Beruflich Dokumente

Kultur Dokumente

Libby Financial Accounting Chapter9

Hochgeladen von

Jie Bo TiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Libby Financial Accounting Chapter9

Hochgeladen von

Jie Bo TiCopyright:

Verfügbare Formate

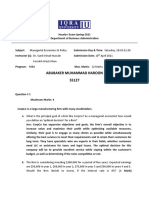

Chapter 09 - Reporting and Interpreting Liabilities

Chapter 09

Reporting and Interpreting Liabilities

ANSWERS TO QUESTIONS

1. Liabilities are obligations that result from past transactions that require future payment of assets or the future performance of services, that are definite in amount or are subject to reasonable estimation. A liability usually has a definite payment date known as the maturity or due date. A current liability is a short-term liability; that is, one that will be paid during the coming year or the current operating cycle of the business, whichever is longer. It is assumed that the current liability will be paid out of current assets. All other liabilities are defined as long-term liabilities. 2. External parties have difficulty determining the amount of liabilities of a business in the absence of a balance sheet. Therefore, about the only sources available to external parties for determining the number, type, and amounts of liabilities of a business are the published financial statements. These statements have more credibility when they have been audited by an independent CPA. 3. A liability is measured at acquisition at its current cash equivalent amount. Conceptually, this amount is the present value of all of the future payments of principal and interest. For a short-term liability the current cash equivalent usually is the same as the maturity amount. The current cash equivalent amount for an interest-bearing liability at the going rate of interest is the same as the maturity value. For a long-term liability, the current cash equivalent amount will be less than the maturity amount: (1) if there is no stated rate of interest, or (2) if the stated rate of interest is less than the going rate of interest. 4. Most debts specify a definite amount that is due at a specified date in the future. However, there are situations where it is known that an obligation or liability exists although the exact amount is unknown. Liabilities that are known to exist but the exact amount is not yet known must be recorded in the accounts and reported in the financial statements at an estimated amount. Examples of a known obligation of an estimated amount are estimated income tax at the end of the year, property taxes at the end of the year, and obligations under warranty contracts for merchandise sold.

9-1

Chapter 09 - Reporting and Interpreting Liabilities

5. Working capital is computed as total current assets minus total current liabilities. It is the amount of current assets that would remain if all current liabilities were paid, assuming no loss or gain on liquidation of those assets. 6. The quick ratio is the percentage relationship of quick assets (cash, marketable securities, and accounts receivable) to current liabilities. It is computed by dividing quick assets by current liabilities. For example, assuming quick assets of $50,000 and current liabilities of $100,000, the quick ratio would be $50,000/$100,000 = 0.5 (for each dollar of current liabilities there is $0.50 of quick assets). The quick ratio is influenced by the amount of current liabilities. Therefore, it is particularly important that liabilities be considered carefully before classifying them as current versus long term. The shifting of a liability from one of these categories to the other often may affect the quick ratio significantly. This ratio is used by creditors because it is an important index of ability to meet short-term obligations. Thus, the proper classification of liabilities is particularly significant. 7. An accrued liability is an expense that was incurred before the end of the current period but has not been paid or recorded. Therefore, an accrued liability is recognized when such a transaction is recorded. A typical example is wages incurred during the last few days of the accounting period but not recorded because no payroll was prepared and paid that included these wages. Assuming wages of $2,000 were incurred, the adjusting entry to record the accrued liability and the wage expense would be as follows: December 31: Wage expense (+E, -SE) Wages payable (+L) ........ 2,000 2,000

9-2

Chapter 09 - Reporting and Interpreting Liabilities

8. A deferred revenue (usually called unearned revenue or revenue collected in advance) is a revenue that has been collected in advance of being earned and recorded in the accounts by the entity. Because the amount already has been collected and the goods or services have not been provided, there is a liability to provide goods or services to the party who made the payment in advance. A typical example is the collection of rent on December 15 for one full month to January 15 when the accounting period ends on December 31. At the date of the collection of the rent the following entry usually is made: December 15: Cash (+A) ................................................................... Rent revenue (+R, +SE) ........................................ 4,000 4,000

