Beruflich Dokumente

Kultur Dokumente

Top M&A Deals in India 2010

Hochgeladen von

Sandesh Naidu KOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Top M&A Deals in India 2010

Hochgeladen von

Sandesh Naidu KCopyright:

Verfügbare Formate

Top 05 Mergers & Acquisitions in India for 2010 Tata Chemicals buys British salt

Tata Chemicals bought British Salt; a UK based white salt producing company for about US $ 13 billion. The acquisition gives Tata access to very strong brine supplies and also access to British Salts facilities as it produces about 800,000 tons of pure white salt every year

Reliance Power and Reliance Natural Resources merger

This deal was valued at US $11 billion and turned out to be one of the biggest deals of the year. It eased out the path for Reliance power to get natural gas for its power projects

Ariels acquisition of Zain in Africa

Airtel acquired Zain at about US $ 10.7 billion to become the third biggest telecom major in the world. Since Zain is one of the biggest players in Africa covering over 15 countries, Airtels acquisition gave it the opportunity to establish its base in one of the most important markets in the coming decade

Abbotts acquisition of Piramal healthcare solutions

Abbott acquired Piramal healthcare solutions at US $ 3.72 billion which was 9 times its sales. Though the valuation of this deal made Piramals take this move, Abbott benefited greatly by moving to leadership position in the Indian market

ICICI Bank buys Bank of Rajasthan

This merger between the two for a price of Rs 3000 cr would help ICICI improve its market share in northern as well as western India

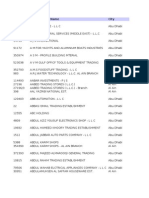

TABLE -1. SHOWING MARKET CAPITAILISATION

RATIOS

PRE MERGER ANALYSIS 2009 2010 2011

POST MERGER 2012

Abbott Airtel Reliance Power Tata Chemicals ICICI Bank

7951070412.72 118782355234 245312480000

12082074540 11869180315 357962080000

28538875051.1 135757903401 365788491166

32303188900.4 128318541943 328620565491

33300442353.3 380286398336

79852873533.7 10603712365

87156168516 124439013857

88341186596.7 102530776555

TABLE -2. SHOWING DEBT EQUITY RATIO

RATIOS

PRE MERGER ANALYSIS 2009 .0593 2010 .0631 2.656 .472 2011 .0272 .1693 .245

POST MERGER 2012 .0454 .1665 .256

Abbott Airtel Reliance Power Tata Chemicals ICICI Bank

4.0635 .053

.952 .245

.687 .259

.545 .269

.439 .295

TABLE -3. SHOWING EARNING PER SHARE

RATIOS

PRE MERGER ANALYSIS 2009 56.68 2010 44.56 24.83 1.14 2011 56.66 20.32 1.06

POST MERGER 2012 68.10 15.09 1.11

Abbott Airtel Reliance Power Tata Chemicals ICICI Bank

20.40 1.04

19.25 33.76

18.38 36.14

16.32 45.27

23.03 56.11

TABLE -4. SHOWING PRICE EARNING RATIO

RATIOS

PRE MERGER ANALYSIS 2009 14.87 2010 19.82 12.58 131 2011 23.70 17.59

POST MERGER 2012 22.32 22.39 105.54

Abbott Airtel Reliance Power Tata Chemicals ICICI Bank

30.67 98.41

123.01

7.35 9.85

17.85 26.35

20.95 24.65

15.05 15.86

TABLE -5. SHOWING RETURN ON INVESTMENT

RATIOS

PRE MERGER ANALYSIS 2009 64 2010 30.82 22.33 2.05 2011 33.10 19.78 1.59

POST MERGER 2012 31.62 14.07 1.93

Abbott Airtel Reliance Power Tata Chemicals ICICI Bank

18.98 1.85

6.88 10.20

10.66 9.13

8.64 8.03

9.38 8.66

TABLE -6. SHOWING NET PROFIT RATIO

RATIOS

PRE MERGER ANALYSIS 2009 24.14 2010 22.60 26.47 132.12 2011 8.07 20.29 58.22

POST MERGER 2012 8.76 13.77 58.11

Abbott Airtel Reliance Power Tata Chemicals ICICI Bank

22.76 93.01

5.40 9.71

8.03 12.12

6.32 15.79

7.20 15.07

Das könnte Ihnen auch gefallen

- Checklist ISO 20000-2018Dokument113 SeitenChecklist ISO 20000-2018roswan83% (6)

