Beruflich Dokumente

Kultur Dokumente

Quizzer Partnership

Hochgeladen von

AdrianneHarveCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Quizzer Partnership

Hochgeladen von

AdrianneHarveCopyright:

Verfügbare Formate

14-1.

The legal characteristic of a partnership whereby each partner is an agent of the partnership and is able to bind the partnership to contracts within the normal scope of the partnership business is known as: a. b. c. d. unlimited liability partnership accounting a partnership contract mutual agency

14-2. Which of the following is not true regarding a partnership? a. b. c. d. A partnership is a voluntary association. Partnerships pay income taxes. Partnerships have limited life. Partners in general partnerships have unlimited liability.

14-3. Which is NOT a condition of a limited partnership? a. b. c. d. Limited partners are expected to have an active role in management. A limited partner's liability will be limited to his/her investment. One partner of the limited partnership must be a general partner. Limited partnerships will have more than one class of partner.

14-4. The partnership agreement provided for a salary allowance of $6,000 per month to partner X, and the balance to be divided equally between partners X and Y. X made no additional partnership investments during the year, but withdrew $7,000 per month. Net income for the year was $120,000. The net change in X's capital account was a: a. b. c. d. $12,000 increase $60,000 increase $54,000 decrease $12,000 decrease

14-5. A and B are partners who share profits and losses on a 2:1 basis, respectively, after a salary allowance of $12,000 is allocated to partner B. Earnings for the period total $39,000. What will be the amount credited to the Capital account of partner A when the books are closed? a. b. c. d. $7,000 $9,000 $18,000 $19,500

14-6. C and D are partners who share profits and losses on a 3:1 basis, respectively, after a salary allowance of $15,000 is allocated to partner C. Earnings for the period total $51,000. What will be the total amount credited to the Capital account of partner C when the Income Summary account is closed? a. b. $15,000 $20,000

c. d.

$42,000 $32,000

14-7. In the partnership of Maxwell and Slade, Maxwell's capital balance is $40,000 and Slade's capital balance is $60,000. Maxwell sold 50% of his partnership interest to Norton, who paid $24,000 for the 50% interest. The journal entry on the partnership books related to this transaction would include: a. b. c. d. a debit to Cash for $24,000 a debit to Cash for $20,000 a debit to Maxwell, Capital for $24,000 a debit to Maxwell, Capital for $20,000

14-8. Norton invested $30,000 in the partnership of Maxwell and Slade. The capital balance of Maxwell and Slade were $30,000 and $60,000, respectively. Norton was to receive a 25% interest in the new partnership. The journal entry to record this transaction would NOT include: a. b. c. d. a debit to cash for $30,000 a credit to Norton's capital account for $30,000 a credit to Slade's capital account for $7,500 a credit to Slade's capital account for $37,500

14-9. Norton invested $20,000 in the partnership of Maxwell and Slade. The capital balance of Maxwell and Slade were $40,000 and $60,000, respectively. Income and loss is shared according to the ratio of equity balances. Norton was to receive 25% interest in the new partnership. The journal entry to record this transaction would include: a. b. c. d. a credit to cash for $20,000 a credit to Maxwell's capital account for $4,000 a credit to Slade's capital account for $6,000 a credit to Norton's capital account for $30,000

14-10. Norton invested $40,000 in the partnership of Maxwell and Slade. The capital balance of Maxwell and Slade were $40,000 and $60,000, respectively. Income and loss is shared according to the ratio of equity balances. Norton was to receive 25% interest in the new partnership. The journal entry to record this transaction would NOT include: a. b. c. d. a debit to cash for $40,000 a credit to Maxwell's capital account for $2,000 a credit to Slade's capital account for $3,000 a credit to Norton's capital account for $30,000

14-11. Norton was paid $25,000 from the partnership cash account for his withdrawal from the partnership of Maxwell, Slade, and Norton. Their capital balances were $40,000, $60,000, and $35,000, respectively. Income and loss is shared according to the ratio of equity balances. The journal entry to record the withdrawal of Norton would NOT include: a. b. a credit to cash for $25,000 a debit to Maxwell's capital account for $2,000

c. d.