On the last day of the period, the following adjusting entry should be made to recognize the deferred revenue as a liability: December 31: Rent revenue (-R, -SE)............................................... Deferred rent revenue (or Rent revenue collected in advance) (+L) ...................................................... 2,000 2,000

The deferred rent revenue (credit) is reported as a liability on the balance sheet because two weeks occupancy is owed in the next period for which the lessee already has made payment. 9. A note payable is a written promise to pay a stated sum at one or more specified dates in the future. A secured note payable is one that has attached to it (or coupled with it) a mortgage document which commits specified assets as collateral to guarantee payment of the note when due. An unsecured note is one that does not have specific assets pledged, or committed, to its payment at maturity. A secured note carries less risk for the note holder (creditor). 10. A contingent liability is not an effective liability; rather it is a potential future liability. A contingent liability arises because of some transaction or event that has already occurred which may, depending upon one or more future events, cause the creation of a true liability. A typical example is a lawsuit for damages. Whether the defendant has a liability depends upon the ultimate decision of the court. Pending that decision there is a contingent liability (and a contingent loss). This contingency must be recorded and reported (debit, loss; credit, liability) if it is probable that the decision will require the payment of damages that can be reasonably estimated. If it is only reasonably possible that a loss will be incurred, only footnote disclosure is required.

9-3

Chapter 09 - Reporting and Interpreting Liabilities

11. $4,000 x 12% x 9/12 = $360. 12. The time value of money is another way to describe interest. Time value of money refers to the fact that a dollar received today is worth more than a dollar to be received at any later date because of interest. 13. Future valueThe future value of a number of dollars is the amount that it will increase to in the future at i interest rate for n periods. The future value is the principal plus accumulated interest compounded each period. Present valueThe present value of a number of dollars, to be received at some specified date in the future, is that amount discounted to the present at i interest rate for n periods. It is the inverse of future value. In compound discounting, the interest is subtracted rather than added as in compounding. 14. $8,000 x .3855 = $3,084. 15. An annuity is a term that refers to equal periodic cash payments or receipts of an equal amount each period for two or more periods. In contrast to a future value of $1 or a present value of $1 (which involve a single contribution or amount), an annuity involves a series of equal contributions for a series of equal periods. An annuity may refer to a future value or a present value. 16. Concept PV of $1 PV of annuity of $1 i = 5%; n =4 .8227 3.5460 Table Values i = 10%; n =7 .5132 4.8684

i = 14%; n = 10 .2697 5.2161

17. $18,000 $3,000 = $15,000 4.9173 = $3,050.

ANSWERS TO MULTIPLE CHOICE

1. c) 6. a) 2. e) 7. c) 3. d) 8. b) 4. c) 9. b) 5. c) 10. d)

9-4

Chapter 09 - Reporting and Interpreting Liabilities

EXERCISES

E91. Req. 1 (a) Current assets ............................................................... Current liabilities: Accounts payable....................................................... Income taxes payable ................................................ Liability for withholding taxes...................................... Rent revenue collected in advance ............................ Wages payable .......................................................... Property taxes payable............................................... Note payable, 10% (due in 6 months) ........................ Interest payable.......................................................... Working capital .............................................................. (b) Quick ratio: ($70,000 $102,400) = 0.68. Working capital is critical for the efficient operation of a business. Current assets include cash and assets that will be collected in cash within one year or the normal operating cycle of the company. A business with insufficient working capital may not be able to pay its short term creditors on a timely basis. The quick ratio is a measure of liquidity. It helps analysts assess a companys ability to meet its obligations.

$168,000 $56,000 14,000 3,000 7,000 7,000 3,000 12,000 400

(102,400) $ 65,600

Req. 2 No, contingent liabilities are reported in the notes, not on the balance sheet. Therefore, they are not included in the required computations.

