Beruflich Dokumente

Kultur Dokumente

Opportunity Crude.

Hochgeladen von

deepeshchemicalOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Opportunity Crude.

Hochgeladen von

deepeshchemicalCopyright:

Verfügbare Formate

Designing the CDU/VDU for opportunity crudes

New units for processing heavy crudes should not be designed using conventional practices or run length will be short, and product yields and quality poor

Scott Golden, Tony Barletta and Steve White Process Consulting Services

pportunity crudes cost less than other encountered when processing extra-heavy opporcrudes because they are more difficult to tunity crudes include poor desalting, which often refine into gasoline and middle distillate. results in severe atmospheric crude overhead Yet there is a perception that profitability will system corrosion, including exchangers, piping improve simply by substituting them for more and vessels. These crudes are viscous, contain expensive feedstocks. At times, certain crudes solids, can have amines, can precipitate sell at huge discounts. This may be when produc- asphaltenes when blended with other crudes, and tion exceeds the industrys ability to process have a high fouling tendency in heat exchangers them, whether it is for short periods that are (see Figure 1), column internals and fired heaters. caused by unplanned shutdowns or longer peri- Some have a very high naphthenic acid content, ods when regional logistics arise such as causing desalter problems and corrosion requirdistribution constraints for Canadian bitumen. ing upgraded metallurgy. Other problems include Refiners tend to focus on conversion units such heater coking and asphaltene precipitation inside as the coker or hydrocracker, and the crude and heater tubes, which leads to short run lengths. vacuum unit (CDU/VDU) is often an after- When processing some Northern Alberta bituthought. As more heavy and extra-heavy crudes mens, the vacuum heater outlet temperature must enter the market, there will be more opportunity for refiners to run them. The question is whether it will be profitable or not. Will lessons learned be incorporated into unit designs or will refiners learn only through the school of hard knocks? CDU/VDUs must be designed or revamped for opportunity crudes or there will be unscheduled shutdowns, poor product yield and quality, and maintenance costs much higher than anticipated. Processing opportunity crudes in high blend percentages reliably is different from running common heavy crudes such as Arab Heavy. Common problems Figure 1 Fouled exchanger asphaltene precipitation

www.digitalrefining.com/article/100564

Sour & Heavy 2012 1

be operated as low as 705F (374C) to avoid short run lengths even with well-designed doublefired tube designs. Asphaltene precipitation in the bottom of the atmospheric column can lead to stripping tray plugging, causing run lengths of less than a year. These are just a few of the obstacles experienced by upgraders and refiners processing heavy opportunity crude oils. These are the unfortunate realities, but it is better to design the unit for them than to suffer the consequences that many refiners continue to experience. As producers of opportunity crudes such as Canadian dilbit continue to ramp up production, refiners increasingly are suffering because they either ignored the realities of processing these crudes or were unfamiliar with them.

Global opportunity crude supply

Historically, heavy and extra-heavy crude production has largely come from North and South America. Consequently, refining experience with these crudes is primarily in Canada, the US and South America, and only a few US refiners process high blend percentages. Some producing nations crude units have very poor reliability and performance, but these realities are hidden from the global market. As the global distribution of opportunity crudes improves and more fields come on stream, the worlds refining system will gain experience. Today, most European refineries process light and medium crudes, while Middle East refiners run their own crudes. They process very little opportunity crudes. Refineries in China are primarily designed to process local and Middle East crudes and have little or no experience with opportunity crudes at high blend percentages. While China is planning to build refineries to process them, their approach is to rely on their own institutes or global engineering and construction companies that have little experience designing CDU/VDUs for opportunity crudes. The experiences they do have and have applied resulted in very poor reliability and a low refinery liquid volume yield. Opportunity crudes are different and the CDU/VDUs must be designed for them. One only needs to query refiners with long-term experience of processing opportunity crudes to get a true picture of the processing costs. Short run lengths, low middle and vacuum gas oil (VGO) product yields and poor product quality are common.

