Beruflich Dokumente

Kultur Dokumente

FNMA Form 4080

Hochgeladen von

rapiddocsOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FNMA Form 4080

Hochgeladen von

rapiddocsCopyright:

Verfügbare Formate

EXHIBIT B MODIFICATIONS TO INSTRUMENT (First Lien) 1.

The following new Sections are added to the end of the Instrument after the last numbered Section: "[47.] CONSENT TO SUBORDINATE MORTGAGE. Notwithstanding any provisions of this Instrument or any other Loan Document to the contrary, it is understood and agreed that Lender has consented to additional financing on the Mortgaged Property as evidenced by a Multifamily Note dated __________________, _________, in the original principal amount of $_______________ (as the same may be modified or amended with the approval of noteholder, the " Subordinate Note") made by the Borrower and payable to the order of Lender and secured by a Multifamily [Mortgage] [Deed of Trust] or [Deed to Secure Debt], Assignment of Rents and Security Agreement dated the same date as the Subordinate Note (the "Subordinate Instrument"). [48.] CROSS-DEFAULT. If Borrower is in default under any promissory note evidencing a subordinate loan, including without limitation, the Subordinate Note, the Subordinate Instrument, or any other loan document executed in connection with the indebtedness evidenced by the Subordinate Note, which default remains uncured after the applicable cure period, if any, such default shall constitute an Event of Default under the Note and this Instrument. The occurrence of an Event of Default under the Note or this Instrument shall constitute an Event of Default under the Subordinate Note and the Subordinate Instrument. [49.] PARTIES INTENT REGARDING MERGER. Borrower waives the application of the doctrine of merger as applied to any foreclosure affecting the Property (or other manner of obtaining title to the Property) and agrees that such doctrine shall not affect the enforceability of any obligation described in this Instrument. It is the intent of the parties hereto that (i) in the event that Lender or any of Lender's successors, assigns or transferee, obtains title to the Mortgaged Property pursuant to the Instrument (by virtue of a foreclosure sale, a deed in lieu of foreclosure or otherwise) and such party is also or subsequently becomes the holder of the Subordinate Note and Subordinate Instrument, such party's title interest and lien interest SHALL NOT merge so as to effect an extinguishment of any indebtedness secured by the Subordinate Instrument or evidenced by the Subordinate Note, and (ii) in the event that the holder of the Subordinate Note and Subordinate Instrument obtains title to the Mortgaged Property pursuant to the Subordinate Instrument (by virtue of a foreclosure sale, a deed in lieu of foreclosure or otherwise) and such party is also or subsequently becomes the holder of the Note and this Instrument, such party's title interest and lien interest SHALL NOT merge so as to effect an extinguishment of this Instrument or any indebtedness secured by this Instrument or

First Mortgage Modifications to Instrument (with Second Lien Financing) Form 4080 11/01 Page B-1

1998-2001 Fannie Mae

evidenced by the Note. Borrower further acknowledges and agrees that no course of conduct by Borrower, Lender or holder of the Subordinate Note, or any of their successors, assigns or transferees subsequent to the date hereof shall be used to demonstrate any intent contrary to the express intent stated herein. [50.] REPLACEMENT RESERVE. Borrower hereby assigns to Lender all amounts in the "Replacement Reserve" (as defined in the Replacement Reserve Agreement executed in connection with the Note and this Instrument) as additional security for all of the Borrower's obligations under the Subordinate Note and Subordinate Instrument." 2. All capitalized terms used in this Exhibit not specifically defined herein shall have the meanings set forth in the text of the Instrument that precedes this Exhibit.

_________________________________ INITIALS

First Mortgage Modifications to Instrument (with Second Lien Financing)

Form 4080

11/01

Page B-2

1998-2001 Fannie Mae

Das könnte Ihnen auch gefallen

- Introduction to Negotiable Instruments: As per Indian LawsVon EverandIntroduction to Negotiable Instruments: As per Indian LawsBewertung: 5 von 5 Sternen5/5 (1)

- Security Agreement All Assets of Personal PropertyDokument17 SeitenSecurity Agreement All Assets of Personal PropertyJPF100% (6)

- UCC SecurityAgreementDokument5 SeitenUCC SecurityAgreementTony Britten90% (20)

- Pledge Agreement SummaryDokument4 SeitenPledge Agreement SummaryPhillip Yotoko100% (2)

- Land Trust AgreementDokument18 SeitenLand Trust AgreementIn the Know89% (9)