9-5

Chapter 09 - Reporting and Interpreting Liabilities

E94. Req. 1 November 1 Cash (+A)....................................................................... 4,800,000 Note payable (+L) ....................................................... Borrowed on 6-month, 8%, note payable. Req. 2 December 31 (end of the accounting period): Interest expense (+E, -SE)............................................. Interest payable (+L)................................................... Adjusting entry for 2 months accrued interest ($4,800,000 x 8% x 2/12 = $64,000). Req. 3 April 30 (maturity date): Note payable (-L) ........................................................... 4,800,000 Interest payable (per above) (-L).................................... 64,000 Interest expense ($4,800,000 x 8% x 4/12) (+E, -SE).... 128,000 Cash (-A) .................................................................... Paid note plus interest at maturity. Req. 4 It is doubtful that long-term borrowing would be appropriate in this situation. After the Christmas season, Neiman Marcus will collect cash from its credit sales. At this point, it does not need borrowed funds. It would be costly to pay interest on a loan that was not needed. It might be possible to borrow for a longer term at a lower interest rate and invest idle cash to offset the interest charges. Neiman Marcus should explore this possibility with its bank but in most cases it would be better to borrow on a short-term basis to meet short-term needs. 64,000 64,000

4,800,000

4,992,000

9-6

Chapter 09 - Reporting and Interpreting Liabilities

E95. Req.1 Date November 1 December 31 April 30 Assets Cash + Not Affected Cash Liabilities Note Payable + Interest Payable + Note Payable Interest Payable Req. 2 It is doubtful that long-term borrowing would be appropriate in this situation. After the Christmas season, Neiman Marcus will collect cash from its credit sales. At this point, it does not need borrowed funds. It would be costly to pay interest on a loan that was not needed. It might be possible to borrow for a longer term at a lower interest rate and invest idle cash to offset the interest charges. Neiman Marcus should explore this possibility with its bank but in most cases it would be better to borrow on a short-term basis to meet short-term needs. Stockholders Equity Not Affected Interest Expense Interest Expense

E9-7 Quick ratio = 0.6 = $120,000 / X X = $120,000 / 0.6 X = $200,000

E910. The question of whether a lease will be recorded as a liability depends on the specific facts and circumstances associated with the lease. In the most simple terms, a short-term lease probably would not have to be recorded as a liability but a long-term lease would probably be recorded as a liability. The assistant is correct in the sense that assets could be acquired under a lease and, if the transaction is structured in the proper manner, no liability would be recorded. In class, we like to use this question to explore two issues: (1) Should managers structure transactions to meet the business needs of the company or to comply

9-7

Chapter 09 - Reporting and Interpreting Liabilities

with rules associated with a preferred accounting treatment, and (2) Do users of financial statements react to the manner in which a transaction is reported or to the underlying economic reality of the transaction? E915. Req. 1 $50,000 x 0.7513 Req. 2 $10,000 x 2.4869 = $24,869 It is better to pay in three installments because the economic cost is less. Req. 3 $40,000 x 0.5132 Req. 4 $15,000 x 6.1446 E919. Present value of unequal payments: $11,000 x 0.9091 = $10,000

30,000 x 0.8264 = 50,000 x 0.7513 = 24,792

37,565

$72,357 = $92,169 = $20,528 = $37,565

P92. Req. 1 January 8: Purchases (+A) .............................................................. Accounts payable (+L)................................................ January 17: Accounts payable (-L) .................................................... Cash (-A) .................................................................... 14,860

14,860

14,860

14,860

9-8

Chapter 09 - Reporting and Interpreting Liabilities

April 1: Cash (+A)....................................................................... Note payable, short term (+L)..................................... June 3: Purchases (+A) .............................................................. Accounts payable (+L)................................................ July 5: Accounts payable (-L) .................................................... Cash (-A) .................................................................... August 1: Cash (+A)....................................................................... Rent revenue ($6,000 x 5/6) (+R, +SE) ...................... Deferred rent revenue ($6,000 x 1/6) (+L) .................. December 20: Cash (+A)....................................................................... Liability-deposit on trailer (+L) .................................... December 31: Wage expense (+E, -SE). .............................................. Wages payable (+L) ...................................................

