country Capitals and Currency PDFAbhi RamNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Katalog Zlatnika Zlatara AsDokument1 SeiteKatalog Zlatnika Zlatara AsNikola TrnavacNoch keine Bewertungen

- Calificación de Empresas Transporte de CrudoDokument12 SeitenCalificación de Empresas Transporte de CrudoCRISTINANoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- 2016 05 11 - Southey Capital Distressed and Illiquid PricingDokument8 Seiten2016 05 11 - Southey Capital Distressed and Illiquid PricingSouthey CapitalNoch keine Bewertungen

- Satuan Mata Uang DuniaDokument3 SeitenSatuan Mata Uang DuniaDedi MukhlasNoch keine Bewertungen

- Qdoc - Tips - en 13032 2 2004 eDokument22 SeitenQdoc - Tips - en 13032 2 2004 ejawad chraibiNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Euro Area Fact Book: Key FactsDokument13 SeitenEuro Area Fact Book: Key FactsupatoNoch keine Bewertungen

- Data - Extract - FromInternational Debt StatisticsDokument3 SeitenData - Extract - FromInternational Debt StatisticsArmin StiflerNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Cecm 4455bis 12122015 CF 4221306Dokument1 SeiteCecm 4455bis 12122015 CF 4221306Iordache G. IulianNoch keine Bewertungen

- API BX - Gsr.gnfs - CD Ds2 en Excel v2 9944795Dokument83 SeitenAPI BX - Gsr.gnfs - CD Ds2 en Excel v2 9944795raviNoch keine Bewertungen

- Pohjois-Ja Itäsuomi: / Regional Profile / E. JohnsonDokument3 SeitenPohjois-Ja Itäsuomi: / Regional Profile / E. JohnsonEmily JohnsonNoch keine Bewertungen

- World+Countries+ +Country+Capitals+and+Currency. All at On EplaceDokument6 SeitenWorld+Countries+ +Country+Capitals+and+Currency. All at On EplaceJack HenryNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Single Euro Payments Area (SEPA)Dokument8 SeitenSingle Euro Payments Area (SEPA)Carolina GuedesNoch keine Bewertungen

- Currencies of The World PDFDokument4 SeitenCurrencies of The World PDFRupss Adam JensenNoch keine Bewertungen

- List+No 347+update+Available+BGs, MTNS, CDs+&+BONDsDokument15 SeitenList+No 347+update+Available+BGs, MTNS, CDs+&+BONDsJuan Pablo ArangoNoch keine Bewertungen

- Clia Economic Contribution Report - 16th June 2014Dokument28 SeitenClia Economic Contribution Report - 16th June 2014gracellia89Noch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Euro Coins PDFDokument2 SeitenEuro Coins PDFVictoriaNoch keine Bewertungen

- Cancellation List From Date 04 Nov To 04 Dec 2019 - Consolidate of Premium RefundDokument3 SeitenCancellation List From Date 04 Nov To 04 Dec 2019 - Consolidate of Premium RefundTi BetoNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)