Beruflich Dokumente

Kultur Dokumente

Problem 7

Hochgeladen von

businessdoctor23Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Problem 7

Hochgeladen von

businessdoctor23Copyright:

Verfügbare Formate

ASSIGNMENT VII

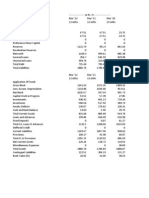

8. Diaz Camera Company is considering two investments, both of which cost $10,000. The cash flows are as follows:

a.

Which of the two projects should be chosen based on the payback method?

Payback period is the number of years in which the initial investment is recouped. Payback for Project A Project A Year

Cash flow (10,000) 6,000 4,000 3,000 3000

Cumulative cash flow (10,000) (4,000) 0 3,000

0 1 2 3

2 years The complete 10,000 investment is recovered in 2 years (6,000+4,000) Payback for Project B Project B Year

Cash flow (10,000) 5,000 3,000 8,000 6000

Cumulative cash flow (10,000) (5,000) (2,000) 6,000

0 1 2 3

2.25 years The complete 10,000 investment is recovered in 2.25 years (5,000+3,000+(8,000/4)) Project A must be selected since it has a smaller payback period. b. Which of the two projects should be chosen based on the net present value method? Assume a cost of capital of 10 percent.

NPV for Project A =

Year

Cash flow

Discount factor @ 10% 1 0.909091 0.826446 0.751315 NPV=

Discounted cash flow=

0 1 2 3

(10,000) 6,000 4,000 3,000

-10,000 5,455 3,306 2,254 1,015

=10000*1 =6000*0.909091 =4000*0.826446 =3000*0.751315

$1,015.00 NPV for Project B

Year

Cash flow

Discount factor @ 10% 1 0.909091 0.826446 0.751315 NPV=

Discounted cash flow=

0 1 2 3

(10,000) 5,000 3,000 8,000

-10,000 4,545 2,479 6,011 3,035

=10000*1 =5000*0.909091 =3000*0.826446 =8000*0.751315

$3,035. Project B must be selected since it has a larger NPV

c.

Should a firm normally have more confidence in answer a or answer b?

The firm should have more confidence in Answer (b) since the payback period has a lot of cons. Payback method does not consider the time value of money and thus leads to incorrect decisions.

16. The Pan American Bottling Co. is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is $45,000. The annual cash flows have the following projections:

a.

If the cost of capital is 10 percent, what is the net present value of selecting a new machine?

Year cost 1 2 3 4 5

Cash Flows 45,000 15,000 20,000 25,000 10,000 5,000

From the table, PV of cash flows = $58,882.90, and its cost is $45,000 now. Then NPV= $58,882.90-45,000= 13,882.90

b.

What is the internal rate of return?

$13,882.90 / 58,882.90 * 100 IRR 23%

c.

Should the project be accepted? Why?

Yes. NPV is greater than 0 and IRR is greater than the cost of capital (10%)

17. You are asked to evaluate the following two projects for the Norton Corporation. Using the net present value method, combined with the profitability index approach described in footnote 2 of this chapter, which project would you select? Use a discount rate of 10 percent.

Year 0 1 2 3 4

Project X Cash Flows -10,000 5,000 3,000 4,000 3,600

Year 0 1 2 3 4

Project Y Cash Flows -30,000 15,000 8,000 9,000 11,000

NPV of Project X NPV of Project Y PI of Project X PI of Project Y

2,488.90 4,522.92 0.25 0.15

NPV of Project Y is higher than that of Project X. However, PI of X is higher than that of Y. Thus, I'll select Project X.

For the formulas I used excel to do my calculations.

Das könnte Ihnen auch gefallen

- MCQDokument3 SeitenMCQPeng GuinNoch keine Bewertungen

- Shaine Andrea P. Sabiña Project 1st HalfDokument15 SeitenShaine Andrea P. Sabiña Project 1st HalfNicole Anne Santiago SibuloNoch keine Bewertungen

- Notes Payable and Debt Restructuring (Ruma, Jamaica)Dokument14 SeitenNotes Payable and Debt Restructuring (Ruma, Jamaica)Jamaica RumaNoch keine Bewertungen

- Exam in Accounting-FinalsDokument5 SeitenExam in Accounting-FinalsIyarna YasraNoch keine Bewertungen

- This Study Resource Was: Problem Set 7 Budgeting Problem 1 (Garrison Et Al. v15 8-1)Dokument8 SeitenThis Study Resource Was: Problem Set 7 Budgeting Problem 1 (Garrison Et Al. v15 8-1)NCT100% (1)

- Partnership Dissolution ProblemsDokument22 SeitenPartnership Dissolution ProblemsMikhaella ZamoraNoch keine Bewertungen