35,000 35,000

17,420 17,420

17,420 17,420

6,000 5,000 1,000

100 100

9,500 9,500

Req. 2 December 31: Interest expense (+E, -SE)............................................. Interest payable (+L)................................................... ($35,000 x 12% x 9/12 = $3,150). 3,150 3,150

Req. 3 Balance Sheet, December 31 Current Liabilities Note payable, short term ............................................ Deposit on trailer ........................................................

$35,000 100

9-9

Chapter 09 - Reporting and Interpreting Liabilities

Wages payable........................................................... Interest payable .......................................................... Deferred rent revenue ............................................... Total ........................................................................ Req. 4 Transaction January 8 January 17 April 1 June 3 July 5 August 1 December 20 December 31 Effect No effect Decrease Financing activity (no effect on operating activities) No effect Decrease Increase Increase No effects for either entry

9,500 3,150 1,000 $48,750

9-10

Chapter 09 - Reporting and Interpreting Liabilities

P97. Req. 1 Not reported---Amount not subject to estimate Req. 2 Not reported---No reason to believe that loss is probable Req. 3 Report liability---Amount can be estimated and loss seems probable Req. 4 Judgment call depending on circumstances. A footnote disclosure might be sufficient, but some auditors would insist on a liability.

Req. 5 Report liability--- Amount is known and loss is probable

9-11

Das könnte Ihnen auch gefallen

- Libby Financial Accounting Chapter13Dokument11 SeitenLibby Financial Accounting Chapter13Jie Bo Ti0% (2)

- Libby Financial Accounting Chapter7Dokument10 SeitenLibby Financial Accounting Chapter7Jie Bo Ti0% (2)

- Libby Financial Accounting Chapter10Dokument8 SeitenLibby Financial Accounting Chapter10Jie Bo TiNoch keine Bewertungen

- Libby Financial Accounting Chapter6Dokument6 SeitenLibby Financial Accounting Chapter6Jie Bo TiNoch keine Bewertungen

- Libby Financial Accounting Chapter14Dokument7 SeitenLibby Financial Accounting Chapter14Jie Bo TiNoch keine Bewertungen

- Libby Financial Accounting Chapter2Dokument12 SeitenLibby Financial Accounting Chapter2Jie Bo TiNoch keine Bewertungen

- CH 02 Review and Discussion Problems SolutionsDokument16 SeitenCH 02 Review and Discussion Problems SolutionsArman Beirami100% (2)

- CH 04 Review and Discussion Problems SolutionsDokument23 SeitenCH 04 Review and Discussion Problems SolutionsArman Beirami67% (3)

- Libby Financial Accounting Chapter4Dokument12 SeitenLibby Financial Accounting Chapter4Jie Bo Ti100% (2)

- Chapter 03 - Operating Decisions and the Income StatementDokument10 SeitenChapter 03 - Operating Decisions and the Income StatementJie Bo Ti67% (3)

- CH 03 Review and Discussion Problems SolutionsDokument23 SeitenCH 03 Review and Discussion Problems SolutionsArman Beirami57% (7)

- Financial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizDokument3 SeitenFinancial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizLevi AlvesNoch keine Bewertungen

- Solution Manual For Financial Accounting 6th Canadian Edition by LibbyDokument29 SeitenSolution Manual For Financial Accounting 6th Canadian Edition by Libbya84964899475% (4)

- Balance Cash HoldingDokument4 SeitenBalance Cash HoldingTilahun S. KuraNoch keine Bewertungen

- Exam 1 QuestionsDokument16 SeitenExam 1 QuestionsArumugamm Ratheeshan100% (1)

