Beruflich Dokumente

Kultur Dokumente

Definition

Hochgeladen von

Ashil Asok VennengottCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Definition

Hochgeladen von

Ashil Asok VennengottCopyright:

Verfügbare Formate

21

Definition: A call may be defined as "A demand made by the company on its share holders to pay whole or part of the balance remaining unpaid on each share at any time during the life time of a company". For example : The price of a share is Rs.100/-. At the time of applying for shares, the investor has to pay Rs.5/- of the nominal value of share i.e. Rs.5, so Rs.95/- is balance on each share. As and when the company needs money its asks its share holders to pay, suppose the company asks its shareholders to pay per share, that is known as calls on shares. Procedure regarding calls on shares: (1) Board Meeting for passing a call resolution: A meeting of the Board of Directors will be called. In this meeting a resolution will be passed regarding making a call. The resolution must specify the amount of call money, the date and place of its payment. (2) Closing of the Register of member and the Share Transfer Book: In the same Board meeting a resolution is passed, whereby the secretary is given permission to close the transfer book and the register of members for a period of about 15 days. (3) Preparing the call lists: After closing the transfer book, the work of preparing the call lists from the register of member, is under taken by the secretary. A call lists shows details like name and address of the share holders, numbers of shares held by them, the amount due on the call etc. This helps the secretary in sending call letters to the members. (4) Drafting call letters: The secretary prepares a draft of the all letter in consultation with the chairman of the company. He gets the call letters printed in the required quantity. A call letter is divided into three parts. They are: (i) A call letter proper, (ii) A call receipt, (iii) A call slip. (5) Issuing call letters / Dispatch of call notice: After the preparation of call lists, the secretary issues a call letter to the share holders on their registered address. He also publishes a call notice in a leading newspaper for the information of shareholders. (6) Arrangement with bankers for call money: The has to make necessary arrangement with the bankers of the company to receive call money from the members. Accordingly instructions are given to the bankers. The amount receive on calls is credited to a separate account called a "Call Account". After receiving the call money, bankers arrange to send the amount to the company. The call letter and call receipt are returned to the shareholder with necessary entries, signature and stamp. (7) Entries in the call list and the register of members: After receiving the call money, bankers return call letter and call receipt to the members and send all call slips to the company's office. The secretary then makes entries against the respective names in the call lists and the register of members. (8) Preparing list of Defaulters: The secretary prepares a list of those members who have not paid the call money on the stipulated date. Such a list is called a list of defaulters. It is placed before the Board for necessary action. Unpaid call money by members is called as "Calls in Arrears".

Das könnte Ihnen auch gefallen

- CAT Sample PaperDokument43 SeitenCAT Sample PaperSabitha RaaviNoch keine Bewertungen

- ConsiderationDokument25 SeitenConsiderationAshil Asok VennengottNoch keine Bewertungen

- Introduction To Sarada-Tilaka Tantram PDFDokument72 SeitenIntroduction To Sarada-Tilaka Tantram PDFAshil Asok VennengottNoch keine Bewertungen

- KSR Vol IDokument230 SeitenKSR Vol IneenarajeshNoch keine Bewertungen

- Aviation Insurance Types and CoverageDokument13 SeitenAviation Insurance Types and CoverageAshil Asok VennengottNoch keine Bewertungen

- Engineering Mathematics III 2009 April (2006 Ad)Dokument2 SeitenEngineering Mathematics III 2009 April (2006 Ad)Ashil Asok VennengottNoch keine Bewertungen

- Walmart Cost LeaderDokument6 SeitenWalmart Cost LeaderSylvia JohnNoch keine Bewertungen

- GDP vs GNP - Key differencesDokument12 SeitenGDP vs GNP - Key differencesAshil Asok VennengottNoch keine Bewertungen

- Application Form (6015308)Dokument2 SeitenApplication Form (6015308)Ashil Asok VennengottNoch keine Bewertungen

- Engineering Mathematics III 2008 April (2006 Ad)Dokument2 SeitenEngineering Mathematics III 2008 April (2006 Ad)Ashil Asok VennengottNoch keine Bewertungen

- Engineering Mathematics III 2009 April (2006 Ad)Dokument2 SeitenEngineering Mathematics III 2009 April (2006 Ad)Ashil Asok VennengottNoch keine Bewertungen

- Advantage Dis EnergyDokument5 SeitenAdvantage Dis EnergydivyaraghavarajuNoch keine Bewertungen

- Capacity of The PartiesDokument29 SeitenCapacity of The PartiesAshil Asok VennengottNoch keine Bewertungen

- Engineering Mathematics III 2009 April (2006 Ad)Dokument2 SeitenEngineering Mathematics III 2009 April (2006 Ad)Ashil Asok VennengottNoch keine Bewertungen

- Applied Thermodynamics 2011 Jan (2006 Ad)Dokument2 SeitenApplied Thermodynamics 2011 Jan (2006 Ad)Ashil Asok VennengottNoch keine Bewertungen

- Esi ActDokument30 SeitenEsi ActAshil Asok VennengottNoch keine Bewertungen

- Life InsuranceDokument39 SeitenLife Insurancearjunmba11962450% (2)

- 2011 B.com. III Semester..Dokument6 Seiten2011 B.com. III Semester..Ashil Asok VennengottNoch keine Bewertungen

- BSNL BB PlansDokument2 SeitenBSNL BB PlansSaravanan GanesanNoch keine Bewertungen

- 2011 B.com. III Semester..Dokument6 Seiten2011 B.com. III Semester..Ashil Asok VennengottNoch keine Bewertungen

- AcceptanceDokument21 SeitenAcceptanceAshil Asok VennengottNoch keine Bewertungen