Refining and upgrader capacity has to match production. Currently, most Venezuelan crude is processed by US refineries, and most, if not all, Canadian crudes are upgraded or refined in Canada or the US. Far East refiners, primarily India, are processing some Venezuelan crudes, but the blend percentages are not high. Whether Canadian or Venezuelan, these crudes are a mixture of bitumen and lighter blend stocks. PetroZuata and Hamaca consist of coker products and bitumen, whereas Merey is a blend of Oronoco bitumen and lighter crudes, albeit there may be other names under which these 15 API gravity Oronoco bitumen blends are marketed. Much of the Canadian crudes are a blend of bitumen and condensate (naphtha) or synthetic crude from the upgraders. Conventional Canadian heavy crude production, such as Bow River, is rapidly declining, with more crudes containing bitumen from Cold Lake, Athabasca or Peace River basins. Some of these bitumens are much more challenging than others and refiners should not assume they are all created equal. They are not! In the mid- to late 1980s, US Gulf Coast refiners began processing large volumes of 21-24 API gravity crudes from Mexico and Venezuela. In the mid- to late 1990s, 15-18 API blends became more prevalent and this trend continues. At least two US refiners process these crudes neat through a CDU/VDU. In all cases, the designer touted a 1050F (565C) VGO product cutpoint, but not one actually achieved it in spite of the rhetoric. Today, few refiners process 100% heavy crudes, with most blending them with higher- gravity crudes. Some refiners claiming they process heavy crudes have blend gravities of only 27-30 API gravity. Processing heavy and extra-heavy crudes neat or in high blend percentages is another story completely. After more than 25 years of industry experience processing these crudes, the economic losses associated with poor CDU/VDU performance are still huge. Low VGO cutpoint is the norm whether refiners admit it or not. In spite of the claims, when one peels back the curtain, the picture is not so good. Short run lengths, low middle distillate and VGO yields, as well as poor product quality are the norm.

Refining and upgrading experience with extra-heavy crude

Canadian bitumen upgraders, Venezuelan refineries and upgraders, as well as a handful of US

2 Sour & Heavy 2012

www.digitalrefining.com/article/100564

refiners, pioneered heavy and with incremental VGO recovery extra-heavy crude processing. are huge. When crudes cost Only these refiners or upgraders $100/bbl, the profit loss of have long-term experience of turning 1000 b/d of VGO into processing them. Today, CDU/ coke is more than $35 million/ VDUs must operate for four to y. Proper vacuum unit design is six years, while maximising essential to maximise VGO middle distillate recovery and and diesel product yield (see minimising vacuum residue Figure 2). (VR) yield. Poor product recovPoor diesel recovery and high ery and quality dramatically diesel boiling range material in reduce the economic benefits of the VGO are another conselower crude costs. Avoiding quence of poor CDU/VDU unscheduled outages has been a design. Maximum diesel recovery chronic problem, reducing profrequires production from the itability. A 10-day shutdown to vacuum unit, yet most US refinreplace failed exchangers or ers have not designed their units piping, or a longer-term outage for diesel production. Many large to fix fire damage caused by loss engineering and construction of containment, dramatically companies continue to design reduces profitability. CDU/VDUs without it, hence the There are only a handful of atmospheric gas oil (AGO) and long-term producers in Canada Figure 2 Deep-cut VGO vacuum unit VGO product contain large with experience of processing producing diesel from the top draw volumes of diesel. It is not 100% Canadian bitumen over uncommon for the FCC or hydromore than a decade. Over the years, they have cracker feed to contain 25-30 vol% diesel boiling made many changes to the process and equip- range material. ment designs to run reliably. Only recently have US refineries started to process these crudes in Heavy crude oil properties high blend percentages and they are experienc- Heavy crude oils properties make it difficult to ing problems similar to those encountered by the reliably process through a conventional CDU/ refiners processing Venezuelan crudes in the VDU. Essential CDU/VDU design properties are mid-1980s to early 1990s. TBP distillation and API gravity curves, contamiRefiners make money producing gasoline and nants distribution (MCR, asphaltenes and middle distillates; coke is a by-product often metals), viscosity, salt content, total acid number having a negative value. A common CDU/VDUs (TAN), solids content, and tramp amine and design basis is a 1050F (565C) VGO product other trace components. These properties dictate cutpoint; however, the reality is that most the design, and if they are ignored the unit will achieve only 950F (510C) or lower. This not work as expected. For example, many of represents an almost 10 vol% higher VR yield these crudes contain amines due to either on whole crude and means VGO is fed to the production water treatment or an H2S scavenger coker instead of the FCC unit or hydrocracker. used. If the desalted crude has a high salt content Coking the heavy portion of the VGO converts and the amines are not removed they will cause 15-20% into coke, with the remainder down- severe plugging and corrosion in the top of the graded to lower-value product than the virgin crude column, requiring replacement of the VGO. Even though VGO produced from extra- vessels shell with exotic metallurgy. This has heavy crude has higher contaminants and happened in several instances. consumes hydrogen to make ULSD and highAs crude blend distillations get heavier, the VR quality FCC feed, the quality of the coked VGO content increases and they become difficult to products is even lower. Heavy and extra-heavy vapourise in the atmospheric and vacuum unit. crudes contain large amounts of VGO compared Units designed with a high crude column AGO with other crudes, and the economics associated cutpoint or a vacuum preflash column make the