- Project Report On WtoDokument81 SeitenProject Report On WtoPoonam Saini60% (10)

- Critical Analysis of Tata SteelDokument41 SeitenCritical Analysis of Tata SteelSanjana GuptaNoch keine Bewertungen

- India IncDokument3 SeitenIndia InckidondrumsNoch keine Bewertungen

- Mergers and Acquisitions - 2010.Dokument15 SeitenMergers and Acquisitions - 2010.eric_joseph_10Noch keine Bewertungen

- Indian Petroleum IndustryDokument10 SeitenIndian Petroleum IndustryToshit GargNoch keine Bewertungen

- Tin Plate India Ltd Research Report AnalysisDokument8 SeitenTin Plate India Ltd Research Report AnalysisPriyank PatelNoch keine Bewertungen

- Results Press Release For December 31, 2015 (Result)Dokument5 SeitenResults Press Release For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Top 10 Indian Mergers and Acquisitions in 2011Dokument3 SeitenTop 10 Indian Mergers and Acquisitions in 2011Lalit KumarNoch keine Bewertungen

- M&A ASSIGNMENT ON MERGERS AND ACQUISITIONSDokument7 SeitenM&A ASSIGNMENT ON MERGERS AND ACQUISITIONSAbhishek ShawNoch keine Bewertungen

- Tata Chemicals LTDDokument19 SeitenTata Chemicals LTDEntertainment OverloadedNoch keine Bewertungen

- Tata Steel Industry AnalysisDokument35 SeitenTata Steel Industry AnalysisDhaval PatelNoch keine Bewertungen

- Tata TeaDokument9 SeitenTata Tearishi777Noch keine Bewertungen

- Benefits View: Tata Nano Essar GroupDokument3 SeitenBenefits View: Tata Nano Essar Groupshreyansh120Noch keine Bewertungen

- Reliance - BP Deal Finally Came ThroughDokument6 SeitenReliance - BP Deal Finally Came Through123anshiNoch keine Bewertungen

- Reliance-BP deal and other major Indian corporate deals in 2011Dokument3 SeitenReliance-BP deal and other major Indian corporate deals in 2011seepi345Noch keine Bewertungen

- Tata IShaktiDokument4 SeitenTata IShaktiPRAPTI TIWARINoch keine Bewertungen

- Tata Chemicals - WikipediaDokument22 SeitenTata Chemicals - WikipediaRavi NayakaNoch keine Bewertungen

- Against The MotionDokument32 SeitenAgainst The MotionSahil SinghalNoch keine Bewertungen

- Management Control System Tata SteelDokument38 SeitenManagement Control System Tata SteelPiyush MathurNoch keine Bewertungen

- Assignment 1Dokument4 SeitenAssignment 1Vivek MishraNoch keine Bewertungen

- Tata Chemicals' Three Core Business Lines and Product PortfolioDokument9 SeitenTata Chemicals' Three Core Business Lines and Product PortfolioAmritMohantyNoch keine Bewertungen

- Raw Material Demand of Processing PotatoDokument10 SeitenRaw Material Demand of Processing Potatoearnmoney.2012Noch keine Bewertungen

- Vedanta Resources Plc.Dokument33 SeitenVedanta Resources Plc.Abhay Pratap SinghNoch keine Bewertungen

- Prepared By-Divya Katragadda Roll No 30 Mba (Pharm Tech) - 4 YearDokument17 SeitenPrepared By-Divya Katragadda Roll No 30 Mba (Pharm Tech) - 4 YearDivya KatragaddaNoch keine Bewertungen

- Tutorial 7 Student Sept2015Dokument5 SeitenTutorial 7 Student Sept2015preetimutiaraNoch keine Bewertungen

- Tata Steel - Company ProfileDokument33 SeitenTata Steel - Company ProfileRAjan Pratap Singh ChauhanNoch keine Bewertungen

- STEEL INDUSTRY Contribution in The Development of India's Economic GrowthDokument16 SeitenSTEEL INDUSTRY Contribution in The Development of India's Economic GrowthaaryanNoch keine Bewertungen

- Ata Steel-Corus: $12.2 BillionDokument3 SeitenAta Steel-Corus: $12.2 Billionsujit89Noch keine Bewertungen

- Equity Valuation of ACC LTDDokument12 SeitenEquity Valuation of ACC LTDAbhishek GuptaNoch keine Bewertungen

- Tata Group Launches Low-Cost Water PurifierDokument2 SeitenTata Group Launches Low-Cost Water PurifierHector OliverNoch keine Bewertungen

