Beruflich Dokumente

Kultur Dokumente

Ias 38.

Hochgeladen von

Samuel Mohau HlonyanaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ias 38.

Hochgeladen von

Samuel Mohau HlonyanaCopyright:

Verfügbare Formate

IFRS AT A GLANCE

IAS 38 Intangible Assets

As at 1 January 2013

IAS 38 Intangible Assets

Also refer: SIC-32 Intangible Assets Web Site Costs Effective Date Periods beginning on or after 31 March 2004

RECOGNITION AND MEASUREMENT SEPARATE ACQUISITION

1. Probable expected future economic benefits will flow to the entity; and 2. Cost can be reliably Specific quantitative measured. Recognition at cost.

ACQUIRED IN BUSINESS COMBINATION

2. Probable always met if fair value (FV) can be determined; FV reflects expectation of future economic benefits. 3. Cost FV at acquisition date. Acquirer recognises it disclosure requirements: separately from goodwill Irrespective of whether the acquiree had recognised it before acquisition.

INTERNALLY GENERATED

Research phase expense costs as incurred. Development phase Capitalise if all criteria are met: Technical feasibility of completion of intangible asset Intention to complete Ability to use or sell the intangible asset Adequate technical, financial and other resources to complete Probable future economic benefits Expenditure measured reliably.

EXCHANGE OF ASSETS

Measure acquired asset

at its fair value If not possible, at book value of asset given up.

INTERNALLY GENERATED GOODWILL

Internally generated goodwill is never recognised as it is not an identifiable resource that can be measured reliably. Examples include: Internally generated brands Customer lists.

GOVERNMENT GRANT

Initially recognised at either: Fair value Nominal value plus direct expenses to prepare for use. Examples include: License to operate national lottery Radio station.

DEFINITION

Intangible assets - identifiable, non-monetary assets, without physical substance. Assets - resources, controlled from past events and with future economic benefits expected. Identifiable if either: Capable of being separated and sold, licensed, rented, transferred, exchanged or rented separately Arise from contractual or other legal rights. Scope exclusions: financial and intangible assets covered by other IFRSs (IAS 2, IAS 12, IAS 17, IAS 19, IAS 32, IFRS 4, IFRS 5).

SUBSEQUENT ACCOUNTING

Finite useful life Choose either amortised cost or revaluation model: Cost model Determine useful life Residual value assumed zero unless active market exists or a commitment by third party to purchase the intangible asset exists Amortisation method Review above annually Amortisation begins when available for use. Revaluation model Fair value at revaluation date Fair value determined by referring to active market If no active market, use cost model Revaluation done regularly Credit to revaluation surplus net of Deferred Tax Transfer to or from retained earnings on realisation.

Indefinite useful lives No foreseeable limit to future expected economic benefits Not amortised Test for impairment annually or when an indication exists Review annually if events and circumstances still support indefinite useful life If no longer indefinite change to finite useful life.

OTHER

Past expenses cannot be capitalised in a later period.

Das könnte Ihnen auch gefallen

- Sector's Contribution To The City of Cape Town's GGP (Percentage)Dokument2 SeitenSector's Contribution To The City of Cape Town's GGP (Percentage)Samuel Mohau HlonyanaNoch keine Bewertungen

- EW Kenyon and His Message of FaithDokument13 SeitenEW Kenyon and His Message of FaithSamuel Mohau Hlonyana88% (8)

- Pray The WordDokument161 SeitenPray The WordSamuel Mohau HlonyanaNoch keine Bewertungen

- WisdomFromThe RichestManDokument17 SeitenWisdomFromThe RichestManSamuel Mohau HlonyanaNoch keine Bewertungen

- SAMlDokument2 SeitenSAMlSamuel Mohau HlonyanaNoch keine Bewertungen

- Kenneth Hagin Faith Lesson No 26Dokument7 SeitenKenneth Hagin Faith Lesson No 26Samuel Mohau HlonyanaNoch keine Bewertungen

- OV2008 Volume LicensingDokument2 SeitenOV2008 Volume LicensingSamuel Mohau HlonyanaNoch keine Bewertungen

- ERP in Business Language7Dokument3 SeitenERP in Business Language7Samuel Mohau HlonyanaNoch keine Bewertungen

- Gautrain FaresDokument1 SeiteGautrain FaresSamuel Mohau Hlonyana100% (1)