- Ucc Copyright NoticeDokument3 SeitenUcc Copyright NoticeRDL100% (6)

- Banksters Gangsters Traitors V3Dokument188 SeitenBanksters Gangsters Traitors V3John@spiritusNoch keine Bewertungen

- 73-08 Security AgreementDokument9 Seiten73-08 Security AgreementJohn OxNoch keine Bewertungen

- Corporate Guarantee SummaryDokument11 SeitenCorporate Guarantee SummaryridhofauzisNoch keine Bewertungen

- Non Recourse Loan Agreement SampleDokument9 SeitenNon Recourse Loan Agreement SampleAnkit Sibbal83% (6)

- Pledge AgreementDokument9 SeitenPledge AgreementjosefNoch keine Bewertungen

- Pledge Agreement SampleDokument4 SeitenPledge Agreement SampleInter_vivos67% (3)

- Sample Promissory NoteDokument4 SeitenSample Promissory NoteJorge Poveda100% (1)

- 230 Short Sale Packet - BayviewDokument16 Seiten230 Short Sale Packet - BayviewrapiddocsNoch keine Bewertungen

- Membership Interest Pledge AgreementDokument6 SeitenMembership Interest Pledge AgreementKnowledge Guru100% (1)

- The U.S. Constitution and Money Part 4 The First and Second Banks of The United StatesDokument39 SeitenThe U.S. Constitution and Money Part 4 The First and Second Banks of The United Statesmichael s rozeffNoch keine Bewertungen

- Is Mers in Your MortgageDokument9 SeitenIs Mers in Your MortgageRicharnellia-RichieRichBattiest-Collins67% (3)

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyVon EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNoch keine Bewertungen

- 7 Collateral Pledge AgreementDokument10 Seiten7 Collateral Pledge AgreementLayla PostigoNoch keine Bewertungen

- Credit Policy and Loan Characteristics - 2nd UnitDokument33 SeitenCredit Policy and Loan Characteristics - 2nd UnitDr VIRUPAKSHA GOUD GNoch keine Bewertungen

- Subordination, Non - Disturbance and Attornment AgreementDokument7 SeitenSubordination, Non - Disturbance and Attornment AgreementDavid CromwellNoch keine Bewertungen

- EFA Agreement Early TerminationDokument2 SeitenEFA Agreement Early TerminationKhoa PhanNoch keine Bewertungen

- Account Number: 123456789: Checking AccountsDokument4 SeitenAccount Number: 123456789: Checking AccountsJane Ly100% (1)

- Form of Bailee Letter (Warehouse Bank) Exhibit III-35 (Cash Purchase) FORM OF BAILEE LETTER (Warehouse Bank) (Cash Purchase)Dokument3 SeitenForm of Bailee Letter (Warehouse Bank) Exhibit III-35 (Cash Purchase) FORM OF BAILEE LETTER (Warehouse Bank) (Cash Purchase)Valerie Lopez100% (1)

- Insurances AssignmentDokument11 SeitenInsurances AssignmentDY KIM (INKO)Noch keine Bewertungen

- Deposit of Escrow SharesDokument18 SeitenDeposit of Escrow SharesPablo MarroquínNoch keine Bewertungen

- Collateral Loan AgreementDokument17 SeitenCollateral Loan Agreementisoldets9770Noch keine Bewertungen

- FNMA Form 4510Dokument5 SeitenFNMA Form 4510rapiddocsNoch keine Bewertungen

- FNMA Form 4510Dokument5 SeitenFNMA Form 4510rapiddocsNoch keine Bewertungen

- Utah District Court Dismisses Plaintiff's Claims in Foreclosure CaseDokument9 SeitenUtah District Court Dismisses Plaintiff's Claims in Foreclosure CaserapiddocsNoch keine Bewertungen

- Deed of Registered Mortgage 6.1.05Dokument25 SeitenDeed of Registered Mortgage 6.1.05Satish KumarNoch keine Bewertungen

- Syndicate MusharakaDokument10 SeitenSyndicate MusharakaImranullah KhanNoch keine Bewertungen

- Cost Estimating WorksheetDokument12 SeitenCost Estimating WorksheetrapiddocsNoch keine Bewertungen

- Pledge Agreement Secures LoanDokument7 SeitenPledge Agreement Secures LoanSofia PoloyapyNoch keine Bewertungen