a credit to Slade's capital account for $6,000 a debit to Norton's capital account for $35,000

14-12. Norton was paid $40,000 from the partnership cash account for his withdrawal from the partnership of Maxwell, Slade, and Norton. Their capital balance were $40,000, $60,000, and $35,000, respectively. The journal entry to record the withdrawal of Norton would include: a. b. c. d. 14-13. Capital Balances Cash Other Assets = $81,000 Liabilities Maxwell Slade Norton $40,000 $11,000 $20,000 $20,000 $30,000 a debit to cash for $40,000 a debit to Maxwell's capital account for $5,000 a debit to Slade's capital account for $5,000 a debit to Norton's capital account for $35,000

The other assets were sold for $60,000, and the liabilities were paid, in preparation to liquidating the partnership. Income and loss was shared evenly. Which of the following is NOT true? a. b. c. d. 14-14. Capital Balances Cash Other Assets = $71,000 Liabilities Maxwell Slade Norton $26,000 $5,000 $10,000 $20,000 $30,000 The loss on liquidation was $21,000. Maxwell's share of the ending cash balance was $23,000 Slade's share of the ending cash balance was $33,000 Norton's share of the ending cash balance was $7,000

The other assets were sold for $50,000, and the liabilities were paid, in preparation to liquidating the partnership. Income and loss was shared evenly. Any deficient partner will be unable to pay the deficiency. Which of the following is NOT true? a. b. c. d. The loss on liquidation was $21,000. The cash balance before final distribution was $40,000. Maxwell's share of the ending cash balance was $22,000 Slade's share of the ending cash

14-1. A partnership is an incorporated association of two or more persons to pursue a business for profit as co-owners. True False 14-2. A written contract is necessary for the legal formation of a partnership. True

False 14-3. Partnerships are subject to income taxes. True False 14-4. Partners can agree to limit the power of negotiating contracts for the partnership to any one or more of the partners. Such an agreement is binding on all outsiders, whether or not they know it exists. True False 14-5. If Partner A contributes cash of $20,000 to the partnership of A and B, and Partner B contributes a building valued at $30,000 to the partnership, the investments become joint property of both partners. True False 14-6. A general partnership may consist of limited partners and general partners. True False 14-7. Limited partners are liable for any debt that cannot be paid through the resources of the partnership. True False 14-8. General partners are included in limited partnerships. True False 14-9. If Partner A invested twice as much as Partner B, and there are only two partners, the income must be divided in a ratio of 2:1, respectively. True False 14-10. If partners agree to a method of sharing net income, but say nothing about net losses, losses are shared in the same way as net income. True False 14-11. When a partnership agreement provides for the division of earnings based on time spent and investment balances, the resulting amounts may be treated by the partners as deductible salary expenses and interest expenses in determining the net income of the partnership. True

False 14-12. In the purchase of partnership interest, the capital accounts of the exiting partner(s) will be reduced. True False 14-13. With a 100% purchase of the interest of a partner, a new partner has all the rights of the remaining partner(s) . True False 14-14. The capital of an existing partnership is $160,000 after Keith invested $40,000 in the partnership. Keith is entitled to 25% (1/4) of the income or loss of the partnership. True False 14-15. When the current value of the partnership is greater than the recorded amounts of equity, the bonus resulting from a purchase of interest is given to the old partner(s). True False 14-16. The withdrawal of a partner from a partnership may result in an increase in the capital accounts of the remaining partners. True False 14-17. There is more than one reason for giving a withdrawing partner assets of value greater than the withdrawing partner's recorded equity. True False 14-18. The death of a partner will require that all noncash assets are sold for cash, all liabilities are paid, and remaining cash be distributed to the estate of the dead partner on the basis of the partnership income and loss agreement. True False 14-19. Partners will share gains and losses on liquidation in their capital investment ratio. True False 14-20. A capital deficiency occurs when a partner has insufficient equity to cover his or her share of losses resulting from liquidation.