- The John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)Dokument10 SeitenThe John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)aicellNoch keine Bewertungen

- ACCT 450 CH Chapter 5 - GROSS INCOME: EXCLUSIONSDokument9 SeitenACCT 450 CH Chapter 5 - GROSS INCOME: EXCLUSIONSacctg46100% (1)

- Chapter 5 Sales TaxDokument5 SeitenChapter 5 Sales Taxali_sattar15Noch keine Bewertungen

- Net Stable Funding Ratio (NSFR)Dokument12 SeitenNet Stable Funding Ratio (NSFR)Salman EjazNoch keine Bewertungen

- Accrual Vs Cash Flows Lecture NotesDokument30 SeitenAccrual Vs Cash Flows Lecture NotesKericho CorryNoch keine Bewertungen

- 11 Accountancy SP 1Dokument13 Seiten11 Accountancy SP 1Ansh YadavNoch keine Bewertungen

- Chapter 5Dokument26 SeitenChapter 5Reese Parker33% (3)

- Soal Ujian KompreDokument26 SeitenSoal Ujian KompreVania Dewi UtamiNoch keine Bewertungen

- Accounting Principles 2: Mr. Mohammed AliDokument43 SeitenAccounting Principles 2: Mr. Mohammed AliramiNoch keine Bewertungen

- ACC 356 Practice Exam (1) - UpdateDokument12 SeitenACC 356 Practice Exam (1) - Updateanon_430129688Noch keine Bewertungen

- FMGT 3310 Midterm ReviewDokument12 SeitenFMGT 3310 Midterm ReviewAndre WardNoch keine Bewertungen

- Finance Applications and Theory 4th Edition Cornett Solutions ManualDokument69 SeitenFinance Applications and Theory 4th Edition Cornett Solutions Manuala36775880550% (2)

- Chapter 009 Test BankDokument13 SeitenChapter 009 Test Banknadecho1Noch keine Bewertungen

- Mod08 - 09 10 09Dokument37 SeitenMod08 - 09 10 09Alex100% (1)

- Cash Book Homework AnswerDokument8 SeitenCash Book Homework AnswerBonnie ChanNoch keine Bewertungen

- Write financial plan under 40 charsDokument6 SeitenWrite financial plan under 40 charsGokul SoodNoch keine Bewertungen

- Multiples Choice Questions With AnswersDokument60 SeitenMultiples Choice Questions With AnswersVaibhav Rusia100% (2)

- Chapter 9Dokument18 SeitenChapter 9Rubén ZúñigaNoch keine Bewertungen

- Answer: Prepaid Insurance ($3,200 X 6/12) $1,600 Total Prepaid Expenses $3,600Dokument7 SeitenAnswer: Prepaid Insurance ($3,200 X 6/12) $1,600 Total Prepaid Expenses $3,600blahblahblah100% (1)

- DerivativesDokument53 SeitenDerivativesnikitsharmaNoch keine Bewertungen

- Bu283 Midterm 2 NotesDokument8 SeitenBu283 Midterm 2 NotesSally MarshallNoch keine Bewertungen

- Costing Methods for Batch ProductionDokument66 SeitenCosting Methods for Batch ProductionDinda syafiraNoch keine Bewertungen

- Test Bank For Management Accounting 7th PDFDokument11 SeitenTest Bank For Management Accounting 7th PDFMingo JiangNoch keine Bewertungen

- Answwr of Quiz 5 (MBA)Dokument2 SeitenAnswwr of Quiz 5 (MBA)Wael_Barakat_3179Noch keine Bewertungen

- TB Chapter05Dokument79 SeitenTB Chapter05Yusairah Benito DomatoNoch keine Bewertungen

- Test Bank For Modern Business Statistics With Microsoft Excel 5th Edition by AndersonDokument6 SeitenTest Bank For Modern Business Statistics With Microsoft Excel 5th Edition by Andersonhezodyvar80% (5)