- Mechanical Question AssignmentsDokument14 SeitenMechanical Question AssignmentsPappuNoch keine Bewertungen

- 4 May Opening BellDokument8 Seiten4 May Opening BelldineshganNoch keine Bewertungen

- Tata CaseDokument18 SeitenTata CaseCHANDRA PRAKASHNoch keine Bewertungen

- Industrial Output: Information Network, and Development / Strengthening of Infrastructure, Grading and StandardizationDokument5 SeitenIndustrial Output: Information Network, and Development / Strengthening of Infrastructure, Grading and StandardizationAsif AliNoch keine Bewertungen

- TATA CORUS MERGER: A Report on the Merger between TATA Steel and Corus GroupDokument36 SeitenTATA CORUS MERGER: A Report on the Merger between TATA Steel and Corus GroupGopal GuptaNoch keine Bewertungen

- Report FinanceDokument21 SeitenReport Financeddpatel24Noch keine Bewertungen

- Biggest M&A deals involving Indian firmsDokument3 SeitenBiggest M&A deals involving Indian firmsvivek24200320034197Noch keine Bewertungen

- Tata Steel - Strategic ManagementDokument17 SeitenTata Steel - Strategic ManagementSanjeev SahuNoch keine Bewertungen

- 8th IssueDokument10 Seiten8th IssueRaviraj GuptaNoch keine Bewertungen

- Heg Limited: Case Write-UpDokument13 SeitenHeg Limited: Case Write-UpUtsavNoch keine Bewertungen

- Final Fsa ProjectDokument88 SeitenFinal Fsa ProjectCharanjit SikhNoch keine Bewertungen

- IREDA InvestorManualDokument704 SeitenIREDA InvestorManualAshish SharmaNoch keine Bewertungen

- 2 April 2015Dokument1 Seite2 April 2015Ady HasbullahNoch keine Bewertungen

- Tata Motors and JLR Case: Merger and Acquisition Research ReportDokument12 SeitenTata Motors and JLR Case: Merger and Acquisition Research ReportMukesh ManwaniNoch keine Bewertungen

- How Is Tata Leading The Way For Greener IndiaDokument2 SeitenHow Is Tata Leading The Way For Greener IndiaPrakriti MandalNoch keine Bewertungen

- Top 10 Co's in Fortune ListDokument11 SeitenTop 10 Co's in Fortune ListCharu ModiNoch keine Bewertungen

- Coal India IPODokument14 SeitenCoal India IPOpurswaniNoch keine Bewertungen

- Mergers and Acquisitions A Case Analysis On Arcelor-Mittal and Tata Corus DealDokument32 SeitenMergers and Acquisitions A Case Analysis On Arcelor-Mittal and Tata Corus DealNeo FoxNoch keine Bewertungen

- Urea ProjectDokument31 SeitenUrea Projectaman singhNoch keine Bewertungen

- M&A IN STEEL: ARCELOR-MITTAL AND TATA-CORUSDokument32 SeitenM&A IN STEEL: ARCELOR-MITTAL AND TATA-CORUSmonukhandelwal1990Noch keine Bewertungen

- Indian Mergers and Acquisitions: The Changing Face of Indian BusinessDokument10 SeitenIndian Mergers and Acquisitions: The Changing Face of Indian BusinessKhadadNoch keine Bewertungen

- Mergers and AcquisitionsDokument37 SeitenMergers and AcquisitionsAbhimanyu VermaNoch keine Bewertungen

- ITC - Tobacco FinalDokument133 SeitenITC - Tobacco FinalRanveer Desai100% (1)

- Assignment Stock Market Operation (Mgt959)Dokument9 SeitenAssignment Stock Market Operation (Mgt959)Rambo VishalNoch keine Bewertungen

- Market Outlook Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Bharti Airtel Annual Report 2009 10Dokument258 SeitenBharti Airtel Annual Report 2009 10Omrakash MistryNoch keine Bewertungen

- Miscellaneous Basic Inorganic Chemicals World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Basic Inorganic Chemicals World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Earth Wars: The Battle for Global ResourcesVon EverandEarth Wars: The Battle for Global ResourcesBewertung: 4 von 5 Sternen4/5 (2)

- Soap & Cleaning Compounds World Summary: Market Values & Financials by CountryVon EverandSoap & Cleaning Compounds World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- FWN Magazine 2017 - Hon. Cynthia BarkerDokument44 SeitenFWN Magazine 2017 - Hon. Cynthia BarkerFilipina Women's NetworkNoch keine Bewertungen