True False

Das könnte Ihnen auch gefallen

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Von EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Bewertung: 3.5 von 5 Sternen3.5/5 (17)

- Sample Quiz Partnership and CorporationDokument9 SeitenSample Quiz Partnership and CorporationKristine Salvador CayetanoNoch keine Bewertungen

- 2nd Quiz Midterm Acctg12Dokument3 Seiten2nd Quiz Midterm Acctg12Erma Caseñas50% (2)

- Partnership Operations Lecture Notes2Dokument7 SeitenPartnership Operations Lecture Notes2bum_24100% (8)

- Prelim Exam, Partnership Formation and Operation PDFDokument2 SeitenPrelim Exam, Partnership Formation and Operation PDFIñego BegdorfNoch keine Bewertungen

- Dissolution Lecture Notes 3t08Dokument6 SeitenDissolution Lecture Notes 3t08bum_24100% (3)

- Partnership OperationDokument28 SeitenPartnership Operationglenn langcuyanNoch keine Bewertungen

- Partnership ExercisesDokument35 SeitenPartnership ExercisesshiieeNoch keine Bewertungen

- Accounting For Partnership Dissolution - Jan 3Dokument49 SeitenAccounting For Partnership Dissolution - Jan 3Maria Anne Genette Bañez50% (2)

- Mock Exam of Partnership AccountingDokument12 SeitenMock Exam of Partnership AccountingArcely Gundran100% (1)

- Partnership Formation and OperationsDokument6 SeitenPartnership Formation and Operationsrodel100% (2)

- MODULE 5 - Partnership Nature and FormationDokument31 SeitenMODULE 5 - Partnership Nature and FormationFRANCES JEANALLEN DE JESUS100% (1)

- Corporation AccountingDokument70 SeitenCorporation AccountingMae Abigail Banquil100% (1)

- Reviewer 1, Fundamentals of Accounting 2Dokument13 SeitenReviewer 1, Fundamentals of Accounting 2Hunson Abadeer76% (17)

- Accounting For Corporation (Review)Dokument2 SeitenAccounting For Corporation (Review)PatOcampoNoch keine Bewertungen

- Corporation - Transactions Subsequent To FormationDokument7 SeitenCorporation - Transactions Subsequent To FormationJohncel Tawat100% (1)

- Reviewer 3, Fundamentals of Accounting 2Dokument21 SeitenReviewer 3, Fundamentals of Accounting 2Hunson Abadeer67% (3)

- Corporation Hand Out - RevisedDokument11 SeitenCorporation Hand Out - RevisedEichelle Joy ZuluetaNoch keine Bewertungen

- Installment Liquidation Lecture NotesDokument5 SeitenInstallment Liquidation Lecture Notesbum_24100% (19)

- Partnership ReviewerDokument11 SeitenPartnership Reviewerbae joohyun0% (1)

- Partnership FormationDokument8 SeitenPartnership FormationWithDoctorWu100% (1)

- Partnership TheoriesDokument5 SeitenPartnership TheoriesThomas MarianoNoch keine Bewertungen

- Partnership Mock ExamDokument15 SeitenPartnership Mock ExamPerbielyn BasinilloNoch keine Bewertungen

- PartnershipDokument24 SeitenPartnershipambi100% (4)

- Partnership Operations Problems PDFDokument7 SeitenPartnership Operations Problems PDFTherese Janine HetutuaNoch keine Bewertungen

- 3 ACCT 2A&B P. DissolutionDokument10 Seiten3 ACCT 2A&B P. DissolutionBrian Christian VillaluzNoch keine Bewertungen

- Comprehensive Review For CorporationDokument25 SeitenComprehensive Review For CorporationJoemar Santos Torres100% (3)

- Partnership Liquidation QuizDokument5 SeitenPartnership Liquidation QuizAlexis TRADIO100% (1)