www.digitalrefining.com/article/100564

Sour & Heavy 2012 3

Problems associated with opportunity crudes

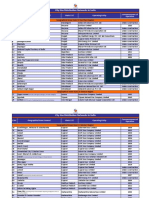

Poor exchanger design low exchanger heat transfer coefficients Poor desalting caused by low temperature, small desalters, poor water system design, high pH water, too small transformers, stable rad layer formation, periodic carry-over, etc Failure to design for high crude water content Crude hydraulic limits caused by poor exchanger design, resulting in rapid fouling, wrong viscosities used, low pump efficiencies and head, etc Preflash drum foaming and carryover Much lower crude preheat, causing high crude heater firing Crude column fouling and corrosion in top section plugging trays, resulting in shutdown Fouling in crude column top pumparound exchangers Severe crude column top section vessel corrosion Stripping section asphaltenes precipitation fouling trays and limiting stripping steam Low atmospheric crude diesel product yield caused by low vapourisation Crude heater asphaltenes precipitation and heater tube coking, requiring shutdown to pig tubes Vacuum heater coking requiring shutdown to pig tubes Crude and vacuum heater transfer line corrosion Vacuum column wash zone coking (see Figure 3) Vacuum ejector system fouling and corrosion, causing poor vacuum and high column pressure Fouling top pumparound section of vacuum column with amine chlorides Low HVGO product draw temperature caused by low crude column distillate yield, resulting in vacuum column heat removal limit Low VGO yield High metals VGO VGO pumparound and product system corrosion High chloride content light vacuum gas oil (LVGO)

CDU/VDU processing difficulties

Table 1 identifies some of the specific problems that refiners face when processing heavy crude oil blends. These are only a few of the difficulties experienced by refiners processing high percentages of these opportunity crudes.

Future heavy crude sources

Table 1

Figure 3 Severe wash zone coking

vacuum column feed very heavy. A high crude heater outlet temperature lifts more diesel and VGO range material out of the vacuum column feed, making it more difficult to vapourise in the vacuum column. A heavier vacuum unit feed lowers the VGO product yield for a given vacuum column flash zone pressure and vacuum heater outlet temperature.