- The Impact of COVID-19 in South AfricaDokument6 SeitenThe Impact of COVID-19 in South AfricaThe Wilson Center100% (10)

- Cash Collateral AgreementDokument11 SeitenCash Collateral AgreementJudge ReinholdNoch keine Bewertungen

- Abb - B (10) (A) Assignment Contract Proceeds (1st Party) (Final) CLN (00155330-6)Dokument42 SeitenAbb - B (10) (A) Assignment Contract Proceeds (1st Party) (Final) CLN (00155330-6)xidaNoch keine Bewertungen

- Jossy Proposal Final Loan Disbursement MWU Commented)Dokument31 SeitenJossy Proposal Final Loan Disbursement MWU Commented)LeulNoch keine Bewertungen

- 360 Degree Feedback Form TemplateDokument2 Seiten360 Degree Feedback Form Templateapi-3756651Noch keine Bewertungen

- CPAR Final Pre-Board With AnswersjjjjDokument8 SeitenCPAR Final Pre-Board With AnswersjjjjMacwin KiatNoch keine Bewertungen

- Guarantee Deed Corporate For Retail HL and Lap 065709200147385837011Dokument13 SeitenGuarantee Deed Corporate For Retail HL and Lap 065709200147385837011AMAN KUMARNoch keine Bewertungen

- Loan AgreementDokument25 SeitenLoan Agreementayan5913Noch keine Bewertungen

- Soccer (Football) Contracts: An Introduction to Player Contracts (Clubs & Agents) and Contract Law: Volume 2Von EverandSoccer (Football) Contracts: An Introduction to Player Contracts (Clubs & Agents) and Contract Law: Volume 2Noch keine Bewertungen

- FNMA Form 4063Dokument2 SeitenFNMA Form 4063rapiddocsNoch keine Bewertungen

- Amendment To Loan and Security AgreementDokument62 SeitenAmendment To Loan and Security Agreementbefaj44984Noch keine Bewertungen

- FNMA Form Number 4067Dokument3 SeitenFNMA Form Number 4067rapiddocsNoch keine Bewertungen

- California Government Code Sections 6103 and 27383 Recording requestedDokument14 SeitenCalifornia Government Code Sections 6103 and 27383 Recording requestedswellowlNoch keine Bewertungen

- Mortgage DeedDokument6 SeitenMortgage Deedleomagbanua916Noch keine Bewertungen

- 7 Collateral Pledge AgreementDokument9 Seiten7 Collateral Pledge AgreementMar RojasNoch keine Bewertungen

- Stock Pledge AgreementDokument5 SeitenStock Pledge AgreementGwen Alistaer CanaleNoch keine Bewertungen

- Assignment of Management AgreementDokument4 SeitenAssignment of Management AgreementrapiddocsNoch keine Bewertungen

- Pre Negotiation AgreementDokument7 SeitenPre Negotiation AgreementMaria VangelosNoch keine Bewertungen

- Owner/Contractor Affidavit, Waiver of Liens and Indemnity AgreementDokument6 SeitenOwner/Contractor Affidavit, Waiver of Liens and Indemnity AgreementNew Life NetworkNoch keine Bewertungen

- EXHIBIT M FORM 3039-PennsylvaniaMortgageDokument16 SeitenEXHIBIT M FORM 3039-PennsylvaniaMortgageLeslie Esposito OrmanNoch keine Bewertungen

- Draft Mortgage Deed-ConsortiumDokument26 SeitenDraft Mortgage Deed-ConsortiumNilesh Pius KujurNoch keine Bewertungen

- Mortgage: - (Space Above This Line For Recording Data)Dokument15 SeitenMortgage: - (Space Above This Line For Recording Data)Teodoro Cabo San LucasNoch keine Bewertungen

- Ella Sabariza 3Dokument4 SeitenElla Sabariza 3Rafaela NicoleNoch keine Bewertungen

- Agreement-TwoWheelerLoanDokument18 SeitenAgreement-TwoWheelerLoanygrjnb5kcqNoch keine Bewertungen

- Mortgage Acquisition AgreementDokument46 SeitenMortgage Acquisition AgreementRohit WankhedeNoch keine Bewertungen

- Loan Modification Agreement: (Providing For Fixed Interest Rate)Dokument3 SeitenLoan Modification Agreement: (Providing For Fixed Interest Rate)ericNoch keine Bewertungen

- Deed of HypothecationDokument8 SeitenDeed of Hypothecationsathish kumarNoch keine Bewertungen