- Partnership Formation: AssignmentDokument6 SeitenPartnership Formation: AssignmentLee SuarezNoch keine Bewertungen

- Share Capital TransactionsDokument65 SeitenShare Capital Transactionsm_kobayashiNoch keine Bewertungen

- Partnership Dissolution - Lecture and Sample ProblemsDokument6 SeitenPartnership Dissolution - Lecture and Sample ProblemsJenina CrisologoNoch keine Bewertungen

- Comprehensive Exam For Partnership AcctgDokument30 SeitenComprehensive Exam For Partnership AcctgchingNoch keine Bewertungen

- Partnership Operation Practice Problems PDFDokument11 SeitenPartnership Operation Practice Problems PDFMeleen TadenaNoch keine Bewertungen

- Partnership LiquidationDokument1 SeitePartnership LiquidationJo Vee VillanuevaNoch keine Bewertungen

- Partnership Operations PDFDokument5 SeitenPartnership Operations PDFSameer Hussain67% (3)

- Corporation Accounting - Share Capital TransactionsDokument7 SeitenCorporation Accounting - Share Capital TransactionsGuadaMichelleGripal100% (3)

- Partnership - Corporation AccountingDokument45 SeitenPartnership - Corporation AccountingAB CloydNoch keine Bewertungen

- Home Quiz Partnership AccountingDokument3 SeitenHome Quiz Partnership AccountingKeith Anthony AmorNoch keine Bewertungen

- Lecture Notes On LiquidationDokument8 SeitenLecture Notes On Liquidationbum_24100% (11)

- Financial Accounting and Reporting Retained EarningsDokument68 SeitenFinancial Accounting and Reporting Retained EarningsRic Cruz0% (1)

- Orca Share Media1579219923157Dokument10 SeitenOrca Share Media1579219923157leejongsuk44% (9)

- Simulated Midterm Exam. Far1 PDFDokument11 SeitenSimulated Midterm Exam. Far1 PDFDyosang BomiNoch keine Bewertungen

- Quizzer - Revised Conceptual FrameworkDokument6 SeitenQuizzer - Revised Conceptual FrameworkJohn Reiven Adaya Mendoza100% (1)

- Nayve, Kimberly IDokument113 SeitenNayve, Kimberly IKim Nayve50% (10)

- Chapter 6 Partnership Liquidation (Lump-Sum)Dokument1 SeiteChapter 6 Partnership Liquidation (Lump-Sum)John Louie Dungca100% (1)

- Partnership OperationsDokument2 SeitenPartnership OperationsKristel SumabatNoch keine Bewertungen

- ACCTG2 - Introduction To Partnership and Corporation AccountingDokument13 SeitenACCTG2 - Introduction To Partnership and Corporation AccountingJaylord Cruz27% (11)

- Partial Goodwill Full GoodwilDokument38 SeitenPartial Goodwill Full GoodwilRose CastilloNoch keine Bewertungen

- Partnership and Corporation Problem ExampleDokument2 SeitenPartnership and Corporation Problem ExampleGabrielle Ruthe LaoNoch keine Bewertungen

- Retake: Financial Accounting and ReportingDokument21 SeitenRetake: Financial Accounting and ReportingJan ryanNoch keine Bewertungen

- Chapter 4 Partnership Liquidation 2021 v2.0Dokument56 SeitenChapter 4 Partnership Liquidation 2021 v2.0Aj ZNoch keine Bewertungen

- BAFINAR - Midterm Draft (R) PDFDokument11 SeitenBAFINAR - Midterm Draft (R) PDFHazel Iris Caguingin100% (1)

- Partnership HandoutsDokument4 SeitenPartnership Handoutsrose anne0% (1)

- CORPORATIONEXERCISES28PROBLEMS29ONORGANIZATION21FEB21Dokument5 SeitenCORPORATIONEXERCISES28PROBLEMS29ONORGANIZATION21FEB21Jasmine Acta0% (1)

- Partnerhip and CorporationDokument6 SeitenPartnerhip and CorporationMae ManansalaNoch keine Bewertungen