- Segment AnalysisDokument53 SeitenSegment AnalysisamanNoch keine Bewertungen

- امتحان البنك العربى الافريقى الدولىDokument3 Seitenامتحان البنك العربى الافريقى الدولىwaiting4y0% (1)

- Final AccountsDokument25 SeitenFinal Accountsbarakkat7275% (4)

- Time Value of Money Solutions Chapter 5Dokument26 SeitenTime Value of Money Solutions Chapter 5Tamir Al Balkhi100% (1)

- Chapter 5 Financial Markets and Institutions AnswersDokument3 SeitenChapter 5 Financial Markets and Institutions AnswersTommy Jing Jie NgNoch keine Bewertungen

- The Balanced Scorecard: A Tool To Implement StrategyDokument39 SeitenThe Balanced Scorecard: A Tool To Implement StrategyAilene QuintoNoch keine Bewertungen

- Intermediate Accounting CASEDokument12 SeitenIntermediate Accounting CASERashimNoch keine Bewertungen

- Abubaker Muhammad Haroon 55127Dokument4 SeitenAbubaker Muhammad Haroon 55127Abubaker NathaniNoch keine Bewertungen

- Irish Spring ReportDokument11 SeitenIrish Spring ReportAri EngberNoch keine Bewertungen

- CH01Dokument41 SeitenCH01ahmad_habibi_70% (1)

- Question Pool Chapter03Dokument35 SeitenQuestion Pool Chapter03Petar N NeychevNoch keine Bewertungen

- ACC 304 Week 2 Quiz 01 - Chapter 8Dokument6 SeitenACC 304 Week 2 Quiz 01 - Chapter 8LereeNoch keine Bewertungen

- Financial Ratio Summary SheetDokument1 SeiteFinancial Ratio Summary SheetKeith Tomasson100% (1)

- ch05 SolDokument18 Seitench05 SolJohn Nigz Payee100% (1)

- Terminology Balance SheetDokument3 SeitenTerminology Balance SheetMarcel Díaz AdriàNoch keine Bewertungen

- Chapter 02 Job Order CostingDokument52 SeitenChapter 02 Job Order Costingbaloojan100% (1)

- Chapter 9 SolutionsDokument9 SeitenChapter 9 SolutionsSrinivasan SivaramakrishnanNoch keine Bewertungen

- Ch10 SM Libby3ceDokument51 SeitenCh10 SM Libby3ceRobby RebolledoNoch keine Bewertungen

- Libby 4ce Solutions Manual - Ch10Dokument50 SeitenLibby 4ce Solutions Manual - Ch107595522Noch keine Bewertungen

- Libby Financial Accounting Chapter4Dokument12 SeitenLibby Financial Accounting Chapter4Jie Bo Ti100% (2)

- Chapter 03 - Operating Decisions and the Income StatementDokument10 SeitenChapter 03 - Operating Decisions and the Income StatementJie Bo Ti67% (3)

- Libby Financial Accounting Chapter2Dokument12 SeitenLibby Financial Accounting Chapter2Jie Bo TiNoch keine Bewertungen

- CH 06Dokument3 SeitenCH 06NaTasha KhanNoch keine Bewertungen

- Termeni Contabili in EnglezaDokument11 SeitenTermeni Contabili in EnglezaCrisan AnamariaNoch keine Bewertungen

- Home Health Care Services Business Plan Sample - Financial PlanDokument11 SeitenHome Health Care Services Business Plan Sample - Financial Plangauravj180% (1)

- Business PlanDokument28 SeitenBusiness PlanAnitaNoch keine Bewertungen

- Indian Restaurant Business PlanDokument23 SeitenIndian Restaurant Business PlanAjit SinghNoch keine Bewertungen

- Salon and Wellness Business PlanDokument43 SeitenSalon and Wellness Business PlanShanu MehtaNoch keine Bewertungen

- Accounting and Finance Unit 6Dokument45 SeitenAccounting and Finance Unit 6vasudhaNoch keine Bewertungen