Up to about 10 years ago, Venezuelan and Mexico crudes were the major sources of heavy and extra-heavy crudes. The US was the predominant market for it. Very little Canadian bitumen was processed in the US and none outside. Today, the production of Canadian extraheavy bitumen-based crude is around 2 million b/d from the Athabasca, Peace River and Cold Lake regions. Much of the Northern Alberta production is upgraded in the Fort McMurray region by the long-term operators Suncor and Syncrude, with newer upgraders operating for only the last five years. Northern Alberta crudes are the most difficult to processes and, in the near future, increasing volumes will reach the US market as diluted bitumen or synbit. Currently, Southern Athabasca, Cold Lake and Peace River blends are being processed, but only a very few refiners run high percentages in their blends. And none currently have long-term experience of processing 100% Canadian bitumen blends in the 18-20 API gravity range. Heavy Venezuelan crudes have been processed since the mid-1980s in high blend percentages by only a few US refiners. In nearly all cases, the CDU/VDUs did not meet design capacity, product yields or reliability. In some instances, none of these goals were achieved, with the units requiring major revamps just to meet their

4 Sour & Heavy 2012

www.digitalrefining.com/article/100564

original design basis. Today, Venezuelan crudes are increasingly going to India and the Far East because they are seen as low-cost alternatives to Middle East and West African crudes. In most instances, the lessons learned in the US have not been incorporated in the CDU/VDU designs. Few major engineering and construction companies have designed units for Oronoco Bitumen blends, and the ones that have often repeat the same mistakes on future designs because they rarely perform rigorous post start-up audits and almost never look at unit performance one to four years after start-up when reliability problems show up.

costs will pay out over the life of the project through an increased VGO product yield, lower maintenance costs, fewer VGO contaminants and a longer run length between decokings.

Scott Golden is a Chemical Engineer with Process Consulting Services, Inc, in Houston, Texas. He specialises in front-end process engineering for refinery unit revamps and has authored more than 100 technical papers on revamping and troubleshooting refinery process units. Email: sgolden@revamps.com Tony Barletta is a Chemical Engineer with Process Consulting Services, Inc., in Houston, Texas. His primary responsibilities are conceptual process design and process design packages for large capital revamps. Email: tbarletta@revamps.com Steve White is a Chemical Engineer with Process Consulting Services, Inc, in Houston, Texas. He has more than 30 years of process design experience for refinery revamps and grassroots units. Email: swhite@revamps.com

Conclusions

Lessons learned by US refiners processing heavy Venezuelan crudes and Canadian upgraders processing bitumen should be applied to new projects that will process increasing amounts of opportunity crudes. These units should not be designed with conventional practices used for light and medium crudes; otherwise, run length will be short, product yields and quality poor, and maintenance costs high. Opportunity crude properties are very different and design requirements will raise initial costs. These higher initial

Links

More articles from: Process Consulting Services More articles from the following categories: Crude Vacuum Units Heavy/Sour Crudes

www.digitalrefining.com/article/100564

Sour & Heavy 2012 5

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Poza Rica Oil WellDokument49 SeitenPoza Rica Oil WellVincent J. CataldiNoch keine Bewertungen

- Unconventional Hydrocarbon Energy Resources and Hydraulic FracturingDokument8 SeitenUnconventional Hydrocarbon Energy Resources and Hydraulic FracturingYash GyanchandaniNoch keine Bewertungen

- Basic Science JSS2 Week 1Dokument10 SeitenBasic Science JSS2 Week 1Gladys EjikemeNoch keine Bewertungen

- Coal LiquefactionDokument48 SeitenCoal LiquefactionMohammed Kabiruddin100% (2)

- CGD Data For Website 7.10.2016Dokument3 SeitenCGD Data For Website 7.10.2016arbaz khanNoch keine Bewertungen

- QP Annual Rev17Dokument113 SeitenQP Annual Rev17xsupermanNoch keine Bewertungen

- Densitometer BuildingDokument7 SeitenDensitometer BuildingCharles HutabaratNoch keine Bewertungen

- Types of WellsDokument2 SeitenTypes of WellsSudeepto GogoiNoch keine Bewertungen