- CIMB Deed of Assignment EngDokument32 SeitenCIMB Deed of Assignment EnghongNoch keine Bewertungen

- Tri-Party Agreement Loan Takeout CommitmentDokument8 SeitenTri-Party Agreement Loan Takeout CommitmentrohitNoch keine Bewertungen

- LAP Term Loan AgreementDokument47 SeitenLAP Term Loan AgreementPrashanth KorukopulaNoch keine Bewertungen

- Jay IndemnityDokument4 SeitenJay IndemnityS ArunNoch keine Bewertungen

- Attachment Deed of HypothecationDokument24 SeitenAttachment Deed of HypothecationMuskan goriaNoch keine Bewertungen

- Commercial Promissory NoteDokument12 SeitenCommercial Promissory NoteCohen DerrickNoch keine Bewertungen

- Untitled 1Dokument9 SeitenUntitled 1Steven B HillNoch keine Bewertungen

- Lease AgreementDokument14 SeitenLease AgreementRes JurisNoch keine Bewertungen

- Deed of Subordination Subordination AgreementDokument10 SeitenDeed of Subordination Subordination AgreementKagimu Clapton ENoch keine Bewertungen

- PDF Template Basic Loan Agreement TemplateDokument7 SeitenPDF Template Basic Loan Agreement TemplateCamila MarabottoNoch keine Bewertungen

- Mortgage+Facility+Agreement - Ver2 - 01122022 4 3Dokument40 SeitenMortgage+Facility+Agreement - Ver2 - 01122022 4 3finserv2998Noch keine Bewertungen

- Matt V HSBC Exhibit - F-2Dokument74 SeitenMatt V HSBC Exhibit - F-2chunga85Noch keine Bewertungen

- Loan Agreement SummaryDokument31 SeitenLoan Agreement SummaryVenkat KakunuriNoch keine Bewertungen

- FNMA Form 3269-44Dokument2 SeitenFNMA Form 3269-44rapiddocsNoch keine Bewertungen

- FNMA Form 4541Dokument9 SeitenFNMA Form 4541rapiddocsNoch keine Bewertungen

- FNMA Form 4067Dokument3 SeitenFNMA Form 4067rapiddocsNoch keine Bewertungen

- AWL Trademark Form 74358690Dokument7 SeitenAWL Trademark Form 74358690rapiddocsNoch keine Bewertungen

- Instructions For Preparing The Mortgage Loan Delivery Package - 4600Dokument52 SeitenInstructions For Preparing The Mortgage Loan Delivery Package - 4600Richarnellia-RichieRichBattiest-CollinsNoch keine Bewertungen

- FNMA Form 4706Dokument3 SeitenFNMA Form 4706rapiddocsNoch keine Bewertungen

- FNMA Form 4518Dokument3 SeitenFNMA Form 4518rapiddocsNoch keine Bewertungen

- FNMA Form 4540Dokument2 SeitenFNMA Form 4540rapiddocsNoch keine Bewertungen

- FNMA Form 4512Dokument12 SeitenFNMA Form 4512rapiddocsNoch keine Bewertungen

- Fannie Mae Assignment of Loan DocumentsDokument2 SeitenFannie Mae Assignment of Loan DocumentsrapiddocsNoch keine Bewertungen

- FNMA Form 4517Dokument16 SeitenFNMA Form 4517rapiddocsNoch keine Bewertungen

- FNMA Form 4508 - ADokument2 SeitenFNMA Form 4508 - ArapiddocsNoch keine Bewertungen

- Assignment of Management AgreementDokument4 SeitenAssignment of Management AgreementrapiddocsNoch keine Bewertungen

- FNMA Form 4506 - ADokument13 SeitenFNMA Form 4506 - ArapiddocsNoch keine Bewertungen

- Fannie Mae Subordination Agreement SummaryDokument16 SeitenFannie Mae Subordination Agreement SummaryrapiddocsNoch keine Bewertungen

- FNMA Form 4505Dokument11 SeitenFNMA Form 4505rapiddocsNoch keine Bewertungen

- Amended Replacement Reserve AgreementDokument14 SeitenAmended Replacement Reserve AgreementrapiddocsNoch keine Bewertungen

- FNMA Form 4506Dokument12 SeitenFNMA Form 4506rapiddocsNoch keine Bewertungen

- FNMA Form 4502 - 44Dokument5 SeitenFNMA Form 4502 - 44rapiddocsNoch keine Bewertungen