- Intermediate Accounting, 11th Edition - Chapter 05 - Balance Sheet and Statement of Cash FlowsDokument149 SeitenIntermediate Accounting, 11th Edition - Chapter 05 - Balance Sheet and Statement of Cash FlowsJarid Wade100% (1)

- Con RailDokument19 SeitenCon Railkenc_519Noch keine Bewertungen

- KPMG Course of Accounting Professional: An Integrated Learning Program For Upcoming Finance ProfessionalsDokument114 SeitenKPMG Course of Accounting Professional: An Integrated Learning Program For Upcoming Finance ProfessionalsKrishna ShahNoch keine Bewertungen

- ACCT 221 Chapter 2Dokument29 SeitenACCT 221 Chapter 2Shane Hundley100% (1)

- CV Raun Sintiya Daftar Akun Periode 31 Desember 2021Dokument4 SeitenCV Raun Sintiya Daftar Akun Periode 31 Desember 2021BeertyavrillianNoch keine Bewertungen

- Thrift Store: (YEAR)Dokument36 SeitenThrift Store: (YEAR)cosifantutt pozzispaNoch keine Bewertungen

- Business Plan Lotus SpaDokument31 SeitenBusiness Plan Lotus SpaJunaid Aftab Abbasi100% (3)

- Download Tally Ledger List in ExcelDokument7 SeitenDownload Tally Ledger List in ExcelAnonymous 3yqNzCxtTz100% (1)

- Herbal Sundries Bplan SummaryDokument19 SeitenHerbal Sundries Bplan SummaryAbhay KapkotiNoch keine Bewertungen

- (Company Name) Business Plan: " (Insert Motto) "Dokument30 Seiten(Company Name) Business Plan: " (Insert Motto) "James ZacharyNoch keine Bewertungen

- MBSS Annual Report 2013Dokument206 SeitenMBSS Annual Report 2013Andri ChandraNoch keine Bewertungen

- Introduction To The Scope of Syllabus and Paper Format.: ISC 2021 Accounts ProjectDokument20 SeitenIntroduction To The Scope of Syllabus and Paper Format.: ISC 2021 Accounts ProjectMariamNoch keine Bewertungen

- Current Liabilities ChapterDokument8 SeitenCurrent Liabilities ChapterJonathan Villazon Rosales67% (3)

- Wiley - Chapter 5: Balance Sheet and Statement of Cash FlowsDokument35 SeitenWiley - Chapter 5: Balance Sheet and Statement of Cash FlowsIvan Bliminse75% (4)

- Audit of LiabsDokument2 SeitenAudit of LiabsRommel Royce CadapanNoch keine Bewertungen

- Ratio Analysis - Excel ExerciseDokument4 SeitenRatio Analysis - Excel ExerciseS JNoch keine Bewertungen

- Thrift Store Business Plan ExampleDokument33 SeitenThrift Store Business Plan ExampleKim So-Hyun0% (2)

- Analyzing External Factors and Addressing Weaknesses for EcoCarDokument4 SeitenAnalyzing External Factors and Addressing Weaknesses for EcoCarThu DongNoch keine Bewertungen

- Chap 004Dokument84 SeitenChap 004MubasherAkramNoch keine Bewertungen

- G K TradingDokument28 SeitenG K Tradingdjpatel10Noch keine Bewertungen

- Module 4 Preparing The Financial Statements: Statement of Financial PositionDokument20 SeitenModule 4 Preparing The Financial Statements: Statement of Financial PositionErine Contrano100% (2)

- Practice Problems CH 12Dokument3 SeitenPractice Problems CH 12Samira PereziqNoch keine Bewertungen

- CH 13Dokument46 SeitenCH 13Muhammad AmirulNoch keine Bewertungen

- Financial Model Template for Skill Training CenterDokument135 SeitenFinancial Model Template for Skill Training CenterGurvinder SinghNoch keine Bewertungen