- Chapter 8 SolucionesDokument6 SeitenChapter 8 SolucionesIvetteFabRuizNoch keine Bewertungen

- Accrued Liabilities: Problem 3-1 (AICPA Adapted)Dokument15 SeitenAccrued Liabilities: Problem 3-1 (AICPA Adapted)Nila FranciaNoch keine Bewertungen

- E1-4 Determine The Total Amount of Various Types of Costs: InstructionsDokument7 SeitenE1-4 Determine The Total Amount of Various Types of Costs: InstructionsNgọc KhánhNoch keine Bewertungen

- 2Dokument13 Seiten2Ashish BhallaNoch keine Bewertungen

- Case Study #3: Wake Up and Smell The Coffee!Dokument4 SeitenCase Study #3: Wake Up and Smell The Coffee!USD 654Noch keine Bewertungen

- Far Ii Finals ProblemDokument17 SeitenFar Ii Finals ProblemSaeym SegoviaNoch keine Bewertungen

- Repealed PD 692 Known As Revised Accountancy LawDokument8 SeitenRepealed PD 692 Known As Revised Accountancy LawLian RamirezNoch keine Bewertungen

- Standard Costing: Answer Key On Chapter 7Dokument5 SeitenStandard Costing: Answer Key On Chapter 7Jaquelyn JacquesNoch keine Bewertungen

- Complete C7Dokument15 SeitenComplete C7tai nguyenNoch keine Bewertungen

- Financial Management BSATDokument9 SeitenFinancial Management BSATEma Dupilas GuianalanNoch keine Bewertungen

- 4 2 Endless Company PDFDokument3 Seiten4 2 Endless Company PDFJulius Mark Carinhay TolitolNoch keine Bewertungen

- Hite Company Has Developed The Following Standard Costs For Its Product For 2009Dokument6 SeitenHite Company Has Developed The Following Standard Costs For Its Product For 2009Ghaill CruzNoch keine Bewertungen

- MAR Paper FINAL PDFDokument5 SeitenMAR Paper FINAL PDFrapgracelimNoch keine Bewertungen

- VALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutDokument5 SeitenVALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutEllah RahNoch keine Bewertungen

- 6&7 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisDokument2 Seiten6&7 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisShenedy Lauresta QuizanaNoch keine Bewertungen

- Guabna Aldyn Bookkeeping TransactionsDokument40 SeitenGuabna Aldyn Bookkeeping TransactionsSHIENNA MAE ALVIS100% (1)

- Chapter 28Dokument6 SeitenChapter 28Shane Ivory ClaudioNoch keine Bewertungen

- 06M Midterm Quiz No. 2 Income Tax On CorporationsDokument4 Seiten06M Midterm Quiz No. 2 Income Tax On CorporationsMarko IllustrisimoNoch keine Bewertungen

- p1 Quiz With Theory 1Dokument15 Seitenp1 Quiz With Theory 1lana del reyNoch keine Bewertungen

- Which Statement Is Incorrect Regarding The Application of The Equity Method of Accounting For Investments in AssociatesDokument1 SeiteWhich Statement Is Incorrect Regarding The Application of The Equity Method of Accounting For Investments in Associatesjahnhannalei marticio0% (1)

- Finalchapter 20Dokument11 SeitenFinalchapter 20Jud Rossette ArcebesNoch keine Bewertungen

- Question Text: Retained Earnings Retained Earnings Retained Earnings Retained EarningsDokument32 SeitenQuestion Text: Retained Earnings Retained Earnings Retained Earnings Retained EarningsYou're WelcomeNoch keine Bewertungen

- This Study Resource Was: (Question)Dokument2 SeitenThis Study Resource Was: (Question)Mir Salman Ajab100% (1)

- Qa PartnershipDokument9 SeitenQa PartnershipFaker MejiaNoch keine Bewertungen

- Partnership and Corporation Solman 2011 Chapter 1Dokument7 SeitenPartnership and Corporation Solman 2011 Chapter 1Reymilyn Sanchez0% (1)

- P2 BautistaDokument8 SeitenP2 BautistaMedalla NikkoNoch keine Bewertungen

- The Simplex Minimization MethodDokument13 SeitenThe Simplex Minimization MethodJean HipolitoNoch keine Bewertungen

- Business Cup Level 1 Quiz BeeDokument28 SeitenBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNoch keine Bewertungen

- CVP VAnswer Practice QuestionsDokument5 SeitenCVP VAnswer Practice QuestionsAbhijit AshNoch keine Bewertungen

- University of Mindanao Panabo CollegeDokument2 SeitenUniversity of Mindanao Panabo CollegeJessa Beloy100% (1)