- Multiple Choice Quiz Part Form (C) NetDokument5 SeitenMultiple Choice Quiz Part Form (C) NetMaarala CoNoch keine Bewertungen

- Problems CH 14Dokument14 SeitenProblems CH 14StephenMcDaniel50% (4)

- Quiz 4 - p2 Answer KeyDokument16 SeitenQuiz 4 - p2 Answer KeyRish Sharma100% (1)

- Question Bank 2021 E2 6Dokument8 SeitenQuestion Bank 2021 E2 6Abanoub AbdallahNoch keine Bewertungen

- Partnership Dissolution - Practice ExercisesDokument5 SeitenPartnership Dissolution - Practice ExercisesVon Andrei Medina0% (2)

- Yung Tinry Mo Pa LangDokument1 SeiteYung Tinry Mo Pa LangAdrianneHarveNoch keine Bewertungen

- Yung Tinry Mo Pa LangDokument1 SeiteYung Tinry Mo Pa LangAdrianneHarveNoch keine Bewertungen

- Yung Tinry Mo Pa LangDokument1 SeiteYung Tinry Mo Pa LangAdrianneHarveNoch keine Bewertungen

- Project E.P.P.: Sherlaine B. Salatan V-Pineapple Ms. Lucila SalacDokument1 SeiteProject E.P.P.: Sherlaine B. Salatan V-Pineapple Ms. Lucila SalacAdrianneHarveNoch keine Bewertungen

- Gorilya AssignmentDokument3 SeitenGorilya AssignmentAdrianneHarveNoch keine Bewertungen

- Project E.P.P.: Sherlaine B. Salatan V-Pineapple Ms. Lucila SalacDokument1 SeiteProject E.P.P.: Sherlaine B. Salatan V-Pineapple Ms. Lucila SalacAdrianneHarveNoch keine Bewertungen

- Project E.P.P.: Sherlaine B. Salatan V-Pineapple Ms. Lucila SalacDokument1 SeiteProject E.P.P.: Sherlaine B. Salatan V-Pineapple Ms. Lucila SalacAdrianneHarveNoch keine Bewertungen

- Ua CatrsDokument7 SeitenUa CatrsAdrianneHarveNoch keine Bewertungen

- Nfjpia Region III Constitution & By-Laws - Final VersionDokument20 SeitenNfjpia Region III Constitution & By-Laws - Final VersionAdrianneHarveNoch keine Bewertungen

- Ua CatrsDokument7 SeitenUa CatrsAdrianneHarveNoch keine Bewertungen

- Ua CatrsDokument7 SeitenUa CatrsAdrianneHarveNoch keine Bewertungen

- MBFI Quiz KeyDokument7 SeitenMBFI Quiz Keypunitha_pNoch keine Bewertungen

- Assignment3 (Clarito, Glezeri BSIT-3A)Dokument9 SeitenAssignment3 (Clarito, Glezeri BSIT-3A)Jermyn G EvangelistaNoch keine Bewertungen

- Magnetic Properties of MaterialsDokument10 SeitenMagnetic Properties of MaterialsNoviNoch keine Bewertungen

- Consultant Agreement PDFDokument6 SeitenConsultant Agreement PDFRathore&Co Chartered AccountantNoch keine Bewertungen

- OOPS Module 1Dokument26 SeitenOOPS Module 1robinptNoch keine Bewertungen

- Project Report On Design of Road IntersectionDokument15 SeitenProject Report On Design of Road IntersectionJohn MalkinNoch keine Bewertungen

- Submitted To: Sir Ahmad Mujtaba Submitted By: Museera Maqbool Roll No: L-21318 Course: Service Marketing Programme: MBA 1.5 (Evening)Dokument3 SeitenSubmitted To: Sir Ahmad Mujtaba Submitted By: Museera Maqbool Roll No: L-21318 Course: Service Marketing Programme: MBA 1.5 (Evening)GlobalNoch keine Bewertungen