- Class Notes 123212wDokument2 SeitenClass Notes 123212wfvebbNoch keine Bewertungen

- Name: Trajano, Jonver Eric I. Section: Bsme-3B Subject: Me-324 Combustion Engineering DATE: JUNE 01, 2021Dokument6 SeitenName: Trajano, Jonver Eric I. Section: Bsme-3B Subject: Me-324 Combustion Engineering DATE: JUNE 01, 2021Princess NobleNoch keine Bewertungen

- Barauni Refinary PresentationDokument20 SeitenBarauni Refinary PresentationraviakashmurtyNoch keine Bewertungen

- Big Coal's Dirty SecretsDokument10 SeitenBig Coal's Dirty SecretsAppalachian VoiceNoch keine Bewertungen

- Domestic Natural Gas MarketDokument10 SeitenDomestic Natural Gas MarketRaouf Reda100% (2)

- Mining in GermanyDokument2 SeitenMining in GermanyLeahu SergheiNoch keine Bewertungen

- BP Stats Review 2021 Approximate Conversion FactorsDokument5 SeitenBP Stats Review 2021 Approximate Conversion Factorsecs71Noch keine Bewertungen

- Bangko VT Monitoring 6 Agustus - 10 Agustus 2023Dokument3 SeitenBangko VT Monitoring 6 Agustus - 10 Agustus 2023sulhanhans8Noch keine Bewertungen

- Answer The Questions From The Units 1-6 of Book "A Primer of Oilwell Drilling"Dokument3 SeitenAnswer The Questions From The Units 1-6 of Book "A Primer of Oilwell Drilling"Luis Ángel Herrera MeridaNoch keine Bewertungen

- LECTURE NOTES PET 416 Oil and Gas Pollution and Control Module 2 2015 2016Dokument9 SeitenLECTURE NOTES PET 416 Oil and Gas Pollution and Control Module 2 2015 2016Abdulganiyu AbdulafeezNoch keine Bewertungen

- Oil ReservesDokument11 SeitenOil ReservesMohammed Abdul SamiNoch keine Bewertungen

- In The Name of God The Merciful The CompassionateDokument47 SeitenIn The Name of God The Merciful The CompassionateschifanoNoch keine Bewertungen

- PPIS Annual 2016 17 FinalDokument97 SeitenPPIS Annual 2016 17 FinalSaad YousufNoch keine Bewertungen

- Oil History in EuropeDokument24 SeitenOil History in EuropeBudi SantosoNoch keine Bewertungen

- Distribution and Production of Petroleum in The WorldDokument7 SeitenDistribution and Production of Petroleum in The WorldLalrinmawia FanaiNoch keine Bewertungen

- 1.1 Overview-Indian E&P Industry 1.1.1 History: Sedimentary Basins of IndiaDokument11 Seiten1.1 Overview-Indian E&P Industry 1.1.1 History: Sedimentary Basins of IndiaRajat MaheshwariNoch keine Bewertungen

- PETRONASAnnualReport2014 PDFDokument250 SeitenPETRONASAnnualReport2014 PDFJessica LimNoch keine Bewertungen

- Barauni Refinery Unit CapacitiesDokument8 SeitenBarauni Refinery Unit Capacitiesrishika sharmaNoch keine Bewertungen

- Our Petroleum Challenge Book PDFDokument156 SeitenOur Petroleum Challenge Book PDFOsama ShaheenNoch keine Bewertungen

- LPG Report - Eng. Onel IsraelDokument12 SeitenLPG Report - Eng. Onel IsraelOnel Israel Badro100% (2)

- MajorProjects 202112 e 1Dokument64 SeitenMajorProjects 202112 e 1xtrooz abiNoch keine Bewertungen

- PPIS Annual 2020 21 Final CompressedDokument94 SeitenPPIS Annual 2020 21 Final CompressedBilalNoch keine Bewertungen