- Accounting For LaborDokument1 SeiteAccounting For LaborkwekwkNoch keine Bewertungen

- Bonds Payable: Intermediate Accounting 2Dokument38 SeitenBonds Payable: Intermediate Accounting 2Rolando Verano TanNoch keine Bewertungen

- Quantitative TechiniquesDokument7 SeitenQuantitative TechiniquesJohn Nowell DiestroNoch keine Bewertungen

- Assignment Module-9 Coefficient of CorrelationDokument4 SeitenAssignment Module-9 Coefficient of CorrelationFranchesca CuraNoch keine Bewertungen

- Land and BuildingDokument5 SeitenLand and BuildingDianna DayawonNoch keine Bewertungen

- Cashflow A. Indirect Method: KM Manufacturing CompanyDokument2 SeitenCashflow A. Indirect Method: KM Manufacturing CompanyArnold AdanoNoch keine Bewertungen

- 1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisDokument3 Seiten1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisGA ZinNoch keine Bewertungen

- 2nd Week - The Master Budget ExercisesDokument5 Seiten2nd Week - The Master Budget ExercisesLuigi Enderez BalucanNoch keine Bewertungen

- Compound Financial InstrumentDokument10 SeitenCompound Financial Instrumentkrisha milloNoch keine Bewertungen

- PARCOR Quiz Chapter 6Dokument2 SeitenPARCOR Quiz Chapter 6Angelica ShaneNoch keine Bewertungen

- Problem 4-29 To 31Dokument1 SeiteProblem 4-29 To 31maryaniNoch keine Bewertungen

- CfasDokument32 SeitenCfasLouiseNoch keine Bewertungen

- Costing ModuleDokument7 SeitenCosting ModuleJoneric RamosNoch keine Bewertungen

- Master in Managerial Advisory Services: Easy QuestionsDokument13 SeitenMaster in Managerial Advisory Services: Easy QuestionsKervin Rey JacksonNoch keine Bewertungen

- AC13 Provisions, Contingencies and Other Liabilities Additional Guide ProblemsDokument2 SeitenAC13 Provisions, Contingencies and Other Liabilities Additional Guide ProblemsDianaNoch keine Bewertungen

- CASE-STUDY Growing PainsDokument9 SeitenCASE-STUDY Growing PainsZion EliNoch keine Bewertungen

- Lobrigas Unit3 Topic2 AssessmentDokument6 SeitenLobrigas Unit3 Topic2 AssessmentClaudine LobrigasNoch keine Bewertungen

- Quiz On Gross Profit Method (Theory and Problem)Dokument2 SeitenQuiz On Gross Profit Method (Theory and Problem)MEHENoch keine Bewertungen

- Tax 321 Prelim Quiz 1 Key PDFDokument13 SeitenTax 321 Prelim Quiz 1 Key PDFJeda UsonNoch keine Bewertungen

- Exam Questionaire in IntermediateDokument5 SeitenExam Questionaire in IntermediateJester IlaganNoch keine Bewertungen

- Sample Questions of Capital BudgetingDokument17 SeitenSample Questions of Capital BudgetingFredy Msamiati100% (1)

- Capital BudgetingDokument2 SeitenCapital BudgetingZarmina ZaidNoch keine Bewertungen

- QuesDokument5 SeitenQuesMonika KauraNoch keine Bewertungen

- Ques On Capital BudgetingDokument5 SeitenQues On Capital BudgetingMonika KauraNoch keine Bewertungen

- Morton Handley & CompanyDokument4 SeitenMorton Handley & Companybusinessdoctor23Noch keine Bewertungen

- Finance 510 Graded Final - AaronDokument14 SeitenFinance 510 Graded Final - Aaronbusinessdoctor23Noch keine Bewertungen

- Chapt 8Dokument2 SeitenChapt 8businessdoctor23Noch keine Bewertungen

- Allied Food ProductsDokument5 SeitenAllied Food Productsbusinessdoctor23Noch keine Bewertungen

- Assignment 4Dokument2 SeitenAssignment 4businessdoctor23Noch keine Bewertungen

- Forum Topic Response Grading RubricDokument1 SeiteForum Topic Response Grading Rubricbusinessdoctor23Noch keine Bewertungen

- FIN 510 Syllabus Part 2 - Winter 2, 2013Dokument14 SeitenFIN 510 Syllabus Part 2 - Winter 2, 2013businessdoctor23Noch keine Bewertungen

- Solutions Ch04 P35 Build A ModelDokument13 SeitenSolutions Ch04 P35 Build A Modelbusinessdoctor23100% (4)