- Gautrain GuideDokument2 SeitenGautrain GuideSamuel Mohau HlonyanaNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Nick Snowdon Makes The CaseDokument2 SeitenNick Snowdon Makes The CasedouglashadfieldNoch keine Bewertungen

- Chapter 6 Dummy Variable AssignmentDokument4 SeitenChapter 6 Dummy Variable Assignmentharis100% (1)

- Blackbook ProjectDokument60 SeitenBlackbook ProjectAnil SontakkeNoch keine Bewertungen

- Gregory Mankiw Slides For Chapter 12Dokument57 SeitenGregory Mankiw Slides For Chapter 12nixen99_gella100% (2)

- Supply Chain MCQDokument14 SeitenSupply Chain MCQdr jaiman100% (1)

- Export Pricing StrategiesDokument14 SeitenExport Pricing StrategiesHarmanjit DhillonNoch keine Bewertungen

- SixtDokument7 SeitenSixtAmit BaharaNoch keine Bewertungen

- Analysis of Working Capital of Parag Milk Industry: BbdnitmDokument34 SeitenAnalysis of Working Capital of Parag Milk Industry: BbdnitmPrakhar MishraNoch keine Bewertungen

- What Is Costing?Dokument27 SeitenWhat Is Costing?wickygeniusNoch keine Bewertungen

- Global Promotion StrategiesDokument4 SeitenGlobal Promotion StrategiesPatricia MumbiNoch keine Bewertungen

- Share Based NotesDokument5 SeitenShare Based NotesJP MJNoch keine Bewertungen

- The Art of Selling PDFDokument256 SeitenThe Art of Selling PDFBMENoch keine Bewertungen

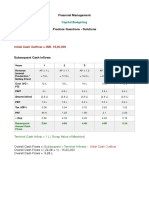

- Capital Budgeting - SolutionDokument5 SeitenCapital Budgeting - SolutionAnchit JassalNoch keine Bewertungen

- Circuit City Accounting CaseDokument4 SeitenCircuit City Accounting CasePookguyNoch keine Bewertungen

- Excise CaseDokument13 SeitenExcise CaseVenkat SujithNoch keine Bewertungen

- Business Ethics Concepts & Cases: Manuel G. VelasquezDokument19 SeitenBusiness Ethics Concepts & Cases: Manuel G. VelasquezAdhi KurniawanNoch keine Bewertungen

- Learning From Public-Private Sector Partnership in Agriculture Research and Innovation SystemDokument16 SeitenLearning From Public-Private Sector Partnership in Agriculture Research and Innovation Systemfajarhidayat1505Noch keine Bewertungen

- 9a83ddoctrine of Caveat Emptor and Its ExceptionsDokument8 Seiten9a83ddoctrine of Caveat Emptor and Its ExceptionsShiv KaushikNoch keine Bewertungen

- URP Unrealised ProfitDokument2 SeitenURP Unrealised ProfitruvaNoch keine Bewertungen

- Foreign Currency ConversionDokument42 SeitenForeign Currency ConversionAvish Shah100% (4)

- Bisk REG 16Dokument62 SeitenBisk REG 16mgorm003Noch keine Bewertungen

- Complete Notes Principles of ManagementDokument45 SeitenComplete Notes Principles of ManagementamitNoch keine Bewertungen

- Airtel - A Case StudyDokument30 SeitenAirtel - A Case StudyTanya Dutta57% (7)

- PEB4102 Chapter 2Dokument41 SeitenPEB4102 Chapter 2LimNoch keine Bewertungen

- Property, Plant and Equipment: Recognition of PPEDokument6 SeitenProperty, Plant and Equipment: Recognition of PPEbigbaekNoch keine Bewertungen

- A211 MA2 EXERCISE 4 (TOPIC 4 Performance Measurement) - Questions - Upoladed 18 Dec 2021Dokument3 SeitenA211 MA2 EXERCISE 4 (TOPIC 4 Performance Measurement) - Questions - Upoladed 18 Dec 2021Amirul Hakim Nor AzmanNoch keine Bewertungen

- 0304 - Ec 1Dokument30 Seiten0304 - Ec 1haryhunter100% (3)

- Study Guide For Students in Cost AccountingDokument41 SeitenStudy Guide For Students in Cost Accountingjanine moldinNoch keine Bewertungen

- Finlatics IBEP Project 2Dokument5 SeitenFinlatics IBEP Project 2Angel AliyaNoch keine Bewertungen

- Chapter 1Dokument31 SeitenChapter 1Đồng DươngNoch keine Bewertungen