- Income Tax Banggawan Chapter 10Dokument18 SeitenIncome Tax Banggawan Chapter 10Earth Pirapat100% (5)

- Data Structures and Algorithms Made Easy-Narasimha KarumanchiDokument228 SeitenData Structures and Algorithms Made Easy-Narasimha KarumanchiPadmalatha Ragu85% (40)

- CPWA Code MCQDokument43 SeitenCPWA Code MCQSamrat Mukherjee100% (3)

- Serial Number Microsoft Office Professioanal 2010Dokument6 SeitenSerial Number Microsoft Office Professioanal 2010Kono KonoNoch keine Bewertungen

- List of TCP and UDP Port NumbersDokument44 SeitenList of TCP and UDP Port NumbersElvis JavierNoch keine Bewertungen

- Lecun 20201027 AttDokument72 SeitenLecun 20201027 AttEfrain TitoNoch keine Bewertungen

- NMIMS Offer LetterDokument4 SeitenNMIMS Offer LetterSUBHAJITNoch keine Bewertungen

- Businesses ProposalDokument2 SeitenBusinesses ProposalSophia Marielle MacarineNoch keine Bewertungen

- 2010 LeftySpeed Oms en 0Dokument29 Seiten2010 LeftySpeed Oms en 0Discord ShadowNoch keine Bewertungen

- QP02Dokument11 SeitenQP02zakwanmustafa0% (1)

- SMB Marketing PlaybookDokument18 SeitenSMB Marketing PlaybookpramodharithNoch keine Bewertungen

- SYKES - Telework Work Area AgreementDokument2 SeitenSYKES - Telework Work Area AgreementFritz PrejeanNoch keine Bewertungen

- Diagrame Des MomentsDokument1 SeiteDiagrame Des Momentsabdoul ndiayeNoch keine Bewertungen

- Bare Copper & Earthing Accessories SpecificationDokument14 SeitenBare Copper & Earthing Accessories SpecificationJayantha SampathNoch keine Bewertungen

- Area & Perimeter - CRACK SSC PDFDokument10 SeitenArea & Perimeter - CRACK SSC PDFSai Swaroop AttadaNoch keine Bewertungen

- Lesson 1 - Basic Concept of DesignDokument32 SeitenLesson 1 - Basic Concept of DesignSithara BandaraNoch keine Bewertungen

- Design and Analysis of Intez Type Water Tank Using SAP 2000 SoftwareDokument7 SeitenDesign and Analysis of Intez Type Water Tank Using SAP 2000 SoftwareIJRASETPublicationsNoch keine Bewertungen

- Philippine Forest Facts and Figures PDFDokument34 SeitenPhilippine Forest Facts and Figures PDFPamela L. FallerNoch keine Bewertungen

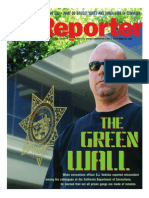

- The Green Wall - Story and Photos by Stephen James Independent Investigative Journalism & Photography - VC Reporter - Ventura County Weekly - California Department of Corrections whistleblower D.J. Vodicka and his litigation against the CDC.Dokument8 SeitenThe Green Wall - Story and Photos by Stephen James Independent Investigative Journalism & Photography - VC Reporter - Ventura County Weekly - California Department of Corrections whistleblower D.J. Vodicka and his litigation against the CDC.Stephen James - Independent Investigative Journalism & PhotographyNoch keine Bewertungen

- Government DaoDokument7 SeitenGovernment DaoGevorg A. GalstyanNoch keine Bewertungen

- Sales Force TrainingDokument18 SeitenSales Force Trainingsaurabh shekhar100% (2)

- Aircraft Materials and Hardware: (Nuts, Studs, Screws)Dokument25 SeitenAircraft Materials and Hardware: (Nuts, Studs, Screws)PakistaniTalent cover songsNoch keine Bewertungen

- Controllogix EthernetDokument136 SeitenControllogix Ethernetcnp0705Noch keine Bewertungen