- Canara Bank Seminar HistoryDokument9 SeitenCanara Bank Seminar Historydhanrajkumar947Noch keine Bewertungen

- TransportPlanning&Engineering PDFDokument121 SeitenTransportPlanning&Engineering PDFItishree RanaNoch keine Bewertungen

- Request Travel Approval Email TemplateDokument1 SeiteRequest Travel Approval Email TemplateM AsaduzzamanNoch keine Bewertungen

- AUH DataDokument702 SeitenAUH DataParag Babar33% (3)

- 1511099786441enterprise Information Systems PDFDokument396 Seiten1511099786441enterprise Information Systems PDFFortune CA100% (1)

- 03 - Review of Literature PDFDokument8 Seiten03 - Review of Literature PDFDevang VaruNoch keine Bewertungen

- Report on Textiles & Jute Industry for 11th Five Year PlanDokument409 SeitenReport on Textiles & Jute Industry for 11th Five Year PlanAbhishek Kumar Singh100% (1)

- Voltas Case StudyDokument8 SeitenVoltas Case StudyAlok Mittal100% (1)

- Beximco Pharmaceuticals International Business AnalysisDokument5 SeitenBeximco Pharmaceuticals International Business AnalysisEhsan KarimNoch keine Bewertungen

- Lumad Struggle for Land and Culture in the PhilippinesDokument10 SeitenLumad Struggle for Land and Culture in the PhilippinesAlyssa Molina100% (1)

- D01 - Scope of Work-Jenna McClendonDokument3 SeitenD01 - Scope of Work-Jenna McClendonadriana sierraNoch keine Bewertungen

- "Potential of Life Insurance Industry in Surat Market": Under The Guidance ofDokument51 Seiten"Potential of Life Insurance Industry in Surat Market": Under The Guidance ofFreddy Savio D'souzaNoch keine Bewertungen

- A4 - Productivity - City Plan 2036 Draft City of Sydney Local Strategic Planning StatementDokument31 SeitenA4 - Productivity - City Plan 2036 Draft City of Sydney Local Strategic Planning StatementDorjeNoch keine Bewertungen

- Integration of Renewable Energie Sources Into The German Power Supply System in The 2015-2020 Period With Outlook To 2025Dokument587 SeitenIntegration of Renewable Energie Sources Into The German Power Supply System in The 2015-2020 Period With Outlook To 2025tdropulicNoch keine Bewertungen

- Value Stream Mapping Case StudyDokument12 SeitenValue Stream Mapping Case StudySaikat GhoshNoch keine Bewertungen

- DocxDokument11 SeitenDocxKeir GaspanNoch keine Bewertungen

- Questionnaire Fast FoodDokument6 SeitenQuestionnaire Fast FoodAsh AsvinNoch keine Bewertungen

- General Terms and ConditionsDokument8 SeitenGeneral Terms and ConditionsSudhanshu JainNoch keine Bewertungen

- Dhakras Bhairavi SDokument137 SeitenDhakras Bhairavi SReshma PawarNoch keine Bewertungen

- Palo Leyte Palo Leyte: Table 1Dokument5 SeitenPalo Leyte Palo Leyte: Table 1samson benielNoch keine Bewertungen

- Constant Elasticity of Subs...Dokument3 SeitenConstant Elasticity of Subs...Masoud BaratiNoch keine Bewertungen

- Recitation 1 Notes 14.01SC Principles of MicroeconomicsDokument3 SeitenRecitation 1 Notes 14.01SC Principles of MicroeconomicsDivya ShahNoch keine Bewertungen

- Cobrapost II - Expose On Banks Full TextDokument13 SeitenCobrapost II - Expose On Banks Full TextFirstpost100% (1)

- Currency and interest rate swaps explainedDokument33 SeitenCurrency and interest rate swaps explainedHiral PatelNoch keine Bewertungen

- Introduction To Macroeconomics: Unit 1Dokument178 SeitenIntroduction To Macroeconomics: Unit 1Navraj BhandariNoch keine Bewertungen

- Real Estate Project Feasibility Study ComponentsDokument2 SeitenReal Estate Project Feasibility Study ComponentsSudhakar Ganjikunta100% (1)

- India Inc's Baby Steps On Long Road To Normalcy: HE Conomic ImesDokument12 SeitenIndia Inc's Baby Steps On Long Road To Normalcy: HE Conomic ImesShobhashree PandaNoch keine Bewertungen