- Repeat The Process With The Second File. in To SPARKDokument7 SeitenRepeat The Process With The Second File. in To SPARKAshil Asok VennengottNoch keine Bewertungen

- Advantage Dis EnergyDokument5 SeitenAdvantage Dis EnergydivyaraghavarajuNoch keine Bewertungen

- Instruction SheetDokument11 SeitenInstruction SheetEduZone ClassesNoch keine Bewertungen

- BSNL BB PlansDokument2 SeitenBSNL BB PlansSaravanan GanesanNoch keine Bewertungen

- Application For LeaveDokument1 SeiteApplication For LeaveAshil Asok VennengottNoch keine Bewertungen

- Advanced Mechanics of Solids 2008 April (2006 Ad)Dokument2 SeitenAdvanced Mechanics of Solids 2008 April (2006 Ad)Ashil Asok VennengottNoch keine Bewertungen

- Btech Fee Dec04 F1-1-EnDokument3 SeitenBtech Fee Dec04 F1-1-EnAshil Asok VennengottNoch keine Bewertungen

- AcceptanceDokument21 SeitenAcceptanceAshil Asok VennengottNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Consigna V PPDokument3 SeitenConsigna V PPCourt Nanquil100% (1)

- Schedule C Instructions 2012Dokument13 SeitenSchedule C Instructions 2012Dunk7Noch keine Bewertungen

- Project On WCDokument80 SeitenProject On WCSamar ZameerNoch keine Bewertungen

- Crump - The Phenomenon of Money (1981)Dokument258 SeitenCrump - The Phenomenon of Money (1981)Anonymous OOeTGKMAdD100% (1)

- Legislation and RegulationsDokument6 SeitenLegislation and RegulationsSrini VasanNoch keine Bewertungen

- Indian Mental Disability ActDokument78 SeitenIndian Mental Disability ActVinit YadavNoch keine Bewertungen

- Bedspace ContractDokument3 SeitenBedspace ContractDana100% (1)

- Service Tax ConclusionDokument9 SeitenService Tax ConclusionAbhas JaiswalNoch keine Bewertungen

- Meaning and Definition of Banking-Banking Can Be Defined As The Business Activity ofDokument32 SeitenMeaning and Definition of Banking-Banking Can Be Defined As The Business Activity ofPunya KrishnaNoch keine Bewertungen

- For Varodara 250 kWp Solar ProjectDokument30 SeitenFor Varodara 250 kWp Solar ProjectSiddhartha SenguptaNoch keine Bewertungen

- Sample Questions and Solutions - Final ExamDokument4 SeitenSample Questions and Solutions - Final ExamNadjah JNoch keine Bewertungen

- BMV L20 3EF LiverpoolDokument6 SeitenBMV L20 3EF LiverpoolOctav CobzareanuNoch keine Bewertungen

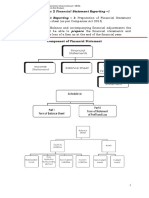

- Financial Statement ReportingDokument20 SeitenFinancial Statement ReportingAshwini Khare0% (1)

- Deloitte Annual Review of Football Finance (2014)Dokument10 SeitenDeloitte Annual Review of Football Finance (2014)Tifoso BilanciatoNoch keine Bewertungen

- 3) Universal Robina vs. Heirs of Angel TevesDokument3 Seiten3) Universal Robina vs. Heirs of Angel TevesLeopoldo, Jr. BlancoNoch keine Bewertungen

- Gold LoanDokument4 SeitenGold LoansekarkarthicNoch keine Bewertungen

- Goldman Sachs QuestionsDokument1 SeiteGoldman Sachs Questionspatrick-searle-3544Noch keine Bewertungen

- DATA MINING LAB MANUALDokument74 SeitenDATA MINING LAB MANUALAakashNoch keine Bewertungen

- FM-cash FlowDokument28 SeitenFM-cash FlowParamjit Sharma100% (5)

- Bank Failures: Major Causes and Economic ImpactDokument3 SeitenBank Failures: Major Causes and Economic ImpactSouvik MukherjeeNoch keine Bewertungen

- Entrepreneurship NotesDokument12 SeitenEntrepreneurship NotesSyed Adeel ZaidiNoch keine Bewertungen

- GS 2008 Entire Annual ReportDokument162 SeitenGS 2008 Entire Annual ReportlelaissezfaireNoch keine Bewertungen

- Case AnalysisDokument3 SeitenCase AnalysisJoshua Adorco75% (12)

- SEx 9Dokument24 SeitenSEx 9Amir Madani100% (1)

- BCom PDFDokument67 SeitenBCom PDFSwathi Nandhagopal100% (1)

- ADVANCED ACCOUNTING PART 1 QUIZZESDokument5 SeitenADVANCED ACCOUNTING PART 1 QUIZZESAnne Camille AlfonsoNoch keine Bewertungen

- Siebert - The Half and The Full Debt CycleDokument10 SeitenSiebert - The Half and The Full Debt CycleMarcosNoch keine Bewertungen

- WWW Manilatimes NetDokument3 SeitenWWW Manilatimes NetEarl Mercado CalingacionNoch keine Bewertungen

- Vere Langford Oliver - The History of The Island of Antigua Vol 2Dokument434 SeitenVere Langford Oliver - The History of The Island of Antigua Vol 2KUNGDO100% (2)

- G.R. No. 85733 February 23, 1990 Land Dispute Case Between Original Owners and Successive BuyersDokument5 SeitenG.R. No. 85733 February 23, 1990 Land Dispute Case Between Original Owners and Successive BuyersJay-ar TeodoroNoch keine Bewertungen