- Assignment 6Dokument3 SeitenAssignment 6businessdoctor23Noch keine Bewertungen

- Day # Subject System/chapter BooksDokument1 SeiteDay # Subject System/chapter Booksbusinessdoctor23Noch keine Bewertungen

- Adjusted Annual Cash Budget by Month 2Dokument2 SeitenAdjusted Annual Cash Budget by Month 2Subhathra Komara SingamNoch keine Bewertungen

- International BusinessDokument2 SeitenInternational BusinessPrateek Sinha0% (2)

- Capital Budgeting ProblemsDokument8 SeitenCapital Budgeting ProblemsAnantdeep Singh Puri100% (1)

- Business Valuation TemplateDokument2 SeitenBusiness Valuation TemplateAkshay MathurNoch keine Bewertungen

- Statement Jazzy1 EstatementDokument2 SeitenStatement Jazzy1 EstatementJoshua HansonNoch keine Bewertungen

- Bal Sheet (Gail)Dokument4 SeitenBal Sheet (Gail)SuhailNoch keine Bewertungen

- DOLE Form On Establishment Termination ReportDokument1 SeiteDOLE Form On Establishment Termination ReportNasir AhmedNoch keine Bewertungen

- Practical Accounting One ReviewersDokument2 SeitenPractical Accounting One ReviewersMarc Eric RedondoNoch keine Bewertungen

- Simple and Compound InterestDokument4 SeitenSimple and Compound InterestJosé Pedro MesquitaNoch keine Bewertungen

- RtgsDokument7 SeitenRtgsDixita ParmarNoch keine Bewertungen

- Mrunal (Economy Q) GDP at Factor Cost and Market Price (GDPFC & GDPMP), NNPFC, NNPMP PrintDokument2 SeitenMrunal (Economy Q) GDP at Factor Cost and Market Price (GDPFC & GDPMP), NNPFC, NNPMP PrintAkash Singh Chauhan0% (2)

- Conversor de Monedas en ExcelDokument5 SeitenConversor de Monedas en ExcelRaúl RivasNoch keine Bewertungen

- Balance Sheet of Reliance IndustriesDokument2 SeitenBalance Sheet of Reliance IndustriesPavitra SoniaNoch keine Bewertungen

- Bajaj Auto Pvt. Ltd. Market Returns and Stock PriceDokument4 SeitenBajaj Auto Pvt. Ltd. Market Returns and Stock PriceArron CarterNoch keine Bewertungen

- FPP1x - Slides Introduction To FPP PDFDokument10 SeitenFPP1x - Slides Introduction To FPP PDFEugenio HerreraNoch keine Bewertungen

- FMtime Value of Money Question in Excel SheetDokument14 SeitenFMtime Value of Money Question in Excel SheetUjjwal MishraNoch keine Bewertungen

- Net Demand and Time LiabilityDokument3 SeitenNet Demand and Time LiabilitypalshrutiNoch keine Bewertungen

- TVS Balance SheetDokument6 SeitenTVS Balance SheetNihal LamgeNoch keine Bewertungen

- CITIC Tower II The Real OptionDokument8 SeitenCITIC Tower II The Real OptionBach CaoNoch keine Bewertungen

- Retirement Planning Problem - SolutionDokument2 SeitenRetirement Planning Problem - SolutionAaron Goh50% (2)

- Tax Planning With Reference To Specific Management DecisionsDokument9 SeitenTax Planning With Reference To Specific Management DecisionsGaurav Mittal67% (3)

- Test AnswersDokument3 SeitenTest AnswersAjay Abraham AnathanamNoch keine Bewertungen

- Time Value of MoneyDokument6 SeitenTime Value of MoneySouvik NandiNoch keine Bewertungen

- PSNT of MFSDokument8 SeitenPSNT of MFSPayal ParmarNoch keine Bewertungen

- What Is PVA and VAL Methods and Trans and Transperiod in RulesDokument3 SeitenWhat Is PVA and VAL Methods and Trans and Transperiod in RulesDeva RajNoch keine Bewertungen

- The Teachings of Warren BuffetDokument2 SeitenThe Teachings of Warren Buffetraghu_s27078Noch keine Bewertungen

- Time Value ProblemDokument8 SeitenTime Value ProblemPrantik RayNoch keine Bewertungen

- PE - L4 - Examples On Financial AnalysisDokument3 SeitenPE - L4 - Examples On Financial AnalysisSajal SinghalNoch keine Bewertungen

- Excel-Based Model To Value Firms Experiencing Financial DistressDokument4 SeitenExcel-Based Model To Value Firms Experiencing Financial DistressgenergiaNoch keine Bewertungen

- FPSO Lease Rate CalculatorDokument1 SeiteFPSO Lease Rate Calculatoreduardo_ricaldi100% (4)