- FNMA Form 4506 - ADokument13 SeitenFNMA Form 4506 - ArapiddocsNoch keine Bewertungen

- FNMA Form 4505Dokument11 SeitenFNMA Form 4505rapiddocsNoch keine Bewertungen

- FNMA Form 4504Dokument14 SeitenFNMA Form 4504rapiddocsNoch keine Bewertungen

- FNMA Form 4502 - 44Dokument5 SeitenFNMA Form 4502 - 44rapiddocsNoch keine Bewertungen

- Insurance Black BookDokument44 SeitenInsurance Black Booksupport NamoNoch keine Bewertungen

- Chapter 7 Hull SwapsDokument1 SeiteChapter 7 Hull SwapsHazel Gayle De PerioNoch keine Bewertungen

- Meezan Bank Internship ReportDokument11 SeitenMeezan Bank Internship Reportayaz latifNoch keine Bewertungen

- BANK FINANCIAL MANAGEMENT GUIDEDokument18 SeitenBANK FINANCIAL MANAGEMENT GUIDESreejith BhattathiriNoch keine Bewertungen

- Compound Interest: Your Best Friend or Worst Enemy: LESSON DESCRIPTION (Background For The Instructor)Dokument12 SeitenCompound Interest: Your Best Friend or Worst Enemy: LESSON DESCRIPTION (Background For The Instructor)Criscel SantiagoNoch keine Bewertungen

- Module 6 - Profit Planning (Budgeting)Dokument82 SeitenModule 6 - Profit Planning (Budgeting)CristineNoch keine Bewertungen

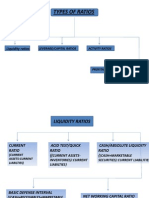

- Types of Financial Ratios ExplainedDokument9 SeitenTypes of Financial Ratios Explainedangelohero6643Noch keine Bewertungen

- Chapter 9 Personal Loans: Personal Finance, 6e (Madura)Dokument26 SeitenChapter 9 Personal Loans: Personal Finance, 6e (Madura)Huỳnh Lữ Thị NhưNoch keine Bewertungen

- L CDokument139 SeitenL CnanaNoch keine Bewertungen

- Role of SACCOs as models for financial services in UgandaDokument11 SeitenRole of SACCOs as models for financial services in UgandashjahsjanshaNoch keine Bewertungen

- Bankard's Gross Negligence in Suspending Credit CardDokument3 SeitenBankard's Gross Negligence in Suspending Credit CardJohn Mark MagbanuaNoch keine Bewertungen

- Ebook Ebook PDF Short Term Financial Management Fifth Edition PDFDokument41 SeitenEbook Ebook PDF Short Term Financial Management Fifth Edition PDFlaura.gray126100% (38)

- Noble Tech Industries Private LimitedDokument3 SeitenNoble Tech Industries Private Limitedkarthikeyan A INoch keine Bewertungen

- Debt Valuation and InterestDokument104 SeitenDebt Valuation and InterestSakinah0% (1)

- Smartphone Melsie C. TudtudDokument10 SeitenSmartphone Melsie C. TudtudEdmon FuentesNoch keine Bewertungen

- Solution Manual For Case Studies in Finance Managing For Corporate Value Creation 6th Edition by BrunerDokument22 SeitenSolution Manual For Case Studies in Finance Managing For Corporate Value Creation 6th Edition by BrunerJonathanBradshawsmkc100% (36)

- Articles 1243-1261 (Extinguishment of Obligations - Payment or Performance II)Dokument49 SeitenArticles 1243-1261 (Extinguishment of Obligations - Payment or Performance II)DJAN IHIAZEL DELA CUADRANoch keine Bewertungen

- Net Working CapitalDokument8 SeitenNet Working CapitalJoseph AbalosNoch keine Bewertungen

- Reformed Church University Consumer Behavior FactorsDokument9 SeitenReformed Church University Consumer Behavior FactorsEvans MulamboNoch keine Bewertungen

- RSKMGT Module III Sec A CH 1estimation of Portfolio Credit RiskDokument12 SeitenRSKMGT Module III Sec A CH 1estimation of Portfolio Credit RiskAstha PandeyNoch keine Bewertungen

- G1 Chapter 1 3 RefSQ - June 7Dokument55 SeitenG1 Chapter 1 3 RefSQ - June 7Rose Ann LazatinNoch keine Bewertungen